0001289308false00012893082022-08-102022-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2024

EnerSys

(Exact name of registrant as specified in its charter)

Commission File Number: 1-32253

| | | | | | | | |

| | |

| Delaware | | 23-3058564 |

(State or other jurisdiction

of incorporation) | | (IRS Employer

Identification No.) |

2366 Bernville Road, Reading, Pennsylvania 19605

(Address of principal executive offices, including zip code)

(610) 208-1991

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | ENS | | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). | ☐ |

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02. Results of Operations and Financial Condition

On November 6, 2024, EnerSys issued an earnings press release discussing its financial results for the second quarter of fiscal 2025. The press release, attached as Exhibit 99.1 hereto and incorporated herein by reference, is being furnished to the SEC and shall not be deemed to be "filed" for any purpose.

Item 8.01. Other Events

On November 6, 2024, EnerSys issued a press release announcing that its Board of Directors has declared a quarterly cash dividend of $0.24 per share of common stock payable on December 27, 2024, to holders of record as of December 13, 2024. The press release, attached hereto as Exhibit 99.2, is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | |

| 99.1 | | | |

| | | |

| 99.2 | | | |

| | | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | | |

Signature(s)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | |

| | | |

| | EnerSys | |

| | | |

Date: November 6, 2024 | By: | /s/ Andrea J. Funk | |

| | Andrea J. Funk | |

| | Chief Financial Officer | |

| | | |

| | | |

| | | |

| | | |

Exhibit 99.1 PRESS RELEASE, DATED NOVEMBER 6, 2024, OF ENERSYS REGARDING FINANCIAL

RESULTS FOR THE SECOND QUARTER FISCAL 2025

ENERSYS REPORTS SECOND QUARTER FISCAL 2025 RESULTS

DELIVERS GROSS MARGIN OF 28.5%, UP 190 BASIS POINTS FROM PRIOR YEAR

Second Quarter Fiscal 2025 Highlights

(All comparisons against the second quarter of fiscal year 2024 unless otherwise noted)

•Delivered net sales of $884M, down 2%, with strength in Motive Power offset by continued pressure in Communications and Class 8 Transportation

•Energy Systems improving with net sales +6% sequentially and backlog increasing for the second consecutive quarter

•Achieved GM of 28.5%, +190 bps, including increased benefits from Inflation Reduction Act / IRC 45X tax credits, +60 bps ex IRA

•Realized diluted EPS of $2.01, +29%, and adjusted diluted EPS(1) of $2.12, +15%

•Net leverage ratio(a) 1.6 X EBITDA on operating cash flow of $34M

•Selected for $199M Department of Energy award negotiation to partially fund EnerSys’ planned lithium-ion cell production facility in Greenville, SC

•Published Climate Action Plan Roadmap, outlining Company's strategic plans to achieve carbon neutrality goals

•Announced planned executive succession; David Shaffer to retire as CEO, Shawn O’Connell named successor

READING, Pa., November 6, 2024 (BUSINESS WIRE) -- EnerSys (NYSE: ENS), the global leader in stored energy solutions for industrial applications, announced today results for its second quarter of fiscal 2025, which ended on September 29, 2024.

In the second quarter, EnerSys delivered revenue and EPS which were in line with our guidance ranges and demonstrated our ability to generate strong and accelerating financial results in an uncertain market environment through our balanced business portfolio.

Energy Systems achieved sequential performance improvement, albeit with continued softness in Communications end markets, with the results of our optimization initiatives flowing through to the bottom line. We saw higher order trends in Communications and Data Centers in the Americas, providing optimism in the market recovery momentum. Motive Power delivered record Q2 adjusted operating earnings, with volumes and margins increasing versus the prior year on consistent customer demand in Logistics and Warehousing, and ongoing customer enthusiasm for our maintenance-free offerings.

Specialty enjoyed excellent A&D results supplemented by the accretive impact of the Bren-Tronics acquisition which expands our lithium portfolio and presence in the defense market. Integration and results are exceeding our expectations. Although we grew our U.S. Transportation aftermarket volume, we were not able to offset the sluggish Class 8 truck OEM demand. The installation of our new production lines in Missouri are on track and will deliver improved productivity, capacity, and flexibility when Transportation and Communications market demand returns to normalized levels. In New Ventures, we installed our first Fast Charge & Storage (FC&S) system in September.

We were very pleased to announce during the quarter that we were selected for a $199 million award negotiation from the Department of Energy to partially fund our planned lithium gigafactory, and that we have received formal approval from our Board to proceed with this important project. We are currently finalizing award negotiations and our construction plans, conducting an environmental study, completing our supply chain selections, and hiring for strategic positions.

While we expect that market uncertainty will persist through the coming months, we are confident our second half of the fiscal year is on track to outperform the first half. We are bullish about our strong position as a leading provider of energy storage solutions as we continue to deliver innovative products and services in growing end markets where the need for access to reliable power is increasing exponentially. We remain focused on delivering profitable long-term growth for our shareholders.

David M. Shaffer, Chief Executive Officer, EnerSys

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Key Financial Results and Metrics | Second quarter ended | | | Six months ended |

In millions, except per share amounts | September 29, 2024 | | October 1, 2023 | | Change | | | September 29, 2024 | | October 1, 2023 | | Change |

| Net Sales | $ | 883.7 | | | $ | 901.0 | | | (1.9) | % | | | $ | 1,736.6 | | | $ | 1,809.6 | | | (4.0) | % |

| Diluted EPS (GAAP) | $ | 2.01 | | | $ | 1.56 | | | $ | 0.45 | | | | $ | 3.72 | | | $ | 3.17 | | | $ | 0.55 | |

Adjusted Diluted EPS (Non-GAAP)(1) | $ | 2.12 | | | $ | 1.84 | | | $ | 0.28 | | | | $ | 4.09 | | | $ | 3.72 | | | $ | 0.37 | |

| Gross Profit (GAAP) | $ | 252.1 | | | $ | 239.6 | | | $ | 12.5 | | | | $ | 490.5 | | | $ | 479.9 | | | $ | 10.6 | |

| | | | | | | | | | | | |

| Operating Earnings (GAAP) | $ | 99.4 | | | $ | 88.6 | | | $ | 10.8 | | | | $ | 190.7 | | | $ | 178.0 | | | $ | 12.7 | |

Adjusted Operating Earnings (Non-GAAP)(2) | $ | 114.6 | | | $ | 103.5 | | | $ | 11.1 | | | | $ | 220.3 | | | $ | 210.7 | | | $ | 9.6 | |

| Net Earnings (GAAP) | $ | 82.3 | | | $ | 65.2 | | | $ | 17.1 | | | | $ | 152.4 | | | $ | 132.0 | | | $ | 20.4 | |

EBITDA (Non-GAAP)(3) | $ | 122.0 | | | $ | 108.2 | | | $ | 13.8 | | | | $ | 235.8 | | | $ | 219.5 | | | $ | 16.3 | |

Adjusted EBITDA (Non-GAAP)(3) | $ | 129.0 | | | $ | 116.4 | | | $ | 12.6 | | | | $ | 250.3 | | | $ | 238.5 | | | $ | 11.8 | |

| Share Repurchases | $ | 63.5 | | | $ | 47.3 | | | $ | 16.2 | | | | $ | 75.1 | | | $ | 47.3 | | | $ | 27.8 | |

| Dividend per share | $ | 0.24 | | $ | 0.225 | | | $ | 0.02 | | | | $ | 0.465 | | | $ | 0.40 | | | $ | 0.07 | |

| Total Capital Returned to Stockholders | $ | 73.1 | | | $ | 56.5 | | | $ | 16.6 | | | | $ | 93.8 | | | $ | 63.7 | | | $ | 30.1 | |

(a) Net leverage ratio is a non-GAAP financial measure as defined pursuant to our credit agreement and discussed under Reconciliations of GAAP to Non-GAAP Financial Measures.

