Form 8-K - Current report

July 12 2024 - 6:03AM

Edgar (US Regulatory)

0001747079false00017470792024-07-112024-07-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

_______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 11, 2024

________________________

BALLY'S CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-38850 | 20-0904604 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 100 Westminster Street |

| Providence | RI | 02903 |

| (Address of Principal Executive Offices and Zip Code) |

________________________

(401) 475-8474

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12 (b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, $0.01 par value | BALY | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On July 11, 2024, Bally’s Corporation (“BALY”), a Delaware corporation (the “Company”), entered into a Binding Term Sheet to form a strategic construction and financing arrangement with Gaming and Leisure Properties, Inc. (“GLPI”), which includes funding to complete the construction of Bally’s permanent casino development in the City of Chicago, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference. The foregoing description of the Binding Term Sheet is qualified in its entirety by reference to the full text of the of Binding Term Sheet.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1* | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| BALLY'S CORPORATION |

| By: | /s/ Kim M. Barker |

| Name: | Kim M. Barker |

| Title: | Chief Legal Officer |

Date: July 12, 2024

Binding Term Sheet

Set forth below are the terms of a legally binding agreement (this “Agreement”), dated as of July 11, 2024, by and between GLP Capital, L.P. (“GLP”) and Bally’s Corporation (“Bally’s” and, together with GLP, each a “Party” and, collectively, the “Parties”). As the context may require, references to GLP and Bally’s in this Agreement shall be deemed to refer to their respective affiliates and subsidiaries. This Agreement serves as a mutually agreed-upon set of terms between the Parties to be incorporated as soon as practicable after the date hereof in definitive documents and agreements (collectively, the “Definitive Documents”) setting forth the terms and conditions addressed herein in further detail, as well as such other terms and conditions as shall be customary and not inconsistent with the terms hereof.

| | | | | | | | | | | | | | |

| | | | |

| Bally’s Chicago: | | Bally’s Chicago Operating Company, LLC (“Tenant”) currently ground leases certain real property located in Chicago, IL (the “Existing Property”) from BACHIL001 LLC, a Delaware limited liability company (“Seller”) pursuant to that certain Ground Lease between Tenant and Seller dated November 18, 2022 (as amended, the “Ground Lease”). Subject to the satisfaction of the Conditions (as defined below), GLP shall acquire the fee interest in the Existing Property (the “Existing Property Transaction”). At the time of closing of the Existing Property Transaction, Tenant shall terminate the Ground Lease and GLP and Tenant shall enter into a new triple-net lease of the Existing Property (other than the outparcels) (the “Chicago Property”) incorporating the terms set forth in this Agreement (the “Chicago Lease”). If GLP is unable to consummate the Existing Property Transaction on terms acceptable to GLP, but obtains Seller’s consent to an assignment of the Tenant’s interest in the Ground Lease from Tenant to GLP, then Tenant shall assign the Tenant’s interest in the Ground Lease to GLP if so elected by GLP, and the terms herein shall continue to apply as modified to the extent necessary to reflect that Tenant will be subleasing (rather than leasing) the Chicago Property from GLP. |

| | | | |

| Bally’s Chicago – Lease: | | Tenant shall lease the Chicago Property from GLP pursuant to the Chicago Lease for an initial term of 15 years (along with multiple renewal extensions to be agreed upon by the Parties, so as to maximize the Chicago Lease term and meet operating lease classification under US GAAP) and pay as rent: (i) $20.0 million annually, subject to annual escalations at the same rate and on the same schedule as escalations under the Bally’s Master Lease 1 (as defined below), plus (ii) Development Rent (as defined below). |

