Earnings per share increases 17% to $2.17 for Full Year 2024

(GAAP)

- Excluding one-time items and weather-related items, adjusted

earnings per share of $1.97 (Non-GAAP)

Company affirms 2025 EPS guidance of $2.07 - $2.11 and

multi-year earnings guidance of 5-7% from $1.97 (Non-GAAP)

PA PUC Approved Settlement for Aqua Pennsylvania rate case

Recently closed Greenville Wastewater Acquisition in

Pennsylvania

Essential Utilities Inc. (NYSE: WTRG) today reported results for

the fourth quarter and full year ended December 31, 2024.

Essential’s net income was $184.8 million or $0.67 per share for

the fourth quarter of 2024, compared to $0.50 per share for the

same period in 2023, an increase of 34%. Essential’s net income was

$595.3 million or $2.17 per share for the full year of 2024,

compared to $1.86 for the prior year, an increase of 17%. The full

year net income and earnings per share include the benefit of a

gain on sale related to the previously announced and closed sale of

the Pittsburgh area energy projects.

“2024 was a very productive and successful year for the

company,” said Essential Utilities Chairman and Chief Executive

Officer Chris Franklin. “I am incredibly proud of the team. This

was a year of near-perfect execution. We filed at the Pennsylvania

Public Utility Commission (PUC) to recover approximately $3 billion

in capital investments we made to improve safety and reliability in

our water and natural gas service areas and achieved strong

outcomes in both rate cases. In addition, we invested more than

$1.3 billion in infrastructure improvements, including significant

mitigation of PFAS contamination. Lastly, we also supported the PA

PUC’s initiatives to continue fair market valuation acquisitions in

the Commonwealth to benefit both customers and the company.”

The accomplishment of this work demonstrates Essential’s

commitment to successfully achieving our priorities while

navigating many of today’s most pressing challenges, including

mitigating PFAS contamination and addressing aging

infrastructure.

“We were pleased to execute well for the benefit of all our

stakeholders,” Franklin added. “These achievements resulted in our

November reinstatement of multi-year earnings guidance with a

compounded annual EPS growth rate of 5-7% through 2027, given the

board’s continued confidence in our business plan model.”

Full Year Operating Results For the full year 2024, the

company reported revenues of $2,086.1 million, an increase of 1.6%,

from $2,053.8 million in 2023. Revenue increases were offset by the

positive impact of lower purchased gas costs in 2024. Operations

and maintenance expenses in the full year of 2024 were $587.3

million, compared to $575.5 million in 2023, an increase of only

2.0%, reflecting the divestitures of the West Virginia utility

assets and the energy projects, as well as management’s long-held

commitment to minimizing expense increases.

For the full year ending December 31, 2024, Essential reported

net income of $595.3 million, or $2.17 per share, compared to

$498.2 million, or $1.86 per share through the same period of 2023.

This represents a 17% increase in 2024 earnings per share compared

to 2023. This increase includes the gain on sale in the first

quarter of 2024 from the energy projects sale and the impacts of

weather.

Essential’s regulated water segment reported revenues of

$1,221.9 million, an increase of 5.9% compared to $1,153.3 million

in 2023. Regulatory recoveries and volume were the largest

contributors to the increase in revenues for the period. Operations

and maintenance expenses for Essential’s regulated water segment

increased to $381.1 million compared to $368.8 million in 2023.

Essential’s regulated natural gas segment reported revenues of

$843.0 million, compared to $863.8 million in 2023. Purchased gas

costs were $267.2 million, compared to $327.5 million in 2023. As a

result, the recovery of lower purchased gas costs was the primary

driver in the decrease of revenues. Operations and maintenance

expenses for the same period for Essential’s regulated natural gas

segment decreased to $207.2 million from $209.1 million in

2023.

Fourth Quarter 2024 Operating Results Essential reported

net income of $184.8 million and earnings per share of $0.67 for

the fourth quarter of 2024, compared to net income of $135.5

million and earnings per share of $0.50 for the same period in

2023. Comparing this quarter’s earnings to those of the fourth

quarter of 2023, increased revenues from regulatory recoveries and

increased water and natural gas volume were offset by higher

depreciation and interest expense.

Revenues for the quarter were $604.4 million compared to $479.4

million in the fourth quarter of 2023, an increase of 26.1%.

Recovery of purchased gas, rates and surcharges, and increased

water and natural gas volumes contributed to this increase.

Operations and maintenance expenses were $163.5 million for the

fourth quarter of 2024 compared to $157.0 million in the fourth

quarter of 2023. Notably, the weather normalization mechanism in

the Pennsylvania gas business worked as intended to stabilize

revenues during the fourth quarter of 2024, given the warmer than

normal weather during the period.

