false

0001163165

0001163165

2024-11-25

2024-11-25

0001163165

us-gaap:CommonStockMember

2024-11-25

2024-11-25

0001163165

cop:SevenPercentDebenturesDueTwentyTwentyNineMember

2024-11-25

2024-11-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 25, 2024

ConocoPhillips

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-32395 |

|

01-0562944 |

(State or other

jurisdiction of

incorporation) |

|

(Commission File

Number) |

|

(I.R.S. Employer

Identification No.) |

925 N. Eldridge Parkway

Houston, Texas 77079

(Address

of principal executive offices and zip code)

Registrant’s telephone number, including area code: (281) 293-1000

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common Stock, $0.01 Par Value |

|

COP |

|

New York Stock Exchange |

| 7% Debentures due 2029 |

|

CUSIP

– 718507BK1 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

On November 25, 2024, ConocoPhillips (“COP”) issued

press releases announcing the following:

|

· |

the commencement of cash tender offers to purchase certain notes issued by

COP, ConocoPhillips Company, and certain of their wholly-owned subsidiaries, including Marathon Oil Corporation (“Marathon”),

as well as concurrent consent solicitations for proposed amendments to the indentures under which the Marathon Notes (as defined below)

were issued; and |

|

· |

the commencement of private offers (the “Exchange Offers”)

to exchange the following notes issued by Marathon for up to $4 billion in aggregate principal amount of new notes issued by ConocoPhillips

Company: (i) 4.400% notes due 2027, (ii) 5.300% notes due 2029, (iii) 6.800% notes due 2032, (iv) 5.700% notes due

2034, (v) 6.600% notes due 2037, and (vi) 5.200% notes due 2045 (collectively, the “Marathon Notes”), as well as

concurrent consent solicitations for proposed amendments to the indentures under which the Marathon Notes were issued. |

Copies of these press releases are filed as Exhibits 99.1 and 99.2

to this Current Report on Form 8-K and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CONOCOPHILLIPS |

| |

|

| Date: November 25, 2024 |

By: |

/s/ Kelly B. Rose |

| |

Name: |

Kelly B. Rose |

| |

Title: |

Senior Vice President, Legal,

General Counsel and Corporate Secretary |

Exhibit 99.1

|

925 North

Eldridge Parkway

Houston,

TX 77079

Media

Relations: 281-293-1149

www.conocophillips.com/media |

NEWS RELEASE

Nov. 25,

2024

ConocoPhillips Company announces cash tender offers for debt

securities and consent solicitations by Marathon Oil Corporation

HOUSTON

– ConocoPhillips (NYSE: COP) (“COP”) announced today that ConocoPhillips Company (“CPCo” or

the “Company”), a wholly-owned subsidiary of COP, has commenced cash tender offers (the “Offers”) to purchase:

(1) any and all of Marathon Oil Corporation’s (“Marathon”) debt securities listed in the first table below

(collectively, the “Any and All Notes”), and (2) (A) for Holders who validly tender their Maximum Offer Notes

(as defined below) on or prior to the Early Tender Deadline (as defined below), a combined aggregate purchase price of up to $4,000,000,000

(as it may be increased or decreased by the Company in accordance with applicable law and the Offer to Purchase (as defined below), the

“Maximum Offer Reference Amount”) less the aggregate purchase price of the Any and All Notes validly tendered

and accepted for purchase through the Early Tender Deadline (excluding accrued and unpaid interest and excluding fees and expenses related

to the Offers) (the “Early Tender Maximum Offer Amount”) of the debt securities listed in the second table below (collectively,

the “Maximum Offer Notes” and together with the Any and All Notes, the “Notes”), subject to the

priorities set forth in the second table below (the “Acceptance Priority Levels”) and proration, and (B) for Holders

who validly tender their Maximum Offer Notes following the Early Tender Deadline but on or prior to the Expiration Date (as defined below),

a combined aggregate purchase price of up to the Maximum Offer Reference Amount less (x) the aggregate purchase price of the

Any and All Notes validly tendered and accepted for purchase through the Early Tender Deadline (excluding accrued and unpaid interest

and excluding fees and expenses related to the Offers), (y) the aggregate purchase price of Maximum Offer Notes validly tendered

and accepted for purchase through the Early Tender Deadline (excluding accrued and unpaid interest and excluding fees and expenses related

to the Offers) and (z) the aggregate purchase price of the Any and All Notes validly tendered and accepted for purchase after the

Early Tender Deadline through the Expiration Date (excluding accrued and unpaid interest and excluding fees and expenses related to the

Offers) (the “Late Tender Maximum Offer Amount”) of Maximum Offer Notes, subject to the Acceptance Priority Levels

and proration, provided that if the deduction of (x), (y) and (z) results in a negative number, the Late Tender Maximum

Offer Amount will be $0. If the Late Tender Maximum Offer Amount is $0, no additional Maximum Offer Notes will be accepted for purchase

after the Early Tender Deadline. The Offers are open to all registered holders of the applicable Notes (collectively, the “Holders”).

Any and All of the Outstanding Securities Listed Below (collectively,

the “Any and All Notes”):

| Title of Security | |

CUSIP / ISIN | |

Issuer | |

Aggregate Principal Amount

Outstanding | | |

Reference U.S.

