CRC’s Carbon TerraVault Receives EPA Permits for CO2 Injection and Storage in California

December 31 2024 - 11:41AM

California Resources Corporation (NYSE: CRC) and its carbon

management business, Carbon TerraVault (CTV), today announced

receipt of final Class VI well permits from the Environmental

Protection Agency (EPA) for underground injection and storage of

carbon dioxide (CO2) into the 26R reservoir, located at CRC’s Elk

Hills Field in Kern County, California. The 26R reservoir is part

of CTV’s joint venture with Brookfield.

“We are proud to have received the state’s first

Class VI permits, enabling us to advance critical clean energy

projects in California,” said Francisco Leon, CRC’s President and

Chief Executive Officer. “This milestone underscores our leadership

in the carbon capture and storage sector and highlights our

capability to deliver carbon management solutions to key industrial

partners across the state.”

26R is one of two depleted oil and natural gas

reservoirs that comprise the CTV I storage site, with an expected

injection rate of 1.46 million metric tons of CO2 storage per

annum. Total estimated capacity of 26R is up to 38 million metric

tons.

About Carbon TerraVault

Carbon TerraVault (CTV), CRC’s carbon management

business, is developing services to capture, transport and

permanently store CO2 for its customers. CTV is engaged in a series

of proposed CCS projects that if developed will inject CO2 captured

from industrial sources into depleted reservoirs deep underground

for permanent sequestration. For more information, visit

carbonterravault.com.

About Carbon TerraVault Joint

Venture

Carbon TerraVault Joint Venture (CTV JV) is a

carbon management partnership focused on CCS development formed

between Carbon TerraVault I, LLC, a subsidiary of CRC, and

Brookfield, to develop both infrastructure and storage assets

required for CCS development in California. CRC owns 51% of CTV JV

with Brookfield owning the remaining 49% interest.

About California Resources

Corporation

California Resources Corporation (CRC) is an

independent energy and carbon management company committed to

energy transition. CRC is committed to environmental stewardship

while safely providing local, responsibly sourced energy. CRC is

also focused on maximizing the value of its land, mineral

ownership, and energy expertise for decarbonization by developing

CCS and other emissions reducing projects. For more information

about CRC, please visit www.crc.com.

Forward-Looking Statements

This document contains statements that CRC

believes to be “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. All statements other than

historical facts are forward-looking statements, and include

statements regarding CRC's future financial position, business

strategy, projected revenues, earnings, costs, capital

expenditures and plans and objectives of management for the future.

Words such as “expect,” “could,” “may,” “anticipate,”

“intend,” “plan,” “ability,” “believe,” “seek,” “see,” “will,”

“would,” “estimate,” “forecast,” “target,” “guidance,” “outlook,”

“opportunity” or “strategy” or similar expressions are generally

intended to identify forward-looking statements. Such

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from those

expressed in, or implied by, such statements.

Although CRC believes the expectations and

forecasts reflected in its forward-looking statements are

reasonable, they are inherently subject to numerous risks and

uncertainties, most of which are difficult to predict and many of

which are beyond its control. No assurance can be given that such

forward-looking statements will be correct or achieved or that the

assumptions are accurate or will not change over time. Particular

uncertainties that could cause CRC's actual results to be

materially different than those expressed in its forward-looking

statements include:

- fluctuations in commodity prices, including supply and demand

considerations for CRC's products and services, and the impact of

such fluctuations on revenues and operating expenses;

- decisions as to production levels and/or pricing by OPEC or

U.S. producers in future periods;

- government policy, war and political conditions and events,

including the military conflicts in Israel, Lebanon, Ukraine, Yemen

and the Red Sea;

- the ability to successfully execute integration efforts in

connection with CRC's merger with Aera Energy LLC, and achieve

projected synergies and ensure that such synergies are

sustainable;

- CRC’s ability to rely on the Class VI permits depends in part

on (i) the expiration of a 30-day waiting period during which

petitions concerning the permits may be submitted to the EPA and

the satisfactory resolution of any such petitions, (ii) completion

of construction of sequestration wells and surface facilities that

are consistent with permit requirements and are approved by the

EPA, and (iii) final authorization from the EPA to inject CO2;

- regulatory actions and changes that affect the oil and gas

industry generally and CRC in particular, including (1) the

availability or timing of, or conditions imposed on, EPA and other

governmental permits and approvals necessary for drilling or

development activities or its carbon management business; (2) the

management of energy, water, land, greenhouse gases (GHGs) or other

emissions, (3) the protection of health, safety and the

environment, or (4) the transportation, marketing and sale of CRC's

products;

