As filed with the Securities and Exchange Commission on August 2, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RIGEL PHARMACEUTICALS, INC.

(Exact name of Registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of incorporation or organization)

|

|

|

94-3248524

(I.R.S. Employer Identification Number)

|

|

611 Gateway Boulevard, Suite 900

South San Francisco, California 94080

(650) 624-1100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Raul R. Rodriguez

President and Chief Executive Officer

Rigel Pharmaceuticals, Inc.

611 Gateway Boulevard, Suite 900

South San Francisco, California 94080

(650) 624-1100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Carlton Fleming

Sidley Austin LLP

555 California Street, Suite 2000

San Francisco, California 94104

Telephone: (415) 772-1200

Fax: (415) 772-7400

Approximate date of commencement of proposed sale to the public: From time to time, after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

|

|

|

☐

|

|

|

Accelerated filer

|

|

|

☒

|

|

| |

Non-accelerated filer

|

|

|

☐

|

|

|

Smaller reporting company

|

|

|

☐

|

|

| |

|

|

|

|

|

|

Emerging growth company

|

|

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

This registration statement contains:

•

a base prospectus, which covers the offering, issuance and sale by us of up to $250,000,000 in the aggregate of the securities identified therein from time to time in one or more offerings, which serves as a replacement for our expiring shelf registration statement previously filed and declared effective by the Securities and Exchange Commission; and

•

a sales agreement prospectus, which covers the offering, issuance and sale by us of up to a maximum aggregate offering price of $100,000,000 of our common stock that may be issued and sold from time to time under a sales agreement with Jefferies LLC, which serves as a continuation our our existing at-the-market (ATM) offering program.

The base prospectus immediately follows this explanatory note. The specific terms of any other securities to be offered pursuant to the base prospectus will be specified in one or more prospectus supplements to the base prospectus. The sales agreement prospectus immediately follows the base prospectus. The specific terms of the securities to be issued and sold under the sales agreement are specified in the sales agreement prospectus that immediately follows the base prospectus. The $100,000,000 of our common stock that may be offered, issued and sold under the sales agreement prospectus is included in the $250,000,000 of securities that may be offered, issued and sold by us under the base prospectus.

This registration statement is a replacement registration statement being filed pursuant to Rule 415(a)(6) under the Securities Act of 1933, as amended (the “Securities Act”), with respect to securities that remain unsold under the Registration Statement on Form S-3 (File No. 333-258426), as amended, originally filed on August 3, 2021 (the “Prior Registration Statement”). Pursuant to Rule 415(a)(5)(ii) under the Securities Act, by filing this registration statement on Form S-3, the Company may issue and sell securities covered by the Prior Registration Statement until the earlier of (i) the effective date of this registration statement and (ii) January 30, 2025, which is 180 days after the third-year anniversary of the original effective date of the Prior Registration Statement. Pursuant to Rule 415(a)(6) under the Securities Act, the offering of securities under the Prior Registration Statement will be deemed terminated as of the date of effectiveness of this registration statement.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 2, 2024

PROSPECTUS

RIGEL PHARMACEUTICALS, INC.

$250,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

Rights

We may offer and sell, from time to time, in one or more series or issuances, and on terms that we will determine at the time of the offering, up to $250,000,000 of any combination of the securities described in this prospectus. This prospectus serves as a replacement for our expiring shelf registration statement previously filed with and declared effective by the Securities and Exchange Commission.

This prospectus provides a general description of the securities we may offer. We will provide specific terms of any offering in a prospectus supplement to this prospectus. Any prospectus supplement and any related free writing prospectus may also add, update, or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement and any related free writing prospectus relating to a particular offering as well as the documents incorporated or deemed to be incorporated by reference before you purchase any of the securities offered hereby.

We may offer and sell these securities in the same offering or in separate offerings; to or through underwriters, dealers, and agents; or directly to purchasers. The names of any underwriters, dealers, or agents involved in the sale of our securities, their compensation and any options to purchase additional securities held by them will be described in the applicable prospectus supplement. None of our securities may be sold without delivery of the applicable prospectus supplement describing the method and terms of the offering of those securities. See “Plan of Distribution.”

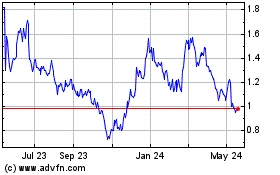

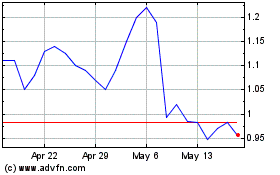

Our common stock is listed on the Nasdaq Global Select Market, or Nasdaq, under the symbol “RIGL.” On July 31, 2024, the last reported sale price of our common stock was $10.58 per share.

This prospectus may not be used to consummate a sale of any securities unless accompanied by a prospectus supplement.

INVESTING IN OUR SECURITIES INVOLVES SIGNIFICANT RISKS. SEE “RISK FACTORS” BEGINNING ON PAGE 3 OF THIS PROSPECTUS AND IN THE APPLICABLE PROSPECTUS SUPPLEMENT, AS WELL AS THE RISK FACTORS THAT ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS AND ANY PROSPECTUS SUPPLEMENT FROM OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, BEFORE INVESTING IN ANY OF OUR SECURITIES.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2024

Table of Contents

| |

|

|

Page

|

|

|

|

|

|

|

|

ii |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

29

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the United States Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, we may, from time to time, offer and sell any combination of the securities described in this prospectus in one or more offerings for an aggregate offering amount of up to $250,000,000.

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus. You should carefully read this prospectus, any applicable prospectus supplement and any free writing prospectuses we have authorized for use in connection with a specific offering, together with the information incorporated herein by reference as described under the section titled “Information Incorporated by Reference,” before buying any of the securities in this offering.

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

We have not, and the underwriters have not, authorized anyone to give you any information other than in this prospectus and the information incorporated by reference herein. We take no responsibility for, and can provide no assurances as to the reliability of, any other information that others may give you. Neither this prospectus nor any prospectus supplement nor any related free writing prospectus shall constitute an offer to sell or a solicitation of an offer to buy offered securities in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation. This prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration statement, including its exhibits.

