--Additional Resin Orders to Support

20-Million Pound Cutlery Award --

-- Company Forecasting Annualized PHA

Revenues to More Than Triple by End of Q2 2025 --

-- Pro-Rata Warrant Dividend Transaction

Provides Balance Sheet Deleveraging Opportunity --

Danimer Scientific, Inc. (NYSE: DNMR) (“Danimer” or the

“Company”), a leading next generation bioplastics company focused

on the development and production of biodegradable materials,

announced today financial results for its second quarter ended June

30, 2024.

Stephen E. Croskrey, Chief Executive Officer of Danimer,

commented, “We completed the second quarter in line with our

expectations considering the temporary impact of Starbucks’

reapportionment of their Nodax-based straw business between our

converter partners. We believe these headwinds will continue into

the third quarter, but at a lesser degree than experienced during

the second quarter. It is important to reiterate that we have

retained 100% of this business, and we remain on track to continue

to grow our PHA business during 2024.”

Mr. Croskrey continued, “Our 20-million-pound cutlery award

continues to progress. Our converter partners have received initial

molds for testing, and some have purchased new injection molding

equipment. To date, we have received four commercial orders, with

one order having been delivered and the others expected to ship by

the end of this month. We expect this award to reach full run rate

in mid-2025."

Mr. Croskrey concluded, “Our recently completed pro-rata warrant

dividend transaction has provided a potential new avenue to

deleverage our balance sheet, strengthen our capital structure and

maximize stockholder value. We are pleased that we have been able

to retire $6.1 million of our 3.25% convertible notes as of the

date of this release.”

Second Quarter 2024 Financial Highlights:

- Revenues of $7.6 million in the second quarter of 2024 were

down by $5.3 million compared to revenue of $12.9 million in the

second quarter of 2023. PHA revenue of $5.9 million decreased by

$2.5 million in the quarter as compared with the prior year

quarter. This was primarily due to the reapportionment of

Starbucks’ straw business which led to excess inventory in the

channel with the Company’s converter partners. PLA revenue of $1.4

million decreased by $2.4 million quarter-over-quarter, primarily

due to a loss of orders from customers affected by the conflict in

Ukraine.

- Gross profit of $(6.9) million was in line with $(6.6) million

in the second quarter of 2023. Adjusted gross profit was $(1.8)

million compared to $(1.6) million in the second quarter of

2023.

- Adjusted EBITDA was $(9.9) million in the second quarter of

2024 which improved as compared to $(10.2) million in the second

quarter of 2023.

Capital Structure

At June 30, 2024, the Company reported total debt outstanding of

$393.9 million, which included approximately $45.7 million dollars

of low-interest New Markets Tax Credit loans that the Company

expects will be forgiven beginning in 2026.

As previously disclosed, on April 19, 2024, the Company entered

into a $20 million asset-based lending agreement (ABL) revolving

credit facility that is secured primarily by its accounts

receivable and inventory, subject to borrowing base limitations.

The Company had borrowed $5.2 million against this facility as of

June 30, 2024 and continues to explore additional avenues to manage

its liquidity position and enable it to maintain strategic and

operational flexibility as it executes its growth strategy.

On July 12, 2024, the Company distributed warrants to

stockholders of record as of May 13, 2024, who received one warrant

(“Dividend Warrant”) for each three shares of common stock. Holders

of the Company’s 3.250% convertible senior notes and its pre-funded

common stock purchase warrants as of the record date also received

Dividend Warrants on a pass-through basis. For additional

information on the Dividend Warrant, please see the FAQs on the

Investor Relations section of the Company’s website at

https://ir.danimerscientific.com/.

Outlook

The Company reported second quarter results that were consistent

with its expectations including the impact of the reapportionment

related to the Starbucks straw resin business. The Company

anticipates that these headwinds will continue into the third

quarter but with a much lower impact compared to the second

quarter. As such, the Company is making the following adjustments

to annual guidance:

- Full-year Adjusted EBITDA is now expected to be in the range of

$(30) million to $(35) million.

