Form 8-K - Current report

December 27 2024 - 3:07PM

Edgar (US Regulatory)

2024-12-27 false 0001587732 0001587732 2024-12-27 2024-12-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Date of report) December 27, 2024

(Date of earliest event reported) December 27, 2024

ONE Gas, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Oklahoma |

|

001-36108 |

|

46-3561936 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

15 East Fifth Street; Tulsa, OK

(Address of principal executive offices)

74103

(Zip code)

(918) 947-7000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of exchange

on which registered |

| Common Stock, par value $0.01 per share |

|

OGS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On December 27, 2024, ONE Gas, Inc. (the “Company”) entered into amendments (the “Amendments”) to the forward sale agreements (the “Forward Sale Agreements”), dated as of September 11, 2023 and September 15, 2023, respectively, between the Company and Bank of America, N.A. (the “Forward Purchaser”), to provide for a December 31, 2025 settlement date (or such earlier time as may be selected by the Company, subject to the terms of the Forward Sale Agreement) for all shares of the Company’s common stock, par value $0.01 per share (the “common stock”) thereunder.

The above summary of the Amendments does not purport to be complete and is qualified in its entirety by the Amendments, copies of which are attached to this Current Report on Form 8-K as Exhibit 10.1 and Exhibit 10.2 and incorporated by reference herein.

Pursuant to the terms of the Forward Sale Agreements, as amended by the Amendments, the Company expects to settle and issue 2,234,000 shares of common stock on before December 27, 2024.

Pursuant to the terms of the Master Forward Confirmation, dated as of February 24, 2023, and the Supplemental Confirmation thereto dated July 17, 2023, between the Company and RBC Capital Markets, LLC, as agent for Royal Bank of Canada, the Company expects to settle and issue 926,465 shares of common stock on before December 27, 2024.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

| Exhibit Number |

|

Description |

|

|

| 10.1 |

|

Amendment dated as of December 27, 2024, to Confirmation of Forward Sale Transaction, dated as of September 11, 2023, between ONE Gas, Inc. and Bank of America, N.A. |

|

|

| 10.2 |

|

Amendment dated as of December 27, 2024, to Confirmation of Forward Sale Transaction, dated as of September 15, 2023, between ONE Gas, Inc. and Bank of America, N.A. |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

| |

|

|

|

ONE Gas, Inc. |

|

|

|

|

| Date: December 27, 2024 |

|

|

|

By: |

|

/s/ Christopher P. Sighinolfi |

| |

|

|

|

|

|

Christopher P. Sighinolfi |

| |

|

|

|

|

|

Officer Senior Vice President and Chief Financial |

3

Exhibit 10.1

December 27, 2024

15 East Fifth Street

Tulsa, OK

74103

| From: |

Bank of America, N.A. |

c/o BofA Securities, Inc.

Bank

of America Tower at One Bryant Park

New York, New York 10036

| From: |

BofA Securities, Inc. |

Bank of America Tower at One Bryant Park

New York, New York 10036

Dear Sirs,

The purpose of this letter agreement (this “Amendment Agreement”) is to amend the terms and conditions of the transaction entered into between

Bank of America, N.A. (“Party A”) and ONE Gas, Inc. (“Party B”), pursuant to a letter agreement dated as of September 11, 2023 (as amended on February 26, 2024 and as further amended, restated,

supplemented or otherwise modified or replaced from time to time, the “Confirmation”). Capitalized terms used herein but not otherwise defined herein shall have the meaning assigned to them in the Confirmation.

For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

| 1. |

Amendments to Confirmation. Effective as of the date hereof: |

| |

(a) |

the definition of “Maturity Date” in Section 2 of the Confirmation shall be amended by replacing

“December 31, 2024” with “December 31, 2025”; |

| |

(b) |

Schedule I in the Confirmation shall be deemed to be replaced by the table below: |

|

|

|

| Forward Price Reduction Date |

|

Forward Price Reduction Amount |

| Trade Date |

|

USD 0.00 |

| November 14 2023 |

|

USD 0.65 |

| February 22, 2024 |

|

USD 0.66 |

| May 17, 2024 |

|

USD 0.66 |

| August 14, 2024 |

|

USD 0.66 |

| November 19, 2024 |

|

USD 0.66 |

| February 21, 2025 |

|

USD 0.66 |

| May 19, 2025 |

|

USD 0.66 |

| August 18, 2025 |

|

USD 0.66 |

| November 14, 2025 |

|

USD 0.66 |

| 2. |

Representations and Warranties. |

| |

(a) |

Party B represents and warrants to, and agrees with, Party A on the date hereof that: |

| |

(i) |

it is duly organized and validly existing under the laws of the jurisdiction of its organization or

incorporation and, if relevant under such laws, in good standing; |

| |

(ii) |

it has the power to execute this Amendment Agreement and any other documentation relating to this Amendment

