Owens Corning (NYSE: OC), a leader in global building and

construction materials, and Masonite International Corporation

(“Masonite”) (NYSE: DOOR), a leading global provider of interior

and exterior doors and door systems, today announced that Owens

Corning has commenced an offer to purchase for cash (the “Tender

Offer”) any and all outstanding 5.375% Senior Notes due 2028 issued

by Masonite (the “Masonite Notes”) in connection with Owens

Corning’s anticipated acquisition of Masonite. In conjunction with

the Tender Offer, Masonite is soliciting consents (the “Consent

Solicitation”) to adopt certain proposed amendments to the

indenture governing the Masonite Notes (the “Masonite Indenture”)

to eliminate certain of the covenants, restrictive provisions and

events of default from such indenture (collectively, the “Proposed

Amendments”).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240415184047/en/

The following table sets forth the amount of the Tender Offer

Consideration, Early Participation Payment, and Total Consideration

(each as defined below) for the Masonite Notes:

Per $1,000 Principal

Amount

Title of Series

CUSIP /

ISIN Nos.

of

Masonite Notes

Aggregate

Principal

Amount

Outstanding

Tender Offer

Consideration(1)

Early

Participation

Payment(2)

Total

Consideration(1)(3)

5.375% Senior

Notes due 2028

144A CUSIP:

575385AD1 144A ISIN:

US575385AD19 Reg. S CUSIP:

C5389UAL4 Reg. S ISIN:

USC5389UAL47

$500,000,000

$973.75

$30.00

$1,003.75

_______________________

(1)

Excludes accrued and unpaid interest to,

but not including, the applicable Settlement Date (as defined

below), which will be paid in addition to the Tender Offer

Consideration.

(2)

In order to be eligible to receive the

early participation payment set out in the table above (the “Early

Participation Payment”), Holders (as defined below) must validly

tender their Masonite Notes and deliver their related consents at

or prior to the Early Participation Deadline (as defined

below).

(3)

Includes the Tender Offer Consideration

and the Early Participation Payment.

Owens Corning and Masonite are making the Tender Offer and

Consent Solicitation pursuant to the terms of and subject to the

conditions set forth in the offer to purchase and consent

solicitation statement dated April 15, 2024 (the “Statement”).

For each $1,000 principal amount of Masonite Notes validly

tendered at or before 5:00 p.m., New York City time, on May 13,

2024, unless extended or terminated (such date and time, as the

same may be extended, the “Expiration Time”), and not validly

withdrawn, holders of Masonite Notes (collectively, the “Holders”)

will be eligible to receive the tender offer consideration set out

in the table above (the “Tender Offer Consideration”). Masonite

Notes that have been validly tendered may be withdrawn at any time

prior to 5:00 p.m., New York City time, on April 26, 2024, unless

extended or terminated (such date and time, as the same may be

extended, the “Withdrawal Deadline”). However, to be eligible to

receive the Tender Offer Consideration, such withdrawn Masonite

Notes must be validly re-tendered and not validly withdrawn prior

to the Expiration Time. Holders that validly tender and deliver

(and do not validly withdraw and revoke) their Masonite Notes and

related consents at or prior to 5:00 p.m., New York City Time, on

April 26, 2024, unless extended or terminated (such date and time,

as the same may be extended, the “Early Participation Deadline”)

and whose Masonite Notes are accepted for purchase by Owens Corning

will be entitled to receive the Tender Offer Consideration and

Early Participation Payment (collectively, the “Total

Consideration”) on the applicable Settlement Date. Holders that

validly tender and deliver (and do not validly withdraw and revoke)

their Masonite Notes and related consents after the Early

Participation Deadline but at or prior to the Expiration Time and

whose Masonite Notes are accepted for purchase by Owens Corning

will be entitled only to the Tender Offer Consideration. In

addition to the Total Consideration or Tender Offer Consideration,

as applicable, tendering Holders whose Masonite Notes are accepted

for purchase pursuant to the Tender Offer will receive accrued and

unpaid interest from the last interest payment date with respect to

the Masonite Notes to, but not including, the applicable Settlement

Date.

