Second highest silver production drives

record revenues, positive free cash flow, and deleveraging

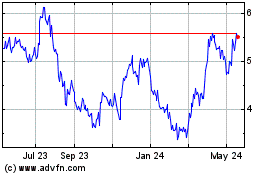

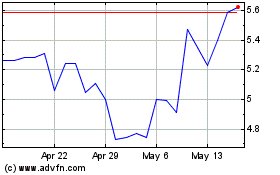

Hecla Mining Company (NYSE:HL, "Company") today announced second

quarter 2024 financial and operating results.

SECOND QUARTER HIGHLIGHTS

Operational

- Production of 4.5 million silver ounces, second highest in

Company history.

- Lucky Friday's silver production of 1.3 million ounces was the

highest since 2000. Record mill throughput of 1,181 tons per day

("tpd").

- Keno Hill All-Injury Frequency Rate ("AIFR") improved by 12% to

1.98, while producing a record 0.9 million ounces of silver, a 39%

increase over the first quarter of 2024.

- 2024 silver production and consolidated cost guidance

reiterated, gold production guidance increased.

Financial

- Revenues of $245.7 million, highest in Company history, 46%

from silver and 34% from gold.

- Net income applicable to common stockholders of $27.7 million

or $0.04 per share, adjusted net income applicable to common

stockholders of $12.3 million or $0.02 per share.1

- Trailing twelve month Adjusted EBITDA of $242.8 million, net

leverage ratio* improved to 2.3.5

- Cash provided by operating activities of $78.7 million, free

cash flow of $28.3 million.2

- Free cash flow generated at all operations, particularly strong

at Greens Creek and Lucky Friday.

- Greens Creek generated $43.3 million in cash flow from

operations and $33.6 million in free cash flow.2

- Lucky Friday generated $44.5 million in cash flow from

operations and $33.7 million in free cash flow (including $17.8

million in insurance receipts).2

- Consolidated silver total cost of sales of $123.3 million and

cash cost and all-in sustaining cost ("AISC") per silver ounce

(each after by-product credits) of $2.08 and $12.54,

respectively.3,4

- Received $17.8 million in Lucky Friday insurance claim

proceeds, $35.2 million received to date.

- Realized silver price of $29.77 per ounce, $0.01375 cash

dividend per common share, includes silver-linked component of

$0.01 per share.

Exploration

- Drilling at Keno Hill intersected significant widths of

high-grade silver mineralization at both the Bermingham and Flame

& Moth deposits, confirmed and expanded mineralization in both

areas. Highlights include:

- Bermingham Bear Vein: 35.4 oz/ton silver, 2.2% lead, and 2.0%

zinc over 20.2 feet.

- Flame & Moth Veins 0, 1, and Stockwork: 28.6 oz/ton silver,

3.3% lead, and 6.2% zinc over 22.3 feet.

- Drilling at Greens Creek intersected strong mineralization in

multiple ore zones adding confidence and expanding mineralization.

Most notably, the West Zone: 72.7 oz/ton silver, 0.23 oz/ton gold,

9.6% zinc, and 5.2% lead over 26.9 feet.

* Net Leverage ratio is calculated as

long-term debt and finance leases less cash to adjusted EBITDA.

"Hecla saw significant improvement in gross profit and free cash

flow during the quarter - with our gross profit increasing more

than 1.5 times over the prior quarter, and free cash flow

generation of $28.3 million, which allowed us to reduce our net

debt by $25.1 million," said Cassie Boggs, interim President and

CEO. "This financial performance was driven by strong results and

free cash flow generated at Greens Creek and Lucky Friday, while

Keno Hill's ramp-up progressed well with throughput in excess of

400 tpd. With this strong performance and favorable price

environment, we will continue our focus on reducing debt while

continuing to invest in our operations and exploration

programs."

Boggs continued, "At Keno Hill, while the ramp-up has gone well,

our focus will be to ensure Hecla's culture of safety and

environmental excellence is instilled in the operational and mining

practices. As a result, we expect costs and investment at the mine

will remain at current levels as more work is required to deliver

long-term value. We are committed to collaborating and working with

the First Nation of Na-Cho Nyäk Dun as they work through the

clean-up work after the heap leach failure at Victoria Gold's Eagle

Gold mine. We have offered our assistance and will continue to be

available where we can during this time of crisis."

Boggs concluded, "Silver demand is projected to remain robust,

supported by the growing solar demand as the world transitions to a

cleaner, greener economy. With Hecla's silver production expected

at about 17 million ounces this year, potentially increasing to 20

million ounces by 2026, Hecla remains the fastest growing

established silver producer with growth in the best mining

jurisdictions."

FINANCIAL OVERVIEW

In the following table and throughout this release, "total cost

of sales" is comprised of cost of sales and other direct production

costs and depreciation, depletion and amortization, and comparisons

are made to the "prior quarter" which refers to the first quarter

of 2024.

In Thousands unless stated otherwise

2Q-2024

1Q-2024

4Q-2023

3Q-2023

2Q-2023

YTD-2024

YTD-2023

FINANCIAL AND PRODUCTION

SUMMARY

Sales

$

245,657

$

189,528

$

160,690

$

181,906

$

178,131

$

435,185

$

377,631

Total cost of sales

$

194,227

$

170,368

$

153,825

$

148,429

$

140,472

$

364,595

$

305,024

Gross profit

$

51,430

$

19,160

$

6,865

$

33,477

$

37,659

$

70,590

$

72,607

Net income (loss) applicable to common

stockholders

$

27,732

$

(5,891

)

$

(43,073

)

$

(22,553

)

$

(15,832

)

$

21,841

$

(19,143

)

Basic income (loss) per common share (in

dollars)

$

0.04

$

(0.01

)

$

(0.07

)

$

(0.04

)

$

(0.03

)

$

0.04

$

(0.03

)

Adjusted EBITDA1

$

90,895

$

72,699

$

32,907

$

46,251

$

67,740

$

163,594

$

129,642

Total Debt

$

590,451

$

571,030

Net Debt to Adjusted EBITDA1

2.3

2.1

Cash provided by operating activities

$

78,718

$

17,080

$

884

$

10,235

$

23,777

$

95,798

$

64,380

Capital Expenditures

$

(50,420

)

$

(47,589

)

$

(62,622

)

$

(55,354

)

$

(51,468

)

$

(98,009

)

$

(105,911

)

Free Cash Flow2

$

28,298

$

(30,509

)

$

(61,738

)

$

(45,119

)

$

(27,691

)

$

(2,211

)

$

(41,531

)

Silver ounces produced

4,458,484

4,192,098

2,935,631

3,533,704

3,832,559

8,650,582

7,873,528

Silver payable ounces sold

3,785,285

3,481,884

2,847,591

3,142,227

3,360,694

7,267,169

6,965,188

Gold ounces produced

37,324

36,592

37,168

39,269

35,251

73,916

74,822

Gold payable ounces sold

35,276

32,189

33,230

36,792

31,961

67,465

71,580

Cash Costs and AISC, each after

by-product credits

Silver cash costs per ounce 3

$

2.08

$

4.78

$

4.94

$

3.31

$

3.32

$

3.38

$

2.70

Silver AISC per ounce 4

$

12.54

$

13.10

$

17.48

$

11.39

$

11.63

$

12.81

$

10.21

Gold cash costs per ounce 3

$

1,701

$

1,669

$

1,702

$

1,475

$

1,658

$

1,685

$

1,725

Gold AISC per ounce 4

$

1,825

$

1,899

$

1,969

$

1,695

$

2,147

$

1,861

$

2,286

Realized Prices

Silver, $/ounce

$

29.77

$

24.77

$

23.47

$

23.71

$

23.67

$

27.37

$

23.12

Gold, $/ounce

$

2,338

$

2,094

$

1,998

$

1,908

$

1,969

$

2,222

$

1,928

Lead, $/pound

$

1.06

$

0.97

$

1.09

$

1.07

$

0.99

$

1.02

$

1.00

Zinc, $/pound

$

1.51

$

1.10

$

1.39

$

1.52

$

1.13

$

1.30

$

1.26

Sales in the second quarter increased by 30% from the prior

quarter to $245.7 million due to higher quantities sold of all

metals produced except zinc, as well as higher realized prices for

all metals. The higher sales volumes were due to a full quarter of

production at Lucky Friday, increased sales at Keno Hill and Casa

Berardi, partially offset by lower volumes sold at Greens

Creek.