Agreement to which it is a party, to deliver this Amendment Agreement and any other document relating to this Amendment Agreement that it is required by this Amendment Agreement to deliver and to perform its obligations under this Amendment

Agreement and has taken all necessary action to authorize such execution, delivery and performance; |

| |

(iii) |

such execution, delivery and performance do not violate or conflict with any law applicable to it, any

provision of its constitutional documents, any order or judgment of any court or other agency of government applicable to it or any of its assets or any contractual restriction binding on or affecting it or any of its assets; |

| |

(iv) |

all governmental and other consents that are required to have been obtained by it with respect to this

Amendment Agreement have been obtained and are in full force and effect and all conditions of any such consents have been complied with; |

| |

(v) |

its obligations under this Amendment Agreement constitute its legal, valid and binding obligations, enforceable

in accordance with its terms (subject to applicable bankruptcy, reorganization, insolvency, moratorium or similar laws affecting creditors’ rights generally and subject, as to enforceability, to equitable principles of general application

(regardless of whether enforcement is sought in a proceeding in equity or at law)); |

| |

(vi) |

it (A) has such knowledge and experience in financial and business affairs as to be capable of evaluating

the merits and risks of entering into this Amendment Agreement; (B) has consulted with its own legal, financial, accounting and tax advisors in connection with this Amendment Agreement; and (C) is entering into this Amendment Agreement for

a bona fide business purpose; |

| |

(vii) |

it is not and has not been the subject of any civil proceeding of a judicial or administrative body of

competent jurisdiction that could reasonably be expected to impair materially its ability to perform its obligations under the Transaction as amended hereby; |

| |

(viii) |

no event that would constitute an Event of Default, a Potential Event of Default or a Potential Adjustment

Event has occurred; |

| |

(ix) |

it (A) is capable of evaluating investment risks independently, both in general and with regard to all

transactions and investment strategies involving a security or securities; (B) will exercise independent judgment in evaluating the recommendations of any broker-dealer or its associated persons, unless it has otherwise notified the

broker-dealer in writing; and (C) has total assets of at least USD 50 million as of the date hereof; and |

| |

(x) |

it is entering into this Amendment Agreement in good faith and not as part of a plan or scheme to evade

compliance with federal securities laws including, without limitation, Rule 10b-5 promulgated under the Exchange Act. |

2

| |

(b) |

Party A represents and warrants to, and agrees with, Party B on the date hereof that: |

| |

(i) |

it is duly organized and validly existing under the laws of the jurisdiction of its organization or

incorporation and, if relevant under such laws, in good standing; |

| |

(ii) |

it has the power to execute this Amendment Agreement and any other documentation relating to this Amendment

Agreement to which it is a party, to deliver this Amendment Agreement and any other document relating to this Amendment Agreement that it is required by this Amendment Agreement to deliver and to perform its obligations under this Amendment

Agreement and has taken all necessary action to authorize such execution, delivery and performance; |

| |

(iii) |

such execution, delivery and performance do not violate or conflict with any law applicable to it, any

provision of its constitutional documents, any order or judgment of any court or other agency of government applicable to it or any of its assets or any contractual restriction binding on or affecting it or any of its assets; |

| |

(iv) |

all governmental and other consents that are required to have been obtained by it with respect to this

Amendment Agreement have been obtained and are in full force and effect and all conditions of any such consents have been complied with; and |

| |

(v) |

its obligations under this Amendment Agreement constitute its legal, valid and binding obligations, enforceable

in accordance with its terms (subject to applicable bankruptcy, reorganization, insolvency, moratorium or similar laws affecting creditors’ rights generally and subject, as to enforceability, to equitable principles of general application

(regardless of whether enforcement is sought in a proceeding in equity or at law)). |

| 3. |

No Additional Amendments or Waivers. Except as expressly amended hereby, all the terms of the

