Orion Group Holdings, Inc. (NYSE: ORN) (the “Company”), a leading

specialty construction company, today reported its financial

results for the second quarter ended June 30, 2024.

Highlights for the quarter ended June

30, 2024:

- Contract revenues of $192.2

million

- GAAP net loss of $6.6 million or

$0.20 per diluted share

- Adjusted net loss of $5.2 million

or $0.16 per diluted share

- Adjusted EBITDA of $5.5

million

- Backlog and contracts awarded

subsequent to quarter end totaled $876.3 million

See definitions and reconciliation of non-GAAP measures

elsewhere in this release.

Management Commentary

“In the second quarter, we generated revenue of $192.2 million

and Adjusted EBITDA of $5.5 million. As previously indicated, we

anticipated a slower ramp up with two large projects. While we had

some logistical setbacks late in the quarter, our Grand Bahama

Shipyard Dry Dock project is now back on track, and our teams on

the Pearl Harbor project are working double time to get back on

schedule. In construction, work delays beyond our control are not

uncommon and can sometimes cause our results to vary from quarter

to quarter. While the total value of the contracts remains

unchanged, revenue recognition will shift. While these delays are

not expected to have any impact on the critical completion of these

large projects, they will affect our full year 2024 financial

results. For this reason, we are lowering our annual guidance to a

revenue range of $850 million to $900 million and an Adjusted

EBITDA range of $40 million to $45 million. We are still on target

to deliver a very strong second half on a comparable basis. We also

continue to add attractive projects to our backlog, and our

pipeline of opportunities has increased to more than $14 billion.

This puts us in a great position for an outstanding 2025,” said

Travis Boone, Chief Executive Officer of Orion Group Holdings,

Inc.

“Our market continues to expand – activity is scaling up. Our

business development efforts translated into some significant

second-quarter wins in both the Marine and Concrete segments,

including our first large Orion Concrete award in Florida since

expanding our concrete business there. In addition to the awards

previously announced, in July we won a total of $118 million in

work across both segments, bringing our total backlog and awarded

work to $876 million.

“As we enter the second half of the year, I am optimistic about

our future. Together with our teams, we have made great strides in

strengthening the foundation and infrastructure of our company. By

instilling disciplined bidding and project performance processes,

and investing in business development, training and IT systems, we

are far stronger today. Most importantly, our teams are aligned on

the same mission: delivering predictable excellence through

outstanding execution,” concluded Boone.

Second Quarter 2024 Results

Contract revenues of $192.2 million increased

5.3% from $182.5 million in the second quarter last year, primarily

due to an increase in Marine segment revenue related to the Pearl

Harbor drydock project, partially offset by lower Concrete segment

revenue due to our deliberate efforts to adhere to disciplined

bidding standards to win quality work at attractive margins.

Gross profit increased to $18.3 million or 9.5% of revenue, up

from $13.8 million or 7.6% of revenue in the second quarter of

2023. The increase in gross profit dollars and margin was primarily

driven by improved pricing of projects in both segments stemming

from higher quality projects and improved execution, partially

offset by lower margin and mix of dredging revenue.

Selling, general and administrative (“SG&A”) expenses were

$21.1 million, up from $18.1 million in the second quarter of 2023.

As a percentage of total contract revenues, SG&A

expenses increased to 11.0% from 9.9%. The increase in

SG&A dollars and percentage reflected an increase in

compensation expense, business development spending and legal

expenses.

Net loss for the second quarter was $6.6 million or $0.20 per

diluted share compared to net loss of $0.3 million or $0.01 per

diluted share in the second quarter of 2023.

Second quarter 2024 net loss included $1.4 million ($0.04

diluted income per share) of non-recurring items. Second quarter

2024 adjusted net loss was $5.2 million ($0.16 diluted loss per

share).

EBITDA for the second quarter of 2024 was $3.3 million,

representing a 1.7% EBITDA margin, as compared to EBITDA of $7.6

million, or a 4.2% EBITDA margin in the second quarter last year.

Adjusted EBITDA increased to $5.5 million, or a 2.9% Adjusted

EBITDA margin. This compares to Adjusted EBITDA of $3.7 million, or

2.0% Adjusted EBITDA margin in the prior-year period.

New Contract Awards

Subsequent to quarter end, the Company won

several notable projects in its Concrete and Marine segments, which

totaled $118 million. In the Marine segment, the Company was

awarded a $28 million construction project at the Clearwater Beach

Marina, a $28 million construction project for the Port of

Galveston, and a $29 million dredging project for the US Army Corps

of Engineers. In the Concrete segment, the Company won a $16.5

million concrete project in south Texas and two additional data

center projects in North Texas, which brings the total number of

data center projects to 24. The data center projects are with Clune

Construction for $8 million and $5 million each.

Backlog

Total backlog at June 30, 2024 was $758.4 million, compared

to $756.6 million at March 31, 2024 and $818.7 million at June 30,

2023. Backlog for the Marine segment was $567.1 million at June 30,

2024, compared to $569.9 million at March 31, 2024 and $614.9

million at June 30, 2023. Backlog for the Concrete segment was

$191.3 million at June 30, 2024, compared to $186.7 million at

March 31, 2024 and $203.8 million at June 30, 2023. In addition,

the Company has been awarded $118 million in new project work thus

far in July 2024.