- Full-year capital expenditures are anticipated to remain in the

previously disclosed range of $8 million to $10 million, which will

support existing commitments related to the Bainbridge greenfield

facility, maintenance expenditures and other capital projects.

- Year-end liquidity, which comprises unrestricted cash and

projected availability under the revolving credit facility, will be

in the range of $15 million to $20 million.

Additionally, the Company is now forecasting annualized PHA

revenues to more than triple by the end of the second quarter of

2025, based solely on demand from existing customer relationships

and their indicated volumes, including the aforementioned

20-million-pound cutlery award.

Webcast, Conference Call and 10-Q Filing

The Company will host a webcast and conference call today,

Thursday August 8, 2024, at 4:30 p.m. Eastern time to review second

quarter 2024 results, discuss recent events and conduct a

question-and-answer session. The live webcast of the conference

call can be accessed on the Investor Relations section of the

Company’s website at https://ir.danimerscientific.com. For

those unable to access the webcast, the conference call will be

accessible domestically or internationally, by dialing

1-800-717-1738 or 1-646-307-1865, respectively. Upon dialing in,

please request to join the Danimer Scientific Second Quarter 2024

Earnings Conference Call. The archived webcast will be available

for replay on the Company's website after the call.

About Danimer Scientific

Danimer is a pioneer in creating more sustainable, more natural

ways to make plastic products. For more than a decade, its

renewable and sustainable biopolymers have helped create plastic

products that are biodegradable and compostable and return to

nature instead of polluting our lands and waters. Danimer’s

technology can be found in a vast array of plastic end products

that people use every day. Applications for its biopolymers include

additives, aqueous coatings, fibers, filaments, films and

injection-molded articles, among others. Danimer holds more than

480 granted patents and pending patent applications in more than 20

countries for a range of manufacturing processes and biopolymer

formulations. For more information, visit

https://danimerscientific.com.

Forward‐Looking Statements

Please note that this press release may use words such as

“appears,” “anticipates,” “believes,” “plans,” “expects,”

“intends,” “future,” and similar expressions which constitute

forward-looking statements within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, without limitation, statements

regarding expectations for the full year 2024 capital expenditures,

Adjusted EBITDA and liquidity, and statements regarding expected

PHA revenue growth, as well as statements regarding the exercise of

Dividend Warrants using 3.250% convertible senior notes to pay the

exercise price. Forward-looking statements are made based on

expectations and beliefs concerning future events impacting the

Company and therefore involve a number of risks and uncertainties.

The Company cautions that forward-looking statements are not

guarantees and that actual results could differ materially from

those expressed or implied in the forward-looking statements.

Potential risks and uncertainties that could cause the actual

results of operations or financial condition of the Company to

differ materially from those expressed or implied by

forward-looking statements in this release include, but are not

limited to, the overall level of consumer demand on our products;

general economic conditions and other factors affecting consumer

confidence, preferences, and behavior; disruption and volatility in

the global currency, capital, and credit markets; the financial

strength of the Company's customers; the Company's ability to

implement its business strategy, including, but not limited to, its

ability to expand its production facilities and plants to meet

customer demand for its products and the timing thereof; risks

relating to the uncertainty of the projected financial information

with respect to the Company; the ability of the Company to execute

and integrate acquisitions; changes in governmental regulation,

legislation or public opinion relating to our products; the

Company’s exposure to product liability or product warranty claims

and other loss contingencies; the outcomes of any litigation

matters; the impact on our business, operations and financial

results from the ongoing conflicts in Ukraine and the Middle East;

the impact that global climate change trends may have on the

Company and its suppliers and customers; the Company's ability to

protect patents, trademarks and other intellectual property rights;

