UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

| Filed by the Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) ☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☒ Soliciting Material Pursuant to §240.14a-12 |

Nuveen AMT-Free Quality Municipal Income Fund

(Exact Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

|

Nuveen Closed-End Funds |

Dear Mr. Lippincott:

The Board of Trustees for the Nuveen New York AMT-Free Quality Municipal Income Fund (NYSE: NRK) and the

Nuveen AMT-Free Quality Municipal Income Fund (NYSE: NEA) received your letter dated May 30, 2024, and recognizes Karpus Investment Management’s significant share ownership in both funds.

As we noted in a previous response to a letter you sent dated January 5, 2024, the Board actively monitors fund performance, discount levels, and

alternative actions available to improve performance consistent with each fund’s mandate. The Board is committed to ensuring that the funds are managed for the benefit of all shareholders and has a proven track record of taking thoughtful

actions to enhance shareholder outcomes, contrary to your assertion that the Board is not taking adequate steps to address shareholder value.

Highlighted below are a few of the actions the Board has taken to enhance shareholder value.

| |

• |

|

Authorized 58 CEF mergers, producing highly scaled funds in respective asset classes resulting in:

|

| |

○ |

|

Lower management fees (breakpoint pricing methodology). |

| |

○ |

|

Reduced operating expenses due to economies of scale. |

| |

○ |

|

Enhanced trading efficiencies. |

| |

○ |

|

Tightened bid/ask spreads in the secondary market. |

| |

• |

|

In addition to mergers, authorized other product actions including mandate adjustments and fund liquidations when

appropriate. |

| |

• |

|

Approved a dividend management program to support secondary market trading through enhanced cash flows to

shareholders. |

| |

○ |

|

Recent distribution increases across the entire Nuveen fund complex have helped spur secondary market trading and

added momentum to discount narrowing already underway. |

| |

• |

|

Approved an innovative complex-wide management fee schedule to share platform economies of scale which results in

lower management fees for fund shareholders. |

| |

• |

|

Established a robust and dedicated investor relations program to increase awareness, engagement, and advocacy for

CEFs. |

Specific to NRK and NEA, the Board advocated for the consolidation of overlapping New York and National funds in the

Nuveen closed-end lineup, resulting in merged funds that are the largest in their respective peer categories and deliver significant expense and trading economies to shareholders. These mergers have resulted

in over $520,000 and $2,800,000 in annual

|

|

|

|

|

|

Nuveen Closed-End Funds |

management fee savings alone for shareholders of NRK and NEA, respectively.

Economies of scale achieved through these mergers have also resulted in total expense ratios for each fund being below peer averages. The Board also approved the AMT-free positioning of both funds, providing

shareholders with the only AMT-free mandate in each fund’s respective peer category.

In response to

a challenging interest rate environment that has impacted fixed-income funds since early 2022, the Board approved distribution policy changes for a broad set of Nuveen’s fixed-income closed-end funds,

including NRK and NEA. These policy and distribution level changes are intended to provide higher regular cash flows to shareholders, enhance shareholder returns, and help support secondary market trading in each fund’s shares. Distribution

increases for NRK and NEA, even prior to the most recently announced increases as of June 3rd, were very material with total percentage increases amounting to 35% and 44% for NRK and NEA, respectively. These increases placed the distribution rate

for both funds at or near the top of each peer category at the time. Including the increases announced on June 3rd, NRK and NEA have increased distributions by 100% and 86%, respectively, placing their current distribution rates materially above

almost all peers. Since the first enhanced distributions were announced on October 23, 2023, and in concert with a more constructive market environment, market prices through June 5, 2024 are up 20.9% and 20.2% for NRK and NEA,

respectively, with discounts narrowing 583 and 596 basis points over that same time period.