Balance Sheet Update

As of June 30, 2024, current assets were $261.5 million,

including unrestricted cash and cash equivalents of $4.8 million.

Total debt outstanding as of June 30, 2024 was $60.3 million. At

the end of the quarter, the Company had $21.0 million in

outstanding borrowings under its revolving credit facility.

Conference Call Details

Orion Group Holdings will host a conference call

to discuss results for the second quarter 2024 at 9:00 a.m. Eastern

Time/8:00 a.m. Central Time on Thursday, July 25, 2024. To

participate, please call (844) 481-2994 and ask for the Orion Group

Holdings Conference Call. A live audio webcast of the call will

also be available on the Investor Relations section of Orion’s

website at https://www.oriongroupholdingsinc.com/investor/ and will

be archived for replay.

About Orion Group Holdings

Orion Group Holdings, Inc., a leading specialty construction

company serving the infrastructure, industrial and building

sectors, provides services both on and off the water in the

continental United States, Alaska, Hawaii, Canada and the Caribbean

Basin through its marine segment and its concrete segment. The

Company’s marine segment provides construction and dredging

services relating to marine transportation facility construction,

marine pipeline construction, marine environmental structures,

dredging of waterways, channels and ports, environmental dredging,

design and specialty services. Its concrete segment provides

turnkey concrete construction services including place and finish,

site prep, layout, forming, and rebar placement for large

commercial, structural and other associated business areas. The

Company is headquartered in Houston, Texas with regional offices

throughout its operating areas. The Company’s website is located

at: https://www.oriongroupholdingsinc.com.

Backlog Definition

Backlog consists of projects under contract that have either (a)

not been started, or (b) are in progress but are not yet complete.

The Company cannot guarantee that the revenue implied by its

backlog will be realized, or, if realized, will result in earnings.

Backlog can fluctuate from period to period due to the timing and

execution of contracts. The typical duration of the Company’s

projects ranges from three to nine months on shorter projects to

multiple years on larger projects. The Company's backlog at any

point in time includes both revenue it expects to realize during

the next twelve-month period as well as revenue it expects to

realize in future years.

Non-GAAP Financial Measures

This press release includes the financial measures “adjusted net

income/loss,” “adjusted earnings/loss per share,” “EBITDA,”

“Adjusted EBITDA” and “Adjusted EBITDA margin.” These measurements

are “non-GAAP financial measures” under rules of

the Securities and Exchange Commission, including Regulation

G. The non-GAAP financial information may be determined or

calculated differently by other companies. By reporting such

non-GAAP financial information, the Company does not intend to give

such information greater prominence than comparable GAAP financial

information. Investors are urged to consider these non-GAAP

measures in addition to and not in substitute for measures prepared

in accordance with GAAP.

Adjusted net income/loss and adjusted earnings/loss per share

should not be viewed as an equivalent financial measure to net

income/loss or earnings/loss per share. Adjusted net income/loss

and adjusted earnings/loss per share exclude certain items that

management believes impairs a meaningful evaluation of the

Company’s financial performance. The Company believes these

adjusted financial measures are a useful supplement to

earnings/loss calculated in accordance with GAAP because they

better inform our common stockholders as to the Company's

operational trends and performance relative to other companies.

Generally, items excluded are one-time items or items whose timing

or amount cannot be reasonably estimated. Accordingly, any guidance

provided by the Company generally excludes information regarding

these types of items.

Orion Group Holdings defines EBITDA as net income/loss

before net interest expense, income taxes, depreciation and

amortization. Adjusted EBITDA is calculated by adjusting EBITDA for

certain items that management believes impairs a meaningful

comparison of operating results. Adjusted EBITDA margin is

calculated by dividing Adjusted EBITDA for the period by contract

revenues for the period. The GAAP financial measure that is most

directly comparable to EBITDA and Adjusted EBITDA is net income,

while the GAAP financial measure that is most directly comparable

to Adjusted EBITDA margin is operating margin, which represents

operating income divided by contract revenues. EBITDA, Adjusted

EBITDA and Adjusted EBITDA margin are used internally to evaluate

current operating expense, operating efficiency, and operating

profitability on a variable cost basis, by excluding the

depreciation and amortization expenses, primarily related to

capital expenditures and acquisitions, and net interest and tax

expenses. Additionally, EBITDA, Adjusted EBITDA and Adjusted EBITDA

margin provide useful information regarding the Company's ability

to meet future debt service and working capital requirements while

providing an overall evaluation of the Company's financial

condition. In addition, EBITDA is used internally for incentive

compensation purposes. The Company includes EBITDA, Adjusted EBITDA

and Adjusted EBITDA margin to provide transparency to investors as

they are commonly used by investors and others in assessing

performance. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin

have certain limitations as analytical tools and should not be used

as a substitute for operating margin, net income, cash flows, or

other data prepared in accordance with GAAP, or as a measure of the

Company's profitability or liquidity.

