UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

Pursuant

to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the month of February 2025

Commission

File Number: 001-35829

Vermilion

Energy Inc.

(Exact

name of registrant as specified in its charter)

3500,

520 – 3rd Avenue S.W., Calgary, Alberta T2P 0R3

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

VERMILION

ENERGY INC.

| |

|

|

| By: |

|

/s/ Lars Glemser |

| Title: |

|

Lars Glemser, VP and Chief Financial Officer |

Date: February 26, 2025

Exhibit 99.1

Vermilion Energy Inc. Announces Closing of the

Acquisition of Westbrick Energy Ltd. and Confirms Q4 2024 Release Date and Conference Call Details

CALGARY, AB, Feb. 26, 2025 /CNW/ - Vermilion

Energy Inc. ("Vermilion" or the "Company") (TSX: VET) (NYSE: VET) is pleased to announce the closing of the acquisition

of Westbrick Energy Ltd. ("Westbrick") pursuant to the terms of the previously announced arrangement agreement (the "Arrangement

Agreement" or the "Acquisition") dated December 22, 2024.

The Acquisition adds stable annual production of 50,000

boe/d(1) (75% gas and 25% liquids) and approximately 1.1 million (770,000 net) acres of land in the southeast portion of the

Deep Basin trend in Alberta, and includes four operated gas plants with total capacity of 102 mmcf/d. This footprint is contiguous and

complementary to Vermilion's legacy Deep Basin assets, providing significant operational and corporate synergies. Vermilion has identified

over 700 future drilling locations on the acquired acreage, across multiple zones including the Ellerslie, Notikewin, Rock Creek, Falher,

Cardium, Wilrich and Niton formations, with half-cycle IRRs ranging from 40% to over 100% based on estimates provided by McDaniel &

Associates Consultants Ltd ("McDaniel")(2). With this depth and quality of inventory, Vermilion expects the acquired

assets to have the ability to maintain flat production for over 15 years while generating significant free cash flow(3) to

enhance the Company's long-term return of capital framework.

Included in the Arrangement Agreement was an option

for Westbrick shareholders to elect to receive up to a maximum of 1.7 million Vermilion common shares not to exceed $25 million in value

as a portion of the total consideration. Certain shareholders of Westbrick have elected to receive Vermilion common shares totaling 1.1

million shares at a value of $14.2 million. The remainder of the consideration for the Acquisition will be paid in cash, funded through

cash on hand, Vermilion's new $450 million term loan, and Vermilion's undrawn $1.35 billion revolving credit facility.

Vermilion will provide updated 2025 budget and financial

guidance reflecting the increased scale of the Company following the Acquisition with the release of its Q4 2024 results on March 5, 2025.

Q4 2024 Release Date and Conference Call Details

Vermilion will release its 2024 fourth quarter and

year-end operating and financial results, along with its 2024 reserves information on Wednesday, March 5, 2025, after the close of

North American markets. The audited financial statements, management discussion and analysis, and annual information form for the year

ended December 31, 2024 will be available on the System for Electronic Document Analysis and Retrieval ("SEDAR+")

at www.sedarplus.ca, on EDGAR at www.sec.gov/edgar.shtml, and on Vermilion's website at www.vermilionenergy.com.

Vermilion will discuss these results in a conference

call and webcast presentation on Thursday, March 6, 2025 at 9:00 AM MST (11:00 AM EST). To participate, call 1-888-510-2154 (Canada and

US Toll Free) or 1-437-900-0527 (International and Toronto Area). A recording of the conference call will be available for replay by calling

1-888-660-6345 (Canada and US Toll Free) or 1-289-819-1450 (International and Toronto Area) and using conference replay entry code 30435#

from March 6, 2025 at 12:00 PM MST to March 20, 2025 at 12:00 PM MST.