Treasury Security(2) | |

Fixed Spread

(basis points)(2)(3) | |

| 4.400% Senior Notes due 2027 | |

565849AP1 / US565849AP16 | |

Marathon | |

$ | 1,000,000,000 | | |

4.125% U.S. Treasury due November 15, 2027 | |

| 35 | |

| 5.300% Senior Notes due 2029 | |

565849AQ9 / US565849AQ98 | |

Marathon | |

$ | 600,000,000 | | |

4.125% U.S. Treasury due October 31, 2029 | |

| 40 | |

| 6.800% Senior Notes due 2032 | |

565849AB2 / US565849AB20 | |

Marathon | |

$ | 550,000,000 | | |

4.250% U.S. Treasury due November 15, 2034 | |

| 50 | |

| 5.700% Senior Notes due 2034 | |

565849AR7 / US565849AR71 | |

Marathon | |

$ | 600,000,000 | | |

4.250% U.S. Treasury due November 15, 2034 | |

| 55 | |

| 6.600% Senior Notes due 2037 | |

565849AE6 / US565849AE68 | |

Marathon | |

$ | 750,000,000 | | |

4.250% U.S. Treasury due November 15, 2034 | |

| 90 | |

| 5.200% Senior Notes due 2045 | |

565849AM8 / US565849AM84 | |

Marathon | |

$ | 500,000,000 | | |

4.625% U.S. Treasury due November 15, 2044 | |

| 80 | |

Up to $4,000,000,000 Combined Aggregate Purchase Price of the Outstanding

Securities Listed Below (collectively, the “Maximum Offer Notes”) less the Aggregate Purchase Price of the Any

and All Notes Validly Tendered and Accepted for Purchase in the Priority Listed Below:

| Title of Security | |

CUSIP / ISIN | |

Issuer | |

Aggregate

Principal

Amount

Outstanding | | |

Acceptance

Priority Level(1) | | |

Reference U.S.

Treasury

Security(2) | |

Fixed Spread

(basis points)(2)(3) | |

| 7.800% Debentures due 2027 | |

891490AR5 /

US891490AR57 | |

CPCo | |

$ | 203,268,000 | | |

| 1 | | |

4.125% U.S. Treasury due November 15, 2027 | |

| 30 | |

| 7.000% Debentures due 2029 | |

718507BK1 / US718507BK18 | |

CPCo | |

$ | 112,493,000 | | |

| 2 | | |

4.125% U.S. Treasury due

October 31, 2029 | |

| 30 | |

| 7.375% Senior Notes due 2029 | |

122014AL7 / US122014AL76 | |

Burlington Resources LLC | |

$ | 92,184,000 | | |

| 3 | | |

4.125% U.S. Treasury due

October 31, 2029 | |

| 30 | |

| 6.950% Senior Notes due 2029 | |

208251AE8 / US208251AE82 | |

CPCo | |

$ | 1,195,359,000 | | |

| 4 | | |

4.125% U.S. Treasury due

October 31, 2029 | |

| 30 | |

| 8.125% Senior Notes due 2030 | |

891490AT1 / US891490AT14 | |

CPCo | |

$ | 389,580,000 | | |

| 5 | | |

4.125% U.S. Treasury due

October 31, 2029 | |

| 30 | |

| 7.400% Senior Notes due 2031 | |

12201PAN6 / US12201PAN69 | |

Burlington Resources LLC | |

$ | 382,280,000 | | |

| 6 | | |

4.250% U.S. Treasury due November 15, 2034 | |

| 40 | |

| 7.250% Senior Notes due 2031 | |

20825UAC8 / US20825UAC80 | |

Burlington Resources Oil & Gas Company L.P. | |

$ | 400,328,000 | | |

| 7 | | |

4.250% U.S. Treasury due November 15, 2034 | |

| 45 | |

| 7.200% Senior Notes due 2031 | |

12201PAB2 / US12201PAB22 | |

Burlington Resources LLC | |

$ | 446,574,000 | | |

| 8 | | |

4.250% U.S. Treasury due November 15, 2034 | |

| 45 | |

| 5.900% Senior Notes due 2032 | |

20825CAF1 / US20825CAF14 | |

ConocoPhillips | |

$ | 504,700,000 | | |

| 9 | | |

4.250% U.S. Treasury due November 15, 2034 | |

| 45 | |

| 5.950% Senior Notes due 2036 | |

20825VAB8 / US20825VAB80 | |

Burlington Resources LLC | |

$ | 326,321,000 | | |

| 10 | | |

4.250% U.S. Treasury due November 15, 2034 | |

| 80 | |

| 5.900% Senior Notes due 2038 | |

20825CAP9 / US20825CAP95 | |

ConocoPhillips | |

$ | 350,080,000 | | |

| 11 | | |

4.250% U.S. Treasury due November 15, 2034 | |

| 90 | |

| 5.950% Senior Notes due 2046 | |

20826FAR7 / US20826FAR73 | |

CPCo | |

$ | 328,682,000 | | |

| 12 | | |

$4.625% U.S. Treasury due November 15, 2044 | |

| 85 | |

| 6.500% Senior Notes due 2039 | |

20825CAQ7 / US20825CAQ78 | |

ConocoPhillips | |

$ | 1,587,744,000 | | |

| 13 | | |

4.250% U.S. Treasury due November 15, 2034 | |

| 90 | |

| (1) |

Subject to the Early Tender Maximum Offer Amount and the Late Tender Maximum Offer Amount, as applicable, and proration, the principal amount of each series of Maximum Offer Notes that are purchased in the Maximum Notes Offer will be determined in accordance with the applicable “Acceptance Priority Level” (in numerical priority order with 1 being the highest Acceptance Priority Level and 13 being the lowest) specified in the applicable column. |

| (2) |

Each applicable Reference U.S. Treasury Security will be quoted from the Bloomberg Reference Page, FIT1 (or any other recognized quotation source selected by the Lead Dealer Managers in their sole discretion). The Bloomberg Reference Page is provided for convenience only. To the extent any Bloomberg Reference Page changes prior to the Price Determination Date (as defined below), the Lead Dealer Managers will quote the applicable Reference Treasury Security from the updated Bloomberg Reference Page. |

| (3) |

Includes the Early Tender Premium of $50.00 per $1,000 principal amount of Notes for each series (the “Early Tender Premium”) as set forth under “Terms of the Offers and Consent Solicitations—Late Tender Offer Consideration.” |

In conjunction with the Offers, Marathon is soliciting consents (each,

a “Consent Solicitation” and, collectively, the “Consent Solicitations”) to adopt certain proposed

amendments to each of the indentures governing the Any and All Notes to eliminate certain of the covenants, restrictive provisions, and

events of default (the “Proposed Amendments”).

The Offers and Consent Solicitations are being made pursuant to and

are subject to the terms and conditions set forth in the Offer to Purchase dated Nov. 25, 2024 (the "Offer to Purchase").

The Any and All Notes Offer is a separate offer from the Maximum Offer, and each of the Any and All Notes Offer and the Maximum Offer

may be individually amended, extended or terminated by the Company.