- the efforts of activists to delay or prevent oil and gas

activities or the development of CRC's carbon management business

through a variety of tactics, including litigation;

- the impact of inflation on future expenses and changes

generally in the prices of goods and services;

- changes in business strategy and CRC's capital plan;

- lower-than-expected production or higher-than-expected

production decline rates;

- changes to CRC's estimates of reserves and related future cash

flows, including changes arising from its inability to develop such

reserves in a timely manner, and any inability to replace such

reserves;

- the recoverability of resources and unexpected geologic

conditions;

- general economic conditions and trends, including conditions in

the worldwide financial, trade and credit markets;

- production-sharing contracts' effects on production and

operating costs;

- the lack of available equipment, service or labor price

inflation;

- limitations on transportation or storage capacity and the need

to shut-in wells;

- any failure of risk management;

- results from operations and competition in the industries in

which CRC operates;

- CRC's ability to realize the anticipated benefits from prior or

future efforts to reduce costs;

- environmental risks and liability under federal, regional,

state, provincial, tribal, local and international environmental

laws and regulations (including remedial actions);

- the creditworthiness and performance of CRC's counterparties,

including financial institutions, operating partners, CCS project

participants and other parties;

- reorganization or restructuring of CRC's operations;

- CRC's ability to claim and utilize tax credits or other

incentives in connection with its CCS projects;

- CRC's ability to realize the benefits contemplated by its

energy transition strategies and initiatives, including CCS

projects and other renewable energy efforts;

- CRC's ability to successfully identify, develop and finance

carbon capture and storage projects and other renewable energy

efforts, including those in connection with the Carbon TerraVault

JV, and its ability to convert its CDMAs and MOUs to definitive

agreements and enter into other offtake agreements;

- CRC's ability to maximize the value of its carbon management

business and operate it on a stand alone basis;

- CRC's ability to successfully develop infrastructure projects

and enter into third party contracts on contemplated terms;

- uncertainty around the accounting of emissions and its ability

to successfully gather and verify emissions data and other

environmental impacts;

- changes to CRC's dividend policy and share repurchase program,

and its ability to declare future dividends or repurchase shares

under its debt agreements;

- limitations on CRC's financial flexibility due to existing and

future debt;

- insufficient cash flow to fund CRC's capital plan and other

planned investments and return capital to shareholders;

- changes in interest rates;

- CRC's access to and the terms of credit in commercial banking

and capital markets, including its ability to refinance its debt or

obtain separate financing for its carbon management business;

- changes in state, federal or international tax rates, including

CRC's ability to utilize its net operating loss carryforwards to

reduce its income tax obligations;

- effects of hedging transactions;

- the effect of CRC's stock price on costs associated with

incentive compensation;

- inability to enter into desirable transactions, including joint

ventures, divestitures of oil and natural gas properties and real

estate, and acquisitions, and CRC's ability to achieve any expected

synergies;

- disruptions due to earthquakes, forest fires, floods, extreme

weather events or other natural occurrences, accidents, mechanical

failures, power outages, transportation or storage constraints,

labor difficulties, cybersecurity breaches or attacks or other

catastrophic events;

- pandemics, epidemics, outbreaks, or other public health events,

such as the COVID-19 pandemic; and

- other factors discussed in Part I, Item 1A – Risk Factors in

CRC's Annual Report on Form 10-K and its other SEC filings

available at www.crc.com.

CRC cautions you not to place undue reliance on

forward-looking statements contained in this document, which speak

only as of the filing date, and it undertakes no obligation to

update this information. This document may also contain information

from third party sources. This data may involve a number of

assumptions and limitations, and CRC has not independently verified

them and does not warrant the accuracy or completeness of such

third-party information.

|

Contacts: |

|

Joanna Park (Investor Relations) 818-661-3731

Joanna.Park@crc.com |

Richard Venn (Media)818-661-6014Richard.Venn@crc.com |

|

|

This press release was published by a CLEAR® Verified

individual.

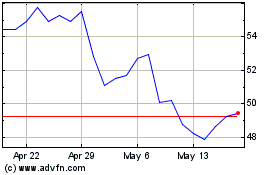

California Resources (NYSE:CRC)

Historical Stock Chart

From Dec 2024 to Jan 2025

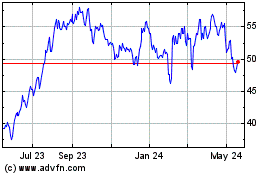

California Resources (NYSE:CRC)

Historical Stock Chart

From Jan 2024 to Jan 2025