To join the conference call without operator assistance,

you may register and enter your phone number at https://emportal.ink/3QfWLEa to receive an instant automated call back. You may also

access the webcast at https://app.webinar.net/ABa84Bo0jdz. The webcast links, along with conference call slides, will be available

on Vermilion's website at https://www.vermilionenergy.com/invest-with-us/events-presentations/ under Upcoming Events prior to the

conference call. Participants who would like to submit questions ahead of time may do so by emailing investor_relations@vermilionenergy.com.

| (1) |

Anticipated 2025 production from acquired assets, based on company estimates at February 26, 2025. Full year production estimates may not align with Company 2025 guidance, which will reflect post-close production contributions. |

| (2) |

Estimated gross proved, developed and producing, total proved, and total proved plus probable reserves as evaluated by McDaniel & Associates Consultants Ltd. ("McDaniel") in a report dated December 17, 2024, with an effective date of November 30, 2024 (the "McDaniel Reserves Report"). Three consultant average October 1, 2024 pricing assumptions used in reserve estimates as follows: 2025 WTI US$72.00/bbl, AECO C$2.50/mmbtu, CAD/USD FX rate 0.747; 2026 WTI US$74.98/bbl, AECO C$3.36/mmbtu, CAD/USD FX rate 0.753; 2027 WTI US$76.65/bbl, AECO C$3.62/mmbtu, CAD/USD FX rate 0.753. |

| (3) |

Free cash flow ("FCF") is a non-GAAP financial measure comparable to cash flows from operating activities. FCF is comprised of fund flows from operations less drilling and development and exploration and evaluation expenditures. For further information refer to the "Non-GAAP Financial Measures and Other Specified Financial Measures" section in Vermilion's MD&A for the three and nine months ended September 30, 2024, available on SEDAR+ at www.sedarplus.ca. |

About Vermilion

Vermilion is a global gas producer that seeks to create

value through the acquisition, exploration, development and optimization of producing assets in North America, Europe and Australia. The

Company's business model emphasizes free cash flow generation and returning capital to investors when economically warranted, augmented

by value-adding acquisitions. Vermilion's operations are focused on the exploitation of light oil and liquids-rich natural gas conventional

and unconventional resource plays in North America and the exploration and development of conventional natural gas and oil opportunities

in Europe and Australia.

Vermilion's priorities are health and safety, the

environment, and profitability, in that order. Nothing is more important than the safety of the public and those who work with Vermilion,

and the protection of the natural surroundings. In addition, the Company emphasizes strategic community investment in each of its operating

areas.

Vermilion trades on the Toronto Stock Exchange and

the New York Stock Exchange under the symbol VET.

Disclaimer

Certain statements included or incorporated by reference

in this document may constitute forward-looking statements or information under applicable securities legislation. Such forward-looking

statements or information typically contain statements with words such as "anticipate", "believe", "expect",

"plan", "intend", "estimate", "propose", or similar words suggesting future outcomes or statements

regarding an outlook. Forward looking statements or information in this document may include, but are not limited to: statements regarding

the expected impacts of completing the Acquisition; well production timing and expected production rates and financial returns, including

half-cycle internal rate of return, therefrom, including related to the Acquisition; wells expected to be drilled in 2025, 2026 and beyond,

including as a result of the Acquisition; exploration and development plans and the timing thereof, including as a result of the Acquisition;

Vermilion's debt capacity, including the availability of funds under financing arrangements that Vermilion has negotiated in connection

with the Acquisition and its ability to meet draw down conditions applicable to such financing, and Vermilion's ability to manage debt

and leverage ratios and raise additional debt; future production levels and the timing thereof, including Vermilion's 2025 guidance, and

rates of average annual production growth, including Vermilion's ability to maintain or grow production; future production weighting,

including weighting for product type or geography; estimated volumes of reserves and resources, including with respect to those reserves

and resources acquired pursuant to the Acquisition; statements regarding the return of capital; the flexibility of Vermilion's capital

program and operations; business strategies and objectives; operational and financial performance, including the ability of Vermilion

to realize synergies from the Acquisition; significant declines in production or sales volumes due to unforeseen circumstances; statements

regarding the growth and size of Vermilion's future project inventory, including the number of future drilling locations expected to be

available following the Acquisition; operating and other expenses, including the payment and amount of future dividends; and the timing

of regulatory proceedings and approvals.