Forward-Looking Statements

The matters discussed in this press release may constitute or

include projections or other forward-looking statements within the

meaning of the “safe harbor” provisions of Section 27A of the

Securities Exchange Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, of which provisions

the Company is availing itself. Certain forward-looking statements

can be identified by the use of forward-looking terminology, such

as 'believes', 'expects', 'may', 'will', 'could', 'should',

'seeks', 'approximately', 'intends', 'plans', 'estimates', or

'anticipates', or the negative thereof or other comparable

terminology, or by discussions of strategy, plans, objectives,

intentions, estimates, forecasts, outlook, assumptions, or goals.

In particular, statements regarding future operations or results,

including those set forth in this press release, and any other

statement, express or implied, concerning future operating results

or the future generation of or ability to generate revenues,

income, net income, gross profit, EBITDA, Adjusted EBITDA, Adjusted

EBITDA margin, or cash flow, including to service debt or maintain

compliance with debt covenants, and including any estimates,

forecasts or assumptions regarding future revenues or revenue

growth, are forward-looking statements. Forward-looking statements

also include project award announcements, estimated project start

dates, ramp-up of contract activity, anticipated revenues, and

contract options, which may or may not be awarded in the future.

Forward-looking statements involve risks, including those

associated with the Company's fixed price contracts that impacts

profits, unforeseen productivity delays that may alter the final

profitability of the contract, cancellation of the contract by the

customer for unforeseen reasons, delays or decreases in funding by

the customer, levels and predictability of government funding or

other governmental budgetary constraints, and any potential

contract options which may or may not be awarded in the future, and

are at the sole discretion of award by the customer. Past

performance is not necessarily an indicator of future results.

Considering these and other uncertainties, the inclusion of

forward-looking statements in this press release should not be

regarded as a representation by the Company that the Company's

plans, estimates, forecasts, goals, intentions, or objectives will

be achieved or realized. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date hereof. The Company assumes no obligation to update

information contained in this press release whether as a result of

new developments or otherwise, except as required by law.

Please refer to the Company's 2023 Annual Report on Form 10-K,

filed on March 1, 2024 which is available on its website at

www.oriongroupholdingsinc.com or at the SEC's website at

www.sec.gov, for additional and more detailed discussion of risk

factors that could cause actual results to differ materially from

our current expectations, estimates or forecasts.

Contact:

Financial Profiles, Inc.Margaret Boyce

310-622-8247orn@finprofiles.com

|

Orion Group Holdings, Inc. and

SubsidiariesCondensed Statements of

Operations(In Thousands, Except Share and Per

Share Information)(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Contract revenues |

|

$ |

192,167 |

|

|

$ |

182,534 |

|

|

$ |

352,839 |

|

|

$ |

341,708 |

|

|

Costs of contract revenues |

|

|

173,886 |

|

|

|

168,748 |

|

|

|

319,020 |

|

|

|

322,082 |

|

|

Gross profit |

|

|

18,281 |

|

|

|

13,786 |

|

|

|

33,819 |

|

|

|

19,626 |

|

|

Selling, general and administrative expenses |

|

|

21,135 |

|

|

|

18,119 |

|

|

|

40,134 |

|

|

|

35,136 |

|

|

Amortization of intangible assets |

|

|

— |

|

|

|

162 |

|

|

|

— |

|

|

|

324 |

|

|

Gain on disposal of assets, net |

|

|

(86 |

) |

|

|

(6,534 |

) |

|

|

(423 |

) |

|

|

(7,230 |

) |

|

Operating (loss) income |

|

|

(2,768 |

) |

|

|

2,039 |

|

|

|

(5,892 |

) |

|

|

(8,604 |

) |

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

|

120 |

|

|

|

250 |

|

|

|

192 |

|

|

|

543 |

|

|

Interest income |

|

|

7 |

|

|

|

41 |

|

|

|

24 |

|

|

|

69 |

|

|

Interest expense |

|

|

(3,345 |

) |

|

|

(2,627 |

) |

|

|

(6,719 |

) |

|

|

(4,260 |

) |

|

Other expense, net |

|

|

(3,218 |

) |

|

|

(2,336 |

) |

|

|

(6,503 |

) |

|

|

(3,648 |

) |

|

Loss before income taxes |

|

|

(5,986 |

) |

|

|

(297 |

) |

|

|

(12,395 |

) |

|

|

(12,252 |

) |

|

Income tax expense (benefit) |

|

|

617 |

|

|

|

(42 |

) |

|

|

265 |

|

|

|

598 |

|

|

Net loss |

|

$ |

(6,603 |

) |

|

$ |

(255 |

) |

|

$ |

(12,660 |

) |

|

$ |

(12,850 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic loss per share |

|

$ |

(0.20 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.40 |

) |

|

Diluted loss per share |

|

$ |

(0.20 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.40 |

) |

|

Shares used to compute loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

33,111,987 |

|

|

|

32,290,392 |

|

|

|

32,832,868 |

|

|

|

32,235,842 |

|

|

Diluted |

|

|

33,111,987 |

|

|

|

32,290,392 |

|

|

|

32,832,868 |

|

|

|

32,235,842 |

|

|

Orion Group Holdings, Inc. and

SubsidiariesSelected Results of

Operations(In Thousands, Except Share and Per

Share Information)(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

Amount |

|

Percent |

|

Amount |

|

Percent |

|

|

|

|

(dollar amounts in thousands) |

|

|

Contract revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Marine segment |