| | | | |

| | | | | | | | | | | | | | |

| | The Chicago Lease shall include: (i) a covenant requiring Bally’s, following the closing of the SLB Transactions (as defined below), to maintain undrawn capacity under its revolving credit facility, which Bally’s represents may be applied toward Project (as defined below) costs subject to the draw conditions of Bally’s credit agreement, as of the last day of each fiscal quarter equal to (x) the net cash proceeds (after taxes and expenses) of the SLB Transactions actually received by Bally’s minus (y) the sum of (A) the aggregate amount of funding of Tenant by Bally’s after July 1, 2024 and applied to the development and construction of the Project, (B) the Excess Chicago IPO Proceeds (to be defined in a manner agreed by the Parties) and (C) the net cash proceeds (after taxes and expenses) of any other Project-level financing obtained by the Tenant (which may be secured by non-real estate assets and Tenant’s interest in the Chicago Lease (but, during Project construction, a financing secured by Tenant’s interest in the Chicago Lease may only be from a Permitted Leasehold Mortgagee (to be defined in the Chicago Lease) that is subject to terms and conditions to be set forth in the Chicago Lease, which shall include an obligation by Tenant’s Permitted Leasehold Mortgagee (or the applicable purchaser at foreclosure) to assume all obligations under the Development Agreement upon such lender’s foreclosure on Tenant’s interest in the Chicago Lease)) (the “Minimum RCF Undrawn Amount Covenant”); and (ii) in the event Bally’s no longer has any publicly traded equity security requiring periodic reporting of financial statements in accordance with the rules and regulations of the Securities and Exchange Commission, a covenant (the “Net Leverage Covenant”) that the “Consolidated Total Net Leverage Ratio” of Bally’s and its “Restricted Subsidiaries” (each as defined and calculated in accordance with Bally’s existing credit agreement as in effect of the date hereof) shall not exceed the greater of (x) 0.25x greater than the Consolidated Total Net Leverage Ratio at the time the Net Leverage Covenant is triggered, which date shall be reasonably determined by the Parties, and (y) 7.25x, tested as of the end of every quarter on a trailing four quarter basis. If Bally’s (i) breaches the Minimum RCF Undrawn Amount Covenant or (ii) breaches the Net Leverage Covenant for two consecutive fiscal quarters and thereafter is not in compliance with the Net Leverage Covenant as of the last day of the fiscal quarter that immediately follows such second consecutive fiscal quarter (it being agreed that the 3rd non-consecutive breach of the Net Leverage Covenant in any 60 month period shall not be entitled to such cure right), then: (i) the Lincoln Open Call Date (as defined below) shall automatically be accelerated to the date of notice by GLP to Bally’s of such breach and, notwithstanding the terms of the Contribution Agreement (as defined below), the proceeds of the Lincoln Contribution (as defined below) shall be applied to the completion of the Project and/or to repayment of Bally’s then existing debt, and (ii) if GLP and Bally’s (and its affiliates) have already consummated the Lincoln Contribution (as defined below), then such breach shall constitute an event of default under the Chicago Lease. The Minimum RCF Undrawn Amount Covenant shall terminate upon the Opening Date (to be defined in the Chicago Lease) of the Project. |

| | | | |

| | All real property assets (including all improvements and fixtures) existing as of the Existing Property Transaction closing or thereafter constructed on the Chicago Property and funded by GLP shall be owned by GLP at all times as they are constructed and included in the property demised to Tenant under the Chicago Lease, subject to customary landlord reversionary interests. |

| | | | |

| | The Chicago Lease shall be cross-defaulted with the Development Agreement (as defined below). The form of the Chicago Lease shall be substantially the same as that certain Master Lease, dated June 3, 2021, by and between Bally’s Management Group, LLC, an affiliate of Bally’s, and GLP (as amended, the “Bally’s Master Lease 1”) except as modified by the terms set forth in this Agreement. The Chicago Lease shall be cross-defaulted with Bally’s Master Lease 1 and Bally’s Master Lease 2 at the earliest point in time that Bally’s refinances, extends, or amends its existing credit facilities with the approval of lenders holding more than 50% of the aggregate commitments and loans under such credit facilities. |

| | | | |

| | | | | | | | | | | | | | |

| | Chicago Holdings LLC (“Bally’s Holdco”), the current owner of 100% of the Tenant, to become 75% owner after the contemplated IPO required to meet conditions set forth in Tenant’s Host Community Agreement with the City of Chicago dated June 9, 2022, will guarantee the Chicago Lease and the Development Agreement along with all other current and future direct unrestricted subsidiaries of Bally’s, and no such unrestricted subsidiary that guarantees the Chicago Lease and the Development Agreement shall make any dividend or distribution (other than customary tax and other dividends and distributions to be agreed) without the prior written consent of GLP; provided, however, that at such time as Tenant becomes a restricted subsidiary under Bally’s credit facilities and bond indentures, (a) Bally’s (or its Parent Company (as defined in Bally’s Master Lease 1), if any, following any Control Transaction (as defined below)) shall also guarantee the Chicago Lease and Development Agreement and (b) following the delivery of such guarantee, the guarantees of the Chicago Lease and the Development Agreement provided by such unrestricted subsidiaries of Bally’s shall terminate. |