Dividend On February 19, 2025, Essential’s board of

directors declared a quarterly cash dividend of $0.3255 per share

of common stock. This dividend will be payable on June 2, 2025, to

shareholders of record on May 13, 2025. The company has paid a

consecutive quarterly cash dividend for eighty years.

Rate Activity In 2024, the company’s regulated water

segment received rate awards or infrastructure surcharges designed

to increase annual revenues in Illinois, New Jersey, Ohio, North

Carolina, Virginia, and Pennsylvania by $53.9 million, and its

regulated natural gas segment received rate awards or

infrastructure surcharges to increase annual revenues in Kentucky

and Pennsylvania by $93.9 million.

On February 6, 2025, the Pennsylvania PUC voted unanimously to

approve the previously announced Aqua Pennsylvania rate case

settlement reached with the statutory advocates. Per the order,

Aqua Pennsylvania raised rates by $73.0 million beginning February

22, 2025.

With the conclusion of the Aqua Pennsylvania rate case, the

company has now achieved two significant regulatory outcomes in

Pennsylvania, where approximately 75% of its operations (by rate

base) are located, in the past six months.

Thus far in 2025, the company’s regulated water segment received

rate awards or infrastructure surcharges designed to increase

annual revenues in Ohio, North Carolina, and Pennsylvania by $86.3

million, and its regulated natural gas segment received

infrastructure surcharges in Kentucky of $0.5 million.

The company currently has infrastructure surcharges pending in

Ohio, for its regulated water segment, which would add an estimated

$3.3 million in incremental annual revenues. In the regulated gas

segment, Kentucky has rate requests and infrastructure surcharges

pending, which would add an estimated $12.7 million in incremental

annual revenues.

Capital Expenditures Essential invested approximately

$1.3 billion in 2024 to improve its regulated water and natural gas

infrastructure systems and to enhance customer service across its

operations. This investment included successfully completing the

mitigation of PFAS at 13 sites in 2024 and conducting a pilot in

which we deployed 30,000 cutting-edge, solid-state meters in our

gas business to bring an elevated level of safety to the

communities we serve. The company continues to be one of the

country’s leaders in replacing miles of aged underground utility

pipe and is committed to maintaining elevated levels of

infrastructure investment.

In 2025, the company expects to invest $1.4 to $1.5 billion in

needed infrastructure investments. From 2025 through 2029, the

company plans to invest approximately $7.8 billion to improve water

and natural gas systems and better serve customers through improved

information technology. Essential’s investments include addressing

PFAS with at least $450.0 million in capital projects, replacing

and expanding its water and wastewater utility infrastructure, and

replacing and upgrading its natural gas utility infrastructure,

with the latter leading to improved safety and reliability and

significant reductions in methane emissions that occur in aged gas

pipes. The company is a leader in remediating PFAS and will comply

with the finalized EPA rule. The capital investments made to

rehabilitate and expand the infrastructure of the communities’

Essential serves are critical to its mission of safely and reliably

delivering Earth’s most essential resources.

Water Utility Growth by Acquisition Essential’s continued

growth via acquisitions allows the company to provide safe and

reliable water and wastewater service to a larger customer base

than it could from organic customer growth alone. Since 2015,

Essential collectively has acquired over $518.0 million in rate

base and added more than 131,000 new customers or equivalent

dwelling units to the company’s footprint.

On January 31, 2025, the company closed on the acquisition of

the Greenville wastewater system for $18 million. This is the first

fair market value acquisition completed in Pennsylvania since the

PUC entered a Final Supplemental Implementation Order (2024 FSIO)

on Docket No. M-2016-2543193 in July 2024. We believe the fair

market value statute combined with the 2024 FSIO will result in a

greater degree of certainty for our municipal transactions and will

be a key factor in continued rate affordability.

The company has six signed purchase agreements for additional

water and wastewater systems in Pennsylvania, Texas, and Ohio that

are pending closing and are expected to serve over 210,000

equivalent retail customers or equivalent dwelling units and total

over $344.0 million in purchase price. Excluding the company’s

$276.5 million agreement to acquire the Delaware County Regional

Water Quality Control Authority (DELCORA), the company has

approximately $67.8 million of signed purchase agreements in the

regulatory approval process.

The pipeline of potential water and wastewater municipal

acquisitions the company is actively pursuing represents

approximately 400,000 total customers.

Additionally, because of our proven expertise, the company has

been appointed the receiver of several investor-owned utilities.

Given the operational stability we bring to communities in need, we

are positioned to quickly address critical challenges and improve

the long-term viability of distressed water and wastewater

systems.

