- Third-Quarter Performance Driven by Focused Commercial

Execution and Robust Double-Digit Revenue Growth Across Product

Portfolio

- Raises Full-Year 2024 Revenue Guidance(1) to a Range of $61.0

to $64.0 Billion and Raises Adjusted(2) Diluted EPS Guidance to a

Range of $2.75 to $2.95

- Third-Quarter 2024 Revenues of $17.7 Billion, Representing 32%

Year-over-Year Operational Growth

- Excluding Contributions from Paxlovid and

Comirnaty(3), Revenues Grew 14% Operationally

- Third-Quarter 2024 Reported(4) Diluted EPS of $0.78 and

Adjusted(2) Diluted EPS of $1.06

- On Track to Deliver Net Cost Savings of At Least $5.5 Billion

from Previously Announced Cost Reduction Initiatives

- At Least $4 Billion Anticipated by End of

2024 from Cost Realignment Program(5)

- Approximately $1.5 Billion Expected by End

of 2027 from First Phase of Manufacturing Optimization Program

Pfizer Inc. (NYSE: PFE) reported financial results for the third

quarter of 2024 and raised its full-year 2024 guidance(1) for both

Revenues and Adjusted(2) diluted EPS.

The third-quarter 2024 earnings presentation and accompanying

prepared remarks from management as well as the quarterly update to

Pfizer’s R&D pipeline can be found at www.pfizer.com.

EXECUTIVE COMMENTARY

Dr. Albert Bourla, Chairman and Chief Executive Officer, stated:

“We delivered another strong quarter of results as we continued to

execute with discipline, strengthen our commercial position and

advance our pipeline. I am pleased with the performance of our

product portfolio in the third quarter as we continued to achieve

exceptional growth with our Oncology products, including strong

revenue growth contributions from Padcev, Xtandi, Lorbrena and

Braftovi/Mektovi, and as we delivered on heightened demand for

Paxlovid during the recent COVID-19 wave.

“Our performance through the first three quarters of the year is

the result of our focus on our most important strategic priorities.

I’m confident that we will deliver on our financial commitments in

2024 and that we are well positioned to continue advancing

scientific breakthroughs meaningful to our patients and our

company, as well as creating long-term shareholder value, in the

years to come.”

David Denton, Chief Financial Officer and Executive Vice

President, stated: “We are extremely pleased with the strong 14%

operational revenue growth of Pfizer’s non-COVID products in the

third quarter. This follows our strong first-half performance,

which demonstrates our continued focus on commercial execution and

confidence in our ability to deliver on our financial guidance this

year. Importantly, we believe our ongoing cost reduction efforts

set the company on a path toward future margin expansion.”

OVERALL RESULTS

In the first quarter of 2024, Pfizer reclassified royalty income

(substantially all of which is related to our Biopharma segment)

from Other (income)/deductions––net to revenues and began

presenting Royalty revenues as a separate line item within Total

revenues in our consolidated statements of operations. Prior-period

amounts have been recast to conform to the current

presentation.

Some amounts in this press release may not add due to rounding.

All percentages have been calculated using unrounded amounts.

References to operational variances pertain to period-over-period

changes that exclude the impact of foreign exchange rates(6).

Results for the third quarter and first nine months of 2024 and

2023(7) are summarized below.

($ in millions, except

per share amounts)

Third-Quarter

Nine Months

2024

2023

Change

2024

2023

Change

Revenues

$ 17,702

$ 13,491

31%

$ 45,864

$ 44,984

2%

Reported(4) Net Income/(Loss)

4,465

(2,382)

*

7,621

5,488

39%

Reported(4) Diluted EPS/(LPS)

0.78

(0.42)

*

1.34

0.96

39%

Adjusted(2) Income/(Loss)

6,050

(968)

*

14,124

9,908

43%

Adjusted(2) Diluted EPS/(LPS)

1.06

(0.17)

*

2.48

1.73

43%

* Indicates calculation not meaningful or

results are greater than 100%.

REVENUES

($ in millions)

Third-Quarter

Nine Months

2024

2023

% Change

2024

2023

% Change

Total

Oper.

Total

Oper.

Global Biopharmaceuticals Business

(Biopharma)

$ 17,392

$ 13,188

32%

33%

$ 44,987

$ 44,051

2%

3%

Pfizer CentreOne (PC1)

285

293

(3%)

(2%)

820

908

(10%)

(9%)

Pfizer Ignite

25

10

*

*

56

25

*

*

TOTAL REVENUES

$ 17,702

$ 13,491

31%

32%

$ 45,864

$ 44,984

2%

3%

* Indicates calculation not meaningful or

results are greater than 100%.

2024 FINANCIAL GUIDANCE(1)

Pfizer raises full-year 2024 revenue guidance by $1.5 billion at

the midpoint to a range of $61.0 to $64.0 billion and raises

Adjusted(2) diluted EPS guidance by $0.30 at the midpoint to $2.75

to $2.95. The company’s updated guidance for revenue includes

approximately $10.5 billion in anticipated revenues for

Comirnaty(3) and Paxlovid, approximately $5 billion and $5.5

billion, respectively. Including the contribution from Seagen and

excluding revenues from Comirnaty(3) and Paxlovid, Pfizer continues

to expect full-year 2024 operational revenue growth of 9% to 11%

compared to 2023 revenues; and this growth guidance takes into

consideration the reduction of sales associated with the previously

announced global withdrawal of Oxbryta.

The updated 2024 Adjusted(2) diluted EPS guidance takes into

consideration our strong year-to-date performance as well as our

continued confidence in our business.

Pfizer’s updated financial guidance(1) is presented below.

