FALSE000183163100018316312025-03-112025-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (or date of earliest event reported): March 11, 2025

_____________________

loanDepot, Inc.

(Exact Name of Registrant as Specified in its Charter)

_____________________

| | | | | | | | | | | | | | |

| Delaware | | 001-40003 | | 85-3948939 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

6561 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (888) 337-6888

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.001 Par Value | | LDI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On March 11, 2025, loanDepot, Inc. (the "Company") issued a press release announcing its results for the quarter and year ended December 31, 2024 (the “Earnings Press Release”). The full press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

On March 11, 2025, the Company posted on the Investor Relations section of its website at investors.loandepot.com a presentation (the “loanDepot Presentation”) on certain financial and operating initiatives available for viewing during the Company’s conference call and webcast announcing its financial results for the quarter and year ended December 31, 2024 at 5:00 p.m. Eastern time on March 11, 2025.

A copy of the loanDepot Presentation is furnished pursuant to this Item 7.01 as Exhibit 99.2 to this Current Report on Form 8-K and incorporated by reference herein in its entirety. The loanDepot Presentation includes references to non-GAAP financial information. Reconciliations between the non-GAAP financial measures and the comparable GAAP financial measures are available in the loanDepot Presentation. The loanDepot Presentation should be read in conjunction with the Earnings Press Release. The Company reserves the right to discontinue availability of the loanDepot Presentation from its website at any time.

The information furnished pursuant to Items 2.02 and 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, or the Exchange Act, as amended, except as specifically identified therein as being incorporated by reference.

Additionally, the submission of the information set forth in this Item 7.01 is not deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 99.2 | |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

loanDepot, Inc. |

| |

| | |

By: | /s/ David Hayes | |

Name: David Hayes |

Title: Chief Financial Officer |

Date: March 11, 2025

loanDepot announces year-end and fourth quarter 2024 financial results

Revenue increased 9% for the year on higher pull-through weighted gain on sale margin and volume, driving significant reduction of losses.

Full-year 2024 highlights:

•Revenue increased 9% to $1.06 billion and adjusted revenue increased 10% to $1.10 billion compared to 2023.

•Pull-through weighted gain on sale margin grew to 317 basis points, up 42 bps compared to 2023.

•Net loss of $202 million, including $25 million of cybersecurity related costs, compared with prior year net loss of $236 million.

•Adjusted net loss of $95 million, compared with prior year adjusted net loss of $152 million, reflecting the positive impact of higher revenue and cost productivity.

•Adjusted EBITDA of $84 million compared with $6 million in 2023.

•Successfully refinanced 2025 corporate debt - extended maturity and reduced outstanding corporate debt by $137 million.

Fourth quarter 2024 highlights:

•Revenue increased 13% to $257 million and adjusted revenue increased 6% to $267 million compared to the prior year on higher volume and pull-through weighted gain on sale margin.

•Expanded network of joint venture partnerships with new agreements with Smith Douglas Homes and Onx Homes.

•Pull-through weighted gain on sale margin grew 38 basis points to 334 basis points.

•Net loss of $67 million compared with net loss of $60 million in the prior year.

•Adjusted net loss of $47 million compared with prior year adjusted net loss of $27 million, primarily reflecting higher volume-related costs associated with increased volumes experienced during the third quarter 2024.

•Strong liquidity profile with cash balance of $422 million.

IRVINE, Calif., March 11, 2025 - loanDepot, Inc. (NYSE: LDI), (together with its subsidiaries, “loanDepot” or the “Company”), a leading provider of products and services that power the homeownership journey, today announced results for the fourth quarter ended December 31, 2024.

“2024 was a year of significant progress for loanDepot with the completion of our Vision 2025 strategic program,” said President and Chief Executive Officer Frank Martell. “The strategic imperatives of Vision 2025 served as our roadmap for successfully navigating the historical downturn in the housing and mortgage markets over the past three years. As the Company enters 2025, I believe team loanDepot is positioned to accelerate revenue growth and continue our progress towards sustainable profitability under the auspices of Project North Star that we announced in November 2024, and under Anthony Hsieh’s new leadership that was announced last week.

“The U.S. housing and mortgage markets are substantial in size and hold many opportunities for loanDepot to grow and realize its strategic objectives. When the market inevitably recovers, the successful execution of Project North Star is expected to position loanDepot to become the technology and data driven lending partner of choice for today’s first-time homeowners through their entire homeownership journey.”

“2024 was a successful year for loanDepot from a financial point of view,” said David Hayes, Chief Financial Officer. “We grew revenue, expanded margins, reduced our corporate debt and made important investments in productivity initiatives that benefited the year. Importantly, during the third quarter we demonstrated our significant operational progress by achieving profitability during a period of modest market improvement. Our

investments in products and operating leverage will provide the foundation for additional momentum in 2025 and beyond.”

Fourth Quarter Highlights:

Financial Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

($ in thousands except per share data)

(Unaudited) | Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec 31,

2024 | | Dec 31,

2023 |

| | | | | | | | | |

| Rate lock volume | $ | 7,648,829 | | | $ | 9,792,423 | | | $ | 6,417,419 | | | $ | 32,541,852 | | | $ | 32,155,455 | |

Pull-through weighted lock volume(1) | 5,592,527 | | | 6,748,057 | | | 4,407,386 | | | 22,854,729 | | | 21,475,262 | |

| Loan origination volume | 7,188,186 | | | 6,659,329 | | | 5,370,708 | | | 24,496,500 | | | 22,671,731 | |

Gain on sale margin(2) | 2.60 | % | | 3.33 | % | | 2.43 | % | | 2.96 | % | | 2.60 | % |

Pull-through weighted gain on sale margin(3) | 3.34 | % | | 3.29 | % | | 2.96 | % | | 3.17 | % | | 2.75 | % |

| | | | | | | | | |

| Financial Results | | | | | | | | | |

| Total revenue | $ | 257,464 | | | $ | 314,598 | | | $ | 228,626 | | | $ | 1,060,235 | | | $ | 974,022 | |

| Total expense | 341,588 | | | 311,003 | | | 302,571 | | | 1,303,084 | | | 1,252,330 | |

Net (loss) income | (67,466) | | | 2,672 | | | (59,771) | | | (202,151) | | | (235,512) | |

| | | | | | | | | |

Diluted (loss) earnings per share | $ | (0.17) | | | $ | 0.01 | | | $ | (0.16) | | | $ | (0.53) | | | $ | (0.63) | |

| | | | | | | | | |

Non-GAAP Financial Measures(4) | | | | | | | | | |

| | | | | | | | | |

| Adjusted total revenue | $ | 266,594 | | | $ | 329,499 | | | $ | 251,395 | | | $ | 1,104,910 | | | $ | 1,007,248 | |

Adjusted net (loss) income | (47,017) | | | 7,077 | | | (26,702) | | | (94,823) | | | (151,641) | |

Adjusted (LBITDA) EBITDA | (15,071) | | | 63,742 | | | 14,902 | | | 83,749 | | | 6,441 | |

| | | | | | | | | |

| | | | | | | | | |

(1)Pull-through weighted rate lock volume is the principal balance of loans subject to interest rate lock commitments, net of a pull-through factor for the loan funding probability.

(2)Gain on sale margin represents the total of (i) gain on origination and sale of loans, net, and (ii) origination income, net, divided by loan origination volume during period.

