false

0001598981

0001598981

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 12, 2024

SKYX

PLATFORMS CORP.

(Exact

name of Registrant as Specified in its Charter)

| Florida |

|

001-41276 |

|

46-3645414 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

2855

W. McNab Road

Pompano

Beach, Florida 33069

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (855) 759-7584

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, no par value per share |

|

SKYX |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition |

On

August 12, 2024, SKYX Platforms Corp. (d/b/a Sky Technologies) (the “Company”) issued a press release announcing its financial

results for the quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form

8-K and is incorporated herein by reference.

Pursuant

to the rules and regulations of the Securities and Exchange Commission, such exhibit and the information set forth therein and in this

Item 2.02 have been furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section nor shall they be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth

by specific reference in such filing regardless of any general incorporation language.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SKYX PLATFORMS CORP. |

| |

|

|

| Date:

August 12, 2024 |

By: |

/s/

John P. Campi |

| |

Name: |

John

P. Campi |

| |

Title: |

Co-Chief

Executive Officer |

Exhibit

99.1

SKYX

Reports Record Second Quarter Sales of $21.4 Million Compared to $15.0 Million for Second Quarter 2023 as it Continues to Grow its Market

Penetration in the U.S and Canada of its Advanced and Smart Platform Products

MIAMI,

FL – August 12, 2024 – SKYX Platforms Corp. (NASDAQ: SKYX) (d/b/a SKYX Technologies) (the “Company” or “SKYX”),

a highly disruptive platform technology company with over 97 pending and issued patents globally and over 60 lighting and home décor

websites, with a mission to make homes and buildings become safe and smart as the new standard, today reported its financial and operational

results for the second quarter ended June 30, 2024.

Second

Quarter 2024 and Recent Achievements

| ● | Generated

record second quarter revenues of $21.4 million compared to $15.0 million for the second

quarter of 2023, including sales of its advanced and smart platform plug and play products. |

| ● | Reported

$15.6 million in cash, cash equivalents, and restricted cash, as of June 30, 2024, as compared

to $19.8 million as of March 31, 2024. As common with companies such as ours when sales are

converted into cash rapidly, often referred to as the “Dell Working Capital Model”,

the Company leverages its trades payable to finance its operations, to enhance its cash position

and to lower its cost of capital. |

| ● | SKYX’s

collaboration with Home Depot, a world leading home improvement retailer, was announced for

its advanced and smart plug & play products. SKYX will offer a variety of its Advanced

and Smart Plug & Play Products including Retrofit Kits, Smart Light Fixtures, Smart Ceiling

Fans, Ceiling Outlet Receptacles, and Recessed Lights among others. A large assortment of

these advanced and smart products is expected to be offered on Home Depot’s website

in the next coming months, while some advanced and smart plug & play retrofit products

are expected to arrive in a variety of stores and online to be offered as a fixture upgrade.

Management believes that the collaboration with Home Depot can be significant for SKYX’s

growth to both retail and professional markets. |

| ● | SKYX

and General Electric / GE Licensing are making progress with initiatives related to the recently

signed 5-year licensing partnership agreement for the U.S. and global markets. SKYX and GE’s

goal is to make SKYX’s game-changing ceiling outlet/receptacle the standard for homes

and buildings by licensing it and its related products including SKYX’s advanced and

smart home platform technologies to various industries including tech, smart home, AI, lighting,

ceiling fans and electrical. |

| ● | The

Company continues to grow its market penetration of its advanced and smart plug & play

products as its products are in nearly 10,000 U.S. and Canadian homes and are expected to

be in tens of thousands of homes in 2025. |

| ● | SKYX

continues to utilize its e-commerce platform of over 60 websites for lighting and home décor

to educate and enhance its market penetration to both retail and professional segments. |

| ● | Company

started production of its new global patented advanced, smart, plug & play recessed light.

The global recessed light market is a multi-billion-unit market. SKYX’s new Plug &

Play recessed light global patents include the U.S., China, Canada, Hong-Kong and Mexico.

