Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 28 2025 - 3:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of February 2025

Commission

file number 001-37775

BROOKFIELD

BUSINESS PARTNERS L.P.

(Exact name of Registrant as specified in its

charter)

73

Front Street, 5th Floor

Hamilton, HM 12 Bermuda

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Exhibit 99.1

included in this Form 6-K is incorporated by reference into Brookfield Business Partners L.P.’s registration statements on

Form F-3 (File Nos: 333-264630, 333-258765, 333-273181 and 333-273180-01).

The following document,

which is attached as an exhibit hereto, is incorporated by reference herein:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

|

BROOKFIELD BUSINESS PARTNERS L.P.

by its general partner, BROOKFIELD BUSINESS PARTNERS LIMITED |

| |

|

|

| Date: |

February 28, 2025 |

By: |

/s/ Jane Sheere |

| |

|

|

Name: Jane Sheere |

| |

|

|

Title: Corporate Secretary |

Exhibit 99.1

UNAUDITED PRO FORMA FINANCIAL STATEMENTS

These Unaudited Pro Forma

Financial Statements of Brookfield Business Partners L.P. (the “partnership”) are prepared based on the historical consolidated

financial statements of the partnership, and have been prepared to illustrate the pro forma effects of the consummated disposition of

our offshore oil services’ shuttle tanker operation on the consolidated financial statements of the partnership.

On January 16, 2025,

the partnership’s offshore oil services completed the previously announced sale of its shuttle tanker operation for consideration

of approximately $484 million (the “Transaction”, or “shuttle tanker disposition”). The consummated disposition

is considered to be significant to the partnership.

The information in the Unaudited

Pro Forma Statements of Operating Results for the year ended December 31, 2023 and for the nine months ended September 30, 2024

gives effect to the pro forma adjustments as if the shuttle tanker disposition had been consummated on January 1, 2023.

The information in the Unaudited

Pro Forma Statement of Financial Position as at September 30, 2024 gives effect to the pro forma adjustments as if the shuttle tanker

disposition had been consummated on September 30, 2024.

All financial data in the

Unaudited Pro Forma Financial Statements is presented in U.S. dollars, unless otherwise noted, and the Unaudited Pro Forma Financial Statements

have been prepared in accordance with Article 11 of Regulation S-X using accounting policies that are consistent with International

Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”).

The Unaudited Pro Forma Financial

Statements are based on preliminary estimates, accounting judgments and currently available information and assumptions that management

believes are reasonable. All financial data for the shuttle tanker disposition has been derived from the historical financial information

of the business disposed, which were included in the audited consolidated financial statements of the partnership as at December 31,

2023 and 2022 and for the years ended December 31, 2023, 2022, and 2021, and the unaudited interim consolidated financial statements

of the partnership as at September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023. The notes to

the Unaudited Pro Forma Financial Statements provide a detailed discussion of how such adjustments were derived and presented in the Unaudited

Pro Forma Financial Statements. The Unaudited Pro Forma Financial Statements should be read in conjunction with the audited consolidated

financial statements of the partnership as at December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and

2021, and the unaudited interim consolidated financial statements of the partnership as at September 30, 2024 and for the three and

nine months ended September 30, 2024 and 2023.

The Unaudited Pro Forma Financial

Statements have been prepared for illustrative purposes only and are not necessarily indicative of the financial position or operating

results of the partnership had the shuttle tanker disposition occurred on the dates indicated, nor is such pro forma financial information

necessarily indicative of the results to be expected for any future period. The actual financial position and operating results may differ

significantly from the pro forma amounts reflected herein due to a variety of factors.

UNAUDITED PRO FORMA STATEMENT OF FINANCIAL

POSITION

| | |

| | |

Transaction

Accounting

Adjustments | | |

| | |

| |

US$

MILLIONS As

at September 30, 2024 | |

Brookfield

Business

Partners L.P.