(3)Pull-through weighted gain on sale margin represents the total of (i) gain on origination and sale of loans, net, and (ii) origination income, net, divided by the pull-through weighted rate lock volume.

(4)See “Non-GAAP Financial Measures” for a discussion of Non-GAAP Financial Measures and a reconciliation of these metrics to their closest GAAP measure.

Year-over-Year Operational Highlights

•Non-volume1 related expenses increased $5.3 million from the fourth quarter of 2023, primarily due to higher headcount related salary expenses, offset somewhat by lower interest, occupancy and general and administrative expenses.

•Accrued $1.9 million expense associated with the first quarter cybersecurity incident (the “Cybersecurity Incident”).

•Recognized a net recovery of restructuring and impairment charges totaling $0.6 million, compared to a charge of $4.3 million during the fourth quarter of 2023.

1 Volume related expenses include commissions, marketing and advertising expense, and direct origination expense. All remaining expenses are considered non-volume related. Marketing and advertising expense has been included in the volume related category beginning this quarter as management considers the majority of these costs to fluctuate with market volumes.

•Pull-through weighted lock volume of $5.6 billion for the fourth quarter of 2024, an increase of $1.2 billion or 27% from the fourth quarter of 2023.

•Loan origination volume for the fourth quarter of 2024 was $7.2 billion, an increase of $1.8 billion or 34% from the fourth quarter of 2023.

•Purchase volume totaled 58% of total loans originated during the fourth quarter, down from 76% during the fourth quarter of 2023, reflecting the increased demand for refinance transactions during the period of lower market rates experienced during the third quarter 2024, which were still being closed during the fourth quarter.

•Our preliminary organic refinance consumer direct recapture rate2 increased to 76% from the fourth quarter 2023’s recapture rate of 57%.

•Net loss for the fourth quarter of 2024 of $67.5 million as compared to net loss of $59.8 million in the fourth quarter of 2023. Net loss widened primarily due to higher volume related expenses from locks taken during the third quarter 2024 period of lower market rates, offset somewhat by increased revenue.

•Adjusted net loss for the fourth quarter of 2024 was $47.0 million as compared to adjusted net loss of $26.7 million for the fourth quarter of 2023.

Outlook for the first quarter of 2025

•Origination volume of between $4.5 billion and $5.5 billion.

•Pull-through weighted rate lock volume of between $4.8 billion and $5.8 billion.

•Pull-through weighted gain on sale margin of between 320 basis points and 340 basis points.

2 We define organic refinance consumer direct recapture rate as the total unpaid principal balance (“UPB”) of loans in our servicing portfolio that are paid in full for purposes of refinancing the loan on the same property, with the Company acting as lender on both the existing and new loan, divided by the UPB of all loans in our servicing portfolio that paid in full for the purpose of refinancing the loan on the same property. The recapture rate is finalized following the publication date of this release when external data becomes available.

Servicing

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

Servicing Revenue Data: ($ in thousands) (Unaudited) | | Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec 31,

2024 | | Dec 31,

2023 |

| | | | | | | | | | |

| Due to collection/realization of cash flows | | $ | (43,227) | | | $ | (41,498) | | | $ | (34,433) | | | $ | (163,010) | | | $ | (149,211) | |

| | | | | | | | | | |

| Due to changes in valuation inputs or assumptions | | 68,228 | | | (52,557) | | | (71,195) | | | 59,538 | | | 2,227 | |

Realized (losses) gains on sale of servicing rights | | (56) | | | 32 | | | 55 | | | (3,036) | | | 12,466 | |

Net (losses) gains from derivatives hedging servicing rights | | (77,302) | | | 37,624 | | | 48,371 | | | (101,177) | | | (47,919) | |

Changes in fair value of servicing rights, net of hedging gains and losses | | (9,130) | | | (14,901) | | | (22,769) | | | (44,675) | | | (33,226) | |

Other realized losses on sales of servicing rights (1) | | (162) | | | (164) | | | (247) | | | (7,453) | | | (1,980) | |

| Changes in fair value of servicing rights, net | | $ | (52,519) | | | $ | (56,563) | | | $ | (57,449) | | | $ | (215,138) | | | $ | (184,417) | |

| | | | | | | | | | |

Servicing fee income (2) | | $ | 108,426 | | | $ | 124,133 | | | $ | 132,482 | | | $ | 481,699 | | | $ | 492,811 | |

| | | | | | | | | | |

(1)Includes the (provision) recovery for sold MSRs and broker fees.

(2)Servicing fee income for the three months and year ended December 31, 2023, has been adjusted to incorporate earnings credits, which were previously classified as part of net interest income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

Servicing Rights, at Fair Value: ($ in thousands) (Unaudited) | | Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec 31,

2024 | | Dec 31,

2023 |

| Balance at beginning of period | | $ | 1,526,013 | | | $ | 1,566,463 | | | $ | 2,038,654 | | | $ | 1,985,718 | | | $ | 2,025,136 | |

| Additions | | 75,547 | | | 62,039 | | | 62,158 | | | 252,076 | | | 277,387 | |

| Sales proceeds | | (10,995) | | | (8,466) | | | (9,521) | | | (514,772) | | | (180,687) | |

| Changes in fair value: | | | | | | | | | | |

| Due to changes in valuation inputs or assumptions | | 68,228 | | | (52,557) | | | (71,195) | | | 59,538 | | | 2,227 | |

| Due to collection/realization of cash flows | | (43,227) | | | (41,498) | | | (34,433) | | | (163,010) | | | (149,211) | |

Realized (losses) gains on sales of servicing rights | | (56) | | | 32 | | | 55 | | | (4,040) | | | 10,866 | |

| Total changes in fair value | | 24,945 | | | (94,023) | | | (105,573) | | | (107,512) | | | (136,118) | |

Balance at end of period (1) | | $ | 1,615,510 | | | $ | 1,526,013 | | | $ | 1,985,718 | | | $ | 1,615,510 | | | $ | 1,985,718 | |

(1)Balances are net of $18.2 million, $16.7 million, and $14.0 million of servicing rights liability as of December 31, 2024, September 30, 2024, and December 31, 2023, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | % Change |

Servicing Portfolio Data: ($ in thousands) (Unaudited) | Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec-24

vs

Sep-24 | | Dec-24

vs

Dec-23 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Servicing portfolio (unpaid principal balance) | $ | 115,971,984 | | | $ | 114,915,206 | | | $ | 145,090,199 | | | 0.9 | % | | (20.1) | % |

| | | | | | | | | |

| Total servicing portfolio (units) | 417,875 | | | 409,344 | | | 496,894 | | | 2.1 | | | (15.9) | |

| | | | | | | | | |

| 60+ days delinquent ($) | $ | 1,826,105 | | | $ | 1,654,955 | | | $ | 1,392,606 | | | 10.3 | | | 31.1 | |

| 60+ days delinquent (%) | 1.6 | % | | 1.4 | % | | 1.0 | % | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Servicing rights, net to UPB | 1.4 | % | | 1.3 | % | | 1.4 | % | | | | |

Balance Sheet Highlights | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | % Change |

