false

0001659617

0001659617

2025-01-27

2025-01-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): January 27, 2025

MOLECULIN BIOTECH, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-37758

|

47-4671997

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Commission File No.)

|

(I.R.S. Employer Identification

No.)

|

5300 Memorial Drive, Suite 950, Houston, TX 77007

(Address of principal executive offices and zip code)

(713) 300-5160

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

MBRX

|

The NASDAQ Stock Market LLC

|

|

Item 7.01

|

Regulation FD Disclosure

|

On January 27, 2025, Moleculin Biotech, Inc. (the “Company”), issued a press release which announced that Walter Klemp, Chairman and Chief Executive Officer of Moleculin participated in a Virtual Investor “What this Means” segment.

A copy of the script is attached to this report as Exhibit 99.1 and is incorporated by reference herein.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be “filed” for the purpose of the Securities Exchange Act of 1934, as amended (“Exchange Act”), nor shall it be incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (“Securities Act”), unless specifically identified therein as being incorporated by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

104

|

Cover page Interactive Data File (formatted as Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MOLECULIN BIOTECH, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

Date:

|

January 27, 2025

|

|

| |

|

|

|

| |

By:

|

/s/ Jonathan P. Foster

|

|

| |

|

Jonathan P. Foster

|

|

Exhibit 99.1

Virtual Investor What This Means featuring Moleculin Bio

Participants:

| |

●

|

Wally Klemp, Chairman and Chief Executive Officer

|

Moleculin Bio (Nasdaq: MBRX)

Jenene Introduction:

| |

●

|

Welcome back to another Virtual Investor What This Means segment. My name is Jenene Thomas, CEO of JTC IR.

|

Today we are featuring Moleculin Biotech! I am pleased to be joined by Walter Klemp, Chairman and Chief Executive Officer of the Company.

Before we get started, I just want to inform our audience that Moleculin Bio is listed on the Nasdaq and trades under the ticker M B R X. During today’s discussion, the Company will be making forward-looking statements and actual results could differ materially from these forward-looking statements. Some of the factors that could cause actual results to differ materially from these contemplated by such forward-looking statements are discussed in the periodic reports Moleculin files with the Securities and Exchange Commission. These documents are available in the Investors section of the Company's website and on the Securities and Exchange Commission's website. We encourage you to review these documents carefully.

Moderated Questions

| |

1.

|

Wally – You are gearing up for an exciting 2025 with the launch of your MIRACLE pivotal study for the treatment of second line R/R AML. Can you please speak to how preparations are going?

|

It is really exciting, Jenene! And, what some investors may not know is just how much work goes into gearing up a global registration trial. When we say registration, we mean that the trial is intended to be used for new drug approval by the FDA and equivalent authorities in Europe and beyond. This means we need to be working with FDA-audited clinical sites, and with the global reach we are targeting, you need a global CRO or contract research organization to manage the process, including site initiation, site monitoring, data management and safety oversight and reporting.

To date, we’ve selected over 25 sites and expect before the trial is done, we may have over 70 sites active. A number of site initiation visits have already been completed, and we still expect the first patient to be treated this quarter. At the same time, behind the scenes, drug distribution depots are being set up in strategic locations around the world, with drug labeled in the local language for each country and ready to be shipped on a moment’s notice.

In the EU, there is a new system called CTIS, which stands for Clinical Trials Information System, and although it requires a bit of lead time and paperwork, once the CTIS process is completed, the process for starting up individual EU member states is now completely unified and fairly streamlined.

In the US, we’ve already amended our trial protocol consistent with guidance from the FDA, and have IRB approval so the remaining lead time here is getting individual institutional ethics committee signoffs and negotiating hospital contracts.

All of this work is intense and complex, but we believe we are on track to reach the first 45 subject unblinding this year and completion of the entire 90-patient Part A of the trial by the first half of 2026.

| |

2.

|

You just returned from your trip, really around the world, meeting with clinical sites to have them involved in the MIRACLE pivotal study. How was that trip and what was the reception like from the physicians you met with?

|

The meetings we’ve had over the last few months have been tremendous. I’ve personally met with over 30 investigators in 11 countries in this process and I’m happy to say that the vast majority of investigators are very excited to participate in this trial. Virtually all investigators acknowledge that Annamycin could fill a significant unmet need for AML patients. That said, some of those investigators view the control arm of our trial to be a challenge and would prefer that all of their patients could receive Annamycin but unfortunately, it isn’t possible to do that while also satisfying the FDA’s requirement for a blinded, randomized trial.