Multi-Year Financial and Growth Guidance The company

reaffirms its previously initiated long-term earnings guidance. The

company’s latest expectations are the following:

- 2025 diluted earnings per share guidance range of $2.07 to

$2.11.

- Grow long-term earnings per share at a compounded annual growth

rate of 5 to 7% from the adjusted 2024 earnings per share of $1.97

(Non-GAAP) for the three-year period through 2027.

- In 2025, regulated infrastructure investments will be $1.4 to

$1.5 billion.

- Through 2029, we plan to make regulated infrastructure

investments of approximately $7.8 billion.

- Through 2029, the regulated water segment rate base will grow

at a compounded annual growth rate of approximately 6%; this only

includes acquisitions scheduled to close in 2025 and excludes

DELCORA.

- Through 2029, the regulated natural gas segment rate base will

grow at a compounded annual growth rate of approximately 11%.

- Through 2029, the combined regulated utility rate base will

grow at a compounded annual growth rate of over 8%.

- The regulated water customer base (or equivalent dwelling

units) of the business will grow at an average annual growth rate

of between 2 and 3% from acquisitions and organic customer growth

over the long term.

- The regulated natural gas customer base of the business will be

stable for 2025.

- Through 2027, the company expects to raise equity via its ATM

program. In 2025, the company expects to raise a total of

approximately $315 million in equity.

- Reduction of Scope 1 and Scope 2 greenhouse gas emissions by

60% by 2035 from the company’s 2019 baseline.

- Multiyear plan to ensure that finished water does not exceed

the federal maximum contaminant level of the six EPA-regulated PFAS

chemicals.

Essential reaffirms its commitment to substantially reduce Scope

1 and 2 greenhouse gas emissions by 2035. The company plans to

achieve these reductions through extensive gas pipeline

replacement, the purchase of renewable energy, accelerated methane

leak detection and repair, and various other planned initiatives.

Essential continues to be an industry leader regarding water

quality with its commitment to test and treat for six regulated

PFAS chemicals across all states served by its regulated water

segment. The company reaffirms its commitment to providing finished

water that will meet the EPA timelines and standards. For the

fourth consecutive year the company was named to Newsweek’s list of

America’s Most Responsible Companies.

Guidance Assumptions Essential Utilities does not

guarantee future results of any kind. Guidance is subject to risks

and uncertainties, including, without limitation, those factors

outlined in the “Forward Looking Statements” of this release and

the “Risk Factors” section of the company’s annual and quarterly

reports filed with the Securities and Exchange Commission. The

earnings per share, infrastructure investment, and rate base

guidance include the signed municipal water and wastewater

acquisitions for which the company has entered into signed purchase

agreements as of the date the guidance was announced but do not

include DELCORA or other potential municipal acquisitions from the

company’s list of acquisition opportunities that currently

represents over 400,000 customer equivalents. While the company

remains confident in its ability to close DELCORA, for guidance

purposes, DELCORA has been removed from all guidance metrics.

The average annual regulated water segment growth guidance

reflects the company’s proven acquisition track record of adding

nearly 131,000 customers or equivalent dwelling units and over $518

million in rate base since 2015, its current backlog of

approximately $344.0 million of signed pending acquisitions with

over 210,000 equivalent customers, and the current acquisition

landscape.

The company’s guidance includes the expectation that the company

will continue to issue equity and debt on an as-needed basis to

support acquisitions and capital investment plans.

Full Year 2024 Earnings Call Information Date: February

27, 2025 Time: 11 a.m. EST (please dial in by 10:45 a.m.) Webcast

and slide presentation link:

https://www.essential.co/events-and-presentations/events-calendar

Replay Dial-in #: (800) 770-2030 (U.S.) Pass code: 9261648#

The company’s conference call with financial analysts will take

place on Thursday, February 27, 2025, at 11 a.m. Eastern Standard

Time. The call and presentation will be webcast live so interested

parties may listen over the internet by logging on to Essential.co

and following the link for Investors. The conference call will be

archived in the Investor Relations section of the company’s website

following the call. Additionally, the call will be recorded and

made available for replay at 2 p.m. on February 27, 2025, for seven

days following the call. To access the audio replay in the U.S.

dial (800) 770-2030 toll-free or (609) 800-9909 (pass code 9261648

followed by the # key).

About Essential Essential Utilities, Inc. (NYSE: WTRG)

delivers safe, clean, reliable services that improve quality of

life for individuals, families, and entire communities. With a

focus on water, wastewater, and natural gas, Essential is committed

to sustainable growth, operational excellence, a superior customer

experience, and premier employer status. We are advocates for the

communities we serve and are dedicated stewards of natural lands,

protecting more than 7,600 acres of forests and other habitats

throughout our footprint.

