0001163370false00011633702024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | | | | | | | | | | | | | |

| Date of Report (Date of Earliest Event Reported): | | | November 1, 2024 | ( | October 31, 2024 | ) |

Northrim BanCorp, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Alaska | 0-33501 | 92-0175752 |

________________________

(State or other jurisdiction | _____________

(Commission | _________________

(I.R.S. Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | |

| 3111 C Street, | Anchorage, | Alaska | | 99503 |

___________________________________

(Address of principal executive offices) | | ___________

(Zip Code) |

| | | | | | | | | | | |

| Registrant’s telephone number, including area code: | | 907- | 562-0062 |

Not Applicable

___________________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None | | | | | | | | |

| TITLE OF EACH CLASS | TRADING SYMBOL | NAME OF EXCHANGE |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.126-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On October 31, 2024, Northrim Bank (the “Bank”) entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) by and among the Bank, Sallyport Commercial Finance, LLC (“Sallyport”) and the equity owners of Sallyport identified in the Purchase Agreement (the “Selling Members”). The transactions contemplated by the Purchase Agreement closed on October 31, 2024.

The Bank is a wholly-owned subsidiary of Northrim BanCorp, Inc. (the “Company”). Sallyport and its direct and indirect subsidiaries provide services and products related to factoring and asset-based lending in the United States, Canada, and the United Kingdom. Prior to entering into the Purchase Agreement, the Bank provided loans to Sallyport in the ordinary course of business of the Bank.

The Purchase Agreement provides that, upon the terms and subject to the conditions set forth therein, the Bank will acquire all of the membership interests in Sallyport (the “Membership Interests”), owned by the Selling Members, which constitute all of the outstanding Membership Interests (the “Acquired Interests”). The aggregate consideration payable by the Bank for the Acquired Interests (the “Purchase Price”) shall be equal to $50 million in cash, minus the amount, if any, by which the estimated closing book value of Sallyport is less than $16.4 million, minus the amount of Sallyport’s estimated transaction expenses, minus the net unreserved amount of certain doubtful receivables, plus earn-out payments, if any. The Purchase Price will be paid to the Selling Members in cash. The Purchase Price is also subject to certain post-closing adjustments based on differences between the preliminary estimated book value of Sallyport at closing and the actual book value of Sallyport at closing to be calculated within 45 days following the closing of the transaction.

The Selling Members may receive additional cash proceeds of up to $6 million (the “Earn-Out Payments”). The Earn-Out Payments of $2 million per year are payable on each of the first three anniversaries of the closing of the Purchase Agreement, provided that certain principal employees of Sallyport, including certain of the Seller Members, have not been terminated for “cause” or terminated their employment without “good reason”. The Earn-Out Payments will be accelerated if the Bank experiences a change in control or certain principal employees of Sallyport, including certain of the Seller Members, terminate their employment with Sallyport for “good reason” or are terminated by Sallyport for any reason other than “cause”, including death or disability.

The terms of the Purchase Agreement also allow the Bank to withhold and deduct from the Earn-Out Payments any amount owed to the Bank under certain indemnification provisions of the Purchase Agreement.

The Purchase Agreement contains customary representations and warranties from the Bank and the Selling Members. Additionally, the Selling Members have made representations and warranties on behalf of Sallyport and its subsidiaries related to: organization, authority and qualification; execution and enforceability; capitalization; subsidiaries (including capitalization of subsidiaries); absence of any conflicts or required consents; financial statements; undisclosed liabilities; absence of changes; material contracts; title to assets; sufficiency of assets; intellectual property; systems and data; accounts receivable; material customers; insurance; legal compliance with governmental orders; compliance with laws; employee benefits; tax matters; financing arrangement matters; compliance with anti-corruption laws; books and records, and brokers.

The Bank and the Selling Members have each agreed to customary covenants, including, among others, a two-year non-competition and non-solicitation arrangement. The Purchase Agreement also provides that the Selling Members may receive additional consideration equal to the net amount of any recovery related to the doubtful receivables up to the amount deducted from the initial Purchase Price at closing.

The Purchase Agreement is subject to various customary conditions, including, among others, accuracy of the representations and warranties of Sallyport and the Selling Members, and receipt of required third-party consents.

The Purchase Agreement provides that indemnification for the general representations and warranties will not survive the closing and recovery for any related losses will be limited to the representation and warranty insurance policy entered into in connection with the Purchase Agreement. Certain fundamental representations and identified matters of the Bank, Sallyport and the Selling Members survive until the expiration of the applicable statute of limitations with respect to the particular matter. In the event that the Bank suffers damages due to a breach or inaccuracy in any of the general representations and warranties of Sallyport or the Selling Members, indemnification for such damages will be limited to recovery under the representation and warranty insurance policy. In the event that the Bank suffers damages due to a breach or inaccuracy in the fundamental representations and warranties of Sallyport or the Selling Members or with respect to certain specified matters, indemnification will be apportioned among the Selling Members in proportion to their respective pre-closing ownership of the Membership Interests. The total amount of indemnification payments that each Selling Member is required to make under the Purchase Agreement related to a breach of the fundamental representations and warranties of Sallyport or the Selling Members or with respect to certain specified matters is limited to the amount of each Selling Members pro-rata share of the Purchase Price actually received by the Selling Members. Further, pursuant to the terms of the Purchase Agreement, the Bank must first seek recovery from the representation and warranty insurance for any indemnification claim arising out of a breach of the representations, warranties or covenants of Sallyport or the Selling Members.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full and complete text of the Purchase Agreement, which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2024.

