false

0001642122

0001642122

2024-11-08

2024-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 8, 2024

ASSOCIATED CAPITAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

1-37387

|

47-3965991

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

|

191 Mason Street, Greenwich, CT

|

|

06830

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(203) 629-9595

(Registrant's telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.001 per share

|

AC

|

New York Stock Exchange

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

The following information is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition.”

On November 8, 2024, Associated Capital Group, Inc. (NYSE: AC) (“Associated Capital”), announced its results of operations for the quarter ended September 30, 2024. A copy of the related press release is being filed as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference in its entirety.

The information furnished under Item 2.02, including the exhibit attached hereto, is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, except otherwise as expressly stated in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Associated Capital Group, Inc.

By: /s/ Ian J. McAdams

Ian J. McAdams

Chief Financial Officer

Date: November 8, 2024

Exhibit 99.1

|

For Immediate Release:

|

Contact: |

Ian J. McAdams

Chief Financial Officer

(914) 921-5078

Associated-Capital-Group.com

|

Associated Capital Reports Results for the Third Quarter 2024

|

-

|

Book Value per share ended the quarter at $42.02 |

|

-

|

Returned $45.9 million to shareholders through dividends declared and share repurchases in the third quarter |

|

-

|

Approved $0.20 per share shareholder designated charitable contribution for registered shareholders, bringing total to $42 million since our spin-off in 2015 |

GREENWICH, Connecticut, November 8, 2024 – Associated Capital Group, Inc. (“AC” or the “Company”), a diversified financial services company, today reported its financial results for the third quarter of 2024.

Financial Highlights

($ in 000's except AUM and per share data)

|

(Unaudited)

|

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

AUM - end of period (in millions)

|

|

$ |

1,340 |

|

|

$ |

1,588 |

|

|

$ |

1,340 |

|

|

$ |

1,588 |

|

|

AUM - average (in millions)

|

|

|

1,349 |

|

|

|

1,580 |

|

|

|

1,450 |

|

|

|

1,686 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

2,415 |

|

|

|

2,200 |

|

|

|

8,021 |

|

|

|

7,047 |

|

|

Operating loss before management fee (Non-GAAP)

|

|

|

(3,604 |

) |

|

|

(3,533 |

) |

|

|

(9,824 |

) |

|

|

(9,050 |

) |

|

Investment and other non-operating income/(loss), net

|

|

|

37,239 |

|

|

|

3,794 |

|

|

|

67,116 |

|

|

|

37,140 |

|

|

Income before income taxes and noncontrolling interests

|

|

|

30,323 |

|

|

|

273 |

|

|

|

51,556 |

|

|

|

25,015 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/(loss)

|

|

|

23,242 |

|

|

|

(16 |

) |

|

|

40,048 |

|

|

|

21,109 |

|

|

Net income/(loss) per share - basic and diluted

|

|

|

1.09 |

|

|

|

0.00 |

|

|

|

1.87 |

|

|

|

0.97 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A shares outstanding (000's)

|

|

|

2,297 |

|

|

|

2,672 |

|

|

|

2,297 |

|

|

|

2,672 |

|

|

Class B " "

|

|

|

18,951 |

|

|

|

18,951 |

|

|

|

18,951 |

|

|

|

18,951 |

|

|

Total " "

|

|

|

21,248 |

|

|

|

21,623 |

|

|

|

21,248 |

|

|

|

21,623 |

|

|

Book value per share

|

|

$ |

42.02 |

|

|

$ |

41.43 |

|

|

$ |

42.02 |

|

|

$ |

41.43 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Giving Back to Society - (Y)our "S" in ESG

AC seeks to be a good corporate citizen by supporting our community through sponsoring local organizations. On August 7, 2024, the Board of Directors approved up to a $4.3 million, or $0.20 per share, shareholder designated charitable contribution (“SDCC”) for registered shareholders as of October 18, 2024. Based on the program created by Warren Buffett at Berkshire Hathaway, our corporate charitable giving is unique in that the recipients of AC's charitable contributions are chosen directly by our shareholders, rather than by our corporate officers. Since our spin off as a public company, the shareholders of AC have donated approximately $42 million, including the most recent SDCC, to over 190 501(c)(3) organizations across the United States.

Third Quarter Financial Data

Third Quarter Results

Total revenues in the third quarter of 2024 were $2.4 million compared to $2.2 million in the third quarter of 2023. Revenues generated by the GAMCO International SICAV – GAMCO Merger Arbitrage (the “SICAV”) were $1.1 million versus $0.8 million in the prior year period. All other revenues were $1.3 million compared to $1.4 million in the year ago quarter.

