As filed with the Securities and Exchange Commission

on December 18, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Zhongchao Inc.

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

N/A |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

Nanxi Creative Center, Suite 216

841 Yan’an Middle Road

Jing’An District, Shanghai, China 200040

Tel: +86 21-32205987

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue

Suite 204

Newark, Delaware 19711

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Wei Wang Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas

New York, NY 10105

Phone: (212) 370-1300

Fax: (212) 370-7889

Approximate date of commencement of proposed sale

to the public: From time to time after the effective date of the registration statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

| |

† |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information in

this prospectus is not complete and may be changed. The Selling Shareholders may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED DECEMBER 18, 2024

PROSPECTUS

Zhongchao Inc.

19,600,000 Class A Ordinary Shares

This prospectus relates to

the resale, from time to time, of up to an aggregate of 19,600,000 Class A ordinary shares, par value US$0.001 per share (the “Class

A Ordinary Shares”), consisting of (i) 10,000,000 Class A Ordinary Shares issued in the Private Placement (as defined below) and

(ii) 9,600,000 Class A Ordinary Shares issued upon cashless exercise of certain warrants (the “Warrants”) of Zhongchao Inc.,

a Cayman Islands exempted company (“Zhognchao Cayman,” collectively with its subsidiaries, “we,” “us,”

“our,” “our company,” the “Company,” or similar terms), which may be offered and sold from time to

time by shareholders set forth in the “Selling Shareholders” section of this prospectus (the “Selling Shareholders”).

The Selling Shareholders acquired the Class A Ordinary Shares and the Warrants pursuant to certain securities purchase agreements, dated

as of November 14, 2024 (the “Securities Purchase Agreements”) by and among us and the purchasers named therein. The Class

A Ordinary Shares and Warrants were issued to the Selling Shareholders in a private placement (the “Private Placement”) pursuant

to an exemption from registration under the Securities Act of 1933, as amended, in reliance upon Regulation S promulgated thereunder.

On December 12, 2024, the Company issued an aggregate of 9,600,000 Class A Ordinary Shares to the Selling Shareholders upon the cashless

exercise of the Warrants pursuant to the terms of the Warrants.

The Selling Shareholders will

receive all of the net proceeds from the sale of the Class A Ordinary Shares offered hereby. The Selling Shareholders may resell the Class

A Ordinary Shares offered for resale through this prospectus to or through underwriters, broker-dealers, or agents, who may receive compensation

in the form of discounts, concessions or commissions. We will not receive any proceeds from the sale of these shares by the Selling Shareholders,

but we will bear all costs, fees and expenses in connection with the registration of the Class A Ordinary Shares offered by the Selling

Shareholders. The Selling Shareholders will bear all commissions and discounts, if any, attributable to the sale of the Class A Ordinary

Shares offered for resale through this prospectus.

The Selling Shareholders will

determine where they may sell the shares through public or private transactions at market prices prevailing at the time of sale, at prices

related to the prevailing market prices, or at negotiated prices. For information regarding the Selling Shareholders and the times and

manner in which they may offer or sell Class A Ordinary Shares, see “Selling Shareholders” and “Plan of Distribution.”

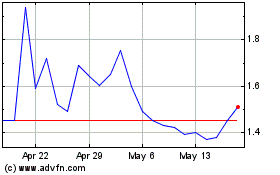

Our Class A Ordinary Shares are listed on the Nasdaq Capital Market

(“Nasdaq”) under the symbol “ZCMD.” As of December 16, 2024, the closing sale price of our Class A Ordinary Shares

was US$2.06.

Zhongchao Cayman is an offshore

holding company incorporated as an exempted company with limited liability in the Cayman Islands. Zhongchao Cayman is not a Chinese operating

company, but a Cayman Islands holding company with no material operations of its own. Zhongchao Cayman, through the contractual arrangements

(the “Contractual Arrangements”), between Beijing Zhongchao Zhongxing Technology Limited (“Zhongchao WFOE”), a

wholly-owned subsidiary of Zhongchao Cayman incorporated in the People’s Republic of China (the “PRC” or “China”),

and a variable interest entity (the “VIE”), Zhongchao Medical Technology (Shanghai) Co., Ltd. (“Zhongchao Shanghai”)

and its subsidiaries (collectively with the VIE, the “PRC operating entities”), consolidate the financial results of the PRC

operating entities. We chose such VIE structure due to the restrictions imposed by PRC laws and regulations on foreign ownership of companies

engaged in value-added telecommunication services and certain other businesses, and the PRC operating entities operate their businesses

in which foreign investment is restricted or prohibited in the PRC. For a description of the VIE contractual arrangements, see “Prospectus

Summary — Our Corporate Structure — Contractual Arrangements between Zhongchao WFOE and Zhongchao Shanghai” starting

on page 6 of this prospectus.

You are not investing in the

PRC operating entities. The securities offered under this prospectus are securities of Zhongchao Cayman, the Cayman Islands holding company,

rather than any securities of the PRC operating entities, therefore, our investors may never hold equity interests in the PRC operating

entities. Neither we nor our subsidiaries own any share or equity interest in the PRC operating entities. Instead, we consolidate financial

results of the PRC operating entities through the Contractual Arrangements by and among Zhongchao WFOE, the VIE and shareholders of the

VIE. As a result of Zhongchao Cayman’s direct ownership in Zhongchao WFOE and the Contractual Arrangements, we treat the VIE and

the VIE’s subsidiaries as the consolidated entities under U.S. GAAP. We have consolidated the financial results of the VIE and the

VIE’s subsidiaries in our consolidated financial statements for accounting purposes in accordance with U.S. GAAP.

The VIE structure is used

to provide investors with exposure to foreign investment in China-based companies where Chinese law prohibits direct foreign investment

in the operating companies. As we chose such VIE structure, we are subject to certain unique risks and uncertainties that may not otherwise

exist if we had direct equity ownership in the PRC operating entities. Further, we are subject to risks due to uncertainty of the interpretation

and the application of the PRC laws and regulations, including but not limited to, limitations on foreign ownership and regulatory review

of overseas listings of PRC companies through a special purpose vehicle, and the validity and enforcement of the Contractual Arrangements.

We are also subject to the risks of uncertainty of any future actions of the PRC government in this regard that could disallow the VIE

structure, which would likely result in a material change in the operations of the PRC operating entities and/or cause the value of our

securities to decrease significantly or become worthless. As of the date of this prospectus, the agreements under the Contractual Arrangements

have not been tested in any courts of law. See “Prospectus Summary - Permission Required from the PRC Authorities for Our and

PRC Operating Entities’ Operation in China” starting on page 11 of this prospectus, and “Item 3. Key Information

D. Risk Factors - We depend upon the VIE Arrangements in consolidating the financial results of the PRC operating entities, which

may not be as effective as direct ownership” in our most recent annual report on Form 20-F filed on April 30, 2024 (the “Annual

Report”) and “Risk Factors – We conduct our business through Zhongchao Shanghai and its subsidiaries by means

of Contractual Arrangements. If the PRC courts or administrative authorities determine that these Contractual Arrangements do not comply

with applicable regulations, we could be subject to severe penalties and our business could be adversely affected, and our securities

may decline in value or become worthless. In addition, changes in such PRC laws and regulations may materially and adversely affect our

business” on page 22 of this prospectus.

