TRUE000145493800014549382025-02-032025-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 3, 2025

Outbrain Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40643 | | 20-5391629 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

111 West 19th Street

New York, NY 10011

(Address of principal executive offices, including zip code)

(Registrant’s telephone number, including area code): (646) 867-0149

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

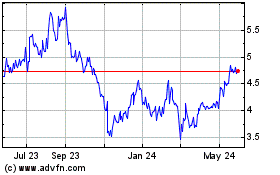

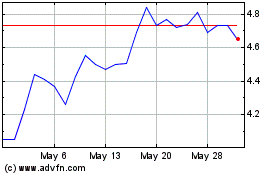

| Common stock, par value $0.001 per share | | OB | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Amendment No. 1 on Form 8-K/A amends the Current Report on Form 8-K filed by Outbrain Inc. (the “Company”) on February 3, 2025 (the “Original Form 8-K”). The Original Form 8-K reported the completion of the Company’s acquisition (the “Acquisition”) of the issued and outstanding equity interests of TEADS (“Teads”) from Altice Teads S.A.

This Amendment No. 1 amends the Original Form 8-K to provide the financial statements and pro forma financial information required under Item 9.01 of Form 8-K.This Amendment No. 1 reports no other updates or amendments to the Original Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(a)Financial Statements of Business Acquired.

The audited consolidated financial statements of Teads as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021 appearing in the section entitled “Index to Consolidated Financial Statements of Teads SA” in the Company’s Definitive Proxy Statement on Schedule 14A filed on October 31, 2024 are incorporated herein by reference as Exhibit 99.1.

The unaudited condensed interim consolidated financial statements of Teads as of September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023 attached as Exhibit 99.2 to the Company’s second Form 8-K filed on February 3, 2025 are incorporated herein by reference as Exhibit 99.2.

(b) Pro Forma Financial Information.

The unaudited pro forma condensed combined financial statements of the Company as of September 30, 2024, for the nine months ended September 30, 2024, and for the year ended December 31, 2023 are attached hereto as Exhibit 99.3 and incorporated by reference.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| OUTBRAIN INC.

|

| Date: February 24, 2025 | By: | /s/ David Kostman |

| | Name: David Kostman |

| | Title: Chief Executive Officer |

CONSENT OF INDEPENDENT AUDITOR

We consent to the incorporation by reference in Registration Statements on Form S-8 (Nos. 333-258535, 333-270568 and 333-277801) of Outbrain Inc. of our report dated September 13, 2024 relating to the consolidated financial statements of TEADS as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021 appearing in the section entitled “Index to Consolidated Financial Statements of Teads SA” in the Definitive Proxy Statement on Schedule 14A of Outbrain Inc. filed on October 31, 2024, and which is incorporated by reference into this Current Report on Form 8-K/A of Outbrain Inc..

/s/ Deloitte Audit S. à r.l

Deloitte Audit S. à r.l

Luxembourg, Grand-Duchy of Luxembourg

February 24, 2025

Exhibit 99.3

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

On February 3, 2025, Outbrain acquired Teads pursuant to the Share Purchase Agreement. The following unaudited pro forma condensed combined financial statements and related notes are derived from the historical consolidated financial statements of Outbrain and the historical financial statements of Teads, and give effect to the Acquisition and the other related contemplated financing transactions (the “Financing”) on a pro forma basis as described herein.

The unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2024 and the year ended December 31, 2023 have been prepared as if the Acquisition and the Financing had been completed on January 1, 2023, and the unaudited pro forma condensed combined balance sheet as of September 30, 2024 has been prepared as if the Acquisition and the Financing had been completed on September 30, 2024.

The unaudited pro forma condensed combined financial statements and the accompanying notes should be read in conjunction with:

•The unaudited historical condensed consolidated financial statements and related notes of Outbrain in its Quarterly Report on Form 10-Q as of and for the nine-month period ended September 30, 2024, as filed with the SEC on November 7, 2024 (“Outbrain’s Third Quarter 2024 10-Q”);

•The audited historical consolidated financial statements and related notes of Outbrain in its Annual Report on Form 10-K as of and for the year ended December 31, 2023, as filed with the SEC on March 8, 2024 (“Outbrain’s 2023 Annual Report”);

•The unaudited historical condensed interim consolidated financial statements of Teads as of and for the nine-month period ended September 30, 2024, which are included in this Current Report on Form 8-K (the “Current Report”); and

•The audited historical consolidated financial statements of Teads as of December 31, 2023 and December 31, 2022 and for each of the three years in the period ended December 31, 2023, which are included in this Current Report.

The following unaudited pro forma condensed combined financial information and related notes has been prepared in accordance with Article 11 of Regulation S-X as amended by the Final Rule, Release No. 33-10786, to give effect to the following:

•Application of the acquisition method of accounting under the provisions of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 805 (“ASC 805”), Business Combinations, where certain assets and liabilities of Teads were recorded by Outbrain at their respective fair values as of the date the acquisition was completed;

•Adjustments to conform the financial statement presentation of Teads to Outbrain, based upon a preliminary assessment by Outbrain;

•Adjustments to reflect the following financing transactions and other adjustments:

◦Issuance of $637.5 million in aggregate principal amount of 10.000% Senior Secured Notes due 2030 at an issuance price of 98.087% of the principal amount, or $625.3 million, in a private offering (the “Notes”) ; and

◦Issuance of 43.75 million shares of Outbrain Common Stock;

•Adjustments to reflect transaction costs in connection with the acquisition.

The historical financial statements of Outbrain have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) and in its reporting currency of U.S. dollars. The historical financial statements of Teads have been prepared in accordance with IFRS, as issued by IASB, and in its reporting currency of U.S. dollars. Accordingly, the unaudited pro forma condensed combined financial statements reflect certain adjustments to Teads’ historical consolidated financial statements to align those financial statements with U.S.

GAAP, based on Outbrain management’s preliminary analysis. In addition, certain items within Teads’ historical consolidated financial statements have been reclassified to align with Outbrain’s financial statement presentation.

As of the date of this filing, the Company has not completed the detailed valuation necessary to arrive at the final estimates of the fair value of Teads’ assets acquired and liabilities assumed, and the related allocation of the purchase price, nor has it identified all of the adjustments necessary to conform Teads’ accounting policies to those of Outbrain. Accordingly, the adjustments to the historical book values of assets and liabilities reflect the Company’s best estimates of the fair values, with the excess of the purchase price over the preliminary estimates of fair value recorded as goodwill. Actual results may differ once the Company has completed the detailed valuations necessary to finalize the purchase price allocation. The final calculation of consideration transferred could differ from the amounts presented in the unaudited pro forma condensed combined financial statements due to the finalization of working capital and other customary adjustments. Under applicable guidance, the Company is not required to finalize its acquisition accounting until all information is available, but no later than one year after the Acquisition is completed, and any subsequent adjustments made in connection with the finalization of the Company’s acquisition accounting may be material. There can be no assurance that such finalization will not result in material changes.

The pro forma condensed combined financial statements are unaudited, are presented for illustrative and informational purposes only, and are not necessarily indicative of the financial position or results of operations that would have occurred had the Acquisition and the Financing actually been completed as of the dates presented. In addition, the unaudited pro forma condensed combined financial statements do not purport to project the future consolidated financial position or operating results of the combined company. The unaudited pro forma condensed combined financial statements do not reflect any potential cost savings, operating efficiencies or synergies related to the Acquisition. The pro forma adjustments represent Outbrain management’s best estimates and are based upon currently available information and certain assumptions that the Company believes are reasonable.

