This news release contains forward-looking information that is based upon

assumptions and is subject to risks and uncertainties as indicated in the

cautionary note contained elsewhere in this news release.

Andrew Peller Limited (TSX:ADW.A)(TSX:ADW.B) ("APL" or the "Company") announced

continued growth and strong operating and financial performance for the three

months and year ended March 31, 2014.

FISCAL 2014 HIGHLIGHTS:

-- Sales up 3.8% in fourth quarter, 3.0% for full fiscal year on new

product launches and solid performance across majority of trade channels

-- Selling and administrative expenses decrease due to restructuring

initiatives

-- Cash flow from operating activities rises to $25.0 million from $13.3

million in fiscal 2013

-- 5% increase in common share dividends announced

"Fiscal 2014 was another strong year for the Company as we successfully launched

a number of new products and continued to build our presence across all of our

trade channels, specifically with our high-margin premium and ultra-premium

brands," commented John Peller, President and CEO. "We are also pleased to see

recent improvement in our gross margin as we benefit from programs implemented

over the last two years to reduce costs and enhance production efficiencies. We

look for this progress to continue in fiscal 2015."

Sales for the three months ended March 31, 2014 rose 3.8% to $66.0 million from

$63.6 million in the same quarter last year. For the year ended March 31, 2014

sales increased 3.0% to $297.8 million. The Company experienced solid

performance across the majority of its sales channels, including provincial

liquor stores, the network of company-owned retail stores in Ontario, our export

business, and from our award-winning estate wineries. Performance also improved

at the Company's consumer-made wine business.

Gross margin was 34.2% of sales in the fourth quarter of fiscal 2014 compared to

35.6% in the same period last year. For the year ended March 31, 2014 gross

margin was 36.3% of sales compared to 38.0% in fiscal 2013. Gross margins in

fiscal 2014 have been affected by higher costs for wine, juice, and concentrate

purchased on international markets and intense price competition in Western and

Atlantic Canada. The decrease in gross margin was partially offset by successful

cost control initiatives to reduce distribution, operating, and packaging

expenses. A special levy implemented by the Ontario government on July 1, 2010

served to reduce sales and gross margin by approximately $2.0 million in fiscal

2014 and fiscal 2013.

Selling and administrative expenses declined in fiscal 2014 due to the ongoing

restructuring that began in the fourth quarter of fiscal 2013 in the Company's

personal winemaking division. As a percentage of sales, selling and

administrative expenses for the year ended March 31, 2014 improved to 24.9% from

26.4% last year.

Earnings before interest, amortization, unrealized derivative gains (losses),

other expenses, and income taxes ("EBITA") were $3.7 million and $33.7 million

for the three months and year ended March 31, 2014 compared to $3.1 million and

$33.5 million for the same periods in fiscal 2013.

In fiscal 2014 the Company incurred restructuring charges of $1.4 million in the

personal winemaking division related to ongoing cost savings initiatives to

outsource distribution and reduce marketing and administrative expenses.

The Company recorded a non-cash gain in fiscal 2014 related to mark-to-market

adjustments on an interest rate swap and foreign exchange contracts aggregating

approximately $0.8 million compared to a non-cash gain of $1.3 million in the

prior year. The Company has elected not to apply hedge accounting and

accordingly these financial instruments are reflected in the Company's financial

statements at fair value each reporting period. These instruments are considered

to be effective economic hedges and have enabled management to mitigate the

volatility of changing costs and interest rates during the year.

Other expenses in fiscal 2014 relate primarily to pension liabilities incurred

for prior service that were negotiated as part of the new collective agreement

with the BC labour union signed in June 2013 which were partially offset by

income from the expropriation of the Company's Port Moody facility which was

closed effective December 31, 2005. The property is temporarily being used as a

staging area for the construction of a rapid transit project. Payments amounting

to $2.0 million for the use of the property were received in advance and were

recorded as deferred income and are being recognized as other income over the

five-year term of the expropriation which began on July 1, 2012.

Adjusted net earnings, defined as net earnings not including restructuring

charges, unrealized losses and gains on derivative financial instruments, and

other expenses or income were $14.6 million for the year ended March 31, 2014

compared to $14.0 million in the prior year.

