Remitly Global, Inc. (NASDAQ: RELY), a trusted provider of digital

financial services that transcend borders, reported results for the

fourth quarter and full year ended December 31, 2024.

“We delivered an exceptional fourth quarter and

full year, exceeding expectations, as our product strength and

customer loyalty drove durable growth and improving profitability,”

said Matt Oppenheimer, co-founder and Chief Executive Officer,

Remitly. “Our product experience continues to resonate with

customers as we deliver simplicity, convenience, and trust. As we

look ahead to 2025 and beyond, I am excited about the growth

opportunities and innovation that will enable us to deliver on our

vision.”

Fourth Quarter 2024 Highlights and Key

Operating Data(All comparisons relative to the fourth

quarter of 2023)

- Active customers increased to 7.8

million, from 5.9 million, up 32%.

- Send volume increased to $15.4

billion, from $11.1 billion, up 39%.

- Revenue totaled $351.9 million,

compared to $264.8 million, up 33%.

- Net loss was $5.7 million, compared to

a net loss of $35.0 million.

- Adjusted EBITDA was

$43.7 million, compared to $8.2 million, up 434%.

Full Year 2024 Highlights and Key Operating

Data:(All comparisons relative to the full year 2023)

- Send volume increased to $54.6

billion, from $39.5 billion, up 38%.

- Revenue totaled $1,264.0 million,

compared to $944.3 million, up 34%.

- Net loss was $37.0 million, compared

to a net loss of $117.8 million.

- Adjusted EBITDA was

$134.8 million, compared to $44.5 million, up 203%.

2025 Financial OutlookFor fiscal

year 2025, Remitly currently expects:

- Total revenue in the range of $1.565

billion to $1.580 billion, representing a growth rate of 24% to 25%

year over year.

- GAAP net income to

be positive for 2025 and for Adjusted EBITDA to be in the range of

$180 million to $200 million.

For the first quarter of 2025, Remitly currently

expects:

- Total revenue in the range of $345

million to $348 million, representing a growth rate of 28% to 29%

year over year.

- A GAAP net loss

position for the first quarter of 2025 and for Adjusted EBITDA to

be in the range of $36 million to $40 million.

Reconciliation of GAAP to

Non-GAAP Financial MeasuresA reconciliation of GAAP to

non-GAAP financial measures has been provided in the financial

statement tables included in this earnings release. An explanation

of these measures is also included below under the heading

“Non-GAAP Financial Measures.” We have not provided a quantitative

reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net

income (loss) or to forecasted GAAP income (loss) before income

taxes within this earnings release because we cannot, without

unreasonable effort, calculate certain reconciling items with

confidence due to the variability, complexity, and limited

visibility of the adjusting items that would be excluded from

forecasted Adjusted EBITDA. These items include, but are not

limited to, income taxes and stock-based compensation expense,

which are directly impacted by unpredictable fluctuations in the

market price of our common stock. The variability of these items

could have a significant impact on our future GAAP financial

results.

Note: All percentage changes described within this

press release are calculated using amounts in the Company’s Annual

Reports on Form 10-K and Quarterly Reports on Form 10-Q filed with

the Securities and Exchange Commission (the “SEC”), for which

revenue and active customers are presented in thousands and send

volume is presented in millions. Rounding differences may occur

when individually calculating percentages or totals from rounded

amounts included within the press release body as compared to the

amounts included within the Company’s SEC filings.

Webcast InformationRemitly will

host a webcast at 5:00 p.m. Eastern time on Wednesday,

February 19, 2025 to discuss its fourth quarter and full year

2024 financial results. The live webcast and investor presentation

will be accessible on Remitly’s website at https://ir.remitly.com.

A webcast replay will be available on our website at

https://ir.remitly.com following the live event.

We have used, and intend to continue to use, the

Investor Relations section of our website at https://ir.remitly.com

as a means of disclosing material nonpublic information and for

complying with our disclosure obligations under Regulation FD.