You should read the entire prospectus and any accompanying prospectus supplement and any related free writing prospectus, as well as the documents incorporated by reference before making an investment decision. Neither the delivery of this prospectus or any prospectus supplement or any related free writing prospectus nor any sale made hereunder shall under any circumstances imply that the information contained or incorporated by reference herein or in any prospectus supplement or related free writing prospectus is correct as of any date subsequent to the date hereof or of such prospectus supplement or related free writing prospectus, as applicable. You should assume that the information appearing in this prospectus, any prospectus supplement or any document incorporated by reference is accurate only as of the date of the applicable documents, regardless of the time of delivery of this prospectus or any sale of securities. Our business, financial condition, results of operations and prospects may have changed since that date.

Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section titled “Where You Can Find More Information.”

THE COMPANY

This summary description about us and our business highlights selected information contained elsewhere in this prospectus or incorporated in this prospectus by reference. This summary does not contain all of the information you should consider before buying securities in this offering. You should carefully read this entire prospectus and any applicable prospectus supplement, including each of the documents incorporated herein or therein by reference, before making an investment decision. As used in this prospectus, “Rigel,” “the Company,” “we,” “us,” and “our” refer to Rigel Pharmaceuticals, Inc., a Delaware corporation.

Overview

We are a biotechnology company dedicated to developing and providing novel therapies that significantly improve the lives of patients with hematologic disorders and cancer. We focus on products that address signaling pathways that are critical to disease mechanisms.

TAVALISSE® (fostamatinib disodium hexahydrate) is our first product approved by the U.S. Food and Drug Administration (FDA). TAVALISSE is the only approved oral spleen tyrosine kinase (SYK) inhibitor for the treatment of adult patients with chronic immune thrombocytopenia (ITP) who have had an insufficient response to a previous treatment. The product is also commercially available in Europe and the United Kingdom (UK) (as TAVLESSE), and in Canada, Israel and Japan (as TAVALISSE) for the treatment of chronic ITP in adult patients.

REZLIDHIA® (olutasidenib) is our second FDA-approved product. REZLIDHIA capsules are indicated for the treatment of adult patients with relapsed or refractory (R/R) acute myeloid leukemia (AML) with a susceptible isocitrate dehydrogenase-1 (IDH1) mutation as detected by an FDA-approved test. We in-licensed olutasidenib from Forma Therapeutics, Inc., now Novo Nordisk (Forma), with exclusive, worldwide rights for its development, manufacturing and commercialization.

GAVRETO® (pralsetinib) is our third FDA-approved product which we began commercializing on June 27, 2024. GAVRETO is a once daily, small molecule, oral, kinase inhibitor of wild-type rearranged during transfection (RET) and oncogenic RET fusions. GAVRETO is approved by the FDA for the treatment of adult patients with metastatic RET fusion-positive non-small cell lung cancer (NSCLC) as detected by an FDA-approved test. GAVRETO is also approved under accelerated approval based on overall response rate and duration response rate, for the treatment of adult and pediatric patients 12 years of age and older with advanced or metastatic RET fusion-positive thyroid cancer who require systemic therapy and who are radioactive iodine-refractory (if radioactive iodine is appropriate). We acquired the rights to research, develop, manufacture and commercialize GAVRETO (pralsetinib) in the US from Blueprint Medicines Corporation (Blueprint) pursuant to an Asset Purchase Agreement entered in February 2024.

We continue to advance the development of R289, our interleukin receptor-associated kinases 1 and 4 (IRAK 1/4) inhibitor program, in an open-label, Phase 1b trial to determine the tolerability and preliminary efficacy of the drug in patients with lower-risk myelodysplastic syndrome (MDS) who are relapsed, refractory or resistant to prior therapies.

We have strategic development collaborations with the University of Texas MD Anderson Cancer Center (MDACC) to expand our evaluation of REZLIDHIA (olutasidenib) in AML and other hematologic cancers with IDH1 mutations, and with Collaborative Network for Neuro-Oncology Clinical Trials (CONNECT) to conduct a Phase 2 clinical trial to evaluate REZLIDHIA (olutasidenib) in combination with temozolomide in patients with high-grade glioma (HGG) harboring an IDH1 mutation.

We have a receptor-interacting serine/threonine-protein kinase 1 (RIPK1) inhibitor program in clinical development with our partner Eli Lilly and Company (Lilly). We also have product candidates in clinical development with partners BerGenBio ASA (BerGenBio) and Daiichi Sankyo (Daiichi).

Reverse Stock Split

We filed with the Secretary of State of the State of Delaware a certificate of amendment to our amended and restated certificate of incorporation, as amended, to effect a 1-for-10 reverse stock split, effective June 27, 2024. As a result of the reverse stock split, every ten issued and outstanding shares of our common stock were

automatically combined into one issued and outstanding share of common stock. No fractional shares were issued in connection with the reverse stock split. Stockholders who otherwise would be entitled to receive fractional shares of common stock were entitled to receive a check representing the cash value equal to the fraction to which the stockholder would otherwise be entitled, multiplied by the closing price of the common stock as reported by Nasdaq on the last trading day prior to the effective date of the split. As a result of the reverse stock split, proportionate adjustments were made to the number of shares underlying (and as applicable, the exercise or conversion prices of) our outstanding equity awards and to the number of shares of common stock issuable under our equity incentive plans. The reverse stock split did not change the par value of our common stock, which remains $0.001, or the authorized number of shares of our common stock. All share amounts and per share amounts disclosed in this prospectus have been adjusted to reflect the reverse stock split on a retroactive basis for all periods presented.

Corporate Information

We were incorporated in Delaware in June 1996. Our principal executive office is located at 611 Gateway Boulevard, Suite 900, South San Francisco, California 94080. Our telephone number is (650) 624-1100. Our website address is www.rigel.com. The information in, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus and you should not consider it part of this prospectus or part of any prospectus supplement.