Item 7.01 Regulation FD Disclosure.

The information furnished under Item 7.01 of this Current Report shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Attached as Exhibit 99.1 are presentation materials relating to Northrim BanCorp, Inc.

Item 8.01 Other Events.

On November 1, 2024, Northrim and Sallyport issued a joint press release announcing the execution and closing of the Purchase Agreement. A copy of the joint press release is attached hereto as Exhibit 99.2, and is incorporated by reference herein.

Forward-looking Statements

This current report on Form 8-K contains “forward-looking statements” that are subject to risks and uncertainties. These statements include, but are not limited to, descriptions of Northrim’s and Sallyport’s financial condition, results of operations, asset based lending volumes, asset and credit quality trends and profitability and statements about the expected timing, completion, financial benefits and other effects of the proposed acquisition of Sallyport by Northrim Bank. All statements, other than statements of historical fact, regarding the financial position, business strategy and respective management’s plans and objectives for future operations of each of Northrim and Sallyport are forward-looking statements. Readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. When used in this report, the words “anticipate,” “believe,” “estimate,” “expect,” and “intend” and words or phrases of similar meaning, as they relate to Northrim, Northrim’s management, Sallyport, or Sallyport’s management are intended to help identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Although we believe that management’s respective expectations as reflected in forward-looking statements are reasonable, we cannot assure readers that those expectations will prove to be correct. Forward-looking statements are subject to various risks and uncertainties that may cause actual results to differ materially and adversely from expectations as indicated in the forward-looking statements. These risks and uncertainties include: expected cost savings, synergies and other financial benefits from the proposed acquisition of Sallyport by Northrim Bank might not be realized within the expected time frames and costs or difficulties relating to integration matters might be greater than expected; and the ability of Northrim and Sallyport to execute their respective business plans (including the acquisition of Sallyport by Northrim Bank). Further, actual results may be affected by the ability to compete on price and other factors with other financial institutions; customer acceptance of new products and services; the regulatory environment in which we operate; and general trends in the local, regional and national banking industry and economy as those factors relate to the cost of funds and return on assets. In addition, there are risks inherent in the mortgage and banking industries relating to collectability of loans and changes in interest rates. Many of these risks, as well as other risks that may have a material adverse impact on our operations and business, are identified in other filings of Northrim made with the SEC. However, you should be aware that these factors are not an exhaustive list, and you should not assume these are the only factors that may cause our actual results to differ from our expectations. These forward-looking statements are made only as of the date of this current report, and neither Northrim nor Sallyport undertakes an obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this current report.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements – not applicable

(b) Proforma financial information – not applicable

(c) Shell company transactions – not applicable

| | | | | | | | |

| (d) Exhibit No. | | Description |

| | |

| 99.1 | | Presentation Materials relating to Northrim BanCorp, Inc. |

| 99.2 | | Press Release dated November 1, 2024. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | Northrim BanCorp, Inc. |

| | | | | |

| November 1, 2024 | | By: | | /s/ Michael G. Huston |

| | | | | Name: Michael G. Huston |

| | | | | Title: President & Chief Executive Officer |

Exhibit Index

Strategic Acquisition of Sallyport Commercial Finance Investor Presentation November 1, 2024 Nasdaq: NRIM 1