As billions of recessed lights are installed globally with hazardous electrical wires, SKYX’s

recessed light solution enables an advanced, simple Plug & Play installation that saves

time, cost and lives. SKYX’s Plug & Play recessed lights can be controlled through

SKYX’s App, Voice Control and Phone and works with Apple’s Siri, Amazon Alexa,

Google Home and Samsung. |

| ● | Collaboration

with a world-leading Chinese Lighting supplier and manufacturer Ruee Appliances. The collaboration

with Ruee includes SKYX’s advanced and smart products to both professional and retail

markets and provides SKYX substantial backing in several areas including financial, mass

production manufacturing capabilities, and distribution to global markets, including China

and Europe. The collaboration is expected to substantially enhance gross margins on SKYX’s

product sales and favorably impact its cash conversion cycle. |

| ● | New

Global Smart Home and AI Related Patents. SKYX’s new and existing patents, including

the new global patented advanced, smart, plug & play recessed light, enable and enhance

performance of smart home and AI sensors in addition to home safety sensors bringing the

Company’s intellectual property portfolio to a total of over 97 issued and pending

patents, 36 of which are issued patents covering SKYX’s advanced plug and play and

smart home platform technologies for the smart home, AI, electrical, and lighting industries

in the U.S. and internationally including China, Europe, Mexico and 2 patents in India. This

also includes the recent issuance of 6 additional patents in the U.S. and internationally,

in China, India, Europe, Canada, and Mexico for its advanced smart Plug & Play Ceiling

Fan & Heater. The 6 additional patent issuances cover SKYX’s advanced plug-and-play

smart ceiling fan and heater, enabling an all-in-one all-season product providing cool air

for summertime and hot air for wintertime. |

| ● | Announced

a collaboration with world-leading lighting company Kichler, to include SKYX’s advanced

smart and standard products online, for retail, and professional channels. |

| ● | Announced

a collaboration with Quoizel, a premier U.S. lighting manufacturer for nearly 100 years,

to integrate SKYX’s advanced smart and standard products for online, retail, and professional

channels. |

| ● | The

Company entered into an agreement to supply approximately 1,000 homes with its advanced smart

home platform technologies and is expected to deliver approximately 30,000 units representing

a variety of its advanced and smart platform technology products to the developer’s

upcoming projects. |

| ● | SKYX

won 7 CES (Consumer Electronics Show) Awards including most recently two awards for its All-In-One

Smart Home Platform. |

| ● | Announced

a collaboration with Golden Lighting, a leading provider of elegant lighting solutions in

the U.S., which will feature SKYX advanced smart and standard products for online, retail,

and professional channels. |

Safety

Standardization Highlights

The

Company filed for a mandatory safety standardization with the National Electrical Code (NEC) for its ceiling outlet receptacle for ceilings

in homes and buildings in 2023.

Management

believes that after over 12 years of its standardization process, including its product specification approval voting for by ANSI / NEMA

(American National Standardization Institute / National Electrical Manufacturing Association), it has met the necessary safety conditions

for becoming a ceiling safety standardization requirement for homes and buildings. In the past 12 years, the Company’s product

was voted into 10 segments in the NEC Code Book. Voting decisions are at the discretion of the NEC voting members.

The

Company’s code team is led by Mark Earley – former head of the National Electrical Code (NEC) and former Chief Electrical

Engineer of the National Fire Protection Association (NFPA) – as well as Eric Jacobson, former President and CEO of The American

Lighting Association (ALA). Mr. Earley and Mr. Jacobson were instrumental in numerous code and safety changes in both the electrical

and lighting industries.

Second

Quarter 2024 Financial Results

Revenue

in the second quarter of 2024 increased to a record $21.4 million, including E-commerce sales as well as smart and standard plug and

play products, as compared to $15.0 million in the second quarter of 2023.

Reported

$15.6 million in cash, cash equivalents, and restricted cash, as of June 30, 2024, as compared to $19.8 million as of March 31, 2024.