Net earnings (loss) for the three months and year ended March 31, 2014 were

$(0.6) million or $(0.04) per Class A Share and $14.0 million or $1.01 per Class

A Share compared to $(0.9) million or $(0.07) per Class A Share and $14.5

million or $1.04 per Class A Share for the comparable prior year periods. The

reduction in net earnings in fiscal 2014 is primarily due to the decrease in

gross margins, the one-time restructuring charges, the change in non-cash gains

on derivative financial instruments, and other income and expenses between the

two fiscal years.

Strong Financial Position

Working capital at March 31, 2014 increased to $44.6 million compared to $41.7

million at March 31, 2013. An increase in inventory and a decrease in bank

indebtedness more than offset an increase in accounts payable and accrued

charges and a decrease in accounts receivable. The Company's debt to equity

ratio was 0.73:1 at March 31, 2014 compared to 0.83:1 at March 31, 2013.

Shareholders' equity as at March 31, 2014 was $138.0 million or $9.65 per common

share compared to $129.7 million or $9.07 per common share as at March 31, 2013.

The increase in shareholders' equity is due to solid net earnings for the year

partially offset by the payment of dividends.

In fiscal 2014 the Company generated cash from operating activities, after

changes in non-cash working capital items, of $25.0 million compared to $13.3

million in the prior year. Cash flow from operating activities increased due to

strong earnings performance and improved use of working capital compared to the

prior year.

On April 28, 2014 the Company renegotiated its credit facilities to support its

strategic direction and to capitalize on lower debt service costs. These

facilities now mature on April 28, 2019. The operating loan facility was

increased to $90.0 million and the term loan was increased to $60.0 million. The

interest rate on the term loan was effectively fixed at 4.93% through August 31,

2015 and at 3.91% for the period from September 1, 2015 to April 28, 2019. The

Company also added a $15.0 million facility to fund future capital expenditures

that will also mature on April 28, 2019. Monthly amortization payments on the

term loan were reduced to $0.333 million.

Increase in Common Share Dividends

On June 4, 2014 the Company's Board of Directors announced a 5% increase in

common share dividends for shareholders of record on June 30, 2014 payable on

July 4, 2014. The annual dividends on Class A Shares were increased to $0.420

from $0.400 per share and the dividends on Class B Shares were increased to

$0.365 per share from $0.348 per share.

"We are very pleased to be increasing our common share dividends, the 6th

increase in 9 years, and a testament to our commitment to enhance shareholder

value over the long term," Mr. Peller stated.

Investor Conference Call

An investor conference call hosted by John Peller, President and CEO and Peter

Patchet, CFO, will be held Thursday, June 5, 2014 at 10:00 a.m. EST. The

telephone numbers for the conference call are: Local/International: (416)

340-2216, North American Toll Free: (866) 226-1792. The telephone numbers to

listen to the call after it is completed (Instant Replay) are

local/international (905) 694-9451 or North American toll free (800) 408-3053.

The Passcode for the Instant Replay is 6016172#. The Instant Replay will be

available until midnight, June 12, 2014. The call will also be archived on the

Company's website at www.andrewpeller.com

Financial Highlights (Unaudited)

(Condensed consolidated financial statements to follow)

----------------------------------------------------------------------------

For the three months and year ended Three Months Year

March 31,

(in $000 ) 2014 2013(1) 2014 2013(1)

----------------------------------------------------------------------------

Sales 66,026 63,586 297,824 289,143

Gross margin 22,606 22,635 107,982 109,743

Gross margin (% of sales) 34.2% 35.6% 36.3% 38.0%

Selling and administrative expenses 18,951 19,557 74,253 76,254

EBITA 3,655 3,078 33,729 33,489

Restructuring charge 1,056 1,118 1,409 1,118

Net unrealized gains on derivatives (231) (216) (750) (1,295)

Other (income) expenses (97) (331) 145 (544)

Net earnings (578) (935) 14,021 14,519

Earnings per share - Class A $(0.04) $(0.07) $1.01 $1.04

Earnings per share - Class B $(0.03) $(0.06) $0.88 $0.91

Dividend per share - Class A $0.400 $0.360

(annual)

Dividend per share - Class B $0.348 $0.314

(annual)

Cash provided by operations (after 25,018 13,325

changes in non-cash working capital

items)

Working capital 44,564 41,670

Shareholders' equity per share $9.65 $9.07

----------------------------------------------------------------------------

(1) Amounts for the periods ended March 31, 2013 were restated to reflect the

adoption of the amendments to IAS 19. Please refer to the Notes to the

Consolidated Financial Statements for the year.