Starting in December 2023, the Company recognized 100% of the merger arbitrage SICAV revenues received by Gabelli Funds, LLC. In turn, AC pays the marketing expenses of the SICAV previously paid by Gabelli Funds, and remits an administrative fee to Gabelli Funds for administrative services provided. This change better aligns the financial arrangements with the services rendered by each party. The net effect of this change had no material impact on our operating results.

Total operating expenses, excluding management fee, were $6.0 million in the third quarter of 2024 and $5.7 million in the third quarter of 2023. The increase is primarily attributed to the $0.5 million of marketing expenses on the merger arbitrage SICAV, offset partially by lower variable based compensation expenses.

Net investment and other non-operating income was $37.2 million for the third quarter of 2024 compared to $3.8 million in the third quarter of 2023. The primary drivers of this quarter's results included gains from our merger arbitrage partnerships, a $2 per share special dividend declared on our holdings of GAMCO Investors, Inc. and interest income.

For the quarter ended September 30, 2024, the management fee was $3.3 million versus none in the year ago quarter.

The effective tax rate applied to our pre-tax income for the quarter ended September 30, 2024 was 22.9%. In the year ago quarter, the effective tax rate was 60.8% due to the deferred tax expense from a foreign investment.

Assets Under Management (AUM)

Assets under management at September 30, 2024 were $1.34 billion, $251 million lower than year-end 2023, the result of net outflows of $288 million and the impact of currency fluctuations in non-US dollar denominated classes of investment funds of $4 million, offset partially by market appreciation of $41 million.

| |

|

September 30,

|

|

|

December 31,

|

|

|

September 30,

|

|

| |

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

($ in millions)

|

|

|

|

|

|

|

|

|

|

|

Merger Arbitrage(a)

|

|

$ |

1,095 |

|

|

$ |

1,312 |

|

|

$ |

1,322 |

|

|

Long/Short Value(b)

|

|

|

208 |

|

|

|

244 |

|

|

|

233 |

|

|

Other

|

|

|

37 |

|

|

|

35 |

|

|

|

33 |

|

|

Total AUM

|

|

$ |

1,340 |

|

|

$ |

1,591 |

|

|

$ |

1,588 |

|

(a) Includes $431, $621, and $613 of sub-advisory AUM related to GAMCO International SICAV - GAMCO Merger Arbitrage, and $68, $69, and $67 of sub-advisory AUM related to Gabelli Merger Plus+ Trust Plc at September 30, 2024, December 31, 2023 and September 30, 2023, respectively.

(b) Includes $201, $237 and $226 for which Associated Capital receives only performance fees, less expenses of $25, $25, and $24 at September 30, 2024, December 31, 2023 and September 30, 2023, respectively.

Alternative Investment Management

The alternative investment strategy offerings center around our merger arbitrage strategy, which has an absolute return focus of generating returns independent of the broad equity and fixed income markets. We also offer strategies utilizing fundamental, active, event-driven and special situations investments.

Merger Arbitrage

For the third quarter of 2024, the longest continuously offered fund in the merger arbitrage strategy generated gross returns of 4.88% (3.80% net of fees). A summary of the performance is as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

Full Year |

|

|

|

|

|

|

|

|

|

|

Performance%(a)

|

|

3Q '24

|

|

|

3Q '23

|

|

|

YTD '24

|

|

|

YTD '23

|

|

|

2023

|

|

|

2022

|

|

|

2021

|

|

|

2020

|

|

|

5 Year(b)

|

|

|

Since 1985(b)(c)

|

|

|

Merger Arb

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross

|

|

|

4.88 |

|

|

|

2.88 |

|

|

|

4.82 |

|

|

|

2.23 |

|

|

|

5.49 |

|

|

|

4.47 |

|

|

|

10.81 |

|

|

|

9.45 |

|

|

|

7.66 |

|

|

|

10.01 |

|

|

Net

|

|

|

3.80 |

|

|

|

2.33 |

|

|

|

3.23 |

|

|

|

1.17 |

|

|

|

3.56 |

|

|

|

2.75 |

|

|

|

7.78 |

|

|

|

6.70 |

|

|

|

5.28 |

|

|

|

7.08 |

|

(a) Net performance is net of fees and expenses, unless otherwise noted. Performance shown for an actual fund in this strategy. The performance of other funds in this strategy may vary. Past performance is no guarantee of future results.

