0000071829false00000718292025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2025

NPK International Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | 001-02960 | 72-1123385 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 9320 Lakeside Boulevard, | Suite 100 | |

| The Woodlands, | Texas | 77381 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (281) 362-6800

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | NPKI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 26, 2025, NPK International Inc. (the “Company”) issued a press release announcing financial information for the three and twelve months ended December 31, 2024. The press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information in Item 2.02 of this Current Report on Form 8-K and the information in the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing.

Use of Non-GAAP Financial Information

To help understand the Company’s financial performance, the Company has supplemented its financial results that it provides in accordance with generally accepted accounting principles (“GAAP”) with non-GAAP financial measures. Such financial measures include Adjusted Income (Loss) from Continuing Operations, Adjusted Income (Loss) from Continuing Operations Per Common Share, earnings before interest, taxes, depreciation and amortization (“EBITDA”) from Continuing Operations, Adjusted EBITDA from Continuing Operations, Adjusted EBITDA Margin from Continuing Operations, and Free Cash Flow.

We believe these non-GAAP financial measures are frequently used by investors, securities analysts and other parties in the evaluation of our performance and liquidity with that of other companies in our industry. Management uses these measures to evaluate our operating performance, liquidity and capital structure. In addition, our incentive compensation plan measures performance based on our consolidated EBITDA, along with other factors. The methods we use to produce these non-GAAP financial measures may differ from methods used by other companies. These measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP. Applicable reconciliations to the nearest GAAP financial measure of each non-GAAP financial measure are included in the attached Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | NPK International Inc. |

| | | (Registrant) |

| | | | |

| Date: | February 26, 2025 | By: | /s/ Gregg S. Piontek |

| | | Gregg S. Piontek |

| | | | Senior Vice President and Chief Financial Officer |

| | | | (Principal Financial Officer) |

NPK REPORTS FOURTH QUARTER

AND FULL YEAR 2024 RESULTS

THE WOODLANDS, TEXAS – February 26, 2025 – NPK International Inc. (NYSE: NPKI) (“NPK” or the “Company”) today announced results for the three and twelve months ended December 31, 2024.

FOURTH QUARTER 2024 RESULTS

(all comparisons versus the prior year period unless otherwise noted)

•Revenues of $57.5 million, +24%

•Operating income from continuing operations of $11.6 million

•Operating margin from continuing operations of 20.2%

•Income from continuing operations of $8.0 million, or $0.09 per diluted share; Adjusted Income from Continuing Operations of $7.1 million, or $0.08 per diluted share

•Adjusted EBITDA from Continuing Operations of $17.1 million, +35%

•Adjusted EBITDA margin from Continuing Operations of 29.7%

•Total cash of $18 million and total debt of $8 million as of December 31, 2024

FULL YEAR 2024 RESULTS

(all comparisons versus the prior year period unless otherwise noted)

•Revenues of $217.5 million, +5%

•Operating income from continuing operations of $32.4 million

•Operating margin from continuing operations of 14.9%

•Income from continuing operations of $35.6 million, or $0.41 per diluted share; Adjusted Income from Continuing Operations of $20.3 million, or $0.23 per diluted share

•Adjusted EBITDA from Continuing Operations of $54.9 million, +12%

•Adjusted EBITDA margin from Continuing Operations of 25.2%

| | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter | | | |

| (In millions) | 2024 | | 2023 | | Change | |

| Revenues | $ | 57.5 | | $ | 46.5 | | $ | 11.0 | |

| Operating income from continuing operations | $ | 11.6 | | $ | 6.1 | | $ | 5.5 | |

| Adjusted EBITDA from continuing operations | $ | 17.1 | | $ | 12.7 | | $ | 4.4 | |

| Operating margin from continuing operations (%) | 20.2% | | 13.1% | | 710 | bps |

| Adjusted EBITDA margin from continuing operations (%) | 29.7% | | 27.3% | | 240 | bps |

| | | | | | | | | | | | | | | | | | | | |

| Full Year | | | |

| (In millions) | 2024 | | 2023 | | Change | |

| Revenues | $ | 217.5 | | $ | 207.6 | | $ | 9.9 | |

| Operating income from continuing operations | $ | 32.4 | | $ | 22.9 | | $ | 9.5 | |

| Adjusted EBITDA from continuing operations | $ | 54.9 | | $ | 48.9 | | $ | 6.0 | |

| Operating margin from continuing operations (%) | 14.9% | | 11.0% | | 390 | bps |

| Adjusted EBITDA margin from continuing operations (%) | 25.2% | | 23.6% | | 160 | bps |