On Nov. 22, 2024, COP completed the acquisition of Marathon (the

“Merger” or the “Marathon acquisition”) pursuant to a definitive agreement. In connection with the

closing of the Marathon acquisition, Marathon became a wholly-owned subsidiary of COP and is no longer a publicly traded company. COP

intends to cause Marathon to file a Form 15 with the SEC to terminate the registration of legacy Marathon securities (including the

Any and All Notes) under the Exchange Act and suspend Marathon’s reporting obligations under Section 13 and Section 15(d) of

the Exchange Act. Following the termination of Marathon’s Exchange Act registration, Marathon will no longer file current and periodic

reports with the SEC.

Substantially concurrently with the commencement of the Offers, the

Company is offering eligible Holders of each series of Any and All Notes, in each case upon the terms and conditions set forth in the

Offering Memorandum and Consent Solicitation (the “Offering Memorandum”), a copy of which may be obtained from the

information agent, the opportunity to exchange the outstanding Any and All Notes for up to $4,000,000,000 aggregate principal amount of

new notes issued by the Company and fully and unconditionally guaranteed by COP (the “Concurrent Exchange Offer”).

Holders of any series of Any and All Notes who validly tender and do not validly withdraw their Any and All Notes pursuant to the Concurrent

Exchange Offer will also be deemed to have consented to the Proposed Amendments under the Consent Solicitations described below. The applicable

consent threshold for the Proposed Amendments may be satisfied for any series of Any and All Notes by tenders pursuant to the Any and

All Notes Offer or the Concurrent Exchange Offer, or both combined. A Holder will only be able to tender Any and All Notes within a series

into either the Any and All Notes Offer or the Concurrent Exchange Offer, as the same Any and All Notes cannot be tendered into more than

one tender offer at the same time.

If a Holder tenders Any and All Notes in either the Any and All Notes

Offer or the Concurrent Exchange Offer, such Holder will be deemed to deliver its consent, with respect to the principal amount of such

tendered Any and All Notes, to the Proposed Amendments. Holders who validly withdraw tenders of their Any and All Notes prior to the execution

of the applicable supplemental indentures will be deemed to have withdrawn their consents to the Proposed Amendments under the Consent

Solicitations. Holders may not consent to the Proposed Amendments in the Consent Solicitations without tendering their Any and All Notes

and may not revoke consents without withdrawing previously tendered Any and All Notes to which such consents relate. The Company may complete

the Any and All Notes Offer or the Concurrent Exchange Offer even if valid consents sufficient to effect the Proposed Amendments to the

corresponding Existing Marathon Indenture are not received.

Substantially concurrently with the commencement of the Offers and

the Concurrent Exchange Offer, the Company has commenced a public offering of senior debt securities to be issued by the Company and guaranteed

by COP (the “Concurrent Notes Offering”). The Company intends to use the aggregate net proceeds of the Concurrent Notes

Offering, subject to the terms and conditions of the Offers, to purchase, on each Settlement Date, all Notes that are validly tendered

and not validly withdrawn before the Early Tender Deadline or the Expiration Date, as applicable, and accepted for purchase.

The Company, in its sole discretion, may modify or terminate the Offers

and may extend the Early Tender Deadline, the Expiration Date, the Early Settlement Date and/or the Final Settlement Date (each as defined

below) with respect to the Offers, subject to applicable law. Any such modification, termination or extension by the Company will automatically

modify, terminate or extend the corresponding Consent Solicitation, as applicable.

At any time at or before the Expiration Date, if Marathon receives

valid consents for any series of Any and All Notes sufficient to effect the applicable Proposed Amendments for such series, it is expected

that Marathon and the trustee for the Any and All Notes will execute and deliver supplemental indentures relating to the applicable Proposed

Amendments on the date thereof or promptly thereafter, which will be effective upon execution but will only become operative upon the

purchase or exchange by the Company of all of the Any and All Notes of the applicable series validly tendered and not validly withdrawn

and accepted for purchase or exchange on or prior to the Expiration Date, pursuant to the Offers or the Concurrent Exchange Offer, as

applicable. As a result, once the relevant supplemental indenture is executed, any subsequent withdrawal of a tender will not revoke

the previously delivered consent. However, even if such supplemental indentures are executed, if the Company does not purchase or exchange

all Any and All Notes that are validly tendered and not validly withdrawn and accepted for purchase or exchange pursuant to the Offers

or the Concurrent Exchange Offers, such supplemental indentures will be of no force and effect.

The Offers and Consent Solicitations are scheduled to expire at 5:00

p.m., New York City time, on Dec. 24, 2024, unless extended or earlier terminated by the Company (the "Expiration Date").

Tendered Notes may be withdrawn on or prior to, but not after, 5:00 p.m., New York City time, on Dec. 9, 2024 (such date and time,

as may be extended by the Company, the "Withdrawal Deadline"), except in certain limited circumstances where additional

withdrawal rights are required by law.

Holders of Notes validly tendered and not validly withdrawn on or prior

to 5:00 p.m., New York City time on Dec. 9, 2024, (the “Early Tender Deadline”) and accepted for purchase, will

receive the applicable total tender offer consideration (the "Total Tender Offer Consideration”), which includes an

early tender premium of $50.00 per $1,000 principal amount of the Maximum Offer Securities accepted for purchase (the "Early Tender

Premium"). Only Holders that validly tender and do not validly withdraw their Notes on or prior to the Early Tender Deadline

will be eligible to receive the Early Tender Premium. Holders of Notes validly tendered following the Early Tender Deadline, but on or

prior to the Expiration Date, and accepted for purchase, will receive the Late Tender Offer Consideration, which is equal to the applicable

Total Tender Offer Consideration minus the Early Tender Premium (the “Late Tender Offer Consideration”) and is payable

on the Final Settlement Date. The Total Tender Offer Consideration for each series of Notes, validly tendered and accepted for purchase

will be determined in the manner described in the Offer to Purchase by reference to the applicable fixed spread specified for the applicable

series in the tables above and in the Offer to Purchase over the yield to maturity based on the bid side price of the applicable Reference

U.S. Treasury Security specified in the tables above and in the Offer to Purchase. In calculating the applicable Total Tender Offer Consideration

for a series of Notes, the application of the par call date will be in accordance with standard market practice. The Total Tender Offer

Consideration for the Notes will be determined at 10:00 a.m., New York City time, on Dec. 10, 2024, (such date and time, as may be

extended by the Company, the “Price Determination Date”) in the manner described in the Offer to Purchase. In addition

to the Total Tender Offer Consideration or Late Tender Offer Consideration, as applicable, Holders of Notes accepted for purchase will

also receive accrued and unpaid interest rounded to the nearest cent on such $1,000 principal amount of Note from the last applicable

interest payment date up to, but not including, the applicable settlement date.

