LIBERTY LATIN AMERICA AND MILLICOM AGREE TO COMBINE OPERATIONS IN COSTA RICA

August 01 2024 - 8:00AM

Business Wire

TRANSACTION TARGETS GREATER INVESTMENT IN FIBER NETWORKS TO

DELIVER ENHANCED SERVICES AND CUSTOMER EXPERIENCE

Liberty Latin America Ltd. (“Liberty Latin America” or “LLA”)

(NASDAQ: LILA and LILAK, OTC Link: LILAB) and Millicom

International Cellular S.A. (“Millicom”) (NASDAQ U.S.: TIGO, Nasdaq

Stockholm: TIGO_SDB) today announced that the parties have entered

into an agreement to combine the companies’ respective operations

in Costa Rica. Under the terms of the all-stock agreement, Liberty

Latin America and its minority partner in Costa Rica will hold an

approximate 86% interest and Millicom 14% in the joint operations,

with the final ownership percentage confirmed at closing.

As of December 31, 2023, the combined operations had Adjusted

OIBDA1 of approximately $255 million2, more than 440,000 broadband

subscribers, and net debt of $533 million3.

The transaction reinforces the parties’ commitment to Costa Rica

by creating the opportunity for a scaled platform and accelerated

investments in fiber network expansion. In a market that is

undergoing rapid technological advancements with the deployment of

fiber networks by multiple operators, this combination would

increase fiber competition and promote high-quality, good value

services and access to the digital economy for all Costa

Ricans.

Balan Nair, President and CEO of Liberty Latin America,

commented, “Costa Rica is a great country to operate in and Liberty

Costa Rica is a strong business for us. By combining Liberty and

Tigo, the fixed operations will accelerate the transition to FTTH

and will enable us to deliver exceptional high-speed services for

consumers, provide enhanced customer experiences, drive innovation,

and offer growth opportunities for our people. With this

transaction, Liberty Costa Rica will continue to be a leading

connectivity operator in the market.”

Mauricio Ramos, Chair, Millicom, said, “Our combined operations

would significantly benefit the telecommunications sector by

enhancing fiber network investment to help accelerate Costa Rica's

technological evolution in a highly competitive market. This merger

is expected to generate new efficiencies and improve commercial

offerings, providing customers with access to mobile services and

premium content. It creates a stronger, more competitive entity

with high investment capacity to meet the accelerated technological

changes, network expansion, and service improvements, ensuring that

long-term market conditions remain competitive while maintaining

high-quality and valuable services for our customers in Costa

Rica.”

The transaction is subject to customary closing conditions,

including regulatory authorizations, and we expect the transaction

to be completed during the second half of 2025.

Liberty Latin America was advised by JP Morgan, while Millicom

was advised by Aldo J. Polak and FTI Consulting.

About Liberty Latin America

Visit: www.lla.com

About Millicom

Visit: www.millicom.com

1Based on the combined Adjusted OIBDA (defined as operating

income before depreciation and amortization, share-based

compensation, provisions and provision releases related to

significant litigation and impairment, restructuring and other

operating items) for the fiscal year ended December 31, 2023 of

LLA’s Costa Rican operation in accordance with accounting

principles generally accepted in the United States (U.S. GAAP), and

Millicom’s Costa Rican operation in accordance with International

Financial Reporting Standards (“IFRS”), as adjusted to include

certain lease costs that are capitalized as tangible assets under

IFRS 16 in accordance with Millicom’s IFRS accounting policies and

that will be expensed as an operating cost in accordance with U.S.

GAAP.

2140 billion Costa Rica Colons at representative exchange rate

of 545:1 as of December 31, 2023.

3290 billion Costa Rica Colons at representative exchange rate

of 545:1 as of December 31, 2023.

FORWARD LOOKING STATEMENT

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including, but not limited to, statements regarding the

timing, benefits and expected impact of the transaction and other

information and statements that are not historical fact. These

forward-looking statements involve certain risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by these statements. These risks and

uncertainties include, but are not limited to, events that are

outside of our control, such as natural disasters and pandemics,

our ability to obtain regulatory approvals for the transaction as

well as satisfying other conditions to closing, as well as other

factors detailed from time to time in our filings with the

Securities and Exchange Commission, including our most recently

filed Form 10-K and Form 10-Q. These forward-looking statements

speak only as of the date of this press release. We expressly

disclaim any obligation or undertaking to disseminate any updates

or revisions to any forward-looking statement contained herein to

reflect any change in our expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731921810/en/

Liberty Latin America

Investor Relations Kunal Patel, ir@lla.com

Media Relations Kim Larson, llacommunications@lla.com

Millicom

Investor Relations Michel Morin,

investors@millicom.com

Media Relations Sofia Corral, press@millicom.com

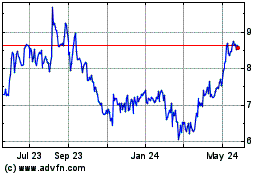

Liberty Latin America (NASDAQ:LILAK)

Historical Stock Chart

From Dec 2024 to Jan 2025

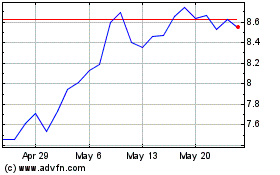

Liberty Latin America (NASDAQ:LILAK)

Historical Stock Chart

From Jan 2024 to Jan 2025