Trademarks

Rigel and our logo are some of our tradenames used in this prospectus and in the documents incorporated by reference in this prospectus. This prospectus also includes trademarks, tradenames, and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus or in the documents incorporated by reference in this prospectus appear without the ™ or ® symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

RISK FACTORS

An investment in our securities involves significant risks. The prospectus supplement applicable to each offering of our securities will contain a discussion of the risks applicable to an investment in our securities. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the heading “Risk Factors” in the applicable prospectus supplement, together with all of the other information contained or incorporated by reference. You should also consider the risks, uncertainties and assumptions discussed under Item 1A, “Risk Factors,” in our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q filed subsequent to such Annual Report on Form 10-K, as well as any amendments thereto, all of which are incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other subsequent reports we file with the SEC in the future and by information contained in any prospectus supplement related to a particular offering. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, result of operations and financial conditions and could result in a partial or complete loss of your investment. Please also carefully read the section titled “Forward-Looking Statements.”

FORWARD-LOOKING STATEMENTS

This prospectus, each prospectus supplement and the information incorporated by reference in this prospectus and each prospectus supplement contains and may contain certain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “seek,” “should,” “target,” “will,” “would” and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Those statements appear in this prospectus, any accompanying prospectus supplement and the documents incorporated herein and therein by reference, particularly in the sections entitled “The Company,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” and include statements regarding the intent, belief or current expectations of the Company and management that are subject to known and unknown risks, uncertainties and assumptions.

This prospectus, any prospectus supplement and the information incorporated by reference in this prospectus and any prospectus supplement also contain statements that are based on the current expectations of the Company and management. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. The risks, uncertainties and assumptions that could cause actual results to differ materially from those anticipated or implied in our forward-looking statements include, but are not limited to, those set forth above under the section entitled “Risk Factors” and in the applicable prospectus supplement, together with all of the other information contained in or incorporated by reference into the prospectus supplement or appearing or incorporated by reference into this prospectus.

Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we do not plan to publicly update or revise any forward-looking statements contained herein after we distribute this prospectus, whether as a result of any new information, future events or otherwise.

USE OF PROCEEDS

Unless otherwise indicated in the prospectus supplement or any free writing prospectuses we have authorized for use in connection with such offering, we will use the net proceeds from the sale of securities offered by this prospectus for general corporate purposes, which may include, among other purposes, working capital, capital expenditures, other corporate expenses and acquisitions of assets, licenses, products, technologies or businesses. The timing and amount of our actual expenditures will be based on many factors, including the anticipated growth of our business. As a result, unless otherwise indicated in the prospectus supplement or any free writing prospectuses, our management will have broad discretion to allocate the net proceeds of the offerings. Pending their ultimate use, we intend to invest the net proceeds in short-term, investment-grade, interest-bearing instruments.

DESCRIPTION OF CAPITAL STOCK

The following description is a general summary of the terms of the shares of common stock or shares of preferred stock that we may issue. The description below and in any prospectus supplement does not include all of the terms of the shares of common stock or shares of preferred stock and should be read together with our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) and Amended and Restated Bylaws (the “Bylaws”). This description also summarizes relevant provisions of the General Corporation Law of the State of Delaware, or “DGCL.” Therefore, please carefully consider the actual provisions of the Certificate of Incorporation and Bylaws, which have been filed with the SEC as exhibits to the registration statement of which this prospectus forms a part, and the DGCL.

General

Our authorized capital stock consists of 400,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock, par value $0.001 per share.

Common Stock

Dividend rights. Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of our common stock are entitled to receive dividends out of funds legally available if our board of directors, in its discretion, determines to declare dividends and then only at the times and in the amounts that our board of directors may determine.

Voting rights. Each holder of common stock is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders. Our Certificate of Incorporation does not provide for the right of stockholders to cumulate votes for the election of directors. Our Certificate of Incorporation establishes a classified board of directors, divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. These provisions in our Certificate of Incorporation could discourage potential takeover attempts. See “Anti-Takeover Effects of Provisions of our Certificate of Incorporation, our Bylaws and Delaware Law” below.

No preemptive or similar rights. Our common stock is not entitled to preemptive rights and is not subject to conversion, redemption or sinking fund provisions. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of any series of our preferred stock that we may designate and issue in the future.

Right to receive liquidation distributions. Upon our dissolution, liquidation or winding-up, the assets legally available for distribution to our stockholders are distributable ratably among the holders of our common stock, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights and payment of liquidation preferences, if any, on any outstanding shares of our preferred stock.

The rights of the holders of our common stock are subject to, and may be adversely affected by, the rights of holders of shares of any preferred stock that we may designate and issue in the future.

Preferred Stock

The following description of preferred stock and the description of the terms of any particular series of preferred stock that we choose to issue hereunder and that will be set forth in the related prospectus supplement are not complete. These descriptions are qualified in their entirety by reference to our Certificate of Incorporation and the certificate of designation relating to any series. The rights, preferences, privileges and restrictions of the preferred stock of each series will be fixed by the certificate of designation relating to that series. The prospectus supplement also will contain a description of certain U.S. federal income tax consequences relating to the purchase and ownership of the series of preferred stock that is described in the prospectus supplement.

Our board of directors is authorized, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series, to establish from time to time the number of shares to be included in each series and to fix the designation, powers, preferences and rights of the shares of each series and any of its

qualifications, limitations or restrictions. Our board of directors can also increase or decrease the number of shares of any series, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the common stock. The issuance of preferred stock, while providing flexibility in connection with financings, possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring, discouraging or preventing a change in control of our Company, may adversely affect the market price of our common stock and the voting and other rights of the holders of common stock, and may reduce the likelihood that common stockholders will receive dividend payments and payments upon liquidation.

