false

0001433607

0001433607

2024-11-12

2024-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 12, 2024

InspireMD,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35731

|

|

26-2123838 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

6303

Waterford District Drive,

Suite

215 Miami,

Florida |

|

33126 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888) 776-6804

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

NSPR |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure.

On

November 12, 2024, InspireMD, Inc. issued a press release announcing its financial and operating results and recent highlights for the

three and nine months ended September 30, 2024. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein

by reference.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K that is furnished pursuant to

this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

INSPIREMD,

INC. |

| |

|

|

| Date:

November 12, 2024 |

By: |

/s/

Craig Shore |

| |

Name: |

Craig

Shore |

| |

Title: |

Chief

Financial Officer |

Exhibit 99.1

InspireMD

Reports Third Quarter 2024 Financial Results and Provides

Business

Update

-

Submitted a Premarket Approval (PMA) application to the FDA seeking marketing approval of the CGuard Prime carotid stent system in the

U.S. -

-

Announced approval of an IDE application to initiate the CGUARDIANS II pivotal study of the CGuard Prime carotid stent system for use

during TCAR procedures –

-

Established its Headquarters in Miami, Florida, to optimally support the anticipated U.S. commercial launch of CGuard Prime in H1 2025,

if approved –

Achieved

another record high revenue and unit quarter of $1.81M and 3,121 respectively in served markets

—

Management

to host investor conference call today, November 12th, at 8:30am ET

—

Miami,

FL — November 12, 2024 – InspireMD, Inc. (Nasdaq: NSPR), developer of the CGuard™ Prime carotid stent system for

the treatment of carotid artery disease (CAD) and prevention of stroke, today announced financial and operating results for the third

quarter ended September 30, 2024.

Third

Quarter 2024 and Recent Developments:

| ● | Announced

that it has submitted a Premarket Approval (PMA) application to the U.S. Food and Drug Administration

(FDA) seeking marketing approval for the CGuard Prime carotid stent system in the U.S. |

| ● | Announced

approval of its Investigational Device Exemption (IDE) application to initiate the CGUARDIANS

II pivotal study of the CGuard Prime carotid stent system for use during TCAR procedures. |

| ● | Established

its Headquarters in Miami, Florida, to optimally support the anticipated U.S. commercial

launch of CGuard Prime in the first half of 2025, if approved. |

| ● | Announced

completion of enrollment in the groundbreaking CREST-2 clinical trial, with 23 patients in

the stenting arm treated with CGuard, the only investigational device allowed by FDA for

inclusion in the trial. |

| ● | Generated

record quarterly revenue of $1.81 million, an increase of 16.3% over the third quarter of

2023, on 3,129 CGuard stents sold, up nearly 14.4% over the third quarter of 2023. |

Marvin

Slosman, CEO of InspireMD, commented: “Since our last quarterly update, we have made significant progress advancing our best-in-class

carotid implant, CGuard Prime, towards potential U.S. approval while also moving toward the initiation of a pivotal study of CGuard Prime

for a TCAR indication, which represents a key component of our commercial strategy.”

“The

submission of our PMA application to FDA seeking U.S. approval of CGuard Prime is the result of years of tireless work by the entire

InspireMD team and gives us line of sight to entry into the U.S. market in the first half of 2025, if approved. To support a robust launch,

we’ve announced the opening of our new headquarters in Miami, Florida, that ideally positions us to support the world class commercial

and operational infrastructure that we are assembling. South Florida has a rich history of medical device innovation, and we are pleased

to be able to continue in that tradition.”

“We

also announced that the FDA has approved our IDE application allowing us to move forward with the initiation of a pivotal trial of CGuard

Prime for use in TCAR procedures. This represents an important step in the advancement of our development pipeline and demonstrates our

commitment to addressing the broadest set of physician and patient needs with tools for both CAS and TCAR procedures. I look forward

to additional clinical and regulatory milestones in the months ahead, highlighted by the potential U.S. approval and commercial launch

of CGuard Prime in the first half of next year,” Mr. Slosman concluded.

Financial

Results for the Third Quarter Ended September 30, 2024

For

the three months ended September 30, 2024, revenue increased by $254,000, or 16.3%, to $1,810,000, from $1,556,000 during the three months

ended September 30, 2023. This increase was driven by growth in existing and new markets.