Unaudited Pro Forma Condensed Combined Balance Sheet

As of September 30, 2024

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Outbrain

Historical | | Teads Historical After Reclassifications (see Note 3) | | GAAP &

Policy

Adjustments | | Notes | | Transaction Accounting and Financing Adjustments | | Notes | | Pro Forma

Combined |

| ASSETS | | | | | | | | | | | | | |

| Current assets: | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 57,061 | | | $ | 64,597 | | | $ | — | | | | | $ | (625,000) | | | 5 | | $ | 92,711 | |

| | | | | | | | | 596,053 | | | 7(a) | | |

| Short-term investments in marketable securities | 73,467 | | | — | | | — | | | | | — | | | | | 73,467 | |

| Accounts receivable, net of allowances | 157,542 | | | 210,267 | | | — | | | | | (29) | | | 6(a) | | 367,780 | |

| Prepaid expenses and other current assets | 38,133 | | | 618,021 | | | — | | | | | (593,584) | | | 6(b) | | 62,570 | |

| Total current assets | 326,203 | | | 892,885 | | | — | | | | | (622,560) | | | | | 596,528 | |

| Non-current assets: | | | | | | | | | | | | | |

| Long-term investments in marketable securities | — | | | — | | | — | | | | | — | | | | | — | |

| Property, equipment and capitalized software, net | 43,934 | | | 4,287 | | | 21,198 | | | 4(a) | | (20,957) | | | 6(c) | | 48,462 | |

| Operating lease right-of-use assets, net | 15,791 | | | 14,831 | | | 615 | | | 4(c) | | (639) | | | 6(d) | | 30,598 | |

| Intangible assets, net | 17,834 | | | 21,692 | | | (21,198) | | | 4(a) | | 375,506 | | | 6(e) | | 393,834 | |

| Goodwill | 63,063 | | | 37,013 | | | — | | | | | 382,848 | | | 6(f) | | 482,924 | |

| Deferred tax assets | 42,166 | | | 11,383 | | | — | | | | | 28,636 | | | 6(j) | | 82,185 | |

| Other assets | 21,140 | | | 2,596 | | | — | | | | | 21,019 | | | 6(k) | | 45,658 | |

| | | | | | | | | 1,710 | | | 7(a) | | |

| | | | | | | | | (807) | | | 7(b) | | |

| TOTAL ASSETS | $ | 530,131 | | | $ | 984,687 | | | $ | 615 | | | | | $ | 164,756 | | | | | $ | 1,680,189 | |

| | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY: | | | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | | | | |

| Accounts payable | $ | 123,355 | | | $ | 121,229 | | | $ | — | | | | | $ | (29) | | | 6(a) | | $ | 244,555 | |

| Accrued compensation and benefits | 18,721 | | | 20,833 | | | — | | | | | — | | | | | 39,554 | |

| Accrued and other current liabilities | 124,053 | | | 37,671 | | | (868) | | | 4(c) | | (673) | | | 6(d) | | 182,429 | |

| | | | | | | | | 21,420 | | | 6(g) | | |

| | | | | | | | | 826 | | | 7(b) | | |

| Deferred revenue | 6,598 | | | 2,894 | | | — | | | | | — | | | | | 9,492 | |

| Total current liabilities | 272,727 | | | 182,627 | | | (868) | | | | | 21,544 | | | | | 476,030 | |

| Non-current liabilities: | | | | | | | | | | | | | |

| Long-term debt | — | | | 21 | | | — | | | | | 611,626 | | | 7(a) | | 611,647 | |

| Operating lease liabilities, non-current | 12,634 | | | 12,363 | | | (1,076) | | | 4(c) | | (389) | | | 6(d) | | 23,532 | |

| Deferred tax liabilities | 3,459 | | | 1,484 | | | 650 | | | 4(c) | | 72,726 | | | 6(j) | | 78,319 | |

| Other liabilities | 14,155 | | | 1,886 | | | — | | | | | 21,019 | | | 6(k) | | 37,060 | |

| TOTAL LIABILITIES | $ | 302,975 | | | $ | 198,381 | | | $ | (1,294) | | | | | $ | 726,526 | | | | | $ | 1,226,588 | |

| | | | | | | | | | | | | |

| Commitments and Contingencies | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| STOCKHOLDERS’ EQUITY: | | | | | | | | | | | | | |

| Common stock | 63 | | | 17,379 | | | — | | | | | (17,379) | | | 6(i) | | 93 | |

| | | | | | | | | 30 | | | 7(b) | | |

| Additional paid-in capital | 480,440 | | | 99,178 | | | — | | | | | (99,178) | | | 6(i) | | 667,636 | |

| | | | | | | | | 188,829 | | | 7(b) | | |

| | | | | | | | | (1,633) | | | 7(b) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Outbrain

Historical | | Teads Historical After Reclassifications (see Note 3) | | GAAP &

Policy

Adjustments | | Notes | | Transaction Accounting and Financing Adjustments | | Notes | | Pro Forma

Combined |

| Treasury stock, at cost | (74,079) | | | — | | | — | | | | | 74,079 | | | 7(b) | | — | |

| Accumulated other comprehensive loss | (9,942) | | | (29,107) | | | — | | | | | 29,107 | | | 6(i) | | (9,942) | |

| Accumulated deficit | (169,326) | | | 698,856 | | | 1,909 | | | 4(c) | | 423 | | | 6(d) | | (204,186) | |

| | | | | | | | | (21,420) | | | 6(g) | | |

| | | | | | | | | (700,765) | | | 6(i) | | |

| | | | | | | | | (13,863) | | | 7(a) | | |

| TOTAL STOCKHOLDERS’ EQUITY: | 227,156 | | | 786,306 | | | 1,909 | | | | | (561,770) | | | | | 453,601 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY: | $ | 530,131 | | | $ | 984,687 | | | $ | 615 | | | | | $ | 164,756 | | | | | $ | 1,680,189 | |

See Accompanying Notes to Unaudited Pro Forma Condensed Combined Financial Statements.

Unaudited Pro Forma Condensed Combined Statement of Operations

For the Nine Months Ended September 30, 2024

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Outbrain

Historical | | Teads Historical After Reclassifications (see Note 3) | | GAAP &

Policy

Adjustments | | Notes | | Transaction Accounting and Financing Adjustments | | Notes | | Pro Forma

Combined |

| Revenue | $ | 655,289 | | | $ | 428,482 | | | $ | — | | | | | $ | (107) | | | 6(a) | | $ | 1,083,664 | |

| Cost of revenue: | | | | | | | | | | | | | |

| Traffic acquisition costs | 487,484 | | | 210,314 | | | (48,575) | | | 4(b) | | (107) | | | 6(a) | | 649,116 | |

| Other cost of revenue | 31,765 | | | 31,398 | | | 8,539 | | | 4(a) | | (8,539) | | | 6(c) | | 75,249 | |

| | | | | | | | | 12,086 | | | 6(e) | | |

| Total cost of revenue | 519,249 | | | 241,712 | | | (40,036) | | | | | 3,440 | | | | | 724,365 | |

| Gross profit | 136,040 | | | 186,770 | | | 40,036 | | | | | (3,547) | | | | | 359,299 | |

| Operating expenses: | | | | | | | | | | | | | |

| Research and development | 27,646 | | | 28,781 | | | (8,539) | | | 4(a) | | (5,629) | | | 6(h) | | 42,294 | |

| | | | | 35 | | | 4(c) | | | | | | |

| Sales and marketing | 71,762 | | | 85,554 | | | 48,575 | | | 4(b) | | 21,735 | | | 6(e) | | 218,481 | |

| | | | | 309 | | | 4(c) | | (10,402) | | | 6(h) | | |

| | | | | | | | | 948 | | | 6(k) | | |

| General and administrative | 51,805 | | | 41,987 | | | 44 | | | 4(c) | | (12,058) | | | 6(h) | | 83,824 | |