Transaction and provisions in the Confirmation shall remain and continue in full force and effect and are hereby confirmed in all respects. |

| 4. |

Notices. Any notice or other communication in respect of this Amendment Agreement may be delivered in

any manner permitted for notices or communications in respect of the Confirmation to the address or number specified for purposes of notices or communications in respect of the Confirmation. |

| 5. |

Counterparts. This Amendment Agreement may be executed in two or more counterparts, each of which shall

be deemed an original, but all of which together shall constitute one and the same instrument. Delivery of an executed Agreement by one party to the other may be made by facsimile or e-mail transmission. The

words “execution,” “signed,” “signature,” and words of like import in this Amendment Agreement or in any other certificate, agreement or document related to this Amendment Agreement, if any, shall include images of

manually executed signatures transmitted by facsimile or other electronic format (including, without limitation, “pdf,” “tif” or “jpg”) and other electronic signatures (including, without limitation, DocuSign and

AdobeSign). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic means) shall be of the same legal effect,

validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New

York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act or the Uniform Commercial Code. |

3

| 6. |

Amendments. No amendment, modification or waiver in respect of this Amendment Agreement will be

effective unless in writing (including a writing evidenced by a facsimile transmission) and executed by each of the parties hereto. |

| 7. |

Entire Agreement. This Amendment Agreement constitutes the entire agreement and understanding of the

parties with respect to the subject matter and supersedes all prior or contemporaneous written and oral communications with respect thereto. Each of the parties acknowledges that, in entering into this Amendment Agreement, it has not relied on any

oral or written representation, warranty or other assurance (except as provided for or referred to in this Amendment Agreement) and waives all rights and remedies which might otherwise be available to it in respect thereof, except that nothing in

this Amendment Agreement will limit or exclude any liability of a party for fraud. |

| 8. |

Governing Law. This Amendment Agreement shall be governed by and construed in accordance with the laws

of the State of New York. |

| 9. |

Waiver of Right to Trial by Jury. Each party waives, to the fullest extent permitted by applicable

law, any right it may have to a trial by jury in respect of any suit, action or proceeding relating to this Amendment Agreement. Each party (a) certifies that no representative, agent or attorney of the other party has represented,

expressly or otherwise, that such other party would not, in the event of such a suit, action or proceeding, seek to enforce the foregoing waiver and (b) acknowledges that it and the other party have been induced to enter into this Amendment

Agreement by, among other things, the mutual waivers and certifications herein. |

[Remainder of page intentionally left

blank]

4

Please confirm that the foregoing correctly sets forth the terms of our agreement executing a copy of this

Amendment Agreement and returning it to Party A.

Very truly yours,

|

|

|

| BANK OF AMERICA, N.A. |

|

|

| By: |

|

/s/ Rohan Handa |

| Name: |

|

Rohan Handa |

| Title: |

|

Managing Director |

|

Accepted and confirmed as of

the date first written above: |

|

| ONE GAS, INC. |

|

|

| By: |

|

/s/ Mark W. Smith |

| Name: |

|

Mark W. Smith |

| Title: |

|

Vice President and Treasurer |

[Signature Page to

Forward Amendment]

Exhibit 10.2

December 27, 2024

15 East Fifth Street

Tulsa, OK

74103

| From: |

Bank of America, N.A. |

c/o BofA Securities, Inc.

Bank

of America Tower at One Bryant Park

New York, New York 10036

| From: |

BofA Securities, Inc. |

Bank of America Tower at One Bryant Park

New York, New York 10036

Dear Sirs,

The purpose of this letter agreement (this “Amendment Agreement”) is to amend the terms and conditions of the transaction entered into

between Bank of America, N.A. (“Party A”) and ONE Gas, Inc. (“Party B”), pursuant to a letter agreement dated as of September 15, 2023 (as amended on February 26, 2024 and as further amended, restated,

supplemented or otherwise modified or replaced from time to time, the “Confirmation”)]. Capitalized terms used herein but not otherwise defined herein shall have the meaning assigned to them in the Confirmation.

