Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

CITIZENS, INC.

STOCK INVESTMENT PLAN

Up to 5,000,000 Shares of Class A Common Stock

This prospectus relates to 5,000,000 shares of Citizens, Inc. Class A common stock, registered for purchase under the Citizens, Inc. Stock Investment Plan (the “Plan”). This prospectus provides a general description of the Plan and the securities we may offer through the Plan.

The Plan provides existing holders of shares of our Class A common stock and new investors with a convenient and economical means of purchasing shares of our Class A common stock.

Plan highlights include:

•Purchase our Class A common stock through a convenient, low-cost method;

•Build your investment over time, starting with as little as $5001;

•Purchase shares directly through the Internet or by check;

•Authorize automatic monthly investments of $50 or more from your U.S. bank account;

•Invest up to $120,000 per year2; and

•A convenient method for our insurance policyholders to use any cash dividends paid on our policies and for our independent consultants to use commissions earned to purchase shares of our Class A common stock.

We may issue up to 5,000,000 authorized but unissued shares of our Class A common stock under the Plan. Under the Plan, the administrator, Computershare Trust Company, N.A. ("Computershare"), an agent independent of us, may purchase shares of our Class A common stock in the open market or, at our option, directly from us from newly issued or treasury shares for the account of the participants who enroll in the Plan with proceeds provided by Plan participants. If we do not choose to issue new or treasury shares, none of the shares registered under this offering will be used.

Offering Price: If we issue new or treasury shares, the offering price will be the average of the high and low sales price of our Class A common stock on the New York Stock Exchange during regular trading hours for that investment date. For shares purchased through Computershare in the open market, such shares will generally be purchased through a bulk purchase order and each Plan participant will receive the weighted average price of all shares of our Class A common stock purchased by the Plan administrator’s broker for such order on the investment date.

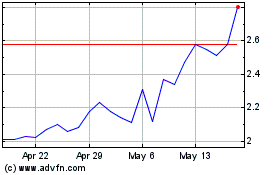

Our Class A common stock is traded on the New York Stock Exchange under the ticker symbol “CIA.” The closing price of our Class A common stock on December 5, 2024 was $4.36 per share.

Our principal executive office is located at 11815 Alterra Pkwy., Floor 15, Austin, Texas 78758, and our telephone number is (512)837-7100.

INVESTING IN OUR CLASS A COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE RISK FACTORS DESCRIBED HEREIN.

1 Minimum amount does not apply to policyholders investing policy dividends or independent consultants investing commissions.

2 We may waive the maximum investment amount in certain circumstances at our sole discretion.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

WE SPONSOR THE PLAN AND THE PLAN ADMINISTRATOR ADMINISTERS THE PLAN. THE SECURITIES HELD IN PLAN ACCOUNTS ON BEHALF OF PARTICIPANTS ARE NOT SUBJECT TO PROTECTION UNDER THE SECURITIES INVESTOR PROTECTION ACT OF 1970. YOU MUST MAKE INDEPENDENT INVESTMENT DECISIONS WITH RESPECT TO YOUR PARTICIPATION IN THE PLAN BASED ON YOUR OWN JUDGMENT AND RESEARCH.

PLAN ACCOUNTS ARE NOT SAVINGS ACCOUNTS, DEPOSIT ACCOUNTS OR OBLIGATIONS OF A BANK. THUS, PLAN ACCOUNTS ARE NOT INSURED BY THE FDIC, SIPC OR ANY OTHER GOVERNMENT AGENCY, AND MAY LOSE VALUE. THERE IS NO BANK GUARANTY OF YOUR PLAN ACCOUNT OR THE SECURITIES IN YOUR ACCOUNT.

You should rely solely on the information contained, or incorporated by reference, in this prospectus. We have not authorized anyone to provide you with information different from that contained, or incorporated by reference, in this prospectus. We are offering to sell shares of Class A common stock pursuant to the Plan only in jurisdictions where offers and sales are permitted. The information contained, or incorporated by reference, in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the shares.

The date of this prospectus is December 6, 2024

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3, which we refer to in this document as the “registration statement,” that has been filed with the Securities and Exchange Commission (the “SEC”) by Citizens, Inc., a Colorado corporation (which we refer to in this prospectus as “we,” “us,” “our”, “Citizens” or the “Company”) to register shares of our Class A common stock that may be issued under the Plan.

This prospectus and any accompanying prospectus supplement do not contain all of the information included in the registration statement, including the exhibits. Statements contained in this prospectus and any accompanying prospectus supplement about the provisions or contents of any agreement or other document are not necessarily complete. If the rules and regulations of the SEC require that such agreement or document be filed as an exhibit to the registration statement, please see such agreement or document for a complete description of these matters.

You should rely only on the information contained or incorporated by reference in this prospectus to decide whether you wish to participate in the Plan. We have not authorized anyone to provide you with information that is different from what is contained in this prospectus. You should not assume that the information appearing in this prospectus, any prospectus supplement or any document incorporated by reference is accurate as of any date other than the date of the applicable document, and neither the delivery of this prospectus nor the issuance of shares pursuant to the Plan shall create any implication to the contrary. Our business, financial condition, results of operations and prospects may have changed since that date.

You should not consider any information in this prospectus or any prospectus supplement to be investment, legal or tax advice. You should consult your own counsel, accountant and other advisors for legal, tax, business, financial and related advice regarding the investment in our common stock. We are not making any representation to you regarding the legality of an investment in our common stock by you under applicable investment or similar laws.

We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. Neither this prospectus nor any prospectus supplement accompanying the prospectus constitutes an offer, or an invitation on our behalf or on behalf of the underwriters, to subscribe for and purchase any of the securities and may not be used for or in connection with an offer or solicitation by anyone, in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

Before enrolling in the Plan, you should carefully read both this prospectus together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” If you own shares of Citizens Class A common stock now, or if you decide to buy shares in the future, then please keep this prospectus with your permanent investment records, since it contains important information about the Plan.

The registration statement containing this prospectus, including exhibits, may be obtained and read at the SEC’s Internet website found at http://www.sec.gov or as described below under the heading “Where You Can Find More Information.”

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public at the website maintained by the SEC at www.sec.gov. We also make our SEC filings accessible on our website at www.citizensinc.com. The reference to our website is intended to be an inactive textual reference only. The information on or connected to our website is not a part of this prospectus or any prospectus supplement and is not incorporated into this prospectus or any prospectus supplement.

We will provide, without charge, to each person to whom a copy of this prospectus has been delivered, upon written or oral request of such person, a copy of any or all of the documents incorporated by reference herein (other than certain exhibits to such documents not specifically incorporated by reference). You may obtain documents incorporated by reference into this prospectus by requesting them in writing or by telephone from us at the following address: 11815 Alterra Pkwy., Floor 15, Austin, Texas 78758, Attention: Secretary, telephone (512) 837-7100, e-mail legal@citizensinc.com.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus are not statements of historical fact and constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Forward-looking statements can also be identified by words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “can,” “may,” and similar terms. Forward-looking statements are not guarantees of future performance and the Company’s actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such differences include, but are not limited to, those discussed under the heading “Risk Factors”. The Company assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law.

INFORMATION ABOUT CITIZENS, INC.