Non-GAAP Financial MeasuresSome of

the financial information and data contained in this earnings

release, such as Adjusted EBITDA and non-GAAP operating expenses,

have not been prepared in accordance with United States generally

accepted accounting principles (“GAAP”). We regularly review our

key business metrics and non-GAAP financial measures to evaluate

our performance, identify trends affecting our business, prepare

financial projections, and make strategic decisions. We believe

that these key business metrics and non-GAAP financial measures

provide meaningful supplemental information for management and

investors in assessing our historical and future operating

performance. Adjusted EBITDA and non-GAAP operating expenses are

key output measures used by our management to evaluate our

operating performance, inform future operating plans, and make

strategic long-term decisions, including those relating to

operating expenses and the allocation of internal resources.

Remitly believes that the use of Adjusted EBITDA and non-GAAP

operating expenses provides additional tools to assess operational

performance and trends in, and in comparing Remitly’s financial

measures with, other similar companies, many of which present

similar non-GAAP financial measures to investors. Remitly’s

non-GAAP financial measures may be different from non-GAAP

financial measures used by other companies. The presentation of

non-GAAP financial measures is not intended to be considered in

isolation or as a substitute for, or superior to, financial

measures determined in accordance with GAAP. Because of the

limitations of non-GAAP financial measures, you should consider the

non-GAAP financial measures presented herein in conjunction with

Remitly’s financial statements and the related notes thereto.

Please refer to the non-GAAP reconciliations in this press release

for a reconciliation of these non-GAAP financial measures to the

most comparable financial measure prepared in accordance with

GAAP.

We calculate Adjusted EBITDA as net loss adjusted

by (i) interest (income) expense, net, (ii) provision for income

taxes, (iii) noncash charges of depreciation and amortization, (iv)

gains and losses from the remeasurement of foreign currency assets

and liabilities into their functional currency, (v) noncash charges

associated with our donation of common stock in connection with our

Pledge 1% commitment, (vi) noncash stock-based compensation

expense, net, and (vii) certain acquisition, integration,

restructuring, and other costs. We calculate non-GAAP operating

expenses as our GAAP operating expenses adjusted by (i) noncash

stock-based compensation expense, net, (ii) noncash charges

associated with our donation of common stock in connection with our

Pledge 1% commitment, as well as (iii) certain acquisition,

integration, restructuring, and other costs.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements other than statements of historical fact are

forward-looking statements. These statements include, but are not

limited to, statements regarding our future results of operations

and financial position, including our fiscal year and first quarter

2025 financial outlook, including forecasted fiscal year and first

quarter 2025 revenue, net income (loss), and Adjusted EBITDA,

anticipated future expenses and investments, expectations relating

to certain of our key financial and operating metrics, our business

strategy and plans, our growth, our position and potential

opportunities, and our objectives for future operations. The words

such as “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “likely,” “plan,” “potential,”

“predict,” “project,” “seek,” “should,” “target,” “will,” “would,”

or similar expressions and the negatives of those terms are

intended to identify forward-looking statements. Forward-looking

statements are based on management’s expectations, assumptions, and

projections based on information available at the time the

statements were made. These forward-looking statements are subject

to a number of risks, uncertainties, and assumptions, including

risks and uncertainties related to our expectations regarding our

revenue, expenses, and other operating results; our ability to

acquire new customers and successfully retain existing customers;