| | | | |

| | Neither Bally’s nor any such unrestricted subsidiary may enter into an agreement or make or approve any decision the effect of which would be to restrict such subsidiary’s ability to provide such guarantee or restrict Bally’s ability to guarantee the Chicago Lease and Development Agreement upon the current maturity of Bally’s existing revolving credit facility without the prior written consent of GLP (such consent not to be unreasonably withheld). |

| | | | |

| Bally’s Chicago – Development Agreement: | | Tenant shall construct a new casino resort project on the Chicago Property, as more particularly described on Exhibit A attached hereto and as may be modified with GLP’s prior reasonable approval (and, following execution of Definitive Documents, in accordance therewith) (the “Project”), all at Tenant’s sole cost and expense, subject to GLP’s commitment set forth below and the terms of this Agreement applicable thereto. In connection therewith, Tenant and GLP, in each such Party’s capacity under the Chicago Lease, shall enter into an agreement (the “Development Agreement”) which shall incorporate the following terms and conditions, along with such other terms and conditions which are reasonably acceptable to GLP and Bally’s: |

| | | | |

| | 1. | GLP will commit to funding (the “Project Funding”) up to $940 million (the “Commitment Amount”) for the payment of hard costs used to construct in-place Project improvements, subject to and in accordance with the terms set forth in this Agreement and as otherwise agreed upon in the Development Agreement. |

| | | | |

| | | | | | | | | | | | | | |

| | 2. | It shall be a condition precedent to GLP’s initial advance of the Project Funding that, inter alia, (1) Tenant shall (a) have invested equity into the development and construction of the Project equal to at least $560 million since inception and (b) have unrestricted access to funds in an amount sufficient at the time of such initial advance to complete the Project (which amount is currently anticipated to be approximately $450 million), as reasonably confirmed by GLP (which may include anticipated funds from the expected IPO at Bally’s Chicago Inc. and/or the SLB Transactions (in the case of the SLB Transactions, to the extent the related purchase agreements have been signed, or, if such agreements cannot be signed without regulatory approval required under applicable law and such regulatory approval is the sole condition precedent to the signing of such agreements, such agreements are in final form and have been submitted for regulatory approval) and/or availability under Bally’s revolving credit facility which, at the time of determination, may be applied to the Project in compliance with such revolving credit facility), Bally’s hereby agreeing that the condition in this clause (1)(b) shall be a condition precedent to each advance of Project Funding and for the avoidance of doubt, such condition in 1(b) shall take into consideration the monies already spent by Tenant to complete the Project and the amount that may remain to be funded by Tenant at the time of such advance, (2) Tenant shall have assigned to GLP its lease to the temporary property at which Tenant is currently conducting gaming operations (which the Parties acknowledge shall require prior receipt of regulatory, City of Chicago and landlord approvals), which shall then be leased back to Tenant pursuant to the Chicago Lease, and agrees, upon a termination of the Chicago Lease, to convey all of its other property at such temporary property to GLP or a successor tenant to enable GLP or such successor tenant to continue such operations upon GLP’s exercise of remedies under the Chicago Lease and Development Agreement, with such transfer of such other property to be accomplished in accordance with terms to be set forth in the Chicago Lease and consistent with Article XXXVI of the Bally’s Master Lease 1, (3) all of the Definitive Documents have been signed, or, if such agreements cannot be signed without regulatory approval required under applicable law and such regulatory approval is the sole condition precedent to the signing of such agreements, such agreements are in final form and have been submitted for regulatory approval, and (4) the Existing Property Transaction shall have closed on terms acceptable to GLP. |

| | | | |

| | 3. | Without limiting Bally’s obligation to pay all costs of constructing and completing the Project (other than Project Funding), in anticipation of the total Project hard costs exceeding the Commitment Amount, the Parties acknowledge and agree that Tenant shall pay all demolition, excavation, site preparation, and other hard costs of Project construction that do not result in the construction of actual improvements. Following GLP’s funding of the full Commitment Amount, Tenant will fund all additional hard costs necessary to achieve completion of the Project. If necessary, the Parties will work in good faith to identify specific improvements owned by Tenant. |

| | | | |

| | 4. | Upon completion, Tenant shall have accepted all Project Funding made available by GLP up to the lesser of (i) the total amount of hard construction costs incurred to perform and complete the Project and (ii) the Commitment Amount. |

| | | | |

| | 5. | GLP will not be obligated to advance any Project Funding unless and until conditions to be set forth in the Development Agreement have been satisfied, including, without limitation, at least 90 days’ prior written notice to the first requested advance, or earlier as the Parties may reasonably agree. |