|

|

|

|

|

|

|

|

|

|

|

|

Public sector |

|

$ |

103,341 |

|

|

78.9 |

|

% |

$ |

74,743 |

|

|

74.3 |

|

% |

|

Private sector |

|

|

27,612 |

|

|

21.1 |

|

% |

|

25,800 |

|

|

25.7 |

|

% |

|

Marine segment total |

|

$ |

130,953 |

|

|

100.0 |

|

% |

$ |

100,543 |

|

|

100.0 |

|

% |

|

Concrete segment |

|

|

|

|

|

|

|

|

|

|

|

|

Public sector |

|

$ |

6,025 |

|

|

9.8 |

|

% |

$ |

5,542 |

|

|

6.8 |

|

% |

|

Private sector |

|

|

55,189 |

|

|

90.2 |

|

% |

|

76,449 |

|

|

93.2 |

|

% |

|

Concrete segment total |

|

$ |

61,214 |

|

|

100.0 |

|

% |

$ |

81,991 |

|

|

100.0 |

|

% |

|

Total |

|

$ |

192,167 |

|

|

|

|

$ |

182,534 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

|

|

|

|

|

|

|

|

|

|

|

|

Marine segment |

|

$ |

(5,466 |

) |

|

(4.2 |

) |

% |

$ |

3,492 |

|

|

3.5 |

|

% |

|

Concrete segment |

|

|

2,698 |

|

|

4.4 |

|

% |

|

(1,453 |

) |

|

(1.8 |

) |

% |

|

Total |

|

$ |

(2,768 |

) |

|

|

|

$ |

2,039 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

Amount |

|

Percent |

|

Amount |

|

Percent |

|

|

|

|

(dollar amounts in thousands) |

|

|

Contract revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Marine segment |

|

|

|

|

|

|

|

|

|

|

|

|

Public sector |

|

$ |

196,276 |

|

|

82.7 |

|

% |

$ |

132,669 |

|

|

73.8 |

|

% |

|

Private sector |

|

|

41,002 |

|

|

17.3 |

|

% |

|

47,172 |

|

|

26.2 |

|

% |

|

Marine segment total |

|

$ |

237,278 |

|

|

100.0 |

|

% |

$ |

179,841 |

|

|

100.0 |

|

% |

|

Concrete segment |

|

|

|

|

|

|

|

|

|

|

|

|

Public sector |

|

$ |

9,429 |

|

|

8.2 |

|

% |

$ |

9,688 |

|

|

6.0 |

|

% |

|

Private sector |

|

|

106,132 |

|

|

91.8 |

|

% |

|

152,179 |

|

|

94.0 |

|

% |

|

Concrete segment total |

|

$ |

115,561 |

|

|

100.0 |

|

% |

$ |

161,867 |

|

|

100.0 |

|

% |

|

Total |

|

$ |

352,839 |

|

|

|

|

$ |

341,708 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

|

|

|

|

|

|

|

|

|

|

|

|

Marine segment |

|

$ |

(10,332 |

) |

|

(4.4 |

) |

% |

$ |

(2,588 |

) |

|

(1.4 |

) |

% |

|

Concrete segment |

|

|

4,440 |

|

|

3.8 |

|

% |

|

(6,016 |

) |

|

(3.7 |

) |

% |

|

Total |

|

$ |

(5,892 |

) |

|

|

|

$ |

(8,604 |

) |

|

|

|

|

Orion Group Holdings, Inc. and

SubsidiariesReconciliation of Adjusted Net Income

(Loss)(In thousands except per share

information)(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

Net loss |

|

$ |

(6,603 |

) |

|

$ |

(255 |

) |

|

$ |

(12,660 |

) |

|

$ |

(12,850 |

) |

|

|

One-time charges and the tax effects: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net gain on Port Lavaca South Yard property sale |