We face risks and uncertainties

associated with the complex and evolving PRC laws and regulations and as to whether and how the recent PRC government statements and regulatory

developments. The Chinese government may intervene or influence the operation of the PRC operating entities and exercise significant oversight

and discretion over the conduct of the PRC operating entities’ business and may intervene or influence the operations of the PRC

operating entities at any time, which could result in a material change in the operations of the PRC operating entities and/or the value

of our securities. Further, any actions by the Chinese government to exert more oversight and control over offerings that are conducted

overseas and/or foreign investment in China-based issuers, such as us, could significantly limit or completely hinder our ability to offer

or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. See “Risk

Factors — China’s economic, political and social conditions, as well as changes in any government policies, laws and regulations

may be quick with little advance notice and could have a material adverse effect on the PRC operating entities’ business and the

value of our securities” starting on page 23 of this prospectus, and “—The Chinese government exerts substantial

influence over the manner in which the PRC operating entities must conduct their business activities. We are currently not required to

obtain approval from Chinese authorities to list or continue to list on U.S. exchanges nor for the execution of VIE agreements, however,

if the VIE or the holding company were required to obtain approval and were denied permission from Chinese authorities to list or continue

to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange or continue to offer securities to investors, which

could materially affect the interest of the investors and cause the value of our securities to significantly decline or be worthless”

starting on page 23 of this prospectus.

The PRC government has initiated

a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking

down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding

the efforts in anti-monopoly enforcement. On February 17, 2023, the China Securities Regulatory Commission (the “CSRC”) promulgated

the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, and five

supporting guidelines, which became effective on March 31, 2023. Under the Trial Measures, a filing-based regulatory system applies to

“indirect overseas offerings and listings” of companies in mainland China, which refers to securities offerings and listings

in an overseas market made under the name of an offshore entity but based on the underlying equity, assets, earnings or other similar

rights of a company in mainland China that operates its main business in mainland China. The Trial Measures states that, any post-listing

follow-on offering by an issuer in an overseas market, including issuance of shares, convertible notes and other similar securities, shall

be subject to filing requirement within three business days after the completion of the offering. Therefore, in the opinion of our PRC

legal counsel, Han Kun Law Offices, we are required to go through filing procedures with the CSRC within three business days after the

completion of the Private Placement and for our future offerings under the Trial Measures. On November 22, 2024, we submitted initial

filing documents to the CSRC in connection with the Private Placement (“CSRC Filings”) and they are currently under review

of the CSRC.

As the Trial Measures were

newly published, there are substantial uncertainties as to the implementation and interpretation, and how they will affect our current

listing, and future offering or financing. If we are required by the Trial Measures for any future offering or any other financing activities

to file with the CSRC, we cannot assure you that we will be able to complete such filings in a timely manner, or even at all. Any failure

of us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to continue to offer our

securities, cause significant disruption to the business operations of the PRC operating entities, severely damage our reputation, materially

and adversely affect our financial condition and results of operations and cause our securities to significantly decline in value or become

worthless. See “Risk Factors – We are required to complete filing procedures with the CSRC in connection with the offerings

in connection with this registration statement, it is uncertain whether such filing can be completed or how long it will take to complete

such filing.” starting on page 26 of this prospectus.

As of the date of this prospectus,

in the opinion of our PRC legal counsel, Han Kun Law Offices, other than the aforementioned CSRC Filings that were initiated by us and

are under review of the CSRC, no relevant PRC laws or regulations in effect require that we or the PRC operating entities obtain permission

from any PRC authorities to issue securities to foreign investors, and neither we nor the PRC operating entities have received any inquiry,

notice, warning, sanction, or any regulatory objection to the offering in connection with this registration statement from the CSRC, the

CAC (as defined below), or any other PRC authorities that have jurisdiction over our operations.

In the opinion of our PRC

counsel, Han Kun Law Offices, neither we nor the PRC operating entities are required to voluntarily report for a cybersecurity review

with the Cyberspace Administration of China ( the “CAC”) under the Cybersecurity Review Measures which became effective on

February 15, 2022, since neither we nor any of the PRC operating entities have not been identified by the regulatory authorities as a

critical information infrastructure operator, and neither we nor any of the PRC operating entities currently have over one million users’

personal information nor do we anticipate that we will be collecting over one million users’ personal information in the foreseeable

future, which we understand might otherwise subject us , our subsidiaries or the PRC operating entities to the Cybersecurity Review Measures.

However, given that the Cybersecurity Review Measures do not provide explanation or interpretation for ‘affect or may affect national

security’, the PRC regulatory authorities retain broad discretion in interpreting this provision. Should the authorities determine,

at their discretion, that our data processing activities affect or may affect national security, we may be subject to a cybersecurity

review. Notwithstanding this, as of the date of this prospectus, we have not been involved in any cybersecurity review or investigation

by the CAC or other authorities with respect to the Cybersecurity Review Measures. Furthermore, the data processed by us or the PRC operating

entities has not been included in the effective core data and important data catalogs by any authority, and we have taken reasonable and

adequate technical and management measures to ensure data security. In light of these circumstances, in the opinion of our PRC counsel,

Han Kun Law Offices, the likelihood of us being subject to a cybersecurity review is remote.

On September 30, 2024, the

State Council of China published the Regulations on Network Data Security Administration, which provides that data processing operators

engaging in data processing activities that affect or may affect national security must be subject to network data security review by

the relevant cyberspace administration of the PRC. The Regulations on Network Data Security Administration have not been fully implemented

as of the date of this prospectus and will become effective on January 1, 2025. Network data processing activities refers to the collection,

retention, use, processing, transmission, provision, disclosure, deletion, and other activities of network data. Network data processing

activities refers to the collection, retention, use, processing, transmission, provision, disclosure, deletion, and other activities of

network data.

As of the date of this prospectus,

the MDMOOC online platform has approximately 194,700 registered users, and we and the PRC operating entities currently do not hold more

than one million users/users’ individual information. However, we or the PRC operating entities may be deemed as a data processor

under the Regulations on Network Data Security Administration. As of the date of this prospectus, we or the PRC operating entities have

not been informed by any PRC governmental authority of any requirement that we file for a cybersecurity review. However, if we are deemed

to be a critical information infrastructure operator or a company that is engaged in data processing and holds personal information of

more than one million users, we could be subject to PRC cybersecurity review. See “Prospectus Summary – Permission

Required from the PRC Authorities to Issue Our Securities to Foreign Investors.”