| | | | |

| | 6. | Tenant shall be obligated to construct and complete the Project in compliance with terms and conditions to be set forth in the Development Agreement, which shall be customary and reasonable for large scale multi-phase developments and shall include the satisfaction of to-be-specified development and construction milestones. |

| | | | | | | | | | | | | | |

| | | | |

| | 7. | All Project improvements paid for with Project Funding shall be owned at all times by GLP as they are constructed, and shall immediately and automatically become leased property to Tenant under the Chicago Lease. |

| | | | |

| | 8. | Tenant will pay to GLP, as additional rent under the Chicago Lease, the following (collectively, “Development Rent”): |

| | | | |

| | | a. | During the development period until completion of the Project: an amount, calculated and paid in monthly installments in arrears, which is the product of (x) the total outstanding amount of Project Funding that has been funded as of the date of determination, multiplied by (y) the actual number of days elapsed in the period for which the calculation is being made divided by 365 or 366, as applicable, multiplied by (z) 8.50%; and |

| | | | |

| | | b. | Following completion of the Project: an annual amount, paid in monthly installments in advance, equal to the product of (x) the total amount of Project Funding that was actually funded multiplied by (y) 8.50%. |

| | | | |

| | 9. | The Development Agreement will contain customary representations and covenants by Tenant and will contain funding conditions in each case which are customary and reasonable for large scale multi-phase developments, including, without limitation, (i) GLP reasonable approval of plans and specifications, the project budget (including amendments thereto and reallocations therein except those permitted under the Development Agreement), the project schedule, the underlying construction and architect contracts, and all change orders (subject to exceptions to be agreed), (ii) GLP receipt of appropriate lien waivers, (iii) budget balancing requirements, (iv) retainage requirements, (v) identification of a GLP representative as “owners representative” under the construction contract, and (vi) other customary conditions, all to be set forth in the mutually agreed upon Development Agreement. |

| | | | |

| | 10. | A representative of GLP shall be present for all meetings, conference calls, and video conferences between Tenant and its third party contractors and professionals engaged in connection with the Project (the “Third Party Professionals”), and shall have the right to engage directly with all Third Party Professionals without the prior consent of Tenant (and Tenant shall have the right to be present for such conversations if it has made a representative thereof reasonably available). |

| | | | |

| | 11. | Tenant shall cause each Third Party Professional engaged by Tenant to agree in writing that its contract with Tenant may be assigned by Tenant to GLP and that such Third Party Professional consents to the assumption by GLP of such contract upon a default by Tenant under the Development Agreement. |

| | | | |

| | 12. | The Development Agreement shall contain Tenant defaults and GLP remedies which are customary and reasonable for large scale multi-phase developments, including, without limitation, a cross-default with the Chicago Lease and the other Definitive Documents and customary Tenant remedies in case of GLP default. |

| | | | |

| | 13. | Tenant’s interest in the Development Agreement shall not be assigned, financed, transferred, pledged or encumbered without GLP’s prior written consent, whether or not any such Tenant transaction is permitted with respect to the Chicago Lease, other than to a Permitted Leasehold Mortgagee under the Chicago Lease (it being understood that in order to foreclose on any such mortgage of the Chicago Lease, the purchaser at foreclosure will have to assume all the obligations of the Tenant under the Chicago Lease and the Development Agreement). |

| | | | | | | | | | | | | | |

| | | | |

| Definitive Documents: | | The Parties hereto agree that this Agreement shall be binding upon the Parties hereto unless or until superseded by long-form definitive documents that reflect the terms set forth herein and are otherwise mutually acceptable to the Parties (the “Definitive Documents”). The Definitive Documents shall contain usual and customary representations and warranties and closing conditions for transactions of this nature and require compliance with all applicable laws. The Parties agree to negotiate diligently and in good faith and use commercially reasonable efforts to enter into the Definitive Documents promptly after the execution of this Agreement. |

| | | | |

| Conditions: | | Each Party’s obligations under this Agreement are subject to the satisfaction of each of the following conditions (collectively, the “Conditions”) for the benefit of the applicable “Beneficiary” described below, as determined by such applicable Beneficiary in its sole and absolute discretion: |

| | | | |

| | 1. | GLP shall have completed its customary title, survey, zoning, environmental, construction, and other real property and business diligence with respect to each Property, which GLP shall use commercially reasonable efforts to complete promptly following the mutual execution and delivery of this Agreement. (Beneficiary: GLP) |

| | | | |

| | 2. | Each Party (and its applicable affiliates) shall have received all governmental approvals (including all gaming approvals) required for all transactions contemplated by this Agreement, and each Party shall have approved all final documentation to be entered into in connection with all such approvals. (Beneficiary: Each Party) |