MANAGEMENT COMMENTARY

“We delivered a strong finish to a historic year for NPK,” stated Matthew Lanigan, President and CEO of NPK International. “Through our third quarter 2024 divestiture, we streamlined our business model to focus exclusively on site-access and specialty rental solutions. We have also sharpened our commercial strategy and completed the expansion of our commercial sales team, to accelerate the penetration of higher-value growth opportunities. This transformative shift positions us to further optimize our return on invested capital through continued investments in organic expansion, targeted investments in inorganic growth and our $50 million share repurchase authorization.”

“Our nationwide sales coverage model and targeted focus on key growth accounts has positioned us to prioritize higher-growth, higher-value opportunities, consistent with our strategic focus. Our team demonstrated strong execution on our commercial growth and operational excellence initiatives throughout the year, a performance that culminated in 12% year-over-year organic growth in Adjusted EBITDA,” continued Lanigan. “Revenue growth and continued cost discipline contributed to improved operating leverage, resulting in 160 bps of Adjusted EBITDA margin expansion, when compared to the prior year.”

“We delivered an outstanding fourth quarter performance,” continued Lanigan. “Fourth quarter revenue and Adjusted EBITDA increased by 24% and 35%, respectively, as rental revenue reached a new single-quarter record. Gross margin increased by nearly 500 bps to a two-year high, supported by a more favorable sales mix, while Adjusted EBITDA margin increased by 240 bps to 29.7%, when compared to the prior year.”

“During the fourth quarter, we launched our new brand identity, NPK International, a leading worksite access solutions company committed to providing best-in-class products and services to support our customers critical infrastructure projects,” continued Lanigan. “We continue to make progress with our industry reclassification process and currently expect our new industry classification to be finalized before our first quarter 2025 results conference call.”

“Today, we are introducing financial guidance for the full-year 2025,” continued Lanigan. “We remain constructive on the long-term outlook for utility and critical infrastructure spending, together with our proven ability to deliver profitable growth through the cycle. To that end, at the midpoint of our 2025 financial guidance, we anticipate revenue and Adjusted EBITDA growth of 10% and 18%, respectively,

when compared to the full-year 2024. Our guidance also assumes 2025 net capital expenditures of between $35 million to $40 million, approximately 80% of which is expected to be allocated toward the continued expansion of our rental fleet.”

“Entering 2025, NPK is uniquely positioned to capitalize on both favorable demand conditions within our utilities transmission and critical infrastructure markets, along with increased adoption of our next-generation composite matting technology,” continued Lanigan. “We remain focused on accelerating our pace of organic growth through geographic expansion, market share gains, and capabilities expansion within our worksite access markets, while continuing to drive efficiency improvements and cost optimization across the organization, consistent with our long-term focus on sustained value creation.”

BUSINESS UPDATE

NPK is engaged in a multi-year business transformation plan designed to drive organic commercial growth within targeted, higher-margin product and rental markets; improve asset optimization and organizational efficiency; and pursue a capital allocation strategy that prioritizes investments in opportunities with superior return profiles, together with a programmatic return of capital program.

Fourth quarter 2024 highlights include:

•Strong customer demand for matting rental and related services. Revenues from specialty rental and related services increased to a record $42 million in the fourth quarter, driven by elevated demand from key customer accounts in support of scheduled transmission projects. Revenues from product sales also increased to $16 million for the fourth quarter of 2024, reflecting typical quarterly fluctuations in order and delivery timing.

•Improved operating efficiency. NPK remains focused on efficiency improvements and operating cost optimization across every aspect of its business. The Company continues to evaluate and execute actions intended to streamline the organization and its cost structure, while targeting SG&A as percentage of revenue in the mid-teens percent range by early 2026. In the fourth quarter of 2024, NPK’s SG&A as percentage of revenue was 18.6%, a decline of nearly 350 bps versus the prior year period.