Separately, the Board has noted that Karpus

materially increased ownership in both funds beginning in Q4 2022 with ownership levels increasing from approximately 10.5% for NRK and 0.2% for NEA to current levels of 23.9% and 8.4% for the funds, respectively. We also note that as of the most

recent 13F filings for Karpus, Nuveen closed-end funds comprise approximately $862 million of your firm’s roughly $3.6 billion in assets under management. As the manager of your client’s

assets, you have selected investments in Nuveen closed-ends that represent 24% of your total investment portfolio. We find it odd that in a recent NRK filing, you suggest the Nuveen Board owes it to shareholders to assess available options, other

than Nuveen, as the Fund’s Adviser, while Karpus, as an investor on behalf of your clients, has proactively chosen Nuveen for a significant portion of your client’s investments.

The Board further notes that despite your repeated claims you are not a hedge fund, your tactics are exactly the same of those employed by hedge fund

activists in the CEF space. There is no discernible difference in how you engage with funds, the rhetoric you espouse in public communications, your short-term investment goals, and the tactics you employ during a proxy contest. Karpus accumulated

large, concentrated ownership positions at discounts, and has seen these positions materially appreciate from the combination of portfolio appreciation and a tightening of the fund’s discount and is now looking to the funds and other

shareholders, many of whom likely bought the funds for the primary investment objective of attractive levels of tax-free income, to provide you liquidity at or near net asset value. This tactic, if successful,

provides Karpus a short-term discount arbitrage gain while burdening remaining shareholders with a fund whose portfolio has been significantly disrupted and with higher expenses and reduced trading and secondary market economies of scale. Your

actions appear to be identical to that of hedge fund activists looking to achieve short-term gains at the expense of long-term individual shareholders.

|

|

|

|

|

|

Nuveen Closed-End Funds |

The Board, as a fiduciary for all shareholders, takes its commitment seriously

and will continue to act in the best interests of all shareholders by ensuring the funds deliver on their investment objectives over the long-term and through multiple market cycles. The Board will continue to support fund actions that it believes

improve fund and secondary market performance while maintaining economies of scale that benefits all shareholders, including Karpus.

Sincerely,

Terence J. Toth and Thomas J. Kenny

Co-Chairs of the Board of Trustees for NRK and NEA

IMPORTANT INFORMATION / SOLICITATION PARTICIPANTS

This

filing is not a solicitation of a proxy from any shareholder of Nuveen New York AMT-Free Quality Municipal Income Fund or Nuveen AMT-Free Quality Municipal Income Fund (collectively, the “Funds”). Information regarding the

persons who may, under SEC rules, be deemed participants in the solicitation of the Funds’ shareholders in connection with each Fund’s annual meeting of shareholders, including, without limitation, the Funds and Nuveen Fund Advisors, LLC,

the Funds’ investment adviser, and a description of the participants’ direct or indirect interests, by security holdings or otherwise, will be set forth in each Fund’s definitive proxy statement when available. Shareholders may

obtain a free copy of the definitive proxy statement and proxy card (when available) and other documents filed by the participants with the SEC, at the SEC’s web site at

www.sec.gov. The definitive proxy statement (when available) and other related SEC documents filed by the participants with the SEC, may also be

obtained free of charge from the Funds by calling (800) 257-8787. Shareholders are urged to read the definitive proxy statement and proxy card when they become available, because they will contain important information about the Funds, the

participants, the proposals to be voted upon by Fund shareholders, and related matters.

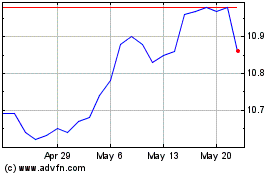

Nuveen AMT Free Quality ... (NYSE:NEA)

Historical Stock Chart

From Feb 2025 to Mar 2025

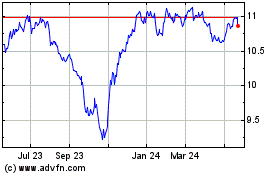

Nuveen AMT Free Quality ... (NYSE:NEA)

Historical Stock Chart

From Mar 2024 to Mar 2025