RGC Resources, Inc. Reports 2024 Earnings

November 13 2024 - 3:56PM

RGC Resources, Inc. (Nasdaq: RGCO) announced consolidated Company

earnings of $11,760,896, or $1.16 per share, for the fiscal year

ended September 30, 2024, compared to $11,299,282, or $1.14 per

share, for the fiscal year ended September 30, 2023. The increase

reflected higher levels of earnings from the Company’s investment

in the Mountain Valley Pipeline (“MVP”) due to more AFUDC in fiscal

2024 prior to the pipeline being placed in service in June 2024.

The lower cost of natural gas in 2024 reduced bills to customers

and revenues for the Company, despite inflationary costs leading to

higher tariffs. Interest expense also increased primarily due to

higher interest rates.

Roanoke Gas continued investing in utility

infrastructure to enhance system reliability and enable growth in

customers and earnings. CEO Paul Nester stated, “Gas flowing

through the MVP in 2024 is a major milestone we worked hard to

achieve, and one we and the region will long appreciate. We are

pleased to have recently reached a settlement on our pending rate

proceeding with the State Corporation Commission staff that

provides for an incremental increase in annual revenues of $4.08

million, subject to approval by the Commission.”

Net income for the quarter ended September 30,

2024 was $140,822, or $0.01 per share, compared to $1,014,175, or

$0.10 per share, for the quarter ended September 30, 2023. A lower

level of earnings from our investment in MVP along with higher

interest expense resulted in lower net income compared to the same

quarter a year ago.

RGC Resources, Inc. provides energy and related

products and services to customers in Virginia through its

operating subsidiaries Roanoke Gas Company and RGC Midstream,

LLC.

The statements in this release that are not

historical facts constitute “forward-looking statements” made

pursuant to the safe harbor provision of the Private Securities

Litigation Reform Act of 1995 that involve risks and uncertainties.

In order to comply with the terms of the safe harbor, the Company

notes that a variety of factors could cause the Company’s actual

results and experience to differ materially from any expectations

expressed in the Company’s forward-looking statements, regarding

customer growth, infrastructure investment and margins. These risks

and uncertainties include gas prices and supply, geopolitical

considerations, expectations regarding the rate making, MVP

operation and Southgate construction, along with risks included

under Item 1-A in the Company’s fiscal 2023 Form10-K.

Forward-looking statements reflect the Company’s current

expectations only as of the date they are made. The Company assumes

no duty to update these statements should expectations change or

actual results differ from current expectations except as required

by applicable laws and regulations.

Past performance is not necessarily a predictor

of future results.

Summary financial statements for the fourth

quarter and twelve months are as follows:

|

|

|

RGC Resources, Inc. and Subsidiaries |

|

Condensed Consolidated Statements of Income |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Twelve Months Ended |

| |

|

September 30, |

|

September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

Operating revenues |

|

$ |

13,104,302 |

|

|

$ |

12,467,528 |

|

|

$ |

84,641,232 |

|

|

$ |

97,439,765 |

|

|

Operating expenses |

|

|

12,861,881 |

|

|

|

11,723,420 |

|

|

|

67,559,472 |

|

|

|

79,761,285 |

|

|

Operating income |

|

|

242,421 |

|

|

|

744,108 |

|

|

|

17,081,760 |

|

|

|

17,678,480 |

|

|

Equity in earnings of unconsolidated affiliate |

|

|

872,048 |

|

|

|

1,561,409 |

|

|

|

3,851,871 |

|

|

|

2,084,990 |

|

|

Other income, net |

|

|

887,837 |

|

|

|

443,373 |

|

|

|

1,028,761 |

|

|

|

646,528 |

|

|

Interest expense |

|

|

1,734,906 |

|

|

|

1,430,213 |

|

|

|

6,504,885 |

|

|

|

5,618,805 |

|

|

Income before income taxes |

|

|

267,400 |

|

|

|

1,318,677 |

|

|

|

15,457,507 |

|

|

|

14,791,193 |

|

|

Income tax expense |

|

|

126,578 |

|

|

|

304,502 |

|

|

|

3,696,611 |

|

|

|

3,491,911 |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

140,822 |

|

|

$ |

1,014,175 |

|

|

$ |

11,760,896 |

|

|

$ |

11,299,282 |

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings per share of common stock: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.01 |

|

|

$ |

0.10 |

|

|

$ |

1.16 |

|

|

$ |

1.14 |

|

|

Diluted |

|

$ |

0.01 |

|

|

$ |

0.10 |

|

|

$ |

1.16 |

|

|

$ |

1.14 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per common share |

$ |

0.2000 |

|

|

$ |

0.1975 |

|

|

$ |

0.8000 |

|

|

$ |

0.7900 |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

10,223,785 |

|

|

|

10,009,491 |

|

|

|

10,152,909 |

|

|

|

9,922,701 |

|

|

Diluted |

|

|

10,228,365 |

|

|

|

10,011,039 |

|

|

|

10,156,480 |

|

|

|

9,927,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

Assets |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

Current assets |

|

|

|

$ |

25,072,301 |

|

|

$ |

26,795,262 |

|

|

|

|

Utility property, net |

|

|

|

|

262,041,454 |

|

|

|

247,583,551 |

|

|

|

|

Other non-current assets |

|

|

|

|

33,777,404 |

|

|

|

29,350,527 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

|

|

|

$ |

320,891,159 |

|

|

$ |

303,729,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

$ |

28,698,430 |

|

|

$ |

32,918,787 |

|

|

|

|

Long-term debt, net |

|

|

|

|

136,672,908 |

|

|

|

125,844,728 |

|

|

|

|

Deferred credits and other non-current liabilities |

|

|

|

47,383,046 |

|

|

|

44,233,200 |

|

|

|

|

Total Liabilities |

|

|

|

|

212,754,384 |

|

|

|

202,996,715 |

|

|

|

|

Stockholders' Equity |

|

|

|

|

108,136,775 |

|

|

|

100,732,625 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity |

|

|

$ |

320,891,159 |

|

|

$ |

303,729,340 |

|

|

|

|

Contact: |

Timothy J. Mulvaney |

| |

VP, Treasurer and CFO |

| Telephone: |

(540) 777-3997 |

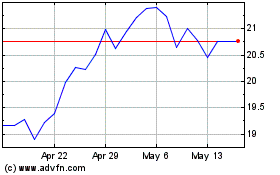

RGC Resources (NASDAQ:RGCO)

Historical Stock Chart

From Oct 2024 to Nov 2024

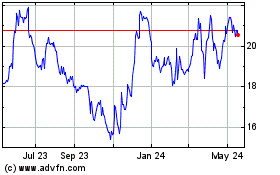

RGC Resources (NASDAQ:RGCO)

Historical Stock Chart

From Nov 2023 to Nov 2024