Citizens, Inc. ("Citizens" or the "Company") is an insurance holding company incorporated in Colorado serving the life insurance needs of individuals in the United States since 1969 and internationally since 1975. Through our domestic insurance subsidiaries, we are licensed to provide insurance benefits to residents in 42 U.S. states and through our international subsidiary, we provide insurance benefits to residents in over 75 different countries. We pursue a strategy of offering traditional insurance products in niche markets where we believe we are able to achieve competitive advantages. As of September 30, 2024, we had approximately $1.7 billion of total assets and approximately $5.2 billion of direct insurance in force.

We operate in two business segments:

•Life Insurance –

◦Internationally, we sell U.S. dollar-denominated ordinary whole life insurance and endowment policies to non-U.S. residents located principally in Latin America and the Pacific Rim. We sell these products through independent consultants in various countries.

◦Our domestic life insurance business issues primarily ordinary whole life, final expense and life products with living benefits throughout the U.S. We sell these products through independent agent channels.

•Home Service Insurance segment – in this segment we sell final expense life insurance policies to middle- and lower-income households in Louisiana, Mississippi and Arkansas. We sell these products through independent agents and funeral homes.

Our principal executive office is located at 11815 Alterra Pkwy., Floor 15, Austin, Texas 78758, and our telephone number is (512) 837-7100. Our website is www.citizensinc.com. The information on our website is not intended to constitute and shall not be deemed to constitute part of this prospectus.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

SUMMARY PLAN INFORMATION

The following summary of the Plan focuses on the material terms of the Plan and may omit certain information that may be important to you. The summary is qualified in its entirety by reference to the text of the complete Plan, attached as Appendix A to this prospectus.

The Transaction and Fee Table that is attached to this prospectus as Appendix B sets forth in summary form the transaction types, the minimum and maximum permitted investments, and the Transaction Fees associated with the respective transaction types. The information set forth in the Transaction and Fee Table is discussed in more detail below.

You should carefully read this prospectus to find out more about the Plan. You must make any investment decision concerning your participation in the Plan based on your own judgment and research. Your participation in the Plan is entirely voluntary, and you may terminate your participation at any time. You should keep this prospectus and all account statements for future reference. If you have any questions about the Plan, please contact the Plan administrator, as set forth below under “Plan Administrator.”

EXCEPT FOR DELIVERY OF COPIES OF THIS PROSPECTUS AND RELATED MATERIALS FOR CLERICAL PURPOSES ONLY, WE HAVE NOT AUTHORIZED ANY OF OUR EMPLOYEES OR INDEPENDENT CONSULTANTS TO ANSWER QUESTIONS OR RESPOND TO NON-MINISTERIAL INQUIRIES CONCERNING THE PLAN, AND YOU MUST INSTEAD CONTACT THE PLAN ADMINISTRATOR. ANY PERSON WHO CONTACTS US CONCERNING THE PLAN WILL BE REFERRED TO THE PLAN ADMINISTRATOR FOR RESPONSES TO THE PERSON’S QUESTIONS AND NON-MINISTERIAL INQUIRIES.

What is the purpose of the Plan?

The purpose of the Plan is to provide a convenient and economical means to purchase our Class A common stock without payment of any brokerage commissions by our shareholders, insurance policyholders, independent consultants who sell our insurance policies, employees, directors and new investors who are not members of any of the preceding groups but independently inquire about the Plan.

The Plan allows for beneficial owners to have Class A common stock registered on our records in their names, in contrast to the common practice of registering the shares in the street name of a broker, who holds the shares on behalf of an investor.

The Plan is intended primarily to benefit long-term investors who seek to increase their investment in our Class A common stock and not for the benefit of individuals or institutions that engage in short-term trading activities that could cause aberrations in the overall trading volume of our Class A common stock. We reserve the right to reject, modify, suspend or terminate participation in this Plan by otherwise eligible participants in order to eliminate practices that are inconsistent with the purpose of the Plan or for any other reason. We also may use the Plan to raise additional capital through the direct sale of shares of our Class A common stock to shareholders or new investors, who, in connection with any resales of such shares, may be deemed to be underwriters. Our ability to waive limitations applicable to the amounts that participants may invest pursuant to the optional cash purchase feature of the Plan will allow for these sales to raise additional capital.

Am I eligible to participate in the Plan?

The Plan is offered to existing record holders of our Class A common stock, owners of insurance policies issued by the Company or our subsidiaries, our employees, directors and our independent consultants. Copies of this prospectus will be provided to members of these groups upon their request. We may distribute copies of this prospectus to members of these groups without first receiving a request.

The Plan may also be offered to other persons who make inquiries regarding the Plan to us or the Plan administrator. A copy of this prospectus may be delivered to persons who make these inquiries upon their request.

If you wish to participate in the Plan, you may do so only after receiving a copy of this prospectus, and you must complete an enrollment form, return it to the Plan administrator and comply with any other applicable requirements as set forth below and in the copy of the Plan included at the end of this prospectus and as may be communicated to you by the Plan administrator.

Can I participate in the Plan if I am a non-U.S. resident?

If you live outside the U.S., you should first determine if there are any laws or governmental regulations that would prohibit your participation in the Plan. If you live outside the U.S., you may be requested to provide satisfactory evidence to the Plan administrator that your participation in the Plan would not violate local laws applicable to us, the Plan, or you. We reserve the right to terminate participation of any stockholder and to refuse participation in the Plan to any person if it deems it advisable under any foreign laws or regulations.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

How do I enroll in the Plan?

Both existing and prospective Class A common stockholders may enroll in the Plan via the Internet by going to www.computershare.com/investor and following the instructions provided, or by completing and returning an enrollment form to the Plan administrator. To receive a Plan enrollment form or additional copies of this prospectus, simply contact the Plan administrator as set forth below under “Plan Administrator.”

If you are not a registered owner of our Class A common stock, you can get started in the Plan by returning a completed enrollment form to the Plan administrator, along with your check payable to: Computershare – Citizens, Inc. The minimum initial investment amount is $500. If you join the Plan via the Internet, you may fund your initial investment with a one-time online bank debit from your U.S. bank account. Alternatively, you can agree to authorize a minimum of ten consecutive automatic deductions of at least $50 each from your U.S. bank account to fund the amount of your initial investment. The Plan administrator will arrange for the purchase of shares for your account but will not pay interest on amounts held pending investment. Please allow two weeks for your account to be established, initial shares to be purchased and a statement to be mailed to you.

The minimum initial investment amount does not apply to our policyholders who have elected to assign policy benefits (including dividends) or our independent consultants who elect to have their commissions withheld for purchase of Class A common stock under the Plan.

What investment options are available under the Plan?

Once enrolled in the Plan, you may purchase our Class A common stock through the following investment options:

Optional Cash Investments. You can purchase our shares of our Class A common stock by using the Plan’s optional cash purchase feature. To purchase shares using this feature, you must invest at least $50 at any one time (at least $500 for an initial investment if you are not already a shareholder), but you cannot invest more than $120,000 in any calendar year. However, we may, at our discretion, waive the maximum limit upon request. You have no obligation to make any optional cash purchases under the Plan.

You may make optional cash investments by sending a check to the Plan administrator payable to: Computershare – Citizens, Inc. To facilitate processing of your investment, please use the transaction stub located on the bottom of your Plan statement. Mail your investment and transaction stub to the address specified on the statement. The Plan administrator will not accept cash, traveler’s checks, money orders or third party checks. You may also invest by making a one-time online bank debit from your U.S. bank account.

