0001373715false00013737152024-12-242024-12-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 24, 2024

___________

SERVICENOW, INC.

(Exact name of registrant as specified in its charter)

___________

| | | | | | | | | | | | | | |

Delaware | | 001-35580 | | 20-2056195 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

2225 Lawson Lane

Santa Clara, California 95054

(Address of principal executive offices and Zip Code)

(408) 501-8550

(Registrant's telephone number, including area code)

| | |

Not Applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | | NOW | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 24, 2024, ServiceNow, Inc. (“ServiceNow” or the “Company”) entered into amendments to the previously filed employment agreements with, among others, William R. McDermott, Chairman and Chief Executive Officer; Gina Mastantuono, Chief Financial Officer; and Jaqueline Canney, Chief People Officer. The amendments, which become effective January 1, 2025, incorporate the terms of the new ServiceNow, Inc. Executive Severance Policy (the “Policy”) adopted by the Company to standardize severance payments and benefits for the Company’s executive leadership team.

Pursuant to the Policy, the Chief Executive Officer (the “CEO”), executive officers of the Company who directly report to the CEO and any employee whose employment agreement indicates that the Policy should apply (collectively, the “Eligible Employees”) may become eligible to receive certain severance payments and benefits upon a Qualifying Termination (as defined in the Policy), subject to a timely release of claims as described in the Policy.

The Policy provides Eligible Employees other than the CEO who incur a Qualifying Termination within three months before or 12 months following a Change in Control (as defined in the Policy), the following benefits: (i) a lump sum equal to 1.5 times the sum of the Eligible Employee’s then-current annual base salary, plus the Eligible Employee’s Target Bonus (as defined in the Policy) for the then-current fiscal year, with the Target Bonus amount becoming payable when such bonus would otherwise have been paid absent the Qualifying Termination, but in all events no later than March 15th of the year following the then-current fiscal year; (ii) an additional lump sum equal to the cost of COBRA medical, vision and dental benefits coverage for a period of 18 months; (iii) immediate vesting of 100% of then-unvested time-based restricted stock units (“RSUs”); and (iv) immediate vesting of 100% of then-unvested performance-based restricted stock units (“PRSUs”), based on actual performance.

Eligible Employees other than the CEO who incur a Qualifying Termination not in connection with a Change in Control are entitled to the following benefits under the Policy: (i) cash severance equal to the Eligible Employee’s then-current annual base salary, payable in a lump sum; (ii) the Eligible Employee’s Actual Bonus (as defined in the Policy) for the then-current fiscal year, payable when such Actual Bonus would otherwise have been paid absent the Qualifying Termination, but in all events no later than March 15th of the year following the then-current fiscal year; (iii) an additional lump sum equal to the cost of COBRA medical, vision and dental benefits coverage for a period of 12 months; and (iv) pro-rata vesting of PRSUs at the end of the applicable performance period based on actual performance.

Further, the Policy provides that the Company’s CEO is entitled to the following benefits upon a Qualifying Termination within three months before or 12 months following a Change in Control: (i) a lump sum equal to 2 times the sum of the CEO’s then-current annual base salary, plus the CEO’s Target Bonus for the then-current fiscal year, with the Target Bonus amount becoming payable when such bonus would otherwise have been paid absent the Qualifying Termination, but in all events no later than March 15th of the year following the then-current fiscal year; (ii) an additional lump sum equal to the cost of COBRA medical, vision and dental benefits coverage for a period of 24 months; (iii) immediate vesting of 100% of then-unvested RSUs; and (iv) immediate vesting of 100% of then-unvested PRSUs, based on actual performance.

If the CEO incurs a Qualifying Termination not in connection with a Change in Control, the Policy provides for the following benefits: (i) cash severance equal to the CEO’s then-current annual base salary, payable in a lump sum; (ii) the CEO’s Actual Bonus for the then-current fiscal year, payable when such bonus would otherwise have been paid absent the Qualifying Termination, but in all events no later than March 15th of the year following the then-current fiscal year; (iii) an additional lump sum equal to the cost of COBRA medical, vision and dental benefits coverage for a period of 12 months; (iv) immediate vesting of the number of then-unvested RSUs that would have vested during the 15-month period following the CEO’s termination date had the CEO remained employed with the Company through such period; and (v) immediate pro-rata vesting based on actual performance of then-unvested PRSUs, in addition to the number of such PRSUs that would have vested during the 15-month period following the CEO’s termination date based on actual performance.

Additionally, all Eligible Employees who incur a termination of employment upon death are entitled under the Policy to immediate vesting of 100% of then-unvested RSUs and immediate pro-rata vesting of then-unvested PRSUs at the target level of performance.

Finally, the Policy provides that all Eligible Employees who incur a termination of employment for Disability (as defined in the Policy) are entitled to continued vesting of RSUs and PRSUs, with the PRSUs vesting on a pro-rata basis.

The foregoing description of the employment agreement amendments and the Policy is only a summary and is qualified in its entirety by reference to the full text of the Form of Employment Agreement Amendment and the Policy, copies of which are filed as exhibits hereto and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| | |

(d) | Exhibits. | |

| | |

| | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | SERVICENOW, INC. |

| | | | |

| | | By: | /s/ Russell S. Elmer |

| | | | Russell S. Elmer

General Counsel |

| | | | |

| Date: December 27, 2024 | | |

Form of Amendment to Employment Agreement

This Amendment No. [__] (this “Amendment”) to that certain Employment Agreement by and between ServiceNow, Inc. (the “Company”) and [______] (“Executive”), dated as of [_______] (as may be amended, supplemented or modified from time to time, the “Employment Agreement”), is made and entered into by and between the Company and Executive, effective as of January 1, 2025. Any capitalized term that is used but not otherwise defined in this Amendment shall have the meaning set forth in the Employment Agreement.

In consideration of the mutual covenants and agreements set forth herein and for good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, and intending to be legally bound hereby, the parties hereto do hereby agree as follows:

1.Section [__] of the Employment Agreement is hereby amended by deleting and replacing the language in such section to read as follows:

“a. ‘Cause’ shall have the meaning it is given in the Severance Policy.”

