$1 Billion Share Repurchases Completed During

Quarter Full-Year Fiscal 2025 Earnings Outlook Revised FedEx

Completes FedEx Freight Assessment, Will Pursue Full Separation and

Create a New Publicly Traded LTL Company

FedEx Corp. (NYSE: FDX) today reported the following

consolidated results for the second quarter ended November 30

(adjusted measures exclude the item listed below):

Fiscal 2025

Fiscal 2024

As Reported (GAAP)

Adjusted (non-GAAP)

As Reported (GAAP)

Adjusted (non-GAAP)

Revenue

$22.0 billion

$22.0 billion

$22.2 billion

$22.2 billion

Operating income

$1.05 billion

$1.38 billion

$1.28 billion

$1.42 billion

Operating margin

4.8%

6.3%

5.8%

6.4%

Net income

$0.74 billion

$0.99 billion

$0.90 billion

$1.01 billion

Diluted EPS

$3.03

$4.05

$3.55

$3.99

This year’s and last year’s quarterly consolidated results have

been adjusted for:

Impact per diluted share

Fiscal 2025

Fiscal 2024

Business optimization costs

$1.02

$0.44

“Our second quarter results demonstrate that our efforts to

transform our operations are working. The Federal Express segment

delivered operating profit growth despite several headwinds,

including the continued weak U.S. domestic demand environment as

well as the expiration of our U.S. Postal Service contract,” said

Raj Subramaniam, FedEx Corp. president and chief executive officer.

“I am proud of the team for continuing to deliver solid service to

our customers throughout the Peak season, as we create a more

flexible, efficient, and intelligent network.”

Consolidated operating results were negatively affected by

lower-than-expected FedEx Freight revenue and profit, as sustained

weakness in U.S. industrial production continued to pressure

less-than-truckload industry demand. The lower FedEx Freight

results were mostly offset by cost reduction benefits at Federal

Express from DRIVE program initiatives and higher base yields at

each transportation segment.

Federal Express segment adjusted operating results improved

during the quarter, driven by cost reduction benefits from DRIVE,

higher base yield, and increased international export volume. These

factors were partially offset by higher wage and purchased

transportation rates, the expiration of the U.S. Postal Service

contract for transportation services on September 29, 2024, and

U.S. domestic package demand weakness.

FedEx Freight segment operating results decreased during the

quarter due to fewer shipments, lower fuel surcharges, and reduced

weight per shipment, partially offset by higher base yield. Last

year's second quarter operating income included a $30 million gain

on the sale of facilities.

Share Repurchase Program

FedEx completed $1 billion in share repurchases via open market

and accelerated share repurchase transactions during the quarter.

Approximately 3.7 million shares were delivered from the

transactions, with the decrease in outstanding shares benefiting

second quarter results by $0.07 per diluted share.

The company expects to repurchase an additional $500 million of

common stock during fiscal 2025, for a buyback total of $2.5

billion. As of November 30, 2024, $3.1 billion remained available

for repurchases under the company's 2024 stock repurchase

authorization.

Cash on-hand as of November 30, 2024, was $5.0 billion.

FedEx Freight Assessment

Earlier today, FedEx announced that its Board of Directors has

concluded a comprehensive assessment of the role of FedEx Freight

as part of its portfolio and has decided to pursue a full

separation through the capital markets, creating a new publicly

traded company.

The separation is expected to be achieved in a tax-efficient

manner for FedEx stockholders and executed within the next 18

months.

Additional information can be found in the related press release

at investors.fedex.com.

Outlook

FedEx is unable to forecast the fiscal 2025 mark-to-market

("MTM") retirement plans accounting adjustments. As a result, FedEx

is unable to provide a fiscal 2025 earnings per share ("EPS") or

effective tax rate ("ETR") outlook on a GAAP basis and is relying

on the exemption provided by the Securities and Exchange Commission

("SEC"). It is reasonably possible that the fiscal 2025 MTM

retirement plans accounting adjustments could have a material

effect on fiscal 2025 consolidated financial results and ETR.

FedEx is revising its fiscal 2025 revenue and earnings

forecasts, and now expects:

- Approximately flat revenue year over year, compared to the

prior forecast of a low single-digit percentage increase;

- Diluted EPS of $16.45 to $17.45 before the MTM retirement plans

accounting adjustments compared to the prior forecast of $17.90 to

$18.90 per share; and $19.00 to $20.00 per share after also

excluding costs related to business optimization initiatives,

compared to the prior forecast of $20.00 to $21.00 per share;

and

- ETR of approximately 24.0% prior to the MTM retirement plans

accounting adjustments, compared to the prior forecast of

approximately 24.5%.