•Robust return of capital program. In February 2024, the Board of Directors increased the authorization for repurchases of common stock up to $50.0 million. No share repurchases were made in 2024 due to trading blackout restrictions associated with the Fluids Systems sale process that was completed in September 2024, along with other events.

•New brand identity. During the fourth quarter of 2024, the Company announced a name change from Newpark Resources (NYSE: NR) to NPK International (NYSE: NPKI). On December 19, 2024, the Company’s common stock began trading on the NYSE under the ticker symbol ‘NPKI’.

FINANCIAL PERFORMANCE

In the fourth quarter of 2024, NPK generated income from continuing operations of $8.0 million, or $0.09 per diluted share, on total revenue of $57.5 million, compared to income from continuing operations of $5.2 million, or $0.06 per diluted share, on total revenue of $46.5 million, in the prior year period. Income from continuing operations for the fourth quarter of 2024 includes an income tax benefit of $1.3 million primarily reflecting the release of valuation allowances on U.S. state net operating losses following the sale of the Fluids Systems business. Gross margin was 39.2% in the fourth quarter 2024, compared to 34.2% in the fourth quarter of 2023. The Company reported Adjusted EBITDA from Continuing Operations of $17.1 million in the fourth quarter of 2024, or 29.7% of total revenue, compared to $12.7 million, or 27.3% of total revenue, in the fourth quarter of 2023.

Selling, general and administrative expenses were $10.7 million (18.6% of revenues) in the fourth quarter of 2024, compared to $10.2 million (22.1% of revenues) in the prior year period. For the full year 2024, selling, general and administrative expenses were $46.0 million (21.2% of revenues), compared to $51.1 million (24.6%) in the prior year.

BALANCE SHEET AND LIQUIDITY

As of December 31, 2024, NPK had total cash of $18 million, total debt of $8 million, and available liquidity under its U.S. ABL credit facility of $66 million. Additionally, the Company had $18 million of receivables and net deferred consideration from the Fluids Systems sale as of December 31, 2024.

Operating cash flow used $4 million in the fourth quarter of 2024, which included $20 million usage in net working capital driven by the elevated business activity. Capital investments used $12 million, net,

primarily funding the expansion of the mat rental fleet to support increased fourth quarter customer demand. The Company reduced debt outstanding by $6 million in the fourth quarter and remained in a net cash positive position as of December 31, 2024.

FINANCIAL GUIDANCE

The following forward-looking guidance reflects the Company’s current expectations and beliefs as of February 26, 2025 and is subject to change. The following statements apply only as of the date of this disclosure and are expressly qualified in their entirety by the cautionary statements included elsewhere in this document.

For the full year 2025, NPK currently anticipates the following:

•Revenues in a range of $230 million to $250 million

•Adjusted EBITDA in a range of $60 million to $70 million

•Capital expenditures in a range of $35 million to $40 million

FOURTH QUARTER 2024 RESULTS CONFERENCE CALL

A conference call will be held Thursday, February 27, 2025 at 9:30 a.m. ET to review the Company’s financial results and conduct a question-and-answer session.

A webcast of the conference call will be available in the Investor Relations section of the Company’s website at www.npki.com. Individuals can also participate by teleconference dial-in. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software.

To participate in the live teleconference:

| | | | | |

Domestic Live: | 800-245-3047 |

International Live: | 203-518-9765 |

Conference ID: | NPKIQ424 |

To listen to a replay of the teleconference, which subsequently will be available through March 6, 2025:

| | | | | |

Domestic Replay: | 800-839-5629 |

International Replay: | 402-220-2556 |

ABOUT NPK INTERNATIONAL

NPK International Inc. is a temporary worksite access solutions company that manufactures, sells, and rents recyclable composite matting products, along with a full suite of services, including planning, logistics, and site restoration. As a geographically diversified company, the Company delivers superior quality and reliability across critical infrastructure markets, including electrical transmission and distribution, oil and gas exploration, pipeline, renewable energy, petrochemical, construction, and other industries. For more information, visit our website at www.npki.com.