| | | | |

| | 3. | In addition to the approvals described above, except as otherwise previously disclosed by the Parties and to be specifically set forth in the Definitive Documents, each Party shall have received all third party consents necessary for such Party to perform all of its obligations under this Agreement, which shall include Seller’s consent to the Existing Property Transaction on terms acceptable to GLP. (Beneficiary: Each Party) |

| | | | |

| | 4. | Each Party shall have received reasonably satisfactory evidence that the other Party has the authority to enter into and perform its obligations under this Agreement. (Beneficiary: Each Party) |

| | | | |

| | 5. | No injunction, judgment, order, decree, ruling or charge shall be in effect under any action, suit or proceeding before any court or quasi-judicial or administrative agency of any federal, state, local or foreign jurisdiction or before any arbitrator that (A) prevents entrance into this Agreement and/or consummation of any of the transactions contemplated by this Agreement or (B) could reasonably be expected to cause any of the transactions contemplated by this Agreement to be rescinded following consummation, provided that the Party that is asserting the failure of such condition has not, directly or indirectly, solicited, directed or encouraged any such action, suit or proceeding. (Beneficiary: Each Party) |

| | | | |

| | 6. | There shall exist no actions, suits, arbitrations, claims, attachments, proceedings, assignments for the benefit of creditors, insolvency, bankruptcy, reorganization or other proceedings (collectively, “Proceedings”), pending or threatened, against Seller or either Party (or any of their applicable affiliates) that could reasonably be expected to materially and adversely affect Seller’s and/or such Party’s (or its affiliate’s) ability to perform its respective obligations under this Agreement or materially delay or increase the cost of development of the Project, provided that the Party that is asserting the failure of such condition has not, directly or indirectly, solicited, directed or encouraged any such Proceeding. (Beneficiary: Each Party) |

| | | | | | | | | | | | | | |

| | | | |

| | 7. | There shall exist no ongoing material regulatory action, review or proceeding under any applicable gaming regulations with respect to the licensing, operation, development, and/or construction of any Property (as defined below) or the Project. (Beneficiary: GLP) |

| | | | |

| | 8. | No “Event of Default” by Bally’s under the Bally’s Master Lease 1, and no default under this Agreement or any of the Definitive Documents (in each case after the delivery of any required notice and the expiration of any applicable cure period), shall be continuing. (Beneficiary: GLP) |

| | | | |

| | 9. | Since the date of this Agreement, there shall not have been any event, change, development, occurrence, circumstance, or effect that, individually or in the aggregate with all other events, changes, developments, occurrences or effects, has resulted in, or could reasonably be expected to result in, a Material Adverse Effect with respect to any Property or the Project. As used herein, “Material Adverse Effect” shall mean any event, change, development, occurrence, circumstance, or effect that has or could reasonably be expected to have a material adverse effect, whether individually or in the aggregate, on: (i) the assets, business, financial condition or long-term results of the operation of the business at the subject Property, taken as a whole; (ii) the ability of Bally’s (and/or any affiliate and/or subsidiary thereof) to timely perform its obligations hereunder and/or under any of the Definitive Documents; or (iii) the ability of Tenant to timely complete the construction of the Project in accordance with the Definitive Documents. (Beneficiary: GLP) |

| | | | |

| | 10. | The Parties acknowledge and understand that the board of directors of Bally’s is currently considering strategic alternatives for Bally’s, including a potential control transaction. In the event any such transaction or other capital transaction involving Bally’s (a “Control Transaction”) is announced or consummated prior to the closing of the Existing Property Transaction and other transactions contemplated by this Agreement, it shall be a condition to closing that the structure, leverage and other terms of such Bally’s capital transaction shall not, as reasonably determined by GLP in good faith in consultation with its financial advisers, be adverse to GLP’s rights and benefits contemplated hereunder, including without limitation, the ongoing ability of Bally’s and its applicable affiliates to timely and fully perform their respective obligations under this Agreement, the Definitive Documents, and the other related documents and instruments, including, without limitation, the Bally’s Master Lease 1, the Bally’s Master Lease 2 (as defined below), the Chicago Lease, and the Development Agreement. (Beneficiary: GLP) |

| | | | |

| Bally’s Kansas City, Shreveport, and Twin River Lincoln: | | In addition to the transactions described above with respect to Bally’s Chicago, Bally’s (on behalf of itself and its applicable subsidiaries and affiliates) and GLP hereby agree as follows: |