As of the date hereof, in

the opinion our PRC legal counsel, Han Kun Law Offices, we are in compliance with the applicable PRC laws and regulations governing the

data privacy and personal information in all material respects, including the data privacy and personal information requirements of CAC,

and we have not received any complaints from any third party, or been investigated or punished by any PRC competent authority in relation

to data privacy and personal information protection. However, as there remains significant uncertainty in the interpretation and enforcement

of relevant PRC cybersecurity laws and regulations, we could be subject to cybersecurity review, and if so, we may not be able to pass

such review. In addition, we could become subject to enhanced cybersecurity review or investigations launched by PRC regulators in the

future. Any failure or delay in the completion of the cybersecurity review procedures or any other non-compliance with the related laws

and regulations may result in fines or other penalties, including suspension of business, website closure, removal of our app from the

relevant app stores, and revocation of prerequisite licenses, as well as reputational damage or legal proceedings or actions against us,

which may have material adverse effect on our business, financial condition or results of operations.

Pursuant to the Holding Foreign

Companies Accountable Act (the “HFCA Act”), if the Public Company Accounting Oversight Board, or the PCAOB, is unable to inspect

an issuer’s auditors for three consecutive years, the issuer’s securities are prohibited to trade on a U.S. stock exchange.

Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”),

which, if signed into law, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S.

stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive years. Pursuant

to the HFCA Act, the PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate

completely registered public accounting firms headquartered in: (1) mainland China, and (2) Hong Kong. In addition, the PCAOB’s

report identified the specific registered public accounting firms which are subject to these determinations. On August 26, 2022, the CSRC,

the Ministry of Finance of the PRC, and PCAOB signed a Statement of Protocol, or the Protocol, governing inspections and investigations

of audit firms based in China and Hong Kong. Pursuant to the Protocol, the PCAOB has independent discretion to select any issuer audits

for inspection or investigation and has the unfettered ability to transfer information to the SEC. Under the PCAOB’s rules, a reassessment

of a determination under the HFCA Act may result in the PCAOB reaffirming, modifying or vacating the determination. On December 15, 2022,

the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms

headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, whether the PCAOB

will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China

and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. The PCAOB is

continuing to demand complete access in mainland China and Hong Kong moving forward, as well as to continue pursuing ongoing investigations

and initiate new investigations as needed. The PCAOB has indicated that it will act immediately to consider the need to issue new determinations

with the HFCA Act if needed and does not have to wait another year to reassess its determinations. In the future, if there is any regulatory

change or step taken by PRC regulators that does not permit our auditor to provide audit documentations located in China or Hong Kong

to the PCAOB for inspection or investigation, or the PCAOB expands the scope of the Determination such that we would become subject to

the HFCA Act, as the same may be amended, you may be deprived of the benefits of such inspection which could result in limitation or restriction

to our access to the U.S. capital markets and trading of our securities, including trading on the national exchange and trading on “over-the-counter”

markets, may be prohibited under the HFCA Act. On December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023”

(the “Consolidated Appropriations Act”), was signed into law by President Biden. The Consolidated Appropriations Act contained,

among other things, an identical provision to AHFCAA, which reduces the number of consecutive non-inspection years required for triggering

the prohibitions under the HFCA Act from three years to two. See “Item 3. Key Information—D. Risk Factors — The

recent joint statement by the SEC and the PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable

Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of

their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our

offering.” in the Annual Report.

Marcum Asia CPAs LLP (“MarcumAsia”

formerly known as “Marcum Bernstein & Pinchuk LLP”) was our auditor for the financial statements for the fiscal year ended

December 31, 2021. The Company then appointed Prager Metis CPAs, LLC (“Prager Metis”) as the independent registered public

accounting firm. Prager Metis replaced MarcumAsia, which the Company dismissed effective as of September 27, 2022. Both MarcumAsia and

Prager Metis are headquartered in New York, New York, registered with PCAOB and subject to laws in the United States pursuant to which

the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Neither our former auditor,

MarcumAsia, nor our current auditor, Prager Metis, was/is headquartered in mainland China or Hong Kong or was identified in the Determination

Report as a firm subject to the PCAOB’s determination.

We intend to keep any future

earnings to re-invest in and finance the expansion of the business of the PRC operating entities, and we do not anticipate that any cash

dividends will be paid in the foreseeable future. Under Cayman Islands law, a Cayman Islands company may pay a dividend on its shares

out of either profit or share premium amount, provided that in no circumstances may a dividend be paid if this would result in the Company

being unable to pay its debts due in the ordinary course of business. Cash proceeds raised from overseas financing activities, including

the cash proceeds from the Private Placement, may be transferred by Zhongchao Cayman to Zhongchao Group Limited, a Hong Kong company (“Zhongchao

HK”), and then transferred to Zhongchao WFOE via capital contribution or shareholder loans, as the case may be. Cash proceeds may

flow to the VIE from Zhongchao WFOE pursuant to certain contractual agreements between Zhongchao WFOE and the VIE as permitted by the

applicable PRC regulations. The process for sending such proceeds back to mainland China may be time-consuming. We may be unable to use

these proceeds to grow the business of the PRC operating entities until the PRC operating entities receive such proceeds in mainland China.

Any transfer of funds by us to our PRC subsidiaries, either as a shareholder loan or capital contribution, are subject to PRC regulations.

As a holding company, for

Zhongchao Cayman’s cash and financing requirements, Zhongchao Cayman may rely on transfer of funds, dividends and other distributions

on equity paid by Zhongchao HK, which relies on transfer of funds, dividends and other distributions by Zhongchao WFOE, which relies on

payment by the PRC operating entities pursuant to the Contractual Arrangement. If any of these entities incurs debt on its own behalf

in the future, the instruments governing such debt may restrict their ability to pay dividends, make distribution or transfer funds to

Zhongchao Cayman. See “Prospectus Summary – Dividend Distributions or Transfers of Cash among the Holding Company,

Its Subsidiaries, and the Consolidated VIE” on page 12 of this prospectus.

Zhongchao Cayman and Zhongchao

WFOE are not able to make direct capital contribution to the VIE. However, they may transfer cash to the VIE in the form of loans or advances

or by making payments to the VIE for inter-group transactions. For the year ended December 31, 2023, 2022 and 2021, Zhongchao Cayman made

cash transfers of $0.1 million, $1.5 million and $3.4 million, respectively, to Zhongchao USA LLC (“Zhongchao USA”) as loans.

See “Consolidated Financial Statements” included in our Annual Report. Except as otherwise disclosed above, for the

years ended December 31, 2023, 2022 and 2021, no other cash transfer or transfer of other assets have occurred between Zhongchao Cayman,

its subsidiaries, the consolidated VIE and the subsidiaries of the VIE. For the years ended December 31, 2023, 2022 and 2021, none of

our subsidiaries, the consolidated VIE, or the subsidiaries of the VIE have made any dividends or distributions to Zhongchao Cayman. For

the years ended December 31, 2023, 2022 and 2021, no dividends or distributions have been made to any U.S. investors.

We

plan to distribute earnings or settle amounts owed under the Contractual Arrangements with the VIE when required in the future. As

of the date of this prospectus, none of Zhongchao HK, Zhongchao WFOE and the PRC operating entities have made any dividends to Zhongchao

Cayman. As of the date of this prospectus, we have not made any dividends or distributions to any U.S. investors. As of the date of this

prospectus, Zhongchao Cayman and its subsidiaries, as well as the PRC operating entities have not adopted or maintained any other cash

management policies and procedures, and each entity needs to comply with applicable law or regulations with respect to transfer of funds,

dividends and distributions with other entities.