($ in thousands) (Unaudited) | Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec-24

vs

Sep-24 | | Dec-24

vs

Dec-23 |

| | | | |

| | | | | | | | | |

| Cash and cash equivalents | $ | 421,576 | | | $ | 483,048 | | | $ | 660,707 | | | (12.7) | % | | (36.2) | % |

| Loans held for sale, at fair value | 2,603,735 | | | 2,790,284 | | | 2,132,880 | | | (6.7) | | | 22.1 | |

| Loans held for investment, at fair value | 116,627 | | | 122,066 | | | — | | | (4.5) | | | NM |

| Servicing rights, at fair value | 1,633,661 | | | 1,542,720 | | | 1,999,763 | | | 5.9 | | | (18.3) | |

| Total assets | 6,344,028 | | | 6,417,627 | | | 6,151,048 | | | (1.1) | | | 3.1 | |

| Warehouse and other lines of credit | 2,377,127 | | | 2,565,713 | | | 1,947,057 | | | (7.4) | | | 22.1 | |

| Total liabilities | 5,837,417 | | | 5,825,578 | | | 5,446,564 | | | 0.2 | | | 7.2 | |

| Total equity | 506,611 | | | 592,049 | | | 704,484 | | | (14.4) | | | (28.1) | |

An increase in loans held for sale at December 31, 2024, resulted in a corresponding increase in the balance on our warehouse lines of credit. Total funding capacity with our lending partners was $3.7 billion at December 31, 2024, and $3.1 billion at December 31, 2023. Available borrowing capacity was $1.2 billion at December 31, 2024.

Consolidated Statements of Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in thousands except per share data) | Three Months Ended | | Year Ended |

| Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec 31,

2024 | | Dec 31,

2023 |

| (Unaudited) | | (Unaudited) | | |

| REVENUES: | | | | | | | | | |

| Interest income | $ | 41,835 | | | $ | 38,673 | | | $ | 34,992 | | | $ | 146,485 | | | $ | 133,263 | |

| Interest expense | (40,491) | | | (39,488) | | | (33,686) | | | (147,328) | | | (130,145) | |

Net interest income (expense) | 1,344 | | | (815) | | | 1,306 | | | (843) | | | 3,118 | |

| | | | | | | | | |

| Gain on origination and sale of loans, net | 161,071 | | | 198,027 | | | 113,185 | | | 642,078 | | | 524,521 | |

| Origination income, net | 25,515 | | | 23,675 | | | 17,120 | | | 82,290 | | | 65,209 | |

| Servicing fee income | 108,426 | | | 124,133 | | | 132,482 | | | 481,699 | | | 492,811 | |

| Change in fair value of servicing rights, net | (52,519) | | | (56,563) | | | (57,449) | | | (215,138) | | | (184,417) | |

| Other income | 13,627 | | | 26,141 | | | 21,982 | | | 70,149 | | | 72,780 | |

| Total net revenues | 257,464 | | | 314,598 | | | 228,626 | | | 1,060,235 | | | 974,022 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | | |

| Personnel expense | 163,800 | | | 161,330 | | | 132,752 | | | 600,483 | | | 573,010 | |

| Marketing and advertising expense | 36,860 | | | 36,282 | | | 28,360 | | | 132,671 | | | 132,880 | |

| Direct origination expense | 21,392 | | | 23,120 | | | 16,790 | | | 84,234 | | | 67,141 | |

| General and administrative expense | 50,344 | | | 22,984 | | | 55,258 | | | 204,231 | | | 212,732 | |

| Occupancy expense | 4,321 | | | 4,800 | | | 5,433 | | | 19,434 | | | 23,516 | |

| Depreciation and amortization | 8,779 | | | 8,931 | | | 9,922 | | | 36,108 | | | 41,261 | |

| Servicing expense | 12,218 | | | 8,427 | | | 8,572 | | | 37,373 | | | 27,687 | |

| Other interest expense | 43,874 | | | 45,129 | | | 45,484 | | | 188,550 | | | 174,103 | |

| | | | | | | | | |

| Total expenses | 341,588 | | | 311,003 | | | 302,571 | | | 1,303,084 | | | 1,252,330 | |

| | | | | | | | | |

(Loss) income before income taxes | (84,124) | | | 3,595 | | | (73,945) | | | (242,849) | | | (278,308) | |

| | | | | | | | | |

Income tax (benefit) expense | (16,658) | | | 923 | | | (14,174) | | | (40,698) | | | (42,796) | |

| | | | | | | | | |

Net (loss) income | (67,466) | | | 2,672 | | | (59,771) | | | (202,151) | | | (235,512) | |

| | | | | | | | | |

Net (loss) income attributable to noncontrolling interests | (34,232) | | | 1,303 | | | (32,578) | | | (103,820) | | | (125,370) | |

| | | | | | | | | |

Net (loss) income attributable to loanDepot, Inc. | $ | (33,234) | | | $ | 1,369 | | | $ | (27,193) | | | $ | (98,331) | | | $ | (110,142) | |

| | | | | | | | | |

Basic (loss) income per share | $ | (0.17) | | | $ | 0.01 | | | $ | (0.15) | | | $ | (0.53) | | | $ | (0.63) | |

Diluted (loss) income per share | $ | (0.17) | | | $ | 0.01 | | | $ | (0.16) | | | $ | (0.53) | | | $ | (0.63) | |

| | | | | | | | | |

| Weighted average shares outstanding | | | | | | | | | |

| Basic | 193,413,971 | | | 185,385,271 | | | 178,888,225 | | | 185,641,675.00 | | | 174,906,063.00 | |

| Diluted | 193,413,971 | | | 332,532,984 | | | 326,288,272 | | | 185,641,675.00 | | | 174,906,063.00 | |

Consolidated Balance Sheets

| | | | | | | | | | | | | | | | | |

| ($ in thousands) | Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 |

| (Unaudited) | | |

| ASSETS | | | | | |

| Cash and cash equivalents | $ | 421,576 | | | $ | 483,048 | | | $ | 660,707 | |

| Restricted cash | 105,645 | | | 95,593 | | | 85,149 | |

| Loans held for sale, at fair value | 2,603,735 | | | 2,790,284 | | | 2,132,880 | |

| Loans held for investment, at fair value | 116,627 | | | 122,066 | | | — | |

| Derivative assets, at fair value | 44,389 | | | 68,647 | | | 93,574 | |

| Servicing rights, at fair value | 1,633,661 | | | 1,542,720 | | | 1,999,763 | |

| Trading securities, at fair value | 87,466 | | | 92,324 | | | 92,901 | |

| Property and equipment, net | 61,079 | | | 62,974 | | | 70,809 | |

| Operating lease right-of-use asset | 20,432 | | | 23,020 | | | 29,433 | |

| Loans eligible for repurchase | 995,398 | | | 860,300 | | | 711,371 | |

| Investments in joint ventures | 18,113 | | | 17,899 | | | 20,363 | |

| Other assets | 235,907 | | | 258,752 | | | 254,098 | |

| | | | | |

| | | | | |

| | | | | |

| Total assets | $ | 6,344,028 | | | $ | 6,417,627 | | | $ | 6,151,048 | |

| | | | | |

| LIABILITIES AND EQUITY | | | | | |

| LIABILITIES: | | | | | |

| Warehouse and other lines of credit | $ | 2,377,127 | | | $ | 2,565,713 | | | $ | 1,947,057 | |

| Accounts payable and accrued expenses | 379,439 | | | 381,543 | | | 379,971 | |

| Derivative liabilities, at fair value | 25,060 | | | 22,143 | | | 84,962 | |

| Liability for loans eligible for repurchase | 995,398 | | | 860,300 | | | 711,371 | |

| Operating lease liability | 33,190 | | | 38,538 | | | 49,192 | |

| Debt obligations, net | 2,027,203 | | | 1,957,341 | | | 2,274,011 | |

| Total liabilities | 5,837,417 | | | 5,825,578 | | | 5,446,564 | |

| EQUITY: | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total equity | 506,611 | | | 592,049 | | | 704,484 | |

| Total liabilities and equity | $ | 6,344,028 | | | $ | 6,417,627 | | | $ | 6,151,048 | |