| | | | |

| | Bally’s Kansas City and Bally’s Shreveport. Bally’s (and its affiliated property owners) and GLP shall enter into one or more purchase agreements pursuant to which GLP will acquire the real estate assets of the casino properties known as Bally’s Kansas City, located at 1800 East Front Street, Kansas City, MO 64120 (“Bally’s Kansas City” and GLP’s acquisition thereof, the “Bally’s Kansas City Transaction”), and Bally’s Shreveport, located at 451 Clyde Fant Parkway, Shreveport, LA 71101 (“Bally’s Shreveport” and GLP’s acquisition thereof, the “Bally’s Shreveport Transaction”), and lease such real estate assets back to Bally’s tenant subsidiaries under, and pursuant to the terms of, a new master lease (“Bally’s Master Lease 2”), substantially in identical form as the current Bally’s Master Lease 1 (the “SLB Transactions”). Bally’s Master Lease 2 shall be guaranteed by Bally’s, and shall have cross-default provisions with Bally’s Master Lease 1, for the benefit of GLP (and Bally’s Master Lease 1 shall be amended to be cross-defaulted with Bally’s Master Lease 2). |

| | | | | | | | | | | | | | |

| | | | |

| | The cash purchase price payable by GLP in connection with such SLB Transactions will be $395.0 million, subject to any customary real estate prorations. The initial rent under the Bally’s Master Lease 2 will be an initial annual fixed rent amount of $32.2 million and shall be subject to escalations on the schedule set forth in the Bally’s Master Lease 2 (same formulation as Bally’s Master Lease 1). |

| | | | |

| | The structure of the documentation and the tax structuring of the SLB Transactions shall be consistent with the documentation and tax structuring used in the Parties’ Biloxi / Tiverton sale/leaseback transactions, including reimbursing for capital expenditures spent within 24 months prior to the closing of the SLB Transactions, as long as (i) each Party deems such tax structuring to be appropriate under the IRS rules and (ii) the tax deferral accomplished by such tax structuring is material. |

| | | | |

| | Closing under the SLB Transactions will be subject to the Conditions and other customary closing conditions, including, without limitation, receipt of all governmental (including, without limitation, gaming) approvals. To the extent that the Bally’s Kansas City Transaction is approved first, at Bally’s election, the Parties shall (a) implement such transaction first with a tax deferral structure at a cash purchase price equal to $275.0 million, and subsequently add Bally’s Shreveport without a tax deferral structure at a cash purchase price equal to $120.0 million once that transaction has received regulatory approvals or (b) wait to receive the Bally’s Shreveport approval and close the SLB Transactions with a tax deferral structure simultaneously. If the Bally’s Shreveport Transaction is approved first, then the Parties shall wait to receive the Bally’s Kansas City Transaction approvals and close on the SLB Transactions with a tax deferral structure simultaneously. The Parties shall reasonably cooperate and use commercially reasonable efforts to obtain the required approvals for the SLB Transactions as soon as reasonably practicable. |

| | | | |

| | The Parties will make customary mutual representations, warranties and covenants, on such terms and conditions as shall be customary and reasonable for transactions of this nature, size and scope, with such modifications as agreed between the Parties, each acting in a commercially reasonably manner. Indemnification and termination rights will likewise be on such terms and conditions as shall be customary and reasonable for transactions of this nature, size and scope, with such modifications as agreed between the Parties, each acting in a commercially reasonably manner. |

| | | | |

| | Twin River Lincoln. Bally’s casino and hotel facility known as “Twin River Lincoln Casino & Hotel” located 100 Twin River Road, Lincoln, RI 02865 (together with the Chicago Property, Bally’s Kansas City, and Bally’s Shreveport, each a “Property”), is currently the subject of that certain Contribution Agreement, dated September 6, 2022 among Bally’s, GLP and the other parties named therein (as amended, the “Contribution Agreement”). Notwithstanding anything in the Contribution Agreement to the contrary, the Parties agree to (and will cause their respective affiliates to) enter into an amendment to the Contribution Agreement providing that: (i) beginning October 1, 2026 (the “Lincoln Open Call Date”), GLP shall have the right to cause Bally’s and its applicable affiliates to effect the Lincoln Contribution at a Lincoln Contribution Value (as such terms are defined in the Contribution Agreement) equal to $735.0 million, and otherwise on terms substantially consistent with those set forth in the Contribution Agreement (except a change in law or facts with respect to Bally’s tax treatment), with Bally’s (and its applicable affiliates’) obligation to do so subject only to receipt of all required gaming approvals; and (ii) upon such closing, Twin River Lincoln shall be added to the Bally’s Master Lease 2 and annual fixed rent thereunder shall initially be increased by $58.8 million and shall be subject to escalations equivalent to the schedule set forth in the Bally’s Master Lease 1. The Parties and their applicable affiliates shall enter into such amendment to the Contribution Agreement simultaneously with entrance into the purchase agreements reflecting the SLB Transactions described above. |