our ability to develop new products and services in a timely

manner; our ability to achieve or sustain our profitability; our

ability to maintain and expand our strategic relationships with

third parties; our business plan and our ability to effectively

manage our growth; anticipated trends, growth rates, and challenges

in our business and in the market segments in which we operate; our

ability to attract and retain qualified employees; uncertainties

regarding the impact of geopolitical and macroeconomic conditions,

including currency fluctuations, inflation, regulatory changes

(including as may be related to immigration, fiscal policy, foreign

trade, or foreign investment), or regional and global conflicts or

related government sanctions; our ability to maintain the security

and availability of our solutions; our ability to maintain our

money transmission licenses and other regulatory clearances; our

ability to maintain and expand international operations; and our

expectations regarding anticipated technology needs and

developments and our ability to address those needs and

developments with our solutions. It is not possible for our

management to predict all risks, nor can we assess the impact of

all factors on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements

we may make. In light of these risks, uncertainties, and

assumptions, our actual results could differ materially and

adversely from those anticipated or implied in the forward-looking

statements. Further information on risks that could cause actual

results to differ materially from forecasted results is included in

our annual report on Form 10-K for the year ended December 31, 2024

to be filed with the SEC, and within our annual report on Form 10-K

for the year ended December 31, 2023 filed with the SEC, which are

or will be available on our website at https://ir.remitly.com and

on the SEC’s website at www.sec.gov. Except as required by law, we

assume no obligation to update these forward-looking statements, or

to update the reasons if actual results differ materially from

those anticipated in the forward-looking statements.

About RemitlyRemitly is a trusted

provider of digital financial services that transcend borders. With

a global footprint spanning more than 170 countries, Remitly’s

digitally native, cross-border payments app delights customers with

a fast, reliable, and transparent money movement experience.

Building on its strong foundation, Remitly is expanding its suite

of products to further its vision and transform lives around the

world.

Contacts

Media:Kendall

Sadlerkendall@remitly.com

Investor Relations:Stephen

Shulsteinstephens@remitly.com

|

REMITLY GLOBAL, INC. |

|

Condensed Consolidated Statements of

Operations |

|

(unaudited) |

| |

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(in thousands, except share and per share data) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

351,895 |

|

|

$ |

264,758 |

|

|

$ |

1,263,963 |

|

|

$ |

944,285 |

|

|

Costs and expenses |

|

|

|

|

|

|

|

|

Transaction expenses(1) |

|

118,389 |

|

|

|

89,118 |

|

|

|

431,604 |

|

|

|

329,113 |

|

|

Customer support and operations(1) |

|

22,008 |

|

|

|

19,917 |

|

|

|

83,918 |

|

|

|

82,521 |

|

|

Marketing(1) |

|

83,937 |

|

|

|

75,343 |

|

|

|

303,799 |

|

|

|

234,417 |

|

|

Technology and development(1) |

|

70,611 |

|

|

|

59,240 |

|

|

|

269,817 |

|

|

|

219,939 |

|

|

General and administrative(1) |

|

54,875 |

|

|

|

48,657 |

|

|

|

195,857 |

|

|

|

179,372 |

|

|

Depreciation and amortization |

|

5,814 |

|

|

|

3,484 |

|

|

|

18,054 |

|

|

|

13,118 |

|

|

Total costs and expenses |

|

355,634 |

|

|

|

295,759 |

|

|

|

1,303,049 |

|

|

|

1,058,480 |

|

|

Loss from operations |

|

(3,739 |

) |

|

|

(31,001 |

) |

|

|

(39,086 |

) |

|

|

(114,195 |

) |

|

Interest income |

|

1,844 |

|

|

|

2,247 |

|

|

|

8,077 |

|

|

|

7,447 |

|

|

Interest expense |

|

(967 |

) |

|

|

(786 |

) |

|

|

(3,241 |

) |

|

|

(2,352 |

) |

|

Other income (expense), net |

|

(2,273 |

) |

|

|

(64 |

) |

|

|

3,999 |

|

|

|

(2,838 |

) |

|

Loss before provision for income taxes |

|

(5,135 |

) |

|

|

(29,604 |

) |

|

|

(30,251 |

) |

|

|

(111,938 |

) |

|

Provision for income taxes |

|

589 |

|

|

|

5,417 |

|

|

|

6,727 |

|

|

|

5,902 |

|

|

Net loss |

$ |

(5,724 |

) |

|

$ |

(35,021 |

) |

|

$ |

(36,978 |

) |

|

$ |

(117,840 |

) |

|

Net loss per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.03 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.65 |

) |

|

Weighted-average shares used in computing net loss per share

attributable to common stockholders: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