Revenues

$61.0 to $64.0 billion

(previously $59.5 to $62.5

billion)

Adjusted(2) SI&A Expenses

$13.8 to $14.8 billion

Adjusted(2) R&D Expenses

$11.0 to $12.0 billion

Effective Tax Rate on Adjusted(2)

Income

Approximately 13.0%

Adjusted(2) Diluted EPS

$2.75 to $2.95

(previously $2.45 to $2.65)

Changes in foreign exchange rates have had a minimal incremental

impact since full-year 2024 guidance was updated on July 30, 2024.

Please refer to Press Release Footnote (1) for additional

information.

CAPITAL ALLOCATION

During the first nine months of 2024, Pfizer deployed its

capital in a variety of ways, which primarily include the following

two categories:

- Reinvesting capital into initiatives intended to enhance the

future growth prospects of the company, including:

- $7.8 billion invested in internal research and development

projects, and

- Approximately $200 million invested in business development

transactions.

- Returning capital directly to shareholders through $7.1 billion

of cash dividends, or $1.26 per share of common stock.

No share repurchases were completed to date in 2024. As of

October 29, 2024, Pfizer’s remaining share repurchase authorization

is $3.3 billion. Current financial guidance does not anticipate any

share repurchases in 2024.

Third-quarter 2024 diluted weighted-average shares outstanding

used to calculate Reported(4) and Adjusted(2) diluted EPS were

5,705 million shares. For the third quarter of 2023, basic

weighted-average shares outstanding of 5,646 million were used to

calculate Reported(4) and Adjusted(2) diluted LPS.

QUARTERLY FINANCIAL HIGHLIGHTS (Third-Quarter 2024 vs.

Third-Quarter 2023)

Third-quarter 2024 revenues totaled $17.7 billion, an increase

of $4.2 billion, or 31%, compared to the prior-year quarter,

reflecting an operational increase of $4.3 billion, or 32%,

primarily due to growth contributions from Paxlovid as well as

several of our acquired products, key in-line products, and recent

commercial launches, partially offset by an unfavorable impact of

foreign exchange of $133 million, or 1%. Excluding contributions

from Paxlovid and Comirnaty(3), revenues totaled $13.6 billion, an

increase of $1.7 billion, or 14%, operationally compared with the

prior-year quarter.

Third-quarter 2024 Paxlovid revenues of $2.7 billion increased

$2.5 billion operationally compared with the prior-year quarter,

primarily due to strong demand, particularly in the U.S., driven by

higher utilization during a recent global COVID-19 wave; the

one-time contractual delivery of one million treatment courses to

the U.S. Strategic National Stockpile in the third quarter of 2024

that accounted for $442 million in revenue; and no U.S. sales in

the prior-year quarter in anticipation of the transition to

commercial markets in November 2023.

Third-quarter 2024 Comirnaty(3) revenues of $1.4 billion

increased $119 million, or 9%, operationally compared with the

prior-year quarter, driven primarily by timing of stocking as a

result of earlier approval of the new variant vaccine in the U.S.

in 2024 compared to 2023, partially offset by lower contractual

deliveries and demand in international markets.

Excluding contributions from Comirnaty(3) and Paxlovid,

third-quarter 2024 operational revenue growth was driven primarily

by:

- Global revenues of $854 million from legacy Seagen, which was

acquired in December of 2023;

- Vyndaqel family (Vyndaqel, Vyndamax, Vynmac) globally, up 63%

operationally, driven largely by continued strong demand, primarily

in the U.S. and international developed markets;

- Eliquis globally, up 9% operationally, driven primarily by

continued oral anti-coagulant adoption and market share gains in

the non-valvular atrial fibrillation indication in the U.S. and

certain markets in Europe, partially offset by declines due to loss

of patent-based exclusivity and generic competition in certain

international markets;

- Xtandi, up 28% operationally, driven primarily by strong demand

due to uptake of the non-metastatic castration-sensitive prostate

cancer (nmCSPC) indication following approval in the fourth quarter

of 2023; and

- Nurtec ODT/Vydura globally, up 45% operationally, driven

primarily by strong demand in the U.S. and, to a much lesser

extent, recent launches in international markets;

partially offset primarily by lower revenues for:

- Xeljanz globally, down 35% operationally, driven primarily by

decreased prescription volumes globally resulting from ongoing

shifts in prescribing patterns related to label changes, as well as

lower net price in the U.S. and the impact of regulatory

exclusivity expiry in Canada; and

- Ibrance globally, down 12% operationally, driven primarily by

lower demand due to competitive pressure globally and price

decreases in certain international developed markets, partially

offset by increased clinical trial supply orders in certain

international developed markets versus prior year.

GAAP Reported(4) Statement of Operations Highlights

SELECTED REPORTED(4) COSTS AND EXPENSES

($ in millions)

Third-Quarter

Nine Months

2024

2023

% Change

2024

2023

% Change

Total

Oper.

Total

Oper.

Cost of Sales(4)

$ 5,263

$ 9,269

(43%)

(43%)

$ 11,942

$ 17,391

(31%)

(30%)

Percent of Revenues

29.7%

68.7%

N/A

N/A

26.0%

38.7%

N/A

N/A

SI&A Expenses(4)

3,244

3,281

(1%)

—

10,456

10,196

3%

3%

R&D Expenses(4)

2,598

2,711

(4%)

(4%)

7,787

7,864

(1%)

(1%)

Acquired IPR&D Expenses(4)

13

67

(80%)

(80%)

20

122

(84%)

(84%)

Other (Income)/Deductions—net(4)

243

181

34%

57%

2,030

381

*

*

Effective Tax Rate on Reported(4)

Income/(Loss)

5.0%

28.8%

4.9%

(6.2%)

* Indicates calculation not meaningful or

results are greater than 100%.