The settlement date for Notes validly

tendered and not validly withdrawn on or prior to the Early Tender Deadline and accepted for purchase is expected to be Dec. 12,

2024, the third business day after the Early Tender Deadline (the "Early Settlement Date"). The settlement date for Notes

validly tendered and not validly withdrawn, on or prior to the Expiration Date and accepted for purchase is expected to be Dec. 30,

2024, the third business day after the Expiration Date (the "Final Settlement Date"), assuming (1) all of

the Any and All Notes are not purchased on the Early Settlement Date and (2) the Early Tender Maximum Offer Amount of Maximum Offer

Notes is not purchased on the Early Settlement Date. No tenders of the Notes will be valid if submitted after the Expiration Date.

Subject to the Early Tender Maximum Offer Amount and the Late Tender

Maximum Offer Amount, the Maximum Offer Notes will be purchased in accordance with the “Acceptance Priority Level” (in numerical

priority order) as set forth in the above table. Any Maximum Offer Notes of series in the last Acceptance Priority Level accepted for

purchase in accordance with the terms of the Maximum Offer may be subject to proration so that the Company will only accept for purchase

Maximum Offer Notes having an aggregate purchase price up to the Early Tender Maximum Offer Amount (in the case of Holders tendering Maximum

Offer Notes on or prior to the Early Tender Deadline) or the Late Tender Maximum Offer Amount (in the case of Holders tendering Maximum

Offer Notes following the Early Tender Deadline but on or prior to the Expiration Date). Subject to the Early Tender Maximum Offer Amount,

all Maximum Offer Notes validly tendered and not validly withdrawn before the Early Tender Deadline having a higher Acceptance Priority

Level will be accepted before any validly tendered and not validly withdrawn Maximum Offer Notes having a lower Acceptance Priority Level,

and, subject to the Late Tender Maximum Offer Amount, all Maximum Offer Notes validly tendered after the Early Tender Deadline having

a higher Acceptance Priority Level will be accepted before any Maximum Offer Notes tendered after the Early Tender Deadline having a lower

Acceptance Priority Level. However (subject to the Early Tender Maximum Offer Amount), if Maximum Offer Notes are validly tendered and

not validly withdrawn as of the Early Tender Deadline, Maximum Offer Notes validly tendered and not validly withdrawn before the Early

Tender Deadline will be accepted for purchase in priority to Maximum Offer Notes tendered after the Early Tender Deadline, even if such

Maximum Offer Notes tendered after the Early Tender Deadline have a higher Acceptance Priority Level than Maximum Offer Notes validly

tendered and not validly withdrawn before the Early Tender Deadline. Furthermore, if Maximum Offer Notes are validly tendered and not

validly withdrawn having an aggregate purchase price equal to or greater than the Early Tender Maximum Offer Amount as of the Early Tender

Deadline, Holders who validly tender Notes after the Early Tender Deadline but before the Expiration Date will not have any of their Notes

accepted for purchase.

If the Maximum Offer is fully subscribed as of the Early Tender Deadline,

Holders who validly tender Maximum Offer Notes following the Early Tender Deadline but on or prior to the Expiration Date will not have

any of their Maximum Offer Notes accepted for purchase, regardless of the Acceptance Priority Level of their tendered Maximum Offer Notes.

There are no guaranteed delivery provisions provided for by the

Company in conjunction with the Offers under the terms of the Offer to Purchase. Holders must tender their Notes in accordance with

the procedures set forth in the Offer to Purchase.

The Company’s obligation to accept for purchase, and to pay for,

the Notes validly tendered and not validly withdrawn in the Offers is subject to the satisfaction or waiver of the conditions as described

in the Offer to Purchase. The Company reserves the absolute right, subject to applicable law, to: (i) waive any and all conditions

applicable to any of the Offers; (ii) extend or terminate any of the Offers; (iii) increase or decrease the Maximum Offer Reference

Amount for purposes of determining the Early Tender Maximum Offer Amount or the Late Tender Maximum Offer Amount, in either case, without

extending the Early Tender Deadline or the Withdrawal Deadline; or (iv) otherwise amend any of the Offers in any respect.

TD Securities (USA) LLC, HSBC

Securities (USA) Inc., J.P. Morgan Securities LLC and Wells Fargo Securities, LLC are the Lead Dealer Managers and Solicitation

Agents for the Tender Offer. Global Bondholder Services Corporation is the Tender Agent and Information Agent. Persons with

questions regarding the Tender Offer should contact TD Securities (USA) LLC (toll-free) at (866) 584-2096, HSBC Securities (USA)

Inc. (toll free) at (888) HSBC-4LM, J.P. Morgan Securities LLC (toll-free) at (866) 834-4666 or (collect) at (212) 834-4818, and

Wells Fargo Securities (toll-free) at (866) 309-6316 or (collect) at (704) 410-4235. Requests for copies of the Offer to Purchase,

the related Letter of Transmittal and related materials should be directed to Global Bondholder Services Corporation at (+1)

(212) 430-3774, (toll-free) (855) 654-2015 or contact@gbsc-usa.com. Questions regarding the tendering of Notes may be directed to

Global Bondholder Services Corporation (toll-free) at (855) 654-2015.