The prospectus supplement for a series of preferred stock will specify, among other things:

•

the maximum number of shares;

•

the designation of the shares;

•

the annual dividend rate, if any, whether the dividend rate is fixed or variable, the date or dates on which dividends will accrue, the dividend payment dates, and whether dividends will be cumulative;

•

the price and the terms and conditions for redemption, if any, including redemption at our option or at the option of the holders, including the time period for redemption, and any accumulated dividends or premiums;

•

the liquidation preference, if any, and any accumulated dividends upon the liquidation, dissolution or winding up of our affairs;

•

any sinking fund or similar provision, and, if so, the terms and provisions relating to the purpose and operation of the fund;

•

the terms and conditions, if any, for conversion or exchange of shares of any other class or classes of our capital stock or any series of any other class or classes, or of any other series of the same class, or any other securities or assets, including the price or the rate of conversion or exchange and the method, if any, of adjustment;

•

the voting rights; and

•

any or all other preferences and relative, participating, optional or other special rights, privileges or qualifications, limitations or restrictions.

Stock Options

As of March 31, 2024, we had outstanding options to purchase 3,713,227 shares of our common stock, with a weighted-average exercise price of $23.58 per share under our stock option plans.

Anti-Takeover Effects of Provisions of our Certificate of Incorporation, our Bylaws and Delaware Law

Certificate of Incorporation and Bylaws

Our Certificate of Incorporation provides that our board of directors is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms.

Because holders of our common stock do not have cumulative voting rights in the election of directors, stockholders holding a majority of the shares of common stock outstanding are able to elect all of our directors. Our board of directors is able to elect a director to fill a vacancy created by the expansion of the board of directors or due to the resignation or departure of an existing board member. Our Certificate of Incorporation and Bylaws also provide that all stockholder actions must be effected at a duly called meeting of stockholders and not by written consent. Further, our Bylaws provide that a special meeting of stockholders may only be called by the Chairman of our board of directors, our Chief Executive Officer, or the board of directors pursuant to a resolution adopted by a majority of the total number of authorized directors.

In addition, our Bylaws include a requirement for the advance notice of nominations for election to the board of directors or for proposing matters that can be acted upon at a stockholders’ meeting. Our Certificate

of Incorporation provides for the ability of the board of directors to issue, without stockholder approval, up to 10,000,000 shares of preferred stock with terms set by the board of directors, which rights could be senior to those of our common stock. Our Certificate of Incorporation and Bylaws also provide that approval of at least 66-2/3% of the shares entitled to vote at an election of directors will be required to adopt, amend or repeal our Bylaws, or repeal the provisions of our Certificate of Incorporation, including provisions regarding amending or repealing our Certificate of Incorporation or Bylaws, the election of directors and the inability of stockholders to take action by written consent in lieu of a meeting. Our Bylaws also provide that our board of directors may unilaterally alter, amend, repeal our Bylaws or adopt new bylaws.

The foregoing provisions make it difficult for holders of our common stock to replace our board of directors. In addition, the authorization of undesignated preferred stock makes it possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of our Company.

Section 203 of the DCGL

In general, Section 203 prohibits, with some exceptions, a publicly held Delaware corporation such as us from engaging in a “business combination” with an “interested stockholder” for a period of three years following the time that the stockholder became an interested stockholder, unless:

•

prior to the time the stockholder became an interested stockholder, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

•

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned by (a) persons who are directors and also officers and (b) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

•

at or subsequent to such time that the stockholder became an interested stockholder, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders by at least 66-2/3% of the outstanding voting stock which is not owned by the interested stockholder.

Section 203 of the DGCL generally defines a “business combination” to include any of the following:

•

any merger or consolidation involving the corporation and the interested stockholder;

•

any sale, lease, exchange, mortgage, transfer, pledge or other disposition involving the interested stockholder (in one transaction or a series of transactions) of assets of the corporation having an aggregate market value equal to 10% or more of the aggregate market value of either all of the assets of the corporation or its outstanding stock;

•

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

•

subject to exceptions, any transaction involving the corporation that has the effect, directly or indirectly, of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; and

•

the receipt by the interested stockholder of the benefit, directly or indirectly (except proportionately as a stockholder of such corporation), of any loans, advances, guarantees, pledges or other financial benefits, other than certain benefits set forth in Section 203, provided by or through the corporation.

In general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates and associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock of the corporation.

A Delaware corporation may “opt out” of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares. We do not plan to “opt out” of these provisions. The statute could prohibit or delay mergers or other takeover or change in control attempts and, accordingly, may discourage attempts to acquire us.

Undesignated Preferred Stock

The ability to authorize undesignated preferred stock makes it possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of us. These and other provisions may have the effect of deterring hostile takeovers or delaying changes in control or management of our Company.

Special Stockholder Meetings

Our Bylaws provide that a special meeting of stockholders may be called only by our chairman of the board of directors, the Chief Executive Officer or our board of directors pursuant to a resolution adopted by a majority of the total number of authorized directors.

Requirements for Advance Notification of Stockholder Nominations and Proposals

Our Bylaws establish advance notice procedures with respect to stockholder proposals and the nomination of candidates for election as directors, other than nominations made by or at the direction of the board of directors or a committee of the board of directors.

Elimination of Stockholder Action by Written Consent

Our Certificate of Incorporation and our Bylaws eliminate the right of stockholders to act by written consent without a meeting.

Amendment of Charter Provisions

The amendment of any of the above provisions, except for the provision making it possible for our board of directors to issue preferred stock, would require approval by holders of at least 66-2/3% of the voting power of our then outstanding voting stock.

The provisions of the DGCL, our Certificate of Incorporation and our Bylaws could have the effect of discouraging others from attempting hostile takeovers and, as a consequence, they may also inhibit temporary fluctuations in the market price of our common stock that often result from actual or rumored hostile takeover attempts. These provisions may also have the possible that these provisions could make it more difficult to accomplish transactions that stockholders may otherwise deem to be in their best interests.

The Nasdaq Global Select Market Listing

Our common stock is listed on Nasdaq under the symbol “RIGL.”

Transfer Agent and Registrar

The transfer agent for our common stock is EQ Shareowner Services, 1110 Centre Pointe Curve, Suite 101, Mendota Heights, MN 55120, equiniti.com/us.