|

|

— |

|

|

|

(5,202 |

) |

|

|

— |

|

|

|

(5,202 |

) |

|

|

ERP implementation |

|

|

613 |

|

|

|

310 |

|

|

|

1,299 |

|

|

|

496 |

|

|

|

Severance |

|

|

19 |

|

|

|

24 |

|

|

|

81 |

|

|

|

126 |

|

|

|

Tax rate applied to one-time charges (1) |

|

|

(13 |

) |

|

|

584 |

|

|

|

(239 |

) |

|

|

550 |

|

|

|

Total one-time charges and the tax effects |

|

|

619 |

|

|

|

(4,284 |

) |

|

|

1,141 |

|

|

|

(4,030 |

) |

|

|

Federal and state tax valuation allowances |

|

|

825 |

|

|

|

13 |

|

|

|

2,410 |

|

|

|

2,070 |

|

|

|

Adjusted net loss |

|

$ |

(5,159 |

) |

|

$ |

(4,526 |

) |

|

$ |

(9,109 |

) |

|

$ |

(14,810 |

) |

|

|

Adjusted EPS |

|

$ |

(0.16 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.46 |

) |

|

____________________________

|

(1) |

Items are taxed discretely using the Company's effective tax rate

which differs from the Company’s statutory federal rate primarily

due to state income taxes and the non-deductibility of other

permanent items. |

|

Orion Group Holdings, Inc. and

SubsidiariesAdjusted EBITDA and Adjusted EBITDA

Margin Reconciliations(In Thousands, Except Margin

Data)(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

Net loss |

|

$ |

(6,603 |

) |

|

$ |

(255 |

) |

|

$ |

(12,660 |

) |

|

$ |

(12,850 |

) |

|

|

Income tax expense (benefit) |

|

|

617 |

|

|

|

(42 |

) |

|

|

265 |

|

|

|

598 |

|

|

|

Interest expense, net |

|

|

3,338 |

|

|

|

2,586 |

|

|

|

6,695 |

|

|

|

4,191 |

|

|

|

Depreciation and amortization |

|

|

5,970 |

|

|

|

5,343 |

|

|

|

11,990 |

|

|

|

10,789 |

|

|

|

EBITDA (1) |

|

|

3,322 |

|

|

|

7,632 |

|

|

|

6,290 |

|

|

|

2,728 |

|

|

|

Share-based compensation |

|

|

1,556 |

|

|

|

945 |

|

|

|

1,914 |

|

|

|

1,469 |

|

|

|

Net gain on Port Lavaca South Yard property sale |

|

|

— |

|

|

|

(5,202 |

) |

|

|

— |

|

|

|

(5,202 |

) |

|

|

ERP implementation |

|

|

613 |

|

|

|

310 |

|

|

|

1,299 |

|

|

|

496 |

|

|

|

Severance |

|

|

19 |

|

|

|

24 |

|

|

|

81 |

|

|

|

126 |

|

|

|

Adjusted EBITDA(2) |

|

$ |

5,510 |

|

|

$ |

3,709 |

|

|

$ |

9,584 |

|

|

$ |

(383 |

) |

|

|

Operating income margin |

|

|

(1.3 |

) |

% |

|

1.1 |

|

% |

|

(1.7 |

) |

% |

|

(2.5 |

) |

% |

|

Impact of other income |

|

|

— |

|

% |

|

0.1 |

|

% |

|

0.1 |

|

% |

|

0.2 |

|

% |

|

Impact of depreciation and amortization |

|

|

3.1 |

|

% |

|

2.9 |

|

% |

|

3.4 |

|

% |

|

3.2 |

|

% |

|

Impact of share-based compensation |

|

|

0.8 |

|

% |

|

0.5 |

|

% |

|

0.5 |

|

% |

|

0.4 |

|

% |

|

Impact of net gain on Port Lavaca South Yard property sale |

|

|

— |

|

% |

|

(2.8 |

) |

% |

|

— |

|

% |

|

(1.5 |

) |

% |

|

Impact of ERP implementation |

|

|

0.3 |

|

% |

|

0.2 |

|

% |

|

0.4 |

|

% |

|

0.1 |

|

% |

|

Impact of severance |

|

|

— |

|

% |

|

— |

|

% |

|

— |

|

% |

|

— |

|

% |

|

Adjusted EBITDA margin(2) |

|

|

2.9 |

|

% |

|

2.0 |

|

% |

|

2.7 |

|

% |

|

(0.1 |

) |

% |

____________________________

|

(1) |

EBITDA is a non-GAAP measure that represents earnings before

interest, taxes, depreciation and amortization. |

|

(2) |

Adjusted EBITDA is a non-GAAP measure that represents EBITDA

adjusted for share-based compensation, net gain on Port Lavaca

South Yard property sale, ERP implementation, and severance.

Adjusted EBITDA margin is a non-GAAP measure calculated by dividing

Adjusted EBITDA by contract revenues. |

|

Orion Group Holdings, Inc. and

SubsidiariesAdjusted EBITDA and Adjusted EBITDA

Margin Reconciliations by Segment(In Thousands,

Except Margin Data)(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marine |