The PRC government also imposes

controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. To the extent cash or assets

in our business is in mainland China or Hong Kong or in an entity domiciled in mainland China or Hong Kong, and may need to be used to

fund operations outside of mainland China or Hong Kong, the funds and assets may not be available to fund operations or for other uses

outside of mainland China or Hong Kong due to interventions in or the imposition of restrictions and limitations by the government on

our ability to transfer cash and assets.Therefore, we may experience difficulties in completing the administrative procedures necessary

to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if any of our subsidiaries in

the PRC and the PRC operating entities incurs debt on its own in the future, the instruments governing the debt may restrict its ability

to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from the PRC operating entities’

operations through the current Contractual Arrangements, we may be unable to pay dividends on our Class A Ordinary Shares. See “Risk

Factors – “To the extent cash or assets in our business is in mainland China or Hong Kong or in an entity domiciled in mainland

China or Hong Kong, and may need to be used to fund operations outside of mainland China or Hong Kong, the funds and assets may not be

available to fund operations or for other uses outside of mainland China or Hong Kong due to interventions in or the imposition of restrictions

and limitations by the government on our ability to transfer cash and assets, which may materially and adversely affect our business,

financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies”

in this prospectus and “Item 3. Key Information—D. Risk Factors — Governmental control of currency conversion

may limit our ability to use our revenues effectively and the ability of our PRC subsidiaries to obtain financing” in the Annual

Report.

The transfer of funds among

the PRC operating entities are subject to the Provisions of the Supreme People’s Court on Several Issues Concerning the Application

of Law in the Trial of Private Lending Cases (2020 Second Amendment Revision, the “Provisions on Private Lending Cases”),

which was implemented on January 1, 2021 to regulate the financing activities between natural persons, legal persons and unincorporated

organizations. In the opinion of our PRC counsel, Han Kun Law Offices, the Provisions on Private Lending Cases does not prohibit using

cash generated from one PRC operating entity to fund another affiliated PRC operating entity’s operations. We or the PRC operating

entities have not been notified of any other restriction which could limit the PRC operating entities’ ability to transfer cash

among each other. In the future, cash proceeds from overseas financing activities, including the Private Placement, may be transferred

by Zhongchao Cayman to Zhongchao HK, and then transferred to Zhongchao WFOE via capital contribution or shareholder loans, as the case

may be. Cash proceeds may flow to Zhongchao Shanghai from Zhongchao WFOE pursuant to the Contractual Arrangements between Zhongchao WFOE

and Zhongchao Shanghai as permitted by the applicable PRC regulations. For more details, see “Prospectus Summary —

Dividend Distributions or Transfers of Cash among the Holding Company, Its Subsidiaries, and the PRC Operating Entities”

starting on page 12 of this prospectus.

Cash dividends, if any, on

our Class A Ordinary Shares will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends

we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a

rate of up to 10.0%. In order for us to pay dividends to our shareholders, we will rely on payments made from Zhongchao Shanghai to Zhongchao

WFOE, pursuant to the Contractual Arrangements between them, and the distribution of such payments to Zhongchao HK as dividends from Zhongchao

WFOE. Certain payments from Zhongchao Shanghai to Zhongchao WFOE are subject to PRC taxes, including business taxes and value added tax.

Further, any transfer of funds

by us to our PRC subsidiaries, either as a shareholder loan or as a capital contribution, are subject to PRC regulations. Capital contributions

to our PRC subsidiaries are subject to the report to the Ministry of Commerce of the People’s Republic of China, or the MOFCOM,

in its local branches and registration with a local bank authorized by the China’s State Administration of Foreign Exchange, or

the SAFE. Any foreign loan procured by our PRC subsidiaries is required to be registered or filed with the SAFE or its local branches

or satisfy relevant requirements as provided by the SAFE. Any medium- or long-term loan to be provided by us to the VIEs must be registered

with the National Development and Reform Commission, or the NDRC, and the SAFE or its local branches. We may not be able to obtain these

government approvals or complete such registrations on a timely basis, if at all, with respect to future capital contributions or foreign

loans by us to our PRC subsidiaries. If we fail to receive such approvals or complete such registration or filing, our ability to use

the proceeds of our financing activities and to capitalize our PRC operations may be negatively affected, which could adversely affect

our liquidity and our ability to fund and expand our business. See “Item 3. Key Information—D. Risk Factors—

Risks Related to Doing Business in China—PRC regulation of loans and direct investment by offshore holding companies to PRC

entities may delay or prevent us from using the proceeds of the initial public offering or any subsequent offerings to make loans or additional

capital contributions to our PRC subsidiary, which could materially and adversely affect our liquidity and our ability to fund and expand

our business” in the Annual Report.

Zhongchao Cayman is a Cayman

Islands company and consolidates the financial results of the PRC operating entities through the Contractual Arrangement. The substantially

all of the operations and assets of the PRC operating entities are located in China. In addition, our management consists of five executive

officers who are all located in China and three independent directors, among which two (Mr. John C. General and Mr. Kevin Dean Vassily)

are located in the United States and one (Ms. Dan Li) is located in China. A substantial portion of the assets of these persons is located

outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons.

It may also be difficult for you to enforce the U.S. courts judgments including judgments based on the civil liability provisions of the

U.S. federal securities laws against us and our officers and directors, none of whom (except two independent director) are residents in

the United States, and whose significant assets are located outside the United States. See “Risk Factors – You may experience

difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in mainland China against

us based on Hong Kong or other foreign laws, and the ability of U.S. authorities to bring actions in China may also be limited”

starting on page 26 of this prospectus.

We are an “emerging

growth company” under the federal securities laws and are subject to reduced public company reporting requirements. See “Prospectus

Summary — Implications of Being an Emerging Growth Company, a Foreign Private Issuer and a Controlled Company” on page

19 of this prospectus for additional information.

The information contained

or incorporated in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus

or any sale of our securities.

Investing in our securities

involves a high degree of risk. See “Risk Factors” on page 22 of this prospectus and in the documents incorporated

by reference in this prospectus, as updated in the applicable prospectus supplement, and any other future filings we make with the Securities

and Exchange Commission that are incorporated by reference into this prospectus, for a discussion of the factors you should consider carefully

before deciding to purchase our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [_], 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should carefully read

this prospectus and the information described under the heading “Where You Can Find More Information.” Neither we nor the

Selling Shareholders have authorized anyone to give any information or make any representation about our company that is different from,

or in addition to, that contained in this prospectus, including in any of the materials that have been incorporated by reference into

this prospectus. Therefore, if anyone does give you information of this sort, you should not rely on it as authorized by us. You should

rely only on the information contained or incorporated by reference in this prospectus.