As common with companies such as ours when their sales are converted into cash rapidly, often referred to as the “Dell Working

Capital Model”, we leverage our trades payable to finance our operations to enhance our cash position and lower our cost of capital.

We

had a $2.5 million reduction in net cash loss before interest, taxes, depreciation, and amortization, as adjusted for share-based payments

(“adjusted EBITDA”), a non-GAAP measure, to $2.1 million, in the second quarter of 2024, as compared to $4.6 million, in

the first quarter of 2024.

Adjusted

EBITDA loss, a non-GAAP measure, amounted to $2.1 million, in addition to a non-cash basis loss of $5.4 million, amounted to a net loss

of $7.5 million, or $(0.08) per share, in the second quarter of 2024, as compared to a net cash loss of $2.7 million, in addition to

a non-cash basis loss of $9.6 million, amounted to a net loss of $12.3 million, or $(0.14) per share, in the second quarter of 2023.

The

Company’s financial statements for the quarter ended June 30, 2024, will be filed with the SEC and are available on the Company’s

investor relations website. https://ir.skyplug.com/sec-filings/

Management

Commentary

The

second quarter of 2024 was highlighted by our continued market penetration and positioning that includes our announced collaboration

with Home Depot which we believe can be significant for our growth to both retail and professional markets. Additionally, the Ruee Appliances

collaboration will assist us with product variety, gross margins, future distribution channels, and sales and marketing programs with

key stakeholders in such channels. We believe we have accelerated our cadence of sales, notably managing our cash burn, while our e-commerce

platform with over 60 websites is providing additional cash flow to the Company, which, when combined with our existing cash, enhances

our cash position to continue executing our business plan. We believe we will be cash flow positive during 2025.

We

are encouraged by our path to the builder/commercial segments, large online and brick-and-mortar retail partners as well as our future

potential to realize incremental licensing, subscription, and AI/data aggregation revenues.

Furthermore,

our e-commerce website platform with 60 websites enhances the acceleration of marketing, distribution channels, collaborations, and sales

to both professional and retail segments. Our websites include banners, videos, and educational materials regarding the simplicity, cost

savings, timesaving, and lifesaving aspects of the Company’s patented technologies.

About

SKYX Platforms Corp.

As

electricity is a standard in every home and building, our mission is to make homes and buildings become safe-advanced and smart as the

new standard. SKYX has a series of highly disruptive advanced-safe-smart platform technologies, with over 97 U.S. and global patents

and patent pending applications. Additionally, the Company owns over 60 lighting and home decor websites for both retail and commercial

segments. Our technologies place an emphasis on high quality and ease of use, while significantly enhancing both safety and lifestyle

in homes and buildings. We believe that our products are a necessity in every room in both homes and other buildings in the U.S. and

globally. For more information, please visit our website at https://skyplug.com/ or follow us on LinkedIn.

Forward-Looking

Statements

Certain

statements made in this press release are not based on historical facts, but are forward-looking statements. These statements can be

identified by the use of forward-looking terminology such as “aim,” “anticipate,” “believe,” “can,”

“could,” “continue,” “estimate,” “expect,” “evaluate,” “forecast,”

“guidance,” “intend,” “likely,” “may,” “might,” “objective,”

“ongoing,” “outlook,” “plan,” “potential,” “predict,” “probable,”

“project,” “seek,” “should,” “target” “view,” “will,” or “would,”

or the negative thereof or other variations thereon or comparable terminology, although not all forward-looking statements contain these

words. These statements reflect the Company’s reasonable judgment with respect to future events and are subject to risks, uncertainties

and other factors, many of which have outcomes difficult to predict and may be outside our control, that could cause actual results or

outcomes to differ materially from those in the forward-looking statements. Such risks and uncertainties include statements relating

to the Company’s ability to successfully launch, commercialize, develop additional features and achieve market acceptance of its

products and technologies and integrate its products and technologies with third-party platforms or technologies; the Company’s

efforts and ability to drive the adoption of its products and technologies as a standard feature, including their use in homes, hotels,

offices and cruise ships; the Company’s ability to capture market share; the Company’s estimates of its potential addressable

market and demand for its products and technologies; the Company’s ability to raise additional capital to support its operations

as needed, which may not be available on acceptable terms or at all; the Company’s ability to continue as a going concern; the