any breaches of, or interruptions in, our information systems; the

ability of our information technology systems or information

security systems to operate effectively, including as a result of

security breaches, viruses, hackers, malware, natural disasters,

vendor business interruptions or other causes; our ability to

properly maintain, protect, repair or upgrade our information

technology systems or information security systems, or problems

with our transitioning to upgraded or replacement systems; the

impact of adverse publicity about the Company and/or its brands,

including without limitation, through social media or in connection

with brand damaging events and/or public perception; fluctuations

in the price, availability and quality of raw materials and

contracted products as well as foreign currency fluctuations; our

ability to utilize potential net operating loss carryforwards; and

changes in tax laws and liabilities, tariffs, legal, regulatory,

political and economic risks. More information on potential factors

that could affect the Company's financial results is included from

time to time in the Company's public reports filed with the

Securities and Exchange Commission, including the Company's Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K. All forward-looking statements included in

this press release are based upon information available to the

Company as of the date of this press release and speak only as of

the date hereof. The Company assumes no obligation to update any

forward-looking statements to reflect events or circumstances after

the date of this press release.

Danimer Scientific,

Inc.

Condensed Consolidated Balance

Sheets

June 30,

December 31,

(in thousands, except share and per share data)

2024

2023

Assets: Current assets: Cash and cash equivalents

$

40,254

$

59,170

Accounts receivable, net

10,928

15,227

Other receivables, net

580

652

Inventories, net

26,277

25,270

Prepaid expenses and other current assets

5,907

4,714

Contract assets, net

2,928

3,005

Total current assets

86,874

108,038

Property, plant and equipment, net

434,257

445,153

Intangible assets, net

76,415

77,790

Right-of-use assets

19,163

19,160

Leverage loans receivable

31,446

31,446

Restricted cash

14,167

14,334

Other assets

4,218

2,210

Total assets

$

666,540

$

698,131

Liabilities and Stockholders' Equity: Current liabilities:

Accounts payable

$

2,880

$

5,292

Accrued liabilities

4,781

4,726

Unearned revenue and contract liabilities

850

1,000

Current portion of lease liability

3,723

3,337

Current portion of long-term debt, net

6,976

1,368

Total current liabilities

19,210

15,723

Long-term lease liability, net

21,461

21,927

Long-term debt, net

386,910

381,436

Warrant liability

3,914

5

Other long-term liabilities

1,017

1,020

Total liabilities

$

432,512

$

420,111

Stockholders' equity: Common stock, $0.0001 par value;

200,000,000 shares authorized: 116,608,522 and 102,832,103 shares

issued and outstanding at June 30, 2024 and December 31, 2023,

respectively

$

12

$

10

Additional paid-in capital

738,061

732,131

Accumulated deficit

(504,045

)

(454,121

)

Total stockholders’ equity

234,028

278,020

Total liabilities and stockholders’ equity

$

666,540

$

698,131

Danimer Scientific,

Inc.

Condensed Consolidated

Statements of Operations

Three Months Ended June

30,

Six Months Ended June

30,

(in thousands, except share and per share data)

2024

2023

2024

2023

Revenue: Products

$

7,246

$

12,174

$

17,201

$

23,270

Services

382

691

651

1,521

Total revenue

7,628

12,865

17,852

24,791

Costs and expenses: Cost of revenue

14,531

19,433

31,066

37,642

Selling, general and administrative

6,752

16,844

13,621

35,543

Research and development

5,109

7,709

10,451

14,784

Loss on sale of assets

565

-

565

170

Total costs and expenses

26,957

43,986

55,703

88,139

Loss from operations

(19,329

)

(31,121

)

(37,851

)

(63,348

)

Nonoperating income (expense) Gain (loss) on remeasurement of

warrants

5,742

1,083

5,841

(33

)

Interest, net

(9,072

)

(9,162

)

(17,910

)

(12,548

)

Loss on loan extinguishment

-

(102

)

-

(102

)

Total nonoperating expense:

(3,330

)

(8,181

)

(12,069

)

(12,683

)

Loss before income taxes

(22,659

)

(39,302

)

(49,920

)

(76,031

)

Income taxes

(2

)

61

(4

)

151

Net loss

$

(22,661

)

$

(39,241

)

$

(49,924

)

$

(75,880

)

Basic net loss per share

$

(0.19

)

$

(0.38

)

$

(0.45

)

$

(0.74

)

Weighted average shares outstanding

116,465,086

101,938,376

110,114,660

101,917,585

Danimer Scientific,

Inc.

