Hyatt Hotels Corporation (“Hyatt” or the “Company”) (NYSE: H), a

leading global hospitality company, announced today that it is

commencing, through an indirect wholly owned subsidiary, HI

Holdings Playa B.V. (“Buyer”), a cash tender offer to purchase all

of the outstanding ordinary shares of Playa Hotels & Resorts

N.V. (“Playa”) (NASDAQ: PLYA) for $13.50 per share in cash, less

any applicable withholding taxes and without interest. The offer is

being made pursuant to the previously announced purchase agreement,

dated February 9, 2025, among Hyatt, Buyer and Playa.

Playa is a leading owner and operator of all-inclusive resorts

in Mexico, the Dominican Republic and Jamaica. Buyer is currently

the beneficial owner of 9.4% of Playa’s outstanding shares.

The tender offer is scheduled to expire at 5:00 p.m. New York

City Time, on April 25, 2025, unless extended in accordance with

the terms of the purchase agreement. The tender offer is subject to

various conditions, including, among other things, satisfaction of

a minimum tender condition and the receipt of regulatory approvals

in various jurisdictions.

Hyatt will file today with the U.S. Securities and Exchange

Commission (the “SEC”) a tender offer statement on Schedule TO,

which includes the terms of the tender offer. Additionally, Playa

will file a Schedule 14D-9 with the SEC containing the

recommendation of its Board of Directors that Playa shareholders

accept the tender offer and tender their shares. The Schedule TO,

Schedule 14D-9, related letter of transmittal (together with any

amendments or supplements thereto) and other tender offer documents

can be obtained free of charge at the website maintained by the SEC

at www.sec.gov or by contacting the information agent for the

tender offer, Georgeson LLC as described in the tender offer

documents.

About Hyatt Hotels Corporation

Hyatt Hotels Corporation (NYSE: H), headquartered in Chicago, is

a leading global hospitality company guided by its purpose - to

care for people so they can be their best. As of December 31, 2024,

the Company's portfolio included more than 1,400 hotels and

all-inclusive properties in 79 countries across six continents. The

Company's offering includes brands in the Luxury Portfolio,

including Park Hyatt®, Alila®, Miraval®,

Impression by Secrets, and The Unbound Collection by

Hyatt®; the Lifestyle Portfolio, including Andaz®,

Thompson Hotels®, The Standard®, Dream®

Hotels, The StandardX, Breathless Resorts &

Spas®, JdV by Hyatt®, Bunkhouse® Hotels,

and Me and All Hotels; the Inclusive Collection, including

Zoëtry® Wellness & Spa Resorts, Hyatt

Ziva®, Hyatt Zilara®, Secrets® Resorts &

Spas, Dreams® Resorts & Spas, Hyatt Vivid

Hotels & Resorts, Sunscape® Resorts &

Spas, and Alua Hotels & Resorts®; the Classics

Portfolio, including Grand Hyatt®, Hyatt Regency®,

Destination by Hyatt®, Hyatt Centric®, Hyatt

Vacation Club®, and Hyatt®; and the Essentials

Portfolio, including Caption by Hyatt®, Hyatt Place®,

Hyatt House®, Hyatt Studios, and UrCove.

Subsidiaries of the Company operate the World of Hyatt® loyalty

program, ALG Vacations®, Mr & Mrs Smith, Unlimited Vacation

Club®, Amstar® DMC destination management services, and Trisept

Solutions® technology services. For more information, please visit

www.hyatt.com.

About Playa Hotels & Resorts N.V.

Playa Hotels & Resorts N.V., through its subsidiaries

(NASDAQ: PLYA, “Playa”), is a leading owner, operator and developer

of all-inclusive resorts in prime beachfront locations in Mexico,

Jamaica and the Dominican Republic. Playa currently owns and/or

manages a total portfolio consisting of 22 resorts (8,342 rooms)

under the following brands: Hyatt Zilara, Hyatt Ziva, Hilton

All-Inclusive, Wyndham Alltra, Seadust, Kimpton, Jewel Resorts and

The Luxury Collection. Playa leverages years of all-inclusive

resort operating expertise and relationships with globally

recognized hospitality brands to provide a best-in-class experience

and exceptional value to guests, while building a direct

relationship to improve customer acquisition cost and drive repeat

business. For more information, please visit

www.playaresorts.com.

Important Information About the Tender Offer

This press release is for informational purposes only and is

neither an offer to purchase nor a solicitation of an offer to sell

Ordinary Shares of Playa Hotels & Resorts N.V. (“Playa”) or any

other securities, nor is it a substitute for the tender offer

materials that HI Holdings Playa B.V. (the “Buyer”) filed with the

SEC upon the commencement of the tender offer. The Purchaser has

filed with the SEC a tender offer statement on Schedule TO (the

“Tender Offer Statement”) and the Company has filed with the SEC a

solicitation/recommendation statement on Schedule 14D-9 (the

“Solicitation/Recommendation Statement”) with respect to the tender

offer. THE TENDER OFFER STATEMENT (INCLUDING AN OFFER TO

PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER

OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON

SCHEDULE 14D-9 CONTAIN IMPORTANT INFORMATION. PLAYA’S SHAREHOLDERS

ARE URGED TO READ THESE DOCUMENTS CAREFULLY (AS EACH MAY BE AMENDED

OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY CONTAIN IMPORTANT

INFORMATION THAT HOLDERS OF PLAYA’S SECURITIES SHOULD CONSIDER

BEFORE MAKING ANY DECISION WITH RESPECT TO THE TENDER OFFER.