This news release is neither an offer to purchase nor a solicitation

of an offer to sell the Notes. The Offers and Consent Solicitations are made only by the Offer to Purchase and the information in this

news release is qualified by reference to the Offer to Purchase and related Letter of Transmittal, dated Nov. 25, 2024. None of ConocoPhillips

or its affiliates, their respective boards of directors, the Dealer Managers, the Solicitation Agents, the Tender Agent and Information

Agent or the trustees with respect to any Notes is making any recommendation as to whether holders should tender any Notes in response

to the Offers, and neither ConocoPhillips nor any such other person has authorized any person to make any such recommendation. Holders

must make their own decision as to whether to tender any of their Notes, and, if so, the principal amount of Notes to tender.

--- # # # ---

About ConocoPhillips

ConocoPhillips is one of the world’s leading exploration and

production companies based on both production and reserves, with a globally diversified asset portfolio. Headquartered in Houston, Texas,

ConocoPhillips had operations and activities in 13 countries, $97 billion of total assets, and approximately 10,300 employees at Sept.

30, 2024. Production averaged 1,921 MBOED for the nine months ended Sept. 30, 2024, and proved reserves were 6.8 BBOE as of Dec. 31,

2023.

For more information, go to www.conocophillips.com.

Contacts

Dennis Nuss (media)

281-293-1149

dennis.nuss@conocophillips.com

Investor Relations

281-293-5000

investor.relations@conocophillips.com

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE "SAFE HARBOR"

PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements as defined

under the federal securities laws. Forward-looking statements relate to future events, plans and anticipated results of operations, business

strategies, and other aspects of our operations or operating results. Words and phrases such as “ambition,” “anticipate,”

“believe,” “budget,” “continue,” “could,” “effort,” “estimate,”

“expect,” “forecast,” “goal,” “guidance,” “intend,” “may,” “objective,”

“outlook,” “plan,” “potential,” “predict,” “projection,” “seek,”

“should,” “target,” “will,” “would,” and other similar words can be used to identify forward-looking

statements. However, the absence of these words does not mean that the statements are not forward-looking. Where, in any forward-looking

statement, the company expresses an expectation or belief as to future results, such expectation or belief is expressed in good faith

and believed to be reasonable at the time such forward-looking statement is made. However, these statements are not guarantees of future

performance and involve certain risks, uncertainties and other factors beyond our control. Therefore, actual outcomes and results may

differ materially from what is expressed or forecast in the forward-looking statements. Factors that could cause actual results or events

to differ materially from what is presented include changes in commodity prices, including a prolonged decline in these prices relative

to historical or future expected levels; global and regional changes in the demand, supply, prices, differentials or other market conditions

affecting oil and gas, including changes resulting from any ongoing military conflict, including the conflicts in Ukraine and the Middle

East, and the global response to such conflict, security threats on facilities and infrastructure, or from a public health crisis or from

the imposition or lifting of crude oil production quotas or other actions that might be imposed by OPEC and other producing countries

and the resulting company or third-party actions in response to such changes; insufficient liquidity or other factors, such as those listed

herein, that could impact our ability to repurchase shares and declare and pay dividends such that we suspend our share repurchase program

and reduce, suspend, or totally eliminate dividend payments in the future, whether variable or fixed; changes in expected levels of oil

and gas reserves or production; potential failures or delays in achieving expected reserve or production levels from existing and future

oil and gas developments, including due to operating hazards, drilling risks or unsuccessful exploratory activities; unexpected cost increases,

inflationary pressures or technical difficulties in constructing, maintaining or modifying company facilities; legislative and regulatory

initiatives addressing global climate change or other environmental concerns; public health crises, including pandemics (such as COVID-19)

and epidemics and any impacts or related company or government policies or actions; investment in and development of competing or alternative

energy sources; potential failures or delays in delivering on our current or future low-carbon strategy, including our inability to develop

new technologies; disruptions or interruptions impacting the transportation for our oil and gas production; international monetary conditions

and exchange rate fluctuations; changes in international trade relationships or governmental policies, including the imposition of price

caps, or the imposition of trade restrictions or tariffs on any materials or products (such as aluminum and steel) used in the operation

of our business, including any sanctions imposed as a result of any ongoing military conflict, including the conflicts in Ukraine and

the Middle East; our ability to collect payments when due, including our ability to collect payments from the government of Venezuela

or PDVSA; our ability to complete any announced or any future dispositions or acquisitions on time, if at all; the possibility that regulatory

approvals for any announced or any future dispositions or acquisitions will not be received on a timely basis, if at all, or that such

approvals may require modification to the terms of the transactions or our remaining business; business disruptions relating to the acquisition

of Marathon Oil Corporation (Marathon Oil) or following any other announced or other future dispositions or acquisitions, including the

diversion of management time and attention; the ability to deploy net proceeds from our announced or any future dispositions in the manner

and timeframe we anticipate, if at all; our ability to successfully integrate Marathon Oil’s business and technologies, which may

result in the combined company not operating as effectively and efficiently as expected; our ability to achieve the expected benefits

and synergies from the Marathon Oil acquisition in a timely manner, or at all; potential liability for remedial actions under existing

or future environmental regulations; potential liability resulting from pending or future litigation, including litigation related directly

or indirectly to pending or completed transactions; the impact of competition and consolidation in the oil and gas industry; limited access

to capital or insurance or significantly higher cost of capital or insurance related to illiquidity or uncertainty in the domestic or

international financial markets or investor sentiment; general domestic and international economic and political conditions or developments,

including as a result of any ongoing military conflict, including the conflicts in Ukraine and the Middle East; changes in fiscal regime

or tax, environmental and other laws applicable to our business; and disruptions resulting from accidents, extraordinary weather events,

civil unrest, political events, war, terrorism, cybersecurity threats or information technology failures, constraints or disruptions;

and other economic, business, competitive and/or regulatory factors affecting our business generally as set forth in our filings with

the Securities and Exchange Commission. Unless legally required, ConocoPhillips expressly disclaims any obligation to update any forward-looking

statements, whether as a result of new information, future events or otherwise.