(1) Adjusted Diluted EPS is a non-GAAP financial measure and discussed under Reconciliations of GAAP to Non-GAAP Financial Measures.

(2) Operating Earnings are adjusted for charges that the Company incurs as a result of restructuring and exit activities, impairment of goodwill and indefinite-lived intangibles and other assets, acquisition activities and those charges and credits that are not directly related to operating unit performance. A reconciliation of operating earnings to Non-GAAP Adjusted Earnings are provided in tables under the section titled Business Segment Operating Results.

(3) Non-GAAP EBITDA is calculated as net earnings adjusted for depreciation, amortization, interest and income taxes. Non-GAAP Adjusted EBITDA is further adjusted for certain charges such as restructuring and exit activities, impairment of goodwill and indefinite-lived intangibles and other assets, acquisition activities and other charges and credits as discussed under Reconciliations of GAAP to Non-GAAP Financial Measures.

Summary of Results

Second Quarter 2025

Net sales for the second quarter of fiscal 2025 were $883.7 million, a decrease of 1.9% from the prior year second quarter net sales of $901.0 million, and in the range of the second quarter of fiscal 2025 guidance of $880 million to $920 million. The decrease compared to prior year quarter was the result of a 3% decrease in organic volume, a 1% decrease in pricing, partially offset by a 2% increase in acquisitions.

Net earnings attributable to EnerSys stockholders (“Net earnings”) for the second quarter of fiscal 2025 was $82.3 million, or $2.01 per diluted share, which included an unfavorable highlighted net of tax impact of $4.2 million, or $0.11 per diluted share, from highlighted items described in further detail in the tables shown below, reconciling non-GAAP adjusted financial measures to reported amounts.

Net earnings for the second quarter of fiscal 2024 was $65.2 million, or $1.56 per diluted share, which included an unfavorable highlighted net of tax impact of $11.3 million, or $0.28 per diluted share, from highlighted items described in further detail in the tables shown below, reconciling non-GAAP adjusted financial measures to reported amounts.

Excluding these highlighted items, adjusted Net earnings per diluted share for the second quarter of fiscal 2025, on a non-GAAP basis, were $2.12, compared to the guidance of $2.05 to $2.15 per diluted share for the second quarter given by the Company on August 7, 2024. These earnings compare to the prior year second quarter adjusted Net earnings of $1.84 per diluted share. Please refer to the section included herein under the heading “Reconciliations of GAAP to Non-GAAP Financial Measures” for a discussion of the Company’s use of non-GAAP adjusted financial information, which includes tables reconciling GAAP and non-GAAP adjusted financial measures for the quarters ended September 29, 2024 and October 1, 2023.

Fiscal Year to Date 2025

Net sales for the six months of fiscal 2025 were $1,736.6 million, a decrease of 4.0% from the prior year six months net sales of $1,809.6 million. This decrease was due to a 3% decrease in organic volume, a 1% decrease in pricing, and a 1% decrease in foreign currency translation, partially offset by a 1% increase in acquisitions.

Net earnings for the six months of fiscal 2025 was $152.4 million, or $3.72 per diluted share, which included an unfavorable highlighted net of tax impact of $15.0 million, or $0.37 per diluted share, from highlighted items described in further detail in the tables shown below, reconciling non-GAAP adjusted financial measures to reported amounts.

Net earnings for the six months of fiscal 2024 was $132.0 million, or $3.17 per diluted share, which included an unfavorable highlighted net of tax impact of $23.1 million, or $0.55 per diluted share, from highlighted items described in further detail in the tables shown below, reconciling non-GAAP adjusted financial measures to reported amounts.

Adjusted Net earnings per diluted share for the six months of fiscal 2025, on a non-GAAP basis, were $4.09. This compares to the prior year six months adjusted Net earnings of $3.72 per diluted share. Please refer to the section included herein under the heading “Reconciliations of GAAP to Non-GAAP Financial Measures” for a discussion of the Company’s use of non-GAAP adjusted financial information.

Quarterly Dividend

The company announced today that its Board of Directors has declared a quarterly cash dividend of $0.24 per share of common stock payable on December 27, 2024, to holders of record as of December 13, 2024.

Balance Sheet and Cash Flow

As of September 29, 2024, cash and cash equivalents were $407.9 million and net debt was $839.6 million. The net leverage ratio at the end of the second quarter was 1.6 X, up from 1.4 X in the prior year period. Capital expenditures during the second quarter were $30.4 million, up from $19.8 million in the prior year period, driven by investments in plant improvements. During the second quarter, cash from operating activities was $33.6 million and free cash flow was $3.2 million.

The Company also returned approximately $73.1 million to shareholders through $63.5 million in share repurchases and $9.6 million through its quarterly dividend payment in the second quarter.

Third Quarter and Full Year 2025 Outlook

In the third quarter of fiscal 2025, EnerSys expects:

•Net sales in the range of $920M to $960M

•Adjusted diluted earnings per share in the range of $2.20 to $2.30*

For the full year fiscal 2025, EnerSys expects:

•Net sales in the range of $3,675 to $3,765M, down from prior guidance of $3,735M to $3,885M

•Adjusted diluted earnings per share in the range of $8.75 to $9.05*, down from prior guidance of $8.80 to $9.20*

•Capital expenditures in the range of $100M to $120M

"While we are seeing encouraging demand trends in the majority of our end markets, including improving order rates in the Communications and Data Center markets and stable trends in our Motive Power and A&D businesses, we are managing our business prudently to navigate the continued spending pause in the Class 8 truck OEM market and near-term macro uncertainty. We are excited about our progress in New Ventures, delivering our first Fast Charge and Storage (FC&S) system at the end of the second quarter, but deployment schedules have been pushed out due to installation and site readiness challenges. As a result, we are modestly lowering our revenue range for our full year fiscal 2025. As we enter the second half of the year, we expect the profitability of our baseline business to deliver accelerating returns, driven by improving volumes, favorable product mix, the accretive contribution of Bren-Tronics, continued cost improvements, and benefits from operational efficiencies flowing through to our bottom line. We are excited to advance the next phase of our lithium-ion gigafactory in Greenville and expect to incur modest related non-capitalizable expenses in the second half of the year as we move forward with this strategic project. As a result, we are slightly lowering the mid-point of our full year fiscal 2025 adjusted diluted earnings per share guidance by $0.10 to account for these increased expenditures. We believe the global concern over energy scarcity will persist as major trends drive a swift rise in the demand for reliable power. As a key provider of energy systems and storage solutions, EnerSys is well-positioned to take advantage of this growth opportunity. We remain focused on delivering long-term value to our stockholders," said Andrea Funk, EnerSys Chief Financial Officer.

*Inclusive of IRC 45X tax benefits created with the IRA.