Gross profit increased by 168% to $51.4 million, reflecting

higher realized prices and higher sales volumes at Lucky Friday and

Casa Berardi.

Net income applicable to common stockholders for the quarter was

$27.7 million, a $33.6 million improvement from the prior quarter,

primarily because of:

- Ramp-up and suspension costs decreased by $9.0 million to $5.5

million, reflecting a full quarter of Lucky Friday production

following the restart in January and improved performance at Keno

Hill.

- Fair value adjustments, net increased by $6.9 million due to

unrealized gains on both our derivative contracts not designated as

accounting hedges, and marketable equity securities portfolio.

The above items were partly offset by:

- Income and mining tax provision increased by $7.3 million to

$9.1 million reflecting higher taxable income of our US

operations.

- General and administrative costs increased by $3.5 million due

to costs incurred related to the former CEO's retirement, which

were primarily non cash equity compensation costs.

Consolidated silver total cost of sales in the second quarter

increased by 14% to $123.3 million, reflecting a full quarter of

production at Lucky Friday and increased sales at Keno Hill.

Consolidated cash costs and AISC per silver ounce, each after

by-product credits, were $2.08 and $12.54 respectively and only

include costs of Greens Creek and Lucky Friday for the full quarter

(commercial production has not been declared at Keno Hill). The

decrease in cash costs and AISC per silver ounce was due to higher

silver production and higher by-product credits partially offset by

higher production costs.3,4

Consolidated gold total cost of sales were $67.3 million,

reflecting an increase in sales volumes at Casa Berardi. Cash costs

and AISC per gold ounce, each after by-product credits, were $1,701

and $1,825, respectively.3,4 The increase in cash costs per ounce

was attributable to higher contractor, maintenance and consumables

costs partially offset by higher gold production at Casa Berardi,

with AISC also impacted by lower sustaining capital.

Adjusted EBITDA for the quarter was a record $90.9 million, an

increase of $18.2 million primarily due to higher gross profit for

the reasons mentioned above.5 The net leverage ratio improved to

2.3 from 2.7 in the prior quarter due to higher adjusted EBITDA and

a reduction in net debt of $25.1 million as the Company decreased

borrowings under its revolving credit facility.5 Cash and cash

equivalents at the end of the quarter were $24.6 million and

included $62.0 million drawn on the revolving credit facility.

Borrowing on the revolving credit facility decreased by $78 million

in the quarter as the Company utilized free cash flow and insurance

proceeds to reduce the drawn amount. At current price levels and

expected production, the Company anticipates the net leverage ratio

to return to the Company's target of less than 2.0 by the end of

the year 2024.5

Cash provided by operating activities was $78.7 million and

increased by $61.6 million due to an increase in net income

adjusted for non-cash items of $32.3 million and a favorable

working capital change of $29.3 million.

Capital expenditures of $50.4 million increased by $2.8 million

from the prior quarter. Capital investments at the operations were

as follows (i) $11.7 million at Greens Creek related to

development, equipment purchases and surface projects, (ii) $12.4

million at Casa Berardi, primarily related to tailings construction

activities, (iii) $10.8 million at Lucky Friday primarily related

to development, pre-production drilling, and equipment purchases,

and (iv) $14.5 million at Keno Hill, related to underground

development, mobile equipment purchases, and camp expansion.

Free cash flow for the quarter was $28.3 million, compared to

negative $30.5 million in the prior quarter.2 The improvement in

free cash flow was attributable to a full quarter of Lucky Friday

production and improved performance at Keno Hill which led to

higher sales volumes and realized prices.

Forward Sales Contracts for Base Metals and Foreign

Currency

The Company uses financially settled forward sales contracts to

manage exposure to zinc and lead price changes in forecasted

concentrate shipments. On June 30, 2024, the Company had contracts

covering approximately 7% and 34% of the forecasted payable zinc

and lead production, respectively, through 2026, at an average zinc

price of $1.37 per pound and a lead price of $0.99 per pound.

The Company also manages Canadian dollar ("CAD") exposure

through forward contracts. At June 30, 2024, the Company had hedged

approximately 54% of forecasted Casa Berardi and Keno Hill CAD-

denominated direct production costs through 2026 at an average

CAD/USD rate of 1.33. The Company has also hedged approximately 21%

of Casa Berardi and Keno Hill's projected CAD-denominated total

capital expenditures through 2026 at 1.35.

OPERATIONS OVERVIEW

Greens Creek Mine - Alaska

Dollars are in thousands except cost per

ton

2Q-2024

1Q-2024

4Q-2023

3Q-2023

2Q-2023

YTD-2024

YTD-2023

GREENS CREEK

Tons of ore processed

225,746

232,188

220,186

228,978

232,465

457,934

465,632

Total production cost per ton

$

218.09

$

212.92

$

223.98

$

200.30

$

194.94

$

215.46

$

196.77

Ore grade milled - Silver (oz./ton)

12.6

13.3

12.9

13.1

12.8

13.0

13.6

Ore grade milled - Gold (oz./ton)

0.09

0.09

0.09

0.09

0.10

0.09

0.09

Ore grade milled - Lead (%)

2.5

2.6

2.8

2.5

2.5

2.5

2.6

Ore grade milled - Zinc (%)

6.2

6.3

6.5

6.5

6.5

6.2

6.2

Silver produced (oz.)

2,243,551

2,478,594

2,260,027

2,343,192

2,355,674

4,722,145

5,128,533

Gold produced (oz.)

14,137

14,588

14,651

15,010

16,351

28,725

31,235

Lead produced (tons)

4,513

4,834

4,910

4,740

4,726

9,347

9,928

Zinc produced (tons)

12,400

13,062

12,535

13,224

13,255

25,462

25,737

Sales

95,659

$

97,310

$

93,543

$

96,459

$

95,891

$

192,969

$

194,502

Total cost of sales

$

(56,786

)

$

(69,857

)

$

(70,231

)

$

(60,322

)

$

(63,054

)

$

(126,643

)

$

(129,342

)

Gross profit

$

38,873

$

27,453

$

23,312

$

36,137

$

32,837

$

66,326

$

65,160

Cash flow from operations

$

43,276

$

28,706

$

34,576

$

36,101

$

43,302

$

71,982

$

86,648

Exploration

$

2,011

$

551

$

1,324

$

4,283

$

1,760

$

2,562

$

2,208

Capital additions

$

(11,704

)

$

(8,827

)

$

(15,996

)

$

(12,060

)

$

(8,828

)

$

(20,531

)

$

(15,486

)

Free cash flow 2

$

33,583

$

20,430

$

19,904

$

28,324

$

36,234

$

54,013

$

73,370

Cash cost per ounce, after by-product

credits 3

$

0.19

$

3.45

$

4.94

$

3.04

$

1.33

$

1.90

$

1.23

AISC per ounce, after by-product credits

4

$

5.40

$

7.16

$

12.00

$

8.18

$

5.34

$

6.33

$

4.51

Greens Creek produced 2.2 million ounces of silver during the

quarter, a decrease of 9% compared to the prior quarter, primarily

due to lower mined grades which reverted to plan. Throughput for

the quarter averaged 2,481 tpd, a decline of 3% as multiple mill

maintenance projects including installation of a new primary

screen, relining of the grinding circuit, and concentrate thickener

rake replacement, were completed during the quarter. By-product

metal production was lower primarily due to lower grades.