(b) Represents annualized returns through September 30, 2024

(c) Inception Date: February 1985

Global M&A activity totaled $2.3 trillion in the first nine months of 2024, an increase of 16% compared to the same period in 2023. The U.S. continued to lead in dealmaking, accounting for $1.1 trillion, or 48% of global activity, the largest percentage for U.S. dealmaking since 2019. Private Equity-backed buyouts represented 24% of M&A activity, with a total value of $548 billion, marking a 40% increase over 2023 levels and the strongest first nine months for private equity dealmaking since 1980. The Technology sector led in activity with a total volume of $375 billion, accounting for 16% of overall value, followed by Energy & Power at $374 billion or 16% and Financials at $308 billion or 12%.

The Merger Arbitrage strategy is offered by mandate and client type through partnerships and offshore corporations serving accredited as well as institutional investors. The strategy is also offered in separately managed accounts, a Luxembourg UCITS (an entity organized as an Undertaking for Collective Investment in Transferrable Securities) and a London Stock Exchange listed investment company, Gabelli Merger Plus+ Trust Plc (GMP-LN).

Acquisitions

Associated Capital Group's plan is to accelerate the use of its capital. We intend to leverage our research and investment capabilities by pursuing acquisitions and alliances that will broaden our product offerings and add new sources of distribution. In addition, we may make direct investments in operating businesses using a variety of techniques and structures to accomplish our objectives.

Gabelli Private Equity Partners was created to launch a private equity business, somewhat akin to the success our predecessor PE firm had in the 1980s. We will continue our outreach initiatives with business owners, corporate management, and various financial sponsors. We are activating our program of buying privately owned, family started businesses, controlled and operated by the founding family.

Shareholder Compensation

On September 19, 2024, the Board of Directors declared a special cash dividend of $2.00 per share, payable on November 4, 2024 to shareholders of record on October 21, 2024. In addition to this special dividend, on November 8, 2024, the Board of Directors declared a semi-annual dividend of $0.10 per share which is payable on December 19, 2024 to shareholders of record on December 5, 2024.

During the third quarter, AC repurchased 107,218 Class A shares, totaling $3.4 million, at an average price of $31.80 per share. For the nine months ended September 30, 2024, AC repurchased 290,041 Class A shares, totaling $9.6 million, at an average price of $33.01 per share. Shares may be purchased from time to time in the future, however share repurchase amounts and prices may vary after considering a variety of factors, including the Company's financial position, earnings, other alternative uses of cash, macroeconomic issues, and market conditions.

Since our inception in 2015, AC has returned $181.9 million to shareholders through share repurchases and exchange offers, in addition to dividends of $81.1 million.

At September 30, 2024, there were 21.248 million shares outstanding, consisting of 2.297 million Class A shares and 18.951 million Class B shares outstanding.

About Associated Capital Group, Inc.

Associated Capital Group, Inc. (NYSE:AC), based in Greenwich, Connecticut, is a diversified global financial services company that provides alternative investment management through Gabelli & Company Investment Advisers, Inc. (“GCIA”). We have also earmarked proprietary capital for our direct investment business that invests in new and existing businesses. The direct investment business is developing along several core pillars, including Gabelli Private Equity Partners, LLC (“GPEP”), which was formed in August 2017 with $150 million of authorized capital as a “fund-less” sponsor and Gabelli Principal Strategies Group, LLC (“GPS”), which was formed in December 2015 to pursue strategic operating initiatives.

Operating Loss Before Management Fee

Operating loss before management fee expense represents a non-GAAP financial measure used by management to evaluate its business operations. We believe this measure is useful in illustrating the operating results of the Company as management fee expense is based on pre-tax income before management fee expense, which includes non-operating items including investment gains and losses from the Company’s proprietary investment portfolio and interest expense.

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

|

($ in 000's)

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss - GAAP

|

|

$ |

(6,916 |

) |

|

$ |

(3,521 |

) |

|

$ |

(15,560 |

) |

|

$ |

(12,125 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: management fee expense (1)

|

|

|

3,312 |

|

|

|

(12 |

) |

|

|

5,736 |

|

|

|

3,075 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss before management fee - Non-GAAP

|

|

$ |

(3,604 |

) |

|

$ |

(3,533 |

) |

|

$ |

(9,824 |

) |

|

$ |

(9,050 |

) |

(1) Management fee expense is incentive-based and is equal to 10% of Income before management fee and income taxes and excludes the impact of consolidating entities. For the three months ended September 30, 2024, Income before management fee, income taxes and excluding consolidated entities was $33,120; as a result $3,312 was accrued for the 10% management fee expense. There was no such accrual in the three months ended September 30, 2023. For the nine months ended September 30, 2024 and 2023, Income before management fee, income taxes and excluding consolidated entities was $57,363 and $30,747, respectively; as a result, $5,736 and $3,075 was accrued for the 10% management fee expense in 2024 and 2023, respectively.