Such forward-looking statements or information are

based on a number of assumptions, all or any of which may prove to be incorrect. In addition to any other assumptions identified in this

document, assumptions have been made regarding, among other things: the ability of Vermilion to obtain equipment, services and supplies

in a timely manner to carry out its activities in Canada and internationally; the ability of Vermilion to market crude oil,

natural gas liquids, and natural gas successfully to current and new customers; the timing and costs of pipeline and storage facility

construction and expansion and the ability to secure adequate product transportation; the timely receipt of required regulatory approvals;

the ability of Vermilion to obtain financing on acceptable terms; foreign currency exchange rates and interest rates; future crude oil,

natural gas liquids, and natural gas prices; management's expectations relating to the timing and results of exploration and development

activities; the impact of Vermilion's dividend policy on its future cash flows; credit ratings; the ability of Vermilion to effectively

maintain its hedging program; expected earnings/(loss) and adjusted earnings/(loss); expected earnings/(loss) or adjusted earnings/(loss)

per share; expected future cash flows and free cash flow and expected future cash flow and free cash flow per share; estimated future

dividends; financial strength and flexibility; debt and equity market conditions; general economic and competitive conditions; ability

of management to execute key priorities; and the effectiveness of various actions resulting from the Vermilion's strategic priorities.

Although Vermilion believes that the expectations

reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward looking statements

because Vermilion can give no assurance that such expectations will prove to be correct. Financial outlooks are provided for the purpose

of understanding Vermilion's financial position and business objectives, and the information may not be appropriate for other purposes.

Forward looking statements or information are based on current expectations, estimates, and projections that involve a number of risks

and uncertainties which could cause actual results to differ materially from those anticipated by Vermilion and described in the forward-looking

statements or information. These risks and uncertainties include, but are not limited to: the ability of management to execute its business

plan; the risks of the oil and gas industry, both domestically and internationally, such as operational risks in exploring for, developing

and producing crude oil, natural gas liquids, and natural gas; risks and uncertainties involving geology of crude oil, natural gas liquids,

and natural gas deposits; risks inherent in Vermilion's marketing operations, including credit risk; the uncertainty of reserves estimates

and reserves life and estimates of resources and associated expenditures; the uncertainty of estimates and projections relating to production

and associated expenditures; potential delays or changes in plans with respect to exploration or development projects; constraints at

processing facilities and/or on transportation; Vermilion's ability to enter into or renew leases on acceptable terms; fluctuations in

crude oil, natural gas liquids, and natural gas prices, foreign currency exchange rates, interest rates and inflation; health, safety,

and environmental risks and uncertainties related to environmental legislation, hydraulic fracturing regulations and climate change; uncertainties

as to the availability and cost of financing; the ability of Vermilion to add production and reserves through exploration and development

activities; the possibility that government policies or laws may change or governmental approvals may be delayed or withheld; weather

conditions, political events and terrorist attacks; uncertainty in amounts and timing of royalty payments; risks associated with existing

and potential future law suits and regulatory actions against or involving Vermilion; and other risks and uncertainties described elsewhere

in this document or in Vermilion's other filings with Canadian securities regulatory authorities.

The forward-looking statements or information contained

in this document are made as of the date hereof and Vermilion undertakes no obligation to update publicly or revise any forward-looking

statements or information, whether as a result of new information, future events, or otherwise, unless required by applicable securities

laws.

This document contains metrics commonly used in the

oil and gas industry. These oil and gas metrics do not have any standardized meaning or standard methods of calculation and therefore

may not be comparable to similar measures presented by other companies where similar terminology is used and should therefore not be used

to make comparisons. Natural gas volumes have been converted on the basis of six thousand cubic feet of natural gas to one barrel of oil

equivalent. Barrels of oil equivalent (boe) may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand

cubic feet to one barrel of oil is based on an energy equivalency conversion method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead.