FedEx is reaffirming its forecast of:

- Permanent cost reductions from the DRIVE transformation program

of $2.2 billion; and

- Capital spending of $5.2 billion, with a priority on

investments in network optimization and efficiency improvement,

including fleet and facility modernization and automation.

These forecasts assume the company's current economic forecast

and fuel price expectations, successful completion of the planned

stock repurchases, and no additional adverse economic or

geopolitical developments. FedEx’s ETR and EPS forecasts are based

on current law and related regulations and guidance.

“I remain confident FedEx will continue to grow earnings this

year despite the challenging demand environment, as we focus on

transforming operations and improving revenue quality,” said John

Dietrich, FedEx Corp. executive vice president and chief financial

officer. “We are resolute in our strategy to prudently manage our

capital expenditures, and expect to deliver on our commitment to

return $3.8 billion to stockholders this fiscal year.”

Corporate Overview

FedEx Corp. (NYSE: FDX) provides customers and businesses

worldwide with a broad portfolio of transportation, e-commerce and

business services. With annual revenue of $87 billion, the company

offers integrated business solutions utilizing its flexible,

efficient, and intelligent global network. Consistently ranked

among the world's most admired and trusted employers, FedEx

inspires its more than 500,000 employees to remain focused on

safety, the highest ethical and professional standards and the

needs of their customers and communities. FedEx is committed to

connecting people and possibilities around the world responsibly

and resourcefully, with a goal to achieve carbon-neutral operations

by 2040. To learn more, please visit fedex.com/about.

Additional information and operating data are contained in the

company’s annual report, Form 10-K, Form 10-Qs, Form 8-Ks and

Statistical Books. These materials, as well as a webcast of the

earnings release conference call to be held at 5:30 p.m. EST on

December 19, are available on the company’s website at

investors.fedex.com. A replay of the conference call webcast will

be posted on our website following the call.

The Investor Relations page of our website, investors.fedex.com,

contains a significant amount of information about FedEx, including

our SEC filings and financial and other information for investors.

The information that we post on our Investor Relations website

could be deemed to be material information. We encourage investors,

the media and others interested in the company to visit this

website from time to time, as information is updated and new

information is posted.

Certain statements in this press release may be considered

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act, such as statements regarding

expected cost savings, the optimization of our network through

Network 2.0, the planned tax-free full separation of the FedEx

Freight business into a new independent publicly traded company

(the "FedEx Freight Separation"), future financial targets,

business strategies, management’s views with respect to future

events and financial performance, and the assumptions underlying

such expected cost savings, targets, strategies, and statements.

Forward-looking statements include those preceded by, followed by

or that include the words “will,” “may,” “could,” “would,”

“should,” “believes,” “expects,” “forecasts,” “anticipates,”