Exhibit 99.2

|

925 North

Eldridge Parkway

Houston,

TX 77079

Media

Relations: 281-293-1149

www.conocophillips.com/media |

NEWS RELEASE

Nov. 25, 2024

ConocoPhillips Company announces exchange offers for debt securities

and consent solicitations by Marathon Oil Corporation

HOUSTON – ConocoPhillips (NYSE: COP) (“COP”)

today announced that, in connection with the acquisition of Marathon Oil Corporation (“Marathon”) (NYSE: MRO) by ConocoPhillips,

ConocoPhillips Company (“CPCo” or the “Company”) has commenced offers to eligible holders to exchange

(each an “Exchange Offer” and collectively, the “Exchange Offers”) any and all outstanding notes

issued by Marathon as set forth in the table below (the “Existing Marathon Notes”) for up to $4,000,000,000 aggregate

principal amount of new notes issued by CPCo and fully and unconditionally guaranteed by COP (the “New Notes”).

The following table sets forth the Exchange Consideration and Total

Exchange Consideration for each series of Existing Marathon Notes:

Title of Series of

Existing Marathon

Notes | |

CUSIP Number /

ISIN | |

Issuer | |

Aggregate

Principal Amount

Outstanding | |

Exchange

Consideration(1) | |

Total Exchange

Consideration(2) |

| 4.400% Senior Notes due 2027 | |

565849AP1 / US565849AP16 | |

Marathon | |

$ | 1,000,000,000 | |

$950 principal amount of New 4.400% Notes due 2027 | |

$1,000 principal amount of New 4.400% Notes due 2027 |

| 5.300% Senior Notes due 2029 | |

565849AQ9 / US565849AQ98 | |

Marathon | |

$ | 600,000,000 | |

$950 principal amount of New 5.300% Notes due 2029 | |

$1,000 principal amount of New 5.300% Notes due 2029 |

| 6.800% Senior Notes due 2032 | |

565849AB2 / US565849AB20 | |

Marathon | |

$ | 550,000,000 | |

$950 principal amount of New 6.800% Notes due 2032 | |

$1,000 principal amount of New 6.800% Notes due 2032 |

| 5.700% Senior Notes due 2034 | |

565849AR7 / US565849AR71 | |

Marathon | |

$ | 600,000,000 | |

$950 principal amount of New 5.700% Notes due 2034 | |

$1,000 principal amount of New 5.700% Notes due 2034 |

| 6.600% Senior Notes due 2037 | |

565849AE6 / US565849AE68 | |

Marathon | |

$ | 750,000,000 | |

$950 principal amount of New 6.600% Notes due 2037 | |

$1,000 principal amount of New 6.600% Notes due 2037 |

| 5.200% Senior Notes due 2045 | |

565849AM8 / US565849AM84 | |

Marathon | |

$ | 500,000,000 | |

$950 principal amount of New 5.200% Notes due 2045 | |

$1,000 principal amount of New 5.200% Notes due 2045 |

| (1) | For each $1,000 principal amount of Existing Marathon Notes validly tendered after the Early Tender Date (as defined herein) but at

or before the Expiration Date, not validly withdrawn and accepted for exchange. |

| (2) | For each $1,000 principal amount of Existing Marathon Notes validly tendered at or before the Early Tender Date (as defined herein),

not validly withdrawn and accepted for exchange. |

In conjunction with the Exchange Offers, Marathon is soliciting consents

(each, a “Consent Solicitation” and, collectively, the “Consent Solicitations”) to adopt certain

proposed amendments to each of the indentures governing the Existing Marathon Notes to eliminate certain of the covenants, restrictive

provisions, and events of default (the “Proposed Amendments”).

The Exchange Offers and Consent Solicitations are being made pursuant

to the terms and subject to the conditions set forth in the offering memorandum and consent solicitation statement, dated as of Nov. 25,

2024 (the “Offering Memorandum and Consent Solicitation Statement”).

On Nov. 22, 2024, COP completed the acquisition of Marathon (the

“Merger” or the “Marathon acquisition”) pursuant to a definitive agreement. In connection with the

closing of the Marathon acquisition, Marathon became a wholly-owned subsidiary of COP and is no longer a publicly traded company. COP

intends to cause Marathon to file a Form 15 with the SEC to terminate the registration of legacy Marathon securities (including the

Existing Marathon Notes) under the Exchange Act and suspend Marathon’s reporting obligations under Section 13 and Section 15(d) of

the Exchange Act. Following the termination of Marathon’s Exchange Act registration, Marathon will no longer file current and periodic

reports with the SEC.

Substantially concurrently with the commencement of the Exchange Offers

and Consent Solicitations, CPCo is commencing cash tender offers to purchase any and all of the Existing Marathon Notes and several series

of debt securities issued by COP and CPCo and subsidiaries thereof (the “Concurrent Tender Offer”). Eligible Holders

of any series of Existing Marathon Notes who validly tender and do not validly withdraw their Existing Marathon Notes pursuant to the

Concurrent Tender Offer will also be deemed to have consented to the Proposed Amendments under the Consent Solicitations described in

this news release. The applicable consent threshold for the Proposed Amendments may be satisfied for any series of Existing Marathon Notes

by tenders pursuant to the Exchange Offer or the Concurrent Tender Offer, or both combined. An Eligible Holder will only be able to tender

specific Existing Marathon Notes within a series into either the Concurrent Tender Offer or the Exchange Offer, as the same Existing Marathon

Notes cannot be tendered into more than one tender offer at the same time.

If an Eligible Holder tenders Existing Marathon Notes in either the

Exchange Offers or the Concurrent Tender Offer, such Eligible Holder will be deemed to deliver its consent, with respect to the principal

amount of such tendered Existing Marathon Notes, to the Proposed Amendments and the related Existing Marathon Notes for that series. Eligible

Holders who validly withdraw tenders of their Existing Marathon Notes prior to the execution of the applicable supplemental indentures

will be deemed to have withdrawn their consents to the Proposed Amendments under the Consent Solicitations. Eligible Holders may not consent

to the Proposed Amendments in the Consent Solicitations without tendering their Existing Marathon Notes and may not revoke consents without

withdrawing previously tendered or exchanged Existing Marathon Notes to which such consents relate. CPCo may complete the Exchange Offer

or Concurrent Tender Offer even if valid consents sufficient to effect the Proposed Amendments to the corresponding indenture governing

the applicable series of Existing Marathon Notes are not received.