|

Concrete |

|

|

|

|

Three months ended |

|

Three months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

Operating (loss) income |

|

$ |

(5,466 |

) |

|

$ |

3,492 |

|

|

$ |

2,698 |

|

|

$ |

(1,453 |

) |

|

|

Other income |

|

|

83 |

|

|

|

250 |

|

|

|

37 |

|

|

|

— |

|

|

|

Depreciation and amortization |

|

|

4,922 |

|

|

|

3,812 |

|

|

|

1,048 |

|

|

|

1,531 |

|

|

|

EBITDA (1) |

|

|

(461 |

) |

|

|

7,554 |

|

|

|

3,783 |

|

|

|

78 |

|

|

|

Share-based compensation |

|

|

1,494 |

|

|

|

923 |

|

|

|

62 |

|

|

|

22 |

|

|

|

Net gain on Port Lavaca South Yard property sale |

|

|

— |

|

|

|

(5,202 |

) |

|

|

— |

|

|

|

— |

|

|

|

ERP implementation |

|

|

420 |

|

|

|

168 |

|

|

|

193 |

|

|

|

142 |

|

|

|

Severance |

|

|

19 |

|

|

|

2 |

|

|

|

— |

|

|

|

22 |

|

|

|

Adjusted EBITDA(2) |

|

$ |

1,472 |

|

|

$ |

3,445 |

|

|

$ |

4,038 |

|

|

$ |

264 |

|

|

|

Operating income margin |

|

|

(4.2 |

) |

% |

|

3.5 |

|

% |

|

4.4 |

|

% |

|

(1.8 |

) |

% |

|

Impact of other income |

|

|

0.1 |

|

% |

|

0.2 |

|

% |

|

0.1 |

|

% |

|

— |

|

% |

|

Impact of depreciation and amortization |

|

|

3.8 |

|

% |

|

3.8 |

|

% |

|

1.7 |

|

% |

|

1.9 |

|

% |

|

Impact of share-based compensation |

|

|

1.1 |

|

% |

|

0.9 |

|

% |

|

0.1 |

|

% |

|

— |

|

% |

|

Impact of net gain on Port Lavaca South Yard property sale |

|

|

— |

|

% |

|

(5.2 |

) |

% |

|

— |

|

% |

|

— |

|

% |

|

Impact of ERP implementation |

|

|

0.3 |

|

% |

|

0.2 |

|

% |

|

0.3 |

|

% |

|

0.2 |

|

% |

|

Impact of severance |

|

|

— |

|

% |

|

— |

|

% |

|

— |

|

% |

|

— |

|

% |

|

Adjusted EBITDA margin (2) |

|

|

1.1 |

|

% |

|

3.4 |

|

% |

|

6.6 |

|

% |

|

0.3 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marine |

|

Concrete |

|

|

|

|

Six months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

Operating income (loss) |

|

$ |

(10,332 |

) |

|

$ |

(2,588 |

) |

|

$ |

4,440 |

|

|

$ |

(6,016 |

) |

|

|

Other income |

|

|

131 |

|

|

|

543 |

|

|

|

61 |

|

|

|

— |

|

|

|

Depreciation and amortization |

|

|

9,853 |

|

|

|

7,647 |

|

|

|

2,137 |

|

|

|

3,142 |

|

|

|

EBITDA (1) |

|

|

(348 |

) |

|

|

5,602 |

|

|

|

6,638 |

|

|

|

(2,874 |

) |

|

|

Share-based compensation |

|

|

1,820 |

|

|

|

1,442 |

|

|

|

94 |

|

|

|

27 |

|

|

|

Net gain on Port Lavaca South Yard property sale |

|

|

— |

|

|

|

(5,202 |

) |

|

|

— |

|

|

|

— |

|

|

|

ERP implementation |

|

|

874 |

|

|

|

261 |

|

|

|

425 |

|

|

|

235 |

|

|

|

Severance |

|

|

81 |

|

|

|

38 |

|

|

|

— |

|

|

|

88 |

|

|

|

Adjusted EBITDA(2) |

|

$ |

2,427 |

|

|

$ |

2,141 |

|

|

$ |

7,157 |

|

|

$ |

(2,524 |

) |

|

|

Operating income margin |

|

|

(4.4 |

) |

% |

|

(1.4 |

) |

% |

|

3.8 |

|

% |

|

(3.7 |

) |

% |

|

Impact of other income |

|

|

— |

|

% |

|

0.3 |

|

% |

|

0.1 |

|

% |

|

— |

|

% |

|

Impact of depreciation and amortization |

|

|

4.2 |

|

% |

|

4.3 |

|

% |

|

1.8 |

|

% |

|

1.9 |

|

% |

|

Impact of share-based compensation |

|

|

0.8 |

|

% |

|

0.8 |

|

% |

|

0.1 |

|

% |

|

— |

|

% |

|

Impact of net gain on Tampa property sale |

|

|

— |

|

% |

|

(2.9 |

) |

% |

|

— |

|

% |

|

— |

|

% |

|

Impact of ERP implementation |

|

|

0.4 |

|

% |

|

0.1 |

|

% |

|

0.4 |

|

% |

|

0.1 |

|

% |

|

Impact of severance |

|

|

— |

|

% |

|

— |

|

% |

|

— |

|

% |

|

0.1 |

|

% |

|

Adjusted EBITDA margin (2) |

|

|

1.0 |

|

% |

|

1.2 |

|

% |

|

6.2 |

|

% |

|

(1.6 |

) |

% |

____________________________

|

(1) |

EBITDA is a non-GAAP measure that represents earnings before

interest, taxes, depreciation and amortization. |

|

(2) |

Adjusted EBITDA is a non-GAAP measure that represents EBITDA

adjusted for share-based compensation, net gain on Port Lavaca

South Yard property sale, ERP implementation, and severance.