Please refer to the section included herein under the heading “Reconciliations of GAAP to Non-GAAP Financial Measures” for a discussion of the Company’s use of non-GAAP adjusted financial information.

Conference Call and Webcast Details

The Company will host a conference call to discuss its second quarter results at 9:00 AM (ET) Thursday, November 7, 2024. A live broadcast as well as a replay of the call can be accessed via https://edge.media-server.com/mmc/p/2h25g7rf/ or the Investor Relations section of the company’s website at https://investor.enersys.com.

To join the live call, please register at https://register.vevent.com/register/BI1012cc0b2b4144b9b4ee866d5476e344. A dial-in and unique PIN will be provided upon registration.

About EnerSys

EnerSys is the global leader in stored energy solutions for industrial applications and designs, manufactures and distributes energy systems solutions and motive power batteries, specialty batteries, battery chargers, power equipment, battery accessories and outdoor equipment enclosure solutions to customers worldwide. The company goes to market through four lines of business: Energy Systems, Motive Power, Specialty and New Ventures. Energy Systems, which combine power conversion, power distribution, energy storage, and enclosures, are used in the telecommunication, broadband, and utility industries, uninterruptible power supplies, and numerous applications requiring stored energy solutions. Motive power batteries and chargers are utilized in electric forklift trucks and other industrial electric powered vehicles. Specialty batteries are used in aerospace and defense applications, portable power solutions for soldiers in the field, large over-the-road trucks, premium automotive, medical and security systems applications. New Ventures provides energy storage and management systems for various applications including demand charge reduction, utility back-up power, and dynamic fast charging for electric vehicles. EnerSys also provides aftermarket and customer support services to its customers in over 100 countries through its sales and manufacturing locations around the world. To learn more about EnerSys please visit https://www.enersys.com/en/.

Sustainability

Sustainability at EnerSys is about more than just the benefits and impacts of our products. Our commitment to sustainability encompasses many important environmental, social and governance issues. Sustainability is a fundamental part of how we manage our own operations. Minimizing our environmental footprint is a priority. Sustainability is our commitment to our employees, our customers and the communities we serve. Our products facilitate positive environmental, social, and economic impacts around the world. To learn more visit: https://www.enersys.com/en/about-us/sustainability/.

Caution Concerning Forward-Looking Statements

This press release, and oral statements made regarding the subjects of this release, contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, or the Reform Act, which may include, but are not limited to, statements regarding EnerSys’ earnings estimates, intention to pay quarterly cash dividends, return capital to stockholders, plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts, including statements identified by words such as “believe,” “plan,” “seek,” “expect,” “intend,” “estimate,” “anticipate,” “will,” and similar expressions. All statements addressing operating performance, events, or developments that EnerSys expects or anticipates will occur in the future, including statements relating to sales growth, earnings or earnings per share growth, order intake, backlog, payment of future cash dividends, commodity prices, execution of its stock buyback program, judicial or regulatory proceedings, ability to identify and realize benefits in connection with acquisition and disposition opportunities, and market share, as well as statements expressing optimism or pessimism about future operating results or benefits from its cash dividend, its stock buyback programs, application of Section 45X of the Internal Revenue Code, future responses to and effects of the pandemic, adverse developments with respect to the economic conditions in the U.S. in the markets in which we operate and other uncertainties, including the impact of supply chain disruptions, interest rate changes, inflationary pressures, geopolitical and other developments and labor shortages on the economic recovery and our business are forward-looking statements within the meaning of the Reform Act. The forward-looking statements are based on management's current views and assumptions regarding future events and operating performance, and are inherently subject to significant business, economic, and competitive uncertainties and contingencies and changes in circumstances, many of which are beyond the Company’s control. The statements in this press release are made as of the date of this press release, even if subsequently made available by EnerSys on its website or otherwise. EnerSys does not undertake any obligation to update or revise these statements to reflect events or circumstances occurring after the date of this press release.

Although EnerSys does not make forward-looking statements unless it believes it has a reasonable basis for doing so, EnerSys cannot guarantee their accuracy. The foregoing factors, among others, could cause actual results to differ materially from those

described in these forward-looking statements. For a list of other factors which could affect EnerSys’ results, including earnings estimates, see EnerSys’ filings with the Securities and Exchange Commission, including “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations,” and “Forward-Looking Statements,” set forth in EnerSys’ Annual Report on Form 10-K for the fiscal year ended March 31, 2024. No undue reliance should be placed on any forward-looking statements.

CONTACT

Lisa Hartman

Vice President, Investor Relations and Corporate Communications

EnerSys

610-236-4040

E-mail: investorrelations@enersys.com

EnerSys

Consolidated Condensed Statements of Income (Unaudited)

(In millions, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Six months ended |

| September 29, 2024 | | October 1, 2023 | | September 29, 2024 | | October 1, 2023 |

| Net sales | $ | 883.7 | | | $ | 901.0 | | | $ | 1,736.6 | | | $ | 1,809.6 | |

| Gross profit | 252.1 | | | $ | 239.6 | | | $ | 490.5 | | | $ | 479.9 | |

| Operating expenses | 150.5 | | | $ | 143.8 | | | $ | 291.7 | | | $ | 288.4 | |

| Restructuring and other exit charges | 2.2 | | | $ | 7.2 | | | $ | 8.1 | | | $ | 13.5 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating earnings | 99.4 | | | $ | 88.6 | | | $ | 190.7 | | | $ | 178.0 | |

| Earnings before income taxes | 84.2 | | | $ | 73.4 | | | $ | 163.5 | | | $ | 146.9 | |

| Income tax expense | 1.9 | | | $ | 8.2 | | | $ | 11.1 | | | $ | 14.9 | |

| Net earnings attributable to EnerSys stockholders | $ | 82.3 | | | $ | 65.2 | | | $ | 152.4 | | | $ | 132.0 | |

| | | | | | | |

| Net reported earnings per common share attributable to EnerSys stockholders: | | | | | | | |

Basic | $ | 2.05 | | | $ | 1.59 | | | $ | 3.79 | | | $ | 3.23 | |

Diluted | $ | 2.01 | | | $ | 1.56 | | | $ | 3.72 | | | $ | 3.17 | |

Dividends per common share | $ | 0.24 | | | $ | 0.225 | | | $ | 0.465 | | | $ | 0.40 | |

| Weighted-average number of common shares used in reported earnings per share calculations: | | | | | | | |

Basic | 40,165,080 | | | 40,922,959 | | | 40,184,546 | | | 40,930,146 | |

Diluted | 40,863,205 | | | 41,684,634 | | | 40,924,660 | | | 41,691,479 | |

EnerSys

Consolidated Condensed Balance Sheets (Unaudited)

(In Thousands, Except Share and Per Share Data)

| | | | | | | | | | | | | | |

| | September 29, 2024 | | March 31, 2024 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 407,919 | | | $ | 333,324 | |