Third-quarter 2024 Cost of Sales(4) as a percentage of revenues

decreased by 39.0 percentage points compared to the prior-year

quarter, driven primarily by the non-recurrence of a non-cash

charge of $5.6 billion recorded in the third quarter of 2023 for

inventory write-offs and related charges ($4.7 billion for Paxlovid

and $0.9 billion for Comirnaty(3)).

Third-quarter 2024 SI&A Expenses(4) were relatively flat

operationally compared with the prior-year quarter, reflecting a

decrease due to lower U.S. healthcare reform fees primarily related

to Paxlovid and Comirnaty(3), largely offset by an increase in

spending related to marketing and promotional expenses for recently

launched and acquired products.

Third-quarter 2024 R&D Expenses(4) decreased 4%

operationally compared with the prior-year quarter, driven

primarily by lower spending on certain ongoing vaccine programs

and, to a lesser extent, lower spending as a result of our cost

realignment program, partially offset by a net increase in spending

mainly to develop certain product candidates acquired from

Seagen.

The unfavorable period-over-period change in Other

deductions—net(4) of $62 million for the third quarter of 2024,

compared with the prior-year quarter, was driven primarily by

higher net interest expense and a charge in the third quarter of

2024 related to the expected sale of one of our facilities

resulting from the discontinuation of our Duchenne muscular

dystrophy (DMD) program, partially offset by net gains on equity

securities in the third quarter of 2024 versus net losses on equity

securities in the prior-year quarter.

Pfizer’s effective tax rate on Reported(4) income for the third

quarter of 2024 is primarily a result of its jurisdictional mix of

earnings. Pfizer’s positive effective tax rate for the third

quarter of 2023 reflects a tax benefit on a pre-tax Reported(4)

loss.

Adjusted(2) Statement of Operations Highlights

SELECTED ADJUSTED(2) COSTS AND EXPENSES

($ in millions)

Third-Quarter

Nine Months

2024

2023

% Change

2024

2023

% Change

Total

Oper.

Total

Oper.

Adjusted(2) Cost of Sales

$ 4,874

$ 8,906

(45%)

(45%)

$ 10,678

$ 16,723

(36%)

(35%)

Percent of Revenues

27.5%

66.0%

N/A

N/A

23.3%

37.2%

N/A

N/A

Adjusted(2) SI&A Expenses

3,219

3,205

—

1%

10,342

9,974

4%

4%

Adjusted(2) R&D Expenses

2,561

2,679

(4%)

(4%)

7,708

7,797

(1%)

(1%)

Adjusted(2) Other

(Income)/Deductions—net

243

(128)

*

*

797

(730)

*

*

Effective Tax Rate on Adjusted(2)

Income/(Loss)

10.8%

22.3%

13.3%

10.4%

* Indicates calculation not meaningful or

results are greater than 100%.

See the reconciliations of certain Reported(4) to non-GAAP

Adjusted(2) financial measures and associated footnotes in the

financial tables section of this press release located at the

hyperlink below.

RECENT NOTABLE DEVELOPMENTS (Since July 30, 2024)

Product Developments

Product/Project

Recent Development

Link

Abrysvo

(respiratory syncytial virus

vaccine)

October 2024. Announced the U.S.

Food and Drug Administration (FDA) approved Abrysvo for the

prevention of lower respiratory tract disease (LRTD) caused by

respiratory syncytial virus (RSV) in individuals 18 through 59

years of age who are at increased risk for LRTD caused by RSV.

Abrysvo now offers the broadest RSV vaccine indication for adults,

which previously included those 60 years and older. Additionally,

it remains the only RSV immunization approved for pregnant

individuals at 32 through 36 weeks of gestation to protect infants

from birth up to 6 months of age.

Full Release

August 2024. Announced positive

top-line safety and immunogenicity results from substudy B of the

pivotal Phase 3 clinical trial (NCT05842967) MONeT (RSV

IMmunizatiON Study for AdulTs at Higher Risk of Severe Illness),

evaluating two doses of Abrysvo vaccine in immunocompromised adults

aged 18 and older at risk of developing severe RSV-associated LRTD.

Results showed Abrysvo was well-tolerated and generated strong

neutralizing responses after a single 120 µg dose in adults ≥ 18

years of age.

Full Release

Braftovi (encorafenib) +

Mektovi (binimetinib)

September 2024. Presented

longer-term follow-up results from the Phase 2 single-arm PHAROS

clinical trial evaluating the efficacy and safety of Braftovi in

combination with Mektovi for patients with BRAF V600E-mutant

metastatic non-small cell lung cancer (NSCLC) at the European

Society for Medical Oncology (ESMO) Congress 2024, in which the

combination of Braftovi + Mektovi continued to show substantial

antitumor activity after a minimum follow up of approximately three

years, and while there are no head-to-head studies, this

corresponds to the longest duration of response and

progression-free survival in treatment-naïve patients compared to

historical outcomes.

Full Release

Comirnaty(3)

(COVID-19 Vaccine,

mRNA)

September 2024. Announced the

Committee for Medicinal Products for Human Use (CHMP) of the

European Medicines Agency (EMA) recommended marketing authorization

for Pfizer and BioNTech’s Omicron KP.2-adapted monovalent COVID-19

vaccine (Comirnaty KP.2) for active immunization to prevent

COVID-19 caused by SARS-CoV-2 in individuals 6 months of age and

older. Subsequently, the European Commission (EC) authorized the

vaccine on September 27, 2024.