2.Section [__] of the Employment Agreement is hereby amended by deleting and replacing the language in such section to read as follows:

“b. ‘Change in Control’ shall have the meaning it is given in the Severance Policy.”

3.Section [__] of the Employment Agreement is hereby amended by deleting and replacing the language in such section to read as follows:

“f. ‘Good Reason’ shall have the meaning it is given in the Severance Policy.”

4.Section [__] of the Employment Agreement is hereby amended by adding the following language at the end of such Section:

“g. ‘Severance Policy’ shall mean the ServiceNow, Inc. Executive Severance Policy effective January 1, 2025.”

5.Section [__] of the Employment Agreement entitled “Effect of Termination of Employment and Non-Renewal of Agreement” is hereby amended by deleting and replacing the entirety of the language in such section with the following language:

“In the event of your termination of employment, you shall be entitled to the benefits and payments, if any, and subject to the terms and conditions, described in the Severance Policy.”

6.Section [__] of the Employment Agreement is hereby amended by deleting and replacing the entirety of the language in the section entitled “Parachute Payments” with the following:

“In the event that the severance and other benefits provided for under in this Agreement, the Severance Policy, or otherwise payable to you constitute “parachute payments” within the meaning of Section 280G of the Code, the payment of such amounts shall be governed by the Severance Policy.”

7.Except as expressly set forth in this Amendment, the Employment Agreement shall remain in full force and effect in accordance with its terms.

8.This Amendment may be signed in counterparts, each of which shall be deemed an original and which together shall constitute one instrument.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed this Amendment effective as of the date set forth above.

| | |

ServiceNow, Inc.

|

By: Russell Elmer Corporate Secretary |

|

Executive

|

By: [Executive] |

SERVICENOW, INC. EXECUTIVE SEVERANCE POLICY

This ServiceNow, Inc. Executive Severance Policy (as amended from time to time, the “Policy”) is intended to help retain qualified senior level employees, maintain a stable work environment and provide economic security to eligible employees by providing severance payments and benefits to such employees. The Company, including each subsidiary that is an employer of an Eligible Employee, hereby adopts the Policy for the benefit of certain senior level employees of the Company on the terms and conditions hereinafter stated, effective as of January 1, 2025.

1. DEFINITIONS. As hereinafter used:

1.1 “Actual Bonus” shall mean the actual bonus amount awarded pursuant to the Executive Bonus Program applicable to the Eligible Employee for the applicable fiscal year.

1.2 “Administrator” shall mean the Compensation Committee of the Board or its delegate.

1.3 “Base Salary” shall mean the Eligible Employee’s annual base rate of pay for services paid by the Employer to the Eligible Employee at the time of his or her termination of employment, as reflected in the Employer’s payroll records. Base Salary shall not include commissions, bonuses, overtime pay, incentive compensation, equity, benefits paid under any qualified plan, group insurance or other welfare benefit or any other additional compensation.

1.4 “Board” shall mean the Board of Directors of the Company.

1.5 “Cause” shall mean the occurrence of any of the following events, as determined by the Company in its good faith discretion: (i) the Eligible Employee’s conviction of, or plea of nolo contendere to, any felony or any crime involving fraud, dishonesty or moral turpitude; (ii) the Eligible Employee’s commission of or participation in a fraud or act of dishonesty against the Company that results in (or would reasonably be expected to result in) material harm to the business of the Company; (iii) the Eligible Employee’s intentional, material violation of any contract or agreement between the Eligible Employee and the Company or any statutory duty the Eligible Employee owes to the Company or improper disclosure of confidential information (as defined in the Company’s standard confidentiality agreement, as may be amended from time to time); (iv) the Eligible Employee’s conduct constitutes gross insubordination or habitual neglect of duties and that results in (or would reasonably be expected to result in) material harm to the business of the Company; (v) the Eligible Employee’s material failure to follow the Company’s material policies; or (vi) the Eligible Employee’s failure to cooperate with the Company in any investigation or formal proceeding; provided, however, that the action or conduct described in clauses (iii), (iv), (v) and (vi) above will constitute “Cause” only if such action or conduct continues after the Company has provided the Eligible Employee

with written notice thereof and thirty (30) days to cure the same if such action or conduct is curable.

1.6 “Change in Control” shall mean the occurrence, in a single transaction or in a series of related transactions, of any one or more of the following events (excluding in any case transactions in which the Company or its successors issues securities to investors primarily for capital raising purposes):

(i) the acquisition by a third party of securities of the Company representing fifty percent (50%) or more of the combined voting power of the Company’s then outstanding securities other than by virtue of a merger, consolidation or similar transaction;

(ii) a merger, consolidation or similar transaction following which the stockholders of the Company immediately prior thereto do not own at least fifty percent (50%) of the combined outstanding voting power of the surviving entity (or that entity’s parent) in such merger, consolidation or similar transaction;

(iii) the dissolution or liquidation of the Company; or

(iv) the sale, lease, exclusive license or other disposition of all or substantially all of the assets of the Company.

Notwithstanding any of the foregoing, any transaction or transactions effected solely for purposes of changing the Company’s domicile will not constitute a Change in Control pursuant to the foregoing definition. Further, notwithstanding anything herein to the contrary, for any payments pursuant to this Policy that are subject to Section 409A of the Code, to the extent required by Section 409A of the Code, a Change in Control shall not be deemed to occur unless such event constitutes a “change in control event” within the meaning of Section 409A of the Code.

1.7 “COBRA” shall mean the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended, and the underlying Treasury Department regulations.

1.8 “Code” shall mean the Internal Revenue Code of 1986, as amended.

1.9 “Company” shall mean ServiceNow, Inc., a Delaware corporation, and, except as the context otherwise requires, its wholly owned subsidiaries and any successor by merger, acquisition, consolidation, restructuring or otherwise that assumes the obligations of the Company under the Policy.

1.10 “Disability” shall have that meaning set forth in Section 22(e)(3) of the Code.

1.11 “Effective Date” shall mean January 1, 2025.