Accounts receivable, net of allowance for doubtful accounts: September 29, 2024 - $8,808; March 31, 2024 - $8,107 | | 549,011 | | | 524,725 | |

| Inventories, net | | 763,516 | | | 697,698 | |

| Prepaid and other current assets | | 335,923 | | | 226,949 | |

| Total current assets | | 2,056,369 | | | 1,782,696 | |

| Property, plant, and equipment, net | | 582,298 | | | 532,450 | |

| Goodwill | | 738,603 | | | 682,934 | |

| Other intangible assets, net | | 395,411 | | | 319,407 | |

| Deferred taxes | | 55,090 | | | 49,798 | |

| Other assets | | 123,261 | | | 98,721 | |

| Total assets | | $ | 3,951,032 | | | $ | 3,466,006 | |

| Liabilities and Equity | | | | |

| Current liabilities: | | | | |

| Short-term debt | | $ | 30,080 | | | $ | 30,444 | |

| Accounts payable | | 333,671 | | | 369,456 | |

| Accrued expenses | | 328,687 | | | 323,957 | |

| Total current liabilities | | 692,438 | | | 723,857 | |

| Long-term debt, net of unamortized debt issuance costs | | 1,202,583 | | | 801,965 | |

| Deferred taxes | | 34,836 | | | 30,583 | |

| Other liabilities | | 179,579 | | | 152,529 | |

| Total liabilities | | 2,109,436 | | | 1,708,934 | |

| Commitments and contingencies | | | | |

| Equity: | | | | |

Preferred Stock, $0.01 par value, 1,000,000 shares authorized, no shares issued or outstanding at September 29, 2024 and at March 31, 2024 | | — | | | — | |

Common Stock, $0.01 par value per share, 135,000,000 shares authorized, 56,680,568 shares issued and 39,813,904 shares outstanding at September 29, 2024; 56,363,924 shares issued and 40,271,936 shares outstanding at March 31, 2024 | | 567 | | | 564 | |

| Additional paid-in capital | | 644,162 | | | 629,879 | |

Treasury stock at cost, 16,866,664 shares held as of September 29, 2024 and 16,091,988 shares held as of March 31, 2024 | | (910,650) | | | (835,827) | |

| Retained earnings | | 2,297,431 | | | 2,163,880 | |

| | | | |

| Accumulated other comprehensive loss | | (193,443) | | | (204,851) | |

| Total EnerSys stockholders’ equity | | 1,838,067 | | | 1,753,645 | |

| Nonredeemable noncontrolling interests | | 3,529 | | | 3,427 | |

| Total equity | | 1,841,596 | | | 1,757,072 | |

| Total liabilities and equity | | $ | 3,951,032 | | | $ | 3,466,006 | |

EnerSys

Consolidated Condensed Statements of Cash Flows (Unaudited)

(In Thousands)

| | | | | | | | | | | | | | |

| | | Six months ended |

| | | September 29, 2024 | | October 1, 2023 |

| Cash flows from operating activities | | | | |

| Net earnings | | $ | 152,377 | | | $ | 132,026 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 48,757 | | | 45,214 | |

| Write-off of assets relating to exit activities | | 244 | | | 4,146 | |

| | | | |

| | | | |

| Derivatives not designated in hedging relationships: | | | | |

| Net losses (gains) | | (1,783) | | | 1,204 | |

| Cash (settlements) proceeds | | 1,320 | | | 695 | |

| Provision for doubtful accounts | | 1,124 | | | 1,456 | |

| Deferred income taxes | | 114 | | | 46 | |

| Non-cash interest expense | | 969 | | | 820 | |

| Stock-based compensation | | 12,187 | | | 13,077 | |

| | | | |

| (Gain) loss on disposal of property, plant, and equipment | | 64 | | | 158 | |

| | | | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable | | (9,323) | | | 93,368 | |

| Inventories | | (12,401) | | | 10,529 | |

| Prepaid and other current assets | | (26,201) | | | (13,891) | |

| Other assets | | 968 | | | (1,306) | |

| Accounts payable | | (40,104) | | | (57,233) | |

| Accrued expenses | | (83,963) | | | (44,803) | |

| Other liabilities | | (303) | | | 217 | |

| Net cash provided by (used in) operating activities | | 44,046 | | | 185,723 | |

| | | | |

| Cash flows from investing activities | | | | |

| Capital expenditures | | (66,486) | | | (35,854) | |

| Purchase of business | | (205,276) | | | (8,270) | |

| | | | |

| | | | |

| Proceeds from disposal of property, plant, and equipment | | 89 | | | 2,007 | |

| Investment in Equity Securities | | (10,852) | | | — | |

| Net cash (used in) provided by investing activities | | (282,525) | | | (42,117) | |

| | | | |

| Cash flows from financing activities | | | | |

| Net (repayments) borrowings on short-term debt | | (434) | | | (61) | |

| Proceeds from Second Amended Revolver borrowings | | 476,600 | | | 172,500 | |

| | | | |

| Repayments of Second Amended Revolver borrowings | | (76,600) | | | (252,500) | |

| | | | |

| | | | |

| Repayments of Second and Third Amended Term Loans | | — | | | (12,736) | |

| | | | |

| | | | |

| Finance lease obligations | | (8) | | | — | |

| Option proceeds, net | | 7,445 | | | 9,668 | |

| Payment of taxes related to net share settlement of equity awards | | (7,984) | | | (7,348) | |

| Purchase of treasury stock | | (75,187) | | | (47,340) | |

| Issuance of treasury stock- ESPP | | 537 | | | — | |

| Dividends paid to stockholders | | (18,598) | | | (16,341) | |

| PPD Deferred Financing on Bond Issue-Legal Fees | | (351) | | | — | |

| Other | | (166) | | | 690 | |

| Net cash (used in) financing activities | | 305,254 | | | (153,468) | |

| Effect of exchange rate changes on cash and cash equivalents | | 7,820 | | | (9,052) | |

| Net decrease in cash and cash equivalents | | 74,595 | | | (18,914) | |

| Cash and cash equivalents at beginning of period | | 333,324 | | | 346,665 | |

| Cash and cash equivalents at end of period | | $ | 407,919 | | | $ | 327,751 | |