| | | | | | | | | | | | | | |

| | | | |

| | Contingent Transactions. Signing of purchase agreements for the SLB Transactions and execution of the amendment to the Contribution Agreement shall be conditions precedent to the Project Funding. For the avoidance of doubt, the closing of the SLB Transactions shall not be a condition precedent to the Project Funding. |

| | | | |

| Confidentiality; Public Disclosures: | | The Parties shall maintain the confidentiality of the negotiations with respect to this Agreement and the transactions contemplated hereby, it being understood that (i) each Party shall be permitted to (a) summarize and file a copy of this Agreement in connection with its SEC reporting obligations, (b) summarize and provide a copy of the Agreement to its credit agreement lenders and (c) disclose this Agreement if legally required pursuant to any legal, governmental, judicial, administrative or regulatory order, authority or process (provided that prior notice is provided to the other Party and the other Party has a reasonable opportunity to challenge such legal requirement), and (ii) each Party shall use commercially reasonable efforts to provide the other Party with an opportunity to review and comment on proposed public disclosures with respect to this Agreement and the transactions contemplated hereby (other than public disclosures which do not materially differ from prior public disclosures made in accordance with this clause (ii)). |

| | | | |

| | Without prejudice to the foregoing, the Parties will use reasonable efforts to collaborate on public disclosures, and no Party shall make an announcement regarding any discussions regarding the transactions contemplated hereby, this Agreement, the Definitive Documents or the closing of the transactions contemplated hereby until such time that all Parties have agreed in writing. |

| | | | |

| Representations and Warranties: | | Each Party hereby represents and warrants to the other Party that: |

| | 1. | | Such Party is duly organized, validly existing and in good standing under the laws of its state of organization and has all requisite power and authority to carry on its business as now being conducted, to enter into this Agreement and the Definitive Documents, and to perform its obligations under this Agreement. This Agreement has been duly authorized, executed and delivered by such Party, and, assuming the due authorization, execution and delivery of this Agreement by the other Party, constitutes and will constitute the valid and binding obligations of such Party, enforceable against such Party in accordance with its terms, except as such enforceability may be limited by creditors’ rights, laws and general principles of equity. |

| | | | |

| | 2. | | The execution of this Agreement and the Definitive Documents and the consummation of the transactions contemplated by this Agreement and the Definitive Documents by such Party do not and will not (x) except for waivers to be obtained prior to entrance into any of the Definitive Documents and regulatory approvals or as otherwise previously disclosed by the Parties and to be specifically set forth in the Definitive Documents, result in a breach of, or require a waiver under, any agreement to which such Party (or any of its affiliates or direct or indirect owners or subsidiaries) is a party or otherwise subject, (y) conflict with, or result in any violation or breach of, any provision of the organizational documents of such Party, or (z) to such Party’s knowledge, contravene, conflict with, or result in a violation of any of the terms or requirements of, or give any governmental authority or any other person or entity the right to revoke, withdraw, suspend, cancel, terminate, or modify, in each case in any respect, any material permit, concession, franchise, license, judgment, or legal requirement applicable to such Party. |

| | | | | | | | | | | | | | |

| | | | |

| | 3. | | No consents or approvals are required to be obtained from any of its affiliates, investors or anyone holding any direct or indirect equity interest in such Party in connection with the execution and delivery of this Agreement and the Definitive Documents or consummation of the transactions contemplated by this Agreement and the Definitive Documents (other than consents or approvals that have been obtained as of the date hereof). |

| | | | |

| Cooperation; Further Assurances: | | The Parties shall cooperate to take any further action necessary or desirable to implement or otherwise consummate the transactions and agreements contemplated hereby. Without limiting the foregoing, the Parties hereby agree to work together in good faith to identify and address any concerns raised by the various governmental/regulatory departments and agencies, including all applicable gaming regulators. |

| | | | |

| | Notwithstanding anything to the contrary set forth herein, GLP shall have no obligation to take any action or refrain from taking any action hereunder to the extent that such action or inaction would reasonably be expected to (i) adversely affect the qualification of Gaming & Leisure Properties, Inc. as a real estate investment trust for federal income tax purposes, and/or (ii) require the divestiture of any of GLP’s other facilities, properties or other assets, or impose, with respect to obtaining any required regulatory approvals, any unusual and/or burdensome conditions, obligations or requirements on GLP. |