The Company calculates adjusted earnings as follows:

----------------------------------------------------------------------------

For the three months and year ended

March 31, 2014 and 2013 Three Months Year

(in $000)

Unaudited 2014 2013(1) 2014 2013(1)

----------------------------------------------------------------------------

Net earnings (578) (935) 14,021 14,519

Restructuring costs 1,056 1,118 1,409 1,118

Net unrealized gains on derivatives (231) (216) (750) (1,295)

Other expenses (income) (97) (331) 145 (544)

Income tax effect of the above (189) (148) (209) 187

----------------------------------------------------------------------------

Adjusted earnings (39) (512) 14,616 13,985

----------------------------------------------------------------------------

(1) Amounts for the periods ended March 31, 2013 were restated to reflect the

adoption of the amendments to IAS 19. Please refer to the Notes to the

Consolidated Financial Statements for the year.

About Andrew Peller Limited

Andrew Peller Limited is a leading producer and marketer of quality wines in

Canada. With wineries in British Columbia, Ontario, and Nova Scotia, the Company

markets wines produced from grapes grown in Ontario's Niagara Peninsula, British

Columbia's Okanagan and Similkameen Valleys, and from vineyards around the

world. The Company's award-winning premium and ultra-premium VQA brands include

Peller Estates, Trius, Hillebrand, Thirty Bench, Crush, Wayne Gretzky, Sandhill,

Calona Vineyards Artist Series, and Red Rooster. Complementing these premium

brands are a number of popularly priced varietal brands including Peller Estates

French Cross in the East, Peller Estates Proprietors Reserve in the West, Copper

Moon, XOXO, skinnygrape, Black Cellar and Verano. Hochtaler, Domaine D'Or,

Schloss Laderheim, Royal, and Sommet are our key value priced brands. The

Company imports wines from major wine regions around the world to blend with

domestic wine to craft these popularly priced and value priced brands. With a

focus on serving the needs of all wine consumers, the Company produces and

markets premium personal winemaking products through its wholly-owned

subsidiary, Global Vintners Inc., the recognized leader in personal winemaking

products. Global Vintners distributes products through over 250 Winexpert and

Wine Kitz authorized retailers and franchisees and more than 600 independent

retailers across Canada, the United States, the United Kingdom, New Zealand,

Australia, and China. Global Vintners award-winning premium and ultra-premium

winemaking brands include Selection, Vintners Reserve, Island Mist, KenRidge,

Cheeky Monkey, Ultimate Estate Reserve, Traditional Vintage, and Cellar Craft.

The Company owns and operates more 102 well-positioned independent retail

locations in Ontario under The Wine Shop, Wine Country Vintners, and Wine

Country Merchants store names. The Company also owns Grady Wine Marketing Inc.

based in Vancouver and The Small Winemaker's Collection Inc. based in Ontario;

both of these wine agencies are importers of premium wines from around the world

and are marketing agents for these fine wines. The Company has entered into an

agreement to produce and market the Wayne Gretzky brands across Canada. The

Company's products are sold predominantly in Canada with a focus on export sales

for its icewine and personal winemaking products. More information about the

Company can be found at www.andrewpeller.com.

The Company utilizes EBITA (defined as earnings before interest, amortization,

unrealized derivative (gain) loss, other expenses, and income taxes). EBITA is

not a recognized measure under IFRS. Management believes that EBITA is a useful

supplemental measure to net earnings, as it provides readers with an indication

of cash available for investment prior to debt service, capital expenditures,

and income taxes. Readers are cautioned that EBITA should not be construed as an

alternative to net earnings determined in accordance with IFRS as an indicator

of the Company's performance or to cash flows from operating, investing, and

financing activities as a measure of liquidity and cash flows. The Company also

utilizes gross margin (defined as sales less cost of goods sold, excluding

amortization) and adjusted earnings as defined above. The Company's method of

calculating EBITA, gross margin, and adjusted earnings may differ from the

methods used by other companies and, accordingly, may not be comparable to

measures used by other companies.

Andrew Peller Limited common shares trade on the Toronto Stock Exchange (symbols

ADW.A and ADW.B).