Adjusted EBITDA margin is a non-GAAP measure calculated by dividing

Adjusted EBITDA by contract revenues. |

|

Orion Group Holdings, Inc. and

SubsidiariesCondensed Statements of Cash Flows

Summarized(In

Thousands)(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

Net loss |

|

$ |

(6,603 |

) |

|

$ |

(255 |

) |

|

$ |

(12,660 |

) |

|

$ |

(12,850 |

) |

|

|

Adjustments to remove non-cash and non-operating items |

|

|

10,506 |

|

|

|

1,511 |

|

|

|

19,512 |

|

|

|

8,179 |

|

|

|

Cash flow from net income (loss) after adjusting for non-cash and

non-operating items |

|

|

3,903 |

|

|

|

1,256 |

|

|

|

6,852 |

|

|

|

(4,671 |

) |

|

|

Change in operating assets and liabilities (working capital) |

|

|

(19,235 |

) |

|

|

(10,199 |

) |

|

|

(45,009 |

) |

|

|

(7,305 |

) |

|

|

Cash flows used in operating activities |

|

$ |

(15,332 |

) |

|

$ |

(8,943 |

) |

|

$ |

(38,157 |

) |

|

$ |

(11,976 |

) |

|

|

Cash flows (used in) provided by investing activities |

|

$ |

(4,560 |

) |

|

$ |

8,341 |

|

|

$ |

(6,133 |

) |

|

$ |

7,041 |

|

|

|

Cash flows provided by financing activities |

|

$ |

20,091 |

|

|

$ |

8,182 |

|

|

$ |

18,189 |

|

|

$ |

11,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures (included in investing activities above) |