Operating as the Aqua and Peoples brands, Essential serves

approximately 5.5 million people across nine states. Essential is

one of the most significant publicly traded water, wastewater

service, and natural gas providers in the U.S. Learn more at

www.essential.co.

Forward-Looking Statements This release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, which generally include

words such as “believes,” “expects,” “intends,” “anticipates,”

“estimates,” and similar expressions. The Company can give no

assurance that any actual or future results or events discussed in

these statements will be achieved. Any forward-looking statements

represent its views only as of today and should not be relied upon

as representing its views as of any subsequent date. Readers are

cautioned that such forward-looking statements are subject to a

variety of risks and uncertainties that could cause the company’s

actual results to differ materially from the statements contained

in this release. Such forward-looking statements include, among

others: the company’s belief that it will comply with the finalized

EPA PFAS rules, the guidance range of net income per diluted common

share; the anticipated amount of infrastructure investment in 2025

through 2029; the rate base growth of company through 2029; the

reduction in volatility related to abnormal weather impacts on

financial results from the Peoples Natural Gas segment; the

reduction of Scope 1 and Scope 2 greenhouse gas emissions by 60% by

2035 from the company’s 2019 baseline; the rate base growth from

its organic capital investment program through 2028; its plan to

raise approximately $315 million in equity through the

At-The-Market equity program in 2025; the Company’s water utility

customer base growth at an average annual long term growth rate of

between 2-3% for acquisitions and organic customer growth; the

regulated natural gas customer base of the business will be stable

in 2025; There are important factors that could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements including: changes in the EPAs

regulations; changes in the United States’ governmental policies,

including those from the Executive Branch; disruptions in the

global economy; potential disruptions in the supply chain for raw

and finished materials; the continuation of the company's

growth-through-acquisition program; general economic business

conditions; the company’s ability to raise additional equity,

including on an as needed basis; housing and customer growth

trends; unfavorable weather conditions; the success of certain

cost-containment initiatives; changes in regulations or regulatory

treatment; the company’s ability to successfully close municipally

owned systems presently under agreement and successfully complete

other acquisitions and dispositions; and other factors discussed in

our Annual Report on Form 10-K and our Quarterly Reports on Form

10-Q, which are filed with the Securities and Exchange Commission.

For more information regarding risks and uncertainties associated

with Essential's business, please refer to Essential's annual,

quarterly, and other SEC filings. Essential is not under any

obligation - and expressly disclaims any such obligation - to

update or alter its forward-looking statements whether as a result

of new information, future events, or otherwise.

WTRGF

Essential Utilities, Inc. and Subsidiaries Selected Operating Data

(In thousands, except per share amounts) (Unaudited)

Quarter Ended

Year Ended

December

31,

December

31,

2024

2023

2024

2023

Operating revenues

$

604,383

$

479,419

$

2,086,113

$

2,053,824

Operations and maintenance expense

$

163,470

$

156,998

$

587,250

$

575,518

Net income

$

184,755

$

135,448

$

595,314

$

498,226

Basic net income per common share

$

0.67

$

0.50

$

2.17

$

1.86

Diluted net income per common share

$

0.67

$

0.50

$

2.17

$

1.86

Basic average common shares outstanding

274,681

273,210

273,914

267,171

Diluted average common shares outstanding

275,161

273,536

274,421

267,659

Essential Utilities, Inc. and Subsidiaries Consolidated Statement

of Operations (In thousands, except per share amounts) (Unaudited)

Quarter Ended

Year Ended

December

31,

December

31,

2024

2023

2024

2023

Operating revenues

$

604,383

$

479,419

$

2,086,113

$

2,053,824

Cost & expenses: Operations

and maintenance

163,470

156,998

587,250

575,518

Purchased gas

94,511

37,468

277,009

352,306

Depreciation

94,164

86,447

363,906

338,655

Amortization

2,337

1,758

5,646

5,040

Taxes other than income taxes

23,275

22,775

94,634

90,208

Total

377,757

305,446

1,328,445

1,361,727

Operating income

226,626

173,973

757,668

692,097

Other expense (income): Interest

expense

79,303

72,922

302,467

283,362

Interest income

(659

)

(670

)

(3,318

)

(3,401

)

Allowance for funds used during construction

(5,807

)

(2,400

)

(21,310

)

(16,967

)

Loss (gain) on sale of other assets

(157

)

119

(92,224

)

(65

)

Other, net

(1,911

)

(612

)

(1,425

)

(2,613

)