Holders may not deliver consents to the Proposed Amendments in

the Consent Solicitation without tendering Masonite Notes in the

Tender Offer, and may not tender Masonite Notes in the Tender Offer

without delivering consents to the Proposed Amendments in the

Consent Solicitation.

The “Early Settlement Date” will be, at Owens Corning’s option,

any time after the Early Participation Deadline and prior to the

Expiration Time, subject to the satisfaction or waiver of all

conditions to consummation of the Tender Offer and the Consent

Solicitation, including the consummation of the Arrangement (as

defined below). The “Final Settlement Date” will be promptly after

the Expiration Time. We refer to the Early Settlement Date and the

Final Settlement Date as the “Settlement Date,” as applicable.

To the extent any Masonite Notes are not tendered and accepted

for purchase pursuant to the Tender Offer, Owens Corning or

Masonite may purchase any outstanding Masonite Notes in the open

market, in privately negotiated transactions, through one or more

additional tender or exchange offers, by redemption or

otherwise.

Masonite is soliciting consents from the Holders (i) to the

Proposed Amendments to eliminate certain covenants, restrictive

provisions and events of default applicable to the Masonite Notes

and (ii) to the execution and delivery of a supplemental indenture

to the Masonite Indenture, containing the Proposed Amendments. The

consent of the Holders of a majority of the outstanding aggregate

principal amount of the Masonite Notes will be required to give

effect to the Proposed Amendments.

The Tender Offer and Consent Solicitation are conditioned upon,

among other conditions, the consummation of the pending acquisition

of Masonite by Owens Corning pursuant to the Arrangement Agreement,

dated as of February 8, 2024 (as it may be amended, the

“Arrangement Agreement”), by and among Owens Corning, MT

Acquisition Co ULC, a wholly owned subsidiary of Owens Corning

(“Purchaser”), and Masonite, which condition cannot be waived.

Subject to the terms and conditions of the Arrangement Agreement,

Purchaser will acquire all of the issued and outstanding common

shares of Masonite (the “Arrangement”). The consummation of the

Arrangement is not conditioned upon the successful closing of the

Tender Offer or Consent Solicitation.

Owens Corning has engaged Morgan Stanley & Co. LLC as Lead

Dealer Manager and Solicitation Agent and Wells Fargo Securities,

LLC as Co-Dealer Manager and Solicitation Agent for the Tender

Offer. Copies of the Statement may be obtained from Global

Bondholder Services Corporation, the Depositary and Information

Agent, by phone at (855) 654-2015 (toll-free) or (212) 430-3774

(collect for banks and brokers) or by email at

contact@gbsc-usa.com. Please direct questions regarding the Tender

Offer to Morgan Stanley & Co. LLC at (800) 624-1808 (toll-free)

or (212) 761-1057 (collect for banks and brokers).

About Owens Corning

Owens Corning is a global building and construction materials

leader committed to building a sustainable future through material

innovation. Our three integrated businesses – Roofing, Insulation,

and Composites – provide durable, sustainable, energy-efficient

solutions that leverage our unique material science, manufacturing,

and market knowledge to help our customers win and grow. We are

global in scope, human in scale with approximately 18,000 employees

in 30 countries dedicated to generating value for our customers and

shareholders and making a difference in the communities where we

work and live. Founded in 1938 and based in Toledo, Ohio, USA,

Owens Corning posted 2023 sales of $9.7 billion.

About Masonite

Masonite is a leading global designer, manufacturer, marketer

and distributor of interior and exterior doors and door systems for

the new construction and repair, renovation and remodeling sectors

of the residential and non-residential building construction

markets. Since 1925, Masonite has provided its customers with

innovative products and superior service at compelling values.

Masonite currently serves approximately 7,000 customers

globally.

