UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of

earliest event reported): May 21,

2024

Assure Holdings Corp.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40785 |

|

82-2726719 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

7887 East Belleview Avenue, Suite 240

Denver, CO |

|

80111 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 720-287-3093

_____________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

IONM |

|

NASDAQ Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.01 Notice of

Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On May 21, 2024, Assure

Holdings Corp. (the “Company”) received a notice (the “Notice”) from the Nasdaq Stock Market LLC (“Nasdaq”)

indicating that as a result of the delinquency in the timely filing of the Company’s quarterly report on Form 10-Q for the period

ended March 31, 2024 (the “10-Q”), the Company is out of compliance with Nasdaq Listing Rules (Listing Rule 5250(c)(1), which

requires listed companies to timely file all required periodic reports with the Securities and Exchange Commission) and that the Nasdaq

Hearings Panel (the “Panel”) will consider this matter as an additional deficiency, under Listing Rule 5810(d), in their decision

regarding the Company’s continued listing on The Nasdaq Capital Market.

The Notice has no immediate

effect on the listing or trading of the Company’s common stock on the Nasdaq Capital Market. The Notice provides that the Company

has until May 28, 2024 to present its views with respect to this additional deficiency to the Panel in writing.

There

can be no assurance that the Company’s plan as presented to the Panel, in relation to this additional deficiency, will be accepted

by the Panel or that, if it is, the Company will be able to regain compliance with the applicable Nasdaq listing requirements, or that

a Panel will stay the suspension of the Company’s securities.

If

the Company’s securities are delisted from the Nasdaq Capital Market, it could be more difficult to buy or sell the Company’s

common stock or to obtain accurate quotations, and the price of the Company’s common stock could suffer a material decline. Delisting

could also impair the Company’s ability to raise capital and/or trigger defaults and penalties under outstanding agreements or securities

of the Company.

The Company continues

to work diligently to complete and file the 10-Q.

Item 9.01 Financial

Statements and Exhibits

(d) Exhibits.

| Exhibit No. |

|

Name |

| 104 |

|

Cover Page Interactive Data File (formatted in Inline XBRL and included as Exhibit 101). |

Additional Information

and Where to Find It

This Current Report may

be deemed to be solicitation material with respect to the proposed transactions between Assure and Danam Health Inc. In connection with

the proposed transaction, Assure has filed relevant materials with the SEC, including a registration statement on Form S-4, filed with

the SEC on May 3, 2024, that contains a prospectus and a proxy statement. Assure will mail the proxy statement/prospectus to the Assure

and Danam stockholders, and the securities may not be sold or exchanged until the registration statement becomes effective.

Investors and securityholders

of Assure and Danam are urged to read these materials when they become available because they will contain important information about

Assure, Danam and the proposed transactions. This Current Report is not a substitute for the registration statement, definitive proxy

statement/prospectus or any other documents that Assure may file with the SEC or send to securityholders in connection with the proposed

transactions. Investors and securityholders may obtain free copies of the documents filed with the SEC, once available, on Assure’s

website at www.assureneuromonitoring.com, on the SEC’s website at www.sec.gov or by directing a request to Assure at 7887 E. Belleview

Ave., Suite 240, Denver, Colorado, USA 80111, Attention: John Farlinger, Chief Executive Officer; or by email at ir@assureiom.com.

Participants in the

Solicitation

Each of Assure and Danam

and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders

of Assure in connection with the proposed transaction. Information about the executive officers and directors of Assure are set forth

in Assure’s Definitive Proxy Statement on Schedule 14A relating to the 2023 Annual Meeting of Stockholders of Assure, filed with

the SEC on December 5, 2023 and in Assure’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the

SEC on April 26, 2024. Other information regarding the interests of such individuals, who may be deemed to be participants in the solicitation

of proxies for the stockholders of Assure are set forth in the proxy statement/prospectus, which is included in Assure’s registration

statement on Form S-4 filed with the SEC on May 3, 2024. You may obtain free copies of these documents as described above.

Cautionary Statements

Regarding Forward-Looking Statements

This

Current Report contains forward-looking statements based upon the current expectations of Assure and Danam. Forward-looking statements

involve risks and uncertainties and include, but are not limited to, statements about the structure, timing and completion of the proposed

transactions; the listing of the combined company on Nasdaq after the closing of the proposed merger; expectations regarding the ownership

structure of the combined company after the closing of the proposed merger; the expected executive officers and directors of the combined

company; the expected cash position of each of Assure and Danam and the combined company at the closing of the proposed merger; the future

operations of the combined company; and other statements that are not historical fact. Actual results and the timing of events could differ

materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without

limitation: (i) the risk that the conditions to the closing of the proposed transaction are not satisfied, including the failure to timely

obtain stockholder approval for the transaction, if at all; (ii) uncertainties as to the timing of the consummation of the proposed transaction

and the ability of each of Assure and Danam to consummate the proposed merger, as applicable; (iii) risks related to Assure’s ability

to manage its operating expenses and its expenses associated with the proposed transactions pending closing; (iv) risks related to the

failure or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate the proposed

transactions; (v) the risk that as a result of adjustments to the exchange ratio, Assure stockholders and Danam stockholders could own

more or less of the combined company than is currently anticipated; (vi) risks related to the market price of Assure’s common stock;

(vii) unexpected costs, charges or expenses resulting from either or both of the proposed transaction; (viii) potential adverse reactions

or changes to business relationships resulting from the announcement or completion of the proposed transactions; (ix) risks related to

the inability of the combined company to obtain sufficient additional capital to continue to advance its business plan; and (x) risks

associated with the possible failure to realize certain anticipated benefits of the proposed transactions, including with respect to future

financial and operating results. Actual results and the timing of events could differ materially from those anticipated in such forward-looking

statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in periodic

filings with the SEC, including the factors described in the section titled “Risk Factors” in Assure’s Annual Report

on Form 10-K for the year ended December 31, 2023 filed with the SEC, and in other filings that Assure makes and will make with the SEC

in connection with the proposed transaction, including the proxy statement/prospectus described under “Additional Information and

Where to Find It.” You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof

or as of the dates indicated in the forward-looking statements. Except as required by law, Assure expressly disclaims any obligation or

undertaking to update or revise any forward-looking statements contained herein to reflect any change in its expectations with regard

thereto or any change in events, conditions or circumstances on which any such statements are based.

SIGNATURE

Pursuant to the requirement of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

|

| |

ASSURE HOLDINGS CORP. |

| |

|

|

| Date: May 28, 2024 |

By: |

/s/ John Farlinger |

| |

Name: |

John Farlinger |

| |

Title: |

Chief Executive Officer |

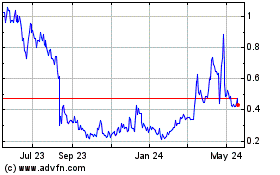

Assure (NASDAQ:IONM)

Historical Stock Chart

From Jan 2025 to Feb 2025

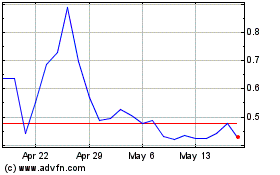

Assure (NASDAQ:IONM)

Historical Stock Chart

From Feb 2024 to Feb 2025