Income before income taxes

155,857

104,614

573,478

431,781

Provision for income taxes (benefit)

(28,898

)

(30,834

)

(21,836

)

(66,445

)

Net income

$

184,755

$

135,448

$

595,314

$

498,226

Net income per common share:

Basic

$

0.67

$

0.50

$

2.17

$

1.86

Diluted

$

0.67

$

0.50

$

2.17

$

1.86

Average common shares outstanding:

Basic

274,681

273,210

273,914

267,171

Diluted

275,161

273,536

274,421

267,659

Essential Utilities, Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Measures (In

thousands, except per share amounts) (Unaudited)

The Company is providing disclosure of the reconciliation of the

non-GAAP financial measures to the most comparable GAAP financial

measures. The Company believes that the non-GAAP financial measures

"adjusted income" and "adjusted diluted income per common share"

provide investors the ability to measure the Company’s financial

operating performance by adjustment, which is more indicative of

the Company’s ongoing operating performance. The Company further

believes that the presentation of these non-GAAP financial measures

is useful to investors as a more meaningful way to compare the

Company’s operating performance against its guidance range for

2024.

This reconciliation includes a presentation of the non-GAAP

financial measures “adjusted income” and “adjusted diluted income

per common share” and have been adjusted for the following

items:

(1) During the first quarter of 2024, the

Company completed the sale of its interest in three non-utility

local microgrid and distributed energy projects and recognized a

gain of $91,236, net of transaction expenses. In October 2023, the

Company completed the sale of its regulated natural gas utility

assets in West Virginia. In 2024, the Company received additional

proceeds from this sale of regulated natural gas utility assets in

West Virginia and post-transaction activities.

(2) Estimated impact to Peoples Natural Gas

(PNG) operating revenues from warmer than normal weather conditions

during 2024 and nonrecurring usage. These impacts are partially

offset by favorable regulated water consumption in 2024 due to

drier than normal weather conditions.

(3) The income tax impact of the non-GAAP

adjustments described above.

These financial measures are measures of the Company’s operating

performance that do not comply with U.S. generally accepted

accounting principles (GAAP), and are thus considered to be

“non-GAAP financial measures” under applicable Securities and

Exchange Commission regulations. These non-GAAP financial measures

are derived from our consolidated financial information, if

available, and is provided to supplement the Company's GAAP

measures, and should not be considered as a substitute for measures

of financial performance prepared in accordance with GAAP.

The following reconciles our GAAP results to the non-GAAP

information we disclose :

Year Ended

December 31, 2024 Net

income (GAAP financial measure)

$

595,314

Adjustments: (1) Gain on sales of assets and related transaction

activities

(94,024

)

(2) Adjustments for estimated effects of unfavorable weather

(addback)

18,749

(3) Income tax effect of non-GAAP adjustments

20,859

Adjusted income (Non-GAAP financial measure)

$

540,898

Net income per common share (GAAP financial measure): Basic

$

2.17

Diluted

$

2.17

Adjusted income per common share (Non-GAAP financial

measure): Basic

$

1.97

Diluted

$

1.97

Average common shares outstanding: Basic

273,914

Diluted

274,421

Essential Utilities, Inc. and Subsidiaries Condensed Consolidated

Balance Sheets (In thousands of dollars) (Unaudited)

December 31,

December 31,

2024

2023

Net property, plant and equipment

$

13,143,476

$

12,097,072

Current assets

485,911

491,979

Regulatory assets and other assets

4,397,167

4,252,408

$

18,026,554

$

16,841,459

Total equity

$

6,198,809

$

5,896,183

Long-term debt, excluding current portion, net of debt issuance

costs

7,368,381

6,826,085

Current portion of long-term debt and loans payable

329,349

227,538

Other current liabilities

645,319

570,389

Deferred credits and other liabilities

3,484,696

3,321,264

$

18,026,554

$

16,841,459

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226832232/en/

Media Contact: David Kralle Vice President, Public

Affairs Media Hotline: 1.877.325.3477 Media@Essential.co

Investor Contact: Brian Dingerdissen Vice President, IR,

and Treasurer O: 610.645.1191 BJDingerdissen@Essential.co

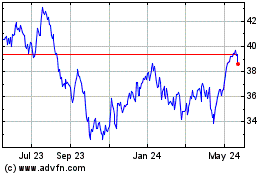

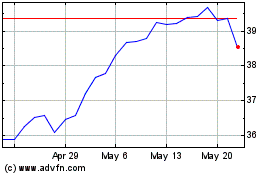

Essential Utilities (NYSE:WTRG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Essential Utilities (NYSE:WTRG)

Historical Stock Chart

From Mar 2024 to Mar 2025