Sales in the quarter were $95.7 million, a 2% decrease due to

lower quantities of all metals sold, partially offset by higher

realized prices. Lower sales volumes were also attributable to an

increase in silver and zinc concentrate inventory due to the timing

of shipments at quarter end. Total cost of sales decreased to $56.8

million, reflecting lower sales volumes. Cash costs and AISC per

silver ounce, each after by-product credits, were $0.19 and $5.40,

respectively, and decreased over the prior quarter due to lower

treatment charges and higher by-product credits (higher realized

prices for by-products offset lower production volumes).3,4

Cash flow from operations was $43.3 million, an increase of

$14.6 million, primarily due to higher realized prices. Free cash

flow for the quarter was $33.6 million, an increase of $13.2

million, as higher cash flow from operations was partially offset

by planned higher capital investment during the quarter.

Lucky Friday Mine - Idaho

Dollars are in thousands except cost per

ton

2Q-2024

1Q-2024

4Q-2023

3Q-2023

2Q-2023

YTD-2024

YTD-2023

LUCKY FRIDAY

Tons of ore processed

107,441

86,234

5,164

36,619

94,043

193,675

189,346

Total production cost per ton

$

233.99

$

233.10

$

201.42

$

191.81

$

248.65

$

233.59

$

229.56

Ore grade milled - Silver (oz./ton)

12.9

12.9

12.7

13.6

14.3

12.9

14.1

Ore grade milled - Lead (%)

8.1

8.2

8.0

8.6

9.1

8.2

9.0

Ore grade milled - Zinc (%)

3.6

3.9

3.5

3.5

4.2

3.7

4.2

Silver produced (oz.)

1,308,155

1,061,065

61,575

475,414

1,286,666

2,369,220

2,549,130

Lead produced (tons)

8,229

6,689

372

2,957

8,180

14,918

16,214

Zinc produced (tons)

3,320

2,851

134

1,159

3,338

6,171

6,651

Sales

$

59,071

$

35,340

$

3,117

$

21,409

$

42,648

$

94,411

$

91,758

Total cost of sales

$

(37,523

)

$

(27,519

)

$

(3,117

)

$

(14,344

)

$

(32,190

)

$

(65,042

)

$

(66,724

)

Gross profit

$

21,548

$

7,821

$

—

$

7,065

$

10,458

$

29,369

$

25,034

Cash flow from operations

$

44,546

$

27,112

$

(7,982

)

$

515

$

18,893

$

71,658

$

65,025

Capital additions

$

(10,818

)

$

(14,988

)

$

(18,819

)

$

(15,494

)

$

(16,317

)

$

(25,806

)

$

(31,024

)

Free cash flow 2

$

33,728

$

12,124

$

(26,801

)

$

(14,979

)

$

2,576

$

45,852

$

34,001

Cash cost per ounce, after by-product

credits 3

$

5.32

$

8.85

N/A

$

4.74

$

6.96

$

6.67

$

5.64

AISC per ounce, after by-product credits

4

$

12.74

$

17.36

N/A

$

10.63

$

14.24

$

14.50

$

12.48

Lucky Friday produced 1.3 million ounces of silver, the highest

quarterly production since 2000 and an increase of 23% over the

prior quarter, reflecting a full quarter of production. Mill

throughput of 1,181 tpd also set a record in the mine's 80-year

history.

Sales in the second quarter were $59.1 million, and total cost

of sales were $37.5 million, compared to $35.3 million and $27.5

million, respectively in the prior quarter, reflecting higher sales

volumes and realized prices. Cash costs and AISC per silver ounce,

each after by-product credits, were $5.32 and $12.74 respectively,

and were lower due to higher production, but higher than guidance

due to higher labor and contractor costs, and higher profit sharing

(under the collective bargaining agreement) reflecting the strong

performance and higher realized prices.

Cash flow from operations was $44.5 million and includes $17.8

million in insurance proceeds received during the quarter, as well

as positive working capital adjustments due to ramp-up being

achieved in the prior quarter.

Capital expenditures for the quarter were $10.8 million, and

included capital development, mobile equipment purchases, and

completion of the rehabilitation work related to the secondary

egress (#2 shaft). Free cash flow for the quarter was $33.7

million, an increase of $21.6 million reflecting a full quarter of

operations and the collection of $17.8 million of insurance

proceeds.2 The Company's underground insurance sublimit coverage is

$50 million, of which $35.2 million has been received to date and

the Company expects to receive the remaining $14.8 million in

insurance proceeds before the end of the year.

Keno Hill - Yukon Territory

Dollars are in thousands except cost per

ton

2Q-2024

1Q-2024

4Q-2023

3Q-2023

2Q-2023

YTD-2024

YTD-2023

KENO HILL

Tons of ore processed

36,977

25,165

19,651

24,616

12,064

62,142

12,064

Total production cost per ton

$

116.48

$

132.42

$

145.36

$

88.97

$

202.66

$

123.60

$

109.42

Ore grade milled - Silver (oz./ton)

25.1

26.3

31.7

33.0

20.2

25.6

20.2

Ore grade milled - Lead (%)

2.4

2.4

2.6

2.4

2.5

2.4

2.5

Ore grade milled - Zinc (%)

1.4

1.3

1.6

2.5

4.1

1.4

4.1

Silver produced (oz.)

900,440

646,312

608,301

710,012

184,264

1,546,752

184,264

Lead produced (tons)

845

576

481

327

417

1,421

417

Zinc produced (tons)

471

298

396

252

691

769

691

Sales

$

28,950

$

10,847

$

17,936

$

16,001

$

1,581

$

39,797

$

1,581

Total cost of sales

$

(28,950

)

$

(10,847

)

$

(17,936

)

$

(16,001

)

$

(1,581

)

$

(39,797

)

$

(1,581

)

Gross profit

$

—

$

—

$

—

$

—

$

—

$

—

$

—

Cash flow from operations

$

14,585

$

(13,334

)

$

1,181

$

(6,200

)

$

(12,900

)

$

1,251

$

(19,224

)

Exploration

$

2,019

$

498

$

1,548

$

1,653

$

1,039

$

2,517

$

1,476

Capital additions

$

(14,533

)

$

(10,346

)

$

(12,549

)

$

(11,498

)

$

(3,505

)

$

(24,879

)

$

(20,625

)

Free cash flow 2

$

2,071

$

(23,182

)

$

(9,820

)

$

(16,045

)

$

(15,366

)

$

(21,111

)

$

(38,373

)

At Keno Hill, ramp-up continued and the mine produced 900,440

ounces of silver in the second quarter, a record for the operation,

and an increase of 39% over the prior quarter. Throughput in the

quarter averaged 406 tpd, an increase of 47%, partially offset by

lower silver grades, which were 25.1 ounces per ton. Production

commenced from the Flame & Moth deposit at the beginning of

July and is expected to supplement ore production from the

Bermingham deposit.

Sales during the quarter were $29.0 million, an increase of

$18.1 million over the prior quarter due to a combination of higher

realized prices and volumes. Ramp-up costs during the quarter were

$1.8 million and are included in ramp-up and suspension costs on

the consolidated statement of operations. Expenditures on

production costs, including ramp-up costs (excluding depreciation),

totaled $27.4 million for the quarter, higher than the guidance of

$15-$17 million per quarter due to increased production volumes and

throughput. Capital investments during the quarter were $14.5

million for underground and surface infrastructure projects

including camp expansion, mine development, and mobile equipment

purchases.