Forward-Looking Statements

This communication contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements present our current forecasts and estimates of future

events. These statements do not strictly relate to historical or

current results and can be identified by words such as

“anticipate,” “appear,” “assume,” “believe,” “estimate,” “expect,”

“forecast,” “intend,” “likely,” “may,” “plan,” “project,” “seek,”

“should,” “strategy,” “will,” “can,” “could,” “predict,” “future,”

“potential,” “intend,” “forecast,” “look,” “build,” “focus,”

“create,” “work,” “continue,” “target,” “poised,” “advance,”

“drive,” “aim,” “approach,” “seek,” “schedule,” “position,”

“pursue,” “progress,” “budget,” “outlook,” “trend,” “guidance,”

“commit,” “on track,” “objective,” “goal,” “opportunity,”

“ambitions,” “aspire” and variations of negatives of such terms or

variations thereof. Other words and terms of similar meaning or

import in connection with any discussion of future plans, actions,

events or operating, financial or other performance identify

forward-looking statements.

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain, such as statements regarding

the transactions contemplated by the Arrangement Agreement,

including the Arrangement (the “Transaction”), including the

expected time period to consummate the Transaction, the anticipated

benefits (including synergies) of the Transaction and integration

and transition plans, opportunities, anticipated future

performance, expected share buyback programs and expected

dividends. All such forward-looking statements are based upon

current plans, estimates, expectations and ambitions that are

subject to risks, uncertainties, assumptions and other factors,

many of which are beyond the control of Masonite and Owens Corning,

that could cause actual results to differ materially from the

results projected in such forward-looking statements. These risks,

uncertainties, assumptions and other factors include, without

limitation: the expected timing and structure of the Transaction;

the ability of the parties to complete the Transaction; the

expected benefits of the Transaction, such as improved operations,

enhanced revenues and cash flow, synergies, growth potential,

market profile, business plans, expanded portfolio and financial

strength; the timing, receipt and terms and conditions of any

required governmental, court and regulatory approvals of the

Transaction; the ability of Owens Corning to successfully integrate

the operations of Masonite and to achieve expected synergies; cost

reductions and/or productivity improvements, including the risk

that problems may arise which may result in the combined company

not operating as effectively and efficiently as expected; the

occurrence of any event, change or other circumstances that could

give rise to the termination of the Arrangement Agreement; the

possibility that Masonite’s shareholders may not approve the

Transaction; the risk that the anticipated tax treatment of the

Transaction is not obtained; the risk that the parties may not be

able to satisfy the conditions to the Transaction in a timely

manner or at all; risks related to disruption of management time

from ongoing business operations due to the Transaction; the risk

that any announcements relating to the Transaction could have

adverse effects on the market price of Masonite’s or Owens

Corning’s common shares; the risk that the Transaction and its

announcement could have an adverse effect on the parties’ business

relationships and businesses generally, including the ability of

Masonite and Owens Corning to retain customers and retain and hire

key personnel and maintain relationships with their suppliers and

customers, and on their operating results and businesses generally;

unexpected future capital expenditures; potential litigation

relating to the Transaction that could be instituted against

Masonite and/or Owens Corning or their respective directors and/or

officers; third party contracts containing material consent,

anti-assignment, transfer or other provisions that may be related

to the Transaction which are not waived or otherwise satisfactorily

resolved; the competitive ability and position of Owens Corning

following completion of the Transaction; legal, economic and

regulatory conditions, and any assumptions underlying any of the

foregoing; levels of residential and commercial or industrial

construction activity; demand for Masonite and Owens Corning

products; industry and economic conditions including, but not

limited to, supply chain disruptions, recessionary conditions,

inflationary pressures, interest rate and financial market

volatility and the viability of banks and other financial

institutions; availability and cost of energy and raw materials;