Forward Looking Statement 2 This investor presentation may contain “forward-looking statements” as that term is defined for purposes of Section 21E of the Securities Exchange Act of 1934, as amended. These statements are, in effect, management’s attempt to predict future events, and thus are subject to various risks and uncertainties. Readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. All statements, other than statements of historical fact, regarding our financial position, business strategy, management’s plans and objectives for future operations are forward-looking statements. When used in this report, the words “anticipate,” “believe,” “estimate,” “expect,” and “intend” and words or phrases of similar meaning, as they relate to Northrim and its management are intended to help identify forward-looking statements. Although we believe that management’s expectations as reflected in forward-looking statements are reasonable, we cannot assure readers that those expectations will prove to be correct. Forward-looking statements, are subject to various risks and uncertainties that may cause our actual results to differ materially and adversely from our expectations as indicated in the forward-looking statements. These risks and uncertainties include: descriptions of Northrim’s and Sallyport’s financial condition, results of operations, asset based lending volumes, asset and credit quality trends and profitability and statements about the expected timing, completion, financial benefits and other effects of the acquisition of Sallyport by Northrim Bank; expected cost savings, synergies and other financial benefits from the acquisition of Sallyport by Northrim Bank might not be realized within the expected time frames and costs or difficulties relating to integration matters might be greater than expected; and the ability of Northrim and Sallyport to execute their respective business plans; potential further increases in interest rates; the value of securities held in our investment portfolio; the impact of the results of government initiatives on the regulatory landscape, natural resource extraction industries, and capital markets; the impact of declines in the value of commercial and residential real estate markets, high unemployment rates, inflationary pressures and slowdowns in economic growth; changes in banking regulation or actions by bank regulators; inflation, supply-chain constraints, and potential geopolitical instability, including the wars in Ukraine and the Middle East; financial stress on borrowers (consumers and businesses) as a result of higher rates or an uncertain economic environment; the general condition of, and changes in, the Alaska economy; our ability to maintain or expand our market share or net interest margin; the sufficiency of our provision for credit losses and the accuracy of the assumptions or estimates used in preparing our financial statements, including those related to current expected credit losses accounting guidance; our ability to maintain asset quality; our ability to implement our marketing and growth strategies; our ability to identify and address cyber-security risks, including security breaches, “denial of service attacks,” “hacking,” and identity theft; disease outbreaks; and our ability to execute our business plan. Further, actual results may be affected by competition on price and other factors with other financial institutions; customer acceptance of new products and services; the regulatory environment in which we operate; and general trends in the local, regional and national banking industry and economy. In addition, there are risks inherent in the banking industry relating to collectability of loans and changes in interest rates. Many of these risks, as well as other risks that may have a material adverse impact on our operations and business, are identified in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and from time to time are disclosed in our other filings with the Securities and Exchange Commission. However, you should be aware that these factors are not an exhaustive list, and you should not assume these are the only factors that may cause our actual results to differ from our expectations. These forward-looking statements are made only as of the date of this investor presentation, and Northrim does not undertake any obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this release.

Overview of Sallyport Commercial Finance 3 Select Financial Highlights1,2 85 Active Clients 22% Debts Factored CAGR Since 2015 11% Adjusted Pre-Tax ROAA $19.5M Total Net Revenue 26% Revenue Yield $7.7M Adjusted Pre-Tax Net Income Company Overview • Founded in 2014, Sallyport Commercial Finance (“Sallyport” or “SCF”) is a leading provider of factoring, asset based lending, and alternative working capital solutions to small and medium sized enterprises • Generated exceptional profitability every year since inception including throughout multiple periods of macroeconomic turmoil • Factored $5.5+ billion of debts across U.S. and Canada, driving consistent growth of the client base, revenue, and profitability • Executive management has 100+ years of combined industry experience and ~7 years of average tenure at SCF • Proven ability to successfully scale with operations throughout the U.S. and Canada and a presence in the U.K. o SCF controls 100% of Sallyport Commercial Finance ULC (Canada) o SCF has a non-controlling interest of 40% of Sallyport Commercial Finance LTD (U.K.) Active Clients by Asset Type and Industry1,3 1 Excludes Sallyport Commercial Finance LTD (U.K.) 2 As of last twelve months ended 9/30/2024 3 As of 9/30/2024 Active Clients by Geography1,3 1 0 Canada (19) Asset Type % Factoring 65.8% Asset Based Lending 22.5% Cash Flow Loan 3.9% Purchase Order 2.8% Inventory 2.6% Real Estate 1.2% Equipment 0.8% Construction 0.4% 2 15 1 3 2 2 1 4 1 1 4 1 3 4 17 1 2 1 1 18.2% 16.2% 13.0% 12.9% 11.5% 9.8% 7.0% 6.0% 5.3% Manufacturing Service Pharmaceuticals Other Energy Staffing Apparel & Accessories Food & Beverage Transportation

$17.4 $19.1 $32.9 $46.0 $57.2 $51.3 $67.1 $67.0 $85.4 $75.6 $154 $223 $281 $446 $597 $520 $765 $1,157 $966 $874 -$500 $0 $500 $1, 00 $1, 50 $0. 0 $20. 0 $40. 0 $60. 0 $80. 0 $100.0 $120.0 $140.0 2015 2016 2017 2018 2019 2020 2021 2022 2023 LTM 9/30/24 NFE ($M) Debts Factored ($M) Adj. Pretax Net Income ($M) Oil and Gas Downturn The price of oil dropped from $136 in June 2014 to $44 in January 2016, impacting the broader economy and particularly the Southwest U.S. SCF was new at the time with some of its clients in the energy business Despite these circumstances, SCF delivered profitability and impressive returns Historical Financial Summary COVID-19 Pandemic Consistently strong equity returns throughout a global pandemic that greatly impacted SCF and all of its small business clients Rising Rate Environment SCF achieved record annual profitability despite inflation and rapidly increasing funding costs Strong Growth in Volume and Net Funds Employed (“NFE”) While Demonstrating Business Model Resiliency through Multiple Periods of Market Volatility Bank Liquidity Crisis Delivering excellent results despite turmoil in the banking industry $0.6 $2.0 $2.3 $3.2 $5.5 $3.6 $5.8 $6.5 $8.1 $7.7 Note: Excludes Sallyport Commercial Finance LTD (U.K.) 4