The Company continues to make progress on the cemented tails

batch plant, a critical infrastructure project, which will

facilitate a change in the mining method at the Bermingham deposit

to underhand mining, which should improve safety and productivity.

Construction of the project is expected to be completed in the

fourth quarter with full conversion to underhand mining expected by

the end of 2025. Other key capital projects in progress are

expansion of camp facilities, water treatment plant upgrades, and

key equipment purchases.

Keno Hill's AIFR, one of several improving measures, improved

12% to 1.98. As the Keno Hill operation moves towards full

production, the Company expects sustained investment in long-term

infrastructure to support sustainable and safe mining operations

throughout the current reserve mine plan of eleven years. Continued

focus on safety, environmental, permitting, and mining practices,

and relations with First Nation of Na-Cho Nyäk Dun are key to

maintaining and increasing production levels and delivering

long-term value at this operation.

Casa Berardi - Quebec

Dollars are in thousands except cost per

ton

2Q-2024

1Q-2024

4Q-2023

3Q-2023

2Q-2023

YTD-2024

YTD-2023

CASA BERARDI

Tons of ore processed - underground

118,485

123,123

104,002

112,544

94,124

241,608

204,369

Tons of ore processed - surface pit

248,494

258,503

251,009

231,075

224,580

506,997

543,489

Tons of ore processed - total

366,979

381,626

355,011

343,619

318,704

748,605

747,858

Surface tons mined - ore and waste

4,064,091

3,639,297

4,639,770

3,574,391

2,461,196

7,703,388

4,598,189

Total production cost per ton

$

107.84

$

96.53

$

108.20

$

103.75

$

97.69

$

102.07

$

103.58

Ore grade milled - Gold (oz./ton) -

underground

0.14

0.14

0.12

0.13

0.14

0.14

0.13

Ore grade milled - Gold (oz./ton) -

surface pit

0.04

0.04

0.06

0.06

0.05

0.04

0.05

Ore grade milled - Gold (oz./ton) -

combined

0.07

0.07

0.07

0.07

0.06

0.07

0.07

Gold produced (oz.) - underground

13,719

13,707

11,206

12,416

10,226

27,426

22,014

Gold produced (oz.) - surface pit

9,468

8,297

11,311

11,843

8,675

17,765

21,573

Gold produced (oz.) - total

23,187

22,004

22,517

24,259

18,901

45,191

43,587

Silver produced (oz.) - total

6,338

6,127

5,730

5,084

5,956

12,465

11,601

Sales

$

58,623

$

41,584

$

42,822

$

46,912

$

36,946

$

100,207

$

87,944

Total cost of sales

$

(67,340

)

$

(58,260

)

$

(58,945

)

$

(56,822

)

$

(42,576

)

$

(125,600

)

$

(105,574

)

Gross loss

$

(8,717

)

$

(16,676

)

$

(16,123

)

$

(9,910

)

$

(5,630

)

$

(25,393

)

$

(17,630

)

Cash flow from operations

$

17,816

$

3,186

$

3,136

$

7,877

$

(8,148

)

$

21,002

$

(8,832

)

Exploration

$

315

$

685

$

635

$

1,482

$

1,107

$

1,000

$

2,161

Capital additions

$

(12,376

)

$

(13,316

)

$

(15,929

)

$

(16,225

)

$

(20,816

)

$

(25,692

)

$

(37,902

)

Free cash flow 2

$

5,755

$

(9,445

)

$

(12,158

)

$

(6,866

)

$

(27,857

)

$

(3,690

)

$

(44,573

)

Cash cost per ounce, after by-product

credits 3

$

1,701

$

1,669

$

1,702

$

1,475

$

1,658

$

1,685

$

1,725

AISC per ounce, after by-product credits

4

$

1,825

$

1,899

$

1,969

$

1,695

$

2,147

$

1,861

$

2,286

Casa Berardi produced 23,187 ounces of gold in the quarter, an

increase of 5% over the prior quarter as a 7% increase in

throughput and recoveries were offset by lower grades from the 160

pit. The mill operated at an average of 4,194 tpd during the

quarter.

Sales were $58.6 million, a 41% increase due to a combination of

higher sales volumes and realized prices. Total cost of sales were

$67.3 million, a 16% increase compared to the prior quarter,

attributable to higher sales volumes and higher costs. Cash costs

and AISC per gold ounce, each after by-product credits increased to

$1,701 and $1,825, respectively, primarily due to higher production

costs attributable to higher contractor costs and consumables

(higher volumes). AISC was favorably impacted by planned lower

sustaining capital spend. 3,4

Cash flow from operations was $17.8 million, an increase of

$14.6 million over the prior quarter. Capital investments for the

quarter totaled $12.4 million ($2.7 million in sustaining and $9.7

million in growth) and were primarily related to construction costs

for tailings facilities. Free cash flow for the quarter was $5.8

million and improved by $15.2 million from the prior quarter due to

higher cash flow from operations and lower capital spending.2

With the increase in gold prices, the Company has completed a

stope-by-stope analysis of the west mine underground operations and

is extending the underground operations for the remainder of 2024.

Please refer to the guidance section of the release for updated

production guidance for the mine.

EXPLORATION AND PRE-DEVELOPMENT

Exploration and pre-development expenses totaled $6.7 million

for the quarter. Exploration activities during the quarter

primarily focused on underground definition and exploration

drilling at Greens Creek, Keno Hill, and Casa Berardi.

Keno Hill

At Keno Hill, underground drilling during the first half of 2024

continued to intersect high-grade silver mineralization over

significant widths and highlights the potential for high-grade

silver mineralization in the district. Underground definition

drilling is focused on extending mineralization and resource

conversion in the high-grade Bermingham Bear Zone veins (Bear,

Footwall, and Main Vein zones) and in the Flame & Moth veins.

During the quarter, two underground drills completed over 13,000

feet of definition drilling. Three surface drills were also active

on the property testing multiple targets including the Bermingham

Deep, Bermingham Townsite, Elsa17-Dixie, and Silver Spoon target

areas that have potential for the discovery of additional large

high-grade silver deposits. Over 25,000 feet of surface exploration

drilling has been completed in 13 drillholes.

Assay highlights include (reported widths are estimates of true

width):

- Bear Vein: 35.4 oz/ton silver, 2.2% lead, and 2.0% zinc over

20.2 feet

- Includes: 150.8 oz/ton silver, 9.9% lead, and 4.8% zinc over

3.0 feet

- Main Vein: 29.8 oz/ton silver, 1.6% lead, and 0.2% zinc over

10.3 feet

- Includes: 86.0 oz/ton silver, and 8.0% lead over 0.8 feet.

- Includes: 203.9 oz/ton silver, 8.4% lead, and 0.1% zinc over

0.9 feet

- Flame & Moth Veins 0, 1, Stockwork: 28.6 oz/ton silver,

3.3% lead, and 6.2% zinc over 22.3 feet

- Includes: 129.8 oz/ton silver, 5.7% lead, and 6.6% zinc over

1.7 feet

- Includes: 35.1 oz/ton silver, 6.6% lead, and 10.6% zinc over

7.4 feet

Greens Creek

At Greens Creek, three underground drills completed over 44,000

feet of drilling focused on resource conversion and exploration to

extend mineralization of known resources. Drilling was focused in

the 9a, 200 South, 5250, NWW, West, Gallagher, and Southwest Bench

areas. In addition, two helicopter-supported surface exploration

drills completed over 8,000 feet of drilling (assays pending)

focused on expanding the Upper Plate Zone to the west of current

resources and drill testing the Mammoth target.