199,049,777 |

|

|

|

186,343,078 |

|

|

|

194,646,436 |

|

|

|

180,818,399 |

|

| ___________________________ |

|

(1) Exclusive of depreciation and amortization, shown

separately. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REMITLY GLOBAL, INC. |

|

Condensed Consolidated Balance Sheets |

|

(unaudited) |

|

|

|

|

December 31, |

|

December 31, |

|

(in thousands) |

2024 |

|

2023 |

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

368,097 |

|

|

$ |

323,710 |

|

|

Disbursement prefunding |

|

288,934 |

|

|

|

195,848 |

|

|

Customer funds receivable, net |

|

193,965 |

|

|

|

379,417 |

|

|

Prepaid expenses and other current assets |

|

46,518 |

|

|

|

33,143 |

|

|

Total current assets |

|

897,514 |

|

|

|

932,118 |

|

| Property and equipment,

net |

|

31,566 |

|

|

|

16,010 |

|

| Operating lease right-of-use

assets |

|

13,002 |

|

|

|

9,525 |

|

| Goodwill |

|

54,940 |

|

|

|

54,940 |

|

| Intangible assets, net |

|

10,463 |

|

|

|

16,642 |

|

| Other noncurrent assets,

net |

|

5,386 |

|

|

|

7,071 |

|

|

Total assets |

$ |

1,012,871 |

|

|

$ |

1,036,306 |

|

|

Liabilities and stockholders’ equity |

|

|

|

| Current liabilities |

|

|

|

|

Accounts payable |

$ |

16,159 |

|

|

$ |

35,051 |

|

|

Customer liabilities |

|

188,984 |

|

|

|

177,473 |

|

|

Short-term debt |

|

2,468 |

|

|

|

2,481 |

|

|

Accrued expenses and other current liabilities |

|

116,652 |

|

|

|

145,802 |

|

|

Operating lease liabilities |

|

4,745 |

|

|

|

6,032 |

|

|

Total current liabilities |

|

329,008 |

|

|

|

366,839 |

|

| Operating lease liabilities,

noncurrent |

|

9,073 |

|

|

|

4,477 |

|

| Long-term debt |

|

— |

|

|

|

130,000 |

|

| Other noncurrent

liabilities |

|

9,319 |

|

|

|

5,653 |

|

|

Total liabilities |

|

347,400 |

|

|

|

506,969 |

|

|

Commitments and contingencies |

|

|

|

|

Stockholders’ equity |

|

|

|

|

Common stock |

|

20 |

|

|

|

19 |

|

|

Additional paid-in capital |

|

1,195,390 |

|

|

|

1,020,286 |

|

|

Accumulated other comprehensive (loss) income |

|

(1,658 |

) |

|

|

335 |

|

|

Accumulated deficit |

|

(528,281 |

) |

|

|

(491,303 |

) |

|

Total stockholders’ equity |

|

665,471 |

|

|

|

529,337 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,012,871 |

|

|

$ |

1,036,306 |

|

| |

|

|

|

|

|

|

|

|

REMITLY GLOBAL, INC. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(unaudited) |

| |

| |

Year Ended December 31, |

|

(in thousands) |

2024 |

|

2023 |

| Cash flows from

operating activities |

|

|

|

|

Net loss |

$ |

(36,978 |

) |

|

$ |

(117,840 |

) |

| Adjustments to reconcile net

loss to net cash provided by (used in) operating activities: |

|

|

|

|

Depreciation and amortization |

|

18,054 |

|

|

|

13,118 |

|

|

Stock-based compensation expense, net |

|

152,137 |

|

|

|

136,967 |

|

|

Donation of common stock |

|

2,587 |

|

|

|

4,600 |

|

|

Other |

|

454 |

|

|

|

713 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Disbursement prefunding |