1.12 “Eligible Employee” shall mean an employee who is actively and regularly employed by an Employer on a Full-Time basis at the time of termination of employment who, as of immediately prior to such employee’s termination of employment, is either: (i) the Chief Executive Officer of the Company, (ii) an executive officer of the Company who directly reports to the Chief Executive Officer or (iii) any employee whose employment agreement indicates that this Policy shall apply.

1.13 “Employer” shall mean the Company, any Subsidiary or any “affiliated organization” which employs an Eligible Employee. For purposes of this Policy, an “affiliated organization” is the Company and (i) any corporation that is a member of a controlled group of corporations (within the meaning of Code Section 1563(a) without regard to Code Sections 1563(a)(4) and 1563(e)(3)(C) that includes the Company, (ii) any trade or business (whether or not incorporated) that is controlled (within the meaning of Code Section 414(c)) by the Company, (iii) any member of an “affiliated service group” (within the meaning of Code Section 414(m) of which the Company is a member or (iv) any other organization that, together with the Company, is treated as a single employer pursuant to Code Section 414(o) or the regulations thereunder; provided that the provisions of Code Section 1563(a) shall be applied by substituting the phrase “more than 50 percent” for the phrase “at least 80 percent” wherever it appears in such Code Section.

1.14 “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

1.15 “ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time and the regulations promulgated thereunder.

1.16 “Excise Tax” shall mean the excise tax imposed by Section 4999 of the Code, and any interest or penalties incurred by the Eligible Employee with respect to such excise tax.

1.17 “Executive Bonus Program” shall mean the ServiceNow, Inc. Corporate Executive Bonus Program and the ServiceNow, Inc. Executive Bonus Program, in each case as amended from time to time.

1.18 “Full-time” with respect to an employee shall mean any employee who is designated as a full-time employee within the Company Human Resources/Payroll system as of his or her Termination Date.

1.19 “Good Reason” shall mean, without the Eligible Employee’s consent:

(i) any material diminution in the Eligible Employee’s title, authority, duties or responsibilities as in effect immediately prior to such reduction or a material diminution in authority, duties or responsibilities of the person to whom the Eligible Employee is required to report;

(ii) a material reduction by the Company in the Eligible Employee’s annual Base Salary or Target Bonus, as initially set forth in the Eligible Employee’s employment agreement or as increased thereafter; provided, however, that Good Reason shall not be deemed to have occurred in the event of a reduction in the Eligible Employee’s annual Base Salary or Target Bonus that is pursuant to a salary or bonus reduction program affecting substantially all of the employees of the Company or substantially all similarly situated executive employees and that does not adversely affect the Eligible Employee to a greater extent than other similarly situated employees;

(iii) a relocation of the Eligible Employee’s business office to a location that would increase the Eligible Employee’s one-way commute distance by more than thirty-five (35) miles from the location at which the Eligible Employee principally performed his or her duties immediately prior to the relocation, except for required travel by the Eligible Employee on the Company’s business to an extent substantially consistent with the Eligible Employee’s business travel obligations prior to the relocation;

(iv) a material breach of the Eligible Employee’s employment agreement by the Company; or

(v) failure of a successor entity to assume the Eligible Employee’s employment agreement;

provided, however, that any such termination by the Eligible Employee shall only be deemed for Good Reason pursuant to this definition if: (1) the Eligible Employee gives the Company written notice of his or her intent to resign for Good Reason within ninety (90) days following the first occurrence of the condition(s) that the Eligible Employee believes constitute(s) Good Reason, which notice shall describe such condition(s); (2) the Company fails to remedy such condition(s) within thirty (30) days following receipt of the written notice (the “Cure Period”); and (3) the Eligible Employee voluntarily resigns his or her employment within one hundred twenty (120) days following the end of the Cure Period.

1.20 “Person” shall have the meaning given in Section 3(a)(9) of the Exchange Act, as modified and used in Sections 13(d) and 15(d) thereof, except that such term shall not include (i) the Company or any of its subsidiaries, (ii) a trustee or other fiduciary holding securities under an employee benefit plan of the Company or any of its affiliates, (iii) an underwriter temporarily holding securities pursuant to an offering of such securities, or (iv) a corporation owned, directly or indirectly, by the shareholders of the Company in substantially the same proportions as their ownership of shares of the Company.

1.21 “Plan” or “Policy” means this ServiceNow, Inc. Executive Severance Policy.

1.22 “Qualifying Termination” shall mean the Eligible Employee’s employment with the Employer is terminated (i) by the Employer for any reason other than Cause, death or Disability, or (ii) by the Eligible Employee for Good Reason. A Qualifying Termination shall not be triggered by a sale of the Eligible Employee’s Employer, or by the sale of any facility, division, business function or other subsidiary of the Company which, in connection therewith, the Eligible Employee’s employment with the Employer is terminated and the Eligible Employee is offered employment by the purchaser or successor (or an affiliate thereof), unless the terms of such employment would have been grounds to terminate employment for Good Reason (as determined by the Administrator in its sole discretion).

1.23 “Qualifying Termination Date” means the date on which an Eligible Employee incurs a Qualifying Termination.

1.24 “Separation and Release Agreement” means the Company’s then-current standard form of release agreement to be entered into between the Eligible Employee and the Employer and /or the Company (as deemed appropriate by the Employer).

1.25 “Target Bonus” shall mean the percentage of an Eligible Employee’s Base Salary that such Eligible Employee is eligible to receive (assuming achievement of 100% of all applicable performance metrics or objectives) pursuant to the Executive Bonus Program applicable to the Eligible Employee for the applicable fiscal year.

1.26 “Termination Date” means the date on which an Eligible Employee’s employment with the Company terminates for any reason.