Assay highlights include (reported widths are estimates of true

width):

- NWW Zone: 32.0 oz/ton silver, 0.18 oz/ton gold, 14.2% zinc, and

5.0% lead over 19.3 feet

- 200 South Zone: 15.7 oz/ton silver, 0.02 oz/ton gold, 2.0%

zinc, and 1.0% lead over 26.9 feet

- West Zone: 72.7 oz/ton silver, 0.23 oz/ton gold, 9.6% zinc, and

5.2% lead over 26.9 feet

At Casa Berardi, underground drilling is continuing to evaluate

the remaining underground stopes and mineral zone extensions.

Detailed complete drill assay highlights can be found in Table A

at the end of the release.

DIVIDENDS

Common Stock

The Board of Directors declared a quarterly cash dividend of

$0.01375 per share of common stock, consisting of $0.00375 per

share for the minimum dividend component and $0.01 per share for

the silver-linked component. The common stock dividend is payable

on or about September 5, 2024, to stockholders of record on August

26, 2024. The quarter realized silver price was $29.77, satisfying

the criterion for the Company’s common stock silver-linked dividend

policy component.

Preferred Stock

The Board of Directors declared a quarterly cash dividend of

$0.875 per share of preferred stock, payable on or about October 1,

2024, to stockholders of record on September 16, 2024.

2024 GUIDANCE 6

The Company has updated its annual gold production, cost and

capital guidance as below. There is no change to silver production

guidance.

2024 Production Outlook

Gold production guidance for Casa Berardi is increased to

reflect the extension of underground operations until the end of

the year 2024.

Silver Production

(Moz)

Gold Production (Koz)

Silver Equivalent

(Moz)

Gold Equivalent (Koz)

Current

Previous

Current

Previous

Current

Previous

Current

2024 Greens Creek *

8.8 - 9.2

46 - 51

46 - 51

21.0 - 21.5

21.0 - 21.5

235 - 245

235 - 245

2024 Lucky Friday *

5.0 - 5.3

N/A

N/A

9.5 - 10.0

9.5 - 10.0

110 - 115

110 - 115

2024 Casa Berardi

N/A

75 - 82

80 - 87

6.5 - 7.2

6.9 - 7.5

75 - 82

80 - 87

2024 Keno Hill*

2.7 - 3.0

N/A

N/A

3.0 - 3.5

3.0 - 3.5

36 - 40

36 - 40

2024 Total

16.5 - 17.5

121 - 133

126 - 138

40.0 - 42.2

40.4 - 42.5

455 - 482

461 - 487

*Equivalent ounces include lead and zinc

production

2024 Cost Outlook

At Greens Creek, guidance for cash costs and AISC per silver

ounce, each after by-product credits, has decreased to reflect

higher by-product credits (due to strong realized prices), and

strong silver production. AISC per silver ounce, after by-product

credits, is also favorably impacted by lower expected capital

investment during the remaining year.

At Lucky Friday, guidance for cash costs and AISC per silver

ounce, each after by-product credits, has increased to reflect

higher labor and contractor costs incurred through the first half

of 2024, and expected higher profit sharing costs (under the

collective bargaining agreement) during the remaining year

attributable to higher prices.

At Keno Hill, expenditures on production costs, excluding

depreciation, are expected to be $25-$27 million per quarter for

the remaining year to reflect current levels of expenditures

associated with the increase in production volumes.

For Casa Berardi, cost of sales guidance is increased to include

expected underground production costs for the rest of 2024. Cash

costs and AISC, per gold ounce, each after by-product credits is

unchanged as the increased costs are offset by higher expected

production.

Costs of Sales

(million)

Cash cost, after by-product

credits, per silver/gold ounce3

AISC, after by-product

credits, per produced silver/gold ounce4

Previous

Current

Previous

Current

Previous

Current

Greens Creek

252

252

$3.50 - $4.00

$2.25 - $3.00

$9.50 - $10.25

$8.25 - $9.00

Lucky Friday

130

135

$2.00 - $3.25

$4.25 - $5.25

$10.50 - $12.25

$12.75 - $14.00

Total Silver

382

387

$3.00 - $3.75

$3.00 - $3.75

$13.00 - $14.50

$13.00 - $14.50

Casa Berardi

200

215

$1,500 - $1,700

$1,500 - $1,700

$1,750 - $1,975

$1,750 - $1,975

2024 Capital and Exploration Guidance

The Company is increasing capital guidance for the year to

reflect higher expected capital investment at Keno Hill, partially

offset by lower capital investment at Greens Creek. At Greens

Creek, capital investment guidance is reduced to reflect lower

capital investment through the first half of the year and timing of

equipment purchases and capital projects.

At Keno Hill, increase in capital investment guidance is

primarily attributable to increased underground development, water

treatment plant upgrades, camp expansion, equipment purchases, and

cemented tails batch plant.

Exploration and pre-development guidance is unchanged.

(millions)

Previous

Current

Current - Sustaining

Current - Growth

2024 Total Capital expenditures

$190 - $210

$196 - $218

$113 - $124

$83 - $94

Greens Creek

$59 - $63

$50 - $55

$47 - $50

$3 - $5

Lucky Friday

$45 - $50

$45 - $50

$42 - $45

$3 - $5

Keno Hill

$30 - $34

$45 - $50

$10 - $12

$35 - $38

Casa Berardi

$56 - $63

$56 - $63

$14 - $17

$42 - $46

2024 Exploration

$25

$25

2024 Pre-Development

$6.5

$6.5

CONFERENCE CALL AND WEBCAST

A conference call and webcast will be held on Wednesday, August

7, 2024, at 10:00 a.m. Eastern Time to discuss these results. The

Company recommends that the participants dial in at least 10

minutes before the call commencement. You may join the conference

call by dialing toll-free 1-888-330-2391 or for international

callers dial 1-240-789-2702. The Conference ID is 4812168 and must

be provided when dialing in. Hecla's live and archived webcast can

be accessed at https://events.q4inc.com/attendee/202789141 or

www.hecla.com under Investors.

VIRTUAL INVESTOR EVENT

Hecla will be holding a Virtual Investor Event on Wednesday,

August 7, from 12:00 p.m. to 1:30 p.m. Eastern Time.

Hecla invites shareholders, investors, and other interested

parties to schedule a personal, 30-minute virtual meeting (video or

telephone) with a member of senior management to discuss Financial,

Exploration, Operations, ESG or general matters. Click on the link

below to schedule a call (or copy and paste the link into your web

browser). You can select a topic once you have entered the meeting

calendar. If you are unable to book a time, either due to high

demand or for other reasons, please reach out to Anvita M. Patil,

Vice President, Investor Relations and Treasurer at

hmc-info@hecla.com or 208-769-4100.

One-on-One meeting URL: https://calendly.com/2024-aug-vie

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE: HL) is the largest

silver producer in the United States. In addition to operating

mines in Alaska, Idaho, and Quebec, Canada, the Company is

developing a mine in the Yukon, Canada, and owns a number of

exploration and pre-development projects in world-class silver and

gold mining districts throughout North America.

NOTES

Non-GAAP Financial Measures

Non-GAAP financial measures are intended to provide additional

information only and do not have any standard meaning prescribed by

United States generally accepted accounting principles ("GAAP").

These measures should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

GAAP. The non-GAAP financial measures cited in this release and

listed below are reconciled to their most comparable GAAP measure

at the end of this release.

(1) Adjusted net income (loss) applicable to common stockholders

is a non-GAAP measurement, a reconciliation of which to net income

(loss) applicable to common stockholders, the most comparable GAAP

measure, can be found at the end of the release. Adjusted net

income (loss) applicable to common stockholders is a measure used

by management to evaluate the Company's operating performance but

should not be considered an alternative to net income (loss)

applicable to common stockholders as defined by GAAP. They exclude

certain impacts which are of a nature which we believe are not

reflective of our underlying performance. Management believes that

adjusted net income (loss) applicable to common stockholders per

common share provides investors with the ability to better evaluate

our underlying operating performance.