“plans,” “estimates,” “targets,” “projects,” “intends” or similar

expressions. Such forward-looking statements are subject to risks,

uncertainties and other factors which could cause actual results to

differ materially from historical experience or from future results

expressed or implied by such forward-looking statements. Potential

risks and uncertainties include, but are not limited to, economic

conditions in the global markets in which we operate; our ability

to successfully implement our business strategy and global

transformation program and optimize our network through Network

2.0, effectively respond to changes in market dynamics, and achieve

the anticipated benefits of such strategies and actions; our

ability to achieve our cost reduction initiatives and financial

performance goals; the timing and amount of any costs or benefits

or any specific outcome, transaction, or change (of which there can

be no assurance), or the terms, timing, and structure thereof,

related to our global transformation program and other ongoing

reviews and initiatives; a significant data breach or other

disruption to our technology infrastructure; our ability to

successfully implement the FedEx Freight Separation and achieve the

anticipated benefits of such transaction; damage to our reputation

or loss of brand equity; our ability to remove costs related to

services provided to the U.S. Postal Service ("USPS") under the

contract for Federal Express Corporation to provide the USPS

domestic transportation services that expired on September 29,

2024; our ability to meet our labor and purchased transportation

needs while controlling related costs; failure of third-party

service providers to perform as expected, or disruptions in our

relationships with those providers or their provision of services

to FedEx; the effects of a widespread outbreak of an illness or any

other communicable disease or public health crises; anti-trade

measures and additional changes in international trade policies and

relations; the effect of any international conflicts or terrorist

activities, including as a result of the current conflicts between

Russia and Ukraine and in the Middle East; changes in fuel prices

or currency exchange rates, including significant increases in fuel

prices as a result of the ongoing conflicts between Russia and

Ukraine and in the Middle East and other geopolitical and

regulatory developments; the effect of intense competition; our

ability to match capacity to shifting volume levels; an increase in

self-insurance accruals and expenses; failure to receive or collect

expected insurance coverage; our ability to effectively operate,

integrate, leverage, and grow acquired businesses and realize the

anticipated benefits of acquisitions and other strategic

transactions; noncash impairment charges related to our goodwill

and certain deferred tax assets; the future rate of e-commerce

growth; evolving or new U.S. domestic or international laws and

government regulations, policies, and actions; future guidance,

regulations, interpretations, challenges, or judicial decisions

related to our tax positions; labor-related disruptions; legal

challenges or changes related to service providers contracted to

conduct certain linehaul and pickup-and-delivery operations and the

drivers providing services on their behalf and the coverage of U.S.

employees at Federal Express Corporation under the Railway Labor

Act of 1926, as amended; our ability to quickly and effectively

restore operations following adverse weather or a localized

disaster or disturbance in a key geography; any liability resulting

from and the costs of defending against litigation; our ability to

achieve our goal of carbon-neutral operations by 2040; and other

factors which can be found in FedEx Corp.’s and its subsidiaries’

press releases and FedEx Corp.’s filings with the SEC, including

our Annual Report on Form 10-K for the fiscal year ended May 31,

2024, and subsequently filed Quarterly Reports on Form 10-Q. Any

forward-looking statement speaks only as of the date on which it is

made. We do not undertake or assume any obligation to update or

revise any forward-looking statement, whether as a result of new

information, future events, or otherwise.

The financial section of this release is provided on the

company's website at investors.fedex.com.

RECONCILIATIONS OF NON-GAAP FINANCIAL

MEASURES TO GAAP FINANCIAL MEASURES

Second Quarter Fiscal 2025 and Fiscal

2024 Results

The company reports its financial results in accordance with

accounting principles generally accepted in the United States

(“GAAP” or “reported”). We have supplemented the reporting of our

financial information determined in accordance with GAAP with

certain non-GAAP (or “adjusted”) financial measures, including our

adjusted second quarter fiscal 2025 and 2024 consolidated operating

income and margin, income taxes, net income and diluted earnings

per share and adjusted second quarter fiscal 2025 and 2024 Federal

Express segment operating income and margin. These financial

measures have been adjusted to exclude the effects of business

optimization costs incurred in fiscal 2025 and 2024.

In fiscal 2023, FedEx announced DRIVE, a comprehensive program

to improve the company’s long-term profitability. This program

includes a business optimization plan to drive efficiency among our

transportation segments, lower our overhead and support costs, and

transform our digital capabilities. We incurred costs associated

with our business optimization initiatives in the second quarter of

fiscal 2025 and fiscal 2024. These costs were primarily related to

professional services and severance.

Costs related to business optimization initiatives are excluded

from our second quarter fiscal 2025 and 2024 consolidated and

Federal Express segment non-GAAP financial measures because they

are unrelated to our core operating performance and to assist

investors with assessing trends in our underlying businesses.

The income tax effect of the business optimization initiatives

is calculated based upon the tax laws and statutory income tax

rates applicable in the tax jurisdiction(s) of the underlying

non-GAAP adjustment. The impact of these non-GAAP items on the

company’s effective tax rate represents the difference in the

effective tax rate calculated with and without the non-GAAP

adjustment.

We believe these adjusted financial measures facilitate analysis

and comparisons of our ongoing business operations because they

exclude items that may not be indicative of, or are unrelated to,

the company’s and our business segments’ core operating

performance, and may assist investors with comparisons to prior

periods and assessing trends in our underlying businesses. These

adjustments are consistent with how management views our

businesses. Management uses these non-GAAP financial measures in

making financial, operating and planning decisions and evaluating

the company’s and each business segment’s ongoing performance.

Our non-GAAP financial measures are intended to supplement and

should be read together with, and are not an alternative or

substitute for, and should not be considered superior to, our

reported financial results. Accordingly, users of our financial

statements should not place undue reliance on these non-GAAP

financial measures. Because non-GAAP financial measures are not

standardized, it may not be possible to compare these financial

measures with other companies’ non-GAAP financial measures having

the same or similar names. As required by SEC rules, the tables

below present a reconciliation of our presented non-GAAP financial

measures to the most directly comparable GAAP measures.

