Apollo Commercial Real Estate Finance, Inc. (the “Company” or

“ARI”) (NYSE:ARI) today reported results for the quarter ended June

30, 2024.

Net income attributed to common stockholders per

diluted share of common stock was $0.23 for the quarter ended June

30, 2024. Distributable Earnings (a non-GAAP financial measure

defined below) and Distributable Earnings prior to net realized

loss on investments per share of common stock were $0.35 for the

quarter ended June 30, 2024.

Subsequent Events – Healthcare LoanIn March

2022, ARI and other Apollo-managed entities co-originated a 55%

loan-to-cost first mortgage loan secured by eight hospitals in

Massachusetts. At origination, ARI’s portion of the loan totaled

$378.7 million. The loan was made in connection with the

capitalization of a joint venture between two parties to own the

hospitals. That joint venture – through its subsidiaries, which

were the mortgage borrowers under ARI and the Apollo managed

entities' loan – then leased the properties to Steward Health Care

("Steward"), who served as the operator. ARI and the Apollo managed

entities did not lend to Steward and do not have any involvement in

Steward's operation of the hospitals or performance under the

lease. The structure and covenants in the loan have provided for

cash collateral and amortization since origination that represents

approximately 11% of the original loan balance, and ARI’s amortized

cost basis was $341.9 million as of June 30, 2024. As of the date

of this quarterly report, the loan remains current on all

contractual interest payments.

Steward filed for Chapter 11 bankruptcy in May

2024. During the three months ended June 30, 2024, ARI downgraded

the loan's risk rating from a three to a four. Subsequent to the

date of ARI’s condensed consolidated financial statements but prior

to the date of ARI’s quarterly report, bids for the hospitals were

received and the bid process and negotiations are continuing to

evolve with multiple constituencies. While there still is a high

degree of uncertainty, based upon the information available as of

the date of this quarterly report, and taking into account

Steward's bankruptcy court documents made publicly available on

July 30, 2024, ARI anticipates recording a Specific CECL Allowance

in a subsequent quarter, which the Company currently estimate to be

approximately $90 million. The actual Specific CECL Allowance may

differ materially based on continuing developments from the date of

this quarterly report.

ARI issued a detailed presentation of the

Company’s quarter ended June 30, 2024 results, which can be viewed

at www.apollocref.com.

Conference Call and WebcastThe

Company will hold a conference call to review second quarter

results on August 7, 2024 at 10am ET. To register for the call,

please use the following link:

https://register.vevent.com/register/BIce901e6ee4f2497f8a7cbe9c722da126

After you register, you will receive a dial-in

number and unique pin. The Company will also post a link in the

Stockholders’ section on ARI’s website for a live webcast. For

those unable to listen to the live call or webcast, there will be a

webcast replay link posted in the Stockholders’ section on ARI’s

website approximately two hours after the call.

Distributable

Earnings“Distributable Earnings,” a non-GAAP financial

measure, is defined as net income available to common stockholders,

computed in accordance with GAAP, adjusted for

(i) equity-based compensation expense (a portion of which may

become cash-based upon final vesting and settlement of awards

should the holder elect net share settlement to satisfy income tax

withholding), (ii) any unrealized gains or losses or other

non-cash items (including depreciation and amortization related to

real estate owned) included in net income available to common

stockholders, (iii) unrealized income from unconsolidated joint

ventures, (iv) foreign currency gains (losses), other than (a)

realized gains/(losses) related to interest income, and (b) forward

point gains/(losses) realized on the Company’s foreign currency

hedges, and (v) provision for loan losses.

As a REIT, U.S. federal income tax law

generally requires the Company to distribute annually at least 90%

of its REIT taxable income, without regard to the deduction for

dividends paid and excluding net capital gains, and that the

Company pay tax at regular corporate rates to the extent that it

annually distributes less than 100% of its net taxable income.

Given these requirements and the Company’s belief that dividends

are generally one of the principal reasons shareholders invest in a

REIT, the Company generally intends over time to pay dividends to

its stockholders in an amount equal to its net taxable income, if

and to the extent authorized by the Company’s board of directors.

Distributable Earnings is a key factor considered by the Company’s

board of directors in setting the dividend and as such the Company

believes Distributable Earnings is useful to investors.