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical facts are forward-looking statements. Words such as “will,” “may,” “could,” “would,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “guidance,” and similar expressions are intended to identify these forward-looking statements but are not the exclusive means of identifying them. These statements are not guarantees that our expectations will prove to be correct and involve a number of risks,

uncertainties, and assumptions. Many factors, including those discussed more fully elsewhere in this release and in documents filed with the Securities and Exchange Commission by NPK, particularly its Annual Report on Form 10-K, and its Quarterly Reports on Form 10-Q, as well as others, could cause actual plans or results to differ materially from those expressed in, or implied by, these statements. These risk factors include, but are not limited to, risks related to our recently completed sale of the Fluids Systems business; our ability to generate organic growth; economic and market conditions that may impact our customers’ future spending; the effective management of our fleet, including our ability to properly manufacture, safeguard, and maintain our fleet; international operations; operating hazards present in our and our customers’ industries and substantial liability claims; our contracts that can be terminated or downsized by our customers without penalty; our product offering and market expansion; our ability to attract, retain, and develop qualified leaders, key employees, and skilled personnel; expanding our services in the utilities sector, which may require unionized labor; the price and availability of raw materials; inflation; capital investments and business acquisitions; market competition; technological developments and intellectual property; severe weather, natural disasters, and seasonality; public health crises, epidemics, and pandemics; our cost and continued availability of borrowed funds, including noncompliance with debt covenants; environmental laws and regulations; legal compliance; the inherent limitations of insurance coverage; income taxes; cybersecurity incidents or business system disruptions; activist stockholders that may attempt to effect changes at our Company or acquire control over our Company; share repurchases; and our amended and restated bylaws, which could limit our stockholders’ ability to obtain what such stockholders believe to be a favorable judicial forum for disputes with us or our directors, officers or other employees. We assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities laws. NPK’s filings with the Securities and Exchange Commission can be obtained at no charge at www.sec.gov, as well as through our website at www.npki.com.

INVESTOR RELATIONS CONTACT

Noel Ryan or Paul Bartolai

Investors@npki.com

NPK International Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| (In thousands, except per share data) | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

| Revenues | $ | 57,524 | | | $ | 44,207 | | | $ | 46,455 | | | $ | 217,489 | | | $ | 207,648 | |

| Cost of revenues | 35,001 | | | 32,067 | | | 30,566 | | | 140,359 | | | 135,094 | |

| Selling, general and administrative expenses | 10,713 | | | 11,005 | | | 10,249 | | | 46,048 | | | 51,083 | |

| Other operating (income) loss, net | 166 | | | (99) | | | (437) | | | (1,269) | | | (1,469) | |

| Operating income from continuing operations | 11,644 | | | 1,234 | | | 6,077 | | | 32,351 | | | 22,940 | |

| | | | | | | | | |

| Foreign currency exchange (gain) loss | 699 | | | (562) | | | (717) | | | 869 | | | (889) | |

| Interest expense, net | 9 | | | 943 | | | 953 | | | 2,621 | | | 4,107 | |

| Income from continuing operations before income taxes | 10,936 | | | 853 | | | 5,841 | | | 28,861 | | | 19,722 | |

| | | | | | | | | |

Provision (benefit) for income taxes from continuing operations (1) | 2,888 | | | (14,016) | | | 673 | | | (6,738) | | | 5,573 | |

| Income from continuing operations | 8,048 | | | 14,869 | | | 5,168 | | | 35,599 | | | 14,149 | |

| | | | | | | | | |

| Discontinued operations: | | | | | | | | | |

| Income (loss) from discontinued operations before income taxes | (712) | | | 629 | | | (3,893) | | | 4,360 | | | 5,460 | |

| Loss on sale of discontinued operations before income taxes | — | | | (195,729) | | | — | | | (195,729) | | | — | |

| Provision (benefit) for income taxes from discontinued operations | (1,367) | | | (5,933) | | | 1,751 | | | (5,508) | | | 5,093 | |

| Income (loss) from discontinued operations | 655 | | | (189,167) | | | (5,644) | | | (185,861) | | | 367 | |

| | | | | | | | | |

| Net income (loss) | $ | 8,703 | | | $ | (174,298) | | | $ | (476) | | | $ | (150,262) | | | $ | 14,516 | |

| | | | | | | | | |

| Income (loss) per common share - basic: | | | | | | | | | |

| Income from continuing operations | $ | 0.09 | | | $ | 0.17 | | | $ | 0.06 | | | $ | 0.41 | | | $ | 0.16 | |