levels of global industrial production; competitive and pricing

factors; relationships with key customers and customer

concentration in certain areas; issues related to acquisitions,

divestitures and joint ventures or expansions; various events that

could disrupt operations, including climate change, weather

conditions and storm activity such as droughts, floods, avalanches

and earthquakes, cybersecurity attacks, security threats and

governmental response to them, and technological changes;

legislation and related regulations or interpretations, in the

United States or elsewhere; domestic and international economic and

political conditions, policies or other governmental actions, as

well as war and civil disturbance; changes to tariff, trade or

investment policies or laws; uninsured losses, including those from

natural disasters, catastrophes, pandemics, theft or sabotage;

environmental, product-related or other legal and regulatory

unforeseen or unknown liabilities, proceedings or actions; research

and development activities and intellectual property protection;

issues involving implementation and protection of information

technology systems; foreign exchange and commodity price

fluctuations; levels of indebtedness, liquidity and the

availability and cost of credit; rating agency actions and

Masonite’s and Owens Corning’s ability to access short- and

long-term debt markets on a timely and affordable basis; the level

of fixed costs required to run Masonite’s and Owens Corning’s

businesses; levels of goodwill or other indefinite-lived intangible

assets; labor disputes or shortages, changes in labor costs and

labor difficulties; effects of industry, market, economic, legal or

legislative, political or regulatory conditions outside of

Masonite’s or Owens Corning’s control; and other factors detailed

from time to time in Masonite’s and Owens Corning’s SEC

filings.

All forward-looking statements in this communication should be

considered in the context of the risks and other factors described

above and in the specific factors discussed under the heading “Risk

Factors” in both Masonite’s and Owens Corning’s most recent Annual

Report on Form 10-K filed with the SEC, in each case as these risk

factors are amended or supplemented by subsequent Quarterly Reports

on Form 10-Q and Current Reports on Form 8-K. Masonite’s reports

that are filed with the SEC are available on Masonite’s website at

https://investor.masonite.com/ and on the SEC’s website at

http://www.sec.gov, and Owens Corning’s reports that are filed with

the SEC are available on Owens Corning’s website at

https://investor.owenscorning.com/investors and on the SEC website

at http://www.sec.gov. Any forward-looking statements speak only as

of the date the statement is made and neither Owens Corning nor

Masonite undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. It is not

possible to identify all of the risks, uncertainties and other

factors that may affect future results. In light of these risks and

uncertainties, the forward-looking events and circumstances

discussed herein may not occur and actual results may differ

materially from those anticipated or implied in the forward-looking

statements. Accordingly, readers are cautioned not to place undue

reliance on any forward-looking statements.

No Offer or Solicitation

This communication is not intended to and does not constitute an

offer to purchase, or the solicitation of an offer to sell, or the

solicitation of tenders or consents with respect to any security.

No offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation, or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. In the case of the Tender

Offer and Consent Solicitation, the Tender Offer and Consent

Solicitation are being made solely pursuant to the Statement and

only to such persons and in such jurisdictions as is permitted

under applicable law.

Owens Corning Company News / Owens Corning Investor Relations

News

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240415184047/en/

Owens Corning Amber Wohlfarth VP, Corporate Affairs &

Investor Relations amber.wohlfarth@owenscorning.com

419.248.5639

Megan James Director, Media Relations

megan.james@owenscorning.com 419.348.0768

Masonite Richard Leland VP, Finance and Treasurer

rleland@masonite.com 813.739.1808

Marcus Devlin Director, Investor Relations mdevlin@masonite.com

813.371.5839

Tali Epstein/ Jim Golden/ Jude Gorman Collected Strategies

Masonite-CS@collectedstrategies.com

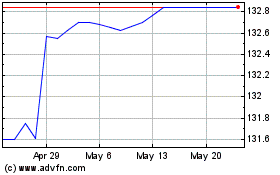

Masonite (NYSE:DOOR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Masonite (NYSE:DOOR)

Historical Stock Chart

From Jan 2024 to Jan 2025