Northrim BanCorp, Inc. (NASDAQ:NRIM) (“Northrim” or the “Company”)

today announced the acquisition of Sallyport Commercial Finance,

LLC (“Sallyport” or “SCF”) in an all cash transaction that closed

on October 31, 2024 and is valued at approximately $53.9 million.

Sallyport Commercial Finance, LLC is a leading provider of

factoring, asset based lending and alternative working capital

solutions to small and medium sized enterprises in the United

States and Canada. The transaction is expected to provide earnings

accretion of approximately 15% to Northrim’s 2025 operating

results.

“Having worked with Nick and the Sallyport team for several

years, we have been impressed by the quality of the business they

have built,” said Mike Huston, President and CEO of Northrim. “We

view this as an opportunity to partner with a company that has

similar core values of customer service, tailored solutions,

creativity and responsiveness without distracting from our growing

Alaskan banking franchise. We believe our 20 year history in the

factoring business through Northrim Funding Services and our low

cost deposit base makes us the ideal partner to help Sallyport

capture an increased share of a dynamic market segment.”

SCF was founded in 2014 and in 2023 the company surpassed $5

billion in debts factored. SCF’s mission is to provide access to

capital through tailored funding solutions to fuel growth and

provide entrepreneurs opportunities to create value. SCF has

generated consistent profitability since inception including

through periods of macroeconomic disruption by cultivating

relationships with an approach based on a thorough understanding of

each of their clients’ business operations, opportunities, and

challenges.

SCF will operate as a wholly-owned subsidiary, and is expected

to complement the products currently offered by Northrim Funding

Services, a factoring division of Northrim Bank. Executive

management at SCF has over 100 years of combined industry

experience and will remain in their current positions.

“The time working closely with Northrim as a lender and partner

to Sallyport has given me a unique insight into how the team

operates at all levels. I have been very impressed with Northrim’s

ability to develop solutions and deliver on commitments which have

provided growth and opportunity for customers. We are excited

to be joining the Northrim team and look forward to what we can

learn and accomplish together,” said Nick Hart, Co-Founder and

President of SCF.

Northrim has previously invested in related financial

enterprises as part of its growth and diversification strategy.

Current affiliates include wholly-owned Residential Mortgage, LLC,

as well as a non-controlling interest in Pacific Wealth Advisors

and Pacific Portfolio Consulting based in Seattle.

Advisors

Northrim was advised in this transaction by Janney Montgomery

Scott LLC, and Accretive Legal, PLLC served as its legal counsel.

Keefe, Bruyette & Woods, A Stifel Company, acted as financial

adviser for Sallyport, while Latham & Watkins LLP served as its

legal counsel.

Investor Conference Call

Management will host a conference call for the investment

community on Monday, November 4, at 9:00 a.m. Alaska Time (1:00

p.m. ET) to discuss the SCF acquisition. Interested parties may

access the call by dialing 800-231-0316.

About Northrim BanCorp

Northrim BanCorp, Inc. is the parent company of Northrim Bank,

an Alaska-based community bank with 20 branches in Anchorage, Eagle

River, the Matanuska Valley, the Kenai Peninsula, Juneau,

Fairbanks, Nome, Kodiak, Ketchikan, and Sitka, serving 90% of

Alaska’s population; and a factoring and asset-based lending

division in Washington; and a wholly-owned residential mortgage

company, Residential Mortgage Holding Company, LLC. The Bank

differentiates itself with its detailed knowledge of Alaska’s

economy and its “Customer First Service” philosophy. Pacific Wealth

Advisors, LLC is an affiliated company of Northrim BanCorp.

About Sallyport Commercial Finance, LLC

Sallyport Commercial Finance, LLC is a specialty finance

company focused on providing entrepreneurs with working capital

solutions for small to medium sized businesses, to help drive

growth and achieve business hopes and dreams. Sallyport Commercial

Finance, LLC offers a full suite of factoring and asset based

products including Accounts Receivable Finance, Purchase Order

Finance, Equipment and Inventory Finance, Cash Flow Loans, and Real

Estate Loans. Industries represented include but are not limited to

Staffing, Energy, Food & Beverage, Apparel, Manufacturing,

Service Industry, Transportation, Government Receivables, and IT.

Through a subsidiary, Sallyport Commercial Finance, LLC has a

minority interest in factoring operations in the United

Kingdom.

