UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | |

Filed by the Registrant x | Filed by a Party other than the Registrant o |

| | |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| o | Definitive Proxy Statement | |

| x | Definitive Additional Materials | |

| o | Soliciting Material Under § 240.14a-12 | |

| | | | | | | | |

| | Oil-Dri Corporation of America | |

| | (Name of Registrant as Specified in Its Charter) | |

| | | |

| | (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

x

| | No fee required. |

o

| | Fee paid previously with preliminary materials. |

o

| | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

OIL-DRI CORPORATION OF AMERICA

410 North Michigan Avenue

Suite 400

Chicago, Illinois 60611-4213

______________

Supplement to the Proxy Statement Dated October 29, 2024

For the 2024 Annual Meeting of Stockholders

To be held Wednesday, December 11, 2024

This Supplement to the Proxy Statement, dated November 18, 2024 (the “Supplement”), supplements the definitive proxy statement filed by Oil-Dri Corporation of America, a Delaware corporation (the “Company”) with the U.S. Securities and Exchange Commission (the “SEC”) on October 29, 2024 (the “Proxy Statement”) and made available to the Company’s stockholders in connection with the solicitation by the Company’s Board of Directors of proxies to be voted at the virtual 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) to be held at 9:30 a.m., Central Time, on Wednesday, December 11, 2024, and at any postponements or adjournments thereof. Except as described below, this Supplement does not modify, amend, supplement, or otherwise affect the Proxy Statement.

THE PROXY STATEMENT CONTAINS IMPORTANT INFORMATION AND THIS SUPPLEMENT SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT.

This Supplement updates, and to the extent inconsistent therewith, supersedes, the disclosures in the Proxy Statement under “Commonly Asked Questions and Answers” to reflect that the New York Stock Exchange (“NYSE”) has determined that Proposal 3 in the Proxy Statement, which seeks stockholder approval of an amendment to the Company’s Certificate of Incorporation to increase the number of authorized shares of the Company’s Common Stock, par value $0.10 per share, from 15 million to 30 million (“Proposal 3”) in order to enable the Company to effect a 2:1 stock split in the form of a stock dividend, is a “routine” matter, eligible for discretionary voting by brokers and other nominees under NYSE rules. The Proxy Statement previously advised stockholders that Proposal 3 is a “non-routine” matter.

Pursuant to NYSE rules, if you hold your shares through a broker or other nominee (i.e., in “street name”) and do not instruct such broker or other nominee on how to vote your shares, your broker or other nominee is not permitted to vote your shares in its discretion on “non-routine” matters as determined by the NYSE but is permitted to vote your shares in its discretion on “routine” matters as determined by the NYSE.

Accordingly, because Proposal 3 has been designated as a “routine” matter, if your shares are held in street name and you do not submit voting instructions, under NYSE rules, your broker or other nominee can vote your shares on Proposal 3.

In addition to the foregoing, this Supplement also updates, and to the extent inconsistent therewith, supersedes, certain disclosures in the Proxy Statement to clarify the voting standard with respect to Proposal 3 and to correct scrivener’s errors in certain dates on pages 21 and 22 of the Proxy Statement.

The penultimate paragraph of the answer to question 9 titled "How do I cast my vote?" on page 5 of the Proxy Statement is hereby revised in its entirety to read as follows:

“If you are a beneficial stockholder (see Question 6 “Who is entitled to vote at the 2024 Annual Meeting?” above for more information), you must provide instructions to your bank, broker or other nominee as to how your shares should be voted. Your bank, broker or other nominee will usually provide you with the appropriate voting instruction form at the time you receive this Proxy Statement. The availability of telephone and Internet voting for beneficial owners of shares held in “street name” will depend on your bank, broker or other nominee. We recommend that you follow the voting instructions on the materials you receive from that entity. Your shares may be voted on certain matters even if you do not provide voting instructions because banks, brokers and nominees generally have the authority under New York Stock Exchange (“NYSE”) rules to vote on “routine matters.” The proposals to ratify the appointment of our independent auditor and the approval of the amendment to the Certificate of Incorporation to authorize additional shares of Common Stock are considered routine matters. The election of directors is considered a non-routine matter. Unless you decide to change your vote, use only one method to send us your vote. If you requested a printed set of the proxy materials and voted by telephone or by Internet, you do not have to return your proxy card or voting instruction form. Even if you plan to virtually attend the 2024 Annual Meeting, we recommend that you vote your shares in advance so that your vote will be counted if you later decide not to attend the virtual meeting.”

The answer to question 12 titled “How are broker non-votes and abstentions counted?” on page 6 of the Proxy Statement is hereby revised in its entirety to read as follows:

“A broker non-vote occurs when shares held as of record by a broker are not voted with respect to a particular proposal because the broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients. If your broker holds your shares in its name and you do not instruct your broker how to vote, your broker will only have discretion to vote your shares on “routine” matters. Where a proposal is not “routine,” a broker who has not received instructions from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal.

At the 2024 Annual Meeting, only the proposals to ratify the appointment of our independent auditor and to amend the Certificate of Incorporation to increase the number of authorized shares of Common Stock are considered routine matters. Therefore, absent directions from you, your broker will have discretion to vote on those proposals but will not have discretion to vote on the election of directors. Broker non-votes and abstentions will be counted towards determining whether or not a quorum is present at the 2024 Annual Meeting. However, on matters other than the election of directors, abstentions will have the effect of a vote “against” such matters, and broker non-votes generally will have no effect on the outcome of such matters.”

The third paragraph of the answer to question 13 titled “How many votes are needed to approve the proposals?” on page 6 of the Proxy Statement is hereby revised in its entirety to read as follows:

“The approval of a majority of the votes entitled to be cast by the holders of our outstanding Common Stock, voting separately as a class, in addition to the approval of a majority of the votes entitled to be cast by the holders of our outstanding Common Stock and Class B Stock, voting together as a single class, is necessary to approve the amendment

to our Certificate of Incorporation to increase the number of authorized shares of Common Stock. Abstentions will have the same effect as a vote “AGAINST” this proposal.”

The first sentence of the third full paragraph on page 21 of the Proxy Statement is hereby revised in its entirety to read as follows:

“If the Share Increase Proposal is approved and the Stock Split implemented, each stockholder of record at the close of business on December 20, 2024 (the “Stock Split Record Date”) will receive on January 3, 2025, the anticipated distribution date for the Stock Split (the “Distribution Date”), one additional share of Common Stock for each share of Common Stock held by such stockholder and one additional share of Class B Stock for each share of Class B Stock held by such stockholder as of the Stock Split Record Date.”

The final sentence of the second paragraph on page 22 of the Proxy Statement is hereby revised in its entirety to read as follows:

“The Company’s Common Stock would be expected to begin trading on a post-split basis at the market open on the first trading day after the Distribution Date, currently expected to be January 6, 2025.”

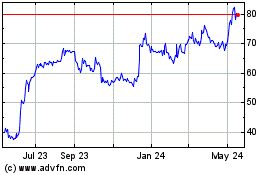

Oil Dri Corp of America (NYSE:ODC)

Historical Stock Chart

From Oct 2024 to Nov 2024

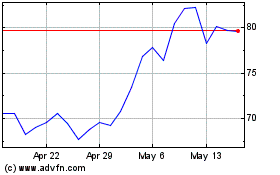

Oil Dri Corp of America (NYSE:ODC)

Historical Stock Chart

From Nov 2023 to Nov 2024