Company’s ability to execute on any sales and licensing or other strategic opportunities; the possibility that any of the Company’s

products will become National Electrical Code (NEC)-code or otherwise code mandatory in any jurisdiction, or that any of the Company’s

current or future products or technologies will be adopted by any state, country, or municipality, within any specific timeframe or at

all; risks arising from mergers, acquisitions, joint ventures and other collaborations; the Company’s ability to attract and retain

key executives and qualified personnel; guidance provided by management, which may differ from the Company’s actual operating results;

the potential impact of unstable market and economic conditions on the Company’s business, financial condition, and stock price;

and other risks and uncertainties described in the Company’s filings with the Securities and Exchange Commission, including its

periodic reports on Form 10-K and Form 10-Q. There can be no assurance as to any of the foregoing matters. Any forward-looking statement

speaks only as of the date of this press release, and the Company undertakes no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise, except as required by U.S. federal securities laws.

Non-GAAP

Financial Measures

Management

considers earnings (loss) before interest, taxes, depreciation and amortization, or EBITDA, as adjusted, an important indicator in evaluating

the Company’s business on a consistent basis across various periods. Due to the significance of non-recurring items, EBITDA, as

adjusted, enables management to monitor and evaluate the business on a consistent basis. The Company uses EBITDA, as adjusted, as a primary

measure, among others, to analyze and evaluate financial and strategic planning decisions regarding future operating investments and

potential acquisitions. The Company believes that EBITDA, as adjusted, eliminates items that are not part of the Company’s core

operations, such as interest expense and amortization expense associated with intangible assets, or items that do not involve a cash

outlay, such as share-based payments and non-recurring items, such as transaction costs. EBITDA, as adjusted, should be considered in

addition to, rather than as a substitute for, pre-tax income (loss), net income (loss) and cash flows used in operating activities. This

non-GAAP financial measure excludes significant expenses that are required by GAAP to be recorded in the Company’s financial statements

and is subject to inherent limitations. Investors should review the reconciliation of this non-GAAP financial measure to the comparable

GAAP financial measure. Investors should not rely on any single financial measure to evaluate the Company’s business.

Investor

Relations Contact:

Jeff

Ramson

PCG

Advisory

jramson@pcgadvisory.com

SKYX

PLATFORMS CORP.

Consolidated

Balance Sheets

| | |

(Unaudited) June 30, 2024 | | |

(Audited) December 31, 2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 10,684,989 | | |

$ | 16,810,983 | |

| Restricted cash | |

| 2,000,000 | | |

| 2,750,000 | |

| Accounts receivable | |

| 3,020,314 | | |

| 3,384,976 | |

| Inventory | |

| 4,220,575 | | |

| 3,425,734 | |

| Deferred cost of revenues | |

| 310,679 | | |

| 224,445 | |

| Prepaid expenses and other assets | |

| 1,314,637 | | |

| 721,717 | |

| Total current assets | |

| 21,551,194 | | |

| 27,317,855 | |

| | |

| | | |

| | |

| Other assets: | |

| | | |

| | |

| Furniture and equipment, net | |

| 347,644 | | |

| 436,587 | |

| Restricted cash | |

| 2,916,678 | | |

| 2,869,270 | |

| Right of use assets | |

| 20,835,756 | | |

| 21,214,652 | |

| Intangibles, definite life | |

| 7,151,496 | | |

| 8,141,032 | |

| Goodwill | |

| 16,157,000 | | |

| 16,157,000 | |

| Other assets | |

| 204,807 | | |

| 204,807 | |

| Total other assets | |

| 47,613,381 | | |

| 49,023,348 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 69,164,575 | | |