(2) Free cash flow is a non-GAAP measure calculated as cash

provided by operating activities less capital expenditures. Cash

provided by operating activities for the Greens Creek, Lucky

Friday, and Casa Berardi operating segments excludes exploration

and pre-development expense, as it is a discretionary expenditure

and not a component of the mines’ operating performance. Capital

expenditures refers to Additions to properties, plants and

equipment from the Consolidated Statements of Cash Flows, net of

finance leases.

(3) Cash cost, after by-product credits, per silver and gold

ounce is a non-GAAP measurement, a reconciliation of total cost of

sales, can be found at the end of the release. It is an important

operating statistic that management utilizes to measure each mine's

operating performance. It also allows the benchmarking of

performance of each mine versus those of our competitors. As a

primary silver mining company, management also uses the statistic

on an aggregate basis - aggregating the Greens Creek and Lucky

Friday mines to compare performance with that of other silver

mining companies. Similarly, the statistic is useful in identifying

acquisition and investment opportunities as it provides a common

tool for measuring the financial performance of other mines with

varying geologic, metallurgical and operating characteristics. In

addition, the Company may use it when formulating performance goals

and targets under its incentive program.

(4) All-in sustaining cost (AISC), after by-product credits, is

a non-GAAP measurement, a reconciliation of which to total cost of

sales, the closest GAAP measurement, can be found in the end of the

release. AISC, after by-product credits, includes total cost of

sales and other direct production costs, expenses for reclamation

at the mine sites and all site sustaining capital costs. AISC,

after by-product credits, is calculated net of depreciation,

depletion, and amortization and by-product credits. Prior year

presentation has been adjusted to conform with current year

presentation.

(5) Adjusted EBITDA is a non-GAAP measurement, a reconciliation

of which to net loss, the most comparable GAAP measure, can be

found at the end of the release. Adjusted EBITDA is a measure used

by management to evaluate the Company's operating performance but

should not be considered an alternative to net loss, or cash

provided by operating activities as those terms are defined by

GAAP, and does not necessarily indicate whether cash flows will be

sufficient to fund cash needs. In addition, the Company may use it

when formulating performance goals and targets under its incentive

program. Net debt to adjusted EBITDA is a non-GAAP measurement, a

reconciliation of which to debt and net income (loss), the most

comparable GAAP measurements, can be found at the end of the

release. It is an important measure for management to measure

relative indebtedness and the ability to service the debt relative

to its peers. It is calculated as total debt outstanding less total

cash on hand divided by adjusted EBITDA.

(6) Expectations for 2024 include silver, gold, lead, and zinc

production from Greens creek, Lucky Friday, Keno Hill, and Casa

Berardi converted using gold $1,950/oz, silver $22.50/oz, zinc

$1.20/lb, and lead $0.95/lb. Numbers are rounded.

Current GAAP measures used in the mining industry, such as total

cost of goods sold, do not capture all the expenditures incurred to

discover, develop and sustain silver and gold production.

Management believes that AISC is a non-GAAP measure that provides

additional information to management, investors and analysts to

help (i) in the understanding of the economics of our operations

and performance compared to other producers and (ii) in the

transparency by better defining the total costs associated with

production. Similarly, the statistic is useful in identifying

acquisition and investment opportunities as it provides a common

tool for measuring the financial performance of other mines with

varying geologic, metallurgical and operating characteristics. In

addition, the Company may use it when formulating performance goals

and targets under its incentive program.

Cautionary Statement Regarding Forward

Looking Statements, Including 2024 Outlook

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws, including

Canadian securities laws. Words such as “may”, “will”, “should”,

“expects”, “intends”, “projects”, “believes”, “estimates”,

“targets”, “anticipates” and similar expressions are used to

identify these forward-looking statements. Such forward-looking

statements may include, without limitation: (i) the Company will

continue to focus on reducing debt while continuing to invest in

operations and exploration programs; (ii) silver demand is

projected to remain robust, supported by the growing solar demand

as the world transitions to a cleaner, greener economy; (iii) the

Company expects to produce 17 million ounces of silver in 2024 and

increase production potentially up to 20 million ounces by 2026;

(iv) at current price levels and expected production, the Company

anticipates the net leverage ratio (net debt to Adjusted EBITDA)

will return to less than 2 by 2024 year-end; (v) the Company

expects to receive an additional $14.8 million in insurance

proceeds in 2024; (vi) Casa Berardi may continue underground

production throughout 2024; (vii) construction of cemented tails

batch plant project is expected to 1) be completed in the fourth

quarter of 2024, 2) improve safety and productivity at the

Bermingham deposit, and 3) facilitate the change of mining method

to underhand mining by the end of 2025; (viii) projected total cost

of sales, as well as cash cost and AISC per ounce (in each case

after by-product credits) for Greens Creek, Lucky Friday, and Casa

Berardi individually and for silver overall for 2024; (ix)

Company-wide and mine-specific estimated spending on capital,

exploration and predevelopment for 2024 and (x) Company-wide and

mine-specific silver, gold, silver-equivalent and gold-equivalent

ounces of production for 2024. The material factors or assumptions

used to develop such forward-looking statements or forward-looking

information include that the Company’s plans for development and

production will proceed as expected and will not require revision

as a result of risks or uncertainties, whether known, unknown or

unanticipated, to which the Company’s operations are subject.

Estimates or expectations of future events or results are based

upon certain assumptions, which may prove to be incorrect, which

could cause actual results to differ from forward-looking

statements. Such assumptions, include, but are not limited to: (i)

there being no significant change to current geotechnical,

metallurgical, hydrological and other physical conditions; (ii)

permitting, development, operations and expansion of the Company’s

projects being consistent with current expectations and mine plans;

(iii) political/regulatory developments in any jurisdiction in

which the Company operates being consistent with its current

expectations; (iv) the exchange rate for the USD/CAD being

approximately consistent with current levels; (v) certain price

assumptions for gold, silver, lead and zinc; (vi) prices for key

supplies being approximately consistent with current levels; (vii)

the accuracy of our current mineral reserve and mineral resource

estimates; (viii) there being no significant changes to the

availability of employees, vendors and equipment; (ix) the

Company’s plans for development and production will proceed as

expected and will not require revision as a result of risks or

uncertainties, whether known, unknown or unanticipated; (x)

counterparties performing their obligations under hedging

instruments and put option contracts; (xi) sufficient workforce is

available and trained to perform assigned tasks; (xii) weather

patterns and rain/snowfall within normal seasonal ranges so as not

to impact operations; (xiii) relations with interested parties,

including First Nations and Native Americans, remain productive;

(xiv) maintaining availability of water rights; (xv) factors do not

arise that reduce available cash balances; and (xvi) there being no

material increases in our current requirements to post or maintain

reclamation and performance bonds or collateral related

thereto.

In addition, material risks that could cause actual results to

differ from forward-looking statements include but are not limited

to: (i) gold, silver and other metals price volatility; (ii)

operating risks; (iii) currency fluctuations; (iv) increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans; (v) community relations; and (vi)

litigation, political, regulatory, labor and environmental risks.

For a more detailed discussion of such risks and other factors, see

the Company's 2023 Form 10-K filed on February 15, 2024 and Form

10-Q expected to be filed on August 7, 2024, for a more detailed

discussion of factors that may impact expected future results. The

Company undertakes no obligation and has no intention of updating

forward-looking statements other than as may be required by

law.