To invest on a regular, periodic basis, you may authorize monthly automatic deductions of $50 or more from your U.S. bank account. To initiate automatic deductions, you may enroll through the Plan administrator’s website, www.computershare.com/investor, or, complete and sign an Authorization Form for Automatic Deductions and return it to the Plan administrator. Forms will be processed and will become effective as promptly as practicable; however, you should allow four to six weeks for your first investment to be initiated. Once automatic deductions are initiated, funds will be drawn from your account on either the 1st or 15th of each month, or both (as chosen by you, or the next business day if either the 1st or the 15th is not a business day, and will normally be invested within five business days). Automatic deductions will continue at the level you set until you change your instructions by notifying the Plan administrator.

You may also make optional cash investments by going to the Plan administrator’s website, www.computershare.com/investor, and authorizing a one-time online bank debit from an account at U.S. bank or financial institution. You should refer to the online confirmation for the account debit date and investment date.

In the event that your check for an optional cash investment is returned unpaid for any reason, or an authorized electronic funds transfer cannot be affected, the Plan administrator will consider the request for investment of such funds null and void, and the Plan administrator will immediately remove from your account those shares, if any, purchased upon the prior credit of such funds. The Plan administrator will thereupon be entitled to sell shares to satisfy an uncollected amount plus a fee of $35. If the net proceeds of the sale of such shares are insufficient to satisfy the balance of such uncollected amounts, the Plan administrator will be entitled to sell such additional shares from your account as may be necessary to satisfy the uncollected balance.

Assignment of Policy Benefits, Commissions or Earnings. Owners of our insurance policies may elect to assign their policy benefits, including dividends on a life insurance policy, to the Plan to be invested in our Class A common stock. Likewise, our employees, directors and independent consultants may elect to participate in the Plan by electing to have a portion of their earnings automatically invested in Class A common stock through the Plan (collectively, the “Other Investment Options”). The minimum investment requirement for investors who purchase our Class A common stock through one of these Other Investment Options is $500 for an initial investment and $50 for each subsequent investment. The minimum amounts do not apply to our insurance policyholders or our independent consultants whose initial investment is made through an assignment of policy benefits or commissions. We reserve the right in our sole discretion to terminate the right of policyholders to invest their cash dividends on their policies or the rights of our independent consultants to invest their earnings in the Plan.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

Dividend Reinvestment Options. If and when we declare dividends on our Class A common stock, you may choose to reinvest the dividends on all, none or any portion of your shares toward the purchase of additional shares of Class A common stock. However, historically we have not paid cash dividends on our Class A common stock and we do not presently have plans for doing so. You can change your dividend reinvestment election at any time by notifying the Plan administrator. For a particular dividend to be reinvested, your notification must be received before the record date for that dividend.

How are my shares purchased and what is the purchase price?

At our option, shares of our Class A common stock may be purchased in the open market through a registered broker or directly from us.

For shares of our Class A common stock purchased in the open market, such shares will be purchased by the Plan administrator through its broker on any securities exchange where such shares are traded, in the over-the-counter market, or by negotiated transactions, upon such terms with respect to price, delivery and other items, as the Plan administrator may accept. The Plan administrator may combine Plan participant purchase requests with other purchase requests received from other Plan participants and may submit the combined purchase requests in bulk to the Plan administrator’s broker as a single purchase order. Purchase requests may be combined, at the Plan administrator’s discretion, according to one or more factors such as purchase type (e.g., dividend reinvestment, one-time online bank debit, check), request date, or request delivery method (e.g., online, regular mail). The Plan administrator will submit bulk purchase orders to its broker as and when required under the terms of the Plan. The Plan administrator’s broker may execute each bulk purchase order in one or more transactions over one or more days, depending on market conditions. Each Plan participant whose purchase request is included in each bulk purchase order will receive the weighted average price of all shares of our Class A common stock purchased by the Plan administrator’s broker for such order on the investment date. On any given trading day, open market purchases made by the Plan administrator may not exceed a certain percentage cap of the average daily trading volume of our Class A common stock, as agreed by the Plan administrator and us from time to time.

For shares of our Class A common stock purchased directly from us, the price will be the average of the high and low sales prices of our Class A common stock on the New York Stock Exchange during regular trading hours for that investment date. If the New York Stock Exchange is open for trading on an investment date but no trading in shares of our Class A common stock occurs on the New York Stock Exchange for that date, we will determine your price per share on the basis of market quotations as we deem appropriate. Shares of our Class A common stock purchased by participants in the Plan may be treasury shares or newly issued shares of our Class A common stock, at our discretion.

When are my funds invested?

After deduction of any applicable service and trading fees, the Plan administrator fully invests money paid to the Plan in our Class A common stock either through the purchase of shares in the open market or directly from us. There may be a delay between the time that you enroll in the Plan or the time money is paid to the Plan administrator and the time that the Plan administrator purchases shares of Class A common stock for your account under the Plan. The Plan Administrator will wait up to three business days after receipt of a check or electronic funds transfer to ensure it receives good funds and will then seek to purchase shares for optional cash investments on the next optional cash investment date. In the unlikely event that, due to unusual market conditions, the Plan administrator is unable to invest the funds within 35 days, the Plan administrator will return the funds to you by check. No interest will be paid on funds held by the Plan administrator pending investment. Shares will be purchased beginning on an investment date, which means each business day on which the Plan administrator determines that sufficient initial cash investments, optional cash investments, assigned policy benefits (including policyholder dividends) and commissions or earnings have been received and not previously invested to warrant investing amounts in our Class A common stock; provide, however, there will be at least one investment date in any week in which the Plan administrator receives funds for at least one investment.

In the event that your check for an optional cash investment is returned unpaid for any reason, or an authorized electronic funds transfer cannot be affected, the Plan administrator will consider the request for investment of such funds null and void, and the Plan administrator will immediately remove from your account those shares, if any, purchased upon the prior credit of such funds. The Plan administrator will thereupon be entitled to sell shares to satisfy an uncollected amount plus a fee of $35. If the net proceeds of the sale of such shares are insufficient to satisfy the balance of such uncollected amounts, the Plan administrator will be entitled to sell such additional shares from your account as may be necessary to satisfy the uncollected balance.

Your account will be credited with that number of shares, including fractional shares computed to six decimal places.

Will I receive a stock certificate?

We will not issue a certificate for any shares of Class A common stock purchased under the Plan. The number of shares purchased for your account under the Plan will appear on your statement of account in book-entry form. Additionally, as a Plan participant, you can deposit (i) any certificates you currently hold for our Class A common stock, or (ii) any shares you may hold in a brokerage, bank or other intermediary account, into your Plan account for safekeeping at no additional cost. The advantage of holding shares in book-entry form under the Plan is protection against certificate loss, theft or damage. If your shares are held in a brokerage, bank or other intermediary account, and you wish to participate directly in the Plan, you should direct your broker, bank or trustee to

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

register some or all of your shares of Class A common stock directly in your name. A stockholder can deposit stock certificates for safekeeping when enrolling in the Plan or at any time thereafter.

How is my investment tracked?