$ | 76,341,203 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 13,223,089 | | |

$ | 12,388,475 | |

| Notes payable, current | |

| 5,495,192 | | |

| 5,724,129 | |

| Operating lease liabilities, current | |

| 2,256,501 | | |

| 1,898,428 | |

| Royalty obligation | |

| 800,000 | | |

| 800,000 | |

| Consideration payable | |

| — | | |

| 730,999 | |

| Deferred revenues | |

| 2,072,123 | | |

| 1,475,519 | |

| Convertible notes, current-related parties | |

| 950,000 | | |

| 950,000 | |

| Convertible notes, current | |

| 3,292,408 | | |

| 225,000 | |

| Total current liabilities | |

| 28,089,313 | | |

| 24,192,550 | |

| | |

| | | |

| | |

| Long term liabilities: | |

| | | |

| | |

| Long term accounts payable and accrued expenses | |

| 261,624 | | |

| 744,953 | |

| Notes payable | |

| 763,276 | | |

| 1,016,924 | |

| Consideration payable | |

| — | | |

| 3,038,430 | |

| Operating lease liabilities | |

| 21,550,497 | | |

| 22,267,558 | |

| Convertible notes | |

| 7,315,775 | | |

| 5,758,778 | |

| Convertible notes related parties | |

| — | | |

| — | |

| Royalty obligations | |

| 1,700,000 | | |

| 3,100,000 | |

| | |

| | | |

| | |

| Total long-term liabilities | |

| 31,591,172 | | |

| 35,926,643 | |

| | |

| | | |

| | |

| Total liabilities | |

| 59,680,485 | | |

| 60,119,193 | |

| Stockholders’ Equity: | |

| | | |

| | |

| Common stock and additional paid-in-capital: $0 par value, 500,000,000 shares authorized; and 101,249,700 and 93,473,433 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | |

| 172,426,254 | | |

| 162,025,024 | |

| Accumulated deficit | |

| (162,942,164 | ) | |

| (145,803,014 | ) |

| Accumulated other comprehensive loss | |

| — | | |

| — | |

| Total stockholders’ equity | |

| 9,484,090 | | |

| 16,222,010 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Equity | |

$ | 69,164,575 | | |

$ | 76,341,203 | |

SKYX

Platforms Corp.

Consolidated

Statements of Operations and Comprehensive Loss

(Unaudited)

| | |

For the three-month ended June 30, | | |

For the six-month ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

| 21,446,148 | | |

| 14,984,055 | | |

$ | 40,423,969 | | |

$ | 14,994,080 | |

| Cost of revenues | |

| 14,869,521 | | |

| 10,288,643 | | |

| 28,269,292 | | |

| 10,290,111 | |

| Gross profit loss | |

| 6,576,627 | | |

| 4,695,412 | | |

| 12,154,677 | | |

| 4,703,969 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selling and marketing expenses | |

| 6,271,708 | | |

| 5,544,230 | | |

| 12,798,524 | | |

| 6,844,089 | |

| General and administrative expenses | |

| 6,540,218 | | |

| 11,402,522 | | |

| 14,479,799 | | |

| 17,350,868 | |

| Total expenses, net | |

| 12,811,926 | | |

| 16,946,752 | | |

| 27,278,323 | | |

| 24,194,957 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (6,235,299 | ) | |

| (12,251,340 | ) | |

| (15,123,646 | ) | |

| (19,490,988 | ) |

| Other income / (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (1,227,650 | ) | |

| (1,218,732 | ) | |

| (2,015,504 | ) | |

| (1,939,353 | ) |

| Gain on extinguishment of debt | |

| — | | |

| 1,201,857 | | |

| — | | |

| 1,201,857 | |

| Other income | |

| — | | |

| — | | |

| — | | |

| — | |

| Total other expense, net | |

| (1,227,650 | ) | |

| (16,875 | ) | |

| (2,015,504 | ) | |

| (737,496 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (7,462,949 | ) | |

| (12,268,215 | ) | |

| (17,139,150 | ) | |

| (20,228,484 | ) |

| Other comprehensive loss: | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss): | |

| — | | |

| 4,653 | | |

| — | | |

| 62,147 | |

| Net comprehensive loss attributed to common stockholders | |

$ | (7,462,949 | ) | |

$ | (12,263,562 | ) | |

$ | (17,139,150 | ) | |

$ | (20,166,337 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and diluted | |