| | | | | 2,046 | | | 4(d) | | | | | | |

| Total operating expenses | 151,213 | | | 156,322 | | | 42,470 | | | | | (5,406) | | | | | 344,599 | |

| (Loss) income from operations | (15,173) | | | 30,448 | | | (2,434) | | | | | 1,859 | | | | | 14,700 | |

| Other income (expense), net: | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Gain on convertible debt | 8,782 | | | — | | | — | | | | | — | | | | | 8,782 | |

| Interest expense | (2,950) | | | (1,060) | | | 813 | | | 4(c) | | (52,712) | | | 7(a) | | (55,909) | |

| Interest income and other income, net | 7,687 | | | 12,431 | | | 2,046 | | | 4(d) | | (18,423) | | | 6(b) | | 3,741 | |

| Total other income (expense), net | 13,519 | | | 11,371 | | | 2,859 | | | | | (71,135) | | | | | (43,386) | |

| (Loss) income before income taxes | (1,654) | | | 41,819 | | | 425 | | | | | (69,276) | | | | | (28,686) | |

| (Benefit) provision for income taxes | (1,110) | | | 22,113 | | | 108 | | | 4(c) | | (24,036) | | | 6(j) | | (2,485) | |

| | | | | | | | | 440 | | | 6(k) | | |

| Net (loss) income | $ | (544) | | | $ | 19,706 | | | $ | 317 | | | | | $ | (45,680) | | | | | $ | (26,201) | |

| | | | | | | | | | | | | |

| Weighted average common shares outstanding (Note 8): | | | | | | | | | | | | | |

| Basic | 49,171,414 | | | | | | | | | 43,750,000 | | | | | 92,921,414 | |

| Diluted | 53,701,925 | | | | | | | | | 43,750,000 | | | | | 97,451,925 | |

| | | | | | | | | | | | | |

| Net loss per common share (Note 8): | | | | | | | | | | | | | |

| Basic | $ | (0.01) | | | | | | | | | | | | | $ | (0.28) | |

| Diluted | $ | (0.10) | | | | | | | | | | | | | $ | (0.32) | |

See Accompanying Notes to Unaudited Pro Forma Condensed Combined Financial Statements.

Unaudited Pro Forma Condensed Combined Statement of Operations

For the Year Ended December 31, 2023

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Outbrain

Historical | | Teads Historical After Reclassifications (see Note 3) | | GAAP &

Policy

Adjustments | | Notes | | Transaction Accounting and Financing Adjustments | | Notes | | Pro Forma

Combined |

| Revenue | $ | 935,818 | | | $ | 649,812 | | | $ | — | | | | | $ | (171) | | | 6(a) | | $ | 1,585,459 | |

| Cost of revenue: | | | | | | | | | | | | | |

| Traffic acquisition costs | 708,449 | | | 286,086 | | | (62,830) | | | 4(b) | | (171) | | | 6(a) | | 931,534 | |

| Other cost of revenue | 42,571 | | | 42,549 | | | 10,295 | | | 4(a) | | (10,295) | | | 6(c) | | 101,234 | |

| | | | | | | | | 16,114 | | | 6(e) | | |

| Total cost of revenue | 751,020 | | | 328,635 | | | (52,535) | | | | | 5,648 | | | | | 1,032,768 | |

| Gross profit | 184,798 | | | 321,177 | | | 52,535 | | | | | (5,819) | | | | | 552,691 | |

| Operating expenses: | | | | | | | | | | | | | |

| Research and development | 36,402 | | | 31,181 | | | (10,295) | | | 4(a) | | (3,596) | | | 6(h) | | 53,751 | |

| | | | | 59 | | | 4(c) | | | | | | |

| Sales and marketing | 98,370 | | | 108,534 | | | 62,830 | | | 4(b) | | 28,981 | | | 6(e) | | 294,233 | |

| | | | | 520 | | | 4(c) | | (6,645) | | | 6(h) | | |

| | | | | | | | | 1,643 | | | 6(k) | | |

| General and administrative | 58,665 | | | 47,073 | | | 74 | | | 4(c) | | 21,420 | | | 6(g) | | 121,946 | |

| | | | | 2,416 | | | 4(d) | | (7,702) | | | 6(h) | | |

| Total operating expenses | 193,437 | | | 186,788 | | | 55,604 | | | | | 34,101 | | | | | 469,930 | |

| (Loss) income from operations | (8,639) | | | 134,389 | | | (3,069) | | | | | (39,920) | | | | | 82,761 | |

| Other income (expense), net: | | | | | | | | | | | | | |

| Gain on convertible debt | 22,594 | | | — | | | — | | | | | — | | | | | 22,594 | |

| Interest expense | (5,393) | | | (929) | | | 891 | | | 4(c) | | (83,003) | | | 7(a) | | (88,434) | |

| Interest income and other income (expense), net | 7,793 | | | 4,549 | | | 2,416 | | | 4(d) | | (14,909) | | | 6(b) | | (151) | |

| Total other income (expense), net | 24,994 | | | 3,620 | | | 3,307 | | | | | (97,912) | | | | | (65,991) | |

| Income (loss) before provision for income taxes | 16,355 | | | 138,009 | | | 238 | | | | | (137,832) | | | | | 16,770 | |

| Provision (benefit) for income taxes | 6,113 | | | 42,186 | | | 60 | | | 4(c) | | (33,895) | | | 6(j) | | 15,267 | |

| | | | | | | | | 803 | | | 6(k) | | |

| Net income (loss) | $ | 10,242 | | | $ | 95,823 | | | $ | 178 | | | | | $ | (104,740) | | | | | $ | 1,503 | |

| | | | | | | | | | | | | |

| Weighted average common shares outstanding (Note 8): | | | | | | | | | | | | | |

| Basic | 50,900,422 | | | | | | | | | 43,750,000 | | | | | 94,650,422 | |

| Diluted | 56,965,299 | | | | | | | | | 43,750,000 | | | | | 100,715,299 | |

| | | | | | | | | | | | | |

| Net income (loss) per common share (Note 8): | | | | | | | | | | | | | |

| Basic | $ | 0.20 | | | | | | | | | | | | | $ | 0.02 | |

| Diluted | $ | (0.06) | | | | | | | | | | | | | $ | (0.12) | |

See Accompanying Notes to Unaudited Pro Forma Condensed Combined Financial Statements.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

1. Description of the Acquisition and the Financing

On August 1, 2024, Outbrain entered into the Share Purchase Agreement with Teads and Altice Teads to acquire, directly and via certain of its subsidiaries, all of the issued and outstanding equity interests of Teads from Altice Teads (the “Acquisition”). The Acquisition closed on February 3, 2025 (the “Acquisition Closing Date”).

The consideration paid on the Acquisition Closing Date consisted of: (1) a cash payment of $625 million, subject to certain customary adjustments as set forth in the Agreement and (2) 43.75 million shares of Outbrain Common Stock, par value $0.001 (the “Common Stock Consideration”).

In connection with the Acquisition, on February 3, 2025, Outbrain as the initial borrower entered into a New Credit Agreement, establishing a New Revolving Credit Facility with aggregate commitments of $100.0 million, including a letter of credit sub-limit of $10.0 million and a swingline sub-limit of $20.0 million. The New Credit Agreement also established a Bridge Facility with aggregate commitments of $625.0 million.