DESCRIPTION OF DEBT SECURITIES

We may issue debt securities in one or more distinct series. This section summarizes the material terms of the debt securities that are expected to be common to all series. Most of the financial terms and other specific material terms, as well as any material U.S. federal income tax consequences, of any series of debt securities that we offer will be described in a prospectus supplement. Since the terms of specific debt securities may differ from the general information provided below, you should read both this prospectus and the relevant prospectus supplement and rely on information in the prospectus supplement that supersedes any contrary or inconsistent information below.

As required by federal law for all bonds and notes of companies that are publicly offered, the debt securities will be governed by a document called an “indenture.” An indenture is a contract between us and a financial institution acting as trustee on your behalf. The trustee has two main roles. First, the trustee can enforce your rights against us if we default. There are some limitations on the extent to which the trustee acts on your behalf. Second, the trustee performs certain administrative duties for us.

Senior or subordinated debt securities will be issued by us under an indenture or indentures, as may be supplemented from time to time, between us, as issuer, and the trustee.

The indenture will be subject to and governed by the Trust Indenture Act of 1939, as amended (the “TIA”). The terms “we,” “our” and “us,” when used to refer to an issuer of securities, mean Rigel Pharmaceuticals, Inc.

Because this section is a summary, it does not describe every aspect of the debt securities and the indenture. We urge you to read the indenture because it, and not this description, defines your rights as a holder of debt securities. For example, in this section, we use capitalized words to signify terms that are specifically defined in the indenture. Some of the definitions are repeated in this prospectus, or in the relevant prospectus supplement, but for the rest you will need to read the indenture. See “Where You Can Find More Information” for information on how to locate the indenture and any supplemental indentures that may be filed.

To the extent our term loan remains outstanding, we will need to obtain the consent of our lender in order to issue any debt securities.

General Provisions of the Indenture

Unless otherwise specified in a prospectus supplement for a particular series, the debt securities covered by this prospectus will be direct, unsecured obligations of Rigel. Any senior securities will be unsecured and will rank equally with all other unsecured and unsubordinated indebtedness of Rigel. Any subordinated securities will be unsecured and will be subordinated in right of payment to the prior payment in full of the senior indebtedness of Rigel, as more fully described in a prospectus supplement.

The indenture provides that any debt securities proposed to be sold under this prospectus and an attached prospectus supplement (“offered debt securities”) and any debt securities issuable upon the exercise of debt warrants or upon conversion or exchange of other offered securities (“underlying debt securities”), as well as other debt securities, may be issued under the indenture in one or more series. Any secured indebtedness of ours will rank ahead of the debt securities to the extent of the value of the assets securing such indebtedness.

You should read the prospectus supplement for the material terms of the offered debt securities and any underlying debt securities, including the following:

•

the title of the debt securities and whether the debt securities will be senior securities or subordinated securities of Rigel;

•

the total principal amount of the debt securities of the series and any limit on such total principal amount;

•

if not the principal amount of the debt securities, the portion of the principal amount payable upon acceleration of the maturity of the debt securities or how this portion will be determined;

•

the date or dates, or how the date or dates will be determined or may be extended, when the principal of the debt securities will be payable;

•

the interest rate or rates, which may be fixed or variable, that the debt securities will bear, if any, or how the rate or rates will be determined, the date or dates from which any interest will accrue or how the date or dates will be determined, the interest payment dates, any record dates for these payments, whether payments of interest will be made in cash or in kind and the basis upon which interest will be calculated if other than that of a 360-day year of twelve 30-day months;

•

any optional redemption provisions;

•

any sinking fund or other provisions that would obligate us to repurchase or otherwise redeem the debt securities;

•

the form in which we will issue the debt securities and whether we will have the option of issuing debt securities in “certificated” form;

•

if other than U.S. dollars, the currency or currencies in which the debt securities are denominated and/or payable;

•

whether the amount of payments of principal, premium or interest, if any, on the debt securities will be determined with reference to an index, formula or other method (which index, formula or method may be based, without limitation, on one or more currencies, commodities, equity indices or other indices), and how these amounts will be determined;

•

the place or places, if any, other than or in addition to The City of New York, of payment, transfer, conversion and/or exchange of the debt securities;

•

if other than minimum denominations of $2,000 or any integral multiple of $1,000 above the minimum denomination in the case of registered securities issued in certificated form, the denominations in which the offered debt securities will be issued;

•

if the provisions of Article Fourteen of the indenture described under “defeasance” are not applicable and any provisions in modification of, in addition to or in lieu of any of these provisions;

•

whether and under what circumstances we will pay additional amounts, in respect of any tax, assessment or governmental charge and, if so, whether we will have the option to redeem the debt securities rather than pay the additional amounts (and the terms of this option);

•

whether the debt securities are subordinated and the terms of such subordination;

•

any provisions granting special rights to the holders of the debt securities upon the occurrence of specified events;

•

any changes or additions to the Events of Default or covenants contained in the applicable indenture;

•

whether the debt securities will be convertible into or exchangeable for any other securities and the applicable terms and conditions;

•

whether the debt securities are guaranteed; and

•

any other material terms of the debt securities.

For purposes of this prospectus, any reference to the payment of principal of or premium or interest, if any, on the debt securities will include additional amounts if required by the terms of the debt securities.

The indenture does not limit the amount of debt securities that may be issued thereunder from time to time. Debt securities issued under the indenture when a single trustee is acting for all debt securities issued under the indenture are called the “indenture securities.” The indenture also provides that there may be more than one trustee thereunder, each with respect to one or more different series of indenture securities. See “— Resignation of Trustee” below. At a time when two or more trustees are acting under the indenture, each with respect to only certain series, the term “indenture securities” means the one or more series of debt securities with respect to which each respective trustee is acting. In the event that there is more than one trustee under the indenture, the powers and trust obligations of each trustee described in this prospectus will

extend only to the one or more series of indenture securities for which it is trustee. If two or more trustees are acting under the indenture, then the indenture securities for which each trustee is acting would be treated as if issued under separate indentures.

The indenture does not contain any provisions that give you protection in the event we issue a large amount of debt, we repurchase a significant amount of equity or effect a recapitalization, or we are acquired by another entity.