2. SEVERANCE BENEFITS.

2.1 Severance Amount.

a. Subject to Section 2.3 hereof, in addition to the Accrued Compensation (as defined below), the Employer shall pay to each Eligible Employee who incurs a Qualifying Termination, or a termination of employment upon the Eligible Employee’s death or Disability, an amount determined in accordance with the applicable termination scenario set forth on the Severance Exhibit attached hereto as Exhibits A-1 and A-2 that corresponds with such Eligible Employee’s designated job level and title. Subject to the terms of the Separation and Release Agreement described in Section 2.3 and subject to Sections 2.5 and 2.6 hereof, the amount payable under this Section 2.1 shall be paid in accordance with the Company’s normal payroll practices at the time and in the form set forth on the Severance Exhibit that corresponds with such Eligible Employee’s designated job level and title. Except as otherwise specified in the Severance Exhibit, if the Severance Exhibit indicates the payment of a lump sum amount, such lump sum amount shall be paid no later than sixty (60) days following the Qualifying Termination Date; provided, that, in no event may an Eligible Employee, directly or indirectly, designate the calendar year of a payment, and if the Release Execution Period begins in one

taxable year and ends in another taxable year, payment shall not be made until the beginning of the second taxable year. Except as otherwise specified in the Severance Exhibit, if the Severance Exhibit indicates the commencement of installment payments, such installment payments shall commence no later than sixty (60) days following the Qualifying Termination Date, provided that, if the Release Execution Period begins in one taxable year and ends in another taxable year, installment payments shall not be commence until the beginning of the second taxable year.

2.2 Accrued Compensation.

a. The Employer shall pay to each Eligible Employee who incurs a termination of employment for any reason, as soon as practicable, but in any event before the earlier to occur of (y) the payment date required by applicable law and (z) thirty (30) days after the Termination Date, the following: (i) any earned but unpaid Base Salary; (ii) except in the case of termination for Cause or resignation without Good Reason, the amount of any Actual Bonus earned and payable from a bonus period ending prior to the Termination Date which remains unpaid by the Company as of the Termination Date determined in good faith in accordance with customary practice, to be paid at the same time as bonuses are paid for that period to other eligible executives; and (iii) reimbursement for all reasonable and necessary expenses incurred by the Eligible Employee in connection with the performance of services on behalf of the Company in accordance with applicable Company policies and guidelines (collectively, the “Accrued Compensation”), in each case as of the Termination Date.

b. Each Eligible Employee who incurs a termination of employment will remain entitled to any benefits to which he or she would otherwise be entitled under the specific terms and conditions of any of the Company’s agreements, plans or awards, including insurance and health and benefit plans in which the Eligible Employee participates (unless otherwise specifically provided herein) and tax-qualified retirement plans and non-qualified deferred compensation plans. Nothing contained in the Policy is intended to waive or relinquish Eligible Employee’s vested rights in such benefits.

2.3 Conditions.

a. No Eligible Employee who incurs a Qualifying Termination shall be eligible to receive the payments or other benefits set forth in Section 2.1 of this Policy unless the Eligible Employee executes and does not revoke the Separation and Release Agreement containing a written general release of claims in accordance with the terms and conditions set forth therein. An Eligible Employee must sign and return the Separation and Release Agreement and satisfy all conditions to make the release effective (including non-revocation of the release), no later than sixty (60) calendar days after the Qualifying Termination Date (the “Release Execution Period”). The Administrator or the Employer (as appropriate) may modify, in good faith, the form of Separation and Release Agreement in order to comply with applicable local law and preserve the intent of the Separation and Release Agreement.

b. Notwithstanding any other provision of this Policy, upon the termination of an Eligible Employee’s employment for any reason, unless otherwise requested by the Board, the Eligible Employee shall immediately resign from all positions (including directorships) that he or she holds or has ever held with the Company or any of its affiliates. Each Eligible Employee agrees to execute any and all documentation to effectuate such resignations upon request by the Board, but he or she shall be treated for all purposes as having so resigned upon termination of his or her employment, regardless of when or whether he or she executes any such documentation.

2.4 Reduction of Severance Benefits. In the event the Company reduces the benefits available to any Eligible Employee under this Policy, the Company will provide such Eligible Employee with advanced notice at least six months prior to the effective date of such reduction, together with an explanation of the Company’s rationale for making such reduction; provided, that no reduction of the benefits available under the Policy shall be made in a manner disproportionate to similarly situated executive employees of the Company.

2.5 Restrictive Covenants. Following an Eligible Employee’s Termination Date, such Eligible Employee shall continue to be subject to any confidentiality or other restrictive covenant agreement with the Company or the Employer (as appropriate) to which the Eligible Employee is a party, including but not limited to any agreement governing non-competition, non-solicitation, non-disparagement, or the treatment, ownership or return of intellectual or other property of the Company or the Employer. The Administrator, in its sole discretion, shall have the right to cease payment, or claw back payment (as appropriate), if Eligible Employee violates any provision of this Section 2.5. However, nothing in this Section 2.5 shall preclude the Eligible Employee from making truthful and accurate statements or disclosures that are required by applicable law or legal process, including, without limitation: (i) reporting violations of law to law enforcement officials; (ii) giving truthful testimony under oath in a judicial, administrative, or arbitral proceeding; (iii) making truthful statements to governmental agencies such as the EEOC or SEC; or (iv) otherwise exercising any of the Eligible Employee's protected rights that cannot be waived by agreement.

2.6 Other Severance Payments. Except as otherwise determined by the Administrator, any cash severance benefits payable under Section 2.1 hereof or other severance benefits provided under Section 2.2 hereof will be reduced by and shall not be in addition to any severance benefits to which the Eligible Employee may otherwise be entitled under any agreement between the Company and the Eligible Employee that provides for severance, or as required by applicable law.