Full Release

August 2024. Announced the FDA

approved the supplemental Biologics License Application for Pfizer

and BioNTech’s Comirnaty(3) for individuals 12 years of age and

older and granted emergency use authorization for individuals 6

months through 11 years of age both for the companies’ Omicron

KP.2-adapted 2024-2025 Formula COVID-19 vaccine.

Full Release

Eliquis

(apixaban)

August 2024. Announced the U.S.

Department of Health and Human Services released the “maximum fair

price” (MFP) for Eliquis, which was selected in the first round of

government price setting as part of the Inflation Reduction Act

(IRA). The imposed MFP for a 30-day equivalent supply of Eliquis,

which is the price that Medicare will pay for Eliquis as of January

1, 2026, is $231.

Full Release

Hympavzi

(marstacimab-hncq)

October 2024. Announced the FDA

approved Hympavzi for routine prophylaxis to prevent or reduce the

frequency of bleeding episodes in adults and pediatric patients 12

years of age and older with hemophilia A (congenital factor VIII

deficiency) without factor VIII (FVIII) inhibitors, or hemophilia B

(congenital factor IX deficiency) without factor IX (FIX)

inhibitors. Hympavzi is Pfizer’s second hemophilia treatment to

receive FDA approval this year.

Full Release

September 2024. Announced the CHMP

of the EMA adopted a positive opinion for marstacimab for the

routine prophylaxis of bleeding episodes in adults and adolescents

12 years and older with severe hemophilia A (congenital factor VIII

[FVIII] deficiency, FVIII <1%) without FVIII inhibitors, or

severe hemophilia B (congenital factor IX [FIX] deficiency, FIX

<1%) without FIX inhibitors.

Full Release

Oxbryta (voxelotor)

September 2024. Announced the

voluntary withdrawal of all lots of Oxbryta for the treatment of

sickle cell disease (SCD) in all markets where it is approved.

Pfizer is also discontinuing all active voxelotor clinical trials

and expanded access programs worldwide. The decision is based on

the totality of clinical data that now indicates the overall

benefit of Oxbryta no longer outweighs the risk in the approved

sickle cell patient population. The data suggest an imbalance in

vaso-occlusive crises and fatal events, which requires further

assessment.

Full Release

Prevnar 20

(20-valent pneumococcal

conjugate vaccine)

October 2024. Announced the U.S.

Centers for Disease Control and Prevention’s (CDC) Advisory

Committee on Immunization Practice (ACIP) voted to expand its

recommendation for the use of certain pneumococcal vaccines,

including Prevnar 20 for all adults aged 50 and older and for

adults aged 19-49 years with certain underlying conditions or risk

factors who have not received a pneumococcal conjugate vaccine

(PCV) or whose vaccination history is unknown. This recommendation

is pending final approval by the director of the CDC and the

Department of Health and Human Services.

Full Release

Talzenna (talazoparib)

October 2024. Announced positive

topline results from the final prespecified overall survival (OS)

analysis of the TALAPRO-2 study of Talzenna, an oral poly

ADP-ribose polymerase (PARP) inhibitor, in combination with Xtandi

(enzalutamide), an androgen receptor pathway inhibitor (ARPI), in

patients with metastatic castration-resistant prostate cancer

(mCRPC). Results showed a statistically significant and clinically

meaningful improvement in the final OS in all-comers (cohort 1) as

well as in those patients with homologous recombination repair

(HRR) gene-mutated mCRPC (cohort 2), compared to Xtandi alone.

These data will be shared with global health authorities and

detailed results submitted for presentation at an upcoming medical

congress.

Full Release

Pipeline Developments

A comprehensive update of Pfizer’s development pipeline was

published today and is now available at

www.pfizer.com/science/drug-product-pipeline. It includes an

overview of Pfizer’s research and a list of compounds in

development with targeted indication and phase of development, as

well as mechanism of action for some candidates in Phase 1 and all

candidates from Phase 2 through registration.

Product/Project

Recent Development

Link

Combination COVID-19 and

Influenza vaccine candidate

August 2024. Announced Phase 3

top-line results for Pfizer and BioNTech’s combination mRNA vaccine

candidate against influenza and COVID-19 in healthy individuals

18-64 years of age. The trial did not meet one of its primary

immunogenicity objectives of non-inferiority against the influenza

B strain despite obtaining higher influenza A responses and

comparable COVID-19 responses versus the comparator vaccines. The

companies are evaluating adjustments to the candidate and are

discussing next steps with health authorities.

Full Release

ponsegromab

September 2024. Presented data from

the Phase 2 study of ponsegromab, a monoclonal antibody directed

against growth differentiation factor-15 (GDF-15), in people with

cancer cachexia and elevated levels of GDF-15 at ESMO Congress

2024. The data were also simultaneously published in The New

England Journal of Medicine. The study met its primary endpoint of

change from baseline in body weight for ponsegromab compared to

placebo across all ponsegromab doses tested, reaching 5.6% mean

increase at the highest dose evaluated at 12 weeks. At the highest

dose evaluated, improvements were seen from baseline in appetite

and cachexia symptoms, physical activity, and muscle mass.

Ponsegromab was generally considered safe and well-tolerated at all

dose levels in the study. Pfizer is discussing late-stage

development plans with regulators with the goal of starting

registration-enabling studies in 2025. Ponsegromab is also being

investigated in a Phase 2 study in patients with heart failure and

elevated serum GDF-15 concentrations (NCT05492500).