| Income (loss) from discontinued operations | 0.01 | | | (2.19) | | | (0.07) | | | (2.17) | | | — | |

| Net income (loss) | $ | 0.10 | | | $ | (2.02) | | | $ | (0.01) | | | $ | (1.75) | | | $ | 0.17 | |

| | | | | | | | | |

| Income (loss) per common share - diluted: | | | | | | | | | |

| Income from continuing operations | $ | 0.09 | | | $ | 0.17 | | | $ | 0.06 | | | $ | 0.41 | | | $ | 0.16 | |

| Income (loss) from discontinued operations | 0.01 | | | (2.16) | | | (0.06) | | | (2.13) | | | — | |

| Net income (loss) | $ | 0.10 | | | $ | (1.99) | | | $ | (0.01) | | | $ | (1.72) | | | $ | 0.16 | |

| | | | | | | | | |

| Weighted average shares: | | | | | | | | | |

| Basic | 86,416 | | | 86,377 | | | 85,003 | | | 85,819 | | | 86,401 | |

| Diluted | 87,222 | | | 87,490 | | | 87,228 | | | 87,395 | | | 88,315 | |

(1) Includes an income tax benefit of $1.3 million and $15.9 million for the three months and twelve months ended December 31, 2024, respectively, primarily reflecting the release of valuation allowances on U.S. federal and state net operating losses and other tax credit carryforwards following the sale of the Fluids Systems business. The three months ended September 30, 2024 includes $14.6 million related to such items.

NPK International Inc.

Operating Results

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| (In thousands) | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

| Revenues | | | | | | | | | |

| Rental and service revenues | $ | 41,800 | | $ | 32,408 | | $ | 35,580 | | $ | 145,785 | | $ | 149,954 |

| Product sales revenues | 15,724 | | 11,799 | | 10,875 | | 71,704 | | 57,694 |

| Total revenues | $ | 57,524 | | $ | 44,207 | | $ | 46,455 | | $ | 217,489 | | $ | 207,648 |

| | | | | | | | | |

| Operating income from continuing operations | $ | 11,644 | | $ | 1,234 | | $ | 6,077 | | $ | 32,351 | | $ | 22,940 |

| Operating margin from continuing operations | 20.2 | % | | 2.8 | % | | 13.1 | % | | 14.9 | % | | 11.0 | % |

NPK International Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| (In thousands, except share data) | December 31,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 17,756 | | | $ | 789 | |

Receivables, net (1) | 74,841 | | | 42,818 | |

| Inventories | 14,659 | | | 18,606 | |

| Prepaid expenses and other current assets | 5,728 | | | 4,690 | |

| Current assets of discontinued operations | — | | | 290,321 | |

| Total current assets | 112,984 | | | 357,224 | |

| | | |

| Property, plant and equipment, net | 187,483 | | | 165,544 | |

| Operating lease assets | 11,793 | | | 11,192 | |

| Goodwill | 47,222 | | | 47,283 | |

| Other intangible assets, net | 10,331 | | | 12,461 | |

| Deferred tax assets | 15,593 | | | 1,367 | |

| Other assets | 8,276 | | | 1,582 | |

| Noncurrent assets of discontinued operations | — | | | 45,683 | |

| Total assets | $ | 393,682 | | | $ | 642,336 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current debt | $ | 2,900 | | | $ | 6,319 | |

| Accounts payable | 19,459 | | | 16,345 | |

| Accrued liabilities | 22,300 | | | 21,026 | |

| Current liabilities of discontinued operations | — | | | 92,594 | |

| Total current liabilities | 44,659 | | | 136,284 | |

| | | . |

| Long-term debt, less current portion | 4,827 | | | 55,710 | |

| Noncurrent operating lease liabilities | 10,896 | | | 10,713 | |

| Deferred tax liabilities | 1,203 | | | 3,697 | |

| Other noncurrent liabilities | 5,602 | | | 4,191 | |

| Noncurrent liabilities of discontinued operations | — | | | 16,377 | |

| Total liabilities | 67,187 | | | 226,972 | |

| | | |

| Common stock, $0.01 par value (200,000,000 shares authorized and 111,669,464 and 111,669,464 shares issued, respectively) | 1,117 | | | 1,117 | |

| Paid-in capital | 633,239 | | | 639,645 | |

| Accumulated other comprehensive loss | (2,871) | | | (62,839) | |

| Retained earnings (deficit) | (139,466) | | | 10,773 | |

| Treasury stock, at cost (25,114,978 and 26,471,738 shares, respectively) | (165,524) | | | (173,332) | |

| Total stockholders’ equity | 326,495 | | | 415,364 | |

| Total liabilities and stockholders’ equity | $ | 393,682 | | | $ | 642,336 | |

(1) Receivables, net as of December 31, 2024, includes $23 million for amounts due from the purchaser including estimated deferred consideration related to the sale of the Fluids Systems business.