The Plan administrator will send a statement of account to you at least annually, and will send additional statements upon your reasonable request. In addition, the Plan administrator will send statements to you when you make an initial or optional cash investment or a deposit, transfer or withdrawal of shares. The statement will include specific cost basis information in accordance with applicable law.

Please retain your Plan statements to establish the cost basis of shares purchased under the Plan for income tax and other purposes.

You may also view year-to-date transaction activity in your Plan account for the current year, as well as activity in prior years, by accessing your Plan account through the Internet at the Plan administrator’s website, www.computershare.com/investor. You should notify the Plan administrator promptly of any change in address since all notices, statements and reports will be mailed to your address of record.

How do I sell my shares out of the Plan?

You may sell any number of shares held in your Plan account by notifying the Plan administrator by telephone, over the Internet or in writing. If you have a certificate for any shares which you desire to sell, you must deliver the certificate as the Plan administrator directs in order to effect the sale.

Attached to this prospectus as Appendix B is a table (the “Transaction and Fee Table”) that sets forth transaction types, the minimum and maximum permitted investments, and the service and trading fees, including any brokerage commissions the Plan administrator is required to pay (such fees and commissions, “Transaction Fees”) associated with the respective transaction types. We reserve the right to amend the Plan and change the amounts and types of Transaction Fees.

You have four choices when making a sale, depending on how you submit your sale request, as follows:

•Market Order: A market order is a request to sell shares promptly at the current market price. Market order sales are only available at www.computershare.com/investor through Investor Center or by calling the Plan administrator directly at 1-877-785-9659. Market order sale requests received at www.computershare.com/investor through Investor Center or by telephone will be placed promptly upon receipt during market hours (normally 9:30 a.m. to 4:00 p.m. Eastern time). Any orders received after 4:00 p.m. Eastern time will be placed promptly on the next day the market is open. Depending on the number of shares being sold and the current trading volume in the shares, a market order may only be partially filled or not filled at all on the trading day in which it is placed, in which case the order, or remainder of the order, as applicable, will be cancelled at the end of such day. To determine if your shares were sold, you should check your account online at www.computershare/investor through Investor Center or call the Plan administrator directly at 1-877-785-9659. The price will be the market price of the sale obtained by the Plan administrator’s broker, less a service fee of $25 and a trading fee of $0.12 per share sold.

•Batch Order: A batch order is an accumulation of all sale requests for a security submitted together as a collective request. Batch orders are submitted on each market day, assuming there are sale requests to be processed. Sale instructions for batch orders received by the Plan administrator will be processed no later than five business days after the date on which the order is received (except where deferral is required under applicable federal or state laws or regulations), assuming the applicable market is open for trading and sufficient market liquidity exists. All sales requests received in writing will be submitted as batch order sales. The Plan administrator will cause your shares to be sold on the open market within five business days of receipt of your request. To maximize cost savings for batch order sales requests, the Plan administrator may combine each selling participant’s shares with those of other selling participants. In every case of a batch order sale, the price to each selling participant shall be the weighted average sale price obtained by the Plan administrator’s broker for each aggregate order placed by the Plan administrator and executed by the broker, less a service fee of $25 and a trading fee of $0.12 per share sold.

•Day Limit Order: A day limit order is an order to sell shares when and if the shares reach a specific trading price on a specific day. The order is automatically cancelled if the price is not met by the end of that day (or, for orders placed after-market hours, the next day the market is open). Depending on the number of shares being sold and the current trading volume in the shares, such an order may only be partially filled, in which case the remainder of the order will be cancelled. The order may be cancelled by the applicable stock exchange, by the Plan administrator at its sole discretion or, if the Plan administrator’s broker has not filled the order, at your request made online at www.computershare.com/investor through Investor Center or by calling the Plan administrator directly at 1-877-785-9659. Each day limit order sale will incur a service fee of $25 per sale and a trading fee of $0.12 per share sold.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

•Good-Til-Cancelled (“GTC”) Limit Order: A GTC limit order is an order to sell shares when and if the shares reach a specific trading price at any time while the order remains open (generally up to 30 days). Depending on the number of shares being sold and the current trading volume in the shares, sales may be executed in multiple transactions and over more than one day. If shares are traded on more than one day during which the market is open, a separate fee will be charged for each such day. The order (or any unexecuted portion thereof) is automatically cancelled if the trading price is not met by the end of the order period. The order may be cancelled by the applicable stock exchange, by the Plan administrator at is sole discretion or, if the Plan administrator’s broker has not filled the order, at your request made online at www.computershare.com/investor through Investor Center or by calling the Plan administrator directly at 1-877-785-9659. Each GTC limit order sale will incur a service fee of $25 per sale and a trading fee of $0.12 per share sold.

Per share trading fees include any applicable brokerage commissions the Plan administrator is required to pay. Any fractional share will be rounded up to a whole share for purposes of calculating the per share trading fee.

All sales requests processed over the telephone will entail an additional fee of $15 if the assistance of a Customer Service Representative is required when selling shares.

The Plan administrator may, for various reasons, require a transaction request to be submitted in writing. Participants should contact the Plan administrator to determine if their particular request, including any sale request, must be submitted in writing. The Plan administrator reserves the right to decline to process a sale if it determines, in its sole discretion, that supporting legal documentation is required. In addition, if you elect to sell shares through the Plan administrator, you will not have any authority or power to direct the time or price at which shares are sold (except for prices specified for day limit orders or GTC limit orders) and only the Plan administrator will select the broker through or from whom sales are to be made.

You should be aware that the price of our Class A common stock may rise or fall during the period between a request for sale, its receipt by the Plan administrator, and the ultimate sale on the open market. Instructions for a market order or a batch sale are binding and may not be rescinded.

Alternatively you may choose to sell your shares through a broker of your choice.

May I gift or transfer my shares out of the Plan?

You may gift or transfer all or part of your shares to any recipient you choose by completing and signing a transfer request form provided by the Plan administrator. If the recipient is already a participant in the Plan, the shares will be credited to the participant’s account. The additional shares in the participant’s account will be subject to whatever election the recipient has made concerning dividend reinvestment. If the recipient is not a participant, a new account will be opened in the recipient’s name, and you may make a dividend reinvestment election on behalf of the recipient. However, the recipient at any time may change the dividend reinvestment election or terminate the recipient’s participation in the Plan. Gifting all or part of your shares may have tax consequences, including imposition of gift tax and reporting with respect to the tax laws applicable to gifts. We strongly recommend you consult with your own tax advisor as to the implications and reporting responsibilities with respect to making a gift or similar transaction. You may request a copy of the Transfer of Ownership Form by calling the Plan administrator or by downloading the forms from the Plan administrator’s website at www.computershare.com/investor. You may call the Plan administrator at 1-877-785-9659 for complete transfer instructions. You may also obtain information about transferring your shares through the Computershare Transfer Wizard at www.computershare.com/transferwizard. The Transfer Wizard will guide you through the transfer process, assist you in completing the transfer form, and identify other necessary documentation you may need to provide.

What shareholder rights do I have when I purchase Class A Common Stock through the Plan?