Table I

ASSOCIATED CAPITAL GROUP, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(Amounts in thousands)

| |

|

September 30,

|

|

|

December 31,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and US Treasury Bills

|

|

$ |

376,697 |

|

|

$ |

406,642 |

|

|

$ |

384,214 |

|

|

Investments in securities and partnerships

|

|

|

472,528 |

|

|

|

420,706 |

|

|

|

433,480 |

|

|

Investment in GAMCO stock

|

|

|

56,401 |

|

|

|

45,602 |

|

|

|

48,031 |

|

|

Receivable from brokers

|

|

|

26,985 |

|

|

|

30,268 |

|

|

|

29,354 |

|

|

Income taxes receivable, including deferred tax assets, net

|

|

|

2,588 |

|

|

|

8,474 |

|

|

|

7,804 |

|

|

Other receivables

|

|

|

6,402 |

|

|

|

5,587 |

|

|

|

1,616 |

|

|

Other assets

|

|

|

35,552 |

|

|

|

26,518 |

|

|

|

21,883 |

|

|

Total assets

|

|

$ |

977,153 |

|

|

$ |

943,797 |

|

|

$ |

926,382 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Payable to brokers

|

|

$ |

7,865 |

|

|

$ |

4,459 |

|

|

$ |

5,618 |

|

| Income taxes payable, including deferred tax liabilities, net |

|

|

989 |

|

|

|

- |

|

|

|

- |

|

|

Compensation payable

|

|

|

17,488 |

|

|

|

15,169 |

|

|

|

10,915 |

|

|

Securities sold short, not yet purchased

|

|

|

7,376 |

|

|

|

5,918 |

|

|

|

5,090 |

|

|

Accrued expenses and other liabilities

|

|

|

2,288 |

|

|

|

5,173 |

|

|

|

1,957 |

|

|

Dividend payable

|

|

|

42,494 |

|

|

|

- |

|

|

|

- |

|

|

Total liabilities

|

|

$ |

78,500 |

|

|

$ |

30,719 |

|

|

$ |

23,580 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interests

|

|

|

5,836 |

|

|

|

6,103 |

|

|

|

7,133 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity

|

|

|

892,817 |

|

|

|

906,975 |

|

|

|

895,669 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities, redeemable noncontrolling interests and equity

|

|

$ |

977,153 |

|

|

$ |

943,797 |

|

|

$ |

926,382 |

|

(1) Certain captions include amounts related to a consolidated variable interest entity ("VIE") and voting interest entity ("VOE"); refer to footnote 4 of the Condensed Consolidated Financial Statements included in the 10-Q report to be filed for the quarter ended September 30, 2024 for more details on the impact of consolidating these entities.

(2) Investment in GAMCO stock: 2,303,023, 2,386,295 and 2,397,974 shares, respectively.

Table II

ASSOCIATED CAPITAL GROUP, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in thousands, except per share data)

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment advisory and incentive fees

|

|

$ |

2,310 |

|

|

$ |

2,098 |

|

|

$ |

7,706 |

|

|

$ |

6,789 |

|

|

Other revenues

|

|

|

105 |

|

|

|

102 |

|

|

|

315 |

|

|

|

258 |

|

|

Total revenues

|

|

|

2,415 |

|

|

|

2,200 |

|

|

|

8,021 |

|

|

|

7,047 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation

|

|

|

4,215 |

|

|

|

4,078 |

|

|

|

11,977 |

|

|

|

11,437 |

|

|

Other operating expenses

|

|

|

1,804 |

|

|

|

1,655 |

|

|

|

5,868 |

|

|

|

4,660 |

|

|

Total expenses

|

|

|

6,019 |

|

|

|

5,733 |

|

|

|

17,845 |

|

|

|

16,097 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss before management fee

|

|

|

(3,604 |

) |

|

|

(3,533 |

) |

|

|

(9,824 |

) |

|

|

(9,050 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment gain/(loss)