Fiscal 2025 Earnings Per Share and

Effective Tax Rate Forecasts

Our fiscal 2025 EPS forecast is a non-GAAP financial measure

because it excludes fiscal 2025 MTM retirement plans accounting

adjustments and estimated costs related to business optimization

initiatives in fiscal 2025. Our fiscal 2025 ETR forecast is a

non-GAAP financial measure because it excludes the effect of fiscal

2025 MTM retirement plans accounting adjustments.

We have provided these non-GAAP financial measures for the same

reasons that were outlined above for historical non-GAAP measures.

Costs related to business optimization initiatives are excluded

from our fiscal 2025 EPS forecast for the same reasons described

above for historical non-GAAP measures.

We are unable to predict the amount of the MTM retirement plans

accounting adjustments, as they are significantly affected by

changes in interest rates and the financial markets, so such

adjustments are not included in our fiscal 2025 EPS and ETR

forecasts. For this reason, a full reconciliation of our fiscal

2025 EPS and ETR forecasts to the most directly comparable GAAP

measures is impracticable. It is reasonably possible, however, that

our fiscal 2025 MTM retirement plans accounting adjustments could

have a material effect on our fiscal 2025 consolidated financial

results and ETR.

The table included below titled “Fiscal 2025 Diluted Earnings

Per Share Forecast” outlines the effects of the items that are

excluded from our fiscal 2025 EPS forecast, other than the MTM

retirement plans accounting adjustments.

Second Quarter Fiscal

2025

FedEx Corporation

Operating

Income

Net

Diluted Earnings

Dollars in millions, except EPS

Income

Margin

Taxes1

Income2

Per Share

GAAP measure

$1,052

4.8%

$240

$741

$3.03

Business optimization costs3

326

1.5%

77

249

1.02

Non-GAAP measure

$1,378

6.3%

$317

$990

$4.05

Federal Express Segment

Operating

Dollars in millions

Income

Margin

GAAP measure

$1,052

5.6%

Business optimization costs

206

1.1%

Non-GAAP measure

$1,258

6.7%

Second Quarter Fiscal

2024

FedEx Corporation

Operating

Income

Net

Diluted Earnings

Dollars in millions, except EPS

Income

Margin4

Taxes1

Income2

Per Share

GAAP measure

$1,276

5.8%

$302

$900

$3.55

Business optimization costs3

145

0.7%

35

110

0.44

Non-GAAP measure

$1,421

6.4%

$337

$1,010

$3.99

Federal Express Segment

Operating

Dollars in millions

Income

Margin

GAAP measure

$1,035

5.5%

Business optimization costs

77

0.4%

Non-GAAP measure

$1,112

5.9%

Fiscal 2025 Diluted Earnings Per Share

Forecast

Dollars in millions, except EPS

Adjustments

Diluted Earnings Per

Share

Diluted earnings per share before MTM

retirement plans accounting adjustments (non-GAAP)5

$16.45 to $17.45

Business optimization costs

$815

Income tax effect1

(195)

Net of tax effect

$620

2.55

Diluted earnings per share with

adjustments (non-GAAP)5

$19.00 to $20.00

Notes:

1 –

Income taxes are based on the

company’s approximate statutory tax rates applicable to each

transaction.

2 –

Effect of “total other (expense)

income” on net income amount not shown.

3 –

These expenses were recognized at

Federal Express, as well as Corporate, other, and eliminations.

4 –

Does not sum to total due to

rounding.

5 –

The MTM retirement plans

accounting adjustments, which are impracticable to calculate at

this time, are excluded.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219552151/en/

Media Contact: Caitlin Maier 901-434-8100

mediarelations@fedex.com Investor Relations Contact: Jeni

Hollander 901-818-7200 ir@fedex.com

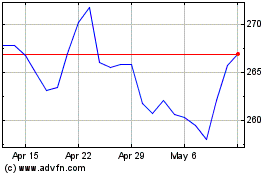

FedEx (NYSE:FDX)

Historical Stock Chart

From Nov 2024 to Dec 2024

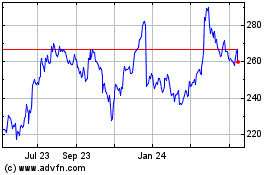

FedEx (NYSE:FDX)

Historical Stock Chart

From Dec 2023 to Dec 2024