We refer you to the applicable prospectus supplement for information with respect to any deletions from, modifications of or additions to the Events of Default or our covenants that are described below, including any addition of a covenant or other provision providing event risk or similar protection.

We have the ability to issue indenture securities with terms different from those of indenture securities previously issued and, without the consent of the holders thereof, to reopen a previous issue of a series of indenture securities and issue additional indenture securities of that series unless the reopening was restricted when that series was created. Any additional indenture securities, together with all other outstanding indenture securities of that series, will constitute a single series of indenture securities under the indenture.

Unless otherwise specified in the applicable prospectus supplement, the debt securities will be denominated in U.S. dollars and all payments on the debt securities will be made in U.S. dollars.

Payment of the purchase price of the debt securities must be made in immediately available funds.

The authorized denominations of debt securities denominated in U.S. dollars will be a minimum denomination of $2,000 and integral multiples of $1,000 above the minimum denomination. The authorized denominations of foreign currency notes will be set forth in the applicable prospectus supplement.

Interest and Interest Rates

Each debt security will begin to accrue interest from the date it is originally issued. The related prospectus supplement will describe the method of determining the interest rate.

Payment and Paying Agents

We will pay interest to the person listed in the trustee’s records as the owner of the debt security at the close of business on a particular day in advance of each regularly scheduled date for interest, even if that person no longer owns the debt security on the interest due date. That day, typically set at a date approximately two weeks prior to the interest due date, is called the “record date.” Because we will pay all the interest for an interest period to the holders on the record date, holders buying and selling debt securities must work out between themselves the appropriate purchase price. The most common manner is to adjust the sales price of the debt securities to prorate interest fairly between buyer and seller based on their respective ownership periods within the particular interest period. This prorated interest amount is called “accrued interest.”

Payments on Global Securities

We will make payments on a global security in accordance with the applicable policies of the depositary as in effect from time to time. Under those policies, we will make payments directly to the depositary, or its nominee, and not to any indirect holders who own beneficial interests in the global security. An indirect holder’s right to those payments will be governed by the rules and practices of the depositary and its participants.

Payments on Certificated Debt Securities

We will make payments on a certificated debt security as follows. We will pay interest that is due on an interest payment date by check mailed on the interest payment date to the holder at his or her address shown on the trustee’s records as of the close of business on the regular record date. We will make payments of principal and premium, if any, duly and punctually to the office of the trustee.

Alternatively, if the holder asks us to do so, we may pay any amount that becomes due on the debt security by wire transfer of immediately available funds to an account at a bank in New York City, on the due date. To request payment by wire, the holder must give the trustee or other paying agent appropriate transfer

instructions at least 15 calendar days before the requested wire payment is due. In the case of any interest payment due on an interest payment date, the instructions must be given by the person who is the holder on the relevant regular record date. Any wire instructions, once properly given, will remain in effect unless and until new instructions are given in the manner described above. In addition, see the description under “— Interest and Interest Rates.”

Material Covenants

The prospectus supplement relating to a particular series of debt securities that we offer will describe the material covenants included in the indenture and will be subject to negotiation between the holder and us. Such material covenants may include covenants with respect to payments of principal, premium (if any) and interest and limitations or restrictions with respect to a consolidation, merger sale or conveyance of us, restrictions on liens, or other covenants, limitations or restrictions on us.

Events of Default

An event of default with respect to the debt securities of any series in the indenture includes:

(a) default for 30 days in payment of any interest on the debt securities of such series when it becomes due and payable;

(b) default in payment of principal of or any premium on the debt securities of such series at maturity or upon redemption or repayment when the same becomes due and payable;

(c) default by us in the performance of any other covenant contained in the applicable indenture for the benefit of the debt securities of such series that has not been remedied by the end of a specified period of time after notice is given as specified in the indenture; and

(d) certain events of bankruptcy, insolvency and reorganization of Rigel.

The prospectus supplement relating to a particular series of debt securities that we offer will describe the events of default included in the indenture and will be subject to negotiation between the holder and us.

Modification of the Indenture

We and the trustee may, without the consent of the holders of the debt securities issued under such indenture, enter into supplemental indentures for, among others, one or more of the following purposes:

•

to evidence the succession of another corporation to us and the assumption by such successor of its obligations under the indenture and the debt securities;

•

to add covenants of Rigel or surrender any of its rights, or add any rights for the benefit of the holders of debt securities;

•

to cure any ambiguity, omission, defect or inconsistency in such indenture;

•

to establish the form or terms of any other series of debt securities, including any subordinated securities;

•

to comply with requirements of the SEC in order to maintain the qualification of the indenture under the TIA;

•

to evidence and provide the acceptance of any successor trustee with respect to the debt securities or one or more other series of debt securities under the indenture or to facilitate the administration of the trusts thereunder by one or more trustees in accordance with the indenture;

•

to provide any additional events of default;

•

to add to, change or eliminate any of the provisions of the indentures in respect of one or more series of debt securities, provided that any such addition, change or elimination, shall become

•

effective only when there is no security outstanding of any series created prior to the adoption of such addition, change or elimination;

•

to make any provisions with respect to the optional conversion rights of holders, including providing for the conversion of the debt securities into any other security or securities of ours, provided that such provisions are not adverse to the interests of the holders of any debt securities then outstanding;

•

to add any guarantee of one or more series of the debt securities; or

•

to supplement any of the provisions of the indenture to such extent as shall be necessary to permit or facilitate the defeasance and discharge of any series of debt securities pursuant to the indenture; provided that any such action shall not adversely affect the interests of the holders of debt securities of such series and any related coupons or any other series of securities in any material respect.