On the Acquisition Closing Date, the Bridge Facility was drawn in full to fund the cash portion of the Total Consideration. On February 11, 2025, Outbrain’s wholly owned subsidiary, OT Midco, completed a private offering (the “Offering”) of $637.5 million in aggregate principal amount of 10.000% senior secured notes due 2030 (the “Notes”) at an issue price of 98.087% of the principal amount thereof in a transaction exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”). The proceeds from the Offering were used, together with cash on hand, to repay in full and cancel the indebtedness incurred under the Bridge Facility, including accrued and unpaid interest thereon, that was used to finance and pay costs related to the acquisition of Teads, as well as pay fees and expenses incurred in connection with the Offering and the Bridge Facility refinancing.

2. Basis of Presentation

The Company and Teads both operate on a calendar year-end basis. The unaudited pro forma condensed combined financial statements have been derived from (i) the unaudited historical condensed consolidated financial statements of Outbrain in its Quarterly Report on Form 10-Q as of September 30, 2024 and for the nine-month period ended September 30, 2024, as filed with the SEC on November 7, 2024, (ii) the audited historical consolidated financial statements of Outbrain in its Annual Report on Form 10-K as of and for the year ended December 31, 2023, as filed with the SEC on March 8, 2024, (iii) the unaudited historical interim condensed consolidated financial statements of Teads as of and for the nine-month period ended September 30, 2024, which are included in this Current Report, and (iv) the audited historical consolidated financial statements of Teads as of December 31, 2023 and December 31, 2022 and for each of the three years in the period ended December 31, 2023, which are included in this Current Report. All historical financial statements have been prepared in U.S. dollars.

The unaudited pro forma condensed combined financial statements show the impact of the Acquisition on the financial statements under the acquisition method of accounting, in accordance with ASC 805, Business Combinations, with Outbrain treated as the accounting acquirer of Teads.

The pro forma adjustments are preliminary and based on estimates of the fair value and useful lives of the assets acquired and liabilities assumed and have been prepared to illustrate the estimated effects of the Acquisition and the Financing and certain other adjustments. The final determination of the consideration transferred and acquisition accounting will be based on the fair values of the Teads assets acquired and liabilities assumed on the Acquisition Closing Date and using the fair value concepts defined in ASC 820, Fair Value Measurements. The Company is not required to finalize its acquisition accounting until all information is available, but no later than one year after the Acquisition is completed, and any subsequent adjustments made in connection with the finalization of the Company’s acquisition accounting may be material. There can be no assurance that such finalization will not result in material changes.

The unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2024 and the year ended December 31, 2023 have been prepared as if the Acquisition and the Financing had been completed on January 1, 2023, and the unaudited pro forma condensed combined balance sheet as of September 30, 2024 has been prepared as if the Acquisition and the Financing had been completed on September 30, 2024.

The accounting policies of Teads under IFRS as issued by the IASB, which are described in Note 2 to Teads’ historical consolidated financial statements included in this filing, are not expected to be significantly different from U.S. GAAP, except for those adjustments discussed further in Note 4 below. Although the adjustments to Teads’ historical financial statements represent the currently known material adjustments to conform to U.S. GAAP, the accompanying unaudited pro forma IFRS to U.S. GAAP adjustments are preliminary and are subject to further adjustments as additional information becomes available and as additional analyses are performed. In addition, the accounting policies of Outbrain may vary materially from those of Teads outside of differences between U.S. GAAP and IFRS. During the preparation of the unaudited pro forma condensed combined financial statements, certain conforming adjustments were made based on the initial analysis of the differences in accounting policies. The Company is in the process of evaluating Teads’ accounting policies, and as a result of that review, additional differences may be identified that, when conformed, could have a material impact on the unaudited pro forma condensed combined financial information.

3. Reclassifications of Teads’ Historical Financial Information

Certain reclassifications have been made to Teads’ historical balance sheet to conform to Outbrain’s balance sheet presentation, as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | As of September 30, 2024 |

| Teads Historical Consolidated Balance Sheet Line Items | | Outbrain Historical Consolidated Balance Sheet Line Items | | Teads Before Reclassifications | | Reclassification Adjustments | | Notes | | Teads After Reclassifications |

| | | | (in thousands) |

| ASSETS | | ASSETS | | | | | | | | |

| Cash and cash equivalents | | Cash and cash equivalents | | $ | 64,597 | | | $ | — | | | | | $ | 64,597 | |

| Trade receivables | | Accounts receivable, net of allowances | | 210,267 | | | — | | | | | 210,267 | |

| Financial assets (current) | | | | 574,158 | | | (574,158) | | | (a) | | — | |

| Other receivables | | Prepaid expenses and other current assets | | 43,863 | | | 574,158 | | | (a) | | 618,021 | |

| Property, plant and equipment | | Property, equipment and capitalized software, net | | 4,287 | | | — | | | | | 4,287 | |

| Right-of-use assets | | Operating lease right-of-use assets, net | | 14,831 | | | — | | | | | 14,831 | |

| Intangible assets | | Intangible assets, net | | 21,692 | | | — | | | | | 21,692 | |

| Goodwill | | Goodwill | | 37,013 | | | — | | | | | 37,013 | |

| Deferred tax assets | | Deferred tax assets | | 11,383 | | | — | | | | | 11,383 | |

| Financial assets (non-current) | | Other assets | | 2,596 | | | — | | | | | 2,596 | |

| Total assets | | Total assets | | $ | 984,687 | | | $ | — | | | | | $ | 984,687 | |

| | | | | | | | | | |

| EQUITY AND LIABILITIES | | LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| Trade and other payables | | Accounts payable | | $ | 121,229 | | | $ | — | | | | | $ | 121,229 | |

| | Accrued compensation and benefits | | — | | | 20,833 | | | (b) | | $ | 20,833 | |

| Short-term borrowings | | | | 16,855 | | | (16,855) | | | (c) | | — | |

| Lease liabilities | | | | 5,450 | | | (5,450) | | | (c) | | — | |

| Current tax liabilities | | | | 2,653 | | | (2,653) | | | (c) | | — | |

| Contract liabilities | | Deferred revenue | | 2,871 | | | 23 | | | (c) | | 2,894 | |

| Other current liabilities | | Accrued and other current liabilities | | 33,569 | | | 4,102 | | | (b),(c) | | 37,671 | |

| Long term borrowings | | Long-term debt | | 21 | | | — | | | | | 21 | |

| Lease liabilities | | Operating lease liabilities, non-current | | 12,363 | | | — | | | | | 12,363 | |

| Non-current provisions | | | | 1,882 | | | (1,882) | | | (d) | | — | |

| Deferred tax liabilities | | | | 1,484 | | | — | | | | | 1,484 | |

| Other non-current liabilities | | Other liabilities | | 4 | | | 1,882 | | | (d) | | 1,886 | |

| | Total liabilities | | 198,381 | | | — | | | | | 198,381 | |

| | | | | | | | | | |

| Share capital | | Common stock | | 17,379 | | | — | | | | | 17,379 | |

| Share premium | | Additional paid-in capital | | 99,178 | | | — | | | | | 99,178 | |

| Reserves | | Accumulated other comprehensive income | | (29,107) | | | — | | | | | (29,107) | |

| Retained earnings | | Accumulated retained earnings (deficit) | | 698,856 | | | — | | | | | 698,856 | |

| Total equity | | Total stockholders’ equity | | $ | 786,306 | | | $ | — | | | | | $ | 786,306 | |

| Total equity and liabilities | | Total liabilities and stockholders’ equity | | $ | 984,687 | | | $ | — | | | | | $ | 984,687 | |

_________________________________

(a) Reclassifications of financial assets to prepaid expenses and other current assets to conform to Outbrain’s presentation.

(b) Reclassification to separately break out accrued compensation and benefits from other current liabilities to conform to Outbrain’s presentation.