Condensed Consolidated

Statements of Cash Flows

Six Months Ended

June 30,

(in thousands)

2024

2023

Cash flows from operating activities: Net loss

$

(49,924

)

$

(75,880

)

Adjustments to reconcile net loss to net cash used in operating

activities: Depreciation and amortization

14,969

14,752

(Gain) loss on remeasurement of warrants

(5,841

)

33

Amortization of debt issuance costs

5,821

3,485

Stock-based compensation

1,169

27,974

Warrant issuance costs

867

-

Loss on disposal of assets

565

170

Accounts receivable reserves

437

(948

)

Inventory reserves

(313

)

464

Amortization of right-of-use assets and lease liability

(83

)

(237

)

Deferred income taxes

-

(155

)

Other

-

1,046

Changes in operating assets and liabilities: Accounts receivable

3,863

5,939

Other receivables

74

38

Inventories, net

(694

)

2,383

Prepaid expenses and other current assets

(751

)

1,130

Contract assets

(185

)

(959

)

Other assets

70

(120

)

Accounts payable

(2,078

)

(2,377

)

Accrued liabilities

227

600

Other long-term liabilities

(4

)

636

Unearned revenue and contract liabilities

(150

)

875

Net cash used in operating activities

(31,961

)

(21,151

)

Cash flows from investing activities: Purchases of property, plant

and equipment and intangible assets

(3,770

)

(23,041

)

Net cash used in investing activities

(3,770

)

(23,041

)

Cash flows from financing activities:

Proceeds from issuance of common

warrants, net of issuance costs

8,883

-

Proceeds from issuance of common

stock, net of issuance costs

4,658

-

Proceeds from long-term debt

11,326

130,000

Principal payments on long-term

debt

(7,227

)

(11,744

)

Cash paid for debt issuance

costs

(1,095

)

(33,295

)

Proceeds from employee stock

purchase plan

118

129

Employee taxes related to

stock-based compensation

(15

)

(61

)

Net cash provided by financing activities

16,648

85,029

Net (decrease) increase in cash and cash equivalents and restricted

cash

(19,083

)

40,837

Cash and cash equivalents and restricted cash-beginning of period

73,504

64,401

Cash and cash equivalents and restricted cash-end of period

$

54,421

$

105,238

Non-GAAP Financial Measures

This press release includes the non-GAAP financial measures

“Adjusted EBITDA”, “Adjusted gross profit” and "Adjusted gross

margin". Danimer management views these metrics as a useful way to

look at the performance of its operations between periods and to

exclude decisions on capital investment and financing that might

otherwise impact the review of profitability of the business based

on present market conditions.

Adjusted EBITDA is defined as net income or loss plus net

interest expense, income taxes, depreciation and amortization, as

adjusted to add back certain charges or gains that Danimer may

record each period such as remeasurement of warrants, stock-based

compensation expense, as well as non-recurring charges such as (i)

asset disposal gains or losses as well as other significant gains

or losses such as debt extinguishments and impairment of goodwill;

(ii) legal settlements; or (iii) other discrete non-recurring

items. Danimer believes these items are not considered an indicator

of ongoing performance. Adjusted EBITDA is not a measure of

performance defined in accordance with GAAP. The measure is used as

a supplement to GAAP results in evaluating certain aspects of

Danimer’s business, as described below.