NPK International Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| Twelve Months Ended December 31, |

| (In thousands) | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (150,262) | | | $ | 14,516 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operations: | | | |

| Loss on divestitures | 195,729 | | | — | |

| Impairments and other non-cash charges | — | | | 6,356 | |

| Depreciation and amortization | 27,530 | | | 31,372 | |

| Stock-based compensation expense | 5,247 | | | 6,638 | |

| Provision for deferred income taxes | (20,304) | | | (482) | |

| Credit loss expense | 698 | | | 1,209 | |

| Gain on sale of assets | (4,297) | | | (2,904) | |

| Gain on insurance recovery | (874) | | | — | |

| Amortization of original issue discount and debt issuance costs | 983 | | | 541 | |

| Change in assets and liabilities: | | | |

| (Increase) decrease in receivables | (28,012) | | | 64,812 | |

| Decrease in inventories | 9,746 | | | 2,256 | |

| (Increase) decrease in other assets | (3,913) | | | 307 | |

| Increase (decrease) in accounts payable | 12,488 | | | (25,065) | |

| Increase (decrease) in accrued liabilities and other | (6,590) | | | 445 | |

| Net cash provided by operating activities | 38,169 | | | 100,001 | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (43,531) | | | (29,232) | |

| Proceeds from divestitures, net of cash disposed | 48,499 | | | 19,833 | |

| Proceeds from sale of property, plant and equipment | 4,997 | | | 3,709 | |

| Proceeds from insurance property claim | 1,385 | | | — | |

| Other investing activities | (3,089) | | | — | |

| Net cash provided by (used in) investing activities | 8,261 | | | (5,690) | |

| | | |

| Cash flows from financing activities: | | | |

| Borrowings on lines of credit | 177,541 | | | 241,873 | |

| Payments on lines of credit | (224,292) | | | (277,591) | |

| Debt issuance costs | (50) | | | — | |

| Purchases of treasury stock | (4,505) | | | (34,265) | |

| Proceeds from employee stock plans | 139 | | | 606 | |

| Other financing activities | (15,715) | | | (11,670) | |

| Net cash used in financing activities | (66,882) | | | (81,047) | |

| | | |

| Effect of exchange rate changes on cash | (212) | | | 576 | |

| | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (20,664) | | | 13,840 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 38,901 | | | 25,061 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 18,237 | | | $ | 38,901 | |

NPK International Inc.

Non-GAAP Reconciliations

(Unaudited)

To help understand the Company’s financial performance, the Company has supplemented its financial results that it provides in accordance with generally accepted accounting principles (“GAAP”) with non-GAAP financial measures. Such financial measures include Adjusted Income (Loss) from Continuing Operations, Adjusted Income (Loss) from Continuing Operations Per Common Share, earnings before interest, taxes, depreciation and amortization (“EBITDA”) from Continuing Operations, Adjusted EBITDA from Continuing Operations, Adjusted EBITDA Margin from Continuing Operations, and Free Cash Flow.

We believe these non-GAAP financial measures are frequently used by investors, securities analysts and other parties in the evaluation of our performance and liquidity with that of other companies in our industry. Management uses these measures to evaluate our operating performance, liquidity and capital structure. In addition, our incentive compensation plan measures performance based on our consolidated EBITDA, along with other factors. The methods we use to produce these non-GAAP financial measures may differ from methods used by other companies. These measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP.