|

$ |

(4,634 |

) |

|

$ |

(2,415 |

) |

|

$ |

(6,487 |

) |

|

$ |

(4,291 |

) |

|

| Orion Group

Holdings, Inc. and SubsidiariesCondensed

Statements of Cash Flows(In

Thousands)(Unaudited) |

| |

|

|

|

|

|

|

| |

|

Six months ended June 30, |

| |

|

2024 |

|

2023 |

| Cash flows

from operating activities |

|

|

|

|

|

|

|

Net loss |

|

$ |

(12,660 |

) |

|

$ |

(12,850 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

8,326 |

|

|

|

9,314 |

|

|

Amortization of ROU operating leases |

|

|

4,912 |

|

|

|

2,464 |

|

|

Amortization of ROU finance leases |

|

|

3,664 |

|

|

|

1,475 |

|

|

Amortization of deferred debt issuance costs |

|

|

995 |

|

|

|

537 |

|

|

Deferred income taxes |

|

|

(38 |

) |

|

|

5 |

|

|

Share-based compensation |

|

|

1,914 |

|

|

|

1,469 |

|

|

Gain on disposal of assets, net |

|

|

(423 |

) |

|

|

(7,230 |

) |

|

Allowance for credit losses |

|

|

162 |

|

|

|

26 |

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

(28,135 |

) |

|

|

(10,068 |

) |

|

Income tax receivable |

|

|

(70 |

) |

|

|

(196 |

) |

|

Inventory |

|

|

(261 |

) |

|

|

(309 |

) |

|

Prepaid expenses and other |

|

|

723 |

|

|

|

2,794 |

|

|

Contract assets |

|

|

10,910 |

|

|

|

8,954 |

|

|

Accounts payable |

|

|

7,291 |

|

|

|

(12,495 |

) |

|

Accrued liabilities |

|

|

(14,160 |

) |

|

|

3,188 |

|

|

Operating lease liabilities |

|

|

(4,492 |

) |

|

|

(2,495 |

) |

|

Income tax payable |

|

|

166 |

|

|

|

176 |

|

|

Contract liabilities |

|

|

(16,981 |

) |

|

|

3,146 |

|

|

Net cash used in operating activities |

|

|

(38,157 |

) |

|

|

(11,976 |

) |

| Cash flows

from investing activities: |

|

|

|

|

|

|

|

Proceeds from sale of property and equipment |

|

|

354 |

|

|

|

11,332 |

|

|

Purchase of property and equipment |

|

|

(6,487 |

) |

|

|

(4,291 |

) |

|

Net cash (used in) provided by investing activities |

|

|

(6,133 |

) |

|

|

7,041 |

|

| Cash flows

from financing activities: |

|

|

|

|

|

|

|

Borrowings on credit |

|

|

29,216 |

|

|

|

57,822 |

|

|

Payments made on borrowings on credit |

|

|

(6,809 |

) |

|

|

(54,960 |

) |

|

Loan costs from Credit Facility |

|

|

(343 |

) |

|

|

(5,978 |

) |

|

Payments of finance lease liabilities |

|

|

(4,209 |

) |

|

|

(1,618 |

) |

|

Payments related to tax withholding for share-based

compensation |

|

|

(34 |

) |

|

|

(189 |

) |

|

Exercise of stock options |

|

|

368 |

|

|

|

— |

|

|

Net cash provided by financing activities |

|

|

18,189 |

|

|

|

11,576 |

|

| Net change

in cash, cash equivalents and restricted cash |

|

|

(26,101 |

) |

|

|

6,641 |

|

| Cash, cash

equivalents and restricted cash at beginning of period |

|

|

30,938 |

|

|

|

3,784 |

|

| Cash, cash

equivalents and restricted cash at end of period |

|

$ |

4,837 |

|

|

$ |

10,425 |

|

| Orion Group

Holdings, Inc. and SubsidiariesCondensed Balance

Sheets(In Thousands, Except Share and Per Share

Information) |

| |

|

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

| |

|

2024 |

|

|

2023 |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,837 |

|

|

$ |

30,938 |

|

|

Accounts receivable: |

|

|

|

|

|

|

|

Trade, net of allowance for credit losses of $523 and $361, as of

June 30, 2024 and December 31, 2023, respectively |

|

|

135,167 |

|

|

|

101,229 |

|

|

Retainage |

|

|

36,428 |

|

|

|

42,044 |

|

|

Income taxes receivable |

|

|

696 |

|

|

|

626 |

|

|

Other current |

|

|

3,515 |

|

|

|

3,864 |

|

|

Inventory |

|

|

2,007 |

|

|

|

2,699 |

|

|

Contract assets |

|

|

70,612 |

|

|

|

81,522 |

|

|

Prepaid expenses and other |

|

|

8,207 |

|

|

|

8,894 |

|

|

Total current assets |

|

|

261,469 |

|

|

|

271,816 |

|

| Property and

equipment, net of depreciation |

|

|

85,975 |

|

|

|

87,834 |

|

| Operating

lease right-of-use assets, net of amortization |

|

|

33,685 |

|

|

|

25,696 |

|

| Financing

lease right-of-use assets, net of amortization |

|

|

24,029 |

|

|

|

23,602 |

|

| Inventory,

non-current |

|

|

7,314 |

|

|

|

6,361 |

|

| Intangible

assets, net of amortization |

|

|

— |

|

|

|

— |

|

| Deferred

income tax asset |

|

|

25 |

|

|

|

26 |

|

| Other

non-current |

|

|

1,522 |

|

|

|

1,558 |

|

|

Total assets |

|

$ |

414,019 |

|

|

$ |

416,893 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Current debt, net of issuance costs |

|

$ |

14,320 |

|

|

$ |

13,453 |

|

|

Accounts payable: |

|

|

|

|

|

|

|

Trade |

|

|

87,452 |

|

|

|

80,294 |

|

|

Retainage |

|

|

2,579 |

|

|

|

2,527 |

|

|

Accrued liabilities |

|

|

25,569 |

|

|

|

37,074 |

|

|

Income taxes payable |

|

|

736 |

|

|

|

570 |

|

|

Contract liabilities |

|

|

47,098 |

|

|

|

64,079 |

|

|

Current portion of operating lease liabilities |

|

|

9,133 |

|

|

|

9,254 |

|

|

Current portion of financing lease liabilities |

|

|

10,363 |

|

|

|

8,665 |

|

|

Total current liabilities |

|

|

197,250 |

|

|

|

215,916 |

|

| Long-term

debt, net of debt issuance costs |

|

|

45,932 |

|

|

|

23,740 |

|

| Operating

lease liabilities |

|

|

24,948 |

|

|

|

16,632 |

|

| Financing

lease liabilities |

|

|

11,315 |

|

|

|

13,746 |

|

| Other

long-term liabilities |

|

|

23,486 |

|

|

|

25,320 |

|

| Deferred

income tax liability |

|

|

25 |

|

|

|

64 |

|

|

Total liabilities |

|

|

302,956 |

|

|

|

295,418 |

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock -- $0.01 par value, 10,000,000 authorized, none

issued |

|

|

— |

|

|

|

— |

|

|

Common stock -- $0.01 par value, 50,000,000 authorized,

34,082,186 and 33,260,011 issued; 33,370,955 and 32,548,780

outstanding at June 30, 2024 and December 31, 2023,

respectively |

|

|

341 |

|

|

|

333 |

|

|

Treasury stock, 711,231 shares, at cost, as of June 30, 2024 and

December 31, 2023, respectively |

|

|

(6,540 |

) |

|

|

(6,540 |

) |

| Additional

paid-in capital |

|

|

191,969 |

|

|

|

189,729 |

|

| Retained

loss |

|

|

(74,707 |

) |

|

|

(62,047 |

) |

|

Total stockholders’ equity |

|

|

111,063 |

|

|

|

121,475 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

414,019 |

|

|

$ |

416,893 |

|

|

Orion Group Holdings, Inc. and

SubsidiariesGuidance - Adjusted EBITDA

Reconciliation(In

Thousands)(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

|

|

|

December 31, 2024 |

|

|

Net (loss) income |

|

$ |

(4,727 |

) |

|

$ |

233 |

|

|

Income tax expense |

|

|

380 |

|

|

|

420 |

|

|

Interest expense, net |

|

|

13,391 |

|

|

|

13,391 |

|

|

Depreciation and amortization |

|

|

24,097 |

|

|

|

24,097 |

|

|

EBITDA (1) |

|

|

33,141 |

|

|

|

38,141 |

|

|

Share-based compensation |

|

|

4,484 |

|

|

|

4,484 |

|

|

ERP implementation |

|

|

2,294 |

|

|

|

2,294 |

|

|

Severance |

|

|

81 |

|

|

|

81 |

|

|

Adjusted EBITDA(2) |

|

$ |

40,000 |

|

|

$ |

45,000 |

|

____________________________

|

(1) |

EBITDA is a non-GAAP measure that represents earnings before

interest, taxes, depreciation and amortization. |

|

(2) |

Adjusted EBITDA is a non-GAAP measure that represents EBITDA

adjusted for share-based compensation, ERP implementation, and

severance. |

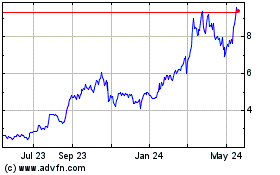

Orion (NYSE:ORN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Orion (NYSE:ORN)

Historical Stock Chart

From Nov 2023 to Nov 2024