Financial data contained within this document are

reported in Canadian dollars, unless otherwise stated.

Estimates of Drilling Locations: Unbooked drilling

locations, including those associated with the Acquisition, are the internal estimates of Vermilion based on Vermilion's prospective acreage

and the acreage that may be acquired pursuant to the Acquisition and an assumption as to the number of wells that can be drilled per section

based on industry practice and internal review. Unbooked locations do not have attributed reserves or resources (including contingent

and prospective). Unbooked locations have been identified by Vermilion's management as an estimation of Vermilion's multiyear drilling

activities based on evaluation of applicable geologic, seismic, engineering, production and reserves information including expected activities

if the Acquisition is completed. There is no certainty that Vermilion will drill all unbooked drilling locations and if drilled there

is no certainty that such locations will result in additional oil and natural gas reserves, resources or production. The drilling locations

on which Vermilion will actually drill wells, including the number and timing thereof is ultimately dependent upon completion of the Acquisition,

the availability of funding, regulatory approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results,

additional reservoir information that is obtained and other factors. While a certain number of the unbooked drilling locations have been

de-risked by Westbrick drilling existing wells in relative close proximity to such unbooked drilling locations, other unbooked drilling

locations are farther away from existing wells where management of Vermilion has less information about the characteristics of the reservoir

and therefore there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that

such wells will result in additional oil and gas reserves, resources or production.

Reserves Data: There are numerous uncertainties inherent

in estimating quantities of crude oil, natural gas and NGL reserves, and the future cash flows attributed to such reserves. The reserve

and associated cash flow information incorporated in this release, including those relating to the reserves to be acquired pursuant to

the Acquisition, are estimates only. Generally, estimates of economically recoverable crude oil, NGL and natural gas reserves (including

the breakdown of reserves by product type) and the future net cash flows from such estimated reserves are based upon a number of variable

factors and assumptions, such as historical production from the properties, production rates, ultimate reserve recovery, timing and amount

of capital expenditures, marketability of oil and natural gas, royalty rates, the assumed effects of regulation by governmental agencies

and future operating costs, all of which may vary materially from actual results. For those reasons, estimates of the economically recoverable

crude oil, NGL and natural gas reserves attributable to any particular group of properties, classification of such reserves based on risk

of recovery and estimates of future net revenues associated with reserves prepared by different engineers, or by the same engineers at

different times, may vary. Vermilion's actual production, revenues, taxes and development and operating expenditures with respect to its

reserves will vary from estimates and such variations could be material.

View original content to download multimedia:https://www.prnewswire.com/news-releases/vermilion-energy-inc-announces-closing-of-the-acquisition-of-westbrick-energy-ltd-and-confirms-q4-2024-release-date-and-conference-call-details-302386286.html

SOURCE Vermilion Energy Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2025/26/c8185.html

%CIK: 0001293135

For further information: For further information please contact:

Dion Hatcher, President & CEO; Lars Glemser, Vice President & CFO; and/or Kyle Preston, Vice President, Investor Relations, TEL

(403) 269-4884 | IR TOLL FREE 1-866-895-8101 | investor_relations@vermilionenergy.com | www.vermilionenergy.com

CO: Vermilion Energy Inc.

CNW 11:41e 26-FEB-25

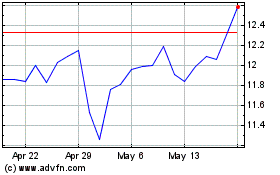

Vermilion Energy (NYSE:VET)

Historical Stock Chart

From Feb 2025 to Mar 2025

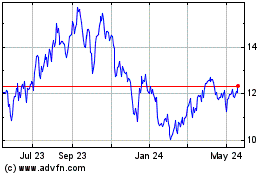

Vermilion Energy (NYSE:VET)

Historical Stock Chart

From Mar 2024 to Mar 2025