(historical) | | |

Shuttle

tanker

(consummated

disposition) | | |

Notes | | |

Pro Forma

-

Combined | |

| | |

| | | |

| (1a) | | |

| | | |

| | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| Current Assets | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,003 | | |

$ | 415 | | |

| (1f) | | |

$ | 3,418 | |

| Financial assets | |

| 1,344 | | |

| (2 | ) | |

| | | |

| 1,342 | |

| Accounts and other receivable, net | |

| 5,530 | | |

| (18 | ) | |

| | | |

| 5,512 | |

| Inventory, net | |

| 2,730 | | |

| (11 | ) | |

| | | |

| 2,719 | |

| Other assets | |

| 1,620 | | |

| (20 | ) | |

| | | |

| 1,600 | |

| | |

| 14,227 | | |

| 364 | | |

| | | |

| 14,591 | |

| Non-Current Assets | |

| | | |

| | | |

| | | |

| | |

| Financial assets | |

| 12,040 | | |

| — | | |

| | | |

| 12,040 | |

| Accounts and other receivable, net | |

| 950 | | |

| (24 | ) | |

| | | |

| 926 | |

| Other assets | |

| 365 | | |

| (19 | ) | |

| | | |

| 346 | |

| Property, plant and equipment | |

| 15,527 | | |

| (1,496 | ) | |

| | | |

| 14,031 | |

| Deferred income tax assets | |

| 1,909 | | |

| — | | |

| | | |

| 1,909 | |

| Intangible assets | |

| 19,334 | | |

| — | | |

| | | |

| 19,334 | |

| Equity accounted investments | |

| 2,364 | | |

| — | | |

| | | |

| 2,364 | |

| Goodwill | |

| 13,540 | | |

| — | | |

| | | |

| 13,540 | |

| | |

$ | 80,256 | | |

$ | (1,175 | ) | |

| | | |

$ | 79,081 | |

| Liabilities and Equity | |

| | | |

| | | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | | |

| | | |

| | |

| Accounts payable and other | |

$ | 10,063 | | |

$ | (33 | ) | |

| (1e) | | |

$ | 10,030 | |

| Non-recourse borrowings in subsidiaries of the partnership | |

| 2,096 | | |

| (62 | ) | |

| | | |

| 2,034 | |

| | |

| 12,159 | | |

| (95 | ) | |

| | | |

| 12,064 | |

| Non-Current Liabilities | |

| | | |

| | | |

| | | |

| | |

| Accounts payable and other | |

| 6,397 | | |

| (279 | ) | |

| | | |

| 6,118 | |

| Corporate borrowings | |

| 1,978 | | |

| — | | |

| | | |

| 1,978 | |

| Non-recourse borrowings in subsidiaries of the partnership | |

| 37,475 | | |

| (1,073 | ) | |

| | | |

| 36,402 | |

| Deferred income tax liabilities | |

| 2,886 | | |

| (3 | ) | |

| | | |

| 2,883 | |

| | |

| 60,895 | | |

| (1,450 | ) | |

| | | |

| 59,445 | |

| Equity | |

| | | |

| | | |

| | | |

| | |

| Limited partners | |

| 1,980 | | |

| 50 | | |

| (1c) | | |

| 2,030 | |

| Non-controlling interests attributable to: | |

| | | |

| | | |

| | | |

| | |

| Redemption-exchange units | |

| 1,858 | | |

| 47 | | |

| (1c) | | |

| 1,905 | |

| Special limited partner | |

| — | | |

| — | | |

| | | |

| — | |

| BBUC exchangeable shares | |

| 1,945 | | |

| 49 | | |

| (1c) | | |

| 1,994 | |

| Preferred securities | |

| 740 | | |

| — | | |

| | | |

| 740 | |

| Interest of others in operating subsidiaries | |

| 12,838 | | |

| 129 | | |

| (1c) | | |

| 12,967 | |

| | |

$ | 19,361 | | |

$ | 275 | | |

| | | |

$ | 19,636 | |

| | |

$ | 80,256 | | |

$ | (1,175 | ) | |

| | | |

$ | 79,081 | |

See the accompanying notes to the Unaudited

Pro Forma Financial Statements.