Qualified Person (QP)

Kurt D. Allen, MSc., CPG, VP - Exploration of Hecla Mining

Company and Keith Blair, MSc., CPG, Chief Geologist of Hecla

Limited, who serve as a Qualified Person under S-K 1300 and NI

43-101, supervised the preparation of the scientific and technical

information concerning Hecla’s mineral projects in this news

release. Technical Report Summaries for each of the Company’s

Greens Creek, Lucky Friday, Casa Berardi and Keno Hill properties

are filed as exhibits 96.1 - 96.4 respectively, to the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023 and

are available at www.sec.gov. Information regarding data

verification, surveys and investigations, quality assurance program

and quality control measures and a summary of analytical or testing

procedures for (i) the Greens Creek Mine are contained in its

Technical Report Summary and in a NI 43-101 technical report titled

“Technical Report for the Greens Creek Mine” effective date

December 31, 2018, (ii) the Lucky Friday Mine are contained in its

Technical Report Summary and in its technical report titled

“Technical Report for the Lucky Friday Mine Shoshone County, Idaho,

USA” effective date April 2, 2014, (iii) Casa Berardi are contained

in its Technical Report Summary and in its NI 43-101 technical

report titled “Technical Report on the Casa Berardi Mine,

Northwestern Quebec, Canada” effective date December 31, 2023 and

(iv) Keno Hill are contained in its Technical Report Summary and in

its NI 43-101 technical report titled “Technical Report on the Keno

Hill Mine, Yukon, Canada” effective date December 31, 2023. Also

included in each technical report is a description of the key

assumptions, parameters and methods used to estimate mineral

reserves and resources and a general discussion of the extent to

which the estimates may be affected by any known environmental,

permitting, legal, title, taxation, socio-political, marketing, or

other relevant factors. Mr. Allen and Mr. Blair reviewed and

verified information regarding drill sampling, data verification of

all digitally collected data, drill surveys and specific gravity

determinations relating to all the mines. The review encompassed

quality assurance programs and quality control measures including

analytical or testing practice, chain-of-custody procedures, sample

storage procedures and included independent sample collection and

analysis. This review found the information and procedures meet

industry standards and are adequate for Mineral Resource and

Mineral Reserve estimation and mine planning purposes.

HECLA MINING COMPANY

Condensed Consolidated Statements

of Income (Loss)

(dollars and shares in thousands,

except per share amounts - unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

March 31, 2024

June 30, 2024

June 30, 2023

Sales

$

245,657

$

189,528

$

435,185

$

377,631

Cost of sales and other direct production

costs

140,464

121,461

261,925

233,304

Depreciation, depletion and

amortization

53,763

48,907

102,670

71,720

Total cost of sales

194,227

170,368

364,595

305,024

Gross profit

51,430

19,160

70,590

72,607

Other operating expenses:

General and administrative

14,740

11,216

25,956

22,853

Exploration and pre-development

6,682

4,342

11,024

11,860

Ramp-up and suspension costs

5,538

14,523

20,061

27,659

Provision for closed operations and

environmental matters

1,153

986

2,139

4,155

Other operating income

(17,283

)

(16,971

)

(34,254

)

(4,284

)

10,830

14,096

24,926

62,243

Income from operations

40,600

5,064

45,664

10,364

Other (expense) income:

Interest expense

(12,505

)

(12,644

)

(25,149

)

(20,476

)

Fair value adjustments, net

5,002

(1,852

)

3,150

623

Foreign exchange gain (loss)

2,673

3,982

6,655

(3,742

)

Other income

1,180

1,512

2,692

2,768

(3,650

)

(9,002

)

(12,652

)

(20,827

)

Income (loss) before income taxes

36,950

(3,938

)

33,012

(10,463

)

Income and mining tax provision

(9,080

)

(1,815

)

(10,895

)

(8,404

)

Net income (loss)

27,870

(5,753

)

22,117

(18,867

)

Preferred stock dividends

(138

)

(138

)

(276

)

(276

)

Net income (loss) applicable to common

stockholders

$

27,732

$

(5,891

)

$

21,841

$

(19,143

)

Basic income (loss) per common share after

preferred dividends (in cents)

$

0.04

$

(0.01

)

0.04

$

(0.03

)

Diluted income (loss) per common share

after preferred dividends (in cents)

$

0.04

$

(0.01

)

$

0.04

$

(0.03

)

Weighted average number of common shares

outstanding basic

617,106

616,199

616,649

602,077

Weighted average number of common shares

outstanding diluted

622,206

616,199

621,936

602,077

HECLA MINING COMPANY

Condensed Consolidated Statements

of Cash Flows

(dollars in thousands -

unaudited)

Quarter Ended

Six Months Ended

June 30, 2024

March 31, 2024

June 30, 2024

June 30, 2023

OPERATING ACTIVITIES

Net income (loss)

$

27,870

$

(5,753

)

$

22,117

$

(18,867

)

Non-cash elements included in net income

(loss):

Depreciation, depletion and

amortization

53,921

51,226

105,147

74,610

Inventory adjustments

2,225

7,671

9,896

7,518

Fair value adjustments, net

(5,002

)

1,852

(3,150

)

(623

)

Provision for reclamation and closure

costs

1,760

1,846

3,606

5,328

Stock compensation

2,982

1,164

4,146

2,688

Deferred income taxes

6,104

(416

)

5,688

4,585

Foreign exchange (gain) loss

(2,673

)

(3,982

)

(6,655

)

3,807

Other non-cash items, net

(715

)

519

(196

)

1,574

Change in assets and liabilities:

Accounts receivable

750

(17,864

)

(17,114

)

28,564

Inventories

(12,127

)

(18,746

)

(30,873

)

(18,121

)

Other current and non-current assets

3,104

5,238

8,342

(15,063

)

Accounts payable, accrued and other

current liabilities

6,518

(8,819

)

(2,301

)

143

Accrued payroll and related benefits

(1,678

)

5,498

3,820

(9,543

)

Accrued taxes

(3,101

)

2,085

(1,016

)

(85

)

Accrued reclamation and closure costs and

other non-current liabilities

(1,220

)

(4,439

)

(5,659

)

(2,135

)

Cash provided by operating

activities

78,718

17,080

95,798

64,380

INVESTING ACTIVITIES

Additions to property, plant and mine

development, net

(50,420

)

(47,589

)

(98,009

)

(105,911

)

Proceeds from disposition of assets

1,227

47

1,274

80

Purchases of investments

(73

)

—

(73

)

—

Net cash used in investing

activities

(49,266

)

(47,542

)

(96,808

)

(105,831

)

FINANCING ACTIVITIES

Proceeds from issuance of stock, net of

related costs

—

1,103

1,103

25,888

Acquisition of treasury shares

—

(1,197

)

(1,197

)

(2,036

)

Borrowing of debt

40,000

27,000

67,000

56,000

Repayment of debt

(118,000

)

(15,000

)

(133,000

)

(25,000

)

Dividends paid to common and preferred

stockholders

(4,000

)

(3,994

)

(7,994

)

(7,808

)

Repayments of finance leases

(2,472

)

(3,033

)

(5,505

)

(4,765

)

Net cash (used in) provided by

financing activities

(84,472

)

4,879

(79,593

)

42,279

Effect of exchange rates on cash

(556

)

(624

)

(1,180

)

1,217

Net (decrease) increase in cash, cash

equivalents and restricted cash and cash equivalents

(55,576

)

(26,207

)

(81,783

)

2,045

Cash, cash equivalents and restricted cash

at beginning of period

81,332

107,539

107,539

105,907

Cash, cash equivalents and restricted cash

at end of period

$

25,756

$

81,332

$

25,756

$

107,952

HECLA MINING COMPANY

Condensed Consolidated Balance

Sheets

(dollars and shares in thousands

- unaudited)