|

(93,086 |

) |

|

|

(31,778 |

) |

|

Customer funds receivable |

|

186,357 |

|

|

|

(183,422 |

) |

|

Prepaid expenses and other assets |

|

(12,224 |

) |

|

|

(13,035 |

) |

|

Operating lease right-of-use assets |

|

5,981 |

|

|

|

5,186 |

|

|

Accounts payable |

|

(20,823 |

) |

|

|

27,559 |

|

|

Customer liabilities |

|

12,666 |

|

|

|

61,718 |

|

|

Accrued expenses and other liabilities |

|

(14,499 |

) |

|

|

47,357 |

|

|

Operating lease liabilities |

|

(6,141 |

) |

|

|

(4,733 |

) |

|

Net cash provided by (used in) operating activities |

|

194,485 |

|

|

|

(53,590 |

) |

| Cash flows from

investing activities |

|

|

|

| Purchases of property and

equipment |

|

(5,998 |

) |

|

|

(2,857 |

) |

|

Capitalized internal-use software costs |

|

(11,704 |

) |

|

|

(6,247 |

) |

|

Cash paid for acquisition, net of acquired cash, cash equivalents,

and restricted cash |

|

— |

|

|

|

(40,933 |

) |

|

Net cash used in investing activities |

|

(17,702 |

) |

|

|

(50,037 |

) |

| Cash flows from

financing activities |

|

|

|

| Proceeds from exercise of

stock options |

|

8,667 |

|

|

|

14,288 |

|

| Proceeds from issuance of

common stock in connection with ESPP |

|

9,382 |

|

|

|

6,132 |

|

| Proceeds from revolving credit

facility borrowings |

|

1,453,000 |

|

|

|

764,000 |

|

| Repayments of revolving credit

facility borrowings |

|

(1,583,000 |

) |

|

|

(634,000 |

) |

| Taxes paid related to net

share settlement of equity awards |

|

(5,228 |

) |

|

|

(6,702 |

) |

| Cash paid for settlement of

amounts previously held back for acquisition consideration |

|

(10,261 |

) |

|

|

— |

|

| Repayment of assumed

indebtedness |

|

— |

|

|

|

(17,068 |

) |

|

Net cash (used in) provided by financing activities |

|

(127,440 |

) |

|

|

126,650 |

|

| Effect of foreign exchange

rate changes on cash, cash equivalents, and restricted cash |

|

(4,555 |

) |

|

|

1,272 |

|

| Net increase in cash, cash

equivalents, and restricted cash |

|

44,788 |

|

|

|

24,295 |

|

|

Cash, cash equivalents, and restricted cash at beginning of

period |

|

325,029 |

|

|

|

300,734 |

|

|

Cash, cash equivalents, and restricted cash at end of period |

$ |

369,817 |

|

|

$ |

325,029 |

|

| Reconciliation of

cash, cash equivalents, and restricted cash |

|

|

|

| Cash and cash equivalents |

$ |

368,097 |

|

|

$ |

323,710 |

|

| Restricted cash included in

prepaid expenses and other current assets |

|

658 |

|

|

|

774 |

|

| Restricted cash included in

other noncurrent assets, net |

|

1,062 |

|

|

|

545 |

|

| Total cash, cash equivalents,

and restricted cash |

$ |

369,817 |

|

|

$ |

325,029 |

|

| |

|

|

|

|

|

|

|

|

REMITLY GLOBAL, INC. |

|

Reconciliation of GAAP to Non-GAAP Financial

Measures |

|

(unaudited) |

|

|

|

Reconciliation of net loss to Adjusted

EBITDA: |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(in thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net loss |