The Tender Offer Statement (including the Offer to Purchase, the

related Letter of Transmittal and certain other tender offer

documents), as well as the Solicitation/Recommendation Statement,

are available to all holders of Playa’s Ordinary Shares at no

expense to them. The Tender Offer Statement and the

Solicitation/Recommendation Statement are available for free at the

SEC’s website at www.sec.gov. Copies of the documents filed by the

Buyer with the SEC will also be available free of charge on Hyatt’s

Investor Relations site at investors.hyatt.com. In addition, Playa

shareholders may obtain free copies of the tender offer materials

by contacting the information agent for the tender offer by

telephone at (866) 828-4304 (toll free) or (210) 664-3693 (non-toll

free), or by email at HyattOffer@georgeson.com.

Forward-Looking Statements

This press release contains certain “forward-looking

statements,” which statements are not historical facts, relating to

Hyatt, Playa and the proposed acquisition. These statements

include, but are not limited to: statements about the proposed

acquisition and the expected timeline for completing the

acquisition; approvals of the acquisition; ability to consummate

and finance the acquisition; method of financing the acquisition;

integration of the acquisition; future operations or benefits;

future business and financial performance; and outcomes of the

proposed acquisition involve known and unknown risks that are

difficult to predict. Words such as “anticipate,” “believe,”

“estimate,” “expect,” “seek,” “likely,” “forecast,” “estimate,”

“continue,” “intend,” “may,” “could,” “plan,” “project,” “predict,”

“should,” “would,” “will” and variations of these terms and similar

expressions, or the negative of these terms or similar expressions,

are intended to identify such forward-looking statements. Such

forward-looking statements are necessarily based upon estimates and

assumptions available to us as of the date the statements are made,

which are inherently uncertain. Our actual results, performance or

achievements may differ materially from those expressed or implied

by these forward-looking statements due to various known and

unknown risks and uncertainties. Factors that may cause actual

results, performance or achievements to differ materially from

current expectations include, but are not limited to: the effects

that the announcement or pendency of the proposed acquisition may

have on us, Playa and our respective business and ability to retain

and hire key personnel and maintain relationships with customers,

suppliers and others with whom we or they do business; inability to

obtain required regulatory or government approvals or to obtain

such approvals on satisfactory conditions; inability to obtain

sufficient shareholder tender of Playa ordinary shares, shareholder

approval or to satisfy other closing conditions; inability to

obtain financing; the occurrence of any event, change or other

circumstance that could give rise to the termination of the

definitive agreement; the effects that any termination of the

definitive agreement may have on us or our business; failure to

successfully complete the proposed acquisition; legal proceedings

that may be instituted related to the proposed acquisition;

significant and unexpected costs, charges or expenses related to

the proposed acquisition; risks associated with potential

divestitures, including of Playa real estate or business; ability

or failure to successfully integrate the acquisition with existing

operations; ability to realize anticipated synergies or obtain the

results anticipated; general economic uncertainty in key global

markets and a worsening of global economic conditions or low levels

of economic growth; the financial condition of, and our and Playa’s

relationships with, third-party owners, franchisees, and

hospitality venture partners; the possible inability of third-party

owners, franchisees, or development partners to access the capital

necessary to fund current operations or implement our plans for

growth; our ability to successfully execute our strategy to expand

our management and hotels services and franchising business while

at the same time reducing Playa’s real estate asset base within

targeted timeframes and at expected values; our and Playa’s ability

to maintain effective internal control over financial reporting and

disclosure controls and procedures; declines in the value of real

estate assets; unforeseen terminations of management and hotels

services or franchise agreements; risks associated with changing,

or the introduction of new, brand concepts, including lack of

acceptance of different or new brands or innovation; general

volatility of the capital markets and our ability to access such

markets; changes in the competitive environment in our industry,

industry consolidation, and the markets where we and Playa operate;

violations of regulations or laws related to our or Playa’s

franchising businesses, licensing businesses or international

operations; and other risks discussed in our filings with the SEC,

including our most recently filed annual report on Form 10-K and

subsequent quarterly reports filed on Form 10-Q, which filings are

incorporated herein by reference and available from the SEC’s

website at www.sec.gov, and in other documents that we may file

with or furnish to the SEC. All forward-looking statements

attributable to us or persons acting on our behalf are expressly

qualified in their entirety by the cautionary statements set forth

above. We caution you not to place undue reliance on any

forward-looking statements, which are made only as of the date of

this press release. We do not undertake or assume any obligation to

update publicly any of these forward-looking statements to reflect

actual results, new information or future events, changes in

assumptions or changes in other factors affecting forward-looking

statements or otherwise, except to the extent required by

applicable law. If we update one or more forward-looking

statements, no inference should be drawn that we will make

additional updates with respect to those or other forward-looking

statements.

HHC-FIN

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224115737/en/

For further information:

Hyatt Media Contact: Franziska Weber

franziska.weber@hyatt.com

Hyatt Investor Contacts: Adam Rohman

adam.rohman@hyatt.com

Ryan Nuckols ryan.nuckols@hyatt.com

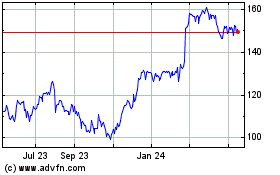

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Jan 2025 to Feb 2025

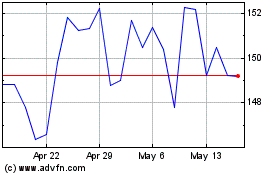

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Feb 2024 to Feb 2025