(c) Reclassifications to condense the presentation of certain Teads’ historical financial statement line items within current liabilities to be included in accrued and other current liabilities, consistent with Outbrain’s presentation.

(d) Reclassifications to condense the presentation of certain Teads’ historical balance sheet line items within non-current liabilities to be included in other liabilities.

Certain reclassifications have been made to Teads’ historical statements of operations to conform to Outbrain’s presentation, as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | For the Nine Months Ended September 30, 2024 |

| Teads Historical Consolidated Statement of Operations Line Items | | Outbrain Historical Consolidated Statement of Operations Line Items | | Teads Before Reclassifications | | Reclassification Adjustments | | Notes | | Teads After Reclassifications |

| | | | (in thousands) |

| Revenue | | Revenue | | $ | 428,482 | | | $ | — | | | | | $ | 428,482 | |

| | Cost of revenue: | | | | | | | | |

| Cost of revenue | | Traffic acquisition costs | | 241,712 | | | (31,398) | | | (a) | | 210,314 | |

| | Other cost of revenue | | | | 31,398 | | | (a) | | 31,398 | |

| | Total cost of revenue | | | | | | | | 241,712 | |

| | Gross profit | | | | | | | | 186,770 | |

| | Operating expenses: | | | | | | | | |

| Technology and development expenses | | Research and development | | 28,781 | | | — | | | | | 28,781 | |

| Sales and marketing expenses | | Sales and marketing | | 85,554 | | | — | | | | | 85,554 | |

| General and administrative expenses | | General and administrative | | 41,987 | | | — | | | | | 41,987 | |

| | Total operating expenses | | | | | | | | 156,322 | |

| Profit from operations | | Income from operations | | 30,448 | | | — | | | | | 30,448 | |

| | Other income (expense), net: | | | | | | | | |

| Finance costs | | Interest expense | | (1,060) | | | — | | | | | (1,060) | |

| Other financial income and (expenses) | | Interest income and other income (expense), net | | 12,431 | | | — | | | | | 12,431 | |

| | Total other income (expense), net | | | | | | | | 11,371 | |

| Profit before tax | | Income before income taxes | | 41,819 | | | — | | | | | 41,819 | |

| Income tax expense | | Provision for income taxes | | 22,113 | | | — | | | | | 22,113 | |

| Profit for the period | | Net income | | $ | 19,706 | | | $ | — | | | | | $ | 19,706 | |

_______________________

(a) Reclassification to separately break out Teads’ cost of revenue between traffic acquisition costs and other cost of revenue, consistent with Outbrain’s presentation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | For the Year Ended December 31, 2023 |

| Teads Historical Consolidated Statement of Operations Line Items | | Outbrain Historical Consolidated Statement of Operations Line Items | | Teads Before Reclassifications | | Reclassification Adjustments | | Notes | | Teads After Reclassifications |

| | | | (in thousands) |

| Revenue | | Revenue | | $ | 649,812 | | | $ | — | | | | | $ | 649,812 | |

| | Cost of revenue: | | | | | | | | |

| Cost of revenue | | Traffic acquisition costs | | 328,635 | | | (42,549) | | | (a) | | 286,086 | |

| | Other cost of revenue | | | | 42,549 | | | (a) | | 42,549 | |

| | Total cost of revenue | | | | | | | | 328,635 | |

| | Gross profit | | | | | | | | 321,177 | |

| | Operating expenses: | | | | | | | | |

| Technology and development expenses | | Research and development | | 31,181 | | | — | | | | | 31,181 | |

| Sales and marketing expenses | | Sales and marketing | | 108,534 | | | — | | | | | 108,534 | |

| General and administrative expenses | | General and administrative | | 47,073 | | | — | | | | | 47,073 | |

| | Total operating expenses | | | | | | | | 186,788 | |

| Profit from operations | | Income from operations | | 134,389 | | | — | | | | | 134,389 | |

| | Other income (expense), net: | | | | | | | | |

| Finance costs | | Interest expense | | (929) | | | — | | | | | (929) | |

| Other financial income and (expenses) | | Interest income and other income (expense), net | | 4,549 | | | — | | | | | 4,549 | |

| | Total other income (expense), net | | | | | | | | 3,620 | |

| Profit before tax | | Income before income taxes | | 138,009 | | | — | | | | | 138,009 | |

| Income tax expense | | Provision for income taxes | | 42,186 | | | — | | | | | 42,186 | |

| Profit for the year | | Net income | | $ | 95,823 | | | $ | — | | | | | $ | 95,823 | |

_______________________

(a) Reclassifications to separately break out Teads’ cost of revenue between traffic acquisition costs and other cost of revenue, consistent with Outbrain’s presentation.

4. IFRS to U.S. GAAP and Accounting Policy Adjustments

Teads’ historical consolidated financial statements have been prepared in accordance with IFRS, which differs in certain respects from U.S. GAAP. The unaudited pro forma condensed combined financial statements include the statement of operations of Teads from the audited historical consolidated financial statements for the year ended December 31, 2023, the statement of operations of Teads from the historical unaudited condensed interim consolidated financial statements for the nine months ended September 30, 2024 and 2023, and the balance sheet of Teads from the historical unaudited condensed interim consolidated financial statements as of September 30, 2024, in each case prepared in accordance with IFRS as issued by the IASB.

The historical figures have been adjusted to reflect Teads’ consolidated statements of operations and balance sheet on a U.S. GAAP basis for the preparation of the unaudited pro forma condensed combined financial statements herein.

The following adjustments have been made to Teads’ historical financial statements to present them on a U.S. GAAP basis and conform them to the Company’s accounting policies for the purposes of the unaudited pro forma condensed combined financial statements:

(a) to reclassify $21.0 million of capitalized software and $0.2 million of leasehold improvements, which are classified within intangible assets on Teads’ balance sheet under IFRS, to property and equipment and capitalized software, net, to conform to Outbrain’s accounting policy of presenting these items within fixed assets, as permitted by U.S. GAAP. The related capital software amortization expenses have been reclassified from operating expenses to other cost of revenue, in accordance with U.S. GAAP;

(b) to present certain allocated compensation-related costs within sales and marketing operating expenses rather than cost of revenue, in accordance with Outbrain’s accounting policies;

(c) Under IFRS, lessees account for all leases as finance leases, with the associated lease expenses recorded within interest expense and depreciation expense. Under U.S. GAAP, Teads’ leases, which were analyzed under Accounting Standards Codification Topic 842, “Leases”, would be classified as operating leases with lease expense recognized on a straight-line basis as part of operating expenses. Accordingly, the below adjustments were reflected to derecognize the lease assets and liabilities recorded for Teads’ finance leases in accordance with IFRS and recognize the corresponding operating lease assets and liabilities in accordance with U.S. GAAP in the unaudited pro forma condensed combined balance sheet:

| | | | | | | | | | | | | | | | | |

| September 30, 2024 |

| Teads Finance Leases under IFRS | | Teads Operating Leases Under U.S. GAAP | | Adjustment |

| (in thousands) |

| Operating lease right-of-use assets, net | $ | 14,831 | | | $ | 15,446 | | | $ | 615 | |

| Accrued and other current liabilities | 5,450 | | | 4,582 | | | (868) | |

| Operating lease liabilities, non-current | 12,363 | | | 11,287 | | | (1,076) | |

| Net adjustment | $ | (2,982) | | | $ | (423) | | | $ | 2,559 | |

In the unaudited pro forma condensed combined statement of operations, Teads’ interest expense for lease liabilities classified as finance leases was removed and the allocated operating expenses were adjusted for the differences between the departmental expenses recognized under IFRS to the amounts to be recognized under U.S. GAAP, as summarized below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 | | | Year Ended December 31, 2023 |