UNAUDITED PRO FORMA STATEMENTS OF OPERATING

RESULTS

| | |

| | |

Transaction

Accounting

Adjustments | | |

| |

US$

MILLIONS (except as noted) For

the nine months ended September 30, 2024 | |

Brookfield

Business

Partners L.P.

(historical) | | |

Shuttle

tanker

(consummated

disposition) | | |

Pro Forma

-

Combined | |

| | |

| | | |

| (1b) | | |

| | |

| Revenues | |

$ | 33,193 | | |

$ | (368 | ) | |

$ | 32,825 | |

| Direct operating costs | |

| (28,875 | ) | |

| 261 | | |

| (28,614 | ) |

| General and administrative expenses | |

| (943 | ) | |

| 16 | | |

| (927 | ) |

| Interest income (expense), net | |

| (2,352 | ) | |

| 95 | | |

| (2,257 | ) |

| Equity accounted income (loss) | |

| 55 | | |

| — | | |

| 55 | |

| Impairment reversal (expense), net | |

| 10 | | |

| — | | |

| 10 | |

| Gain (loss) on acquisitions/dispositions, net | |

| 692 | | |

| — | | |

| 692 | |

| Other income (expense), net | |

| (213 | ) | |

| (18 | ) | |

| (231 | ) |

| Income (loss) before income tax | |

| 1,567 | | |

| (14 | ) | |

| 1,553 | |

| Income tax (expense) recovery | |

| | | |

| | | |

| | |

| Current | |

| (488 | ) | |

| 2 | | |

| (486 | ) |

| Deferred | |

| 924 | | |

| 1 | | |

| 925 | |

| Net income (loss) | |

$ | 2,003 | | |

$ | (11 | ) | |

$ | 1,992 | |

| Attributable to: | |

| | | |

| | | |

| | |

| Limited partners | |

$ | 113 | | |

$ | (2 | ) | |

$ | 111 | |

| Non-controlling interests attributable to: | |

| | | |

| | | |

| | |

| Redemption-exchange units | |

| 106 | | |

| (2 | ) | |

| 104 | |

| Special limited partner | |

| — | | |

| — | | |

| — | |

| BBUC exchangeable shares | |

| 110 | | |

| (2 | ) | |

| 108 | |

| Preferred securities | |

| 39 | | |

| — | | |

| 39 | |

| Interest of others in operating subsidiaries | |

| 1,635 | | |

| (5 | ) | |

| 1,630 | |

| | |

$ | 2,003 | | |

$ | (11 | ) | |

$ | 1,992 | |

| Basic and diluted earnings (loss) per limited partner unit | |

$ | 1.52 | | |

| | | |

$ | 1.49 | |

| Weighted-average LP Units (millions) | |

| 74.3 | | |

| | | |

| 74.3 | |

See the accompanying notes to the Unaudited

Pro Forma Financial Statements.

| | |

| | |

Transaction

Accounting

Adjustments | | |

| | |

| |

US$

MILLIONS (except as noted) For

the year ended December 31, 2023 | |

Brookfield

Business

Partners L.P.