| | | | |

| | | | |

| | | | |

| | | | |

Reconciliations of GAAP to Non-GAAP Financial Measures

This press release contains financial information determined by methods other than in accordance with U.S. Generally Accepted Accounting Principles, ("GAAP"). EnerSys' management uses the non-GAAP measures “adjusted Net earnings”, “adjusted Diluted EPS”, “adjusted operating earnings”, "adjusted gross profit", "adjusted gross margin", "EBITDA", “adjusted EBITDA”, "adjusted EBITDA per credit agreement", "net debt", "net leverage ratio", "free cash flow", and "adjusted free cash flow conversion" as applicable, in their analysis of the Company's performance. Adjusted Net earnings, adjusted gross profit, adjusted gross margin, and adjusted operating earnings measures, as used by EnerSys in past quarters and years, adjusts Net earnings, gross profit, gross margin, and operating earnings determined in accordance with GAAP to reflect changes in financial results associated with the Company's restructuring initiatives and other highlighted charges and income items. Adjusted EBITDA is a key performance measure that our management uses to assess our operating performance. Because adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure as an overall assessment of our performance, to evaluate the effectiveness of our business strategies and for business planning purposes. We calculate adjusted EBITDA as net income before interest income, interest expense, other (income) expense net, provision (benefit) for income taxes, depreciation and amortization, further adjusted to exclude restructuring and exit activities, impairment of goodwill, indefinite-lived intangibles and other assets, acquisition activities and those charges and credits that are not directly related to operating unit performance. EBITDA is calculated as net income before interest income, interest expense, other (income) expense net, provision (benefit) for income taxes, depreciation and amortization. We define non-GAAP adjusted EBITDA per credit agreement as net earnings determined in accordance with GAAP for interest, taxes, depreciation and amortization, and certain charges or credits as permitted by our credit agreements, that were recorded during the periods presented. We define non-GAAP net debt as total debt, finance lease obligations and letters of credit, net of all cash and cash equivalents, as defined in the Fourth Amended Credit Facility on the balance sheet as of the end of the most recent fiscal quarter. We define non-GAAP net leverage ratio as non-GAAP net debt divided by last twelve months non-GAAP adjusted EBITDA per credit agreement. We define non-GAAP free cash flow as net cash provided by or used in operating activities less capital expenditures. We define non-GAAP adjusted free cash flow conversion as free cash flow divided by adjusted net earnings. Free cash flow and adjusted free cash flow conversion are used by investors, financial analysts, rating agencies and management to help evaluate the Company’s ability to generate cash to pursue incremental opportunities aimed toward enhancing shareholder value. Management believes the presentation of these financial measures reflecting these non-GAAP adjustments provides important supplemental information in evaluating the operating results of the Company as distinct from results that include items that are not indicative of ongoing operating results and overall business performance; in particular, those charges that the Company incurs as a result of restructuring activities, impairment of goodwill and indefinite-lived intangibles and other assets, acquisition activities and those charges and credits that are not directly related to operating unit performance, such as significant legal proceedings, amortization of intangible assets, tax valuation allowance changes, withholding tax from repatriation of prior period earnings, and impacts of changes or reform to income tax laws. Because these charges are not incurred as a result of ongoing operations, or are incurred as a result of a potential or previous acquisition, they are not as helpful a measure of the performance of our underlying business, particularly in light of their unpredictable nature and are difficult to forecast. Although we exclude the amortization of purchased intangibles from these non-GAAP measures, management believes that it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and contribute to revenue generation.

Income tax effects of non-GAAP adjustments are calculated using the applicable statutory tax rate for the jurisdictions in which the charges (benefits) are incurred, while taking into consideration any valuation allowances. For those items which are non-taxable, the tax expense (benefit) is calculated at 0%.

EnerSys does not provide a quantitative reconciliation of the Company’s projected range for adjusted diluted earnings per share for the third quarter and full year of fiscal 2025 to diluted earnings per share, which is the most directly comparable GAAP measure, in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. EnerSys' adjusted diluted earnings per share guidance for the third quarter and full year of fiscal 2025 excludes certain items, including but not limited to certain non-cash, large and/or unpredictable charges and benefits, charges from restructuring and exit activities, impairment of goodwill and indefinite-lived intangibles, acquisition and disposition activities, legal judgments, settlements, or other matters, and tax positions, that are inherently uncertain and difficult to predict, can be dependent on future events that are less capable of being controlled or reliably predicted by management and are not part of the Company's routine operating activities can be dependent on future events that are less capable of being controlled or reliably predicted by management and are not part of the Company's routine operating activities. Due to the uncertainty of the occurrence or timing of these future excluded items, management cannot accurately forecast many of these items for internal use and therefore cannot create a quantitative adjusted diluted earnings per share for the third quarter and full year of fiscal 2025 to diluted earnings per share reconciliation without unreasonable efforts.

These non-GAAP disclosures have limitations as an analytical tool, should not be viewed as a substitute for operating earnings, Net earnings or net income determined in accordance with GAAP, and should not be considered in isolation or as a substitute for analysis of the Company's results as reported under GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Management believes that this non-GAAP supplemental information will

be helpful in understanding the Company's ongoing operating results. This supplemental presentation should not be construed as an inference that the Company's future results will be unaffected by similar adjustments to Net earnings determined in accordance with GAAP.

A reconciliation of non-GAAP adjusted operating earnings is set forth in the table below, providing a reconciliation of non-GAAP adjusted operating earnings to the Company’s reported operating results for its business segments. Corporate and other includes amounts managed on a company-wide basis and not directly allocated to any reportable segments, primarily relating to IRA production tax credits. Also, included are start up costs for exploration of a new lithium plant as well as start-up operating expenses from the New Ventures operating segment.

Business Segment Operating Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| ($ millions) |

| September 29, 2024 |

| Energy Systems | | Motive Power | | Specialty | | Corporate and other | | Total |

| Net Sales | $ | 382.1 | | | $ | 366.7 | | | $ | 134.9 | | | $ | — | | | $ | 883.7 | |

| | | | | | | | | |

| Operating Earnings | $ | 17.5 | | | $ | 56.3 | | | $ | 0.3 | | | $ | 25.3 | | | $ | 99.4 | |

| Inventory step up to fair value relating to recent acquisitions | — | | | — | | | 1.9 | | — | | | $ | 1.9 | |

| | | | | | | | | |

| Restructuring and other exit charges | 0.7 | | | 1.1 | | | 0.4 | | | — | | | 2.2 | |

| | | | | | | | | |

| | | | | | | | | |

| Amortization of intangible assets | 6.0 | | | 0.2 | | | 2.0 | | | — | | | 8.2 | |

| | | | | | | | | |

| Integration costs | — | | | — | | | 1.8 | | — | | | 1.8 | |

| Acquisition activity expense | — | | | — | | | 1.1 | | — | | | 1.1 | |

| | | | | | | | | |

| Adjusted Operating Earnings | $ | 24.2 | | | $ | 57.6 | | | $ | 7.5 | | | $ | 25.3 | | | $ | 114.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| ($ millions) |

| October 1, 2023 |

| Energy Systems | | Motive Power | | Specialty | | Corporate and other | | Total |

| Net Sales | $ | 422.5 | | | $ | 355.2 | | | $ | 123.3 | | | $ | — | | | $ | 901.0 | |

| | | | | | | | | |

| Operating Earnings | $ | 16.8 | | | $ | 49.6 | | | $ | 3.3 | | | $ | 18.9 | | | $ | 88.6 | |

| | | | | | | | | |

| | | | | | | | | |

| Restructuring and other exit charges | 2.2 | | | 3.5 | | | 1.5 | | | — | | | 7.2 | |

| | | | | | | | | |

| | | | | | | | | |

| Amortization of intangible assets | 6.3 | | | 0.2 | | | 0.7 | | | — | | | 7.2 | |

| | | | | | | | | |

| | | | | | | | | |

| Integration costs | 0.2 | | — | | | — | | | — | | | 0.2 | |

| Acquisition activity expense | — | | | 0.1 | | — | | | — | | | 0.1 | |

| Other | 0.1 | | — | | | 0.1 | | — | | | 0.2 | |

| Adjusted Operating Earnings | $ | 25.6 | | | $ | 53.4 | | | $ | 5.6 | | | $ | 18.9 | | | $ | 103.5 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Increase (Decrease) as a % from prior year quarter | Energy Systems | | Motive Power | | Specialty | | Corporate and other | | Total |

| Net Sales | (9.6) | % | | 3.2 | % | | 9.3 | % | | —% | | (1.9) | % |

| Operating Earnings | 4.4 | | 13.5 | | | (92.3) | | | 33.8 | | 12.2 | |

| Adjusted Operating Earnings | (4.7) | | 7.7 | | | 31.3 | | | 33.8 | | 10.7 | |

NM = Not Meaningful

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended |

| ($ millions) |

| September 29, 2024 |

| Energy Systems | | Motive Power | | Specialty | | Corporate and other | | Total |