Upon purchase of shares through the Plan, you will have all rights as a holder of our Class A common stock as provided in our Restated and Amended Articles of Incorporation (“Articles”) and Amended and Restated Bylaws (“Bylaws”) and under applicable Colorado law governing business corporations. Under our Articles, shares of two classes of common stock – Class A common stock and Class B common stock – are authorized; however, as of the date of this prospectus, there are no shares of Class B common stock outstanding. All of the shares of Class B common stock are held by the Company and classified as treasury shares. As of October 29, 2021, we had 49,789,339 shares of Class A common stock issued and outstanding, no par value.

The voting rights of our Class A common stock and Class B common stock are equal in all respects except with regard to the election of our directors. The holders of Class B common stock have the exclusive right to elect a simple majority of the members of our board of directors, and the holders of the Class A common stock have the exclusive right to elect the remaining directors. Cumulative voting rights are not allowed in the election of directors. A majority vote of all outstanding shares of the Class A and Class B common stock, each voting separately as a class, would be required for approval of extraordinary corporate transactions, such as a merger or the sale of substantially all of our assets. For other types of actions, a majority vote of a quorum of stockholders at a meeting, represented in person or by proxy, is necessary. Because there are no shares of Class B common stock outstanding, the

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

holders of the Class A common stock currently elect all of the directors of the board and would be the only shareholders to vote for approval of an extraordinary corporate transaction or any other matter brought before the shareholders. The Company may not re-issue any shares of Class B common stock without the approval of the insurance regulators of the states in which the Company’s insurance subsidiaries are domiciled.

We have not, to date, declared or paid any cash dividends on any of our common stock, and we have no present plans for doing so. However, if we were to declare a cash dividend, the dividend per share on the Class A common stock would be required to be twice the cash dividend per share on the Class B common stock.

Our stockholders have no preemptive rights to purchase stock in connection with an issuance of stock by us.

Stockholder Materials and Voting Rights

We will send or forward to you all applicable proxy solicitation materials, other stockholder materials or consent solicitation materials. You shall have the exclusive right to exercise all voting rights respecting your shares. You may vote any of your whole or fractional shares of which you are the record holder in person or by proxy. Your proxy card shall include your whole or fractional shares of which you are the record holder. Your shares shall not be voted unless you vote them. However, unless you notify us in writing that you elect to withhold the Plan administrator’s authority, under the terms of the Plan, the Plan administrator is deemed to have the written authorization to appear in person or by proxy at any annual or special meeting of shareholders of the Company and to submit your unvoted shares at the meeting for the sole purpose of determining a quorum.

Solicitation of the exercise of your voting rights by the management of the Company or others under a proxy or consent provision applicable to all holders of common stock shall be permitted. Solicitation of the exercise of your tender or exchange offer rights by management of the Company or others shall also be permitted.

How do I withdraw from participation in the Plan?

You may withdraw from the Plan at any time. In order to withdraw from the Plan, you must provide notice instructing the Plan administrator to terminate your account. If the Plan administrator receives such notice near a record date for an account whose dividends are to be reinvested, the Plan administrator, in its sole discretion, may either distribute such dividends in cash or reinvest them in shares on your behalf. In the event reinvestment is made, the Plan administrator will process the termination as soon as practicable, but in no event later than five business days after the investment is completed. To terminate your account, call, write or submit your request through the Internet to the Plan administrator.

If you have assigned benefits from one of our life insurance policies, or sales commissions, you must also notify us in writing of your desire to terminate this assignment.

Our shares of Class A common stock are eligible for inclusion in the Direct Registration System (“DRS”) administered by The Depository Trust Company. Under the DRS, the Plan administrator will hold your shares in book-entry form. Alternatively, you may request the sale of all or part of any such shares or have the Plan administrator electronically transfer your shares to your brokerage account. The Plan administrator will convert to cash any fractional shares held in your account at the time of termination at the then current market price of the Class A common stock, net of any service and trading fees and applicable taxes.

After you withdraw from the Plan, you may rejoin the Plan at any time by filing a new enrollment form with the Plan administrator. However, the Plan administrator has the right to reject such enrollment form if you repeatedly join and withdraw from the Plan, or for any other reason. The Plan administrator’s exercise of such right is intended to minimize unnecessary administrative expenses and to encourage use of the Plan as a long-term stockholder investment service.

What are some of the tax consequences of my participation in the Plan?

The following is a general discussion of the material U.S. federal income tax consequences to U.S. Participants (as defined below) of acquiring, owning, and disposing of our Class A common stock via participation in the Plan. This discussion does not purport to be a comprehensive description of all of the U.S. tax considerations that may be relevant to a particular person’s decision to acquire the Class A common stock via the Plan, including any state, local or non-U.S. tax consequences of acquiring, owning, and disposing of common stock. This discussion applies only to those U.S. Participants that hold our Class A common stock under the Plan as capital assets for U.S. tax purposes (generally, for investment and not in connection with the carrying on of a trade or business) and does not address all aspects of U.S. federal income tax law that may be relevant to investors that are subject to special or different treatment under U.S. federal income tax law (including, for example, a participant liable for the alternative minimum tax, a participant that actually or constructively owns 10% or more by voting power or value of our aggregate common stock, or a participant transferring or receiving a transfer of shares intended to constitute a gift for federal income tax purposes). This discussion is based on the U.S. Internal Revenue Code of 1986, as amended (the “Code”), existing and proposed U.S. Treasury regulations, published rulings and other administrative guidance of the U.S. Internal Revenue Service (the “IRS”) and court decisions, all as in effect on the date hereof. These laws are subject to change or differing interpretation by the IRS or a court, possibly on a retroactive basis.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

As used herein, the term “U.S. Participant” means a beneficial owner of our Class A common stock under the Plan that is:

• an individual citizen or resident of the U.S.;

• a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in the U.S. or under the laws of the U.S., any state or political subdivision thereof, or the District of Columbia;

• an estate, the income of which is subject to U.S. federal income tax regardless of its source; or

• a trust (i) if a U.S. court is able to exercise primary supervision over the trust’s administration and one or more U.S. persons are authorized to control all substantial decisions of the trust or (ii) that has a valid election in effect to be treated as a U.S. person under applicable U.S. Treasury regulations.

If a partnership (including any entity treated as a partnership for U.S. federal income tax purposes) is a beneficial owner of our Class A common stock under the Plan, the U.S. tax treatment of a partner in such partnership generally will depend on the status of the partner and the activities of the partnership. A participant in the Plan that is a partnership and partners in such a partnership should consult their own tax advisors about the U.S. federal income tax consequences of acquiring, owning, or disposing of Class A common stock under the Plan.

You should consult your own tax advisor with respect to the tax consequences of participation in the Plan (including U.S. federal, state, local and non- U.S. tax laws) applicable to your particular situation.

Sale, Exchange, or Withdrawal of Class A Common Stock Under the Plan. A U.S. Participant that sells or otherwise disposes of Class A common stock via the Plan will recognize capital gain or loss for U.S. federal income tax purposes equal to the difference between (i) the amount realized on the sale or disposition, and (ii) the tax basis of such Class A common stock (see “Distributions and Tax Basis” below). Such gain or loss will be treated as long-term capital gain or loss if the U.S. Participant’s holding period of the Class A common stock is greater than one year at the time of sale, exchange, or other disposition. Long-term capital gains of individuals are generally subject to preferential maximum U.S. federal income tax rates. A U.S. Participant’s ability to deduct capital losses is subject to certain limitations. Transfers of existing Class A common stock to your Plan account or the withdrawal (without a sale or other disposition) of whole shares from your account generally will result in no gain or loss recognized for U.S. federal income tax purposes. Gain or loss, however, will generally be recognized upon the receipt of cash for a fractional share credited to your account.