1.1% 0.5% 1.3% 2.8% 1.0% 1.6% 6.1% 2.0% (1.5%) 2.0% 30.5% 28.0% 27.3% 27.7% 26.3% 25.2% 30.7% 26.3% 26.5% 26.7% 29.4% 27.5% 26.0% 24.9% 25.3% 23.5% 24.6% 24.4% 28.0% 24.7% -6. 0% -1. 0% 4.0% 9.0% 14. 0% 19. 0% 24. 0% 29. 0% 34. 0% 2015 2016 2017 2018 2019 2020 2021 2022 2023 YTD 9/30/24 (Annualized) Annual Provision Expense / Avg. NFE % Total Revenue Yield % Risk-Adjusted Spread % Historical Credit Performance Proven Track Record of Disciplined Underwriting and Portfolio Monitoring, Supported by Continuous Delivery of Superior Risk-Adjusted Returns 5 Robust Underwriting Portfolio Management Process Systematic Approach to Risk In-depth search and diligence process is performed before a credit is considered Regular portfolio reviews for new clients and large balances along with ongoing verification of receivables and collection activity Thorough credit package is compiled Formal credit approval process Reconciliation and verification of receivables Hands on monitoring approach with clear and constant communication amongst both clients and debtors Senior secured positions with personal and / or corporate guaranties UCC filing on all assets of the client Low effective advance rates across portfolio Diversified portfolio across geography and industry Average Annual Provision Expense / Average NFE: 1.7% Note: Excludes Sallyport Commercial Finance LTD (U.K.)

$3.6 $5.7 2022 2031E Market Opportunity 6 Total Global Factoring Market ($T)1 Total Global Private ABL Market ($T)1 U.S. Small Business Market2 • The global factoring market size was worth over $3.6T in 2022 and is expected to grow to over $5.7T by 2031 • The growth in the factoring market is driven by the challenges small and medium sized businesses face in accessing affordable financing, leading them to turn to alternative funding sources of financing to meet their needs • Rising cross-border trade activities are expected to propel the growth of the factoring market going forward • The vast global private ABL market is estimated to be $5.2T+ and has continued to grow impressively since the global financial crisis • The ongoing disintermediation of traditional bank financing and technological innovation have spurred rapid growth in recent years and the trend is expected to continue • The tremors in the global banking sector in 2023 are expected to bolster the tailwinds driving growth in the private ABL sector . 33.2M SMEs in the U.S. 23.9M (72%) of SMEs Seeking Credit • There are 33.2 million small and medium sized enterprises (“SMEs”), making up 99.9% of all businesses in the U.S. • A strong opportunity exists for alternative lenders 1 Per Straits Research, “Factoring Market Size, Share Forecast till 2031” and Per KKR, “Asset Based Finance: A Fast-Growing Frontier in Private Credit” 2 Per U.S. Small Business Administration $3.1 $5.2 $7.7 2006 2022 2027E

Transaction Culminating a Longstanding Relationship 7 • Completed a comprehensive due diligence review of all aspects of Sallyport’s business by an internal diligence team along with our advisors and consultants • Internal review of 85% of the outstanding credits • Conducted third party Quality of Earnings review • Conducted third party Collateral Exam • Extensive legal review by outside counsel • Annual BDO audited financial statements Diligence Focus Areas Aided by a Thorough Due Diligence Process Operations Cash Flows Human Resources • The management team at Northrim and Northrim Funding Services have had a relationship with Sallyport and its executives since 2018 • Northrim and Sallyport have similar cultures and corporate values, focused on relationship-based customer service to provide solutions to small and mid-sized business • In addition to participating in factoring transactions together, the two companies have often provided each other with referrals in cases where a potential client may be a better fit for the other party’s operating strategy • As a lender to Sallyport, Northrim has also been afforded the opportunity to develop a better understanding of Sallyport’s operations and financial performance o Since 2021, Northrim has participated in a syndicated senior line of credit o In 2023, Northrim provided $6 million in subordinated debt capital Asset Quality Collateral Information Technology Financial & Accounting Legal Compliance: AML / KYC

Strategic Rationale 8 Financially Compelling • Significant accretion (on accrual and cash basis) to projected earnings in first full year, with significant ramp- up as business transitions to bank-funded model o Robust accretion expected to both ROAA and ROATCE • Manageable initial tangible book value dilution with an acceptable TBV earn-back period • Leverages excess capital and liquidity • Attractive IRR Low Execution Risk • Company and management team well-known by NRIM o NRIM has served as a lender to Sallyport since 2021 o NRIM has participated in factoring deals with Sallyport since 2022 • NRIM has successfully referred business from NFS to Sallyport since 2018 • Highly experienced leadership team will continue to operate the business o Two founding leaders (Nick and Emma Hart) each have over 30 years of factoring experience o As a whole, executive management has on average 26 years of experience, seven with Sallyport • Thorough due diligence with internal and third-party teams completed Complementary Business with Enhanced Growth Prospects • Complements NRIM’s core community banking model o Adds North American platform at scale o Additive to existing factoring business at Northrim Funding Services (“NFS”) o Slightly increases NRIM’s portfolio diversification • Strong pipeline supporting potential for double-digit growth in average earning assets o NRIM’s attractive, low-cost deposit base allows for more competitive pricing to win more business • Opportunity for low-cost deposit generation with cash management / lock-box services as well as operating accounts from Sallyport clients • Opportunity to integrate back-office functions into NRIM, allowing Sallyport to focus on their core business and growth