Adjusted gross profit is defined as gross profit plus

depreciation, stock-based compensation and other nonrecurring

items.

Adjusted gross margin is defined as adjusted gross profit

divided by total revenue.

Danimer believes that each of Adjusted EBITDA, Adjusted gross

profit and Adjusted gross margin is useful to investors in

evaluating the Company’s performance because each measure considers

the performance of the Company’s operations, excluding decisions

made with respect to capital investment, financing and other

non-recurring charges as outlined in the preceding paragraph.

Danimer believes these non-GAAP metrics offer additional financial

information that, when coupled with the GAAP results and the

reconciliation to GAAP results, provides a more complete

understanding of its results of operations and the factors and

trends affecting its business.

Adjusted EBITDA, Adjusted gross profit and Adjusted gross margin

should not be considered as an alternative to net income or loss as

an indicator of its performance or as alternatives to any other

measure prescribed by GAAP as there are limitations to using such

non-GAAP measures. Although Danimer believes that Adjusted EBITDA,

Adjusted gross profit and Adjusted gross margin may enhance an

evaluation of its operating performance based on recent revenue

generation and product/overhead cost control because it excludes

the impact of prior decisions made about capital investment,

financing and other expenses, (i) other companies in Danimer’s

industry may define Adjusted EBITDA, Adjusted gross profit and

Adjusted gross margin differently than Danimer does and, as a

result, they may not be comparable to similarly titled measures

used by other companies in its industry, and (ii) Adjusted EBITDA,

Adjusted gross profit and Adjusted gross margin exclude certain

financial information that some may consider important in

evaluating Danimer’s performance.

Danimer compensates for these limitations by providing

disclosure of the differences between Adjusted EBITDA, Adjusted

gross profit and Adjusted gross margin and GAAP results, including

providing a reconciliation to GAAP results, to enable investors to

perform their own analysis of Danimer’s operating results. Because

GAAP financial measures on a forward-looking basis are not

accessible, and reconciling information is not available without

unreasonable effort, reconciliations to GAAP financial measures are

not provided for forward-looking non-GAAP measures. For the same

reasons, the Company is unable to address the probable significance

of the unavailable information, which could be material to future

results.

Danimer Scientific,

Inc.

Reconciliation of Adjusted

EBITDA to Net Loss (Unaudited)

Three Months Ended June

30,

2024

2023

(in thousands)

Net loss

$

(22,661

)

$

(39,241

)

Interest, net

9,072

9,162

Depreciation and amortization

7,438

7,173

(Gain) loss on remeasurement of warrants

(5,742

)

(1,083

)

Transaction and other related

807

-

Strategic reorganization and related

738

28

Litigation and other legal related

280

37

Stock-based compensation

199

13,666

Income taxes

2

(61

)

Loss on extinguishment of debt

-

102

Adjusted EBITDA

$

(9,867

)

$

(10,217

)

Reconciliation of Adjusted

Gross Profit to Gross Profit (Unaudited)

Three Months Ended June

30,

2024

2023

(in thousands) Total revenue

$

7,628

$

12,865

Cost of revenue

14,531

19,433

Gross profit

(6,903

)

(6,568

)

Depreciation

5,105

4,934

Stock-based compensation

3

2

Adjusted gross profit

$

(1,795

)

$

(1,632

)

Adjusted gross margin

(23.5

%)

(12.7

%)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808243882/en/

Investor Relations and Media Blake Chamblee Phone:

770-337-6570 ir@danimer.com

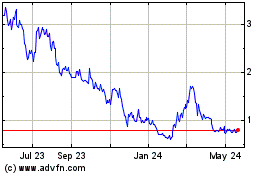

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

From Nov 2024 to Dec 2024

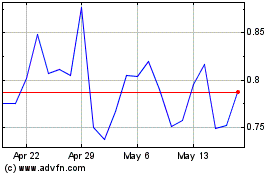

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

From Dec 2023 to Dec 2024