Loan Origination and Sales Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

($ in thousands)

(Unaudited) | | Three Months Ended | | Year Ended |

| Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec 31,

2024 | | Dec 31,

2023 |

| | |

| Loan origination volume by type: | | | | | | | | | | |

| Conventional conforming | | $3,331,526 | | $3,254,702 | | $2,830,776 | | $12,322,808 | | $12,206,382 |

| FHA/VA/USDA | | 2,938,168 | | 2,564,827 | | 2,062,928 | | 9,428,124 | | 8,434,095 |

| Jumbo | | 368,518 | | 300,086 | | 81,591 | | 1,015,305 | | 487,142 |

| Other | | 549,974 | | 539,714 | | 395,413 | | 1,730,263 | | 1,544,112 |

| Total | | $7,188,186 | | $6,659,329 | | $5,370,708 | | $24,496,500 | | $22,671,731 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Loan origination volume by purpose: | | | | | | | | | | |

| Purchase | | $4,139,542 | | $4,378,575 | | $4,071,761 | | $16,197,535 | | $16,474,927 |

| Refinance - cash out | | 2,424,749 | | 1,954,071 | | 1,221,538 | | 7,085,329 | | 5,821,102 |

| Refinance - rate/term | | 623,895 | | 326,683 | | 77,409 | | 1,213,636 | | 375,702 |

| Total | | $7,188,186 | | $6,659,329 | | $5,370,708 | | $24,496,500 | | $22,671,731 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Loans sold: | | | | | | | | | | |

| Servicing retained | | $4,421,935 | | $3,818,375 | | $3,825,478 | | $15,238,250 | | $15,222,156 |

| Servicing released | | 2,937,984 | | 2,487,589 | | 1,572,369 | | 8,771,900 | | 7,918,029 |

| Total | | $7,359,919 | | $6,305,964 | | $5,397,847 | | $24,010,150 | | $23,140,185 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Fourth Quarter Earnings Call

Management will host a conference call and live webcast today at 5:00 p.m. ET to discuss the Company’s financial and operational highlights followed by a question-and-answer session.

The conference call can be accessed by registering online at https://registrations.events/direct/Q4I4144763980 at which time registrants will receive dial-in information as well as a conference ID. At the time of the call, participants will dial in using the participant number and conference ID provided upon registration.

A live audio webcast of the conference call will also be available via the Company's website, investors.loandepot.com, under Events & Presentation tab. A replay of the webcast will be made available on the Investor Relations website following the conclusion of the event.

For more information about loanDepot, please visit the company’s Investor Relations website: investors.loandepot.com.

Non-GAAP Financial Measures

To provide investors with information in addition to our results as determined by GAAP, we disclose certain non-GAAP measures to assist investors in evaluating our financial results. We believe these non-GAAP measures provide useful information to investors regarding our results of operations because each measure assists both investors and management in analyzing and benchmarking the performance and value of our business. They facilitate company-to-company operating performance comparisons by backing out potential differences caused by variations in hedging strategies, changes in valuations, capital structures (affecting interest expense on non-funding debt), taxation, the age and book depreciation of facilities (affecting relative depreciation expense), and other cost or benefit items which may vary for different companies for reasons unrelated to operating performance. These non-GAAP measures include our Adjusted Total Revenue, Adjusted Net Income (Loss), Adjusted Diluted Weighted Average Shares Outstanding, and Adjusted EBITDA (LBITDA). We exclude from these non-GAAP financial measures the change in fair value of MSRs, gains (losses) from the sale of MSRs and related hedging gains and losses that represent realized and unrealized adjustments resulting from changes in valuation, mostly due to changes in market interest rates, and are not indicative of the Company’s operating performance or results of operation. Beginning in the second quarter of 2024, we began to include the gains (losses) from the sale of MSRs in valuation changes in servicing rights, net of hedging gains and losses to appropriately capture all valuation changes in MSRs up to and including the sales date. Prior periods have been revised to conform with this new presentation. We have excluded expenses directly related to the Cybersecurity Incident, net of insurance recoveries during fiscal 2024, including costs to investigate and remediate the Cybersecurity Incident, the costs of customer notifications and identity protection, and professional fees, including legal expenses, litigation settlement costs, and commission guarantees. We also exclude stock-based compensation expense, which is a non-cash expense, gains or losses on extinguishment of debt and disposal of fixed assets, non-cash goodwill impairment, and other impairment charges to intangible assets and operating lease right-of-use assets, as well as certain costs associated with our restructuring efforts, as management does not consider these costs to be indicative of our performance or results of operations. Adjusted EBITDA (LBITDA) includes interest expense on funding facilities, which are recorded as a component of “net interest income (expense),” as these expenses are a direct operating expense driven by loan origination volume. By contrast, interest expense on our non-funding debt is a function of our capital structure and is therefore excluded from Adjusted EBITDA (LBITDA). Adjustments for income taxes are made to reflect historical results of operations on the basis that it was taxed as a corporation under the Internal Revenue Code, and therefore subject to U.S. federal, state and local income taxes. Adjustments to Diluted Weighted Average Shares Outstanding assumes the pro forma conversion of weighted average Class C common stock to Class A common stock. These non-GAAP measures have limitations as analytical tools and should not be considered in isolation or as a substitute for revenue, net income, or any other operating performance measure calculated in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies. Some of these limitations are:

•They do not reflect every cash expenditure, future requirements for capital expenditures or contractual commitments;

•Adjusted EBITDA (LBITDA) does not reflect the significant interest expense or the cash requirements necessary to service interest or principal payment on our debt;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced or require improvements in the future, and Adjusted Total Revenue, Adjusted Net Income (Loss), and Adjusted EBITDA (LBITDA) do not reflect any cash requirement for such replacements or improvements; and

•They are not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows.

Because of these limitations, Adjusted Total Revenue, Adjusted Net Income (Loss), Adjusted Diluted Weighted Average Shares Outstanding, and Adjusted EBITDA (LBITDA) are not intended as alternatives to total revenue, net income (loss), net income (loss) attributable to the Company, or Diluted Earnings (Loss) Per Share or as an indicator of our operating performance and should not be considered as measures of discretionary cash available to us to invest in the growth of our business or as measures of cash that will be available to us to meet our obligations. We compensate for these limitations by using Adjusted Total Revenue, Adjusted Net Income (Loss), Adjusted Diluted Weighted Average Shares Outstanding, and Adjusted EBITDA (LBITDA) along with other comparative tools, together with U.S. GAAP measurements, to assist in the evaluation of operating performance. See below for a reconciliation of these non-GAAP measures to their most comparable U.S. GAAP measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of Total Revenue to Adjusted Total Revenue ($ in thousands) (Unaudited) | | Three Months Ended | | Year Ended |

| Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec 31,

2024 | | Dec 31,

2023 |

| Total net revenue | | $ | 257,464 | | | $ | 314,598 | | | $ | 228,626 | | | $ | 1,060,235 | | | $ | 974,022 | |