| | | | |

| No Assignment: | | Neither all nor any portion of this Agreement or any Party’s interest under this Agreement may be sold, assigned, encumbered, conveyed, or otherwise transferred, whether directly or indirectly, voluntarily or involuntarily, or by operation of law or otherwise, without the prior written consent of the other Parties hereto. |

| | | | |

| Entire Agreement: | | Unless and until superseded by the Definitive Documents, this Agreement and any contemporaneous agreements entered into in connection herewith contain the entire agreement and understanding of the Parties hereto with respect to the subject matter hereof and thereof, and supersede any agreements or understandings of the Parties hereto relating to the subject matter hereof and thereof, and the same may not be amended, modified or discharged nor may any of their terms be waived except by an instrument in writing signed by all Parties hereto. Except as provided in this Agreement, none of the Parties hereto has relied upon any oral or written representation or oral or written information given by any representative of any other Party hereto. |

| | | | |

| Governing Law: | | This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to the conflicts of laws principles thereof. Each of the Parties, with respect to any legal action or proceeding, arising out of or relating to this Agreement brought by any other Party, hereby irrevocably and unconditionally submits, for itself and its property, to the exclusive jurisdiction of any Delaware state court, or federal court of the United States of America, in each case, sitting in Delaware, and any appellate court from any thereof, and each of the Parties hereto hereby irrevocably and unconditionally (A) agrees not to commence any such proceeding except in such courts, (B) agrees that any claim in respect of any such proceeding may be heard and determined in such Delaware state court or, to the extent permitted by law, in such federal court, in each case sitting in Delaware, (C) waives, to the fullest extent it may legally and effectively do so, any objection which it may now or hereafter have to the laying of venue of any such proceeding in any such Delaware state or federal court, and (D) waives, to the fullest extent permitted by law, the defense of an inconvenient forum to the maintenance of such action or proceeding in any such Delaware state or federal court. |

| | | | | | | | | | | | | | |

| | | | |

| | EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES, AND THEREFORE IT HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT AND ANY OF THE AGREEMENTS DELIVERED IN CONNECTION HEREWITH OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY. |

| | | | |

| | In any dispute between the Parties with respect to this Agreement, the substantially prevailing Party shall be entitled to be reimbursed its reasonable costs in connection with such dispute by the other Party, exclusive of any punitive or consequential damages. |

| | | | |

| Specific Performance: | | The Parties agree that irreparable damage would occur in the event that any of the provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached. It is accordingly agreed that the Parties shall be entitled to seek an injunction or injunctions, without the posting of any bond, to prevent breaches of this Agreement and to seek to enforce specifically the terms and provisions of this Agreement in any federal court of the United States of America sitting in the State of Delaware, this being in addition to any other remedy to which they are entitled at law or in equity. For the avoidance of doubt, specific performance shall not be available for any transaction contemplated hereunder for which gaming or other regulatory approval is required until such approval has been received. |

| | | | |

| Costs: | | Each of the Parties will bear its own costs in connection with this Agreement and the Definitive Documents and, if Definitive Documents are agreed to and executed, as provided therein, except that GLP’s legal fees incurred in connection with the Development Agreement and the development and construction of the Project shall be paid by Bally’s. |

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

| | | | | | | | |

| GLP CAPITAL, L.P. |

| By Gaming & Leisure Properties, Inc., |

| its general partner |

| | |

| By: | /s/Brandon J. Moore |

| Name: | Brandon J. Moore |

| Title: | Chief Operating Officer, General Counsel and Secretary |

| | |

| | |

| BALLY’S CORPORATION |

| | |

| By: | /s/Marcus Glover |

| Name: | Marcus Glover |

| Title: | Executive Vice President and Chief Financial Officer |

Exhibit A

Description of the Project

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

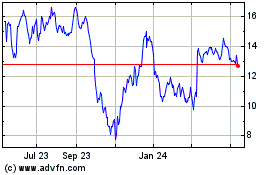

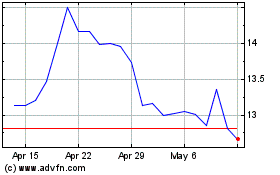

Ballys (NYSE:BALY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ballys (NYSE:BALY)

Historical Stock Chart

From Jan 2024 to Jan 2025