Real August Agent Survey Reveals Stability Amid NAR Settlement-Related Practice Changes

September 26 2024 - 6:30AM

Business Wire

Minimal Market Disruption Observed as Declining

Mortgage Rates Boost Agent Optimism

The Real Brokerage Inc. (NASDAQ: REAX, “Real”), a technology

platform reshaping real estate for agents, home buyers and sellers,

today released results from its August 2024 Agent Survey, including

early insights into the impact of the National Association of

Realtors’ (“NAR”) settlement on the residential home sales market.

With responses from nearly 300 agents across North America, the

survey indicates minimal disruption in market activity and

increasing agent optimism, driven by declining mortgage rates.

“While it's still early days, our internal data shows no

significant changes in average commission rates for buy-side or

sell-side transactions since the rule changes took effect,” said

Tamir Poleg, Chairman and CEO of Real. “This stability suggests

buyers and sellers continue to recognize the essential role agents

play in navigating a home sale transaction, which is often the

largest financial decision of an individual’s life.”

“We’re proud of the significant time and resources we invested

in preparing our agents for these changes, ensuring they can focus

on what they do best - delivering exceptional service and expertise

in helping clients buy and sell homes,” said Sharran Srivatsaa,

President of Real. “With mortgage rates easing, our agents are

optimistic that improving affordability will reignite housing

market activity, creating more opportunities for buyers and sellers

alike.”

Key Survey Findings: Early Impacts of NAR Settlement Rule

Changes

- Significant Majority of Agents Prepared for Change: Most

agents reported feeling ready for the NAR rule changes. Fifty-nine

percent of agents said they felt “very well prepared,” while an

additional 30% felt “somewhat prepared.” Only 5% reported feeling

unprepared for the new rules. Real provided agents with a

comprehensive suite of resources, including instructional videos,

marketing tools, and interactive roleplay sessions (see the Real

Buyer Playbook website for more details), to help prepare agents to

navigate the evolving landscape with confidence.

- Strong Success in Securing Buyer Representation

Agreements: Agents are largely finding it easy to secure buyer

representation agreements under the new rules, with 65% reporting

the process is either “very easy” (32%) or “somewhat easy” (33%).

Only a small fraction of agents (16%) have encountered challenges

in this area.

- No Immediate Impact to Market Activity Observed: When

asked “Have you noticed any change to overall market activity (e.g.

buyer interest, listings) since the rule changes?,” more than half

(55%) of agents reported no significant change since the rule

changes took effect on August 17. However, 26% observed a slight

decrease, and 6% noted a significant decrease, while a combined 12%

of agents saw slight or significant increases. These responses may

be indicative of the typical late-summer seasonal slowdown rather

than a direct impact from the rule changes.

- Most Buyers Expect Sellers to Cover Agent Compensation:

The survey revealed that 83% of agents reported buyers expect

sellers to cover 100% of the buyer’s agent commission, with another

10% expecting the seller to at least cover a portion.

- Sellers Largely Willing to Pay Buyer Agent Commissions:

Sellers seem open to directly paying buyer agent commissions.

Sixty-three percent (63%) of respondents noted sellers are

“frequently” doing so, with another 21% reporting occasional

coverage. However, 12% of agents said they are unsure of any

emerging trends. Sellers in the Midwest were the most likely to

cover buyer agent compensation (67%), followed by the South (64%),

the West (60%), and the Northeast (59%).

- Majority of Sellers Continue to Offer Competitive Buy-Side

Commission Rates: Despite concerns about commission

compression, 55% of agents reported that sellers are offering to

pay buy-side commissions of 2.5% or greater. Meanwhile, 30% of

agents noted that sellers are offering commissions below 2.5%, and

only 1% have observed a shift toward flat fee models, suggesting

these remain uncommon. Notably, Real's internal data on closed U.S.

buy-side transactions since the rule changes shows average

commission rates remaining consistent with historical levels dating

back to 2022.

- Subset of Agents Foresee Modest Adjustments in Future

Buy-Side Commissions: While the majority of agents have not

seen changes in buy-side commission rates to date, a subset

anticipates a gradual shift toward slightly lower commissions in

the future. When asked specifically about their expectations for

buy-side commissions, agents shared the following adjustments pre-

and post-rule changes:

- 49% of agents expect to earn commissions in the 2.6%-3.0%

range, compared to 57% prior to the rule changes.

- 32% expect commissions in the 2.1%-2.5% range, slightly down

from 35% before the changes.

- 10% now anticipate commissions in the 1.6%-2.0% range, up from

just 3% before the rule changes.

- 3% of agents expect to earn commissions in the 3.1%-3.5% range,

up from 2% pre-rule changes, suggesting that some agents are

optimistic about pricing for their value in the current

market.

- A small percentage (2%) of agents expect buy-side commissions

in the 1.0%-1.5% range, with this trend primarily observed in the

South and West regions.