2.7 Section 409A. The Policy is intended to comply with, or be exempt from, the applicable requirements of Section 409A of the Code and the regulations promulgated thereunder (“Section 409A”), and the Policy will be interpreted on a basis consistent with such intent. Notwithstanding anything contained herein to the contrary, the Eligible Employee shall not be

considered to have terminated employment with the Company for purposes of any payments under this Policy which are subject to Section 409A until the Eligible Employee has incurred a “separation from service” from the Company within the meaning of Section 409A. Each amount to be paid or benefit to be provided under this Policy shall be construed as a separate identified payment for purposes of Section 409A. Without limiting the foregoing and notwithstanding anything contained herein to the contrary, to the extent required in order to avoid an accelerated or additional tax or penalty under Section 409A, amounts that would otherwise be payable and benefits that would otherwise be provided pursuant to this Policy during the six-month period immediately following the Eligible Employee’s separation from service shall instead be paid on the first business day after the date that is six months following the Eligible Employee’s separation from service (or, if earlier, the Eligible Employee’s date of death). To the extent required to avoid an accelerated or additional tax or penalty under Section 409A, amounts reimbursable to the Eligible Employee shall be paid to the Eligible Employee on or before the last day of the year following the year in which the expense was incurred and the amount of expenses eligible for reimbursement (and in-kind benefits provided to the Eligible Employee) during one year may not affect amounts reimbursable or provided in any subsequent year. The Company makes no representation that any or all of the payments described in this Policy will be exempt from or comply with Section 409A and makes no undertaking to preclude Section 409A from applying to any such payment.

2.8 Section 280G. Anything in this Policy to the contrary notwithstanding, in the event that any payment or benefit received or to be received by the Eligible Employee (including any payment or benefit received in connection with a Change in Control or the termination of the Eligible Employee’s employment, whether pursuant to the terms of the Policy or any other plan, arrangement or agreement) (all such payments and benefits, including the severance benefits payable hereunder, being hereinafter referred to as the “Total Payments”) would be subject (in whole or part), to the Excise Tax, then, after taking into account any reduction in the Total Payments provided by reason of Section 280G of the Code in such other plan, arrangement or agreement, the severance benefits payable hereunder shall be reduced to the extent necessary so that no portion of the Total Payments is subject to the Excise Tax but only if (A) the net amount of such Total Payments, as so reduced (and after subtracting the net amount of federal, state and local income taxes on such reduced Total Payments and after taking into account the phase out of itemized deductions and personal exemptions attributable to such reduced Total Payments) is greater than or equal to (B) the net amount of such Total Payments without such reduction (but after subtracting the net amount of federal, state and local income taxes on such Total Payments and the amount of Excise Tax to which the Eligible Employee would be subject in respect of such unreduced Total Payments and after taking into account the phase out of itemized deductions and personal exemptions attributable to such unreduced Total Payments). In such event, the Total Payments shall be reduced in the following order: (1) cash payments not subject to Section 409A; (2) cash payments subject to Section 409A; (3) equity-based payments and acceleration not subject to Section 409A; (4) equity-based payment and acceleration subject to

Section 409A; (5) non-cash forms of benefits (other than equity-based payment and acceleration) not subject to Section 409A; and (6) non-cash forms of benefits (other than equity-based payments and acceleration subject to Section 409A. To the extent any payment is to be made over time (e.g., in installments, etc.), then the payments shall be reduced in reverse chronological order. The preceding provisions of this Section 2.8 shall not apply in the case of an Eligible Employee who is a party to an agreement with the Company that provides for a different treatment in the event that payments to the Eligible Employee are subject to the Excise Tax. The calculations contemplated by this Section 2.8 shall be done by such accounting or tax experts as may be designated by the Company prior to a Change in Control and shall be binding on the Company and the Eligible Employee.

3. ADMINISTRATION.

3.1 The Administrator shall have the exclusive right, power and authority, in its sole and absolute discretion, to administer and interpret the Policy and other Policy documents. The Administrator shall have all powers reasonably necessary to carry out its responsibilities under the Policy including, but not limited to, the sole and absolute discretionary authority to: (i) administer the Policy in accordance with its terms and to interpret the Policy and related procedures; (ii) resolve and clarify inconsistencies, ambiguities and omissions in the Policy document and among and between the Policy document and other related documents; (iii) take all actions and make all decisions regarding questions of coverage, eligibility and entitlement to benefits, and benefit amounts; and (iv) process and approve or deny all claims for benefits. The decision of the Administrator on any disputed question arising under the Policy, including, but not limited to, questions of construction, interpretation and administration shall be final, conclusive and binding on all persons having an interest in or under the Policy.

3.2 The Administrator may delegate any of its duties hereunder to such person or persons from time to time as it may designate. Any such delegation shall be in writing.

3.3 The Administrator is empowered, in connection with the Policy, to engage accountants, legal counsel and such other personnel as it deems necessary or advisable to assist it in the performance of its duties under the Policy. The functions of any such persons engaged by the Administrator shall be limited to the specified services and duties for which they are engaged, and such persons shall have no other duties, obligations or responsibilities under the Policy. Such persons shall exercise no discretionary authority or discretionary control respecting the management of the Policy. All reasonable expenses thereof shall be borne by the Company.

4. POLICY MODIFICATION OR TERMINATION.

The Policy may be amended or terminated by the Compensation Committee or its delegate at any time, subject to the requirements of Section 2.4 above; provided, however, that unless required by applicable law, the Policy may not be amended or terminated during the period commencing on the date of a Change in Control and ending on the second anniversary of

the date of the Change in Control in a manner adverse or potentially adverse to any Eligible Employee.

5. GENERAL PROVISIONS.

5.1 Except as otherwise provided herein or by law, no right or interest of any Eligible Employee under the Policy shall be assignable or transferable, in whole or in part, either directly or by operation of law or otherwise, including without limitation by execution, levy, garnishment, attachment, pledge or in any manner; no attempted assignment or transfer thereof shall be effective; and no right or interest of any Eligible Employee under the Policy shall be liable for, or subject to, any obligation or liability of such Eligible Employee. When a payment is due under this Policy to a terminated Eligible Employee who is unable to care for his or her affairs, payment may be made directly to his or her legal guardian or personal representative, upon proof or establishment of same within 90 days of such Eligible Employee’s Termination Date.

5.2 By participating in the Policy, each Eligible Employee acknowledges that the Company may hold and process data relating to him or her (including personal data) in relation to and as a consequence of their rights under the Policy. The Company and the Eligible Employee’s employer hold certain personal information, including the Eligible Employee’s name, home address and telephone number, date of birth, identification number, salary, nationality, job title and rights under the Policy, for the purpose of managing and administering the Policy (“Data”). The Company may transfer Data to any third parties assisting the Company in the implementation, administration and management of the Policy.