Distributions and Tax Basis. A U.S. Participant must include in gross income as dividend income the gross amount of any distribution paid on the Class A common stock held under the Plan, to the extent such distribution is paid out of current or accumulated earnings and profits of the Company. Distributions in excess of our current and accumulated earnings and profits will first be treated as a non-taxable return of capital to the extent of the U.S. Participant’s tax basis in the Class A common stock and thereafter as gain from the sale or exchange of common stock. See “Sale, Exchange, or Withdrawal of Class A Common Stock Under the Plan” above. Dividends received by U.S. Participants that are individuals, estates, or trusts will generally be taxed at preferential rates if such dividends meet the requirements for treatment as “qualified dividend income,” including, among other requirements, that the Class A common stock is considered held by the U.S. Participant for a required period of time, typically 60 days for common stock. Dividends that fail to meet such requirements, and dividends received by corporate U.S. Holders, are taxed at ordinary income rates.

U.S. Participants who reinvest cash dividends (if we were to declare any on our Class A common stock) under the Plan will be treated as acquiring Class A common stock with such cash dividends and will be taxed on such cash dividends for U.S. federal income tax purposes as if they had been received by a U.S. Participant even though such U.S. Participant has not actually received them in cash. In addition, the IRS may require that any per share trading fees (which include any brokerage commissions the Plan administrator is required to pay) incurred in the purchase of shares, paid by us on your behalf, be treated as dividend income to you and generally such amounts can be included in cost basis of shares purchased. An existing policyholder who receives distribution amounts with respect to their existing Company insurance policy may receive some or all of such distribution free from tax if such distribution is treated for tax purposes as a return of premium. An existing policyholder using distribution amounts with respect to their existing Company insurance policy should consult its own tax advisor with respect to the tax treatment of the distribution amount and investment of such proceeds in the Plan. Independent consultants who elect to have their commissions withheld for purchase of Class A common stock under the Plan will be treated as acquiring Class A common stock with such commissions and will be taxed on such commissions for U.S. federal income tax purposes as if they have been received by such independent consultant even though such independent consultant has not actually received them.

A Plan participant’s tax basis in Class A common stock acquired directly from us through the Plan via reinvested dividends will equal the fair market value of the shares on the relevant dividend payment date. Alternatively, when Class A common stock is purchased on the open market with reinvested dividends, a Plan participant’s tax basis will generally equal the purchase price plus allocable per share trading fees (which include any brokerage commissions the Plan administrator is required to pay). In the case of Class A common stock purchased on the open market with voluntary cash payments, tax basis will generally equal the cost of the Class A common stock plus an allocable share of any brokerage commissions paid on the Plan participant’s behalf.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

Net Investment Income Tax. A U.S. Participant that is an individual or estate, or a trust that does not fall into a special class of trusts that is exempt from such tax, will be subject to a 3.8% tax on the lesser of (1) the U.S. Participant’s “net investment income” for the relevant taxable year and (2) the excess of the U.S. Participant’s modified gross income for the taxable year over a certain threshold (which in the case of an individual will be between $125,000 and $250,000, depending on the individual’s circumstances). A U.S. Participant’s net investment income will generally include dividend income and net gains from the disposition of common shares, unless such dividends or net gains are derived in the ordinary course of the conduct of a trade or business (other than a trade or business that consists of certain passive or trading activities). U.S. Participants are urged to consult their own tax advisors regarding the applicability of the Medicare tax in respect of their investment in the Plan and the underlying Class A common stock.

Information Reporting and Backup Withholding. Payments made within the U.S. or by a U.S. payor or U.S. middleman, of dividends on, and/or proceeds arising from the sale or other taxable disposition of, Class A common stock will generally be subject to information reporting and backup withholding tax (currently at a 24% rate) if a U.S. Participant (a) fails to furnish such U.S. Participant’s correct U.S. taxpayer identification number (generally on IRS Form W-9), (b) furnishes an incorrect U.S. taxpayer identification number, (c) is notified by the IRS that such U.S. Participant has previously failed to properly report items subject to backup withholding tax, or (d) fails to certify, under penalty of perjury, that such U.S. Participant has furnished its correct U.S. taxpayer identification number and that the IRS has not notified such U.S. Participant that it is subject to backup withholding tax. Backup withholding is not an additional tax. Any amounts withheld under the U.S. backup withholding tax rules will be allowed as a credit against a U.S. Participant’s U.S. federal income tax liability, if any, or will be refunded, if such U.S. Participant furnishes required information to the IRS in a timely manner. Each U.S. Participant should consult its own tax advisor regarding the information reporting and backup withholding rules.

Who is the Plan Administrator?

Computershare Trust Company, N.A. will administer the Plan and act as agent for the participants. Certain services will be provided by Computershare Inc., a registered transfer agent and affiliate of Computershare Trust Company, N.A., including processing all payments received or made under the Plan.

You may contact the Plan administrator as follows:

By Internet: You may contact the Plan administrator via the Internet at www.computershare.com/investor. Please note that all transactions online are subject to Computershare’s Investor Center Terms and Conditions.

You may call Computershare at: 1-877-785-9659

You may write the Plan administrator at the following address:

Computershare

P. O. Box 43006

Providence, RI 02940-3006

For overnight delivery services:

Computershare

150 Royall Street, Suite 101

Canton, MA 02021

Please reference Citizens, Inc. and include your name, address, account number (as shown on your Plan statement) and daytime telephone number in your correspondence.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

RISK FACTORS

Investing in our Company involves certain risks. Before you invest in our Class A common stock, you should carefully consider the risk factors described under “Item IA. Risk Factors” of our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, this prospectus and those that may be included in any applicable prospectus supplement, together with all of the other information included in this prospectus, any prospectus supplement and the documents we incorporate by reference herein. The risks and uncertainties we have described in those documents are not the only ones we face. Additional risks and uncertainties not presently known to us, or that we currently deem not material, may also adversely affect our business. Any of the risks discussed in those documents or that are presently unknown or not material, if they were to actually occur, could result in a significant adverse impact on our business, operating results, prospects or financial condition.

Additionally:

You will not know the price of our Class A common stock at the time you make an investment decision.

Although we describe generally in this prospectus how the price of any Class A common stock you purchase will be determined, you will not know the price of the shares you are purchasing under the Plan at the time you authorize the investment or elect to have your policyholder dividends or agent commissions invested.

The price of our Class A common stock may fluctuate between the time you make an investment decision and the time our shares of Class A common stock are purchased or sold by you.

The price of our Class A common stock may fluctuate between the time you decide to purchase shares under the Plan and the time of actual purchase. In addition, during this time period, you may become aware of additional information that might affect your investment decision. If you instruct the Plan administrator to sell shares of our Class A common stock under the Plan, you may not be able to direct the time or price at which your shares are sold (except for prices specified for day limit orders or good-til-cancelled limit orders). The price of our Class A common stock may decline between the time you decide to sell shares and the time of actual sale.