At any time at or before the Expiration Date, if Marathon receives

valid consents for any series of Existing Marathon Notes sufficient to effect the applicable Proposed Amendments for such series, it is

expected that Marathon and the trustee for the Existing Marathon Notes will execute and deliver supplemental indentures relating to the

applicable Proposed Amendments on the date thereof or promptly thereafter, which will be effective upon execution but will only become

operative upon the exchange or purchase by CPCo of all of the Existing Marathon Notes of the applicable series validly tendered and not

validly withdrawn and accepted for exchange or purchase on or prior to the Expiration Date, pursuant to the Exchange Offers or the Concurrent

Tender Offer, as applicable. As a result, once the relevant supplemental indenture is executed, any subsequent withdrawal of a tender

will not revoke the previously delivered consent. However, even if such supplemental indentures are executed, if CPCo does not exchange

or purchase all Existing Marathon Notes that are validly tendered and not validly withdrawn and accepted for exchange or exchange pursuant

to the Exchange Offers or the Concurrent Tender Offer, such supplemental indentures will be of no force and effect.

Substantially concurrently with the commencement of the Exchange Offers

and the Concurrent Tender Offer, CPCo has commenced a public offering of senior debt securities to be issued by CPCo and fully and unconditionally

guaranteed by COP (the “Concurrent Notes Offering”). CPCo intends to use the aggregate net proceeds of the Concurrent

Notes Offering, subject to the terms and conditions of the Concurrent Tender Offer, to purchase, on the applicable settlement date, all

Existing Marathon Notes and other debt securities that are validly tendered in the Concurrent Tender Offer and not validly withdrawn,

as applicable, and accepted for purchase.

Each Exchange Offer and Consent Solicitation is conditioned upon the

completion of the other Exchange Offers and Consent Solicitations, although CPCo may waive such condition at any time with respect to

an Exchange Offer. Any waiver of a condition by CPCo with respect to an Exchange Offer will automatically waive such condition with respect

to the corresponding Consent Solicitation.

CPCo, in its sole discretion, may modify or terminate the Exchange

Offers and may extend the Early Tender Date (as defined herein), the Expiration Date (as defined herein) and/or the settlement date with

respect to the Exchange Offers, subject to applicable law. Any such modification, termination or extension by CPCo will automatically

modify, terminate or extend the corresponding Consent Solicitation, as applicable.

Holders who validly tender their Existing Marathon Notes at or prior

to 5:00 p.m., New York City time, on Dec. 9, 2024, unless extended (the “Early Tender Date”), will be eligible

to receive, on the settlement date, the applicable Total Exchange Consideration as set forth in the table above for all such Existing

Marathon Notes that are accepted. Holders who validly tender their Existing Marathon Notes after the Early Tender Date but no later than

5:00 p.m., New York City time, on Dec. 24, 2024, unless extended (the “Expiration Date”), will be eligible to

receive, on the settlement date, the applicable Exchange Consideration as set forth in the table above, for all such Existing Marathon

Notes that are accepted. The settlement date will be promptly after the Expiration Date and is expected to be within three business days

after the Expiration Date.

The Exchange Offers are only being made, and the New Notes are only

being offered and will only be issued, and copies of the offering documents will only be made available, to holders of Existing Marathon

Notes (1) either (a) in the United States, that are “qualified institutional buyers,” or “QIBs,” as

that term is defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), in a private

transaction in reliance upon an exemption from the registration requirements of the Securities Act or (b) outside the United States,

that are persons other than “U.S. persons,” as that term is defined in Rule 902 under the Securities Act, in offshore

transactions in reliance upon Regulation S under the Securities Act, or a dealer or other professional fiduciary organized, incorporated

or (if an individual) residing in the United States holding a discretionary account or similar account (other than an estate or a trust)

for the benefit or account of a non-“U.S. person,” and (2) (a) if located or resident in any Member State of the

European Economic Area, who are persons other than “retail investors” (for these purposes, a retail investor means a person

who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended,

“MiFID II”); or (ii) a customer within the meaning of Directive (EU) 2016/97, where that customer would not qualify

as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a “qualified investor”

as defined in Regulation (EU) 2017/1129), and consequently no key information document required by Regulation (EU) No 1286/2014 (as amended,

the “PRIIPs Regulation”) for offering or selling the New Notes or otherwise making them available to retail investors

in the European Economic Area has been prepared and therefore offering or selling the New Notes or otherwise making them available to

any retail investor in the European Economic Area may be unlawful under the PRIIPs Regulation; or (b) if located or resident in the

United Kingdom, who are persons other than “retail investors” (for these purposes, a retail investor means a person who is

one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms

part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”); or (ii) a customer within

the meaning of the provisions of the Financial Services and Markets Act 2000 (the “FSMA”) and any rules or regulations

made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in

point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA; or (iii) not

a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the EUWA),

and consequently no key information document required by Regulation (EU) No 1286/2014 as it forms part of domestic law by virtue of the

EUWA (the “UK PRIlPs Regulation”) for offering or selling the New Notes or otherwise making them available to retail

investors in the United Kingdom has been prepared and therefore offering or selling the New Notes or otherwise making them available to

any retail investor in the United Kingdom may be unlawful under the UK PRIIPs Regulation (“Eligible Holders”). The

Exchange Offers will not be made to holders of Existing Marathon Notes who are located in Canada. Only Eligible Holders who have completed

and returned the eligibility certification are authorized to receive or review the Offering Memorandum or to participate in the Exchange

Offers. The eligibility form is available electronically at: https://gbsc-usa.com/eligibility/conocophillips. There is no separate letter

of transmittal in connection with the Offering Memorandum and Consent Solicitation Statement.

This news release does not constitute an offer to sell or purchase,

or a solicitation of an offer to sell or purchase, or the solicitation of tenders or consents with respect to, any security. No offer,

solicitation, purchase or sale will be made in any jurisdiction in which such an offer, solicitation, or sale would be unlawful. The Exchange

Offers and Consent Solicitations are being made solely pursuant to the Offering Memorandum and Consent Solicitation Statement and the

Concurrent Tender Offer is being made only by an Offer to Purchase, dated Nov. 25, 2024, and only to such persons and in such jurisdictions

as is permitted under applicable law.