You should not assume that

the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front of the document or

that any information that has been incorporated by reference is correct on any date subsequent to the date of the document incorporated

by reference, even though this prospectus and any accompanying supplement to this prospectus is delivered or securities are sold on a

later date. Neither the delivery of this prospectus, nor any sale made hereunder, shall under any circumstances create any implication

that there has been no change in our affairs since the date hereof or that the information incorporated by reference herein is correct

as of any time subsequent to the date of such information.

The distribution of this prospectus

may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of these restrictions. If you are

in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful,

or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not

extend to you.

COMMONLY USED DEFINED TERMS

Unless otherwise indicated

or the context otherwise requires,

| ● | All

references to “RMB,” “yuan” and “Renminbi” are to the legal currency of China, all references to

“HKD” is to the legal currency of Hong Kong, and all references to “USD,” and “U.S. dollars” are

to the legal currency of the United States; |

| ● | all references to “Zhongchao,” “we,” “us,”

“our,” “the Company,” “the “Registrant” or similar words refer to Zhongchao Inc., together with

our subsidiaries. In the context of describing our consolidated financial information, the terms “we,” “us,” “our

company,” “our,” “Zhongchao” and “Zhongchao Cayman” refer to Zhongchao Inc., a Cayman Islands

exempted company, and its subsidiaries, consolidated affiliated companies and the PRC operating entities, as the context required; |

| ● | “Beijing

Boya” refers to Beijing Zhongchao Boya Medical Technology Co., Ltd., a PRC company; |

| ● | “Beijing

Yisuizhen” refers to Beijing Yisuizhen Technology Co., Ltd., a PRC company; |

| ● | “China”

and “PRC” refer to the People’s Republic of China, including Hong Kong, the special administrative region of Macau

and Taiwan, and “China” or the “PRC” exclude Taiwan, Hong Kong, and the special administrative region of Macau

when we are referencing to specific laws and regulations adopted by the PRC and other specific legal or tax matters in the PRC in this

prospectus; given the PRC government’s authority and oversight may extend to Hong Kong, the legal and operational risks associated

with operating in China also apply to operations in Hong Kong; |

| ● | “Class

A Ordinary Shares” refers to the Class A ordinary shares, $0.001 par value per share, in the capital of the Company; |

| |

● |

“Class B Ordinary Shares” refers to the Class B ordinary shares, $0.001 par value per share, in the capital of the Company; |

| |

|

|

| |

● |

“Contractual Arrangements” refers to the contractual arrangements between Zhongchao WFOE and Zhongchao Shanghai and its subsidiaries; |

| |

● |

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| |

● |

“Hainan Muxin” refers to Hainan Muxin Medical Technology Co., Ltd., a PRC company. |

| |

● |

“Liaoning Zhixun” refers to Zhixun Internet Hospital (Liaoning) Co., Ltd., a PRC company. |

| |

● |

“Maidemu Health” refers to Shanghai Maidemu Health Management Co., Ltd., a PRC company. |

| |

● |

“Ordinary Shares” refers to Class A Ordinary Shares and Class B Ordinary Shares, collectively; |

| |

|

|

| |

● |

“Private Placement” refers to the private placement offering conducted by the Company that closed on November 19, 2024; |

| |

● |

“Securities Act” refers to the U.S. Securities Act of 1933, as amended; |

| |

|

|

| |

● |

“Securities Purchase Agreements” refers to those certain securities purchase agreements, dated as of November 14, 2024, by and among us and the purchasers named therein; |

| |

|

|

| |

● |

“Shanghai Huijing” refers to Shanghai Huijing Information Technology Co., Ltd., a PRC company; |

| |

● |

“Shanghai Jingyi” or “Shanghai Zhongxin” refers to Shanghai Zhongxin Medical Technology Co., Ltd, a PRC company, which was formerly known as Shanghai Jingyi, or Shanghai Jingyi Medical Technology Co., Ltd., a PRC company and changed to its current name as Shanghai Zhongxin on November 16, 2020. |

| |

● |

“Shanghai Maidemu” refers to Shanghai Maidemu Cultural Communication Corp., a PRC company; |

| |

● |

“Shanghai Xingzhong” refers to Shanghai Xingzhong Investment Management LP, a PRC company; |

| |

● |

“Shanghai Xinyuan” refers to Shanghai Xinyuan Human Resources Co., Ltd., a PRC company; |

| |

● |

“Shanghai Zhongxun” refers to Shanghai Zhongxun Medical Technology Co., Ltd., a PRC company; |

| |

● |

“Warrants” refers to the warrants exercisable for Class A Ordinary Shares, issued to the Selling Shareholders pursuant to the Securities Purchase Agreements; |

| |

|

|

| |

● |

“West Angel” refers to West Angel (Beijing) Health Technology Co., Ltd., a PRC company. |

| |

● |

“Xinjiang Pharmaceutical” refers to Chongqing Xinjiang Pharmaceutical Co., Ltd., a PRC company. |

| |

● |

“Zhongchao BVI” refers to Zhongchao Group Inc., a British Virgin Island company; |

| |

● |

“Zhongchao HK” refers to Zhongchao Group Limited, a Hong Kong company; |

| |

● |

“Zhongchao Shanghai” refers to Zhongchao Medical Technology (Shanghai) Co., Ltd., a PRC company; |

| |

|

|

| |

● |

“Zhongchao USA” refers to Zhongchao USA LLC, a United States company; and |

| |

● |

“Zhongchao WFOE” refers to Beijing Zhongchao Zhongxing Technology Limited, a PRC company. |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and our SEC

filings that are incorporated by reference into this prospectus contain forward-looking statements within the meaning of Section 27A of

the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact are “forward-looking

statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and

objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements

regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives,

and any statements of assumptions underlying any of the foregoing. The words “believe,” “anticipate,” “estimate,”

“plan,” “expect,” “intend,” “may,” “could,” “should,” “potential,”

“likely,” “projects,” “continue,” “will,” and “would” and similar expressions

are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking

statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties.

We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed in our forward-looking statements and

you should not place undue reliance on these statements. There are a number of important factors that could cause our actual results to

differ materially from those indicated or implied by forward-looking statements. These important factors include those discussed under

the heading “Risk Factors” contained in or incorporated by reference into this prospectus and in the applicable prospectus

supplement. These factors and the other cautionary statements made in this prospectus should be read as being applicable to all related

forward-looking statements whenever they appear in this prospectus. Except as required by law, we undertake no obligation to update publicly

any forward-looking statements, whether as a result of new information, future events or otherwise.

PROSPECTUS SUMMARY

Investors are cautioned that the securities

offered under this prospectus are securities of Zhongchao Cayman, our Cayman Islands holding company, which is not a PRC operating company

nor does it have any substantive business operations. Zhongchao Cayman conducts business in China through its subsidiaries and affiliated

entities.

The following summary highlights information

contained elsewhere in this prospectus or incorporated by reference in this prospectus and does not contain all of the information that

you need to consider in making your investment decision. We urge you to read this entire prospectus (as supplemented or amended), including

our consolidated financial statements, notes to the consolidated financial statements and other information incorporated by reference

in this prospectus from our other filings with the SEC, before making an investment decision.