| Net Sales | $ | 743.1 | | | $ | 732.9 | | | $ | 260.6 | | | $ | 0.0 | | | $ | 1,736.6 | |

| | | | | | | | | |

| Operating Earnings | $ | 26.5 | | | $ | 110.7 | | | $ | 2.4 | | | $ | 51.1 | | | $ | 190.7 | |

| Inventory step up to fair value relating to recent acquisitions | — | | | — | | | 1.9 | | | — | | | 1.9 | |

| | | | | | | | | |

| Restructuring and other exit charges | 4.5 | | | 2.5 | | | 1.1 | | | — | | | 8.1 | |

| | | | | | | | | |

| | | | | | | | | |

| Amortization of intangible assets | 12.0 | | | 0.4 | | | 2.7 | | | — | | | 15.1 | |

| | | | | | | | | |

| | | | | | | | | |

| Integration costs | 0.2 | | — | | | 1.8 | | — | | | 2.0 | |

| Acquisition activity expense | — | | | — | | | 2.5 | | — | | | 2.5 | |

| Adjusted Operating Earnings | $ | 43.2 | | | $ | 113.6 | | | $ | 12.4 | | | $ | 51.1 | | | $ | 220.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended | |

| ($ millions) | |

| October 1, 2023 | |

| Energy Systems | | Motive Power | | Specialty | | Corporate and other | | Total | |

| Net Sales | $ | 847.1 | | | $ | 706.0 | | | $ | 256.5 | | | $ | 0.0 | | | $ | 1,809.6 | | |

| | | | | | | | | | |

| Operating Earnings | $ | 39.0 | | | $ | 97.8 | | | $ | 4.9 | | | $ | 36.3 | | | $ | 178.0 | | |

| | | | | | | | | | |

| Inventory adjustment relating to exit activities | — | | | — | | | 3.1 | | | — | | | 3.1 | | |

| Restructuring and other exit charges | 2.7 | | | 5.0 | | | 5.8 | | | — | | | 13.5 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Amortization of intangible assets | 12.5 | | | 0.3 | | | 1.4 | | | — | | | 14.2 | | |

| Integration costs | 0.3 | | | — | | | — | | | — | | | 0.3 | | |

| Acquisition activity expense | — | | | 0.2 | | | — | | | — | | | 0.2 | | |

| Other | 0.8 | | | 0.4 | | | 0.2 | | | — | | | 1.4 | | |

| | | | | | | | | | |

| Adjusted Operating Earnings | $ | 55.3 | | | $ | 103.7 | | | $ | 15.4 | | | $ | 36.3 | | | $ | 210.7 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Increase (Decrease) as a % from prior year | Energy Systems | | Motive Power | | Specialty | | Corporate and other | | Total |

| Net Sales | (12.3) | % | | 3.8 | % | | 1.5 | % | | —% | | (4.0) | % |

| Operating Earnings | (31.8) | | 13.1 | | | (52.5) | | | 40.8 | | 7.1 | |

| Adjusted Operating Earnings | (21.5) | | 9.4 | | | (20.6) | | | 40.8 | | 4.5 | |

Reconciliations of GAAP to Non-GAAP Financial Measures

(Unaudited)

The table below presents a reconciliation of Net Earnings to EBITDA and Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Six months ended |

| ($ millions) | | ($ millions) |

| September 29, 2024 | | October 1, 2023 | | September 29, 2024 | | October 1, 2023 |

| Net Earnings | 82.3 | | | $ | 65.2 | | | $ | 152.4 | | | $ | 132.0 | |

| Depreciation | 17.1 | | | 15.4 | | | 33.7 | | | 31.0 | |

| Amortization | 8.2 | | | 7.2 | | | 15.1 | | | 14.2 | |

| Interest | 12.5 | | | 12.2 | | | 23.5 | | | 27.4 | |

| Income Taxes | 1.9 | | | 8.2 | | | 11.1 | | | 14.9 | |

| EBITDA | 122.0 | | | 108.2 | | | 235.8 | | | 219.5 | |

Non-GAAP adjustments | 7.0 | | | 8.2 | | | 14.5 | | | 19.0 | |

| Adjusted EBITDA | $ | 129.0 | | | $ | 116.4 | | | $ | 250.3 | | | $ | 238.5 | |

The following table provides the non-GAAP adjustments shown in the reconciliation above:

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Six months ended |

| ($ millions) | | ($ millions) |

| September 29, 2024 | | October 1, 2023 | | September 29, 2024 | | October 1, 2023 |

| Inventory adjustment relating to exit activities | $ | — | | | $ | — | | | $ | — | | | $ | 3.1 | |

| Inventory step up to fair value relating to recent acquisitions | 1.9 | | | — | | | 1.9 | | | — | |

| Restructuring and other exit charges | 2.2 | | | 7.2 | | | 8.1 | | | 13.5 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Integration Costs | 1.8 | | 0.2 | | | 2.0 | | | 0.3 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Acquisition expense | 1.1 | | 0.1 | | | $ | 2.5 | | | 0.2 | |

| Other | — | | | 0.7 | | | $ | — | | | 1.9 | |

Non-GAAP adjustments | $ | 7.0 | | | $ | 8.2 | | | $ | 14.5 | | | $ | 19.0 | |

The table below presents a reconciliation of Gross Profit and Gross Margin to Adjusted Gross Profit and Adjusted Gross Margin:

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Six months ended |

| ($ millions) | | ($ millions) |

| September 29, 2024 | | October 1, 2023 | | September 29, 2024 | | October 1, 2023 |

| Gross Profit as reported | $ | 252.1 | | | $ | 239.6 | | | $ | 490.5 | | | $ | 479.9 | |

| Inventory adjustment relating to exit activities | — | | | — | | | — | | | 3.1 | |

| Inventory step up to fair value relating to recent acquisitions | 1.9 | | | — | | | 1.9 | | | — | |

| Adjusted Gross Profit | 254.0 | | | 239.6 | | | 492.4 | | | 483.0 | |

| | | | | | | |

| Gross Margin | 28.5 | % | | 26.6 | % | | 28.2 | % | | 26.5 | % |

| | | | | | | |

| Adjusted Gross Margin | 28.7 | % | | 26.6 | % | | 28.4 | % | | 26.7 | % |

| | | | | | | |

The table below presents a reconciliation of Operating Cash Flow to Free Cash Flow and Adjusted Free Cash Flow Conversion percentages:

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Six months ended |

| ($ millions) | | ($ millions) |

| September 29, 2024 | | October 1, 2023 | | September 29, 2024 | | October 1, 2023 |

| Net cash provided by (used in) operating activities | $ | 33.6 | | | $ | 110.8 | | | $ | 44.0 | | | $ | 185.7 | |

| Less Capital Expenditures | (30.4) | | | (19.8) | | | (66.5) | | | (35.9) | |

| Free Cash Flow | 3.2 | | | 91.0 | | | (22.5) | | | 149.8 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Six months ended |

| ($ millions) | | ($ millions) |

| September 29, 2024 | | October 1, 2023 | | September 29, 2024 | | October 1, 2023 |

| Net cash provided by (used in) operating activities | $ | 33.6 | | | $ | 110.8 | | | $ | 44.0 | | | $ | 185.7 | |

| Net earnings | 82.3 | | | 65.2 | | | 152.4 | | | 132.0 | |

| Operating cash flow conversion % | 40.8 | % | | 169.9 | % | | 28.9 | % | | 140.7 | % |

| | | | | | | |

| Free cash flow | 3.2 | | | 91.0 | | | (22.5) | | | 149.8 | |

| Adjusted net earnings | 86.5 | | | 76.5 | | | 167.5 | | | 155.1 | |

| Adjusted free cash flow conversion % | 3.7 | % | | 119.0 | % | | (13.4) | % | | 96.6 | % |