Bottom line, though, those meetings have only increased our confidence in achieving our recruitment goals and they have reinforced how important Annamycin could be to AML patients.

| |

3.

|

Just to add, can you discuss the recent KURA Oncology data and were there any discussions with the KOLs with whom you met around targeted therapies and how Annamycin compares?

|

Yes, the Kura data and their recently announced partnering deal are quite telling. Kura parsed out the performance of their targeted therapy in patients who have relapsed from or were non-responsive to Venetoclax. As you know, roughly half of the AML population is typically treated with a combination of Venetoclax and a hypomethylating agent like Azacitidine. Unfortunately, only about a third of patients treated will succeed with Venetoclax and those who don’t are considered virtually untreatable, with less than 3 months to live, so it’s understandable why Kura would want to focus on their performance in these desperate patients.

Unfortunately, they reported a CRc rate of only 36% in these patients and this was apparently not on an intent to treat basis, meaning they may have excluded patients in the cohort who didn’t receive full treatment. Notably, they didn’t report a CR rate, which is by far the most important measure of efficacy, possibly because they didn’t have any complete responders. By comparison, in the relapsed or refractory Ven-Aza patients we treated in our last trial, we reported a CRc rate of 60% and a CR rate of 40%. And, this was on an intent to treat basis and included a patient who didn’t receive full treatment per protocol. Now, both the Kura data and ours are based on small sample sizes so these all need to be considered preliminary findings, but at least based on these initial data, Annamycin is way outperforming Kura’s targeted therapy.

Now, they lost about half their market cap after announcing the finalization of their partnering deal, which suggests the market was expecting a better deal than the one that was struck. That said, they are still at close to a billion-dollar market cap, which is just one more example of why we have such high expectations for Moleculin’s market value once we start announcing data from our Phase 3 trial this year.

| |

4.

|

It sounds like there is a lot of excitement for this trial in the AML community. Given this positive sentiment from the KOLs how do you think this will translate into the discussions you are having with potential partners?

|

Well, I can tell you that several things are happening. We are having a higher incidence of inbound interest from potential partners and the nature of our discussions is becoming more focused. In particular, it’s becoming clear that the 45-patient data readout could be a pivot point for some big pharma players.

I would also say there has been a bit of a sea change that ties back to the increase in key opinion leaders who are lining up to support what we are doing. In fact, investors can see this for themselves by watching the recording of our recent KOL event. And, in our corporate presentation deck available on our website, we’ve included some of their most important comments and endorsements.

This sort of ties back into your earlier question about targeted therapies. Only a few years ago, these KOL’s would have said the AML community was looking to targeted therapies as the most promising way to address the huge unmet need in AML. Today, that’s all changed, and we believe the investment community just hasn’t caught up with reality yet.

Targeted therapies have been a big disappointment and, in the meantime, Venetoclax, which is a non-targeted chemotherapy, has been pulling up the slack and generating billions in revenue for AbbVie. And, now, we believe Annamycin is in a position to help more AML patients than all of the targeted therapies combined!

| |

5.

|

Before we close, what can investors expect from a timeline perspective as to the start of the study and when can we expect to see data?

|

We continue to expect the first patient to be treated in this first quarter, so that will be a big announcement when it happens. More importantly, as the CTIS application is approved in the EU and as contracts are finalized in the US, a large number of additional sites are expected to come online mid-year, which is why we expect to have unblinded data from the first 45 patients before year-end.

In fact, by the time we have the data scrubbed and unlocked for the first 45 patients, we expect the momentum built with all of these sites will have us completing the entire Part A of the trial, which will be up to 90 patients, by early 2026. As you can tell, we are expecting things to move very quickly for Moleculin in 2025.

Jenene Transition: Closing

| |

●

|

With that, this concludes our What This Means segment featuring Moleculin Biotech. I would like to extend a HUGE thank you to Wally Klemp for joining us today. I would also like to thank our audience for viewing this segment!

|

| |

●

|

As a reminder Moleculin trades on Nasdaq under the ticker M B R X.

|

| |

●

|

If you like what you saw today, I encourage you to visit moleculin.com for more information on the company and to sign up to follow the company to receive their alerts as well as follow their social channels to stay current on the latest information.

|

| |

●

|

You can also visit virtualinvestorco.com for a replay of today’s event as well as our latest segments and event calendar!

|

| |

●

|

Thank you and have a great rest of your day!

|

v3.24.4

Document And Entity Information

|

Jan. 27, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MOLECULIN BIOTECH, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 27, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-37758

|

| Entity, Tax Identification Number |

47-4671997

|

| Entity, Address, Address Line One |

5300 Memorial Drive, Suite 950

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77007

|

| City Area Code |

713

|

| Local Phone Number |

300-5160

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $.001 per share

|

| Trading Symbol |

MBRX

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001659617

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

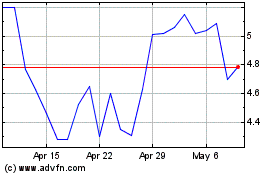

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Jan 2024 to Jan 2025