Overview

We are not a Chinese operating

company, but an offshore holding company incorporated in the Cayman Islands as an exempted company with limited liability. As a holding

company with no material operations of our own, we consolidate the financial results of the PRC operating entities through a series of

the Contractual Arrangements. Neither we nor our subsidiaries own any equity interests in the PRC operating entities.

We conduct our operations

primarily through our PRC operating entities in China, which are described in further detail below. We generate revenues by providing

customized online medical courses, customized on-site medical training services, consulting and academic support services and patient

management services for patient-aid projects to pharmaceutical and healthcare enterprises and not-for-profit organizations, including

medical associations, medical institutions, medical journals, medical foundations and hospitals. We also generate revenues from sales

of pharmaceutical products in the PRC.

Our Class A Ordinary Shares

currently trading on Nasdaq are the shares of the offshore holding company, Zhongchao Cayman. You are not investing in the PRC operating

entities. Instead, we consolidate financial results of Zhongchao Shanghai as primary beneficiary through the Contractual Arrangements.

Zhongchao

Shanghai is a platform-based internet technology company and together with its subsidiaries, are offering services to patients with

oncology and other major diseases in China. The PRC operating entities address the patient’s needs along their journey of

symptoms occurrence, medical consultations, medication prescriptions, medication management, and treatment consultations. The PRC

operating entities provide to their pharmaceutical enterprises and not-for-profit organization customers services including: online

healthcare information, professional training and educational services to healthcare professionals, patient management services in

the professional field of tumor and rare diseases, internet healthcare services and pharmaceutical services. The PRC operating

entities also provide healthcare educational content to the public via their “Sunshine Health Forums,” which is a

platform in China for general healthcare knowledge and information to the public. The

PRC operating entities also engage in sales of patent drugs in China.

The PRC operating

entities provide healthcare information, education, and training services to healthcare professionals under their

“MDMOOC” brand. The PRC operating entities provide focused patient management services, via their “Zhongxun”

IT system and WeChat mini program and Zhongxin Health WeChat mini program, to their pharmaceutical enterprises and not-for-profit

organization customers.

The PRC operating entities

established Xinjiang Pharmaceutical, a PRC company, aiming at realizing medications accessibility and affordability for patients. Xinjiang

Pharmaceutical plans to cooperate with Zhixun Internet Hospital and other internet hospitals to build a 2B2C (to business and to customer)

pharmaceutical procurement platform and streamline the delivery of medications from pharmaceutical factories to retail ends.

MDMOOC-Healthcare Information, Education, and Training for Professionals

The MDMOOC Online Platform

The MDMOOC online platform which is owned and operated by Zhongchao

Shanghai and can be accessed through various channels, including MOOC mobile app, MOOC Medical WeChat subscription account, and MDMOOC

website, where users can access our rich media content and engaging Community of Practice Share (COPS) on the MDMOOC website.

MOOC Mobile App

The MOOC mobile app serves

as a one-stop destination where the PRC operating entities offer users relevant healthcare knowledge and study insights, assist them along

their journey to obtain knowledge and information they are searching for in a supportive community, and allow them to review and test

their understanding of courses by participating in the Practice Improvement (PI) system.

When users open the MOOC mobile

app, they will immediately see featured banners that display academic courses, open classes, case library, and practice improvement courses.

As users scroll down, courses that are most popular among healthcare professionals, courses recommended by the PRC operating entities’

medical editors, and the latest healthcare news appear. Users can also explore various medical courses by medical specialty and subject

areas. Opening Course is a collection of video courses of various medical fields and topics. The courses are often presented by medical

experts. Most of the courses are free to users.

In addition to providing training

and education courses through the platforms, the PRC operating entities have been engaged by certain customers on a project basis to establish

individual columns (created based on different diseases) on the MDMOOC online platform to provide training and knowledge of certain drug

treatment for healthcare professionals and patients. Most of the drug treatments are cancer-related or rare disease-related. The PRC operating

entities also plug in supplemental features, to manage the drug treatment including reviewing patients’ applications, tracking their

usage of drugs, and collecting related information (such programs with new plug-in features are hereinafter referred as the “patient-aid

projects”).

As of the date of this prospectus,

we have created nearly 22 courses for cancer-related drug treatment, including drug treatment for lung cancer, liver cancer, and extended

blood cancer, and four columns for drug treatment of rare diseases, including drug treatment for pulmonary fibrosis, multiple sclerosis,

systemic lupus erythematosus, Crohn’s disease and skin diseases. The total number of patients covered under these patient-aid projects

has reached nearly 125,970 by the end of 2023.

MDMOOC WeChat Subscription Account

WeChat subscription account

provides a new means for media and individuals to disseminate information, building enhanced communication with readers and improving

management efficiency. The subscription account also facilitates discovery and use of services and products. By complementing fully-functional

apps, it contributes to increased user engagement and traffic.

The MDMOOC WeChat subscription

account features similar interfaces and functions as the MOOC mobile app. It serves as additional access points to the PRC operating entities’

platform.

MDMOOC Website

Users can access online healthcare information, education and training

content and the services through the PRC operating entities’ website, www.mdmooc.org. As more internet users shift to mobile

ends, the MDMOOC website mainly serves a comprehensive knowledge base targeting users who are in the process of researching for specific

medical courses, articles, or news.

The MDMOOC website was designed

to meet the needs of their users in a personalized and easy-to-use manner. The PRC operating entities plan to expand into new medical

specialty areas that appeal to their current users base and attract new users. The PRC operating entities’ objective is to be the

category leader in each of their medical specialty areas by delivering the highest quality specialty-based content and selectively acquiring

other high-quality medical specialty Websites. As part of this strategy, the PRC operating entities will (1) work with more medical associations

to produce programs and courses to meet the need of healthcare professionals; (2) expand their R&D team and provide more support to

their self-developed courses; (3) cooperate with international continuing medical education providers to improve the quality and diversity

of their courses; and (4) expand their new media team to create and provide high-quality online courses for mobile users.

The MDMOOC Onsite Activities

In addition to their online

presence, the PRC operating entities also hold onsite activities to provide healthcare information and education services from time to

time under their “MDMOOC” brand. The PRC operating entities’ onsite activities provide their healthcare professionals

with medical knowledge and clinical skills and enhance their professional competitiveness. Also, many of their onsite activities were

accompanied with live steaming, which are uploaded to the MDMOOC online platform.

The PRC operating entities

believe the offering of a combination of online and onsite services provides the greatest convenience to their end-users. By expanding

the choices of healthcare education, the PRC operating entities believe they enhance the overall learning experience of their end-users.

New Plug-in to Certain Programs- Assistance

in Patient-Aid Projects

The PRC operating entities

have been engaged by certain customers on a project basis to create individual columns on the MDMOOC online platform to provide training

and educational contents on certain drug treatment for healthcare professionals and patients. Most of these drug treatments focus on cancer

or rare diseases. The PRC operating entities develop these online columns to help qualified patients access free drug treatments provided

by not-for-profit organizations until the earlier of the expiration of contract period or the free drugs treatment programs are complete.