For

the three months ended September 30, 2024, gross profit (revenue less cost of revenues) decreased by $24,000, or 5.6%, to $414,000, from

$438,000 during the three months ended September 30, 2023. This decrease in gross profit resulted from a $24,000 increase in miscellaneous

expense. Gross margin (gross profits as a percentage of revenue) decreased to 22.9% during the three months ended September 30, 2024,

from 28.1% during the three months ended September 30, 2023, driven by the factor mentioned above.

Total

operating expenses for the third quarter of 2024 were $8,876,000, an increase of $2,799,000, or 46.1%, compared to $6,077,000 for the

third quarter of 2023. This increase was primarily due to an increase in compensation, clinical and development expenses in preparation

for U.S. approval and launch.

Financial

Income for the third quarter of 2024 was $572,000, an increase of $111,000, or 24.1%, compared to $461,000 for the third quarter of 2023.

The increase in financial income primarily resulted from an increase in interest income from investments in marketable securities, money

market funds and short-term bank deposits.

Net

loss for the third quarter of 2024 totaled $7,890,000, or $0.16 per basic and diluted share, compared to a net loss of $5,178,000, or

$0.15 per basic and diluted share, for the same period in 2023.

As

of September 30, 2024, cash, cash equivalents and marketable securities were $40.4 million, compared to $39.0 million as of December

31, 2023.

Financial

Results for the Nine Months Ended September 30, 2024

For

the nine months ended September 30, 2024, revenue increased by $616,000, or 13.9%, to $5,060,000 from $4,444,000 during the nine months

ended September 30, 2023. This sales increase was due to growth in existing and new markets, partially offset by a reduction in clinical

trial revenue driven by the conclusion of C-GUARDIANS enrollment in June 2023.

For

the nine months ended September 30, 2024, gross profit (revenue less cost of revenues) decreased by 20.4%, or $265,000, to $1,037,000,

compared to $1,302,000 for the same period in 2023. This decrease in gross profit resulted from an increase in material and labor costs

mainly due to compensation expense for new and current employees, higher sales volume, additional space to build capacity for anticipated

increased volume requirements and additional training expenses. There were also additional costs related to facility downtime for maintenance

and higher scrap due to increases in production levels. This decrease was offset by an increase in revenue.

Total

operating expenses for the nine months ended September 30, 2024, were $25,173,000, an increase of $8,536,000, or 51.3%, compared to $16,637,000

for the nine months ended September 30, 2023. This increase was primarily due to an increase in compensation and development expenses.

Financial

Income for the nine months ended September 30, 2024 was $1,305,000, an increase of $481,000, or 58.4%, compared to $824,000 for the nine

months ended September 30, 2023. The increase in financial income was driven primarily from a $478,000 increase in interest income from

investments in marketable securities, money market funds and short-term bank deposits.

Net

loss for the nine months ended September 30, 2024 totaled $22,831,000, or $0.58 per basic and diluted share, compared to a net loss of

$14,511,000, or $0.69 per basic and diluted share, for the nine months ended September 30, 2023.

Conference

Call and Webcast Details

Management

will host a conference call at 8:30 am ET today, November 12th, to review financial results and provide an update on corporate

developments. Following management’s formal remarks, there will be a question-and-answer session.

Tuesday,

November 12th at 8:30 a.m. ET

| Domestic:

|

|

1-800-225-9448 |

| International:

|

|

1-203-518-9708 |

| Conference

ID: |

|

IMD3Q24 |

| Webcast:

|

|

Webcast

Link – Click Here |

About

InspireMD, Inc.

InspireMD

seeks to utilize its proprietary MicroNet® technology to make its products the industry standard for carotid stenting by providing

outstanding acute results and durable, stroke-free, long-term outcomes. InspireMD’s common stock is quoted on the Nasdaq under

the ticker symbol NSPR.

We

routinely post information that may be important to investors on our website. For more information, please visit www.inspiremd.com.

Forward-looking

Statements

This

press release contains “forward-looking statements.” Forward-looking statements include, but are not limited to, statements

regarding InspireMD or its management team’s expectations, hopes, beliefs, intentions or strategies regarding future events, future

financial performance, strategies, expectations, competitive environment and regulation, including potential U.S. commercial launch.

Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,”

“anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,”

“hopes,” “potential”, “scheduled” or similar words. Forward-looking statements are not guarantees

of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of

which are beyond the company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially

from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and

uncertainties associated with our history of recurring losses and negative cash flows from operating activities; substantial doubt about

our ability to continue as a going concern; significant future commitments and the uncertainty regarding the adequacy of our liquidity

to pursue our complete business objectives; our need to raise additional capital to meet our business requirements in the future and

such capital raising may be costly or difficult to obtain and could dilute out stockholders’ ownership interests; market acceptance

of our products; an inability to secure and maintain regulatory approvals for the sale of our products; negative clinical trial results

or lengthy product delays in key markets; our ability to maintain compliance with the Nasdaq listing standards; our ability to generate

revenues from our products and obtain and maintain regulatory approvals for our products; our ability to adequately protect our intellectual

property; our dependence on a single manufacturing facility and our ability to comply with stringent manufacturing quality standards

and to increase production as necessary; the risk that the data collected from our current and planned clinical trials may not be sufficient

to demonstrate that our technology is an attractive alternative to other procedures and products; intense competition in our industry,

with competitors having substantially greater financial, technological, research and development, regulatory and clinical, manufacturing,

marketing and sales, distribution and personnel resources than we do; entry of new competitors and products and potential technological

obsolescence of our products; inability to carry out research, development and commercialization plans; loss of a key customer or supplier;

technical problems with our research and products and potential product liability claims; product malfunctions; price increases for supplies

and components; insufficient or inadequate reimbursement by governmental and other third-party payers for our products; our efforts to

successfully obtain and maintain intellectual property protection covering our products, which may not be successful; adverse federal,

state and local government regulation, in the United States, Europe or Israel and other foreign jurisdictions; the fact that we conduct

business in multiple foreign jurisdictions, exposing us to foreign currency exchange rate fluctuations, logistical and communications

challenges, burdens and costs of compliance with foreign laws and political and economic instability in each jurisdiction; the escalation

of hostilities in Israel, which could impair our ability to manufacture our products; and current or future unfavorable economic and

market conditions and adverse developments with respect to financial institutions and associated liquidity risk. More detailed information

about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s

filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly

Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at

http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new

information, future events or otherwise.

Investor

Contacts:

Craig

Shore

Chief

Financial Officer

InspireMD,

Inc.

888-776-6804

craigs@inspiremd.com

Chuck

Padala, Managing Director

LifeSci

Advisors

646-627-8390

chuck@lifesciadvisors.com

investor-relations@inspiremd.com

CONSOLIDATED

BALANCE SHEETS (2)

(U.S.

dollars in thousands)

| | |

September 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 15,818 | | |

$ | 9,640 | |

| Marketable securities | |

| 24,584 | | |

| 29,383 | |

| Accounts receivable: | |

| | | |

| | |

| Trade, net | |

| 1,530 | | |

| 1,804 | |

| Other | |

| 741 | | |

| 648 | |

| Prepaid expenses | |

| 1,276 | | |

| 578 | |

| Inventory | |

| 2,445 | | |

| 2,106 | |

| | |

| | | |

| | |

| Total current assets | |

| 46,394 | | |

| 44,159 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Property, plant and equipment, net | |

| 1,946 | | |

| 1,060 | |

| Operating lease right of use assets | |

| 1,145 | | |

| 1,473 | |

| Funds in respect of employee rights upon retirement | |

| 996 | | |

| 951 | |

| | |

| | | |

| | |

| Total non-current assets | |

| 4,087 | | |

| 3,484 | |

| | |

| | | |

| | |

| Total assets | |

$ | 50,481 | | |

$ | 47,643 | |

| | |

September 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accruals: | |

| | | |

| | |

| Trade | |

| 1,305 | | |

| 939 | |

| Other | |

| 5,960 | | |

| 5,081 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 7,265 | | |

| 6,020 | |

| | |

| | | |

| | |

| Long-term liabilities: | |

| | | |

| | |

| Operating lease liabilities | |

| 682 | | |

| 1,038 | |

| Liability for employees rights upon retirement | |

| 1,183 | | |

| 1,084 | |

| Total long-term liabilities | |

| 1,865 | | |

| 2,122 | |

| | |

| | | |

| | |

| Total liabilities | |

| 9,130 | | |

| 8,142 | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Common stock, par value $0.0001 per share; 150,000,000 shares authorized at September 30, 2024 and December 31, 2023; 25,719,632 and 21,841,215 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 3 | | |