The following table provides a reconciliation of Net earnings to EBITDA (non-GAAP) and adjusted EBITDA (non-GAAP) per credit agreement for September 29, 2024 and October 1, 2023 to calculate our net leverage ratio, in connection with the Fourth Amended Credit Facility:

| | | | | | | | | | | | | | |

| | Last twelve months |

| | September 29, 2024 | | October 1, 2023 |

| | (in millions, except ratios) |

| Net earnings as reported | | $ | 289.5 | | | $ | 242.4 | |

| Add back: | | | | |

| Depreciation and amortization | | 95.6 | | | $ | 90.0 | |

| Interest expense | | 46.0 | | | $ | 59.9 | |

| Income tax expense | | 19.3 | | | 38.2 | |

| EBITDA (non-GAAP) | | 450.4 | | | $ | 430.5 | |

Adjustments per credit agreement definitions(1) | | 79.9 | | | 48.9 | |

Adjusted EBITDA (non-GAAP) per credit agreement(1) | | $ | 530.3 | | | 479.4 | |

Total net debt(2) | | 839.6 | | | 662.0 | |

| Leverage ratios: | | | | |

| Total net debt/credit adjusted EBITDA ratio | | 1.6 X | | 1.4 X |

| | | | |

| | | | |

| | | | |

(1)The $79.9 million adjustment to EBITDA in the last twelve months ending September 29, 2024 primarily related to $29.7 million of non-cash stock compensation, $38.9 million of restructuring and other exit charges, impairment of indefinite-lived intangibles and write-down of other current assets of $10.5 million. The $48.9 million adjustment to EBITDA in the last twelve months ending October 1, 2023 primarily related to $27.6 million of non-cash stock compensation, $17.6 million of restructuring and other exit charges, impairment of indefinite-lived intangibles and write-down of other current assets of $3.6 million.

(2)Debt includes finance lease obligations and letters of credit and is net of all U.S. cash and cash equivalents and foreign cash and investments, as defined in the Fourth Amended Credit Facility. In the last twelve months ending September 29, 2024 and October 1, 2023, the amounts deducted in the calculation of net debt were U.S. cash and cash equivalents and foreign cash investments of $407.9 million, and in fiscal 2023, were $327.8 million.

Included below is a reconciliation of historical non-GAAP adjusted Net earnings to reported amounts. Non-GAAP adjusted operating earnings and historical Net earnings are calculated excluding restructuring and other highlighted charges and credits. The following tables provide additional information regarding certain non-GAAP measures:

| | | | | | | | | | | | | | | | | |

| Quarter ended | | | | |

| (in millions, except share and per share amounts) | | | | |

| September 29, 2024 | | October 1, 2023 | | | | |

| Net earnings reconciliation | | | | | | | |

| As reported Net Earnings | $ | 82.3 | | | $ | 65.2 | | | | | |

Non-GAAP adjustments: | | | | | | | |

| Inventory step up to fair value relating to recent acquisitions | 1.9 | | (1) | — | | | | | |

| | | | | | | |

| Restructuring and other exit charges | 2.2 | | (1) | 7.2 | | (1) | | | |

| | | | | | | |

| | | | | | | |

| Amortization of identified intangible assets | 8.2 | | (2) | 7.2 | | (2) | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Acquisition expense | 1.1 | (3) | 0.1 | | (3) | | | |

| Integration costs | 1.8 | | (4) | 0.2 | | (4) | | | |

| Other | — | | | 0.7 | | | | | |

| | | | | | | |

| Income tax benefit from tax law changes and litigation | (6.8) | | | — | | | | | |

| Income tax effect of above non-GAAP adjustments | (4.2) | | | (4.1) | | | | | |

| Non-GAAP adjusted Net earnings | $ | 86.5 | | | $ | 76.5 | | | | | |

| | | | | | | |

| Outstanding shares used in per share calculations | | | | | | | |

Basic | 40,165,080 | | 40,922,959 | | | | |

Diluted | 40,863,205 | | 41,684,634 | | | | |

| Non-GAAP adjusted Net earnings per share: | | | | | | | |

Basic | $ | 2.15 | | | $ | 1.87 | | | | | |

Diluted | $ | 2.12 | | | $ | 1.84 | | | | | |

| | | | | | | |

| Reported Net earnings (Loss) per share: | | | | | | | |

Basic | $ | 2.05 | | | $ | 1.59 | | | | | |

Diluted | $ | 2.01 | | | $ | 1.56 | | | | | |

| Dividends per common share | $ | 0.24 | | | $ | 0.225 | | | | | |

The following table provides the line of business allocation of the non-GAAP adjustments of items relating operating earnings (that are allocated to lines of business) shown in the reconciliation above:

| | | | | | | | | | | | | | |

| | Quarter ended |

| | ($ millions) |

| | September 29, 2024 | | October 1, 2023 |

| | Pre-tax | | Pre-tax |

| | | | |

| | | | |

| | | | |

| (1) Inventory step up to fair value relating to recent acquisitions - Specialty | | 1.9 | | | — | |

| (1) Restructuring and other exit charges - Energy Systems | | 0.7 | | | 2.2 | |

| (1) Restructuring and other exit charges - Motive Power | | 1.1 | | | 3.5 | |

| (1) Restructuring and other exit charges - Specialty | | 0.4 | | | 1.5 | |

| | | | |

| | | | |

| | | | |

| | | | |

| (2) Amortization of identified intangible assets - Energy Systems | | 6.0 | | | 6.3 | |

| (2) Amortization of identified intangible assets - Motive Power | | 0.2 | | | 0.2 | |

| (2) Amortization of identified intangible assets - Specialty | | 2.0 | | | 0.7 | |

| | | | |

| | | | |

| | | | |

| (3) Acquisition expense - Motive Power | | — | | | 0.1 | |

| (3) Acquisition expense - Specialty | | 1.1 | | | — | |

| (4) Integration costs - Energy Systems | | — | | | 0.2 | |

| (4) Integration costs - Specialty | | 1.8 | | | — | |

| | | | |

| | | | |

| | | | |

| Total Non-GAAP adjustments | | $ | 15.2 | | | $ | 14.7 | |

| | | | | | | | | | | | | | |

| Six months ended | |

| (in millions, except share and per share amounts) | |

| September 29, 2024 | | October 1, 2023 | |

| Net Earnings reconciliation | | | | |

| As reported Net Earnings | $ | 152.4 | | | $ | 132.0 | | |

Non-GAAP adjustments: | | | | |

| Inventory step up to fair value relating to recent acquisitions | 1.9 | | (1) | | |