5.3 Neither the establishment of the Policy, nor any modification thereof, nor the creation of any fund, trust or account, nor the payment of any benefits shall be construed as giving any Eligible Employee, or any person whomsoever, the right to be retained in the service of the Company, and all Eligible Employees shall remain at-will employees and subject to discharge to the same extent as if the Policy had never been adopted, in each case, except as required by applicable law.

5.4 If any provision of this Policy shall be held invalid or unenforceable, such invalidity or unenforceability shall not affect any other provisions hereof, and this Policy shall be construed and enforced as if such provisions had not been included.

5.5 This Policy shall inure to the benefit of and be binding upon the heirs, executors, administrators, successors and assigns of the parties, including each Eligible Employee, present and future, and any successor to the Company, which successor shall assume the obligations under this Policy and expressly agree to perform the obligations of the Company hereunder. If a terminated employee shall die while any amount would still be payable to such terminated employee hereunder if the terminated employee had continued to live, all such amounts, unless otherwise provided herein, shall be paid in accordance with the terms of this

Policy to the executor, personal representative or administrators of the terminated employee’s estate.

5.6 The headings and captions herein are provided for reference and convenience only, shall not be considered part of the Policy, and shall not be employed in the construction of the Policy.

5.7 The Policy shall be unfunded. No Eligible Employee shall have any right to, or interest in, any assets of any Company which may be applied by the Company to the payment of benefits or other rights under this Policy.

5.8 Any notice or other communication required or permitted pursuant to the terms hereof shall be in writing and shall have been duly given when delivered or mailed by United States Mail, postage prepaid, addressed to the intended recipient at his, her or its last known address.

5.9 The provisions of the Policy will be construed, administered and enforced in accordance with the laws of the State of California, to the extent not preempted by federal law, which shall otherwise control.

5.10 All benefits hereunder shall be reduced by applicable withholding and shall be subject to applicable tax reporting, as determined by the Administrator in conjunction with the Employer.

5.11 This Policy constitutes the entire agreement and understanding of the parties relating to the subject matter herein and supersedes all prior discussions between them. Any prior agreements, commitments or negotiations concerning payments or benefits upon termination of employment are superseded. The failure by either party to enforce any rights under this Policy shall not be construed as a waiver of any rights of such party.

5.12 An Eligible Employee’s acceptance of any of the payments or other benefits set forth in Sections 2.1 and 2.2 of the Policy shall be deemed acceptance of the terms of this Policy by the Eligible Employee.

6. OTHER ASPECTS OF THE POLICY.

6.1 Claims Procedure. An Eligible Employee should refer to Exhibit B “Claims Procedures under ERISA” for information regarding the claims procedures that apply under the Policy.

6.2 Arbitration. The terms, conditions and procedures set forth in an Arbitration Agreement or similar agreement entered into between the Eligible Employee and the Company shall apply in all respects to any controversies, claims or disputes arising under or related to the Policy. If an Eligible Employee has not entered into an Arbitration Agreement or similar

agreement with the Company, he or she shall enter into such agreement prior to participating in the Policy.

EXHIBIT A-1

SEVERANCE EXHIBIT

ServiceNow, Inc. Executive Severance Policy Table of Benefits – Eligible Employees other than the CEO

| | | | | | | | | | | |

Termination upon Death(i)(ii) Eligible Employees other than the CEO |

| Cash Severance | Medical, Vision and Dental Benefit Continuation | RSUs | PRSUs |

| None. | None. | Immediate vesting of one hundred percent (100%) of the number of then-unvested shares subject to restricted stock unit awards subject to solely time-based vesting conditions (“RSUs”). | Immediate vesting of then-unvested shares subject to restricted stock unit awards with performance-based vesting conditions (“PRSUs”) on a prorated basis based upon the number of months during the applicable performance period that the Eligible Employee provided services as an Eligible Employee to the Company prior to the Eligible Employee’s death, assuming achievement of 100% of target of the applicable performance objectives. |

| | | | | | | | | | | |

Termination upon Disability(i)(ii) Eligible Employees other than the CEO |

| Cash Severance | Medical, Vision and Dental Benefit Continuation | RSUs | PRSUs |

| None. | None. | Immediate vesting of one hundred percent (100%) of then-unvested shares subject to solely time-based vesting RSUs which will be settled in installments following termination upon Disability in accordance with the vesting schedule set forth in the applicable award agreement. | Then-unvested PRSUs will vest at the end of the applicable performance period in accordance with their terms based upon actual achievement of the applicable performance objectives and subject to the Company’s certification of performance metric attainment, but on a prorated basis based upon the number of months during the applicable performance period that the Eligible Employee provided services as an Eligible Employee to the Company prior to the Eligible Employee’s Disability. |

| | | | | | | | | | | |

Qualifying Termination (Not in Connection with a Change in Control)(i)(ii) Eligible Employees other than the CEO |

| Cash Severance | Medical, Vision and Dental Benefit Continuation | RSUs | PRSUs |

| A lump sum equal to 1.0 times the Base Salary. The Actual Bonus for the then-current fiscal year will be paid when it would otherwise have been paid absent the Qualifying Termination, but in all events no later than March 15th of the year following the then-current fiscal year. | Payment of a lump sum equal to twelve (12) months of the monthly COBRA (or its equivalent) premiums for continued medical, vision and/or dental coverage for the Eligible Employee and his or her dependents. | Immediate forfeiture of the then-unvested shares subject to RSUs. | Then-unvested shares subject to PRSUs will vest at the end of the applicable performance period in accordance with their terms based upon actual achievement of the applicable performance objectives and subject to the Company’s certification of performance metric attainment, but on a prorated basis based upon the number of months that the Eligible Employee provided services as an Eligible Employee to the Company during the applicable performance period prior to the Eligible Employee’s Qualifying Termination Date. |

| | | | | | | | | | | |

Qualifying Termination within 3 Months Before or 12 Months Following a Change in Control(i)(ii) Eligible Employees other than the CEO |

| Cash Severance | Medical, Vision and Dental Benefit Continuation | RSUs | PRSUs |