USE OF PROCEEDS

This prospectus relates to shares of our Class A common stock that may be offered and sold from time to time under the Plan. We do not know either the number of shares of our Class A common stock that will be ultimately sold under the Plan nor the prices at which such shares will be sold. We will receive proceeds from the sale of the shares of our Class A common stock only to the extent that such purchases are made directly from us and not from open market purchases by the Plan administrator. We intend to use the proceeds of the sale of any of newly issued shares of our Class A common stock issued under the Plan, if any, for general corporate purposes.

DESCRIPTION OF SECURITIES TO BE REGISTERED

Authorized Shares

The aggregate number of shares which the Company is authorized to issue is 100,000,000 shares of Class A common stock, with no par value, and 2,000,000 shares of Class B common stock, with no par value. As of November 1, 2024, we had 49,906,575 shares of Class A common stock issued and outstanding and 0 shares of Class B common stock issued and outstanding. These numbers do not include treasury shares. All issued and outstanding shares are fully paid and nonassessable.

Dividend Rights

Any cash dividends paid upon each share of Class A common stock are twice the cash dividends paid on each share of Citizens Class B common stock. The Company has never paid cash dividends on its Class A common stock.

Voting Rights

The voting rights of Class A common stock and Class B common stock are equal in all respects except that the holders of Class B common stock have the exclusive right to elect a simple majority of the members of the Board of Directors, and the holders of Class A common stock have the exclusive right to elect the remaining directors. Because there are currently no shares of Class B common stock outstanding, the holders of the Class A common stock elect all of our directors.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

The holders of common stock do not have cumulative voting rights. The Company’s Articles contain a provision to reduce the two-thirds voting requirement found in the Colorado Corporation Code.

The Company’s Articles provide that the Board of Directors has the power to enact, alter, amend and repeal our Bylaws not inconsistent with the laws of Colorado and the Articles, as the Board of Directors deems best for the management of the Company; however Colorado statutes give shareholders the right to amend and repeal bylaws even if not so provided for in the bylaws themselves.

Special meetings of shareholders may be called by a majority of the Board of Directors or by the holders of shares representing at least ten percent of all votes entitled to be cast on any matter proposed to be considered at the special meeting, if the Company receives one or more written demands for the meeting, stating the purpose or purposes for which it is to be held, signed and dated by such holders. A majority of the shares of the outstanding capital stock entitled to vote constitutes a quorum of shareholders under our Bylaws. Our Bylaws also provide that shareholders can take action without a meeting provided that all the shareholders entitled to vote have consented to the action in writing.

Preemptive Rights

Shares of the Company may be issued at any time, and from time to time, in such amounts, and for such consideration as may be fixed by the Board of Directors. No shareholder has any preemptive or preferential right to purchase or to subscribe for any shares of capital stock or other securities which may be issued by the Company.

Liquidation Rights

In the event of any liquidation, dissolution, or winding up of the Company, whether voluntary or involuntary, the shareholders are entitled to share, on a share-for-share basis, any of the assets or funds of the Company which are distributable to its shareholders upon such liquidation, dissolution, or winding up.

Anti-Takeover Provisions of the Articles, Bylaws and State Insurance Laws

Provisions of our Articles and Bylaws, as well as various state insurance laws, may delay or discourage a takeover attempt our shareholders might consider to be in their best interests. As a result, our shareholders may be prevented from receiving the benefit from any premium to the market price of our Class A common stock that may be offered by a bidder in a takeover context. The following provisions in the Articles and Bylaws make it difficult for our Class A shareholders to replace or remove our directors and have other anti-takeover effects that may delay, deter or prevent a takeover attempt:

•holders of shares of our Class B Common Stock elect a simple majority of our Board; and

•our Board may issue one or more series of preferred stock without the approval of our shareholders.

U.S. state insurance laws generally require prior approval of a change in control of an insurance company. Generally, such laws provide that control over an insurer is presumed to exist if any person, directly or indirectly, owns, controls, holds with the power to vote, or holds proxies representing 10% or more of the voting securities of the insurer. In considering an application to acquire control of an insurer, an insurance commissioner generally will consider such factors as the experience, competence and financial strength of the proposed acquirer, the integrity of the proposed acquirer's board of directors and executive officers, the proposed acquirer's plans for the management and operation of the insurer, and any anti-competitive results that may arise from the acquisition. In addition, a person seeking to acquire control of an insurance company is required in some states to make filings prior to completing an acquisition if the acquirer and the target insurance company and their affiliates have sufficiently large market shares in particular lines of insurance in those states. These state insurance requirements may delay, deter or prevent our ability to complete an acquisition.

Listing

The Company’s Class A common stock is listed on The New York Stock Exchange under the trading symbol “CIA.”

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

PLAN OF DISTRIBUTION

We may issue up to 5,000,000 authorized but unissued shares of our Class A common stock under the Plan. Under the Plan, the administrator, Computershare, may purchase shares of our Class A common stock in the open market or, at our option, directly from us from newly issued or treasury shares for the account of the participants who enroll in the Plan with proceeds provided by Plan participants. If we do not choose to issue new or treasury shares, none of the shares registered under this offering will be used.

The securities registered hereunder are currently offered on the New York Stock Exchange.

EXPERTS

Independent Registered Public Accounting Firm

The audited financial statements and management’s assessment of the effectiveness of internal control over financial reporting incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the reports of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

LEGAL OPINION

Sheryl Kinlaw, Chief Legal Officer and Secretary of Citizens, Inc. passed upon the legality of the Class A common stock covered by this prospectus. Ms. Kinlaw is licensed to practice law in the states of Colorado and Texas. As of the date of this prospectus, Ms. Kinlaw owns 38,209 shares of Citizens, Inc. stock and has been granted 98,470 restricted stock units that remain unvested at this time. As of December 5, 2024, the value of Ms. Kinlaw's shares was $166,591 and the value of the unvested restricted stock units was $429,329.

TRANSFER AGENT AND REGISTRAR

Our Transfer Agent and Registrar is Computershare Trust Company, N.A.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-283406

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus certain information we file with the SEC, which means that we can disclose important information to you by referring you the documents containing this information. The information incorporated by reference is deemed to be part of this prospectus, except for any information superseded by information contained directly in this prospectus.

We are incorporating by reference the Company’s filings listed below and any additional documents that we may file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date hereof and prior to the termination of the offering, except we are not incorporating by reference any information furnished (but not filed) under Item 2.02 or Item 7.01 of any Current Report on Form 8-K and corresponding information furnished under Item 9.01 as an exhibit thereto:

(c)Our Quarterly Reports on Form 10-Q for (i) the quarter ended March 31, 2024, filed on May 7, 2024, (ii) the quarter ended June 30, 2024, filed on August 6, 2024, and (iii) the quarter ended September 30, 2024, filed on November 7, 2024; (e)The description of our common stock contained in our Form 8-A filed on July 25, 2002, as amended by the description of our common stock contained in Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2023, including any amendments or reports filed for the purpose of updating the description.

This prospectus is part of a registration statement that we filed with the SEC. Upon written or oral request, we will provide, without charge, to each person, including beneficial owners of our securities, to whom a copy of this prospectus is delivered, a copy of any or all of the information incorporated by reference in this prospectus (other than exhibits to such documents, unless the exhibits are specifically incorporated by reference in such documents). Your request for copies should be directed to the Secretary, Citizens, Inc., 11815 Alterra Parkway, Floor 15, Austin, Texas 78758; telephone (512) 837-7100; e-mail legal@citizensinc.com. Copies of these documents are also available on our website, www.citizensinc.com.