During the six months ended June 30, 2024, the

Company recorded in the consolidated statement of operations a

realized loss on the sale of a commercial mortgage loan secured by

a hotel in Honolulu, Hawaii.

The Company believes it is useful to its

investors to also present Distributable Earnings prior to net

realized loss on investments and realized gain on extinguishment of

debt, in applicable periods, to reflect its operating results

because (i) the Company’s operating results are primarily comprised

of earning interest income on its investments net of borrowing and

administrative costs, which comprise the Company’s ongoing

operations and (ii) it has been a useful factor related to the

Company’s dividend per share because it is one of the

considerations when a dividend is determined. The Company believes

that its investors use Distributable Earnings and Distributable

Earnings prior to net realized loss on investments and realized

gain on extinguishment of debt, or a comparable supplemental

performance measure, to evaluate and compare the performance of the

Company and its peers.

A significant limitation associated with

Distributable Earnings as a measure of the Company’s financial

performance over any period is that it excludes unrealized gains

(losses) from investments. In addition, the Company’s presentation

of Distributable Earnings may not be comparable to similarly titled

measures of other companies, that use different calculations. As a

result, Distributable Earnings should not be considered as a

substitute for the Company’s GAAP net income as a measure of its

financial performance or any measure of its liquidity under GAAP.

Distributable Earnings are reduced for realized losses on loans

which include losses that management believes are near certain to

be realized.

A reconciliation of Distributable Earnings to

GAAP net income (loss) available to common stockholders is included

in the detailed presentation of the Company’s quarter ended June

30, 2024 results, which can be viewed at www.apollocref.com.

About Apollo Commercial Real Estate

Finance, Inc. Apollo Commercial Real Estate Finance, Inc.

(NYSE: ARI) is a real estate investment trust that primarily

originates, acquires, invests in and manages performing commercial

first mortgage loans, subordinate financings and other commercial

real estate-related debt investments. The Company is externally

managed and advised by ACREFI Management, LLC, a Delaware limited

liability company and an indirect subsidiary of Apollo Global

Management, Inc., a high-growth, global alternative asset manager

with approximately $696 billion of assets under management at June

30, 2024.

Additional information can be found on the

Company’s website at www.apollocref.com.

Forward-Looking

StatementsCertain statements contained in this press

release constitute forward-looking statements as such term is

defined in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

and such statements are intended to be covered by the safe harbor

provided by the same. Forward-looking statements are subject to

substantial risks and uncertainties, many of which are difficult to

predict and are generally beyond the Company’s control. These

forward-looking statements include information about possible or

assumed future results of the Company’s business, financial

condition, liquidity, results of operations, plans and objectives.

When used in this release, the words believe, expect, anticipate,

estimate, plan, continue, intend, should, may or similar

expressions, are intended to identify forward-looking statements.

Statements regarding the following subjects, among others, may be

forward-looking: higher interest rates and inflation; market trends

in the Company’s industry, real estate values, the debt securities

markets or the general economy; the timing and amounts of expected

future fundings of unfunded commitments; the return on equity; the

yield on investments; the ability to borrow to finance assets; the

Company’s ability to deploy the proceeds of its capital raises or

acquire its target assets; and risks associated with investing in

real estate assets, including changes in business conditions and

the general economy. For a further list and description of such

risks and uncertainties, see the reports filed by the Company with

the Securities and Exchange Commission. The forward-looking

statements, and other risks, uncertainties and factors are based on

the Company’s beliefs, assumptions and expectations of its future

performance, taking into account all information currently

available to the Company. Forward-looking statements are not

predictions of future events. The Company disclaims any intention

or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

|

CONTACT: |

Hilary Ginsberg |

|

|

Investor Relations |

|

|

(212) 822-0767 |

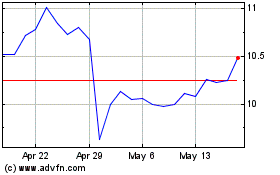

Apollo Commercial Real E... (NYSE:ARI)

Historical Stock Chart

From Nov 2024 to Dec 2024

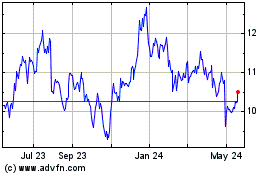

Apollo Commercial Real E... (NYSE:ARI)

Historical Stock Chart

From Dec 2023 to Dec 2024