For each column, the PRC operating entities integrate features to manage the drug treatment process, including reviewing patients’

applications, tracking medication usage, and collecting relevant information. Our not-for-profit organization customers provide those

drugs sponsored by pharmaceutical companies without charge to qualified patients and the PRC operating entities charge those customers

on the services in connection with the online columns and related training and management. The PRC operating entities believe that, by

helping to manage patients’ medication habits and training patients on how to use medications, the online columns not only facilitate

the clinical application of those drugs, but also benefit patients.

Sunshine Health Forums-Healthcare Information

and Education for the Public

The PRC operating entities

aim not only to provide continuing education and training for healthcare professionals but also to promote healthy lifestyles and provide

healthcare knowledge to the general public. In order to achieve that, the PRC operating entities have developed and operate the Sunshine

Health Forums, an online education-for-all platform that shares articles and content on healthcare and wellness, medical behavior interventions,

and emerging health technologies and applications. The PRC operating entities have also developed the Sunshine Health Forum WeChat subscription

account, and the official website, Sunshine Health Forum.org, both of which serve as gateways to leading media platforms with which the

PRC entities maintain strategic partnerships. These strategic relationships enhance the efficiency and effectiveness of the information

delivery to users. The PRC operating entities have organized one school for each disease to make it easier for the general public to obtain

information they would like to know. The PRC operating entities have established presence on several prominent we-media platforms, including

but not limited, Toutiao.com, WeChat official accounts platform, Yidianzixun.com, Douyin.com, CN-Healthcare.com, iQiyi, Youku, and Huoshan.com.

Zhongxin Health Patient Management Services in Patient-aid Projects

The PRC operating entities

utilize their self-developed patient management system, branded as “Zhongxin Health” to provide patient management services

to pharmaceutical and non-for-profits customers supporting the management of patients with cancer, rare diseases or other major diseases.

Cancer patients, in particular,

face various changes during treatments, including issues with dosing punctuality, incorrect dosage, missed doses, drug interactions, and

adverse reaction management. If these challenges are not solved, the treatment process will be negatively affected, undermining patients’

confidence in treatment and potentially affecting the effectiveness of the treatment. To address these medication-related challenges in

a timely manner and promote treatment continuity, the PRC operating entities developed and designed the Zhongxin Health mini program which

offers a range functions. The program can automatically remind patients to take medications and follow precautions based on their specific

types of cancer and medication schedule. It also provides general self-care information to help patients manage potential adverse reactions,

offering timely advice tailored to specific side effects they experience during treatment. Additionally, the program could improve patients’

self-management ability through various illustrations and video courses. Utilizing the program, patients can customize and self-manage

their medication regime based on cancer type and treatment schedule, which helps improve patients’ confidence in the treatment process.

Xinjiang Pharmaceutical Drug Retail Services

Xinjiang Pharmaceutical was

established with a goal to improve medication accessibility and affordability for patients. The company has partnered with Zhixun Internet

Hospital and other internet hospitals to build a 2B2C (to business and to customer) pharmaceutical procurement platform and streamline

the delivery of medications from pharmaceutical manufactures to retail outlets. This approach enables Xinjiang Pharmaceutical to provide

high quality, cost-effective domestic and international drugs, improving drug accessibility and lowering medication costs.

Since the beginning of 2022,

embracing the development opportunity of a series of investment promotion of pharmaceutical industry initiated by the Chongqing government,

Xinjiang Pharmaceutical has experienced rapid growth. Xinjiang Pharmaceutical has obtained several key licenses, including a Pharmaceutical

Trade License, a Medical Device Trade License, and Qualification Certificate for Drug Information Service over the Internet, among others.

Xinjiang Pharmaceutical plans to engage in pharmaceutical import and export trade, original equipment manufacturer (OEM)production, medical

consumables operation, and pharmaceutical internet services, with an aim to continuously expand its industry and supply chains in China’s

pharmaceutical market. Meanwhile, it remains committed to becoming a competitive, technology-based pharmaceutical service enterprise.

Recent Developments

On July 5, 2023, the Company

held an annual general meeting of shareholders at which shareholders, among other things, passed a special resolution to amend and restate

the Company's memorandum and articles of association, pursuant to which each holder of Class B Ordinary Shares became entitled to one

hundred (100) votes for each Class B Ordinary Shares held. Each shareholder of the Company’s Class A Ordinary Shares remains entitled

to one (1) vote for each Class A Ordinary Share held.

On February 20, 2024, the

Company held an extraordinary general meeting of shareholders at which shareholders resolved that: (a) with effect upon the commencement

of the second business day following the extraordinary general meeting or such later date as the Company's board of directors may determine,

that the authorized, issued, and outstanding shares of the Company be consolidated and divided by consolidating: (i) every ten (10) Class

A Ordinary Shares with a par value of US$0.0001 each into one (1) Class A Ordinary Share with a par value of US$0.001 each; and (ii) every

ten (10) Class B Ordinary Shares with a par value of US$0.0001 each into one (1) Class B Ordinary Share with a par value of US$0.001 each,

with such consolidated shares having the same rights and being subject to the same restrictions (save as to par value) as the previously

existing shares of such class (the “Share Consolidation”); (b) subject to and immediately following the Share Consolidation

being effected, the authorized share capital of the Company be increased from US$50,000 divided into 45,000,000 Class A Ordinary Shares

with a par value of US$0.001 each and 5,000,000 Class B Ordinary Shares with a par value of US$0.001 each to US$500,000 divided into 450,000,000

Class A Ordinary Shares with a par value of US$0.001 each and 50,000,000 Class B Ordinary Shares with a par value of US$0.001 each (the

“Share Capital Increase”); and (c) subject to the Share Consolidation and the Share Capital Increase being approved and effected,

the Company adopt an amended and restated memorandum and articles of association in substitution for, and to the exclusion of, the Company’s

existing memorandum and articles of association, to reflect corrected typographical corrections, the Share Consolidation and the Share

Capital Increase.

The Share Consolidation and

the Share Capital Increase were subsequently effected, and the Company's memorandum and articles of association were amended and restated,

on February 29, 2024. Beginning with the opening of trading on February 29, 2024, the Company’s Class A Ordinary Shares began trading

on a post-Share Consolidation basis on the Nasdaq Capital Market under the same symbol “ZCMD,” but under a new CUSIP number

of G9897X115.

October Offering

On October 1, 2024, the Company entered into certain

securities purchase agreements with investors (collectively, the “October Purchase Agreements”) providing for the issuance

and sale by the Company of an aggregate of 3,094,000 Class A Ordinary Shares in a registered direct offering (the “October Offering”)

pursuant to a prospectus supplement dated October 1, 2024, and a prospectus dated December 17, 2021, which is part of a registration statement

on Form F-3 (File No. 333-256190) that was declared effective by the Securities and Exchange Commission on December 17, 2021. On October

2, 2024, the Company consummated the October Offering and issued the shares to the investors at a price of $0.30 per share, generating

the gross proceeds to the Company in the total amount of $928,200. The Company did not retain an underwriter or placement agent with respect

to the October Offering.