A lump sum equal to 1.5 times the sum of (i) Base Salary, plus (ii) the Target Bonus for the then-current fiscal year. The Target Bonus will be paid when it would otherwise have been paid absent the Qualifying Termination, but in all events no later than March 15th of the year following the then-current fiscal year. | Payment of a lump sum equal to eighteen (18) months of the monthly COBRA (or its equivalent) premiums for continued medical, vision and/or dental coverage for the Eligible Employee and his or her dependents. | Immediate vesting of one hundred percent (100%) of the number of then-unvested shares subject to RSUs. | Immediate vesting of one hundred percent (100%) of the number of then-unvested shares subject to PRSUs, based on actual achievement of performance objectives. |

________________________________________________

(i) Any cash severance and severance benefits provided under the Policy will be reduced by and shall not be in addition to any cash severance and other severance benefits to which the Eligible Employee would otherwise be entitled under any agreement between the Company and the Eligible Employee that provides for severance, or as required by applicable law.

(ii) All payments shall be made at the time and in the form shown in the tables above, as applicable, except to the extent necessary to avoid accelerated taxation and/or tax penalties under Section 409A of the Code.

EXHIBIT A-2

SEVERANCE EXHIBIT

ServiceNow, Inc. Executive Severance Policy Table of Benefits – CEO

| | | | | | | | | | | |

Termination upon Death(i)(ii) Chief Executive Officer (“CEO”) |

| Cash Severance | Medical, Vision and Dental Benefit Continuation | RSUs | PRSUs |

| None. | None. | Immediate vesting of one hundred percent (100%) of the number of then-unvested shares subject to restricted stock unit awards subject to solely time-based vesting conditions (“RSUs”). | Immediate vesting of then-unvested shares subject to restricted stock unit awards with performance-based vesting conditions (“PRSUs”) on a prorated basis based upon the number of months during the applicable performance period that the CEO provided services as CEO to the Company prior to the CEO’s death, assuming achievement of 100% of target of the applicable performance objectives. |

| | | | | | | | | | | |

Termination upon Disability(i)(ii) Chief Executive Officer (“CEO”) |

| Cash Severance | Medical, Vision and Dental Benefit Continuation | RSUs | PRSUs |

| None. | None. | Immediate vesting of one hundred percent (100%) of then-unvested shares subject to solely time-based vesting RSUs which will be settled in installments following termination upon Disability in accordance with the vesting schedule set forth in the applicable award agreement. | Then-unvested PRSUs will vest at the end of the applicable performance period in accordance with their terms based upon actual achievement of the applicable performance objectives and subject to the Company’s certification of performance metric attainment, but on a prorated basis based upon the number of months during the applicable performance period that the CEO provided services as CEO to the Company prior to the CEO’s Disability. |

| | | | | | | | | | | |

Qualifying Termination (Not in Connection with a Change in Control)(i)(ii) Chief Executive Officer (“CEO”) |

| Cash Severance | Medical, Vision and Dental Benefit Continuation | RSUs | PRSUs |

A lump sum equal to 1.0 times the Base Salary. The Actual Bonus for the then-current fiscal year will be paid when it would otherwise have been paid absent the Qualifying Termination, but in all events no later than March 15th of the year following the then-current fiscal year. | Payment of a lump sum equal to twelve (12) months of the monthly COBRA (or its equivalent) premiums for continued medical, vision and/or dental coverage for the CEO and his or her dependents. | Immediate vesting of the number of then-unvested shares subject to RSUs that would have vested during the fifteen (15) month period following the CEO’s Qualifying Termination Date as if the CEO had remained employed by the Company through such period. | Immediate vesting of the number of then-unvested shares subject to PRSUs on a prorated basis based upon the number of months during the applicable performance period that the CEO provided services as the CEO to the Company prior to the CEO’s Qualifying Termination, in addition to the number of then-unvested shares subject to PRSUs that would have vested during the next fifteen (15) month period based on actual achievement of performance objectives. |

| | | | | | | | | | | |

Qualifying Termination within 3 Months Before or 12 Months Following a Change in Control(i)(ii) Chief Executive Officer (“CEO”) |

| Cash Severance | Medical, Vision and Dental Benefit Continuation | RSUs | PRSUs |

A lump sum equal to 2.0 times the sum of (i) Base Salary, plus (ii) the Target Bonus for the then-current fiscal year. The Target Bonus will be paid when it would otherwise have been paid absent the Qualifying Termination, but in all events no later than March 15th of the year following the then-current fiscal year. | Payment of a lump sum equal to twenty-four (24) months of the monthly COBRA (or its equivalent) premiums for continued medical, vision and/or dental coverage for the CEO and his or her dependents. | Immediate vesting of one hundred percent (100%) of the number of then-unvested shares subject to RSUs. | Immediate vesting of one hundred percent (100%) of the number of then-unvested shares subject to PRSUs, based on actual achievement of performance objectives. |

________________________________________________

(i) Any cash severance and severance benefits provided under the Policy will be reduced by and shall not be in addition to any cash severance and other severance benefits to which the Eligible Employee would otherwise be entitled under any agreement between the Company and the Eligible Employee that provides for severance, or as required by applicable law.

(ii) All payments shall be made at the time and in the form shown in the tables above, as applicable, except to the extent necessary to avoid accelerated taxation and/or tax penalties under Section 409A of the Code.

EXHIBIT B

ERISA CLAIMS PROCEDURES

1. Claims Procedure. If an Eligible Employee (or the Eligible Employee’s beneficiary, if applicable) believes that the Eligible Employee has not been provided with all benefits to which such Eligible Employee is entitled under the Plan, the Eligible Employee (hereinafter referred to as “you” or a “participant”) may file a written claim with the Administrator with respect to the participant’s rights to receive benefits from the Plan. Participants will be informed of the Administrator’s decision with respect to a claim within ninety (90) days after it is filed. Under special circumstances, the Administrator may require an additional period of not more than ninety (90) days to review your claim. If that happens, you will receive a written notice of that fact, which will also indicate the special circumstances requiring the extension of time and the date by which the Administrator expects to make a determination with respect to the claim. If the extension is required due to the participant’s failure to submit information necessary to decide the claim, the period for making the determination will be tolled from the date on which the extension notice is sent until the date on which the participant responds to the Administrator’s request for information to the extent required by law.