Target • Sallyport Commercial Finance, LLC Purchase Price • $47.9 million upfront and $6.0 million deferred, paid out in equal installments over three years Consideration • 100% cash Executive Management • Executive management will remain with the company in current roles One-Time Costs • Approximately $1.1 million Cost Savings • Minimal expected cost savings (other than funding costs) Timing • Closed Transaction Overview & Pro Forma Impact 9 Pro Forma Impact • EPS Accretion: ~15% for 2025E and ~20% for 2026E • ROAA Improvement: Approx. +15 bps for 2025E and +20 bps for 2026E • ROATCE Improvement: Approx. +475 bps for 2025E and +500 bps for 2026E • TBV Earn-back ~3 ½ years • Internal Rate of Return ~25% • Pro Forma Tier 1 Leverage Ratio ~8%

Summary Overview of Northrim Funding Services 10 • Northrim Funding Services is a division of Northrim Bank that offers factoring solutions to small businesses • Started in 2004; based out of Bellevue, Washington • Higher risk-adjusted returns • Ability to reduce credit exposure to troubled Northrim borrowers NFS: Average NFE NFS: Revenue ($M) and Revenue Yield $4.0 $4.9 $4.2 14.9% 17.8% 15.2% 2022 2023 YTD'24 Revenue ($M) Revenue Yield $24.8 $33.8 $32.5 $27.6 $31.3 $2.7 $6.5 $5.7 $4.2 $5.5 $27.4 $40.3 $38.2 $31.8 $36.8 2023 1Q'24 2Q'24 3Q'24 YTD'24 Avg. Purchased Receivables ($M) Avg. ABL Loans ($M)

Overview of Northrim

Northrim Overview 12 $3.0 billion community bank founded in 1990 to provide financial services to Alaskan residents and businesses • Superior customer first service • Strong balance sheet • Solid net interest margin; pricing reflects quality service • Focus on asset quality • Diversified revenue sources • Leadership to build Alaska’s economy 1990 1999 2000 2007 2008 2014 2020 2021 Founded Acquired Bank of America Branches Wells Fargo acquisition of National Bank of Alaska Assets exceed $1 Billion Acquired Alaska First Bank & Trust Acquired Alaska Pacific Bankshares Acquired 100% of Residential Mortgage, LLC Assets exceed $2 Billion Originated approx. 5,800 ($613M) PPP loans (2,300 to new customers) Anchorage HQ & 9 Branches Nome Fairbanks Soldotna Kodiak Juneau Sitka Ketchikan Legend Scale:100mi Branches: 20 2022 Opened branch in Nome 2023 Opened Kodiak branch Opened Homer LPO Homer 2024 Opened Homer Financial Center 1998 Original investor in Residential Mortgage, LCC at 24% Wasilla

3rd Quarter 2024 | Financial Highlights 13 Earnings & Profitability Q3-24 Q2-24 Q3-23 Earnings per Share $1.57 $1.62 $1.48 Net Income (in Thousands) $8,825 $9,020 $8,374 Net Interest Margin 4.29% 4.24% 4.15% ROAA 1.22% 1.31% 1.22% ROAE 13.69% 14.84% 14.67% Dividends per Share $0.62 $0.61 $0.60 Balance Sheet & Capital Total Loans (in Millions) $2,008 $1,876 $1,720 Total Deposits (in Millions) $2,626 $2,464 $2,428 Total Capital / Risk Adjusted Assets 12.50% 12.58% 12.58% Shareholders' equity / Total assets 8.78% 8.76% 8.07% TCE 8.28% 8.24% 7.54% Tangible Book Value per Share $44.36 $42.03 $37.72 Asset Quality NPAs / Total Assets, net govt guarantees 0.18% 0.18% 0.19% Total Loan ACL/Portfolio Loans 0.97% 0.94% 0.96% Net Income $8.825 million EPS $1.57 ROAA 1.22% ROAE 13.69% Loan Growth 16.7% YoY NIM 4.29% Portfolio Loan Yield 6.91% Cost of IB Deposits 2.24%

Shareholder Value Creation Through TBV Accretion, Dividends and Buy Backs 14 Shares outstanding (millions) 6.427 6.467 6.512 6.538 6.854 6.877 6.898 6.872 6.883 6.560 6.250 6.020 5.700 5.513 5.502 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Sept-'24 Q3 2024 Dividend $0.62 Annualized Dividend $2.48 Price @ October 30, 2024 $66.51 Dividend Yield 3.74% Notes: Tangible book value per share is a non-GAAP financial measure - see Non-GAAP reconciliations in Appendix; 2024 dividend per share as of last twelve months