Key Survey Findings: Market Trends and Insights

- Agent Optimism Index Hits Highest Level Since April:

Agents were asked, “Compared to one month ago, are you more

optimistic or pessimistic about the outlook for your primary market

over the next 12 months?”. Thirty-eight percent felt more

optimistic, with an additional 9% feeling significantly more

optimistic. This outweighed the 11% feeling more pessimistic and 4%

significantly more pessimistic. Meanwhile, 38% of agents remained

neutral. The average response resulted in a weighted Agent Optimism

Index reading of 59.3 from 57.2 in July, with scores above 50

indicating a net positive outlook. The increase was driven by a

2.3-point rise in the U.S., reaching 59.4. Optimism in Canada,

however, dropped 8.3 points to 50.0, though we see volatility in

this index due to a smaller sample size in Canada.

- Market Power Tilting Back Toward Sellers: When asked

whether their market was a buyer’s or seller’s market, 41% of

agents identified a seller’s market, up from 33% in July. The

percentage of agents viewing their markets as balanced fell to 39%

(from 42% in July), while only 20% of agents reported a buyer’s

market, down from 25%.

- North American Industry Transactions Continue Downward

Trend: Agents reported a continued year-over-year decline in

industry home sale transactions in August, with the Transaction

Growth Index reading at 41.6 on a 0-100 scale. While up slightly

from 40.1 in July, this figure remains below 50, indicating a

contraction in transactions. This is consistent with the 4% decline

in August existing home sales reported by NAR.

- Affordability Remains Top Concern: More than half (53%)

of agents identified affordability/mortgage rates as the top

challenge for prospective home buyers, down slightly from 56% in

July, likely the result of ongoing easing of mortgage rates. Lack

of inventory rose to 20%, up from 18%, while economic uncertainty

increased by six points, reaching 18%. Buyer competition eased to

5% of respondents from 8% in July.

A summary presentation of these results can be found on Real’s

investor relations website at the link here.

About the Survey The Real Brokerage August 2024 Agent

Survey included responses from approximately 300 real estate agents

across the United States and Canada and was conducted between

August 30, 2024 and September 15, 2024. Responses to questions

regarding transaction growth and agent optimism were calibrated on

a 0-100 point index scale, with readings above 50 indicating an

improving trend, whereas readings below 50 indicate a declining

trend. Responses are meant to capture industry-level information

and are not meant to serve as an indication of Real’s

company-specific growth trends. Additionally, given the smaller

sample size, there can be greater variability in Canada index

results on a month-to-month basis.

About Real Real (NASDAQ: REAX) is a real estate

experience company working to make life’s most complex transaction

simple. The fast-growing company combines essential real estate,

mortgage and closing services with powerful technology to deliver a

single seamless end-to-end consumer experience, guided by trusted

agents. With a presence in all 50 states throughout the U.S. and

Canada, Real supports over 21,000 agents who use its digital

brokerage platform and tight-knit professional community to power

their own forward-thinking businesses.

Forward-Looking Information This press release contains

forward-looking information within the meaning of applicable

Canadian securities laws. Forward-looking information is often, but

not always, identified by the use of words such as “seek”,

“anticipate”, “believe”, “plan”, “estimate”, “expect”, “likely” and

“intend” and statements that an event or result “may”, “will”,

“should”, “could” or “might” occur or be achieved and other similar

expressions. These statements reflect management’s current beliefs

and are based on information currently available to management as

of the date hereof. Forward-looking information in this press

release includes, without limiting the foregoing, expectations

regarding the residential real estate market in the U.S. and

Canada.

Forward-looking information is based on assumptions that may

prove to be incorrect, including but not limited to Real’s business

objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. Real

considers these assumptions to be reasonable in the circumstances.

However, forward-looking information is subject to known and

unknown risks, uncertainties and other factors that could cause

actual results, performance or achievements to differ materially

from those expressed or implied in the forward-looking information.

Important factors that could cause such differences include, but

are not limited to, slowdowns in real estate markets and economic

and industry downturns. These factors should be carefully

considered and readers should not place undue reliance on the

forward-looking statements. Although the forward-looking statements

contained in this press release are based upon what management

believes to be reasonable assumptions, Real cannot assure readers

that actual results will be consistent with these forward-looking

statements. These forward-looking statements are made as of the

date of this press release, and Real assumes no obligation to

update or revise them to reflect new events or circumstances,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926835526/en/

Investor inquiries, please contact: Ravi Jani Vice President,

Investor Relations and Financial Planning & Analysis

investors@therealbrokerage.com 908.280.2515

For media inquiries, please contact: Elisabeth Warrick Senior

Director, Marketing, Communications & Brand

press@therealbrokerage.com 201.564.4221

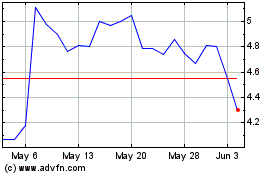

Real Brokerage (NASDAQ:REAX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Real Brokerage (NASDAQ:REAX)

Historical Stock Chart

From Feb 2024 to Feb 2025