UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of

December 2024

Commission File Number: 001-38652

X Financial

(Exact name of registrant as specified in its charter)

7-8F, Block A, Aerospace Science

and Technology Plaza

No. 168, Haide Third Avenue, Nanshan District

Shenzhen, 518067, the People’s Republic of China

+86-755-86282977

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F x

Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation ST Rule 101(b)(1): Not Applicable

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation ST Rule 101(b)(7): Not Applicable

EXHIBIT

INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

X

Financial |

| |

|

| |

By: |

/s/ Yue (Justin) Tang |

| |

Name: |

Yue (Justin) Tang |

| |

Title: |

Chairman and Chief Executive Officer |

Date: December 19, 2024

Exhibit 99.1

X Financial Announces US$48.7 Million Share

Repurchase from Major Shareholder

SHENZHEN,

China, December 19, 2024 /PRNewswire/ -- X Financial (NYSE: XYF) (the “Company” or “we”), a leading

online personal finance company in China, today announced that it has entered into a repurchase agreement with a major shareholder on

December 16, 2024, pursuant to which the Company will repurchase 6,349,206 American depositary shares ("ADSs"), representing

38,095,236 Class A ordinary shares of the Company, at a price of US$7.67 per ADS with a total repurchase price of approximately US$48.7

million (the “Repurchase”).

In order to complete the Repurchase, the Company’s

board of directors (the “Board”) approved a new share repurchase plan under which the Company may repurchase up to US$50 million

worth of its Class A ordinary shares, including the Class A ordinary shares represented by ADSs, effective until June 30,

2026. Upon completion of the Repurchase, the Company’s two previous share repurchase programs will complete, and approximately US$15.9

million will remain for future potential repurchases under the new US$50 million share repurchase plan.

Mr. Frank Fuya Zheng, Chief Financial Officer

of the Company, commented, “We are pleased with this share repurchase agreement as it reflects our confidence in our long-term growth

potential and our commitment to enhancing shareholder value. This repurchase also underscores our robust financial position. We are committed

to a thoughtful and balanced approach to capital management to ensure that we continue to prioritize both growth opportunities and shareholder

value creation.”

“In 2024, we returned a total of approximately

US$76.0 million in value to our shareholders through dividends and share repurchases, including US$16.5 million in cash dividends, US$9.2

million in the tender offer, US$48.7 million in the recent repurchase mentioned above, and US$1.6 million in other repurchases. The total

number of shares repurchased in 2024, including both ADSs and Class A ordinary shares, was equivalent to approximately 52.2 million

Class A ordinary shares, or 17.8% of our ordinary shares issued and outstanding as of December 31, 2023. Going forward, we remain

committed to delivering profitable growth and returning value to our shareholders through ongoing dividends and share repurchases.”

Under

the new share repurchase plan, the repurchase may be made from time to time through various means, including open market transactions,

privately negotiated transactions, and through other legally permissible means, depending on market conditions and in accordance with

applicable rules and regulations. The manner, timing and amount of any share repurchases will be determined by the Company's management

in its discretion based on its evaluation of various factors. The Company expects to fund the new repurchase plan out of its existing

cash balance.

About X Financial

X

Financial (NYSE: XYF) (the "Company") is a leading online personal finance company in China. The Company is committed to connecting

borrowers on its platform with its institutional funding partners. With its proprietary big data-driven technology, the Company has established

strategic partnerships with financial institutions across multiple areas of its business operations, enabling it to facilitate and originate

loans to prime borrowers under a risk assessment and control system.

For

more information, please visit: http://ir.xiaoyinggroup.com.

Safe Harbor Statement

This announcement contains forward-looking statements

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made under

the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified

by terminology such as "will," "expects," "anticipates," "future," "intends," "plans,"

"believes," "estimates," "potential," "continue," "ongoing," "targets," "guidance"

and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities

and Exchange Commission (the "SEC"), in its annual report to shareholders, in press releases and other written materials and

in oral statements made by its officers, directors or employees to third parties. Any statements that are not historical facts, including

statements about the Company’s beliefs and expectations, are forward-looking statements that involve factors, risks and uncertainties

that could cause actual results to differ materially from those in the forward-looking statements. Such factors and risks include, but

not limited to the followings: the Company’s goals and strategies; its future business development, financial condition and results

of operations; the expected growth of the credit industry, and marketplace lending in particular, in China; the demand for and market

acceptance of its marketplace’s products and services; its ability to attract and retain borrowers and investors on its marketplace;

its relationships with its strategic cooperation partners; competition in its industry; and relevant government policies and regulations

relating to the corporate structure, business and industry. Further information regarding these and other risks, uncertainties or factors

is included in the Company’s filings with the SEC. All information provided in this announcement is current as of the date of this

announcement, and the Company does not undertake any obligation to update such information, except as required under applicable law.

For more information, please contact:

X Financial

Mr. Frank Fuya Zheng

E-mail: ir@xiaoying.com

Christensen IR

In China

Mr. Rene Vanguestaine

Phone: +86-178-1749 0483

E-mail: rene.vanguestaine@christensencomms.com

In US

Ms. Linda Bergkamp

Phone: +1-480-614-3004

Email:

linda.bergkamp@christensencomms.com

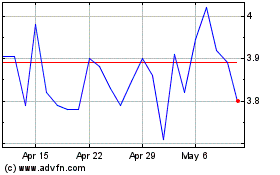

X Financial (NYSE:XYF)

Historical Stock Chart

From Nov 2024 to Dec 2024

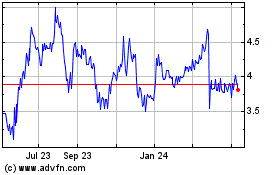

X Financial (NYSE:XYF)

Historical Stock Chart

From Dec 2023 to Dec 2024