$ | (0.08 | ) | |

$ | (0.14 | ) | |

$ | (0.18 | ) | |

$ | (0.24 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding – basic and diluted | |

| 99,445,289 | | |

| 86,621,015 | | |

| 97,261,721 | | |

| 84,843,914 | |

SKYX

Platforms Corp.

Consolidated

Statements of Stockholders’ Equity

(Unaudited)

| | |

For the three months ended June 30, | | |

For the six months ended June

30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Shares of Common stock | |

| | | |

| | | |

| | | |

| | |

| Balance, beginning of period | |

| 97,096,897 | | |

| 83,189,729 | | |

| 93,473,433 | | |

| 82,907,541 | |

| Common stock issued pursuant to offerings | |

| 801,706 | | |

| 2,984,308 | | |

| 3,535,067 | | |

| 2,984,308 | |

| Common stock issued pursuant to services | |

| 1,497,676 | | |

| 1,107,713 | | |

| 2,387,779 | | |

| 1,389,901 | |

| Common stock issued pursuant to conversion of preferred stock | |

| — | | |

| 880,400 | | |

| — | | |

| 880,400 | |

| Common stock issued pursuant to exercise of options and warrants | |

| — | | |

| — | | |

| — | | |

| — | |

| Common stock issued pursuant to acquisition | |

| 1,853,421 | | |

| 1,923,285 | | |

| 1,853,421 | | |

| 1,923,285 | |

| Common stock issued pursuant to antidilutive provisions | |

| — | | |

| — | | |

| — | | |

| — | |

| Common stock issued pursuant to extinguishment of debt | |

| — | | |

| 574,713 | | |

| — | | |

| 574,713 | |

| Balance, June 30 | |

| 101,249,700 | | |

| 90,660,148 | | |

| 101,249,700 | | |

| 90,660,148 | |

| | |

| | | |

| | | |

| | | |

| | |

| Common stock and paid-in capital | |

| | | |

| | | |

| | | |

| | |

| Balance, beginning of period | |

$ | 168,975,808 | | |

$ | 122,573,318 | | |

$ | 162,025,024 | | |

$ | 114,039,638 | |

| Common stock issued pursuant to stock offering | |

| 674,540 | | |

| 7,446,274 | | |

| 4,330,295 | | |

| 7,446,274 | |

| Common stock issued pursuant to services | |

| 2,775,906 | | |

| 7,674,832 | | |

| 6,070,935 | | |

| 10,638,534 | |

| Common stock issued pursuant to conversion of preferred stock | |

| — | | |

| 220,099 | | |

| — | | |

| 220,099 | |

| Common stock issued pursuant to exercise of options and warrants | |

| — | | |

| — | | |

| — | | |

| — | |

| Debt discount | |

| — | | |

| — | | |

| — | | |

| 5,569,978 | |

| Common stock issued pursuant to acquisition | |

| — | | |

| 7,327,716 | | |

| — | | |

| 7,327,716 | |

| Common stock issued pursuant to extinguishment of debt | |

| — | | |

| 2,040,231 | | |

| — | | |

| 2,040,231 | |

| Common stock issued pursuant to antidilutive provisions | |

| — | | |

| — | | |

| — | | |

| — | |

| Balance, June 30 | |

$ | 172,426,254 | | |

$ | 147,282,469 | | |

$ | 172,426,254 | | |

$ | 147,282,469 | |

| | |

| | | |

| | | |

| | | |

| | |

| Accumulated Deficit | |

| | | |

| | | |

| | | |

| | |

| Balance, beginning of period | |

$ | (155,479,215 | ) | |

$ | (114,030,627 | ) | |

$ | (145,803,014 | ) | |

$ | (106,070,358 | ) |

| Net loss | |

| (7,462,949 | ) | |

| (12,268,215 | ) | |

| (17,139,150 | ) | |

| (20,228,484 | ) |

| Non-controlling interest | |

| — | | |

| — | | |

| — | | |

| — | |

| Common stock issued pursuant to antidilutive provisions | |

| — | | |

| — | | |

| — | | |

| — | |

| Preferred dividends | |

| — | | |

| — | | |

| — | | |

| — | |