| Teads Finance Leases under IFRS | | Teads Operating Leases Under U.S. GAAP | | Difference | | | Teads Finance Leases under IFRS | | Teads Operating Leases Under U.S. GAAP | | Difference |

| (in thousands) |

| Interest expense - finance leases | 813 | | | — | | | (813) | | | | 891 | | | — | | | (891) | |

| | | | | | | | | | | | |

| Operating expenses - finance lease depreciation | $ | 4,116 | | | $ | — | | | $ | (4,116) | | | | $ | 5,256 | | | $ | — | | | $ | (5,256) | |

| Operating expenses - fixed lease costs | — | | | 4,504 | | | 4,504 | | | | — | | | 5,909 | | | 5,909 | |

| $ | 4,116 | | | $ | 4,504 | | | $ | 388 | | | | $ | 5,256 | | | $ | 5,909 | | | $ | 653 | |

| | | | | | | | | | | | |

| Research and development | | | | | $ | 35 | | | | | | | | $ | 59 | |

| Sales and marketing | | | | | $ | 309 | | | | | | | | $ | 520 | |

| General and administrative | | | | | $ | 44 | | | | | | | | $ | 74 | |

| | | | | $ | 388 | | | | | | | | $ | 653 | |

The tax effects of the above adjustments were calculated using a blended U.S. federal and state tax rate and statutory rates of the respective foreign jurisdictions in which Teads operates; and

(d) to present bank charges within general and administrative expenses, in accordance with U.S. GAAP, rather than within finance costs under IFRS.

We continue to perform a detailed review of Teads’ historical financial statements prepared under IFRS, as issued by IASB. As a result of that review, the Company may identify additional differences between the accounting policies of the two companies that, when conformed, could have a material impact on the combined financial statements.

5. Preliminary Purchase Price Allocation

The aggregate purchase price paid by the Company to acquire Teads was comprised of (i) a cash payment of $625 million and (ii) 43.75 million shares of Outbrain Common Stock (including Treasury stock). The aggregate purchase price paid by the Company to acquire Teads was approximately $0.9 billion.

From and after closing, Altice Teads agreed to indemnify Outbrain and its affiliates for certain losses that may be incurred by them. For further information about an indemnity related to tax matters and the effect on these unaudited pro forma condensed combined financial statements, refer to 6(k) below.

The following summarizes the preliminary calculation of consideration transferred. The final calculation of consideration transferred is subject to future adjustments:

| | | | | | | | | | | |

| | | Amount |

| | | (in thousands) |

| Cash consideration | | | $ | 625,000 | |

Common equity consideration (including Treasury Stock) (1) | | | 262,938 | |

| Preliminary Aggregate Purchase Consideration | | | $ | 887,938 | |

_______________________________________

(1) Represents the fair value of 43.75 million shares of Outbrain Common Stock based on the closing stock price as of January 31, 2025 of $6.01 per share. The equity consideration is comprised of reissuing all of Outbrain’s treasury stock (13,374,906 shares as of September 30, 2024) and 30,375,094 shares of newly issued common stock.

Under the acquisition method of accounting, the estimated purchase price, calculated as described above, is allocated to the identifiable assets acquired and the identifiable liabilities assumed with any excess being allocated to goodwill.

The allocation of the purchase price is preliminary, and the final determination will be based on the fair values of assets acquired and liabilities assumed, including the fair values of identifiable intangible assets and the fair values of liabilities assumed on the date the Acquisition was consummated. The purchase price allocation is dependent upon certain valuation and other studies that have not yet been completed. Accordingly, the preliminary purchase price allocation is subject to further adjustments as additional information becomes available and as additional analyses and final valuations are conducted at and following the completion of the Acquisition. The final valuations could differ materially from the preliminary valuations presented below and, as such, no assurances can be provided regarding the preliminary purchase price allocation.

The preliminary purchase price allocation was estimated based on Teads’ historical financial statements reflecting IFRS to U.S. GAAP and accounting policy adjustments for pro forma purposes. The following tables summarize the preliminary purchase price allocation to the identifiable assets acquired and liabilities assumed of Teads as well as the identifiable intangible assets recognized as part of the Acquisition (in thousands):

| | | | | | | | | | | |

| | | As of September 30, 2024 |

| | | (in thousands) |

| Purchase consideration | | | $ | 887,938 | |

| | | |

| Amounts of identifiable assets acquired and liabilities assumed | | |

Book value of Teads’ net assets (1) | | $ | 788,215 | |

| Less: | | | |

| Elimination of intercompany transactions with Altice Teads | | (593,584) | |

| Elimination of historical goodwill | | | (37,013) | |

| Elimination of historical capitalized software | | (20,957) | |

| Elimination of historical intangible assets | | (494) | |

| Add: | | |

| Preliminary value of identifiable intangible assets | | 376,000 | |

| Deferred tax impact of identifiable intangible assets | | (44,090) | |

| Preliminary estimate of fair value of identifiable net assets acquired | | $ | 468,077 | |

| Preliminary estimate of goodwill | | | $ | 419,861 | |

____________________________________

(1) The book value of Teads’ net assets reflects preliminary IFRS to U.S. GAAP and accounting policy adjustments. The final goodwill amount that will be recorded in connection with the Acquisition is subject to change due to changes in the book value of Teads’ assets and liabilities at acquisition.

For purposes of determining the consideration transferred on the Acquisition Closing Date, the closing price of Outbrain Common Stock from January 31, 2025 has been utilized. See Note 6 for the preliminary fair value of the identifiable intangible assets.

6. Transaction Accounting Adjustments

The preliminary pro forma adjustments included in the unaudited pro forma condensed combined financial statements are as follows:

(a) Reflects the elimination of Teads’ historical intercompany balances with Outbrain, which will be eliminated in consolidation of the combined company, as well as the related revenue and traffic acquisition costs.

(b) Reflects the elimination of Teads’ intercompany balances with Altice Teads, which was required to be settled prior to the consummation of the Acquisition through a series of intercompany movements and distributions. The unaudited pro forma condensed combined balance sheet reflects the eliminations of $19.5 million interest receivable within prepaid expenses and other current assets and intercompany loans receivable of $574.1 million, net of provision for credit losses, within prepaid expenses and other current assets. The unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2024 and the year ended December 31, 2023 reflect the elimination of net income of $18.4 million and $14.9 million, respectively, from interest income and other income (expense), net. These adjustments eliminate the impacts of the interest income, as well as the provision for credit losses on the intercompany loans.

(c) Reflects an adjustment to eliminate the $21.0 million balance of Teads’ capitalized software included in its consolidated balance sheet as of September 30, 2024, as well to eliminate the related amortization expense of $8.5 million and $10.3 million for the nine months ended September 30, 2024 and the year ended December 31, 2023, respectively, as it is included in the preliminary fair value of the technology intangible asset in (e) below.

(d) Reflects the re-measurement of Teads’ lease portfolio as of September 30, 2024, updated for discount rates as of such date. The Company also reflected the impact of the practical expedient that it adopted at the Acquisition Closing, whereby it will not recognize right-of-use operating lease assets and liabilities for leases with a remaining lease term of twelve months or less. As a result of this re-measurement, operating lease right of use assets, net declined by $0.6 million, accrued and other current liabilities declined by $0.7 million and operating lease liabilities, non-current declined by $0.4 million. The statements of operations impact of this re-measurement was not material for the nine months ended September 30, 2024 and the year ended December 31, 2023.