For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

| 1. |

Amendments to Confirmation. Effective as of the date hereof: |

| |

(a) |

the definition of “Maturity Date” in Section 2 of the Confirmation shall be amended by replacing

“December 31, 2024” with “December 31, 2025”; |

| |

(b) |

the definition of “Settlement Date” in Section 2 of the Confirmation shall be amended by

inserting in the tenth line thereof, after the words “; provided that”, the words “(v) if on December 31, 2024 the Base Amount is greater than 223,000, then December 31, 2024 shall be a Settlement Date for a number of

Settlement Shares equal to such excess,”; |

| |

(c) |

Schedule I in the Confirmation shall be deemed to be replaced by the table below: |

|

|

|

|

|

| Forward Price Reduction Date |

|

Forward Price Reduction Amount |

|

| Trade Date |

|

|

USD 0.00 |

|

| November 14 2023 |

|

|

USD 0.65 |

|

| February 22, 2024 |

|

|

USD 0.66 |

|

| May 17, 2024 |

|

|

USD 0.66 |

|

| August 14, 2024 |

|

|

USD 0.66 |

|

| November 19, 2024 |

|

|

USD 0.66 |

|

| February 21, 2025 |

|

|

USD 0.66 |

|

| May 19, 2025 |

|

|

USD 0.66 |

|

| August 18, 2025 |

|

|

USD 0.66 |

|

| November 14, 2025 |

|

|

USD 0.66 |

|

| 2. |

Representations and Warranties. |

| |

(a) |

Party B represents and warrants to, and agrees with, Party A on the date hereof that: |

| |

(i) |

it is duly organized and validly existing under the laws of the jurisdiction of its organization or

incorporation and, if relevant under such laws, in good standing; |

| |

(ii) |

it has the power to execute this Amendment Agreement and any other documentation relating to this Amendment

Agreement to which it is a party, to deliver this Amendment Agreement and any other document relating to this Amendment Agreement that it is required by this Amendment Agreement to deliver and to perform its obligations under this Amendment

Agreement and has taken all necessary action to authorize such execution, delivery and performance; |

| |

(iii) |

such execution, delivery and performance do not violate or conflict with any law applicable to it, any

provision of its constitutional documents, any order or judgment of any court or other agency of government applicable to it or any of its assets or any contractual restriction binding on or affecting it or any of its assets; |

| |

(iv) |

all governmental and other consents that are required to have been obtained by it with respect to this

Amendment Agreement have been obtained and are in full force and effect and all conditions of any such consents have been complied with; |

| |

(v) |

its obligations under this Amendment Agreement constitute its legal, valid and binding obligations, enforceable

in accordance with its terms (subject to applicable bankruptcy, reorganization, insolvency, moratorium or similar laws affecting creditors’ rights generally and subject, as to enforceability, to equitable principles of general application

(regardless of whether enforcement is sought in a proceeding in equity or at law)); |

| |

(vi) |

it (A) has such knowledge and experience in financial and business affairs as to be capable of evaluating

the merits and risks of entering into this Amendment Agreement; (B) has consulted with its own legal, financial, accounting and tax advisors in connection with this Amendment Agreement; and (C) is entering into this Amendment Agreement for

a bona fide business purpose; |

| |

(vii) |

it is not and has not been the subject of any civil proceeding of a judicial or administrative body of

competent jurisdiction that could reasonably be expected to impair materially its ability to perform its obligations under the Transaction as amended hereby; |

| |

(viii) |

no event that would constitute an Event of Default, a Potential Event of Default or a Potential Adjustment

Event has occurred; |

| |

(ix) |

it (A) is capable of evaluating investment risks independently, both in general and with regard to all

transactions and investment strategies involving a security or securities; (B) will exercise independent judgment in evaluating the recommendations of any broker-dealer or its associated persons, unless it has otherwise notified the

broker-dealer in writing; and (C) has total assets of at least USD 50 million as of the date hereof; and |

| |

(x) |

it is entering into this Amendment Agreement in good faith and not as part of a plan or scheme to evade

compliance with federal securities laws including, without limitation, Rule 10b-5 promulgated under the Exchange Act. |

2

| |

(b) |

Party A represents and warrants to, and agrees with, Party B on the date hereof that: |

| |

(i) |

it is duly organized and validly existing under the laws of the jurisdiction of its organization or

incorporation and, if relevant under such laws, in good standing; |

| |

(ii) |

it has the power to execute this Amendment Agreement and any other documentation relating to this Amendment

Agreement to which it is a party, to deliver this Amendment Agreement and any other document relating to this Amendment Agreement that it is required by this Amendment Agreement to deliver and to perform its obligations under this Amendment