Adjusted Income (Loss) from Continuing Operations and Adjusted Income (Loss) from Continuing Operations Per Common Share

The following tables reconcile the Company’s income from continuing operations and income from continuing operations per common share calculated in accordance with GAAP to the non-GAAP financial measures of Adjusted Net Income from Continuing Operations and Adjusted Net Income from Continuing Operations Per Common Share:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Three Months Ended | | Twelve Months Ended |

| (In thousands) | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

| Income from continuing operations (GAAP) | $ | 8,048 | | | $ | 14,869 | | | $ | 5,168 | | | $ | 35,599 | | | $ | 14,149 | |

| Gain on insurance recovery | — | | | — | | | — | | | (67) | | | — | |

| Gain on legal settlement | — | | | — | | | — | | | (550) | | | — | |

| Severance costs | 416 | | | 113 | | | — | | | 1,337 | | | 1,487 | |

| Tax on adjustments | (87) | | | (24) | | | — | | | (151) | | | (312) | |

Unusual tax items (1) | (1,280) | | | (14,617) | | | — | | | (15,897) | | | — | |

| Adjusted Income from Continuing Operations (non-GAAP) | $ | 7,097 | | | $ | 341 | | | $ | 5,168 | | | $ | 20,271 | | | $ | 15,324 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Income from Continuing Operations (non-GAAP) | $ | 7,097 | | | $ | 341 | | | $ | 5,168 | | | $ | 20,271 | | | $ | 15,324 | |

| | | | | | | | | |

| Weighted average common shares outstanding - basic | 86,416 | | | 86,377 | | | 85,003 | | | 85,819 | | | 86,401 | |

| Dilutive effect of stock options and restricted stock awards | 806 | | | 1,113 | | | 2,225 | | | 1,576 | | | 1,914 | |

| Weighted average common shares outstanding - diluted | 87,222 | | | 87,490 | | | 87,228 | | | 87,395 | | | 88,315 | |

| | | | | | | | | |

| Adjusted Income from Continuing Operations Per Common Share - Diluted (non-GAAP): | $ | 0.08 | | | $ | — | | | $ | 0.06 | | | $ | 0.23 | | | $ | 0.17 | |

(1) Unusual tax items for the three months ended December 31, 2024 and September 30, 2024 primarily reflects the release of valuation allowances on U.S. federal and state net operating losses and other tax credit carryforwards that are now expected to be realized following the sale of the Fluids Systems business.

NPK International Inc.

Non-GAAP Reconciliations (Continued)

(Unaudited)

EBITDA from Continuing Operations, Adjusted EBITDA from Continuing Operations, and Adjusted EBITDA Margin from Continuing Operations

The following table reconciles the Company’s income from continuing operations calculated in accordance with GAAP to the non-GAAP financial measures of EBITDA from Continuing Operations, Adjusted EBITDA from Continuing Operations, and Adjusted EBITDA Margin from Continuing Operations:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Three Months Ended | | Twelve Months Ended |

| (In thousands) | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

| Revenues | $ | 57,524 | | $ | 44,207 | | $ | 46,455 | | $ | 217,489 | | $ | 207,648 |

| Operating income from continuing operations (GAAP) | $ | 11,644 | | $ | 1,234 | | $ | 6,077 | | $ | 32,351 | | $ | 22,940 |

| | | | | | | | | |

| Income from continuing operations (GAAP) | $ | 8,048 | | $ | 14,869 | | $ | 5,168 | | $ | 35,599 | | $ | 14,149 |

| Interest expense, net | 9 | | 943 | | 953 | | 2,621 | | 4,107 |

| Provision (benefit) for income taxes | 2,888 | | (14,016) | | 673 | | (6,738) | | 5,573 |

| Depreciation and amortization | 5,724 | | 5,592 | | 5,908 | | 22,656 | | 23,596 |

| EBITDA from Continuing Operations (non-GAAP) | 16,669 | | 7,388 | | 12,702 | | 54,138 | | 47,425 |

| Gain on insurance recovery | — | | — | | — | | (67) | | — |

| Gain on legal settlement | — | | — | | — | | (550) | | — |

| Severance costs | 416 | | 113 | | — | | 1,337 | | 1,487 |

| Adjusted EBITDA from Continuing Operations (non-GAAP) | $ | 17,085 | | $ | 7,501 | | $ | 12,702 | | $ | 54,858 | | $ | 48,912 |

| Operating Margin (GAAP) | 20.2 | % | | 2.8 | % | | 13.1 | % | | 14.9 | % | | 11.0 | % |

| Adjusted EBITDA Margin from Continuing Operations (non-GAAP) | 29.7 | % | | 17.0 | % | | 27.3 | % | | 25.2 | % | | 23.6 | % |