Investment Opportunity 15 Unique Banking Environment Provides Opportunities to Gain Market Share • Northrim deposit market share has increased by 540 basis points since 2018 Alaska Banking Environment Drives Higher Yields on Loans and Lower Deposit Costs • Northrim loan yields averaged 5.64% over last 10 years vs 4.95% in the U.S. (as of 12/31/2023) • Northrim interest-bearing deposits costs averaged 44 bps over last 10 years vs 72 bps in the U.S. (as of 12/31/2023) • Increasingly diverse economy Experienced Management Team Delivering Asset and Profitability Growth • Branch expansion strategy benefiting from competitor pull back • Adding additional team members has enhanced loan and deposit originations • Credit culture has positioned bank for potential economic downturn New and Repricing Loans Will Drive Stable / Improving NIM • 31% of loans mature or reprice in the next three months, 16% of loans mature or reprice in three to twelve months, and 28% of loans mature or reprice in one to three years • 29% of deposits are non-interest bearing Capital Management • Repurchased ~20% of outstanding shares in last 5 years • Increased dividend by 100% in last 4 years, currently at $0.62 / share / quarter

Appendix

17 Non-GAAP Reconciliation (In thousands) 2020 2021 2022 2023 2023 Q3 2024 Q3 Shareholders' Equity $221,575 $237,817 $218,629 $234,718 $225,259 $260,050 Total Assets 2,121,798 2,724,719 2,672,041 2,807,497 2,790,189 2,963,392 Total Shareholders' Equity to Total Assets Ratio 10.44% 8.73% 8.18% 8.36% 8.07% 8.78% Shareholders' Equity $221,575 $237,817 $218,629 $234,718 $225,259 $260,050 Less: Goodwill and Other Intangible Assets 16,046 16,009 15,984 15,967 15,973 15,967 Tangible Common Shareholders' Equity $205,529 $221,808 $202,645 $218,751 $209,286 $244,083 Total Assets $2,121,798 $2,724,719 $2,674,318 $2,807,497 $2,790,189 $2,963,392 Less: Goodwill and Other Intangible Assets 16,046 16,009 15,984 15,967 15,973 15,967 Tangible assets $2,105,752 $2,708,710 $2,658,334 $2,791,530 $2,774,216 $2,947,425 Tangible Common Equity to Tangible Assets Ratio 9.76% 8.19% 7.62% 7.84% 7.54% 8.28% 2018 2019 2020 2021 2022 2023 2024 (LTM) Operating Expense, Community Banking Segment $49,956 $54,988 $57,614 $58,647 $63,902 $70,684 $73,650 Avg Earning Assets, Consolidated $1,346,449 $1,386,557 $1,758,839 $2,260,778 $2,469,383 $2,491,651 $2,603,353 Less: Avg Consumer Mortgages 131,810 203,252 Less: Avg Loans Held for Sale 46,089 56,344 105,287 101,752 51,566 41,644 59,290 Less: Avg Interest-bearing Cash, RML 4,600 5,803 5,325 5,435 7,726 6,651 8,266 Avg Earning Assets, Community Banking Segment $1,295,760 $1,324,410 $1,648,227 $2,153,591 $2,410,091 $2,311,546 $2,332,545 Community Banking Operating Exp / Avg Earning Assets 3.86% 4.15% 3.50% 2.72% 2.65% 3.06% 3.16%

18 Non-GAAP Reconciliation 2010 2011 2012 2013 2014 2015 Shareholders' Equity $117,122 $125,435 $136,353 $144,318 $164,441 $177,214 Divided by Common Shares Outstanding 6,427 6,467 6,512 6,538 6,854 6,877 Book Value per Share $18.22 $19.40 $20.94 $22.07 $23.99 $25.77 Shareholders' Equity $117,122 $125,435 $136,353 $144,318 $164,441 $177,214 Less: Goodwill and Other Intangible Assets 8,697 8,421 8,170 7,942 24,035 23,776 Tangible Common Shareholders' Equity $108,425 $117,014 $128,183 $136,376 $140,406 $153,438 Divided by Common Shares Outstanding 6,427 6,467 6,512 6,538 6,854 6,877 Tangible Book Value per Share $16.87 $18.09 $19.69 $20.86 $20.48 $22.31 2016 2017 2018 2019 2020 2021 Shareholders' Equity $186,712 $192,802 $205,947 $207,117 $221,575 $237,817 Divided by Common Shares Outstanding 6,898 6,872 6,883 6,559 6,251 6,015 Book Value per Share $27.07 $28.06 $29.92 $31.58 $35.45 $39.54 Shareholders' Equity $186,712 $192,802 $205,947 $207,117 $221,575 $237,817 Less: Goodwill and Other Intangible Assets 16,324 16,224 16,154 16,094 16,046 16,009 Tangible Common Shareholders' Equity $170,388 $176,578 $189,793 $191,023 $205,529 $221,808 Divided by Common Shares Outstanding 6,898 6,872 6,883 6,559 6,251 6,015 Tangible Book Value per Share $24.70 $25.70 $27.57 $29.12 $32.88 $36.88 2022 2023 2023 Q3 2024 Q2 2024 Q3 Shareholders' Equity $218,629 $234,718 $225,259 $247,200 $260,050 Divided by Common Shares Outstanding 5,701 5,513 5,548 5,502 5,502 Book Value per Share $38.35 $42.57 $40.60 $44.93 $47.27 Shareholders' Equity $218,629 $234,718 $225,259 $247,200 $260,050 Less: Goodwill and Other Intangible Assets 15,984 15,967 15,973 15,967 15,967 Tangible Common Shareholders' Equity $202,645 $218,751 $209,286 $231,233 $244,083 Divided by Common Shares Outstanding 5,701 5,513 5,548 5,502 5,502 Tangible Book Value per Share $35.55 $39.68 $37.72 $42.03 $44.36