Agreement and has taken all necessary action to authorize such execution, delivery and performance; |

| |

(iii) |

such execution, delivery and performance do not violate or conflict with any law applicable to it, any

provision of its constitutional documents, any order or judgment of any court or other agency of government applicable to it or any of its assets or any contractual restriction binding on or affecting it or any of its assets; |

| |

(iv) |

all governmental and other consents that are required to have been obtained by it with respect to this

Amendment Agreement have been obtained and are in full force and effect and all conditions of any such consents have been complied with; and |

| |

(v) |

its obligations under this Amendment Agreement constitute its legal, valid and binding obligations, enforceable

in accordance with its terms (subject to applicable bankruptcy, reorganization, insolvency, moratorium or similar laws affecting creditors’ rights generally and subject, as to enforceability, to equitable principles of general application

(regardless of whether enforcement is sought in a proceeding in equity or at law)). |

| 3. |

No Additional Amendments or Waivers. Except as expressly amended hereby, all the terms of the

Transaction and provisions in the Confirmation shall remain and continue in full force and effect and are hereby confirmed in all respects. |

| 4. |

Notices. Any notice or other communication in respect of this Amendment Agreement may be delivered in

any manner permitted for notices or communications in respect of the Confirmation to the address or number specified for purposes of notices or communications in respect of the Confirmation. |

| 5. |

Counterparts. This Amendment Agreement may be executed in two or more counterparts, each of which shall

be deemed an original, but all of which together shall constitute one and the same instrument. Delivery of an executed Agreement by one party to the other may be made by facsimile or e-mail transmission. The

words “execution,” “signed,” “signature,” and words of like import in this Amendment Agreement or in any other certificate, agreement or document related to this Amendment Agreement, if any, shall include images of

manually executed signatures transmitted by facsimile or other electronic format (including, without limitation, “pdf,” “tif” or “jpg”) and other electronic signatures (including, without limitation, DocuSign and

AdobeSign). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic means) shall be of the same legal effect,

validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New

York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act or the Uniform Commercial Code. |

3

| 6. |

Amendments. No amendment, modification or waiver in respect of this Amendment Agreement will be

effective unless in writing (including a writing evidenced by a facsimile transmission) and executed by each of the parties hereto. |

| 7. |

Entire Agreement. This Amendment Agreement constitutes the entire agreement and understanding of the

parties with respect to the subject matter and supersedes all prior or contemporaneous written and oral communications with respect thereto. Each of the parties acknowledges that, in entering into this Amendment Agreement, it has not relied on any

oral or written representation, warranty or other assurance (except as provided for or referred to in this Amendment Agreement) and waives all rights and remedies which might otherwise be available to it in respect thereof, except that nothing in

this Amendment Agreement will limit or exclude any liability of a party for fraud. |

| 8. |

Governing Law. This Amendment Agreement shall be governed by and construed in accordance with the laws

of the State of New York. |

| 9. |

Waiver of Right to Trial by Jury. Each party waives, to the fullest extent permitted by applicable

law, any right it may have to a trial by jury in respect of any suit, action or proceeding relating to this Amendment Agreement. Each party (a) certifies that no representative, agent or attorney of the other party has represented,

expressly or otherwise, that such other party would not, in the event of such a suit, action or proceeding, seek to enforce the foregoing waiver and (b) acknowledges that it and the other party have been induced to enter into this Amendment

Agreement by, among other things, the mutual waivers and certifications herein. |

[Remainder of page intentionally left

blank]

4

Please confirm that the foregoing correctly sets forth the terms of our agreement executing a copy of this

Amendment Agreement and returning it to Party A.

Very truly yours,

BANK OF AMERICA, N.A.

|

|

|

| By: |

|

/s/ Rohan Handa |

| Name: Rohan Handa |

| Title: Managing Director |

Accepted and confirmed as of

the date first written above:

ONE GAS, INC.

|

|

|

| By: |

|

/s/ Mark W. Smith |

| Name: Mark W. Smith |

| Title: Vice President and Treasurer |

[Signature Page to

Forward Amendment]

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

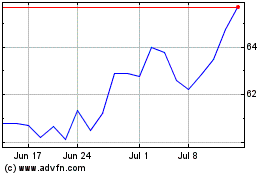

ONE Gas (NYSE:OGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

ONE Gas (NYSE:OGS)

Historical Stock Chart

From Jan 2024 to Jan 2025