| 2 | |

| Preferred C shares, par value $0.0001 per share; 1,172,000 shares authorized at September 30, 2024 and December 31, 2023; 1,718 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| * | | |

| * | |

| Additional paid-in capital | |

| 285,680 | | |

| 261,000 | |

| Accumulated deficit | |

| (244,332 | ) | |

| (221,501 | ) |

| | |

| | | |

| | |

| Total equity | |

| 41,351 | | |

| 39,501 | |

| | |

| | | |

| | |

| Total liabilities and equity | |

$ | 50,481 | | |

$ | 47,643 | |

(1) All 2024

financial information is derived from the Company’s 2024 unaudited financial statements, as disclosed in the Company’s Quarterly

Report on Form 10-Q, filed with the Securities and Exchange Commission; all 2023 financial information is derived from the Company’s

2023 unaudited financial statements, as disclosed in the Company’s Quarterly Report on Form 10-Q, filed with the Securities and

Exchange Commission.

(2) All September 30, 2024, financial

information is derived from the Company’s 2024 unaudited financial statements, as disclosed in the Company’s Quarterly Report

on Form 10-Q, filed with the Securities and Exchange Commission. All December 31, 2023 financial information is derived from the Company’s

2023 audited financial statements as disclosed in the Company’s Annual Report on Form 10-K, for the twelve months ended December

31, 2023 filed with the Securities

CONSOLIDATED STATEMENTS OF OPERATIONS (1)

(U.S. dollars in thousands, except per share data)

| | |

Three months ended | | |

Nine months ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 1,810 | | |

$ | 1,556 | | |

$ | 5,060 | | |

$ | 4,444 | |

| Cost of revenues | |

| 1,396 | | |

| 1,118 | | |

| 4,023 | | |

| 3,142 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 414 | | |

| 438 | | |

| 1,037 | | |

| 1,302 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 3,915 | | |

| 2,110 | | |

| 9,941 | | |

| 5,946 | |

| Selling and marketing | |

| 1,472 | | |

| 876 | | |

| 4,154 | | |

| 2,556 | |

| General and administrative | |

| 3,489 | | |

| 3,091 | | |

| 11,078 | | |

| 8,135 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 8,876 | | |

| 6,077 | | |

| 25,173 | | |

| 16,637 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (8,462 | ) | |

| (5,639 | ) | |

| (24,136 | ) | |

| (15,335 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Financial income | |

| 572 | | |

| 461 | | |

| 1,305 | | |

| 824 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (7,890 | ) | |

$ | (5,178 | ) | |

$ | (22,831 | ) | |

$ | (14,511 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share – basic and diluted | |

$ | (0.16 | ) | |

$ | (0.15 | ) | |

$ | (0.58 | ) | |

$ | (0.69 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares of common stock used in computing net loss per share – basic and diluted | |

| 48,369,412 | | |

| 33,984,953 | | |

| 39,413,004 | | |

| 21,148,538 | |

v3.24.3

Cover

|

Nov. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 12, 2024

|

| Entity File Number |

001-35731

|

| Entity Registrant Name |

InspireMD,

Inc.

|

| Entity Central Index Key |

0001433607

|

| Entity Tax Identification Number |

26-2123838

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

6303

Waterford District Drive

|

| Entity Address, Address Line Two |

Suite

215

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33126

|

| City Area Code |

(888)

|

| Local Phone Number |

776-6804

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

NSPR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

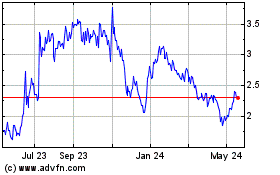

InspireMD (NASDAQ:NSPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

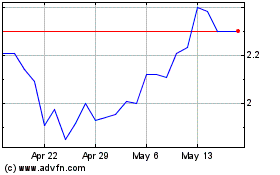

InspireMD (NASDAQ:NSPR)

Historical Stock Chart

From Jan 2024 to Jan 2025