(e) Reflects the net increase in intangible assets based on a preliminary estimated fair value, partially offset by an elimination of historical intangible assets. The preliminary estimated fair value is allocated to intangible assets primarily consisting of customer relationships, publisher relationships, technology and a trade name. The estimated fair values and useful lives of identifiable intangible assets are preliminary and have been performed based on publicly available benchmarking information given the limited time available to perform a full valuation study and limitations of information for the valuation study at this time. The amount that will ultimately be allocated to identifiable intangible assets and the related amount of amortization, may differ materially from this preliminary allocation. Any change in the valuation of intangible assets would cause a corresponding increase or decrease in the balance of goodwill. A hypothetical 10% change in the valuation of intangible assets would result in a change to annual amortization expense of approximately $4.5 million.

These estimated useful lives are preliminary and were determined based on our review of the time period over which economic benefit is estimated to be generated and other factors, including Outbrain management’s view based on historical experience with similar assets and market-based analysis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Estimated Amortization | | |

| Teads Historical Amounts After Reclassifications, net | | Estimated Fair Value | | Increase/Decrease | | Nine Months Ended September 30, 2024 | | Year Ended December 31, 2023 | | Estimated Weighted Average Useful Life (Years) |

| (dollars in thousands) | | | |

Publishers(2) | $ | — | | | $ | 56,400 | | | $ | 56,400 | | | $ | 4,230 | | | $ | 5,640 | | | 10 |

Customers(2) | 326 | | | 169,200 | | | 168,874 | | | 14,100 | | | 18,800 | | | 9 |

Technology(1) | — | | | 112,800 | | | 112,800 | | | 12,086 | | | 16,114 | | | 7 |

Trade name(2) | — | | | 37,600 | | | 37,600 | | | 3,525 | | | 4,700 | | | 8 |

| Other intangible assets | 168 | | | — | | | (168) | | | — | | | — | | | |

| Total estimated intangible assets | $ | 494 | | | $ | 376,000 | | | $ | 375,506 | | | $ | 33,941 | | | $ | 45,254 | | | |

| | | | | | | | | | | |

Less: elimination of historical amortization(2) | | | | 120 | | | 159 | | | |

| Total increase in amortization of intangible assets | | | | | | $ | 33,821 | | | $ | 45,095 | | | |

________________________________________

(1) Amortization expense is recorded within cost of revenue.

(2) Amortization expense is recorded within sales and marketing expenses within operating expenses. This amount excludes the amortization of capitalized software, which is separately eliminated in (c) above.

(f) Reflects the adjustment to eliminate Teads’ historical goodwill and record the preliminary estimate of goodwill related to the Acquisition, which is calculated as the difference between the fair value of the consideration transferred and the estimated fair values assigned to the identifiable tangible and intangible assets acquired and liabilities assumed. The goodwill amount is subject to change due to various factors, including the fair values of assets and liabilities at acquisition date and foreign exchange currency impacts.

| | | | | |

| As of September 30, 2024 |

| (in thousands) |

| Preliminary estimate of goodwill | $ | 419,861 | |

| Teads’ historical goodwill | (37,013) | |

| Adjustment to goodwill | $ | 382,848 | |

(g) Total transaction-related costs are estimated at approximately $30.0 million, $8.6 million of which has been reflected within general and administrative expenses in the Company’s historical consolidated statement of operations for the nine months ended September 30, 2024. The remainder of transaction costs of $21.4 million has been reflected as an adjustment to accounts payable in the unaudited pro forma condensed combined balance sheet as of September 30, 2024, as well as an adjustment to general and administrative expenses in the unaudited pro forma condensed combined statement of operations for the year ended December 31, 2023.

(h) Reflects the elimination of stock-based compensation expense for the PSAR Plan, as the related awards were cancelled prior to Acquisition Closing and the holders will not receive any cash compensation or replacement awards.

| | | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2024 | | Year Ended December 31, 2023 |

| | | (in thousands) |

| Sales and marketing | $ | 10,402 | | | $ | 6,645 | |

| Research and development | 5,629 | | | 3,596 | |

| General and administrative | 12,058 | | | 7,702 | |

| Total stock-based compensation expense | $ | 28,089 | | | $ | 17,943 | |

(i) Reflects the elimination of Teads’ historical equity accounts;

| | | | | | | | |

| | September 30, 2024 |

| | (in thousands) |

| Common stock | | $ | 17,379 | |

| Additional paid-in capital | | 99,178 | |

| Accumulated other comprehensive loss | | (29,107) | |

| Accumulated deficit | | 700,765 | |

| Total stockholders’ equity | | $ | 788,215 | |

(j) Represents the tax effect of the above adjustments using a blended U.S. federal and state tax rate and statutory tax rates of the respective foreign jurisdictions in which Teads operates and reflects any anticipated changes to the tax filing statuses of the acquired entities. The statutory tax rates range from 9% to 35%, which are in effect as of the pro forma balance sheet date. The actual effective tax rate could be materially different (either higher or lower) from the rate presented in the unaudited pro forma condensed combined financial information. These assumptions could change depending on post-acquisition activities, the geographical mix of income, changes in tax law, as well as the final determination of the fair value of the identifiable intangible assets and liabilities.

(k) Represents adjustments to increase uncertain tax positions by $14.0 million and to increase tax contingencies by $7.0 million, with an offsetting increase to other assets of $21.0 million relating to an indemnification provided by the Share Purchase Agreement. The corresponding tax effects have been reflected within the provision for income taxes and sales and marketing expenses in the unaudited pro forma condensed combined statements of operations.

Actual adjustments may differ materially based on the final determination of fair value and are subject to change.

7. Financing Adjustments

The unaudited pro-forma condensed combined financial statements have been adjusted to record the effects of incurring new indebtedness to finance the Acquisition. In connection with the acquisition on February 3, 2025, Outbrain, as the initial borrower, entered in to the New Credit Agreement, establishing the New Revolving Credit Facility with aggregate commitments of $100 million and (ii) the Bridge Facility in an aggregate principal amount of $625 million. We funded the cash consideration of the Acquisition with the Bridge Facility.

On February 11, 2025, Outbrain’s wholly owned subsidiary, OT Midco, completed a private offering (the “Offering”) of $637.5 million in aggregate principal amount of 10.000% senior secured notes due 2030 (the “Notes”) at an issue price of 98.087% of the principal amount thereof in a transaction exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”). The Notes are or will be guaranteed, jointly and severally on a secured, unsubordinated basis by Outbrain and each existing and future wholly-owned subsidiary of Outbrain that becomes a borrower, issuer or guarantor under Outbrain’s super senior secured revolving credit facility. The Notes are or will also be secured by first-priority lien over (i) all or substantially all assets of OT Midco, Outbrain and Teads Australia PTY Ltd, a subsidiary of Outbrain in Australia, and (ii) certain assets of some of the other direct and indirect subsidiaries of Outbrain in England and Wales, Canada, Germany, Mexico, Singapore, Switzerland, Luxembourg, Japan, Italy, France and Israel.

The proceeds from the Offering were used, together with cash on hand, to repay in full and cancel the indebtedness incurred under the Bridge Facility, including accrued and unpaid interest thereon, that was used to finance and pay costs related to the acquisition of Teads, as well as pay fees and expenses incurred in connection with the Offering and the Bridge Facility refinancing.