Full Release

Trivalent Influenza vaccine

candidate

August 2024. Announced data from a

Phase 2 trial with second-generation trivalent (tIRV) influenza

mRNA vaccine candidates which showed encouraging data demonstrating

robust immunogenicity in individuals 18-64 years of age. The tIRV

formulations elicited robust influenza A and B responses, including

continued trend of higher influenza A responses versus a licensed

influenza vaccine. No safety signals were reported in the trial.

Pfizer will continue to evaluate its influenza vaccine program and

discuss next steps with health authorities.

Full Release

VLA15

(Lyme vaccine

candidate)

September 2024. Valneva and Pfizer

announced positive immunogenicity and safety data from a Phase 2

study following a second booster vaccination of their Lyme disease

vaccine candidate, VLA15, given one year after receiving the first

booster dose. The immune response and safety profile of VLA15 one

month after receiving the second booster dose were similar to those

reported after receiving the first booster dose, showing

compatibility with the anticipated benefit of a booster vaccination

prior to each Lyme season. There are currently no approved human

vaccines for Lyme disease, and VLA15 is the Lyme disease vaccine

candidate which has advanced the furthest along the clinical

development timeline, with two Phase 3 trials in progress.

Full Release

Corporate Developments

Topic

Recent Development

Link

Board Election

October 2024. Announced Tim Buckley

was elected to Pfizer’s Board of Directors. Mr. Buckley was also

appointed to and will join the Governance and Sustainability

Committee and the Audit Committee of Pfizer’s Board of

Directors.

Full Release

Haleon Stock Sale

October 2024. Pfizer sold 640

million ordinary shares of its investment in Haleon to

institutional investors and sold 60.5 million Haleon ordinary

shares directly to Haleon for total net consideration of

approximately $3.5 billion. After the share sale, Pfizer’s

ownership interest in Haleon was reduced from approximately 23% to

approximately 15%.

N/A

“PfizerForAll”

August 2024. Introduced

PfizerForAll™, a user-friendly digital platform designed to make

access to healthcare and managing health and wellness more seamless

for people across the U.S. The new, end-to-end experience will

support Americans affected by common illnesses like migraine,

COVID-19 or flu and those seeking to protect themselves with adult

vaccinations. By bringing together critical resources and services

into a single destination, PfizerForAll helps individuals and their

families cut down on the time and steps needed to take important

health actions like getting care, filling prescriptions, and

finding potential savings on Pfizer medicines.

Full Release

Please find Pfizer’s press release and associated financial

tables, including reconciliations of certain GAAP reported to

non-GAAP adjusted information, at the following hyperlink:

https://investors.pfizer.com/Q3-2024-PFE-Earnings-Release

(Note: If clicking on the above link does not open a new

webpage, you may need to cut and paste the above URL into your

browser's address bar.)

For additional details, see the attached financial schedules

and product revenue tables attached to the press release located at

the hyperlink above, and the attached disclosure notice.

(1)

Pfizer does not provide guidance

for GAAP Reported financial measures (other than revenues) or a

reconciliation of forward-looking non-GAAP financial measures to

the most directly comparable GAAP Reported financial measures on a

forward-looking basis because it is unable to predict with

reasonable certainty the ultimate outcome of unusual gains and

losses, certain acquisition-related expenses, gains and losses from

equity securities, actuarial gains and losses from pension and

postretirement plan remeasurements, potential future asset

impairments and pending litigation without unreasonable effort.

These items are uncertain, depend on various factors, and could

have a material impact on GAAP Reported results for the guidance

period.

Financial guidance for full-year

2024 reflects the following:

- Does not assume the completion of any business development

transactions not completed as of September 29, 2024.

- An anticipated immaterial impact in fiscal-year 2024 of recent

and expected generic and biosimilar competition for certain

products that have recently lost patent or regulatory protection or

that are anticipated to lose patent or regulatory protection.

- Exchange rates assumed are a blend of actual rates in effect

through third-quarter 2024 and mid-October 2024 rates for the

remainder of the year. Financial guidance reflects the anticipated

unfavorable impact of approximately $0.3 billion on revenues and no

impact on Adjusted(2) diluted EPS as a result of changes in foreign

exchange rates relative to the U.S. dollar compared to foreign

exchange rates from 2023.

- Guidance for Adjusted(2) diluted EPS assumes diluted

weighted-average shares outstanding of approximately 5.7 billion

shares, and assumes no share repurchases in 2024.

- Guidance assumes the seasonal cadence of certain products in

our portfolio, and that Paxlovid results trend with infection

rates.

(2)

Adjusted income/(loss) and

Adjusted diluted EPS/(LPS) are defined as U.S. GAAP net

income/(loss) attributable to Pfizer Inc. common shareholders and

U.S. GAAP diluted EPS/(LPS) attributable to Pfizer Inc. common

shareholders before the impact of amortization of intangible

assets, certain acquisition-related items, discontinued operations

and certain significant items. See the reconciliations of certain

GAAP Reported to Non-GAAP Adjusted information for the third

quarter and the first nine months of 2024 and 2023 in the press

release located at the hyperlink above. Adjusted income/(loss) and

its components and Adjusted diluted EPS/(LPS) measures are not, and

should not be viewed as, substitutes for U.S. GAAP net

income/(loss) and its components and diluted EPS/(LPS)(4). See the

Non-GAAP Financial Measure: Adjusted Income section of Management’s

Discussion and Analysis of Financial Condition and Results of

Operations in Pfizer’s 2023 Annual Report on Form 10-K and the

accompanying Non-GAAP Financial Measure: Adjusted Income/(Loss)

section of the press release located at the hyperlink above for a

definition of each component of Adjusted income/(loss) as well as

other relevant information.

(3)

As used in this document,

“Comirnaty” refers to, as applicable, and as authorized or

approved, the Pfizer-BioNTech COVID-19 Vaccine; Comirnaty (COVID-19

Vaccine, mRNA) original monovalent formula; the Pfizer-BioNTech

COVID-19 Vaccine, Bivalent (Original and Omicron BA.4/BA.5); the

Pfizer-BioNTech COVID-19 Vaccine (2023-2024 Formula); Comirnaty

(COVID-19 Vaccine, mRNA) 2023-2024 Formula; Comirnaty (COVID-19

Vaccine, mRNA) 2024-2025 Formula; Comirnaty Original/Omicron BA.1;

Comirnaty Original/Omicron BA.4/BA.5; Comirnaty Omicron XBB.1.5;

Comirnaty JN.1 and Comirnaty KP.2. “Comirnaty” includes product

revenues and alliance revenues related to sales of the

above-mentioned vaccines.

(4)

Revenues is defined as revenues

in accordance with U.S. generally accepted accounting principles

(GAAP). Reported net income/(loss) and its components are defined

as net income/(loss) attributable to Pfizer Inc. common

shareholders and its components in accordance with U.S. GAAP.

Reported diluted earnings per share (EPS) and reported diluted loss

per share (LPS) are defined as diluted EPS or LPS attributable to

Pfizer Inc. common shareholders in accordance with U.S. GAAP.

(5)

The targeted $4 billion in net

cost savings is calculated versus the midpoint of Pfizer’s 2023

SI&A and R&D expense guidance provided on August 1, 2023.

As an additional reference, see the ‘2024 Financial Guidance’

section of Pfizer’s fourth-quarter 2023 earnings release.

(6)

References to operational

variances in this press release pertain to period-over-period

changes that exclude the impact of foreign exchange rates. Although

foreign exchange rate changes are part of Pfizer’s business, they

are not within Pfizer’s control and because they can mask positive

or negative trends in the business, Pfizer believes presenting

operational variances excluding these foreign exchange changes

provides useful information to evaluate Pfizer’s results.

(7)

Pfizer’s fiscal year-end for

international subsidiaries is November 30 while Pfizer’s fiscal

year-end for U.S. subsidiaries is December 31. Therefore, Pfizer’s

third quarter and first nine months for U.S. subsidiaries reflects

the three and nine months ended on September 29, 2024 and October

1, 2023, while Pfizer’s third quarter and first nine months for

subsidiaries operating outside the U.S. reflects the three and nine

months ended on August 25, 2024 and August 27, 2023.

DISCLOSURE NOTICE: Except where otherwise noted, the information

contained in this earnings release and the related attachments is

as of October 29, 2024. We assume no obligation to update any

forward-looking statements contained in this earnings release and

the related attachments as a result of new information or future

events or developments.

This earnings release and the related attachments contain

forward-looking statements about, among other topics, our

anticipated operating and financial performance, including

financial guidance and projections; reorganizations; business

plans, strategy, goals and prospects; expectations for our product

pipeline, in-line products and product candidates, including

anticipated regulatory submissions, data read-outs, study starts,

approvals, launches, clinical trial results and other developing

data, revenue contribution and projections, potential pricing and

reimbursement, potential market dynamics, including demand, market

size and utilization rates and growth, performance, timing of

exclusivity and potential benefits; strategic reviews; capital

allocation objectives; an enterprise-wide cost realignment program,

which we launched in October 2023 (including anticipated costs,

savings and potential benefits); a Manufacturing Optimization

Program to reduce our cost of goods sold, which we announced in May

2024 (including anticipated costs, savings and potential benefits);

dividends and share repurchases; plans for and prospects of our

acquisitions, dispositions and other business development

activities, including our December 2023 acquisition of Seagen, and

our ability to successfully capitalize on growth opportunities and

prospects; manufacturing and product supply; our ongoing efforts to

respond to COVID-19, including our plans and expectations regarding

Comirnaty (as defined in this earnings release) and our oral

COVID-19 treatment (Paxlovid); our expectations regarding the

impact of COVID-19 on our business, operations and financial

results; and our Environmental, Social and Governance (ESG)

priorities, strategies and goals. Given their forward-looking

nature, these statements involve substantial risks, uncertainties

and potentially inaccurate assumptions and we cannot assure that

any outcome expressed in these forward-looking statements will be

realized in whole or in part. You can identify these statements by

the fact that they use future dates or use words such as “will,”

“may,” “could,” “likely,” “ongoing,” “anticipate,” “estimate,”

“expect,” “project,” “intend,” “plan,” “believe,” “assume,”

“target,” “forecast,” “guidance,” “goal,” “objective,” “aim,”

“seek,” “potential,” “hope” and other words and terms of similar

meaning. Pfizer’s financial guidance is based on estimates and

assumptions that are subject to significant uncertainties.

Among the factors that could cause actual results to differ

materially from past results and future plans and projected future

results are the following:

Risks Related to Our Business, Industry

and Operations, and Business Development:

- the outcome of research and development (R&D) activities,

including, the ability to meet anticipated pre-clinical or clinical

endpoints, commencement and/or completion dates for our

pre-clinical or clinical trials, regulatory submission dates,

and/or regulatory approval and/or launch dates; the possibility of

unfavorable pre-clinical and clinical trial results, including the

possibility of unfavorable new pre-clinical or clinical data and

further analyses of existing pre-clinical or clinical data; risks

associated with preliminary, early stage or interim data; the risk

that pre-clinical and clinical trial data are subject to differing

interpretations and assessments, including during the peer

review/publication process, in the scientific community generally,

and by regulatory authorities; whether and when additional data

from our pipeline programs will be published in scientific journal

publications and, if so, when and with what modifications and

interpretations; and uncertainties regarding the future development

of our product candidates, including whether or when our product

candidates will advance to future studies or phases of development

or whether or when regulatory applications may be filed for any of

our product candidates;

