Getty Realty Corp. (NYSE: GTY) (“Getty” or the “Company”), a net

lease REIT focused on convenience and automotive retail real

estate, today provided an update on the Company’s fourth quarter

and full year 2024 investment and capital markets activities. The

Company also provided its initial full year 2025 earnings guidance.

2024 Highlights

- Invested

approximately $209 million in convenience and automotive retail

assets at an 8.3% initial cash yield, including approximately $76

million at an 8.9% initial cash yield in the fourth quarter.

- Raised

approximately $289 million of new equity and debt capital,

including approximately $32 million of forward equity through the

Company’s at-the-market ("ATM") equity program and $125 million of

previously announced unsecured notes in the fourth quarter.

“I’m very pleased with our performance in 2024

as we grew our portfolio at attractive returns while navigating the

unique challenges posed by the transaction and capital markets

throughout the year,” stated Christopher J. Constant, Getty’s

President and Chief Executive Officer. “We were able to materially

increase the initial cash yields we generated from our investments,

while still closing a significant volume of transactions that met

our stringent underwriting criteria. We begin 2025 with positive

momentum, including almost $30 million of assets under contract, a

substantial set of investment opportunities under executed letters

of intent, and nearly $240 million of committed equity and debt

capital to fund this transaction activity.”

Portfolio Activities

Investments

In 2024, the Company invested approximately $209

million in convenience and automotive retail assets at an 8.3%

initial cash yield, including the acquisition of fee simple

interests in 31 express tunnel car washes, 19 auto service centers,

17 convenience stores, and four drive-thru quick service

restaurants.

For the quarter ended December 31, 2024, the

Company invested approximately $76 million in convenience and

automotive retail assets at an 8.9% initial cash yield, including

the acquisition of fee simple interests in 14 convenience stores,

two express tunnel car washes, two auto service centers, and one

drive-thru quick service restaurant.

Investment Pipeline

As of December 31, 2024, the Company had a

committed investment pipeline of more than $29 million for the

development and acquisition of 15 convenience and automotive retail

assets. The Company expects to fund the majority of this investment

activity, which includes multiple transactions with six different

tenants, over approximately the next 9-12 months. While the Company

has fully executed agreements for each transaction, the timing and

amount of each investment is ultimately dependent on its

counterparties and the schedules under which they are able to

construct new-to-industry developments.

Redevelopments

In 2024, rent commenced on one redevelopment

property and, as of December 31, 2024, the Company had four

properties under active redevelopment with others in various stages

of feasibility planning for potential recapture from our net lease

portfolio.

Dispositions

In 2024, the Company sold 31 properties for

gross proceeds of approximately $13 million, including seven

properties for gross proceeds of approximately $8 million in the

fourth quarter.

Capital Markets Activities

Common Equity

In 2024, the Company raised approximately $164

million of gross equity proceeds through the sale of 5.4 million

common shares subject to forward sales agreements, including 4.0

million shares ($121 million of gross proceeds) in a follow-on

public offering and 1.4 million shares through its ATM equity

program ($43 million of gross proceeds), of which 1.0 million

shares were sold in the fourth quarter ($32 million of gross

proceeds).

As of December 31, 2024, the Company had a total

of 5.4 million shares subject to outstanding forward equity

agreements, which upon settlement are anticipated to raise gross

proceeds of approximately $164 million.

Unsecured Notes

As previously announced, in November 2024, the

Company closed the private placement of $125 million of senior

unsecured notes, including (i) $50 million of notes priced at a

fixed rate of 5.52% and maturing September 12, 2029 and (ii) $75

million of notes priced at a fixed rate of 5.70% and maturing

February 22, 2032.

The senior unsecured notes will fund on February

25, 2025 and proceeds will be used to repay in full the Company’s

$50 million 4.75% Series C senior unsecured notes due February 25,

2025 and for general corporate purposes, including to fund

investment activity.

2025 Guidance

The Company has established its initial 2025

AFFO guidance at a range of $2.40 to $2.42 per diluted share. The

Company’s outlook includes completed transaction activity as of

December 31, 2024, as well as the issuance and simultaneous

repayment of the senior notes referenced above, but does not

include assumptions for any prospective acquisitions, dispositions,

or capital markets activities (including the settlement of

outstanding forward sale agreements).

The guidance is based on current assumptions and

is subject to risks and uncertainties more fully described in this

press release and the Company’s periodic reports filed with the

Securities and Exchange Commission.

About Getty Realty Corp.

Getty Realty Corp. is a publicly traded, net

lease REIT specializing in the acquisition, financing and

development of convenience, automotive and other single tenant

retail real estate. As of December 31, 2024, the Company’s

portfolio included 1,118 freestanding properties located in 42

states across the United States and Washington, D.C.