| Balance, end of period | |

$ | (162,942,164 | ) | |

| (126,298,842 | ) | |

$ | (162,942,164 | ) | |

| (126,298,842 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Accumulated other comprehensive loss | |

| | | |

| | | |

| | | |

| | |

| Balance, beginning of period | |

| — | | |

| (4,653 | ) | |

| — | | |

| (62,147 | ) |

| Other comprehensive income | |

| — | | |

| 4,653 | | |

| — | | |

| 62,147 | |

| Balance, end of period | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Total stockholders’ equity | |

$ | 9,484,090 | | |

$ | 20,983,627 | | |

$ | 9,484,090 | | |

$ | 20,983,627 | |

SKYX

Platforms Corp.

Consolidated

Statements of Cash Flows

(Unaudited)

| | |

For the six months ended June 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (17,139,150 | ) | |

$ | (20,228,484 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 2,399,350 | | |

| 1,031,732 | |

| Amortization of debt discount | |

| 604,976 | | |

| 520,349 | |

| Gain on forgiveness of debt | |

| — | | |

| (1,201,857 | ) |

| Non-cash equity-based compensation expense | |

| 6,070,935 | | |

| 10,638,534 | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Inventory | |

| (794,841 | ) | |

| (1,114,063 | ) |

| Accounts receivable | |

| 364,662 | | |

| 40,551 | |

| Prepaid expenses and other assets | |

| (592,920 | ) | |

| 449,358 | |

| Deferred charges | |

| (86,234 | ) | |

| 186,900 | |

| Deferred revenues | |

| 596,604 | | |

| (266,218 | ) |

| Operating lease liabilities | |

| (1,021,684 | ) | |

| (199,417 | ) |

| Accretion operating lease liabilities | |

| — | | |

| 798,229 | |

| Other assets | |

| — | | |

| — | |

| Royalty obligation | |

| (400,000 | ) | |

| — | |

| Consideration payable | |

| (750,000 | ) | |

| — | |

| Accounts payable and accrued expenses | |

| 351,283 | | |

| 2,700,311 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (10,397,019 | ) | |

| (6,644,075 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of debt securities | |

| — | | |

| (136,033 | ) |

| Proceeds from disposition of debt securities | |

| — | | |

| 7,572,136 | |

| Acquisition, net of cash acquired | |

| — | | |

| (4,206,200 | ) |

| Purchase of property and equipment | |

| (279,277 | ) | |

| — | |

| Net cash used in investing activities | |

| (279,277 | ) | |

| 3,229,903 | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from issuance of common stock- offerings | |

| 4,418,721 | | |

| 7,826,045 | |

| Placement cost | |

| (88,426 | ) | |

| (379,772 | ) |

| Proceeds from line of credit | |

| — | | |

| 2,000,000 | |

| Proceeds from issuance of convertible notes | |

| — | | |

| 10,350,000 | |

| Principal repayments of notes payable | |

| (482,585 | ) | |

| (2,147,900 | ) |

| Net cash provided by financing activities | |

| 3,847,710 | | |

| 17,648,373 | |

| | |

| | | |

| | |

| (Decrease) increase in cash, cash equivalents and restricted cash | |

| (6,828,586 | ) | |

| 14,234,201 | |

| Cash, cash equivalents, and restricted cash at beginning of period | |

| 22,430,253 | | |

| 9,461,597 | |

| Cash, cash equivalents and restricted cash at end of period | |

$ | 15,601,667 | | |

$ | 23,695,798 | |

| Supplementary disclosure of non-cash financing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Substitution of consideration payable to convertible notes | |