Valuation changes in servicing rights, net of hedging gains and losses(1) | | 9,130 | | | 14,901 | | | 22,769 | | | 44,675 | | | 33,226 | |

| Adjusted total revenue | | $ | 266,594 | | | $ | 329,499 | | | $ | 251,395 | | | $ | 1,104,910 | | | $ | 1,007,248 | |

| | | | | | | | | | |

(1)Represents the change in the fair value of servicing rights due to changes in valuation inputs or assumptions, net of gains or losses from derivatives hedging servicing rights. Beginning in the second quarter of 2024, we began to include the gains (losses) from the sale of MSRs in valuation changes in servicing rights, net of hedging gains and losses to appropriately capture all valuation changes in MSRs up to and including the sales date. Prior periods have been revised to conform with this new presentation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of Net (Loss) Income to Adjusted Net (Loss) Income ($ in thousands) (Unaudited) | | Three Months Ended | | Year Ended |

| Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec 31,

2024 | | Dec 31,

2023 |

Net (loss) income attributable to loanDepot, Inc. | | $ | (33,234) | | | $ | 1,369 | | | $ | (27,193) | | | $ | (98,331) | | | $ | (110,142) | |

Net (loss) income from the pro forma conversion of Class C common shares to Class A common stock (1) | | (34,232) | | | 1,303 | | | (32,578) | | | (103,820) | | | (125,370) | |

Net (loss) income | | (67,466) | | | 2,672 | | | (59,771) | | | (202,151) | | | (235,512) | |

Adjustments to the benefit (provision) for income taxes(2) | | 7,928 | | | (326) | | | 7,776 | | | 26,131 | | | 32,872 | |

Tax-effected net (loss) income | | (59,538) | | | 2,346 | | | (51,995) | | | (176,020) | | | (202,640) | |

Valuation changes in servicing rights, net of hedging gains and losses(3) | | 9,130 | | | 14,901 | | | 22,769 | | | 44,675 | | | 33,226 | |

| | | | | | | | | | |

| Stock-based compensation expense | | 5,966 | | | 8,200 | | | 6,375 | | | 24,919 | | | 21,993 | |

| | | | | | | | | | |

Restructuring charges(4) | | 93 | | | 1,853 | | | 3,517 | | | 7,199 | | | 11,811 | |

| | | | | | | | | | |

Cybersecurity incident(5) | | 1,868 | | | (18,880) | | | — | | | 24,628 | | | — | |

| Loss (gain) on extinguishment of debt | | — | | | — | | | — | | | 5,680 | | | (1,690) | |

Loss on disposal of fixed assets | | 33 | | | 3 | | | 325 | | | 8 | | | 1,430 | |

| | | | | | | | | | |

Other impairment(6) | | (690) | | | 10 | | | 455 | | | 511 | | | 925 | |

Tax effect of adjustments(7) | | (3,879) | | | (1,356) | | | (8,148) | | | (26,423) | | | (16,696) | |

Adjusted net (loss) income | | $ | (47,017) | | | $ | 7,077 | | | $ | (26,702) | | | $ | (94,823) | | | $ | (151,641) | |

| | | | | | | | | | |

(1)Reflects net (loss) income to Class A common stock and Class D common stock from the pro forma exchange of Class C common stock.

(2)loanDepot, Inc. is subject to federal, state and local income taxes. Adjustments to the benefit (provision) for income taxes reflect the income tax rates below, and the pro forma assumption that loanDepot, Inc. owns 100% of LD Holdings.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec 31,

2024 | | Dec 31,

2023 |

| Statutory U.S. federal income tax rate | | 21.00 | % | | 21.00 | % | | 21.00 | % | | 21.00 | % | | 21.00 | % |

| State and local income taxes (net of federal benefit) | | 2.16 | % | | 4.01 | % | | 2.87 | % | | 4.17 | % | | 5.22 | % |

| Effective income tax rate | | 23.16 | % | | 25.01 | % | | 23.87 | % | | 25.17 | % | | 26.22 | % |

| | | | | | | | | | |

(3)Represents the change in the fair value of servicing rights due to changes in valuation inputs or assumptions, net of gains or losses from derivatives hedging servicing rights, and gains (losses) from the sale of MSRs. Beginning in the second quarter of 2024, we began to include the gains (losses) from the sale of MSRs in valuation changes in servicing rights, net of hedging gains and losses to appropriately capture all valuation changes in MSRs up to and including the sales date. Prior periods have been revised to conform with this new presentation.

(4)Reflects employee severance expense and professional services associated with restructuring efforts subsequent to the announcement of Vision 2025 in July 2022.

(5)Represents expenses directly related to the Cybersecurity Incident, net of insurance recoveries, including costs to investigate and remediate the Cybersecurity Incident, the costs of customer notifications and identity protection, professional fees including legal expenses, litigation settlement costs, and commission guarantees.

(6)Represents lease impairment on corporate and retail locations.

(7)Amounts represent the income tax effect using the aforementioned effective income tax rates, excluding certain discrete tax items.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of Diluted Weighted Average Shares Outstanding to Adjusted Diluted Weighted Average Shares Outstanding (Unaudited) | | Three Months Ended | | Year Ended |

| Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec 31,

2024 | | Dec 31,

2023 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Share Data: | | | | | | | | | | |

Diluted weighted average shares of Class A common stock and Class D common stock outstanding | | 193,413,971 | | | 332,532,984 | | | 326,288,272 | | | 185,641,675 | | | 174,906,063 | |

Assumed pro forma conversion of weighted average Class C common stock to Class A common stock (1) | | 133,595,797 | | | — | | | — | | | 140,148,860 | | | 147,789,060 | |

| Adjusted diluted weighted average shares outstanding | | 327,009,768 | | 332,532,984 | | 326,288,272 | | 325,790,535 | | 322,695,123 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

(1)Reflects the assumed pro forma exchange and conversion of anti-dilutive Class C common shares.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of Net (Loss) Income to Adjusted (LBITDA) EBITDA ($ in thousands) (Unaudited) | | Three Months Ended | | Year Ended |

| Dec 31,

2024 | | Sep 30,

2024 | | Dec 31,

2023 | | Dec 31,

2024 | | Dec 31,

2023 |

Net (loss) income | | $ | (67,466) | | | $ | 2,672 | | | $ | (59,771) | | | $ | (202,151) | | | $ | (235,512) | |

Interest expense - non-funding debt (1) | | 43,874 | | | 45,129 | | | 45,484 | | | 188,550 | | | 174,103 | |

Income tax (benefit) expense | | (16,658) | | | 923 | | | (14,174) | | | (40,698) | | | (42,796) | |

| Depreciation and amortization | | 8,779 | | | 8,931 | | | 9,922 | | | 36,108 | | | 41,261 | |

Valuation changes in servicing rights, net of hedging gains and losses(2) | | 9,130 | | | 14,901 | | | 22,769 | | | 44,675 | | | 33,226 | |

| | | | | | | | | | |

| Stock-based compensation expense | | 5,966 | | | 8,200 | | | 6,375 | | | 24,919 | | | 21,993 | |

| | | | | | | | | | |

Restructuring charges(3) | | 93 | | | 1,853 | | | 3,517 | | | 7,199 | | | 11,811 | |

Cybersecurity incident(4) | | 1,868 | | | (18,880) | | | — | | | 24,628 | | | — | |

| | | | | | | | | | |

Loss on disposal of fixed assets | | 33 | | | 3 | | | 325 | | | 8 | | | 1,430 | |

| | | | | | | | | | |

Other impairment(5) | | (690) | | | 10 | | | 455 | | | 511 | | | 925 | |

Adjusted (LBITDA) EBITDA | | $ | (15,071) | | | $ | 63,742 | | | $ | 14,902 | | | $ | 83,749 | | | $ | 6,441 | |

| | | | | | | | | | |

(1)Represents other interest expense, which includes gain or loss on extinguishment of debt and amortization of debt issuance costs and debt discount, in the Company’s consolidated statements of operations.