APPENDIX A

CITIZENS, INC. STOCK INVESTMENT PLAN

Citizens, Inc., a Colorado corporation (the “Company”), hereby amends and restates the Citizens, Inc. Stock Investment Plan, effective November 9, 2021 (the “Plan”).

WHEREAS, the Company wishes to offer to employees, directors, policyholders, independent consultants, existing shareholders and other prospective investors opportunities to purchase the Company’s Class A common stock, no par value per share (“Common Stock”), and to offer to shareholders the ability to maintain registered ownership of their Common Stock in a manner which facilitates efficient purchases and sales;

WHEREAS, the Company is not an Affiliate (as hereinafter defined) of the Administrator, and has been subject to the reporting requirements of Section 13(a) or 15(d) of the Exchange Act (as defined herein) for a period of at least 90 days;

WHEREAS, the Plan is a direct stock purchase and dividend reinvestment Plan that aims to provide a convenient and simple method for employees, directors, policyholders, independent consultants, existing shareholders and other prospective investors to invest in the Common Stock, and to facilitate registered ownership of the Common Stock; and

WHEREAS, the Company wishes to amend and restate the Plan in its entirety.

NOW, THEREFORE; the Plan is hereby amended and restated in its entirety as follows:

ARTICLE I

DEFINITIONS

The terms defined in this Article I shall, for all purposes of this Plan, have the following respective meanings:

Account. The term “Account” shall mean, as to any Participant, the account maintained by the Administrator evidencing (i) the shares (and/or fraction of a share) of Common Stock, consisting of Plan Book-Entry Shares (a) purchased through the Plan or (b) deposited by such Participant into the Plan pursuant to Section 4.1 hereof, and credited to such Participant and (ii) cash held in the Plan pending investment in Common Stock for such Participant.

Account Shares. The term “Account Shares” shall mean all shares (including any fraction of a share) of Common Stock credited to and included in the Account of a Participant by the Administrator, that are (a) purchased through the Plan and/or (b) deposited by such Participant into the Plan pursuant to Section 4.1 hereof. Any references herein to shares of Common Stock deposited into the Plan or purchased through the Plan (through optional cash investments or reinvestment of Dividends, policy benefits, commissions or employee or director earnings) shall mean Plan Book-Entry Shares held in a Participant’s Account.

Administrator. The term “Administrator” shall mean Computershare Trust Company, N.A. Certain services will be provided by Computershare Inc., a registered transfer agent and an affiliate of the Administrator. In connection with the Plan, the Administrator shall be deemed an agent independent of the Company who satisfies applicable legal requirements (including, without limitation, the requirements of Regulation M under the Exchange Act), for purposes of making purchases and sales of Common Stock under the Plan.

Affiliate. The term “Affiliate” shall mean with respect to any person, any other person directly or indirectly controlling, controlled by, or under direct or indirect common control with such person. A Person shall be deemed to control another person if such first person possesses, directly or indirectly, the power to direct or cause the direction of the management and policies of such other person, whether through ownership of stock, by contract or otherwise.

Business Day. The term “Business Day” shall mean any day, excluding Saturdays, Sundays and legal holidays, on which federally chartered banks in the State of Colorado are regularly open for business.

Common Stock. The term “Common Stock” is defined in the Recitals of this Plan.

DRS Book-Entry Shares. The term “DRS Book-Entry Shares” shall mean shares held in book-entry form in a Participant’s name through the Direct Registration System administered by The Depository Trust Company.

Dividend. The term “Dividend” shall mean cash dividends paid on Common Stock.

Enrollment Form. The term “Enrollment Form” shall mean the documentation that the Administrator and/or Company shall require to be completed and received prior to the enrollment in the Plan of an investor that is an existing registered owner of Common Stock pursuant to Section 2.1 hereof, or a Participant’s changing the Participant’s options under the Plan pursuant to Section 6.1 hereof, or a Participant’s depositing shares of Common Stock into the Plan pursuant to Section 4.1 hereof.

Exchange Act. The term “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder.

Initial Enrollment Form. The term “Initial Enrollment Form” shall mean the documentation that the Administrator and/or Company shall require to be completed and received prior to the enrollment in the Plan of an investor that is not an existing registered owner of Common Stock pursuant to Section 2.1 hereof. At the time of the initial enrollment in the Plan, the investor’s Enrollment Form shall contain a certification of its taxpayer identification number.

Irrevocable Stock Power. The term “Irrevocable Stock Power” shall mean the documentation which the Participant completes and submits to the Administrator prior to such Participant’s gift or transfer of Account Shares pursuant to Section 5.2 hereof.

IRS. The term “IRS” shall mean the Internal Revenue Service.

Investment Date. The term “Investment Date” shall mean each Trading Day on which the Administrator determines, in its sole discretion, that sufficient optional cash investments pursuant to Section 2.4 hereof and/or initial cash investments pursuant to Section 2.3 hereof and/or Dividends and/or assigned policy benefits, employee earnings or independent consultant commissions have been received and not previously invested to warrant investing such optional cash investments and/or initial cash investments and/or assigned policy benefits, employee earnings or independent consultant commissions or reinvesting such Dividends in Common Stock pursuant to Article III hereof; provided, however, that there shall be at least one Investment Date during each period beginning on Monday of each week and ending on Friday of the same week in which the Administrator receives at least one optional cash investment, one initial cash investment, any assigned policy benefits, employee earnings or independent consultant commissions. The Investment Date for reinvesting Dividends shall be the Dividend payment date or the next Trading Day if the Dividend payment date is not a Trading Day.

Market Share Purchase Price. The term “Market Share Purchase Price,” when used with respect to shares of Common Stock (whether whole or fractional shares), shall mean (i) if shares are purchased in the open market, the weighted average purchase price per share of the aggregate number of shares purchased in the open market for the associated bulk purchase order placed on any given Investment Date, or (ii) if, at the Company’s discretion, shares are purchased directly from the Company, (A) the average of the high and low sales prices of Common Stock on the New York Stock Exchange during regular trading hours for that Investment Date or (B) if the New York Stock Exchange is open for trading on an Investment Date but no trading in shares of Common Stock occurs on the New York Stock Exchange for that date, the price as determined on the basis of market quotations as the Company deems appropriate, in each instance, not including any per share trading fees, which include any brokerage commissions the Administrator is required to pay, or other Transaction Fees. Transaction Fees are deducted from the total investment amount, and the net amount remaining is invested.

Market Share Sales Price. The term “Market Share Sales Price,” when used with respect to shares of Common Stock sold in the open market (whether whole or fractional shares), shall mean the sales price per share dependent of the method of sale (whether batch order, market order, day limit order or good-til-canceled limit order) of the aggregate number of shares sold in the open market for the date any sale is made, not including any per share trading fees, which include any brokerage commissions the Administrator is required to pay, or other Transaction Fees. However, Transaction Fees are deducted from the gross proceeds of sale, and the net amount remaining is paid out.

Maximum Amount. The term “Maximum Amount” is defined in Section 2.4 hereof.