Private Placement

On November 14, 2024, the

Company entered into the Securities Purchase Agreements with the Purchasers in connection with the issuance and sale of (i) an aggregate

of 10,000,000 Class A Ordinary Shares and (ii) Warrants to purchase an aggregate of 40,000,000 Class A Ordinary Shares at an exercise

price of $1.80 per share with respect to 50% of the Warrants and an exercise price of $2.00 per share with respect to the other 50% of

the Warrants, subject to adjustment as provided therein, for an aggregate purchase price of $3,000,000. The Warrants became exercisable

for cash or on a cashless basis upon issuance and will expire one year after the issuance date. On November 19, 2024, the parties closed

the Private Placement. The Company intends to use the net proceeds from the Private Placement for working capital purposes.

On December 12, 2024, the Company issued an aggregate of 9,600,000

Class A Ordinary Shares to the Selling Shareholders upon the cashless exercise of the Warrants pursuant to the terms of the Warrants.

As of the date of this prospectus, no Warrants remain outstanding.

Our Corporate History and Structure

Zhongchao Cayman is a holding

company incorporated on April 16, 2019, under the laws of the Cayman Islands. Zhongchao Cayman has no substantive operations other than

holding all of the issued and outstanding shares of Zhongchao BVI, established under the laws of the British Virgin Islands on April 23,

2019.

Zhongchao BVI is also a holding

company holding all of the outstanding equity of Zhongchao HK, which was established in Hong Kong on May 14, 2019. Zhongchao HK is also

a holding company holding all of the outstanding equity of Zhongchao WFOE, which was established on May 29, 2019 under the laws of the

PRC.

We conduct our business through the VIE, Zhongchao Shanghai, a PRC

company, and through 11 subsidiaries of Zhongchao Shanghai, including Shanghai Zhongxun, Shanghai Zhongxin, Maidemu Health, Beijing Boya,

Shanghai Xinyuan, Hainan Muxin, Shanghai Huijing, Xinjiang Pharmaceutical, Beijing Yisuizhen, West Angel and Liaoning Zhixun, each a PRC

company. In 2013, Zhognchao Shanghai commenced its operations under the name Zhongchao Medical Consulting (Shanghai) Limited to provide

medical online and offline training services.

Zhongchao Shanghai was incorporated

on August 17, 2012 by Juru Guo and Baorong Xue, who held 60% and 40% equity interests in Zhongchao Shanghai respectively. On May 25, 2015,

the two shareholders transferred all equity interests to Weiguang Yang who held 100% equity interests in Zhongchao Shanghai after the

transfer. On January 15, 2016, the name was changed to “Zhongchao Medical Technology (Shanghai) Co., Ltd.” On February 5,

2016, the management completed its registration with the State Administration for Industry and Commerce, currently known as State Administration

for Market Regulation, to convert Shanghai Zhongchao Limited into a company limited by shares, or Zhongchao Shanghai. Through direct ownership,

Zhongchao Shanghai has established subsidiaries and branch offices in various cities in PRC, including Beijing, Shanghai, Hainan, Liaoning

and Chongqing.

On April 16, 2019, Zhongchao

Cayman was incorporated in the Cayman Islands as an exempted company with limited liability, shortly following which More Healthy Holding

Limited, a BVI company 100% owned by Weiguang Yang (“More Healthy”), acquired 5,497,715 Class B Ordinary Shares of par value

US$0.0001 per share as founder shares, representing, at that time, 80.94% of total voting power of the Company, on a fully converted basis,

given that each Class B Ordinary Share was entitled to 15 votes and each Class A Ordinary Share was entitled to one vote and assuming

the exercise of the HF Warrant (as defined below).

As part of the Company’s

organization for the purpose of the initial public offering and listing on Nasdaq, on August 1, 2019, the Company and HF Capital Management

Delta, Inc., a company incorporated under the laws of the Cayman Islands (“HF Capital”) entered into a certain warrant agreement

to purchase Class A Ordinary Shares of the Company (the “HF Warrant”). At the issuance of the HF Warrant, Yantai Hanfujingfei

Investment Centre (LP), a limited partnership incorporated under the PRC laws (“Yantai HF,” whose managing partner, Hanfor

Capital Management Co., Ltd., was the sole member of HF Capital, and together with “HF Capital” hereinafter collectively referred

to as “HF”) was a 6.25% shareholder of Zhongchao Shanghai and planned to withdraw its capital contribution in Zhongchao Shanghai

but to contribute the same amount of capital to Zhongchao Cayman directly via HF Capital.

Contractual Arrangements between Zhongchao

WFOE and Zhongchao Shanghai

Zhongchao Cayman is an offshore

holding company incorporated in the Cayman Islands as an exempted company with limited liability. As a holding company with no material

operations of our own, we, through the Contractual Arrangements between Zhongchao WFOE, a wholly subsidiary of Zhongchao Cayman incorporated

in the PRC, and the VIE, Zhongchao Shanghai, and its subsidiaries, consolidate the financial results of the PRC operating entities. Due

to the restrictions imposed by PRC laws and regulations on foreign ownership of companies engaged in value-added telecommunication services

and certain other businesses, we operate our businesses in which foreign investment is restricted or prohibited in the PRC through certain

PRC domestic companies. Accordingly, the Contractual Arrangements are designed to allow Zhongchao Cayman to consolidate Zhongchao Shanghai’s

operations and financial results in its financial statements in accordance with U.S. GAAP as the primary beneficiary. Neither we nor our

subsidiaries own any equity interests in the PRC operating entities.

The Contractual Arrangements

consist of a series of agreements by and among Zhongchao WFOE, Zhongchao Shanghai and the shareholders of Zhongchao Shanghai. A summary

of the material terms of each agreement is set forth below.

Equity Interest Pledge Agreement

Pursuant to the equity interest

pledge agreement, dated August 14, 2019 (the “Equity Interest Pledge Agreement”), each shareholder of Zhongchao Shanghai (each,

a “Shareholder” and collectively, the “Shareholders”) pledged all of its equity interest in Zhongchao Shanghai

to guarantee the Shareholders’ and Zhongchao Shanghai’s performance of their respective obligations under each of the Master

Exclusive Service Agreement, Business Cooperation Agreement, Exclusive Option Agreement and Proxy Agreement and Power of Attorney (each

as defined below). If Zhongchao Shanghai or any of the Shareholders breaches their contractual obligations under these agreements, Zhongchao

WFOE, as pledgee, will be entitled to dispose the pledged equity interest entirely or partially. Each of the Shareholders agrees that,

during the term of the Equity Interest Pledge Agreement, they will not dispose of the pledged equity interests or create or allow any

encumbrance on the pledged equity interests without the prior written consent of Zhongchao WFOE. In addition, Zhongchao WFOE has the right

to collect dividends generated by the pledged equity interest during the term of the pledge. The initial term of the Equity Interest Pledge