$ |

(5,724 |

) |

|

$ |

(35,021 |

) |

|

$ |

(36,978 |

) |

|

$ |

(117,840 |

) |

|

Add: |

|

|

|

|

|

|

|

|

Interest income, net |

|

(877 |

) |

|

|

(1,461 |

) |

|

|

(4,836 |

) |

|

|

(5,095 |

) |

|

Provision for income taxes |

|

589 |

|

|

|

5,417 |

|

|

|

6,727 |

|

|

|

5,902 |

|

|

Depreciation and amortization |

|

5,814 |

|

|

|

3,484 |

|

|

|

18,054 |

|

|

|

13,118 |

|

|

Foreign exchange (gain) loss |

|

2,273 |

|

|

|

(8 |

) |

|

|

(4,394 |

) |

|

|

2,603 |

|

|

Donation of common stock |

|

— |

|

|

|

— |

|

|

|

2,587 |

|

|

|

4,600 |

|

|

Stock-based compensation expense, net |

|

41,614 |

|

|

|

35,960 |

|

|

|

152,137 |

|

|

|

136,967 |

|

|

Acquisition, integration, restructuring, and other costs(1) |

|

— |

|

|

|

(193 |

) |

|

|

1,468 |

|

|

|

4,197 |

|

|

Adjusted EBITDA |

$ |

43,689 |

|

|

$ |

8,178 |

|

|

$ |

134,765 |

|

|

$ |

44,452 |

|

| ___________________________ |

| (1) Acquisition, integration, restructuring,

and other costs for the twelve months ended December 31, 2024

consisted primarily of $0.8 million in restructuring charges

incurred, $0.5 million of non-recurring legal charges, and

$0.2 million related to the change in the fair value of the

holdback liability associated with the acquisition of Rewire

(O.S.G.) Research and Development Ltd. (“Rewire”). Acquisition,

integration, restructuring, and other costs for the three months

ended December 31, 2023 consisted primarily of $(0.8) million

related to the change in the fair value of the holdback liability

and $0.6 million of expenses incurred in connection with the

acquisition and integration of Rewire. Acquisition, integration,

restructuring, and other costs for the twelve months ended December

31, 2023 consisted primarily of $1.7 million of expenses

incurred in connection with the acquisition and integration of

Rewire, $1.4 million in restructuring charges incurred, and

$1.1 million related to the change in the fair value of the

holdback liability associated with the acquisition of Rewire. |

| |

|

Reconciliation of operating expenses to non-GAAP operating

expenses: |

| |

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(in thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Customer support and operations |

$ |

22,008 |

|

$ |

19,917 |

|

|

$ |

83,918 |

|

$ |

82,521 |

|

Excluding: Stock-based compensation expense, net |

|

268 |

|

|

394 |

|

|

|

1,158 |

|

|

1,404 |

|

Excluding: Acquisition, integration, restructuring, and other

costs |

|

— |

|

|

— |

|

|

|

758 |

|

|

739 |

|

Non-GAAP customer support and operations |

$ |

21,740 |

|

$ |

19,523 |

|

|

$ |

82,002 |

|

$ |

80,378 |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Marketing |

$ |

83,937 |

|

$ |

75,343 |

|

|

$ |

303,799 |

|

$ |

234,417 |

|

Excluding: Stock-based compensation expense, net |

|

4,595 |

|

|

3,930 |

|

|

|

17,609 |

|

|

16,165 |

|

Non-GAAP marketing |

$ |

79,342 |

|

$ |

71,413 |

|

|

$ |

286,190 |

|

$ |

218,252 |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Technology and development |

$ |

70,611 |

|

$ |

59,240 |

|

|

$ |

269,817 |

|

$ |

219,939 |

|

Excluding: Stock-based compensation expense, net |

|

22,527 |

|

|

19,920 |

|

|

|

84,381 |

|

|

74,967 |

|

Excluding: Acquisition, integration, restructuring, and other

costs |

|

— |

|

|

700 |

|

|

|

— |

|

|

1,224 |

|

Non-GAAP technology and development |

$ |

48,084 |

|

$ |

38,620 |

|

|

$ |

185,436 |

|

$ |

143,748 |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

General and administrative |

$ |

54,875 |

|

$ |

48,657 |

|

|

$ |

195,857 |

|

$ |

179,372 |

|

Excluding: Stock-based compensation expense, net |

|

14,224 |

|

|

11,716 |

|

|

|

48,989 |

|

|

44,431 |

|

Excluding: Donation of common stock |

|

— |

|

|

— |

|

|

|

2,587 |

|

|

4,600 |

|

Excluding: Acquisition, integration, restructuring, and other

costs |

|

— |

|

|

(893 |

) |

|

|

710 |

|

|

2,234 |

|

Non-GAAP general and administrative |

$ |

40,651 |

|

$ |

37,834 |

|

|

$ |

143,571 |

|

$ |

128,107 |

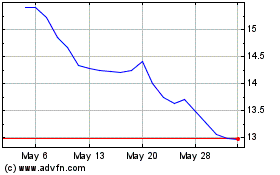

Remitly Global (NASDAQ:RELY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Remitly Global (NASDAQ:RELY)

Historical Stock Chart

From Feb 2024 to Feb 2025