Free Cash Flow

The following table reconciles the Company’s net cash provided by (used in) operating activities calculated in accordance with GAAP to the non-GAAP financial measure of Free Cash Flow:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Three Months Ended | | Twelve Months Ended |

| (In thousands) | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

| Net cash provided by (used in) operating activities (GAAP) | $ | (4,127) | | | $ | 2,765 | | | $ | 36,159 | | | $ | 38,169 | | | $ | 100,001 | |

| Capital expenditures | (13,591) | | | (9,472) | | | (9,098) | | | (43,531) | | | (29,232) | |

| Proceeds from sale of property, plant and equipment | 1,809 | | | 1,146 | | | 757 | | | 4,997 | | | 3,709 | |

| Free Cash Flow (non-GAAP) | $ | (15,909) | | | $ | (5,561) | | | $ | 27,818 | | | $ | (365) | | | $ | 74,478 | |

NPK International Inc.

Non-GAAP Reconciliations (Continued)

(Unaudited)

Trailing Twelve Months (“TTM”)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Three Months Ended | | TTM |

| (In thousands) | March 31,

2024 | | June 30,

2024 | | September 30,

2024 | | December 31,

2024 | | December 31,

2024 |

| Revenues | $ | 48,967 | | $ | 66,791 | | $ | 44,207 | | | $ | 57,524 | | $ | 217,489 |

| Operating income from continuing operations (GAAP) | $ | 6,966 | | $ | 12,507 | | $ | 1,234 | | | $ | 11,644 | | $ | 32,351 |

| | | | | | | | | |

| Income from Continuing Operations (GAAP) | $ | 4,054 | | $ | 8,628 | | $ | 14,869 | | | $ | 8,048 | | $ | 35,599 |

| Interest expense, net | 760 | | 909 | | 943 | | | 9 | | 2,621 |

| Provision (benefit) for income taxes | 1,907 | | 2,483 | | (14,016) | | | 2,888 | | (6,738) |

| Depreciation and amortization | 5,666 | | 5,674 | | 5,592 | | | 5,724 | | 22,656 |

| EBITDA from Continuing Operations (non-GAAP) | 12,387 | | | 17,694 | | | 7,388 | | | 16,669 | | 54,138 |

| Gain on insurance recovery | (67) | | — | | — | | | — | | (67) |

| Gain on legal settlement | (550) | | — | | — | | | — | | (550) |

| Severance costs | 633 | | 175 | | 113 | | | 416 | | 1,337 |

| Adjusted EBITDA from Continuing Operations (non-GAAP) | $ | 12,403 | | | $ | 17,869 | | | $ | 7,501 | | | $ | 17,085 | | $ | 54,858 |

| Operating Margin (GAAP) | 14.2 | % | | 18.7 | % | | 2.8 | % | | 20.2 | % | | 14.9 | % |

| Adjusted EBITDA Margin from Continuing Operations (non-GAAP) | 25.3 | % | | 26.8 | % | | 17.0 | % | | 29.7 | % | | 25.2 | % |

v3.25.0.1

Cover Page

|

Feb. 26, 2025 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0000071829

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 26, 2025

|

| Entity Registrant Name |

NPK International Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-02960

|

| Entity Tax Identification Number |

72-1123385

|

| Entity Address, Address Line One |

9320 Lakeside Boulevard,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

The Woodlands,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77381

|

| City Area Code |

281

|

| Local Phone Number |

362-6800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

NPKI

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

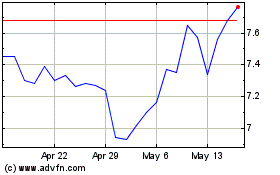

Newpark Resources (NYSE:NR)

Historical Stock Chart

From Feb 2025 to Mar 2025

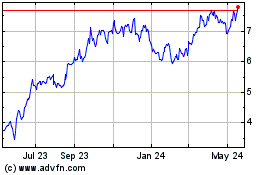

Newpark Resources (NYSE:NR)

Historical Stock Chart

From Mar 2024 to Mar 2025