If a claim is denied in whole or in part, or any adverse benefit determination is made with respect to the claim, you will be provided with a written notice setting forth the reason for the determination, along with specific references to Plan provisions on which the determination is based. This notice will also provide an explanation of what additional information is needed to evaluate the claim (and why such information is necessary), together with an explanation of the Plan’s claims review procedure and the time limits applicable to such procedure, as well as a statement of your right to bring a civil action under Section 502(a) of ERISA following an adverse benefit determination on review.

If your claim has been denied, or an adverse benefit determination has been made, you may request that the Administrator review the denial. The request must be in writing and must be made within 60 days after written notification of denial. In connection with this request, you (or your duly authorized representative) are entitled to (i) be provided, upon written request and free of charge, with reasonable access to (and copies of) all documents, records, and other information relevant to the claim; and (ii) submit to the Administrator written comments, documents, records, and other information related to the claim.

The review by the Administrator will take into account all comments, documents, records, and other information you submit relating to the claim. The Administrator will make a final written decision on a claim review, in most cases within sixty (60) days after receipt of a request for a review. In some cases, the claim may take more time to review, and an additional processing period of up to 60 days may be required. If that happens, you will receive a written notice of that fact, which will also indicate the special circumstances requiring the extension of

time and the date by which the Administrator expects to make a determination with respect to the claim. If the extension is required due to your failure to submit information necessary to decide the claim, the period for making the determination will be tolled from the date on which the extension notice is sent to you until the date on which you respond to the Plan’s request for information to the extent required by law.

The Administrator’s decision on the claim for review will be communicated to you in writing. If an adverse benefit determination is made with respect to the claim, the notice will include: (i) the specific reason(s) for any adverse benefit determination, with references to the specific Plan provisions on which the determination is based; (ii) a statement that you are entitled to receive, upon request and free of charge, reasonable access to (and copies of) all documents, records and other information relevant to the claim; and (iii) a statement of your right to bring a civil action under Section 502(a) of ERISA. The decision of the Administrator is final, conclusive and binding on all parties.

The foregoing procedures must be exhausted before you bring a legal action seeking payment of benefits under the Plan. In the event of your death, the claims procedure set forth above shall be applicable to your beneficiaries.

2. Plan Interpretation and Benefit Determination. The Plan is administered and operated by the Administrator which has complete authority, in its sole and absolute discretion, to construe the terms of the Plan (and any related or underlying documents or policies), and to determine the eligibility for, and amount of, benefits due under the Plan to participants and their beneficiaries. All such interpretations and determinations of the Administrator shall be made in its sole and absolute discretion and shall be final, conclusive and binding upon all persons.

3. Rights Under ERISA. Eligible Employees who primarily provide services in the United States are entitled to certain rights and protections under ERISA. ERISA provides that all Plan participants will be entitled to:

a. Receive Information About Your Plan and Benefits.

(i) Examine, without charge, at the Administrator’s office, and at other specified locations, all Plan documents.

(ii) Obtain copies of all Plan documents and other Plan information upon written request to the Administrator. The Administrator may make a reasonable charge for the copies.

b. Prudent Actions by Plan Fiduciaries. In addition to creating rights for Plan participants, ERISA imposes duties upon the people who are responsible for the operation of the employee benefit plan. The people who operate your Plan, called “fiduciaries” of the Plan, have a duty to do so prudently and in the interest of you and other participants and beneficiaries.

No one, including your Employer or any other person, may fire you or otherwise discriminate against you in any way to prevent you from obtaining a welfare benefit or exercising your rights under ERISA.

c. Enforce Your Rights.

(i) If your claim for a welfare benefit is denied or ignored, in whole or in part, you have a right to know why this was done, to obtain copies of documents relating to the decision without charge, and to appeal any denial, all within certain time schedules.

(ii) Under ERISA, there are steps you can take to enforce the above rights. For instance, if you request a copy of Plan documents from the Plan and do not receive them within thirty (30) days, you may file suit in a federal court. In such a case, the court may require the Plan Administrator to provide the materials and pay you up to one hundred ten dollars ($110) a day until you receive the materials, unless the materials were not sent because of reasons beyond the control of the Administrator. If you have a claim for benefits which is denied or ignored, in whole or in part, you may file suit in a state or Federal court. If you are discriminated against for asserting your rights, you may seek assistance from the U.S. Department of Labor, or you may file suit in a federal court. The court will decide who should pay court costs and legal fees. If you are successful, the court may order the person you have sued to pay these costs and fees. If you lose, the court may order you to pay these costs and fees, for example, if it finds your claim is frivolous.

d. Assistance with Your Questions. If you have any questions about the Plan, you should contact the Administrator. If you have any questions about this statement or about your rights under ERISA, or if you need assistance in obtaining documents from the Administrator, you should contact the nearest office of the Employee Benefits Security Administration, U.S. Department of Labor, listed in your telephone directory or the Division of Technical Assistance and Inquiries, Employee Benefits Security Administration, U.S. Department of Labor, 200 Constitution Avenue N.W., Washington, D.C. 20210. You may also obtain certain publications about your rights and responsibilities under ERISA by calling the publications hotline of the Employee Benefits Security Administration.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

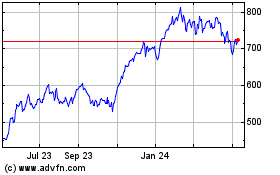

ServiceNow (NYSE:NOW)

Historical Stock Chart

From Nov 2024 to Dec 2024

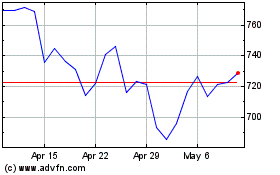

ServiceNow (NYSE:NOW)

Historical Stock Chart

From Dec 2023 to Dec 2024