Forward-Looking Statement

This release may contain “forward-looking

statements” as that term is defined for purposes of Section 21E of

the Securities Exchange Act of 1934, as amended. These statements

are, in effect, management’s attempt to predict future events, and

thus are subject to various risks and uncertainties. Readers should

not place undue reliance on forward-looking statements, which

reflect management’s views only as of the date hereof. All

statements, other than statements of historical fact, regarding our

financial position, business strategy, management’s plans and

objectives for future operations are forward-looking statements.

When used in this report, the words “anticipate,” “believe,”

“estimate,” “expect,” and “intend” and words or phrases of similar

meaning, as they relate to Northrim and its management are intended

to help identify forward-looking statements. Although we believe

that management’s expectations as reflected in forward-looking

statements are reasonable, we cannot assure readers that those

expectations will prove to be correct. Forward-looking statements,

are subject to various risks and uncertainties that may cause our

actual results to differ materially and adversely from our

expectations as indicated in the forward-looking statements. These

risks and uncertainties include: descriptions of Northrim’s and

Sallyport’s financial condition, results of operations, asset based

lending volumes, asset and credit quality trends and profitability

and statements about the expected timing, completion, financial

benefits and other effects of the acquisition of Sallyport by

Northrim Bank; expected cost savings, synergies and other financial

benefits from the acquisition of Sallyport by Northrim Bank might

not be realized within the expected time frames and costs or

difficulties relating to integration matters might be greater than

expected; and the ability of Northrim and Sallyport to execute

their respective business plans; potential further increases in

interest rates; the value of securities held in our investment

portfolio; the impact of the results of government initiatives on

the regulatory landscape, natural resource extraction industries,

and capital markets; the impact of declines in the value of

commercial and residential real estate markets, high unemployment

rates, inflationary pressures and slowdowns in economic growth;

changes in banking regulation or actions by bank regulators;

inflation, supply-chain constraints, and potential geopolitical

instability, including the wars in Ukraine and the Middle East;

financial stress on borrowers (consumers and businesses) as a

result of higher rates or an uncertain economic environment; the

general condition of, and changes in, the Alaska economy; our

ability to maintain or expand our market share or net interest

margin; the sufficiency of our provision for credit losses and the

accuracy of the assumptions or estimates used in preparing our

financial statements, including those related to current expected

credit losses accounting guidance; our ability to maintain asset

quality; our ability to implement our marketing and growth

strategies; our ability to identify and address cyber-security

risks, including security breaches, “denial of service attacks,”

“hacking,” and identity theft; disease outbreaks; and our ability

to execute our business plan. Further, actual results may be

affected by competition on price and other factors with other

financial institutions; customer acceptance of new products and

services; the regulatory environment in which we operate; and

general trends in the local, regional and national banking industry

and economy. In addition, there are risks inherent in the banking

industry relating to collectability of loans and changes in

interest rates. Many of these risks, as well as other risks that

may have a material adverse impact on our operations and business,

are identified in the “Risk Factors” section of our Annual Report

on Form 10-K for the fiscal year ended December 31, 2023, and from

time to time are disclosed in our other filings with the Securities

and Exchange Commission. However, you should be aware that these

factors are not an exhaustive list, and you should not assume these

are the only factors that may cause our actual results to differ

from our expectations. These forward-looking statements are made

only as of the date of this release, and Northrim does not

undertake any obligation to release revisions to these

forward-looking statements to reflect events or conditions after

the date of this release.

Note Transmitted on GlobeNewswire on November 1,

2024, at 5:15am Alaska Standard Time.

|

Contact: |

Mike Huston, President, CEO, and COO |

| |

(907) 261-8750 |

| |

Jed Ballard, Chief Financial

Officer |

| |

(907) 261-3539 |

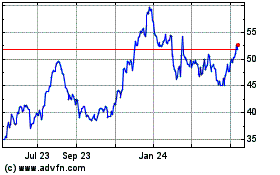

Northrim BanCorp (NASDAQ:NRIM)

Historical Stock Chart

From Dec 2024 to Jan 2025

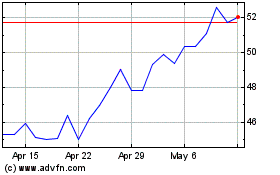

Northrim BanCorp (NASDAQ:NRIM)

Historical Stock Chart

From Jan 2024 to Jan 2025