The New Notes have not been and will not be registered under the Securities

Act or any state securities laws. Therefore, the New Notes may not be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements of the Securities Act and any applicable state securities laws.

--- # # # ---

About ConocoPhillips

ConocoPhillips is one of the world’s leading exploration and

production companies based on both production and reserves, with a globally diversified asset portfolio. Headquartered in Houston, Texas,

ConocoPhillips had operations and activities in 13 countries, $97 billion of total assets, and approximately 10,300 employees at Sept.

30, 2024. Production averaged 1,921 MBOED for the nine months ended Sept. 30, 2024, and proved reserves were 6.8 BBOE as of Dec. 31,

2023.

For more information, go to www.conocophillips.com.

Contacts

Dennis Nuss (media)

281-293-1149

dennis.nuss@conocophillips.com

Investor Relations

281-293-5000

investor.relations@conocophillips.com

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE "SAFE HARBOR"

PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements as defined

under the federal securities laws. Forward-looking statements relate to future events, plans and anticipated results of operations, business

strategies, and other aspects of our operations or operating results. Words and phrases such as “ambition,” “anticipate,”

“believe,” “budget,” “continue,” “could,” “effort,” “estimate,”

“expect,” “forecast,” “goal,” “guidance,” “intend,” “may,” “objective,”

“outlook,” “plan,” “potential,” “predict,” “projection,” “seek,”

“should,” “target,” “will,” “would,” and other similar words can be used to identify forward-looking

statements. However, the absence of these words does not mean that the statements are not forward-looking. Where, in any forward-looking

statement, the company expresses an expectation or belief as to future results, such expectation or belief is expressed in good faith

and believed to be reasonable at the time such forward-looking statement is made. However, these statements are not guarantees of future

performance and involve certain risks, uncertainties and other factors beyond our control. Therefore, actual outcomes and results may

differ materially from what is expressed or forecast in the forward-looking statements. Factors that could cause actual results or events

to differ materially from what is presented include changes in commodity prices, including a prolonged decline in these prices relative

to historical or future expected levels; global and regional changes in the demand, supply, prices, differentials or other market conditions

affecting oil and gas, including changes resulting from any ongoing military conflict, including the conflicts in Ukraine and the Middle

East, and the global response to such conflict, security threats on facilities and infrastructure, or from a public health crisis or from

the imposition or lifting of crude oil production quotas or other actions that might be imposed by OPEC and other producing countries

and the resulting company or third-party actions in response to such changes; insufficient liquidity or other factors, such as those listed

herein, that could impact our ability to repurchase shares and declare and pay dividends such that we suspend our share repurchase program

and reduce, suspend, or totally eliminate dividend payments in the future, whether variable or fixed; changes in expected levels of oil

and gas reserves or production; potential failures or delays in achieving expected reserve or production levels from existing and future

oil and gas developments, including due to operating hazards, drilling risks or unsuccessful exploratory activities; unexpected cost increases,

inflationary pressures or technical difficulties in constructing, maintaining or modifying company facilities; legislative and regulatory

initiatives addressing global climate change or other environmental concerns; public health crises, including pandemics (such as COVID-19)

and epidemics and any impacts or related company or government policies or actions; investment in and development of competing or alternative

energy sources; potential failures or delays in delivering on our current or future low-carbon strategy, including our inability to develop

new technologies; disruptions or interruptions impacting the transportation for our oil and gas production; international monetary conditions

and exchange rate fluctuations; changes in international trade relationships or governmental policies, including the imposition of price

caps, or the imposition of trade restrictions or tariffs on any materials or products (such as aluminum and steel) used in the operation

of our business, including any sanctions imposed as a result of any ongoing military conflict, including the conflicts in Ukraine and

the Middle East; our ability to collect payments when due, including our ability to collect payments from the government of Venezuela

or PDVSA; our ability to complete any announced or any future dispositions or acquisitions on time, if at all; the possibility that regulatory

approvals for any announced or any future dispositions or acquisitions will not be received on a timely basis, if at all, or that such

approvals may require modification to the terms of the transactions or our remaining business; business disruptions relating to the acquisition

of Marathon Oil Corporation (Marathon Oil) or following any other announced or other future dispositions or acquisitions, including the

diversion of management time and attention; the ability to deploy net proceeds from our announced or any future dispositions in the manner

and timeframe we anticipate, if at all; our ability to successfully integrate Marathon Oil’s business and technologies, which may

result in the combined company not operating as effectively and efficiently as expected; our ability to achieve the expected benefits

and synergies from the Marathon Oil acquisition in a timely manner, or at all; potential liability for remedial actions under existing

or future environmental regulations; potential liability resulting from pending or future litigation, including litigation related directly

or indirectly to pending or completed transactions; the impact of competition and consolidation in the oil and gas industry; limited access

to capital or insurance or significantly higher cost of capital or insurance related to illiquidity or uncertainty in the domestic or

international financial markets or investor sentiment; general domestic and international economic and political conditions or developments,

including as a result of any ongoing military conflict, including the conflicts in Ukraine and the Middle East; changes in fiscal regime

or tax, environmental and other laws applicable to our business; and disruptions resulting from accidents, extraordinary weather events,

civil unrest, political events, war, terrorism, cybersecurity threats or information technology failures, constraints or disruptions;

and other economic, business, competitive and/or regulatory factors affecting our business generally as set forth in our filings with

the Securities and Exchange Commission. Unless legally required, ConocoPhillips expressly disclaims any obligation to update any forward-looking

statements, whether as a result of new information, future events or otherwise.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_CapitalUnitsByClassAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_CapitalUnitsByClassAxis=cop_SevenPercentDebenturesDueTwentyTwentyNineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

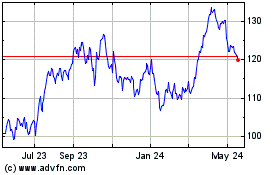

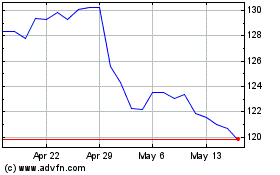

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Jan 2025 to Feb 2025

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Feb 2024 to Feb 2025