(historical) | | |

Shuttle

tanker

(consummated

disposition) | | |

Notes | | |

Pro Forma

-

Combined | |

| | |

| | | |

| (1b) | | |

| | | |

| | |

| Revenues | |

$ | 55,068 | | |

$ | (523 | ) | |

| | | |

$ | 54,545 | |

| Direct operating costs | |

| (50,021 | ) | |

| 407 | | |

| | | |

| (49,614 | ) |

| General and administrative expenses | |

| (1,538 | ) | |

| 23 | | |

| | | |

| (1,515 | ) |

| Interest income (expense), net | |

| (3,596 | ) | |

| 135 | | |

| | | |

| (3,461 | ) |

| Equity accounted income (loss), net | |

| 132 | | |

| — | | |

| | | |

| 132 | |

| Impairment reversal (expense), net | |

| (831 | ) | |

| — | | |

| | | |

| (831 | ) |

| Gain (loss) on acquisitions/dispositions, net | |

| 4,686 | | |

| 275 | | |

| (1c) | | |

| 4,961 | |

| Other income (expense), net | |

| (178 | ) | |

| (7 | ) | |

| | | |

| (185 | ) |

| Income (loss) before income tax | |

| 3,722 | | |

| 310 | | |

| | | |

| 4,032 | |

| Income tax (expense) recovery | |

| | | |

| | | |

| | | |

| | |

| Current | |

| (775 | ) | |

| (1 | ) | |

| (1d) | | |

| (776 | ) |

| Deferred | |

| 830 | | |

| 2 | | |

| (1d) | | |

| 832 | |

| Net income (loss) | |

$ | 3,777 | | |

$ | 311 | | |

| | | |

$ | 4,088 | |

| Attributable to: | |

| | | |

| | | |

| | | |

| | |

| Limited partners | |

$ | 482 | | |

$ | 57 | | |

| | | |

$ | 539 | |

| Non-controlling interests attributable to: | |

| | | |

| | | |

| | | |

| | |

| Redemption-exchange units | |

| 451 | | |

| 53 | | |

| | | |

| 504 | |

| Special limited partner | |

| — | | |

| — | | |

| | | |

| — | |

| BBUC exchangeable shares | |

| 472 | | |

| 55 | | |

| | | |

| 527 | |

| Preferred securities | |

| 83 | | |

| — | | |

| | | |

| 83 | |

| Interest of others in operating subsidiaries | |

| 2,289 | | |

| 146 | | |

| | | |

| 2,435 | |

| | |

$ | 3,777 | | |

$ | 311 | | |

| | | |

$ | 4,088 | |

| Basic and diluted earnings (loss) per limited partner unit | |

$ | 6.49 | | |

| | | |

| | | |

$ | 7.23 | |

| Weighted-average LP Units (millions) | |

| 74.5 | | |

| | | |

| | | |

| 74.5 | |

See the accompanying notes to the Unaudited

Pro Forma Financial Statements.

NOTES TO THE UNAUDITED PRO FORMA FINANCIAL STATEMENTS

| 1. | Altera shuttle tanker operation disposition |

| (1a) | On January 16, 2025, the partnership’s offshore oil services completed the previously announced

sale of its shuttle tanker operation. The adjustment to the Unaudited Pro Forma Statement of Financial Position includes the derecognition

of total assets of $1.7 billion and the derecognition of total liabilities of $1.5 billion. The pro forma adjustment to the

Unaudited Pro Forma Statement of Financial Position to reflect the shuttle tanker disposition also includes other effects discussed in

note (1c), (1d), (1e) and (1f). |

| (1b) | These pro forma adjustments include the elimination of the historical operating results of the shuttle

tanker operation for the nine months ended September 30, 2024 and for the year ended December 31, 2023. |

| (1c) | The estimated pre-tax net gain of approximately $275 million from the disposition is reflected as

an adjustment on the Unaudited Pro Forma Statement of Operating Results for the year ended December 31, 2023. The estimated net gain

on disposition is based on the historical carrying value of the net assets as of September 30, 2024. The actual gain will be calculated

based on the net book value as of the closing of the transaction and therefore, could differ from the current estimate. |

| (1d) | There are no current or deferred income tax impacts expected in relation to the pro forma adjustments

reflected in the Unaudited Pro Forma Statement of Operating Results for the year ended December 31, 2023. |

| (1e) | Includes the accrual of approximately $14 million of transaction costs incurred by the partnership

upon the disposition of the shuttle tanker operation. |

| (1f) | Includes estimated cash proceeds of approximately $484 million, included in cash and cash equivalents. |

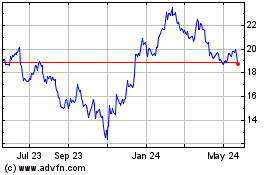

Brookfield Business Part... (NYSE:BBU)

Historical Stock Chart

From Feb 2025 to Mar 2025

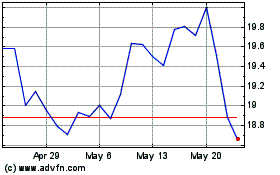

Brookfield Business Part... (NYSE:BBU)

Historical Stock Chart

From Mar 2024 to Mar 2025