(a) Debt Financing

The following debt financing adjustments were made in the unaudited pro forma condensed combined balance sheet and statements of operations:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet | | Statement of Operations Adjustments | |

| (in thousands) | Recorded as of September 30, 2024 | | Adjustment As of September 30, 2024 | | Total Amount | | Nine Months Ended September 30, 2024 | | Year Ended December 31, 2023 | |

| Long-term debt, net of discount of $12.2 million | $ | — | | | $ | 625,305 | | | $ | 625,305 | | | $ | 49,433 | | | $ | 65,717 | | |

| Deferred issuance costs | (526) | | | (13,153) | | | (13,679) | | | $ | 2,052 | | | $ | 2,736 | | |

Total long-term debt (1) | $ | (526) | | (2) | $ | 612,152 | | (3) | $ | 611,626 | | (4) | | | | |

| | | | | | | | | | |

| Deferred issuance costs - New Revolving Credit Facility | $ | 110 | | | $ | 3,675 | | (5) | $ | 3,785 | | | $ | 568 | | | $ | 757 | | |

| Deferred issuance costs - prior facility | 231 | | (6) | (231) | | | — | | | (83) | | | (111) | | |

| Increase in deferred financing fees | $ | 341 | | | $ | 3,444 | | (7) | $ | 3,785 | | | | | | |

| | | | | | | | | | |

Bridge Facility fees (1) | $ | 1,208 | | | $ | (1,208) | | (8) | $ | — | | | $ | 538 | | | $ | 12,374 | | (9) |

Bridge facility interest expense (1) | | | | | | | — | | | 1,258 | | (9) |

| Commitment fee - New Revolving Credit Facility | | | | | | | 375 | | 500 | |

| Commitment fee - prior facility | | | | | | | (171) | | | (228) | | |

| Total incremental expenses | | | | | | | $ | 52,712 | | | $ | 83,003 | | |

__________________________

(1) On February 3, 2025, the Bridge Facility was drawn in full to fund the cash portion of the Total Consideration. Because we used the proceeds from the Notes, together with cash on hand, to repay in full and cancel the indebtedness incurred under the Bridge Facility, including accrued and unpaid interest thereon, and to pay fees and expenses incurred in connection therewith, these unaudited pro forma financial statements assume that the Notes are the only long-term indebtedness outstanding in connection with the Acquisition. The amounts recorded in the

statement of operations for the Bridge Facility include both, the related fees and expenses and the interest accrued for the nine days the facility was outstanding before it was refinanced with the Notes. The unaudited pro forma condensed combined balance sheet assumes that $637.5 million aggregate principal amount of the Notes are issued on September 30, 2024 at an issue price of 98.087% of the principal amount, or $625.3 million, and the unaudited pro forma condensed combined statements of operations assume that the Notes are issued on January 1, 2023. The discount on the Notes is amortized using the effective-interest method and recognized as part of interest expense.

(2) Recorded as a decrease in other assets.

(3) Recorded as an increase in cash and cash equivalents.

(4) Recorded as an increase in long-term debt .

(5) Recorded as a decrease in cash and cash equivalents.

(6) Represents an increase in accumulated deficit for the amount recorded in the statement of operations.

(7) Recorded as an increase in other assets.

(8) Recorded as a decrease in other assets and an increase in cash and cash equivalents.

(9) Represents an increase in accumulated deficit for amount recorded in the statement of operations and a decrease in cash and cash equivalents.

(b) Equity Financing

As previously described above, the unaudited pro forma condensed combined financial statements assumed that the Company issued 43.75 million shares of Common Stock, as detailed below:

| | | | | |

| September 30, 2024 |

| (in thousands) |

Common stock, par value of $0.001 per share(1) | $ | 30 | |

Reissuance of treasury stock (1) | 74,079 | |

Additional paid in capital (1) | 188,829 | |

| Pro-forma adjustment to stockholders’ equity | $ | 262,938 | |

__________________

(1) Equity consideration of 43,750,000 is comprised of reissuing all of Outbrain’s treasury stock (13,374,906 shares as of September 30, 2024) and 30,375,094 shares of newly issued common stock, par value of $0.001 per share in connection with the Acquisition, based on the closing stock price as of January 31, 2025 of $6.01 per share.

In connection with the issuance of equity as described above, the Company incurred equity issuance cost as described below:

| | | | | | | | | | | | | | | | | | | | |

| Decrease to additional paid-in capital | | Recorded on Balance Sheet As of September 30, 2024 | | Equity Issuance Costs Net of Amounts Recorded | |

| (in thousands) | |

| | | | | | |

| Total equity issuance costs | $ | 1,633 | | | $ | 807 | | (1) | $ | 826 | | (2) |

___________________

(1) Reflected as a decrease to other assets, where these costs have been recorded as of September 30, 2024.

(2) Reflected as an increase to accrued and other current liabilities.

8. Earnings (Loss) per Share

The following unaudited pro forma condensed combined basic and diluted earnings (loss) per share calculations are based on unaudited pro forma net income for the combined company and historical basic and diluted weighted average shares of Outbrain, adjusted to give effect to the issuance of consideration in the form of Common Stock.

| | | | | | | | | | | |

| Nine Months Ended September 30, 2024 | | Twelve Months Ended December 31, 2023 |

| (Dollars in thousands) |

| Numerator: | | | |

| Pro-forma net (loss) income attributed to common stockholders - basic | $ | (26,201) | | | $ | 1,503 | |

Adjustments related to convertible debt (1) | (4,834) | | | (13,930) | |

| Pro-forma net loss attributable to common stockholders - diluted | $ | (31,035) | | | $ | (12,427) | |

| | | |

| Denominator: | | | |

| Basic weighted average number of common shares outstanding - reported | 49,171,414 | | | 50,900,422 | |

| Common shares issued as part of the Acquisition | 43,750,000 | | | 43,750,000 | |

| Pro-forma weighted average shares - basic | 92,921,414 | | | 94,650,422 | |

Convertible debt (1) | 4,530,511 | | | 6,064,877 | |

| Restricted stock units | — | | | — | |

| Pro-forma weighted average shares - diluted | 97,451,925 | | | 100,715,299 | |

| | | |

| Pro forma net (loss) income per common share: | | | |

| Basic | $ | (0.28) | | | $ | 0.02 | |

| Diluted | $ | (0.32) | | | $ | (0.12) | |

____________________

(1) The Company uses the if-converted method to calculate the dilutive impact of the Convertible Notes, which assumes share settlement as of the beginning of the period if the effect is more dilutive than cash settlement.

The following potentially dilutive weighted-average shares have been excluded from the calculation of diluted net loss per share for each period presented because they are anti-dilutive:

| | | | | | | | | | | |

| Nine Months Ended September 30, 2024 | | Twelve Months Ended December 31, 2023 |

| Options to purchase common stock | 2,337,331 | | | 2,523,643 | |

| Warrants | 188,235 | | | 188,235 | |

| Restricted stock units | 3,854,406 | | | 3,275,430 | |

| Performance-based stock units | 492,353 | | | 51,534 | |

| Total shares excluded from diluted loss per share | 6,872,325 | | | 6,038,842 | |

v3.25.0.1

Cover

|

Feb. 03, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

Feb. 03, 2025

|

| Entity Registrant Name |

Outbrain Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40643

|

| Entity Tax Identification Number |

20-5391629

|

| Entity Address, Address Line One |

111 West 19th Street

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10011

|

| City Area Code |

(646)

|

| Local Phone Number |

867-0149

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

OB

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Amendment Flag |

true

|

| Entity Central Index Key |

0001454938

|

| Entity Ex Transition Period |

false

|

| Amendment Description |

This Amendment No. 1 on Form 8-K/A amends the Current Report on Form 8-K filed by Outbrain Inc. (the “Company”) on February 3, 2025 (the “Original Form 8-K”). The Original Form 8-K reported the completion of the Company’s acquisition (the “Acquisition”) of the issued and outstanding equity interests of TEADS (“Teads”) from Altice Teads S.A. This Amendment No. 1 amends the Original Form 8-K to provide the financial statements and pro forma financial information required under Item 9.01 of Form 8-K.This Amendment No. 1 reports no other updates or amendments to the Original Form 8-K.

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |