false

0000091847

SOURCE CAPITAL INC /DE/

0000091847

2024-11-19

2024-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): November 19, 2024

SOURCE CAPITAL, INC.

(Exact name of Registrant as specified

in its charter)

Delaware

(State or other jurisdiction of

incorporation)

| 811-1731 |

95-2559370 |

| (Commission File Number) |

(I.R.S. Employer Identification No.) |

235 West Galena Street

Milwaukee, WI 53212-3948

(Address of principal executive

offices, zip code)

Registrant’s telephone number, including area code: (626) 385-5777

Not Applicable

(Former name or former address,

if changed since last report.)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule13e-4(c) under the Exchange Act (17CFR 240.13e-4(c)) |

Item 8.01 Other Events

The Board of Directors of Source Capital, Inc.

(the “Fund”) announced that it will reorganize into a Delaware Trust after the close of business on December 31, 2024,

under the terms and conditions approved by shareholders at the Annual Meeting held in July 2024. Upon the reorganization, the Fund’s

name will change to “Source Capital” and it will continue to trade on the NYSE under the SOR ticker. The Fund also announced

that a special year-end distribution will be required for 2024. This year the special year-end distribution will still be taxable for

2024 but declared at or near the end of December paid in early January 2025. These matters are more fully described in the press

release published on November 19, 2024, which is attached to this Current Report on Form 8-K as Exhibit 99.1

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Source Capital, Inc. |

| |

|

| Dated: November 19,

2024 |

/s/

Diane J. Drake |

| |

Name: Diane J. Drake |

| |

Title: Secretary |

Exhibit 99.1

Source Capital, Inc. Announces Reorganization Date and

Timing for Special Year-End Distribution

LOS ANGELES, November 19, 2024---

Source Capital, Inc. (NYSE: SOR) (the “Fund”), announced that it will reorganize into a Delaware Trust after the close of

business on December 31, 2024, under the terms and conditions approved by shareholders at the Annual Meeting held in July 2024. Upon the

reorganization, the Fund’s name will change to “Source Capital” but will continue to trade on the NYSE under the SOR

ticker.

The Fund also announced

that a special year-end distribution will be required for 2024. Due to the timing of the reorganization, the special year-end distribution

will be declared at or near the end of December and paid in early January 2025. The distribution will be taxable in 2024 and is estimated

to be approximately 1%-3% of net asset value. In future years, should a special year-end distribution be required, the Fund expects to

return to its past practice of declaring and paying at the same time as the regular monthly distribution in December.

About Source Capital, Inc.

Source Capital, Inc. is a closed-end

investment company managed by First Pacific Advisors, LP. Its shares are listed on the New York Stock Exchange under the symbol “SOR.”

The investment objective of the Fund is to seek maximum total return for shareholders from both capital appreciation and investment income

to the extent consistent with protection of invested capital. The Fund may invest in longer duration assets like dividend paying equities

and illiquid assets like private loans in pursuit of its investment objective and is thus intended only for those investors with a long-term

investment horizon (greater than or equal to ~5 years).

You can obtain additional

information by visiting the website at fpa.com, by email at crm@fpa.com, toll free by calling 1-800-982-4372, or by contacting

the Fund in writing.

Important Disclosures

Investments contain risk and may

lose value. You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before you invest.

Distributions may include the

net income from dividends and interest earned by fund securities, net capital gains, or in certain cases it may include a return of capital.

The Fund may also pay a special distribution at the end of a calendar year to comply with federal tax requirements. All mutual funds,

including closed-end funds, periodically distribute profits they earn to investors. By law, if a fund has net gains from the sale of securities,

or if it earns dividends and interest from securities, it must pass substantially all of those earnings to its shareholders or it will

be subject to corporate income taxes and excise taxes. These taxes would, in effect, reduce investors' total return.

The Fund’s distributions

in any period may be more or less than the net return earned by the Fund on its investments, and therefore should not be used as a measure

of performance or confused with “yield” or “income.” A return of capital is not taxable; rather it reduces a shareholder’s

tax basis in his or her shares of the Fund. If the Fund estimates that a portion of its distribution may be comprised of amounts from

sources other than net investment income, the Fund will notify shareholders of the estimated composition of such distribution through

a separate written Section 19 notice. Such notices are provided for informational purposes only, and should not be used for tax reporting

purposes. Final tax characteristics of all Fund distributions will be provided on Form 1099-DIV, which is mailed after the close of the

calendar year.

It is important to note that differences

exist between the Fund’s daily internal accounting records and practices, the Fund’s financial statements prepared in accordance

with U.S. GAAP, and recordkeeping practices under income tax regulations. Please see the Fund’s most recent shareholder reports

for more detailed tax information.

The Fund’s distribution

rate may be affected by numerous factors, including changes in realized and projected market returns, Fund performance, and other factors.

There can be no assurance that a change in market conditions or other factors will not result in a change in the Fund’s distribution

rate at a future time.

As with any stock, the price of

the Fund’s common shares will fluctuate with market conditions and other factors. Shares of closed-end management investment companies

frequently trade at a price that is less than (a “discount”) or more than (a “premium”) their net asset value.

If the Fund’s shares trade at a premium to net asset value, there is no assurance that any such premium will be sustained for any

period of time and will not decrease, or that the shares will not trade at a discount to net asset value thereafter.

The Fund’s portfolio

statistics and performance as of the most recent quarter end are available by visiting the website at https://fpa.com/funds/overview/source-capital,

by email at crm@fpa.com, toll free by calling 1-800-279-1241 (option 1), or by contacting the Fund in writing.

This press release shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer,

solicitation or sale would be unlawful under the securities laws of any such state. In the event of a tender offer, there may be tax consequences

for a stockholder. For example, a stockholder may owe capital gains taxes on any increase in the value of the shares over your original

cost.

Investments, including investments

in closed-end funds, carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in

response to adverse issuer, political, regulatory, market, or economic developments. It is important to remember that there are risks

inherent in any investment and there is no assurance that any investment or asset class will provide positive performance over time. Value

style investing presents the risk that the holdings or securities may never reach our estimate of intrinsic value because the market fails

to recognize what the portfolio management team considers the true business value or because the portfolio management team has misjudged

those values. In addition, value style investing may fall out of favor and underperform growth or other style investing during given periods.

Non-U.S. investing presents additional risks, such as the potential for adverse political, currency, economic, social or regulatory developments

in a country, including lack of liquidity, excessive taxation, and differing legal and accounting standards. Non-U.S. securities, including

American Depository Receipts (ADRs) and other depository receipts, are also subject to interest rate and currency exchange rate risks.

Fixed income instruments are subject

to interest rate, inflation and credit risks. Such investments may be secured, partially secured or unsecured and may be unrated, and

whether or not rated, may have speculative characteristics. The market price of the Fund’s fixed income investments will change

in response to changes in interest rates and other factors. Generally, when interest rates rise, the values of fixed income instruments

fall, and vice versa. Certain fixed income instruments are subject to prepayment risk and/or default risk.

Private placement securities are

securities that are not registered under the federal securities laws, and are generally eligible for sale only to certain eligible investors.

Private placements may be illiquid, and thus more difficult to sell, because there may be relatively few potential purchasers for such

investments, and the sale of such investments may also be restricted under securities laws.

The Fund may use leverage. While

the use of leverage may help increase the distribution and return potential of the Fund, it also increases the volatility of the Fund’s

net asset value (NAV), and potentially increases volatility of its distributions and market price. There are costs associated with the

use of leverage, including ongoing dividend and/or interest expenses. There also may be expenses for issuing or administering leverage.

Leverage changes the Fund’s capital structure through the issuance of preferred shares and/or debt, both of which are senior to

the common shares in priority of claims. If short-term interest rates rise, the cost of leverage will increase and likely will reduce

returns earned by the Fund’s common stockholders.

This material has been distributed

for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy

or investment product. No part of this material may be reproduced in any form, or referred to in any other publication, without express

written permission.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

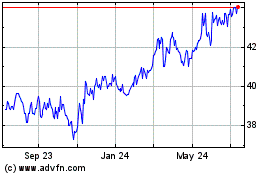

Source Capital (NYSE:SOR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Source Capital (NYSE:SOR)

Historical Stock Chart

From Mar 2024 to Mar 2025