With certain exceptions, the indenture or the rights of the holders of the debt securities may be modified by us and the trustee with the consent of the holders of a majority in aggregate principal amount of the debt securities then outstanding affected thereby, but no such modification may be made without the consent of the holder of each outstanding note affected thereby that would:

•

change the maturity of the principal of, or any premium on, or any installment of principal of or interest on any debt securities, or reduce the principal amount or any premium or the rate or manner of calculating interest or any premium payable upon redemption or repayment of any debt securities, or change the dates or periods for any redemption or repayment or change any place of payment where, or the coin or currency in which, any principal, premium or interest is payable, or impair the right to institute suit for the enforcement of any such payment on or after the maturity thereof (or, in the case of redemption or repayment, on or after the redemption or repayment date);

•

reduce the percentage in principal amount of the outstanding debt securities, the consent whose holders is required for any such modification, or the consent of whose holders is required for any waiver of compliance with certain provisions of the indenture or certain defaults thereunder and their consequences provided for in the indenture; or

•

modify any of the provisions of certain sections of the indenture, including the provisions summarized in this paragraph, except to increase any such percentage or to provide that certain other provisions of the indenture cannot be modified or waived without the consent of the holder of each of the outstanding debt securities affected thereby.

Defeasance

The following provisions will be applicable to each series of debt securities unless we state in the applicable prospectus supplement that the provisions of covenant defeasance and full defeasance will not be applicable to that series.

Covenant Defeasance

Under current U.S. federal tax law, we can make the deposit described below and be released from some of the restrictive covenants in the indenture under which the particular series was issued. This is called “covenant defeasance.” In that event, you would lose the protection of those restrictive covenants but would gain the protection of having money and government securities set aside in trust to repay your debt securities. In order to achieve covenant defeasance, we must do the following:

•

deposit in trust for the benefit of all holders of such debt securities a combination of money and government or government agency debt securities or bonds in the relevant currency that will generate enough cash to make interest, principal and any other payments on the debt securities of such series in the relevant currency on their various due dates; and

•

deliver to the trustee a legal opinion of our counsel confirming that, under current U.S. federal income tax law, we may make the above deposit without causing you to be taxed on the debt securities of such series any differently than if we did not make the deposit and just repaid such debt securities ourselves at maturity.

If we accomplish covenant defeasance, you can still look to us for repayment of the debt securities if there were a shortfall in the trust deposit or the trustee is prevented from making payment. In fact, if one of

the remaining Events of Default occurred (such as our bankruptcy) and the debt securities became immediately due and payable, there might be a shortfall. Depending on the event causing the default, you may not be able to obtain payment of the shortfall.

Full Defeasance

If there is a change in U.S. federal tax law, as described below, we can legally release ourselves from all payment and other obligations on the debt securities of a particular series (called “full defeasance”) if we put in place the following other arrangements for you to be repaid:

•

we must deposit in trust for the benefit of all holders of the debt securities of such series a combination of money and government or government agency debt securities or bonds in the relevant currency that will generate enough cash to make interest, principal and any other payments on the debt securities of such series in the relevant currency on their various due dates; and

•

we must deliver to the trustee a legal opinion confirming that there has been a change in current U.S. federal tax law or an Internal Revenue Service ruling that allows us to make the above deposit without causing you to be taxed on the debt securities of such series any differently than if we did not make the deposit and just repaid such debt securities ourselves at maturity. Under current U.S. federal tax law, the deposit and our legal release from the debt securities of such series would be treated as though we paid you your share of the cash and debt securities or bonds at the time the cash and debt securities or bonds were deposited in trust in exchange for your debt securities and you would recognize gain or loss on your debt securities at the time of the deposit.

If we ever did accomplish full defeasance, as described above, you would have to rely solely on the trust deposit for repayment of the debt securities of such series. You could not look to us for repayment in the unlikely event of any shortfall. Conversely, the trust deposit would most likely be protected from claims of our lenders and other creditors if we ever became bankrupt or insolvent.

Covenant defeasance and full defeasance are both subject to certain conditions, such as no default or event of default occurring and continuing, and no breach of any material agreement.

Discharge of the Indenture

We may satisfy and discharge our obligations under the indenture by delivering to the trustee for cancellation all outstanding debt securities or by depositing with the trustee or the paying agent after the debt securities have become due and payable, whether at stated maturity, or any redemption or repayment date, or otherwise, cash sufficient to pay all of the outstanding debt securities and paying all other sums payable under the indenture.

No Personal Liability of Directors, Officers, Employees and Stockholders

No recourse for the payment of the principal of or premium, if any, or interest on any debt security or any coupons appertaining thereto, or for any claim based thereon or otherwise in respect thereof, and no recourse under or upon any obligation, covenant or agreement of ours in the indenture or in any supplemental indenture, or in any debt security or any coupons appertaining thereto, or because of the creation of any indebtedness represented thereby, shall be had against any director, officer, employee, or stockholder as such, past, present or future, of ours or any of our affiliates or any successor person, either directly or through us or any of our affiliates or any successor person, whether by virtue of any constitution, statute or rule of law, or by the enforcement of any assessment or penalty or otherwise; it being expressly understood that all such liability is hereby expressly waived and released as a condition of, and as a consideration for, the execution of the indenture and the issue of the debt securities.

Governing Law

New York law will govern the indenture and the debt securities.

Form, Exchange and Transfer of Certificated Debt Securities

If registered debt securities cease to be issued in book-entry form, they will be issued:

•

only in fully registered certificated form,

•

without interest coupons, and

•

unless we indicate otherwise in the prospectus supplement, in a minimum denomination of $2,000 and amounts above the minimum denomination that are integral multiples of $1,000.

Holders may exchange their certificated debt securities of smaller denominations or combined into fewer debt securities of larger denominations, as long as the total principal amount is not changed.

Holders may exchange or transfer their certificated debt securities at the office of the trustee. We have appointed the trustee to act as our agent for registering debt securities in the names of holders transferring debt securities. We may appoint another entity to perform these functions or perform them ourselves.

Holders will not be required to pay a service charge to transfer or exchange their certificated securities, but they may be required to pay any tax or other governmental charge associated with the transfer or exchange. The transfer or exchange will be made only if our transfer agent is satisfied with the holder’s proof of legal ownership.

If we have designated additional transfer agents for your debt security, they will be named in the applicable prospectus supplement. We may appoint additional transfer agents or cancel the appointment of any particular transfer agent. We may also approve a change in the office through which any transfer agent acts.

If any certificated debt securities of a particular series are redeemable and we redeem less than all the debt securities of that series, we may block the transfer or exchange of those debt securities during the period beginning 15 days before the day we mail the notice of redemption and ending on the day of that mailing, in order to freeze the list of holders to prepare the mailing. We may also refuse to register transfers or exchanges of any certificated debt securities selected for redemption, except that we will continue to permit transfers and exchanges of the unredeemed portion of any debt security that will be partially redeemed.

If a registered debt security is issued in book-entry form, only the depositary will be entitled to transfer and exchange the debt security as described in this subsection, since it will be the sole holder of the debt security.

Resignation of Trustee

The trustee may resign or be removed at any time with respect to one or more series of indenture securities provided that a successor trustee is appointed to act with respect to these series. In the event that two or more persons are acting as trustee with respect to different series of indenture securities under the indenture, each of the trustees will be a trustee of a trust separate and apart from the trust administered by any other trustee.

The Trustee under the Indenture

The trustee may be one of a number of banks with which we maintain ordinary banking relationships and from which we may obtain credit facilities and lines of credit in the future. The trustee may also serve as trustee under other indentures under which we are the obligor in the future.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of our preferred stock, common stock, debt securities or any combination thereof. Warrants may be issued independently or together with our preferred stock, common stock or debt securities and may be attached to or separate from any offered securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a bank or trust company, as warrant agent. The warrant agent will act solely as our agent in connection with the warrants. The warrant agent will not have any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants. This summary of certain provisions of the warrants is not complete. For the terms of a particular series of warrants, you should refer to the prospectus supplement for that series of warrants and the warrant agreement for that particular series.

The prospectus supplement relating to a particular series of warrants to purchase such securities will describe the terms of the warrants, including the following:

•

the title of the warrants;

•

the offering price for the warrants, if any;

•

the aggregate number of warrants;

•

the designation and terms of the securities that may be purchased upon exercise of the warrants;

•

if applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued with each security;

•

if applicable, the date from and after which the warrants and any securities issued with the warrants will be separately transferable;

•

whether the warrants will be issued in registered form or bearer form;

•

information with respect to book entry procedures, if any;

•

the number and basic terms of the securities that may be purchased upon exercise of a warrant and the exercise price for the warrants;

•

the dates on which the right to exercise the warrants shall commence and expire;

•

if applicable, the minimum or maximum amount of the warrants that may be exercised at any one time;

•

the currency or currency units in which the offering price, if any, and the exercise price are payable;

•

if applicable, a discussion of material U.S. federal income tax considerations;

•

the antidilution provisions of the warrants, if any;

•

the redemption or call provisions, if any, applicable to the warrants;

•

any provisions with respect to the holder’s right to require us to repurchase the warrants upon a change in control or similar event; and

•

any additional terms of the warrants, including procedures, and limitations relating to the exchange, exercise and settlement of the warrants.

Holders of equity warrants will not be entitled:

•

to vote, consent or receive dividends;

•

receive notice as stockholders with respect to any meeting of stockholders for the election of our directors or any other matter; or

•

exercise any rights as stockholders of us.

Holders of warrants to purchase debt securities will not be entitled to payments of principal of, or any premium or interest on, the debt securities purchasable on exercise, or to exercise any of the rights of the holders of such debt securities until such warrant is exercised.

Exercise of Warrants

Each warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise price that we describe in the applicable prospectus supplement. Unless we otherwise specify in the applicable prospectus supplement, holders of the warrants may exercise the warrants at any time up to the specified time on the expiration date that we set forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

Holders of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together with specified information, and paying the required amount to the warrant agent in immediately available funds, as provided in the applicable prospectus supplement. We will set forth on the reverse side of the warrant certificate and in the applicable prospectus supplement the information that the holder of the warrant will be required to deliver to the warrant agent.

Upon receipt of the required payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement, we will issue and deliver the securities purchasable upon such exercise. If fewer than all of the warrants represented by the warrant certificate are exercised, then we will issue a new warrant certificate for the remaining amount of warrants. If we so indicate in the applicable prospectus supplement, holders of the warrants may surrender securities as all or part of the exercise price for warrants.

Enforceability of Rights by Holders of Warrants

Each warrant agent will act solely as our agent under the applicable warrant agreement and will not assume any obligation or relationship of agency or trust with any holder of any warrant. A single bank or trust company may act as warrant agent for more than one issue of warrants. A warrant agent will have no duty or responsibility in case of any default by us under the applicable warrant agreement or warrant, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a warrant may, without the consent of the related warrant agent or the holder of any other warrant, enforce by appropriate legal action its right to exercise, and receive the securities purchasable upon exercise of, its warrants.

DESCRIPTION OF UNITS

We may issue units consisting of any combination of the other types of securities offered under this prospectus in one or more series. We may evidence each series of units by unit certificates that we will issue under a separate agreement. We may enter into unit agreements with a unit agent. Each unit agent will be a bank or trust company that we select. We will indicate the name and address of any unit agent in the applicable prospectus supplement relating to a particular series of units.

The following description summarizes certain features of the units that we may offer under this prospectus. When we offer to sell any units, we will describe the specific terms and conditions of the units in a prospectus supplement to this prospectus. We urge you to read the applicable prospectus supplement and any related free writing prospectus, as well as the complete unit agreements that contain the terms of the units. If we offer any units, certain terms of that series of units will be described in the applicable prospectus supplement, including, without limitation, the following, as applicable:

•

the title of the series of units;

•

identification and description of the separate constituent securities comprising the units;

•

the price or prices at which the units will be issued;

•

the date, if any, on and after which the constituent securities comprising the units will be separately transferable;

•

a discussion of certain U.S. federal income tax considerations applicable to the units; and

•

any other terms of the units and their constituent securities.

The description in the applicable prospectus supplement and any free writing prospectus of any units that we may offer will not necessarily be complete and will be subject, and qualified in its entirety by reference, to the unit agreement and, if applicable, collateral arrangements and depositary arrangements relating to such units, which will be filed with the SEC.

DESCRIPTION OF RIGHTS