| | | | | |

| Contact: | Mike Huston, President, CEO, and COO |

| (907) 261-8750 |

| Jed Ballard, Chief Financial Officer |

| (907) 261-3539 |

Northrim BanCorp to Purchase Sallyport Commercial Finance, LLC

ANCHORAGE, Alaska - November 1, 2024 - Northrim BanCorp, Inc. (NASDAQ:NRIM) ) (“Northrim” or the “Company”) today announced the acquisition of Sallyport Commercial Finance, LLC (“Sallyport” or “SCF”) in an all cash transaction that closed on October 31, 2024 and is valued at approximately $53.9 million. Sallyport Commercial Finance, LLC is a leading provider of factoring, asset based lending and alternative working capital solutions to small and medium sized enterprises in the United States and Canada. The transaction is expected to provide earnings accretion of approximately 15% to Northrim’s 2025 operating results.

“Having worked with Nick and the Sallyport team for several years, we have been impressed by the quality of the business they have built,” said Mike Huston, President and CEO of Northrim. “We view this as an opportunity to partner with a company that has similar core values of customer service, tailored solutions, creativity and responsiveness without distracting from our growing Alaskan banking franchise. We believe our 20 year history in the factoring business through Northrim Funding Services and our low cost deposit base makes us the ideal partner to help Sallyport capture an increased share of a dynamic market segment.”

SCF was founded in 2014 and in 2023 the company surpassed $5 billion in debts factored. SCF’s mission is to provide access to capital through tailored funding solutions to fuel growth and provide entrepreneurs opportunities to create value. SCF has generated consistent profitability since inception including through periods of macroeconomic disruption by cultivating relationships with an approach based on a thorough understanding of each of their clients’ business operations, opportunities, and challenges.

SCF will operate as a wholly-owned subsidiary, and is expected to complement the products currently offered by Northrim Funding Services, a factoring division of Northrim Bank. Executive management at SCF has over 100 years of combined industry experience and will remain in their current positions.

“The time working closely with Northrim as a lender and partner to Sallyport has given me a unique insight into how the team operates at all levels. I have been very impressed with Northrim’s ability to develop solutions and deliver on commitments which have provided growth and opportunity for customers. We are excited to be joining the Northrim team and look forward to what we can learn and accomplish together,” said Nick Hart, Co-Founder and President of SCF.

Northrim has previously invested in related financial enterprises as part of its growth and diversification strategy. Current affiliates include wholly-owned Residential Mortgage, LLC, as well as a non-controlling interest in Pacific Wealth Advisors and Pacific Portfolio Consulting based in Seattle.

Advisors

Northrim was advised in this transaction by Janney Montgomery Scott LLC, and Accretive Legal, PLLC served as its legal counsel. Keefe, Bruyette & Woods, A Stifel Company, acted as financial adviser for Sallyport, while Latham & Watkins LLP served as its legal counsel.

Investor Conference Call

Management will host a conference call for the investment community on Monday, November 4, at 9:00 a.m. Alaska Time (1:00 p.m. ET) to discuss the SCF acquisition. Interested parties may access the call by dialing 800-231-0316.

About Northrim BanCorp

Northrim BanCorp, Inc. is the parent company of Northrim Bank, an Alaska-based community bank with 20 branches in Anchorage, Eagle River, the Matanuska Valley, the Kenai Peninsula, Juneau, Fairbanks, Nome, Kodiak, Ketchikan, and Sitka, serving 90% of Alaska’s population; and a factoring and asset-based lending division in Washington; and a wholly-owned residential mortgage company, Residential Mortgage Holding Company, LLC. The Bank differentiates itself with its detailed knowledge of Alaska’s economy and its “Customer First Service” philosophy. Pacific Wealth Advisors, LLC is an affiliated company of Northrim BanCorp.