- our ability to successfully address comments received from

regulatory authorities such as the FDA or the EMA, or obtain

approval for new products and indications from regulators on a

timely basis or at all;

- regulatory decisions impacting labeling, including the scope of

indicated patient populations, product dosage, manufacturing

processes, safety and/or other matters, including decisions

relating to emerging developments regarding potential product

impurities; uncertainties regarding the ability to obtain, and the

scope of, recommendations by technical or advisory committees; and

the timing of, and ability to obtain, pricing approvals and product

launches, all of which could impact the availability or commercial

potential of our products and product candidates;

- claims and concerns that may arise regarding the safety or

efficacy of in-line products and product candidates, including

claims and concerns that may arise from the conduct or outcome of

post-approval clinical trials, pharmacovigilance or Risk Evaluation

and Mitigation Strategies, which could impact marketing approval,

product labeling, and/or availability or commercial potential;

- the success and impact of external business development

activities, such as the December 2023 acquisition of Seagen,

including the ability to identify and execute on potential business

development opportunities; the ability to satisfy the conditions to

closing of announced transactions in the anticipated time frame or

at all; the ability to realize the anticipated benefits of any such

transactions in the anticipated time frame or at all; the potential

need for and impact of additional equity or debt financing to

pursue these opportunities, which has in the past and could in the

future result in increased leverage and/or a downgrade of our

credit ratings and could limit our ability to obtain future

financing; challenges integrating the businesses and operations;

disruption to business and operations relationships; risks related

to growing revenues for certain acquired or partnered products;

significant transaction costs; and unknown liabilities;

- competition, including from new product entrants, in-line

branded products, generic products, private label products,

biosimilars and product candidates that treat or prevent diseases

and conditions similar to those treated or intended to be prevented

by our in-line products and product candidates;

- the ability to successfully market both new and existing

products, including biosimilars;

- difficulties or delays in manufacturing, sales or marketing;

supply disruptions, shortages or stock-outs at our facilities or

third-party facilities that we rely on; and legal or regulatory

actions;

- the impact of public health outbreaks, epidemics or pandemics

(such as COVID-19) on our business, operations and financial

condition and results, including impacts on our employees,

manufacturing, supply chain, sales and marketing, R&D and

clinical trials;

- risks and uncertainties related to our efforts to continue to

develop and commercialize Comirnaty and Paxlovid or any potential

future COVID-19 vaccines, treatments or combinations, as well as

challenges related to their manufacturing, supply and distribution,

including, among others, the risk that as the market for COVID-19

products continues to become more endemic and seasonal, demand for

our COVID-19 products has and may continue to be reduced or not

meet expectations, or may no longer exist, which has and may

continue to lead to reduced revenues, excess inventory on-hand

and/or in the channel which, for Paxlovid and Comirnaty, resulted

in significant inventory write-offs in 2023 and could continue to

result in inventory write-offs, or other unanticipated charges;

risks related to our ability to develop and commercialize variant

adapted vaccines; challenges related to the transition to the

commercial market for our COVID-19 products; uncertainties related

to the public’s adherence to vaccines, boosters, treatments or

combinations; risks related to our ability to accurately predict or

achieve our revenue forecasts for Comirnaty and Paxlovid or any

potential future COVID-19 vaccines or treatments; and potential

third-party royalties or other claims related to Comirnaty or

Paxlovid;

- trends toward managed care and healthcare cost containment, and

our ability to obtain or maintain timely or adequate pricing or

favorable formulary placement for our products;

- interest rate and foreign currency exchange rate fluctuations,

including the impact of currency devaluations and monetary policy

actions in countries experiencing high inflation or deflation

rates;

- any significant issues involving our largest wholesale

distributors or government customers, which account for a

substantial portion of our revenues;

- the impact of the increased presence of counterfeit medicines,

vaccines or other products in the pharmaceutical supply chain;

- any significant issues related to the outsourcing of certain

operational and staff functions to third parties;

- any significant issues related to our JVs and other third-party

business arrangements, including modifications or disputes related

to supply agreements or other contracts with customers including

governments or other payors;

- uncertainties related to general economic, political, business,

industry, regulatory and market conditions including, without

limitation, uncertainties related to the impact on us, our

customers, suppliers and lenders and counterparties to our

foreign-exchange and interest-rate agreements of challenging global

economic conditions, such as inflation or interest rate

fluctuations, and recent and possible future changes in global

financial markets;

- the exposure of our operations globally to possible capital and

exchange controls, economic conditions, expropriation, sanctions

and/or other restrictive government actions, changes in

intellectual property legal protections and remedies, unstable

governments and legal systems and inter-governmental disputes;

- the impact of disruptions related to climate change and natural

disasters, including uncertainties related to the impact of the

tornado at our manufacturing facility in Rocky Mount, NC in

2023;

- any changes in business, political and economic conditions due

to actual or threatened terrorist activity, geopolitical

instability, political or civil unrest or military action,

including the ongoing conflicts between Russia and Ukraine and in

the Middle East and the resulting economic or other

consequences;

- the impact of product recalls, withdrawals and other unusual

items, including uncertainties related to regulator-directed risk

evaluations and assessments, such as our ongoing evaluation of our

product portfolio for the potential presence or formation of

nitrosamines, and our voluntary withdrawal of all lots of Oxbryta

in all markets where it is approved and any potential regulatory or

other impact on other sickle cell disease assets;

- trade buying patterns;

- the risk of an impairment charge related to our intangible

assets, goodwill or equity-method investments;