June 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

24,585

$

106,374

Accounts receivable

49,293

33,116

Inventories

109,744

93,647

Other current assets

16,608

27,125

Total current assets

200,230

260,262

Investments

38,135

33,724

Restricted cash

1,171

1,165

Property, plant and mine development,

net

2,657,995

2,666,250

Operating lease right-of-use assets

8,302

8,349

Other non-current assets

33,931

41,354

Total assets

$

2,939,764

$

3,011,104

LIABILITIES

Current liabilities:

Accounts payable and other current accrued

liabilities

$

123,234

$

123,643

Finance leases

7,874

9,752

Accrued reclamation and closure costs

10,049

9,660

Accrued interest

14,368

14,405

Total current liabilities

155,525

157,460

Accrued reclamation and closure costs

109,777

110,797

Long-term debt including finance

leases

582,577

653,063

Deferred tax liability

100,732

104,835

Other non-current liabilities

11,088

16,845

Total liabilities

959,699

1,043,000

STOCKHOLDERS’ EQUITY

Preferred stock

39

39

Common stock

156,745

156,076

Capital surplus

2,354,004

2,343,747

Accumulated deficit

(489,738

)

(503,861

)

Accumulated other comprehensive (loss)

income, net

(6,054

)

5,837

Treasury stock

(34,931

)

(33,734

)

Total stockholders’ equity

1,980,065

1,968,104

Total liabilities and stockholders’

equity

$

2,939,764

$

3,011,104

Non-GAAP Measures (Unaudited)

Reconciliation of Total Cost of Sales to Cash Cost, Before

By-product Credits and Cash Cost, After By-product Credits

(non-GAAP) and All-In Sustaining Cost, Before By-product Credits

and All-In Sustaining Cost, After By-product Credits

(non-GAAP)

The tables below present reconciliations between the most

comparable GAAP measure of total cost of sales to the non-GAAP

measures of (i) Cash Cost, Before By-product Credits, (ii) Cash

Cost, After By-product Credits, (iii) AISC, Before By-product

Credits and (iv) AISC, After By-product Credits for our operations

and for the Company for the three months ended June 30, 2024, March

31, 2024, December 31, 2023, September 30, 2023, June 30, 2023 and

the six months ended June 30, 2024 and 2023.

Cash Cost, After By-product Credits, per Ounce and AISC, After

By-product Credits, per Ounce are measures developed by precious

metals companies (including the Silver Institute and the World Gold

Council) in an effort to provide a uniform standard for comparison

purposes. There can be no assurance, however, that these non-GAAP

measures as we report them are the same as those reported by other

mining companies.

Cash Cost, After By-product Credits, per Ounce is an important

operating statistic that we utilize to measure each mine's

operating performance. We use AISC, After By-product Credits, per

Ounce as a measure of our mines' net cash flow after costs for

reclamation and sustaining capital. This is similar to the Cash

Cost, After By-product Credits, per Ounce non-GAAP measure we

report, but also includes reclamation and sustaining capital costs.

Current GAAP measures used in the mining industry, such as cost of

goods sold, do not capture all the expenditures incurred to

discover, develop and sustain silver and gold production. Cash

Cost, After By-product Credits, per Ounce and AISC, After

By-product Credits, per Ounce also allow us to benchmark the

performance of each of our mines versus those of our competitors.

As a silver and gold mining company, we also use these statistics

on an aggregate basis - aggregating the Greens Creek and Lucky

Friday mines to compare our performance with that of other silver

mining companies. Similarly, these statistics are useful in

identifying acquisition and investment opportunities as they

provide a common tool for measuring the financial performance of

other mines with varying geologic, metallurgical and operating

characteristics.

Cash Cost, Before By-product Credits and AISC, Before By-product

Credits include all direct and indirect operating cash costs

related directly to the physical activities of producing metals,

including mining, processing and other plant costs, third-party

refining expense, on-site general and administrative costs,

royalties and mining production taxes. AISC, Before By-product

Credits for each mine also includes reclamation and sustaining

capital costs. AISC, Before By-product Credits for our consolidated

silver properties also includes corporate costs for general and

administrative expense and sustaining capital costs. By-product

credits include revenues earned from all metals other than the

primary metal produced at each unit. As depicted in the tables

below, by-product credits comprise an essential element of our

silver unit cost structure, distinguishing our silver operations

due to the polymetallic nature of their orebodies.

In addition to the uses described above, Cash Cost, After

By-product Credits, per Ounce and AISC, After By-product Credits,

per Ounce provide management and investors an indication of

operating cash flow, after consideration of the average price,

received from production. We also use these measurements for the

comparative monitoring of performance of our mining operations

period-to-period from a cash flow perspective.

The Casa Berardi information below reports Cash Cost, After

By-product Credits, per Gold Ounce and AISC, After By-product

Credits, per Gold Ounce for the production of gold, their primary

product, and by-product revenues earned from silver, which is a

by-product at Casa Berardi. Only costs and ounces produced relating

to units with the same primary product are combined to represent

Cash Cost, After By-product Credits, per Ounce and AISC, After

By-product Credits, per Ounce. Thus, the gold produced at our Casa

Berardi unit is not included as a by-product credit when

calculating Cash Cost, After By-product Credits, per Silver Ounce

and AISC, After By-product Credits, per Silver Ounce for the total

of Greens Creek and Lucky Friday, our combined silver properties.

Similarly, the silver produced at our other two units is not

included as a by-product credit when calculating the gold metrics

for Casa Berardi.

In thousands (except per ounce

amounts)

Three Months Ended June 30,

2024

Three Months Ended March 31,

2024

Six Months Ended June 30,

2024

Six Months Ended June 30,

2023

Greens Creek

Lucky Friday

Keno Hill (4)

Corporate and other(3)

Total Silver

Greens Creek

Lucky Friday

Keno Hill (4)

Corporate and other(3)

Total Silver

Greens Creek

Lucky Friday(2)

Keno Hill (4)

Corporate and other(3)

Total Silver

Greens Creek

Lucky Friday(2)

Keno Hill (4)

Corporate and other(3)

Total Silver

Total cost of sales

$

56,786

$

37,523

$

28,950

$

—

$

123,259

$

69,857

$

27,519

$

10,847

$

—

$

108,223

$

126,643

$

65,042

$

39,797

$

—

$

231,482

$

129,342

$

66,724

$

1,581

$

—

$

197,647

Depreciation, depletion and

amortization

(11,316

)

(10,708

)

(4,729

)

—

(26,753

)

(14,443

)

(7,911

)

(3,602

)

—

(25,956

)

(25,759

)

(18,619

)

(8,331

)

—

(52,709

)

(27,542

)

(19,435

)

(261

)

—

(47,238

)

Treatment costs

6,069

2,746

-

—

8,815

9,724

3,223

—

—

12,947

15,793

5,969

-

—

21,762

20,745

9,464

113

—

30,322

Change in product inventory

7,296

(115

)

—

—

7,181

(2,196

)

611

—

—

(1,585

)

5,100

496

—

—

5,596

(2,856

)

(863

)

—

—

(3,719

)

Reclamation and other costs

(882

)

(311

)

—

—

(1,193

)

(655

)

(102

)

—

—

(757

)

(1,537

)

(413

)

—

—

(1,950

)

134

(658

)

—

—

(524

)

Exclusion of Lucky Friday cash costs

(5)

—

—

—

—

—

—

(3,634

)

—

—

(3,634

)

-

(3,634

)

—

—

(3,634

)

—

—

—

—

—

Exclusion of Keno Hill cash costs (4)

—

—

(24,221

)

—

(24,221

)

—

—

(7,245

)

—

(7,245

)

-

-

(31,466

)

—

(31,466

)

—

—

(1,433

)

—

(1,433

)

Cash Cost, Before By-product Credits

(1)

57,953

29,135

—

—

87,088

62,287

19,706

—

—

81,993

120,240

48,841

—

—

169,081