About Sallyport Commercial Finance, LLC

Sallyport Commercial Finance, LLC is a specialty finance company focused on providing entrepreneurs with working capital solutions for small to medium sized businesses, to help drive growth and achieve business hopes and dreams. Sallyport Commercial Finance, LLC offers a full suite of factoring and asset based products including Accounts Receivable Finance, Purchase Order Finance, Equipment and Inventory Finance, Cash Flow Loans, and Real Estate Loans. Industries represented include but are not limited to Staffing, Energy, Food & Beverage, Apparel, Manufacturing, Service Industry, Transportation, Government Receivables, and IT. Through a subsidiary, Sallyport Commercial Finance, LLC has a minority interest in factoring operations in the United Kingdom.

Forward-Looking Statement

This release may contain “forward-looking statements” as that term is defined for purposes of Section 21E of the Securities Exchange Act of 1934, as amended. These statements are, in effect, management’s attempt to predict future events, and thus are subject to various risks and uncertainties. Readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. All statements, other than statements of historical fact, regarding our financial position, business strategy, management’s plans and objectives for future operations are forward-looking statements. When used in this report, the words “anticipate,” “believe,” “estimate,” “expect,” and “intend” and words or phrases of similar meaning, as they relate to Northrim and its management are intended to help identify forward-looking statements. Although we believe that management’s expectations as reflected in forward-looking statements are reasonable, we cannot assure readers that those expectations will prove to be correct. Forward-looking statements, are subject to various risks and uncertainties that may cause our actual results to differ materially and adversely from our expectations as indicated in the forward-looking statements. These risks and uncertainties include: descriptions of Northrim’s and Sallyport’s financial condition, results of operations, asset based lending volumes, asset and credit quality trends and profitability and statements about the expected timing, completion, financial benefits and other effects of the acquisition of Sallyport by Northrim Bank; expected cost savings, synergies and other financial benefits from the acquisition of Sallyport by Northrim Bank might not be realized within the expected time frames and costs or difficulties relating to integration matters might be greater than expected; and the ability of Northrim and Sallyport to execute their respective business plans; potential further increases in interest rates; the value of securities held in our investment portfolio; the impact of the results of government initiatives on the regulatory landscape, natural resource extraction industries, and capital markets; the impact of declines in the value of commercial and residential real estate markets, high unemployment rates, inflationary pressures and slowdowns in economic growth; changes in banking regulation or actions by bank regulators; inflation, supply-chain constraints, and potential geopolitical instability, including the wars in Ukraine and the Middle East; financial stress on borrowers (consumers and businesses) as a result of higher rates or an uncertain economic environment; the general condition of, and changes in, the Alaska economy; our ability to maintain or expand our market share or net interest margin; the sufficiency of our provision for credit losses and the accuracy of the assumptions or estimates used in preparing our financial statements, including those related to current expected credit losses accounting guidance; our ability to maintain asset quality; our ability to implement our marketing and growth strategies; our ability to identify and address cyber-security risks, including security breaches, “denial of service attacks,” “hacking,” and identity theft; disease outbreaks; and our ability to execute our business plan. Further, actual results may be affected by competition on price and other factors with other financial institutions; customer acceptance of new products and services; the regulatory environment in which we operate; and general trends in the local, regional and national banking industry and economy. In addition, there are risks inherent in the banking industry relating to collectability of loans and changes in interest rates. Many of these risks, as well as other risks that may have a material adverse impact on our operations and business, are identified in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and from time to time are disclosed in our other filings with the Securities and Exchange Commission. However, you should be aware that these factors are not an exhaustive list, and you should not assume these are the only factors that may cause our actual results to differ from our expectations. These forward-looking statements are made only as of the date of this release, and Northrim does not undertake any obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this release.

Note Transmitted on GlobeNewswire on November 1, 2024, at 5:15 am Alaska Standard Time.

v3.24.3

Document and Entity Information Document

|

Oct. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 31, 2024

|

| Entity Registrant Name |

Northrim BanCorp, Inc.

|

| Entity Central Index Key |

0001163370

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

AK

|

| Entity File Number |

0-33501

|

| Entity Tax Identification Number |

92-0175752

|

| Entity Address, Address Line One |

3111 C Street,

|

| Entity Address, City or Town |

Anchorage,

|

| Entity Address, State or Province |

AK

|

| Entity Address, Postal Zip Code |

99503

|

| City Area Code |

907-

|

| Local Phone Number |

562-0062

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

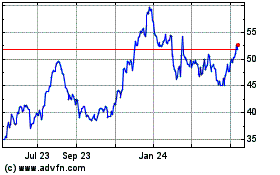

Northrim BanCorp (NASDAQ:NRIM)

Historical Stock Chart

From Dec 2024 to Jan 2025

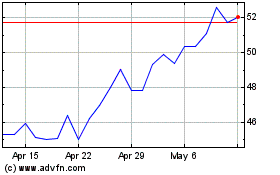

Northrim BanCorp (NASDAQ:NRIM)

Historical Stock Chart

From Jan 2024 to Jan 2025