- the impact of, and risks and uncertainties related to,

restructurings and internal reorganizations, as well as any other

corporate strategic initiatives and growth strategies, and

cost-reduction and productivity initiatives, including any

potential future phases, each of which requires upfront costs but

may fail to yield anticipated benefits and may result in unexpected

costs, organizational disruption, adverse effects on employee

morale, retention issues or other unintended consequences;

- the ability to successfully achieve our climate goals and

progress our environmental sustainability and other ESG

priorities;

Risks Related to Government Regulation and

Legal Proceedings:

- the impact of any U.S. healthcare reform or legislation or any

significant spending reduction or cost control efforts affecting

Medicare, Medicaid or other publicly funded or subsidized health

programs, including the Inflation Reduction Act of 2022, or changes

in the tax treatment of employer-sponsored health insurance that

may be implemented;

- U.S. federal or state legislation or regulatory action and/or

policy efforts affecting, among other things, pharmaceutical

product pricing, intellectual property, reimbursement or access or

restrictions on U.S. direct-to-consumer advertising; limitations on

interactions with healthcare professionals and other industry

stakeholders; as well as pricing pressures for our products as a

result of highly competitive biopharmaceutical markets;

- legislation or regulatory action in markets outside of the

U.S., such as China or Europe, including, without limitation, laws

related to pharmaceutical product pricing, intellectual property,

medical regulation, environmental protections, reimbursement or

access, including, in particular, continued government-mandated

reductions in prices and access restrictions for certain

biopharmaceutical products to control costs in those markets;

- legal defense costs, insurance expenses, settlement costs and

contingencies, including without limitation, those related to legal

proceedings and actual or alleged environmental contamination;

- the risk and impact of an adverse decision or settlement and

risk related to the adequacy of reserves related to legal

proceedings;

- the risk and impact of tax related litigation and

investigations;

- governmental laws and regulations affecting our operations,

including, without limitation, the Inflation Reduction Act of 2022,

changes in laws and regulations or their interpretation, including,

among others, changes in tax laws and regulations internationally

and in the U.S., the adoption of global minimum taxation

requirements outside the U.S. generally effective in most

jurisdictions since January 1, 2024, and potential changes to

existing tax laws following the November 2024 U.S. elections;

Risks Related to Intellectual Property,

Technology and Security:

- any significant breakdown or interruption of our information

technology systems and infrastructure (including cloud

services);

- any business disruption, theft of confidential or proprietary

information, security threats on facilities or infrastructure,

extortion or integrity compromise resulting from a cyber-attack,

which may include those using adversarial artificial intelligence

techniques, or other malfeasance by, but not limited to, nation

states, employees, business partners or others;

- risks and challenges related to the use of software and

services that include artificial intelligence-based functionality

and other emerging technologies;

- the risk that our currently pending or future patent

applications may not be granted on a timely basis or at all, or any

patent-term extensions that we seek may not be granted on a timely

basis, if at all; and

- risks to our products, patents and other intellectual property,

such as: (i) claims of invalidity that could result in patent

revocation; (ii) claims of patent infringement, including asserted

and/or unasserted intellectual property claims; (iii) claims we may

assert against intellectual property rights held by third parties;

(iv) challenges faced by our collaboration or licensing partners to

the validity of their patent rights; or (v) any pressure, or legal

or regulatory action by, various stakeholders or governments that

could potentially result in us not seeking intellectual property

protection or agreeing not to enforce or being restricted from

enforcing intellectual property rights related to our products,

including Comirnaty and Paxlovid.

Should known or unknown risks or uncertainties materialize or

should underlying assumptions prove inaccurate, actual results

could vary materially from past results and those anticipated,

estimated or projected. Investors are cautioned not to put undue

reliance on forward-looking statements. A further list and

description of risks, uncertainties and other matters can be found

in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 and in our subsequent reports on Form 10-Q, in

each case including in the sections thereof captioned

“Forward-Looking Information and Factors That May Affect Future

Results” and “Item 1A. Risk Factors,” and in our subsequent reports

on Form 8-K.

This earnings release may include discussion of certain clinical

studies relating to various in-line products and/or product

candidates. These studies typically are part of a larger body of

clinical data relating to such products or product candidates, and

the discussion herein should be considered in the context of the

larger body of data. In addition, clinical trial data are subject

to differing interpretations, and, even when we view data as

sufficient to support the safety and/or effectiveness of a product

candidate or a new indication for an in-line product, regulatory

authorities may not share our views and may require additional data

or may deny approval altogether.

The information contained on our website or any third-party

website is not incorporated by reference into this earnings

release. All trademarks mentioned are the property of their

owners.

Certain of the products and product candidates discussed in this

earnings release are being co-researched, co-developed and/or

co-promoted in collaboration with other companies for which

Pfizer’s rights vary by market or are the subject of agreements

pursuant to which Pfizer has commercialization rights in certain

markets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029363831/en/

Media

PfizerMediaRelations@Pfizer.com 212.733.1226

Investors IR@Pfizer.com

212.733.4848

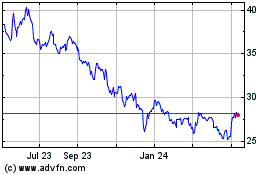

Pfizer (NYSE:PFE)

Historical Stock Chart

From Dec 2024 to Jan 2025

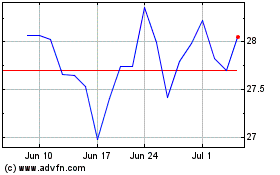

Pfizer (NYSE:PFE)

Historical Stock Chart

From Jan 2024 to Jan 2025