|

|

|

26,173 |

|

|

|

(2,173 |

) |

|

|

42,808 |

|

|

|

21,635 |

|

|

Interest and dividend income from GAMCO

|

|

|

4,700 |

|

|

|

96 |

|

|

|

5,362 |

|

|

|

288 |

|

|

Interest and dividend income, net

|

|

|

6,366 |

|

|

|

6,106 |

|

|

|

19,395 |

|

|

|

16,821 |

|

|

Shareholder-designated contribution

|

|

|

- |

|

|

|

(235 |

) |

|

|

(449 |

) |

|

|

(1,604 |

) |

|

Investment and other non-operating income, net

|

|

|

37,239 |

|

|

|

3,794 |

|

|

|

67,116 |

|

|

|

37,140 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before management fee and income taxes

|

|

|

33,635 |

|

|

|

261 |

|

|

|

57,292 |

|

|

|

28,090 |

|

|

Management fee

|

|

|

3,312 |

|

|

|

(12 |

) |

|

|

5,736 |

|

|

|

3,075 |

|

|

Income before income taxes

|

|

|

30,323 |

|

|

|

273 |

|

|

|

51,556 |

|

|

|

25,015 |

|

|

Income tax expense

|

|

|

6,933 |

|

|

|

166 |

|

|

|

11,415 |

|

|

|

3,586 |

|

|

Income before noncontrolling interests

|

|

|

23,390 |

|

|

|

107 |

|

|

|

40,141 |

|

|

|

21,429 |

|

|

Income attributable to noncontrolling interests

|

|

|

148 |

|

|

|

123 |

|

|

|

93 |

|

|

|

320 |

|

|

Net income/(loss) attributable to Associated Capital Group

|

|

$ |

23,242 |

|

|

$ |

(16 |

) |

|

$ |

40,048 |

|

|

$ |

21,109 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share attributable to Associated Capital Group

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

1.09 |

|

|

$ |

0.00 |

|

|

$ |

1.87 |

|

|

$ |

0.97 |

|

|

Diluted

|

|

$ |

1.09 |

|

|

$ |

0.00 |

|

|

$ |

1.87 |

|

|

$ |

0.97 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

21,275 |

|

|

|

21,672 |

|

|

|

21,389 |

|

|

|

21,836 |

|

|

Diluted

|

|

|

21,275 |

|

|

|

21,672 |

|

|

|

21,389 |

|

|

|

21,836 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual shares outstanding - end of period

|

|

|

21,248 |

|

|

|

21,623 |

|

|

|

21,248 |

|

|

|

21,623 |

|

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

The financial results set forth in this press release are preliminary. Our disclosure and analysis in this press release, which do not present historical information, contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements convey our current expectations or forecasts of future events. You can identify these statements because they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning. They also appear in any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance of our products, expenses, the outcome of any legal proceedings, and financial results. Although we believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know about our business and operations, the economy and other conditions, there can be no assurance that our actual results will not differ materially from what we expect or believe. Therefore, you should proceed with caution in relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors, some of which are listed below, that are difficult to predict and could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements. Some of the factors that could cause our actual results to differ from our expectations or beliefs include a decline in the securities markets that adversely affect our assets under management, negative performance of our products, the failure to perform as required under our investment management agreements, and a general downturn in the economy that negatively impacts our operations. We also direct your attention to the more specific discussions of these and other risks, uncertainties and other important factors contained in our Form 10 and other public filings. Other factors that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We do not undertake to update publicly any forward-looking statements if we subsequently learn that we are unlikely to achieve our expectations whether as a result of new information, future developments or otherwise, except as may be required by law.

v3.24.3

Document And Entity Information

|

Nov. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ASSOCIATED CAPITAL GROUP, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 08, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

1-37387

|

| Entity, Tax Identification Number |

47-3965991

|

| Entity, Address, Address Line One |

191 Mason Street

|

| Entity, Address, City or Town |

Greenwich

|

| Entity, Address, State or Province |

CT

|

| Entity, Address, Postal Zip Code |

06830

|

| City Area Code |

203

|

| Local Phone Number |

629-9595

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AC

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001642122

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

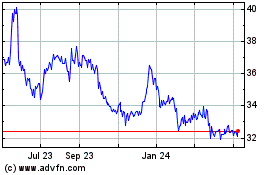

Associated Capital (NYSE:AC)

Historical Stock Chart

From Feb 2025 to Mar 2025

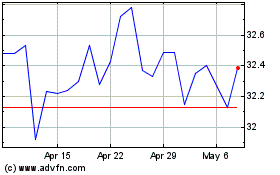

Associated Capital (NYSE:AC)

Historical Stock Chart

From Mar 2024 to Mar 2025