(2)Represents the change in the fair value of servicing rights due to changes in valuation inputs or assumptions, net of gains or losses from derivatives hedging servicing rights, and gains (losses) from the sale of MSRs. Beginning in the second quarter of 2024, we began to include the gains (losses) from the sale of MSRs in valuation changes in servicing rights, net of hedging gains and losses to appropriately capture all valuation changes in MSRs up to and including the sales date. Prior periods have been revised to conform with this new presentation.

(3)Reflects employee severance expense and professional services associated with restructuring efforts subsequent to the announcement of Vision 2025 in July 2022.

(4)Represents expenses, directly related to the Cybersecurity Incident, net of insurance recoveries, that occurred in the first quarter of 2024, including costs to investigate and remediate the Cybersecurity Incident, the costs of customer notifications and identity protection, professional fees including legal expenses, litigation settlement costs, and commission guarantees.

(5)Represents lease impairment on corporate and retail locations.

Forward-Looking Statements

This press release and related management commentary contain, and responses to investor questions may contain, forward-looking statements that can be identified by the fact that they do not relate strictly to historical or current facts and may contain the words “believe,” “anticipate,” “expect,” “intend,” “plan,” “predict,” “estimate,” “project,” “will be,” “will continue,” “will likely result,” or other similar words and phrases or future or conditional verbs such as “will,” “may,” “might,” “should,” “would,” or “could” and the negatives of those terms. Examples of forward-looking statements include, but are not limited to, statements about future operations, performance, financial condition, prospects, plans and strategies, including Project North Star, sustainable profitability, revenue growth, and executive management changes.

These forward-looking statements are based on current available operating, financial, economic and other information, and are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict, including but not limited to, the following: our ability to achieve the expected benefits of Project North Star and the success of other business initiatives; our ability to achieve profitability; our loan production volume; our ability to maintain an operating platform and management system sufficient to conduct our business; our ability to maintain warehouse lines of credit and other sources of capital and liquidity; impacts of cybersecurity incidents, cyberattacks, information or security breaches and technology disruptions or failures, of ours or of our third party vendors; the outcome of legal proceedings to which we are a party; our ability to reach a definitive settlement agreement related to the Cybersecurity Incident; adverse changes in macroeconomic and U.S residential real estate and mortgage market conditions, including changes in interest rates; changing federal, state and local laws, as well as changing regulatory enforcement policies and priorities; and other risks detailed in the "Risk Factors" section of loanDepot, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2023, and Quarterly Reports on Form 10-Q as well as any subsequent filings with the Securities and Exchange Commission. Therefore, current plans, anticipated actions, and financial results, as well as the anticipated development of the industry, may differ materially from what is expressed or forecasted in any forward-looking statement. loanDepot does not undertake any obligation to publicly update or revise any forward-looking statement to reflect future events or circumstances, except as required by applicable law.

About loanDepot

At loanDepot (NYSE: LDI), we know home means everything. That’s why we are on a mission to support homeowners with a suite of products and services that fuel the American Dream. Our portfolio of digital-first home purchase, home refinance and home equity lending products make homeownership more accessible, achievable, and rewarding, especially for the increasingly diverse communities of first-time homebuyers we serve. Headquartered in Southern California with local market offices nationwide, loanDepot and its sister real estate and home services company, mellohome, are dedicated to helping customers put down roots and bring dreams to life – all while building stronger communities and a better tomorrow.

Investor Relations Contact:

Gerhard Erdelji

Senior Vice President, Investor Relations

(949) 822-4074

gerdelji@loandepot.com

Media Contact:

Rebecca Anderson

Senior Vice President, Communications & Public Relations

(949) 822-4024

rebeccaanderson@loandepot.com

LDI-IR

4Q 2024 INVESTOR PRESENTATION March 11, 2025

DISCLAIMER 2 Forward-Looking Statements and Other Information This presentation and the related management commentary contain, and responses to investor questions may contain, forward-looking statements that can be identified by the fact that they do not relate strictly to historical or current facts and may contain the words “believe,” “anticipate,” “expect,” “intend,” “plan,” “predict,” “estimate,” “project,” “will be,” “will continue,” “will likely result,” or other similar words and phrases or future or conditional verbs such as “will,” “may,” “might,” “should,” “would,” or “could” and the negatives of those terms. Examples of forward-looking statements include, but are not limited to, statements about future operations, performance, financial condition, prospects, plans and strategies, including Project North Star, sustainable profitability, revenue growth, and executive management changes. These forward-looking statements are based on current available operating, financial, economic and other information, and are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict, including but not limited to, the following: our ability to achieve the expected benefits of Project North Star and the success of other business initiatives; our ability to achieve profitability; our loan production volume; our ability to maintain an operating platform and management system sufficient to conduct our business; our ability to maintain warehouse lines of credit and other sources of capital and liquidity; impacts of cybersecurity incidents, cyberattacks, information or security breaches and technology disruptions or failures, of ours or of our third party vendors; the outcome of legal proceedings to which we are a party; our ability to reach a definitive settlement agreement related to the Cybersecurity Incident; adverse changes in macroeconomic and U.S residential real estate and mortgage market conditions, including changes in interest rates; changing federal, state and local laws, as well as changing regulatory enforcement policies and priorities; and other risks detailed in the "Risk Factors" section of loanDepot, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2023, and Quarterly Reports on Form 10-Q as well as any subsequent filings with the Securities and Exchange Commission. Therefore, current plans, anticipated actions, and financial results, as well as the anticipated development of the industry, may differ materially from what is expressed or forecasted in any forward-looking statement. loanDepot does not undertake any obligation to publicly update or revise any forward-looking statement to reflect future events or circumstances, except as required by applicable law. Non-GAAP Financial Information To provide investors with information in addition to our results as determined by GAAP, we disclose certain non-GAAP measures to assist investors in evaluating our financial results. We believe these non- GAAP measures provide useful information to investors regarding our results of operations because each measure assists both investors and management in analyzing and benchmarking the performance and value of our business. They facilitate company-to-company operating performance comparisons by backing out potential differences caused by variations in hedging strategies, changes in valuations, capital structures (affecting interest expense on non-funding debt), taxation, the age and book depreciation of facilities (affecting relative depreciation expense), and other cost or benefit items which may vary for different companies for reasons unrelated to operating performance. These non-GAAP measures include our Adjusted Total Revenue, Adjusted Net Income (Loss), Adjusted Diluted Weighted Average Shares Outstanding, and Adjusted EBITDA (LBITDA). We exclude from these non-GAAP financial measures the change in fair value of MSRs, gains (losses) from the sale of MSRs and related hedging gains and losses that represent realized and unrealized adjustments resulting from changes in valuation, mostly due to changes in market interest rates, and are not indicative of the Company’s operating performance or results of operation. Beginning in the second quarter of 2024, we began to include the gains (losses) from the sale of MSRs in valuation changes in servicing rights, net of hedging gains and losses to appropriately capture all valuation changes in MSRs up to and including the sales date. Prior periods have been revised to conform with this new presentation. We have excluded expenses directly related to the Cybersecurity Incident, net of actual and expected insurance recoveries during fiscal 2024, including costs to investigate and remediate the Cybersecurity Incident, the costs of customer notifications and identity protection, and professional fees, including legal expenses, litigation settlement costs, and commission guarantees. We also exclude stock-based compensation expense, which is a non-cash expense, gains or losses on extinguishment of debt and disposal of fixed assets, non-cash goodwill impairment, and other impairment charges to intangible assets and operating lease right-of-use assets, as well as certain costs associated with our restructuring efforts, as management does not consider these costs to be indicative of our performance or results of operations. Adjusted EBITDA (LBITDA) includes interest expense on funding facilities, which are recorded as a component of “net interest income (expense),” as these expenses are a direct operating expense driven by loan origination volume. By contrast, interest expense on our non-funding debt is a function of our capital structure and is therefore excluded from Adjusted EBITDA (LBITDA). Adjustments for income taxes are made to reflect historical results of operations on the basis that it was taxed as a corporation under the Internal Revenue Code, and therefore subject to U.S. federal, state and local income taxes. Adjustments to Diluted Weighted Average Shares Outstanding assumes the pro forma conversion of weighted average Class C common stock to Class A common stock. These non-GAAP measures have limitations as analytical tools and should not be considered in isolation or as a substitute for revenue, net income, or any other operating performance measure calculated in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies. Market and Industry Data This presentation also contains information regarding the loanDepot’s market and industry that is derived from third-party research and publications. That information may rely upon a number of assumptions and limitations, and the Company has not independently verified its accuracy or completeness.