$ | 3,117,408 | | |

$ | — | |

| Substitution of royalty payable to convertible notes | |

| 1,000,000 | | |

| — | |

| Common stock issued pursuant to extinguishment of debt | |

| — | | |

| 2,040,231 | |

| Right-of-use assets and operating lease liabilities | |

| 662,698 | | |

| — | |

| Preferred stock conversion to common | |

| — | | |

| 220,099 | |

| Business acquisition: | |

| | | |

| | |

| Assets acquired excluding identifiable intangible assets and goodwill and cash | |

| — | | |

| 7,090,094 | |

| Liabilities assumed and consideration payable | |

| — | | |

| 19,439,856 | |

| Identifiable intangible assets and goodwill, net of cash outlay | |

| — | | |

| 19,677,478 | |

| Fair value of shares issued pursuant to acquisition | |

| — | | |

| 7,327,716 | |

| Debt discount | |

| — | | |

| 5,569,978 | |

Non-GAAP

Financial Measures

Management

considers earnings (loss) before interest, taxes, depreciation and amortization, or EBITDA, as adjusted, an important indicator in evaluating

our business on a consistent basis across various periods. Due to the significance of non-recurring items, EBITDA, as adjusted, enables

our management to monitor and evaluate our business on a consistent basis. We use EBITDA, as adjusted, as a primary measure, among others,

to analyze and evaluate financial and strategic planning decisions regarding future operating investments and potential acquisitions.

We believe that EBITDA, as adjusted, eliminates items that are not part of our core operations, such as interest expense and amortization

expense associated with intangible assets, or items that do not involve a cash outlay, such as share-based payments, and non-recurring

items, such as transaction costs. EBITDA, as adjusted, should be considered in addition to, rather than as a substitute for, pre-tax

income (loss), net income (loss) and cash flows used in operating activities. This non-GAAP financial measure excludes significant expenses

that are required by GAAP to be recorded in our financial statements and is subject to inherent limitations. Investors should review

the reconciliation of this non-GAAP financial measure to the comparable GAAP financial measure included below. Investors should not rely

on any single financial measure to evaluate our business.

| | |

For the three-months ended

June 30, | | |

For the six-months ended

June 30 | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net loss | |

$ | (7,462,949 | ) | |

$ | (12,268,215 | ) | |

$ | (17,139,150 | ) | |

$ | (20,228,484 | ) |

| Share-based payments | |

| 2,775,906 | | |

| 7,674,832 | | |

| 6,070,935 | | |

| 10,638,534 | |

| Interest expense | |

| 1,227,650 | | |

| 1,218,732 | | |

| 2,015,504 | | |

| 1,939,353 | |

| Depreciation, amortization | |

| 1,338,779 | | |

| 534,359 | | |

| 2,399,350 | | |

| 1,031,732 | |

| Transaction costs | |

| - | | |

| 123,000 | | |

| - | | |

| 516,601 | |

| EBITDA, as adjusted | |

$ | (2,120,614 | ) | |

$ | (2,717,292 | ) | |

$ | (6,653,361 | ) | |

$ | (6,102,264 | ) |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

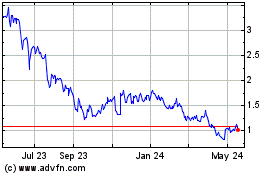

SKYX Platforms (NASDAQ:SKYX)

Historical Stock Chart

From Dec 2024 to Jan 2025

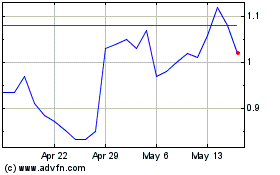

SKYX Platforms (NASDAQ:SKYX)

Historical Stock Chart

From Jan 2024 to Jan 2025