Non-GAAP Financial Measures

In addition to measurements defined by

accounting principles generally accepted in the United States of

America (“GAAP”), the Company also focuses on Funds From Operations

(“FFO”) and Adjusted Funds From Operations (“AFFO”) to measure its

performance.

FFO and AFFO are generally considered by

analysts and investors to be appropriate supplemental non-GAAP

measures of the performance of REITs. FFO and AFFO are not in

accordance with, or a substitute for, measures prepared in

accordance with GAAP. In addition, FFO and AFFO are not based on

any comprehensive set of accounting rules or principles. Neither

FFO nor AFFO represent cash generated from operating activities

calculated in accordance with GAAP and therefore these measures

should not be considered an alternative for GAAP net earnings or as

a measure of liquidity. These measures should only be used to

evaluate the Company’s performance in conjunction with

corresponding GAAP measures.

FFO is defined by the National Association of

Real Estate Investment Trusts (“NAREIT”) as GAAP net earnings

before (i) depreciation and amortization of real estate assets,

(ii) gains or losses on dispositions of real estate assets, (iii)

impairment charges, and (iv) the cumulative effect of accounting

changes.

The Company defines AFFO as FFO excluding (i)

certain revenue recognition adjustments (defined below), (ii)

certain environmental adjustments (defined below), (iii)

stock-based compensation, (iv) amortization of debt issuance costs

and (v) other non-cash and/or unusual items that are not reflective

of the Company’s core operating performance.

Other REITs may use definitions of FFO and/or

AFFO that are different than the Company’s and, accordingly, may

not be comparable.

The Company believes that FFO and AFFO are

helpful to analysts and investors in measuring the Company’s

performance because both FFO and AFFO exclude various items

included in GAAP net earnings that do not relate to, or are not

indicative of, the core operating performance of the Company’s

portfolio. Specifically, FFO excludes items such as depreciation

and amortization of real estate assets, gains or losses on

dispositions of real estate assets, and impairment charges. With

respect to AFFO, the Company further excludes the impact of (i)

deferred rental revenue (straight-line rent), the net amortization

of above-market and below-market leases, adjustments recorded for

the recognition of rental income from direct financing leases, and

the amortization of deferred lease incentives (collectively,

“Revenue Recognition Adjustments”), (ii) environmental accretion

expenses, environmental litigation accruals, insurance

reimbursements, legal settlements and judgments, and changes in

environmental remediation estimates (collectively, “Environmental

Adjustments”), (iii) stock-based compensation expense, (iv)

amortization of debt issuance costs and (v) other items, which may

include allowances for credit losses on notes and mortgages

receivable and direct financing leases, losses on extinguishment of

debt, retirement and severance costs, and other items that do not

impact the Company’s recurring cash flow and which are not

indicative of its core operating performance.

The Company pays particular attention to AFFO

which it believes provides the most useful depiction of the core

operating performance of its portfolio. By providing AFFO, the

Company believes it is presenting information that assists analysts

and investors in their assessment of the Company’s core operating

performance, as well as the sustainability of its core operating

performance with the sustainability of the core operating

performance of other real estate companies.

Forward-Looking Statements

Certain statements contained herein may

constitute “forward-looking statements” within the meaning of the

private securities litigation reform act of 1995. When the words

“believes,” “expects,” “plans,” “projects,” “estimates,”

“anticipates,” “predicts,” “outlook” and similar expressions are

used, they identify forward-looking statements. These

forward-looking statements are based on management’s current

beliefs and assumptions and information currently available to

management and involve known and unknown risks, uncertainties and

other factors which may cause the actual results, performance or

achievements of the company to be materially different from any

future results, performance or achievements expressed or implied by

these forward-looking statements. Examples of forward-looking

statements include, but are not limited to, those regarding the

company’s 2025 AFFO per share guidance, those made by Mr. Constant,

and statements regarding AFFO as a measure best representing core

operating performance and its utility in comparing the

sustainability of the company’s core operating performance with the

sustainability of the core operating performance of other

REITs.

Information concerning factors that could cause

the company’s actual results to differ materially from these

forward-looking statements can be found elsewhere from this press

release, including, without limitation, those statements in the

company’s periodic reports filed with the securities and exchange

commission. The company undertakes no obligation to publicly

release revisions to these forward-looking statements to reflect

future events or circumstances or reflect the occurrence of

unanticipated events.

|

Contacts: |

Brian Dickman |

Investor Relations |

|

|

Chief Financial Officer |

(646) 349-0598 |

|

|

(646) 349-6000 |

ir@gettyrealty.com |

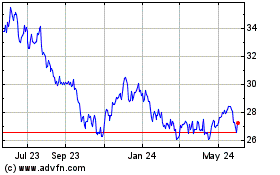

Getty Realty (NYSE:GTY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Getty Realty (NYSE:GTY)

Historical Stock Chart

From Feb 2024 to Feb 2025