We make the American Dream of home possible. Partnering with homeowners throughout the lifecycle of the homeownership journey. Finding An Agent Serving the Buyer First Time Homebuyer Veteran / Active Duty Move Up / Downsize Relocation Local referral Supporting The Purchase Servicing the Mortgage Optimizing the Journey Title Services Escrow/ Closing Homeowners Insurance Building Trust Continuing Customer Relationship Facilitate additional lending opportunities HELOC Closed-End Second Refinance 3 Managing the Home Solar Finance Home Security Home Renovation Solutions for Aging in Place

4 FOURTH QUARTER FACT SHEET Financial Operational • Originations: $7.2 billion in funded volume, on the high-end fourth quarter 2024 guidance • Total Revenue: $257.5 million on $5.6 billion of pull-through weighted lock volume; Adjusted revenue of $266.6 million • Total Expenses: Increased by $39.0 million, or ~12% from the fourth quarter of 2023 • primarily reflecting higher volume-related costs associated with increased volumes during the quarter; also higher headcount related salary expenses, offset somewhat by lower interest, occupancy and general and administrative expenses • Liquidity: Unrestricted cash of $422.0 million • Servicing: Increase in UPB from the third quarter of 2024 to $116.0 billion as portfolio rebuilds from retaining servicing on new originations • Expanded network of joint venture partnerships with new agreements with Smith Douglas Homes and Onx Homes • Purchase Mix: 58% of originations during the fourth quarter, down from 76% during the fourth quarter of 2023, reflecting the increased demand for refinance transactions during the period of lower market rates experienced during the third quarter 2024 • Organic Refinance Consumer Direct Recapture Rate(1): Increased to 76% for the quarter compared to 57% in fourth quarter 2023 • Unit Market Share: 174 basis points in fourth quarter 2024 vs. 175 basis points in the third quarter 2024 and 186 basis points in fourth quarter 2023 • Purchase Unit Market Share: 144 basis points in fourth quarter 2024 vs. 130 basis points in third quarter 2024 and 140 basis points in fourth quarter 2023 (1) We define organic refinance consumer direct recapture rate as the total unpaid principal balance (“UPB”) of loans in our servicing portfolio that are paid in full for purposes of refinancing the loan on the same property, with the Company acting as lender on both the existing and new loan, divided by the UPB of all loans in our servicing portfolio that paid in full for the purpose of refinancing the loan on the same property. The recapture rate is finalized following the publication date of this release when external data becomes available

DIVERSE & EXPERIENCED MANAGEMENT TEAM WITH UNIQUE SKILLSETS Dan Binowitz Jeff DerGurahian Chief Investment Officer and Head Economist Chief Marketing and Customer Experience Officer TJ Freeborn Chief Information Officer George Brady Managing Director Servicing 5 Gregg Smallwood Chief Legal Officer, Corporate Secretary Joe Grassi Chief Risk Officer Darren Graeler Chief Accounting Officer Melanie Graper Chief Human Resources Officer Jeff Walsh President, LDI Mortgage Town & Country Credit Corp. President and CEO Frank Martell David Hayes Chief Financial Officer Anthony Hsieh Executive Chairman of Mortgage Originations

A Nationwide Lender SCALED ORIGINATOR DELIVERING CUSTOMERS A COMPLETE SOLUTION The loanDepot Ecosystem Established Scalable Infrastructure 2010 to 2012 Diversification & Expansion 2013 to 2015 Brand, Technology & Operational Transformation 2016 to 2021 Vision 2025 2022 To 2024 • Launched with the goal of disrupting mortgage • Created scalable platform and infrastructure • Expanded in-market retail reach through acquisitions • Leveraged infrastructure to launch LD Wholesale • Strategic decision to begin retaining servicing • Launched proprietary mello® technology • Grew servicing book with long-term relationships to a half million loanDepot customers • Launched mellohome and melloInsurance • Acquired leading title insurance company • Formed mello® focused on mortgage adjacent, digital-first products and services • Repositioned the Company for long term value creation • Purpose driven sustainable lending • Simplified operational structure and increased operating leverage • Maintained strong balance sheet liquidity • Additions to executive team to position company for next era • Launch of HELOC 6 Title Insurance Escrow Services Homeowners Insurance First Mortgage Home Equity Solutions Project North Star 2025+ • AI driven customer and relationship management • Operational excellence • Innovative product development, aspiring to double purchase originations • Low cost producer generating durable margins and profitability

ORIGINATION GROWTH RELATIVE TO INDUSTRY (1) Calculated as LDI origination volume, in dollars, divided by total mortgage originations, in dollars, for 1-4 family homes, as measured by MBA as of 2/19/2025 Note: Pull through weighted rate lock volume is the unpaid principal balance of loans subject to interest rate lock commitments, net of a pull-through factor for the loan funding probability 7 Purchase Mix % : ($ in billions) Total Market Share (%)(1) 2.9% 34% 37% 3.1% 59% 2.4% 2.1% 70% 1.6% 76% 1.7% 71% 1.5% 73% 71% 1.5% 76% 1.5% 72% 1.2% 72% 1.4% 66% 1.4% 1.5% 58% $23 $20 $12 $9 $4 $5 $6 $6 $4 $5 $6 $7 $6 $29 $22 $16 $10 $6 $5 $6 $6 $5 $5 $6 $7 $7 281 213 150 203 221 226 285 293 296 274 322 329 334 - 50 100 150 200 250 300 350 400 $0 $10 $20 $30 $40 $50 $60 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Pull-Through Weighted (PTW) Lock Volume Origination Volume PTW GOS Margin, bps