| Inventory adjustment relating to exit activities | — | | | 3.1 | | (1) |

| Restructuring and other exit charges | 8.1 | | (1) | 13.5 | | (1) |

| | | | |

| | | | |

| Amortization of identified intangible assets | 15.1 | | (2) | 14.2 | | (2) |

| | | | |

| | | | |

| Acquisition activity expense | 2.5 | | (3) | 0.2 | | (3) |

| | | | |

| | | | |

| | | | |

| Integration costs | 2.0 | | (4) | 0.3 | | (4) |

| Other | — | | | 1.9 | | |

| Income tax benefit from tax law changes and litigation | (6.8) | | | — | | |

| Income tax effect of above non-GAAP adjustments | (7.7) | | | (10.1) | | |

| | | | |

| Non-GAAP adjusted Net Earnings | $ | 167.5 | | | $ | 155.1 | | |

| | | | |

| Outstanding shares used in per share calculations | | | | |

Basic | 40,184,546 | | 40,930,146 | |

Diluted | 40,924,660 | | 41,691,479 | |

| Non-GAAP adjusted Net Earnings per share: | | | | |

Basic | $ | 4.17 | | | $ | 3.79 | | |

Diluted | $ | 4.09 | | | $ | 3.72 | | |

| | | | |

| Reported Net Earnings (Loss) per share: | | | | |

Basic | $ | 3.79 | | | $ | 3.23 | | |

Diluted | $ | 3.72 | | | $ | 3.17 | | |

| Dividends per common share | $ | 0.465 | | | $ | 0.40 | | |

The following table provides the line of business allocation of the non-GAAP adjustments of items relating operating earnings (that are allocated to lines of business) shown in the reconciliation above:

| | | | | | | | | | | | | | |

| | Six months ended |

| | ($ millions) |

| | September 29, 2024 | | October 1, 2023 |

| | Pre-tax | | Pre-tax |

| (1) Inventory step up to fair value relating to recent acquisitions - Specialty | | 1.9 | | | — | |

| | | | |

| | | | |

| (1) Inventory Adjustment relating to exit activities - Specialty | | — | | | 3.1 | |

| (1) Restructuring and other exit charges - Energy Systems | | 4.5 | | | 2.7 | |

| (1) Restructuring and other exit charges - Motive Power | | 2.5 | | | 5.0 | |

| (1) Restructuring and other exit charges - Specialty | | 1.1 | | | 5.8 | |

| | | | |

| | | | |

| | | | |

| | | | |

| (2) Amortization of identified intangible assets - Energy Systems | | 12.0 | | | 12.5 | |

| (2) Amortization of identified intangible assets - Motive Power | | 0.4 | | | 0.3 | |

| (2) Amortization of identified intangible assets - Specialty | | 2.7 | | | 1.4 | |

| (3) Acquisition expense - Motive Power | | — | | | 0.2 | |

| (3) Acquisition expense - Specialty | | 2.5 | | | — | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| (4) Integration costs - Energy Systems | | 0.2 | | | 0.3 | |

| (4) Integration costs - Specialty | | 1.8 | | | — | |

| Total Non-GAAP adjustments | | $ | 29.6 | | | $ | 31.3 | |

Exhibit 99.2

ENERSYS ANNOUNCES DIVIDEND OF $0.24 PER SHARE FOR THE THIRD QUARTER OF FISCAL YEAR 2025

Reading, PA, USA, November 6, 2024 – EnerSys (NYSE: ENS), the global leader in stored energy solutions for industrial applications, announced today that its Board of Directors has declared a quarterly cash dividend of $0.24 per share of common stock payable on December 27, 2024, to holders of record as of December 13, 2024.

About EnerSys

EnerSys is the global leader in stored energy solutions for industrial applications and designs, manufactures and distributes energy systems solutions and motive power batteries, specialty batteries, battery chargers, power equipment, battery accessories and outdoor equipment enclosure solutions to customers worldwide. The company goes to market through four lines of business: Energy Systems, Motive Power, Specialty and New Ventures. Energy Systems, which combine power conversion, power distribution, energy storage, and enclosures, are used in the telecommunication, broadband, and utility industries, uninterruptible power supplies, and numerous applications requiring stored energy solutions. Motive power batteries and chargers are utilized in electric forklift trucks and other industrial electric powered vehicles. Specialty batteries are used in aerospace and defense applications, portable power solutions for soldiers in the field, large over-the-road trucks, premium automotive, medical and security systems applications. New Ventures provides energy storage and management systems for various applications including demand charge reduction, utility back-up power, and dynamic fast charging for electric vehicles. EnerSys also provides aftermarket and customer support services to its customers in over 100 countries through its sales and manufacturing locations around the world. To learn more about EnerSys please visit https://www.enersys.com/en/.

Sustainability

Sustainability at EnerSys is about more than just the benefits and impacts of our products. Our commitment to sustainability encompasses many important environmental, social and governance issues. Sustainability is a fundamental part of how we manage our own operations. Minimizing our environmental footprint is a priority. Sustainability is our commitment to our employees, our customers and the communities we serve. Our products facilitate positive environmental, social and economic impacts around the world. To learn more visit: https://www.enersys.com/en/about-us/sustainability/.

Caution Concerning Forward-Looking Statements

This press release, and oral statements made regarding the subjects of this release, contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, or the Reform Act, which may include, but are not limited to, statements regarding EnerSys’ earnings estimates, intention to return capital to stockholders, plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts, including statements identified by words such as “believe,” “plan,” “seek,” “expect,” “intend,” “estimate,” “anticipate,” “will,” and similar expressions. All statements addressing operating performance, events, or developments that EnerSys expects or anticipates will occur in the future, including statements relating to sales growth, continuing to pay cash dividends at the current rate, earnings or earnings per share growth, its intention to pay quarterly cash dividends and return capital to stockholders, execution of its stock repurchase program, and market share, as well as statements expressing optimism or pessimism about future operating results or benefits from either its cash dividend or its stock repurchase programs, are forward-looking statements within the meaning of the Reform Act. The forward-looking statements are based on management’s current views and assumptions regarding future events and operating performance, and are inherently subject to significant business, economic, and competitive uncertainties and contingencies and changes in circumstances, many of which are beyond EnerSys’ control. The statements in this press release are made as of the date of this press release, even if subsequently made

available by EnerSys on its website or otherwise. EnerSys does not undertake any obligation to update or revise these statements to reflect events or circumstances occurring after the date of this press release.

Although EnerSys does not make forward-looking statements unless it believes it has a reasonable basis for doing so, EnerSys cannot guarantee their accuracy. For a list of other factors which could affect EnerSys’ results, including earnings estimates, see EnerSys’ filings with the Securities and Exchange Commission, including “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations,” and “Forward-Looking Statements,” set forth in EnerSys’ Annual Report on Form 10-K for the fiscal year ended March 31, 2024. The foregoing factors, among others, could cause actual results to differ materially from those described in these forward-looking statements. No undue reliance should be placed on any forward-looking statements.

CONTACT

Lisa Hartman

Vice President, Investor Relations and Corporate Communications

EnerSys

610-236-4040

E-mail: investorrelations@enersys.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

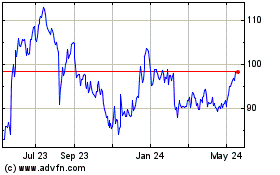

Enersys (NYSE:ENS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Enersys (NYSE:ENS)

Historical Stock Chart

From Jan 2024 to Jan 2025