Nubank reaches 80 million customers in Brazil

July 25 2023 - 2:33PM

Business Wire

The company also became the 4th largest financial institution in

the country according to the Central Bank, while diversifying its

portfolio and increasing customer activity; Nu has launched over 25

products and features in 2023.

Nu Holdings Ltd. ("Nu" or the "Company") (NYSE: NU | B3: NUBR33)

surpassed 80 million customers in Brazil, as of July 2023. Along

with its operations in Mexico and Colombia, the company reached 85

million customers across Latin America. This number has more than

doubled in two years, since June 2021, when Nubank had a base of 41

million.

Based on official data from the end of Q2’23, the Brazilian

Central Bank also positioned Nubank as the fourth-largest

financial institution in the country in number of customers. In

October 2022, the company had reached the 5th position, quickly

moving up the rank in comparison to long-established incumbent

banks. Nubank also remains in the top three institutions with the

lowest rate of complaints in the country, reinforcing the company’s

focus on putting the customer first, through its awarded service

and innovative products.

"The sustained growth in our customer base continues to

reinforce the inherent efficiency and potential of our digital

business model. This makes it possible to grow at scale while

providing high-quality and low-cost financial services. We have

robust activity levels above 82% and rising capabilities to

cross-sell and upsell, which have been fueling the company’s

revenues. We continue to invest in growth as we believe there is

still a huge potential to increase market share in several

products”, says David Vélez, Nubank’s founder and CEO.

Internationally, the company now serves 4.5 million customers in

Mexico and Colombia, as of July 2023. Mexico was Nu’s first

international operation, and now offers credit and debit cards,

having recently launched a digital account. Cuenta Nu attracted

over one million people just one month after its official release,

offering 24/7 liquidity and one of the most competitive yield rates

on the market, 9% per year. Nu’s digital account in Mexico allows

access to local deposits and unlocks more growth opportunities by

expanding the customer base at an even faster pace. This product

will also allow Nu to better understand a larger customer base and

thus improve its credit models, an important competitive

advantage.

The launch of a digital account is also in the company’s 2023

roadmap for Colombia – Nubank’s most recent, but fastest-growing

geography, which now offers La Moradita, our no-fee credit

card.

Growing portfolio in Brazil

Nubank’s market share in almost all verticals it operates still

allows a lot of room for growth through cross-sell and up-sell. So

far in 2023, the company has launched over 25 products and features

in Brazil – from new insurance options (Nubank Auto, Nu Vidas

Juntas, and Parcela Segura) to the company’s debut in payroll loans

with NuConsignado.

“Almost half of the Brazilian adult population is already a

Nubank customer. To keep growing our base in this scenario is a

statement to the quality of our products and services”, says Livia

Chanes, Country Manager of Nubank in Brazil. “We’re always

carefully assessing our portfolio to offer the best options that

eliminate complexity and empower people with the tools and the

autonomy to make the best decisions about their money”, she

adds.

The portfolio is also growing for business customers (PJs),

which are now more than 3 million. Beyond an account, and credit

and debit cards, individual microentrepreneurs (MEIs) can count on

Nubank to simplify their business management, with new features

that facilitate tax payment and organization, for example.

Almost 60% of active SME customers have Nubank as their primary

account, according to research conducted in May. Among the

company’s customer base, there are 10 million entrepreneurs, which

represents great potential for even further growth in the PJ

segment.

Improving financial trends

S&P Global Ratings has recently upgraded Nubank Brazil’s

rating from brAA to brAA+ with a stable outlook. The decision was

based on the company’s consistent improvement of operational

trends, as reinforced by our most recent Q1’23 financial

results.

Nu posted a net income of $142 million in Q1’23, with revenue

nearly doubling year over year, reaching $1.6 billion. The Brazil

operation has consistently showcased the compounding effects of the

company’s business model, reaching a net income of $171 million and

an ROE of 37%, also in the first quarter of the year.

S&P further highlights Nubank’s strong capitalization (Basel

Index in Brazil of 18.7%) and efficiency ratio (at 39% in Q1'23),

which position the company as one of the most efficient and

well-capitalized players in Latin America. Nu also registered a

robust liquidity position in Q1’23, with a 33% loan-to-deposit

ratio. S&P anticipates further improvement in financial results

throughout 2023 and 2024 and expects the company to continue to

outperform in the industry.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230725769905/en/

Investor Relations J�rg Friedemann

investors@nubank.com.br Media Relations Leila Suwwan

press@nubank.com.br

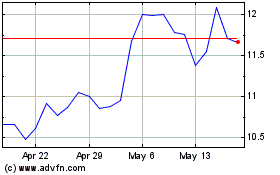

Nu (NYSE:NU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nu (NYSE:NU)

Historical Stock Chart

From Jan 2024 to Jan 2025