HISTORICAL COST STRUCTURE COMPARISON ($M) 8 Salaries Other Interest Marketing Commissions Other G&A FTEs Direct Origination Expense Expenses To Note: Restructuring Charges $3.5 $2.1 $3.1 $1.9 $0.1 Loss on Disposal of Fixed Assets and Other Impairments/(Recoveries) $0.8 ($0.0) $1.2 $0.0 ($0.7) Accruals for Expected Legal Settlements (1) $3.7 $1.1 ($0.8) $0.0 $0.0 (Gain) Loss on Extinguishment of Debt $0.0 $0.0 $5.7 $0.0 $0.0 Cybersecurity Incident(2) $0.0 $14.7 $26.9 ($18.9) $1.9 Total $8.0 $17.9 $36.1 ($17.0) $1.3 (1) Excluding Cybersecurity Incident-related (2) Represents expenses directly related to the Cybersecurity Incident, net of actual and expected insurance recoveries, including costs to investigate and remediate the Cybersecurity Incident, the costs of customer notifications and identity protection, professional fees including legal expenses, litigation settlement costs, and commission guarantees. $97 $98 $96 $107 $108 $79 $81 $96 $45 $76 $45 $47 $53 $45 $44 $36 $36 $45 $54 $56 $28 $28 $31 $36 $37 $17 $18 $22 $23 $21 4,250 4,188 4,246 4,615 4,675 N on-V olum e Related V olum e Related N on-V olum e Related V olum e Related N on-V olum e Related V olum e Related N on-V olum e Related V olum e Related N on-V olum e Related V olum e Related Q4-2023 Q1-2024 Q2-2024 Q3-2024 Q4-2024

$145 $142 $114 $115 $116 137 138 137 133 139 - 20 40 60 80 100 120 140 $50 $70 $90 $110 $130 $150 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 UPB $ MSR FV, bps HISTORICAL SERVICING PORTFOLIO TREND 9 ($ in billions) Retention %(2) : Recapture %(1) : (1) Recapture rate as defined on page 3. (2) Portion of loan origination volume that was sold servicing retained in the period divided by total sold volume in the period. (3) At time of origination, strats for agency (FHLMC, FNMA, GNMA) portfolio only. Excludes HELOC Total Serv Exp$ to Avg. UPB $, bps: Portfolio @ 12/31/24 (3) W.A. Coupon 3.79% W.A. FICO 729 W.A. LTV 74% W.A. Age (Mths) 36.2 DQ Rate 60D+ 1.6% 90D+ 1.2% Composition GSE 56.1% Gov’t 34.4% Other 9.5% 71% 58% 1.9 67% 59% 2.2 68% 70% 2.0 61% 71% 2.6 60% 76% 2.8

$661 $604 $533 $483 $422 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 STRONG LIQUIDITY AND BALANCE SHEET 10 Unrestricted Cash ($M) Debt Obligations, net to Total Equity MSR FV / Total Equity 11% 10% 9% 8% 7% Unrestricted Cash / Total Assets 2.8x 3.1x 2.7x 2.6x 3.2x Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 3.2x 3.6x 3.4x 3.3x 4.0x Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24

11 Q1 2025 OUTLOOK* Metric Low High Pull-through Weighted Rate Lock Volume ($bn) $4.8 $5.8 Origination Volume ($bn) $4.5 $5.5 Pull-through Weighted GOS Margin, bps 320 340 Current Market Conditions • Higher interest rates and home price appreciation adversely impacts home affordability and borrower demand • Limited supply of new and resale homes adversely impacts homebuying activity • Homeowner equity levels drives demand for cash-out refinance and home equity solutions • Industry beginning to increase headcount and capacity for expectations of higher volumes *Q1 2025 outlook reflects current interest rate environment, seasonality, channel mix, and competitive pressures

APPENDIX

BALANCE SHEET & SERVICING PORTFOLIO HIGHLIGHTS 13 $ in MM except units and % 4Q ’24 3Q ’24 4Q ’23 4Q’24 vs 3Q’24 4Q’24 vs 4Q’23 Cash and cash equivalents $421.6 $483.0 $660.7 (12.7%) (36.2%) Loans held for sale, at fair value 2,603.7 2,790.3 2,132.9 (6.7%) 22.1% Servicing rights, at fair value 1,633.7 1,542.7 1,999.8 5.9 (18.3%) Total assets 6,344.0 6,417.6 6,151.0 (1.1)% 3.1% Warehouse and other lines of credit 2,377.1 2,565.7 1,947.1 (7.4%) 22.1% Total liabilities 5,837.4 5,825.6 5,446.6 0.2% 7.2% Total equity 506.6 592.0 704.5 (14.4%) (28.1%) Servicing portfolio (unpaid principal balance) $115,972.0 $114,915.2 $145,090.2 0.9% (20.1%) Total servicing portfolio (units) 417,875 409,344 496,894 2.1% (15.9%) 60+ days delinquent ($) $1,826.1 $1,655.0 $1,392.6 10.3% 31.1% 60+ days delinquent (%) 1.6% 1.4% 1.0% N/A N/A Servicing rights, net to UPB 1.4% 1.3% 1.4% N/A N/A

NON-GAAP FINANCIAL RECONCILIATION 14 ($MM) 4Q ’24 3Q ‘24 4Q ‘23 Adjusted Revenue Total Net Revenue $257.5 $314.6 $228.6 Valuation changes in in Servicing Rights, Net of Hedge 9.1 14.9 22.8 Adjusted Total Revenue $266.6 $329.5 $251.4 Net (Loss) Income ($67.5) $2.7 ($59.8) Interest Expense - Non-Funding Debt 43.9 45.1 45.5 Income Tax (Benefit) Expense (16.7) 0.9 (14.2) Depreciation and Amortization 8.8 8.9 9.9 Valuation changes in in Servicing Rights, Net of Hedge 9.1 14.9 22.8 Stock-Based Compensation Expense 6.0 8.2 6.4 Restructuring Charges 0.1 1.9 3.5 Cyber Incident 1.9 (18.9) 0.0 (Gain) Loss on Disposal of Fixed Assets 0.0 0.0 0.3 Other impairment (recovery) (0.7) 0.0 0.5 Adjusted EBITDA (LBITDA) ($15.1) $63.7 $14.9

NON-GAAP FINANCIAL RECONCILIATION (CONT’D) 15 ($MM) 4Q ’24 3Q ‘24 4Q ’23 Net Income (Loss) ($67.5) $2.7 ($59.8) Adjustments to Income Taxes 7.9 (0.3) 7.8 Tax-Effected Net Income (Loss) ($59.5) $2.3 ($52.0) Valuation changes in in Servicing Rights, Net of Hedge 9.1 14.9 22.8 Stock-Based Compensation Expense 6.0 8.2 6.4 Restructuring Charges 0.1 1.9 3.5 Cyber Incident 1.9 (18.9) 0.0 (Gain) Loss on Extinguishment of Debt 0.0 0.0 0.0 (Gain) Loss on Disposal of Fixed Assets 0.0 0.0 0.3 Other (Recovery) Impairment (0.7) 0.0 0.5 Tax Effect of Adjustments (3.9) (1.4) (8.1) Adjusted Net Income (Loss) ($47.0) $7.1 ($26.7)

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

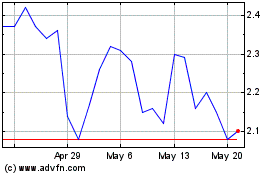

loanDepot (NYSE:LDI)

Historical Stock Chart

From Feb 2025 to Mar 2025

loanDepot (NYSE:LDI)

Historical Stock Chart

From Mar 2024 to Mar 2025