FORWARD-LOOKING INFORMATION

Certain statements in this news release may contain "forward-looking statements"

within the meaning of applicable securities laws, including the "safe harbour

provision" of the Securities Act (Ontario) with respect to Andrew Peller Limited

and its subsidiaries. Such statements include, but are not limited to,

statements about the growth of the business in light of the Company's recent

acquisitions; its launch of new premium wines; sales trends in foreign markets;

its supply of domestically grown grapes; and current economic conditions. These

statements are subject to certain risks, assumptions, and uncertainties that

could cause actual results to differ materially from those included in the

forward-looking statements. The words "believe", "plan", "intend", "estimate",

"expect", or "anticipate" and similar expressions, as well as future or

conditional verbs such as "will", "should", "would", and "could" often identify

forward-looking statements. We have based these forward-looking statements on

our current views with respect to future events and financial performance. With

respect to forward-looking statements contained in this news release, the

Company has made assumptions and applied certain factors regarding, among other

things: future grape, glass bottle, and wine prices; its ability to obtain

grapes, imported wine, glass, and its ability to obtain other raw materials;

fluctuations in the U.S./Canadian dollar exchange rates; its ability to market

products successfully to its anticipated customers; the trade balance within the

domestic Canadian wine market; market trends; reliance on key personnel;

protection of its intellectual property rights; the economic environment; the

regulatory requirements regarding producing, marketing, advertising, and

labeling its products; the regulation of liquor distribution and retailing in

Ontario; and the impact of increasing competition.

These forward-looking statements are also subject to the risks and uncertainties

discussed in this news release, in the "Risk Factors" section and elsewhere in

the Company's MD&A and other risks detailed from time to time in the publicly

filed disclosure documents of Andrew Peller Limited which are available at

www.sedar.com. Forward-looking statements are not guarantees of future

performance and involve risks, uncertainties, and assumptions which could cause

actual results to differ materially from those conclusions, forecasts, or

projections anticipated in these forward-looking statements. Because of these

risks, uncertainties and assumptions, you should not place undue reliance on

these forward-looking statements. The Company's forward-looking statements are

made only as of the date of this news release, and except as required by

applicable law, the Company undertakes no obligation to update or revise these

forward-looking statements to reflect new information, future events or

circumstances or otherwise.

Andrew Peller Limited

Consolidated Balance Sheets

----------------------------------------------------------------------------

Unaudited

(in thousands of Canadian dollars)

March 31, March 31, April 1,

2014 2013(1) 2012(1)

Assets

Current assets

Accounts receivable $ 22,693 $ 25,484 $ 24,937

Inventories 120,751 115,931 110,256

Current portion of biological

assets 1,062 938 881

Prepaid expenses and other

assets 1,381 1,573 1,338

Income taxes recoverable 240 268 -

----------------------------------------

146,127 144,194 137,412

Property, plant and equipment 90,152 88,841 84,490

Biological assets 14,054 13,405 12,556

Intangible assets 13,209 12,606 13,621

Goodwill 37,473 37,473 37,473

----------------------------------------

$ 301,015 $ 296,519 $ 285,552

----------------------------------------

----------------------------------------

Liabilities

Current liabilities

Bank indebtedness $ 54,407 $ 60,099 $ 57,495

Accounts payable and accrued

liabilities 37,371 33,616 37,118

Dividends payable 1,391 1,252 1,252

Income taxes payable - - 40

Current portion of derivative

financial instruments 1,002 1,107 1,272

Current portion of long-term

debt 7,392 6,450 5,366

----------------------------------------

101,563 102,524 102,543

Long-term debt 38,328 41,473 41,456

Long-term derivative financial

instruments 268 1,215 1,943

Post-employment benefit

obligations 6,132 6,411 6,665

Deferred income 910 1,314 -

Deferred income taxes 15,811 13,881 12,038

----------------------------------------

163,012 166,818 164,645

----------------------------------------

Shareholders' Equity

Capital stock 7,026 7,026 7,026

Retained earnings 130,977 122,675 113,881

----------------------------------------

138,003 129,701 120,907

----------------------------------------

$ 301,015 $ 296,519 $ 285,552

----------------------------------------

----------------------------------------

Commitments

(1) Restated to reflect the adoption of IAS 19.

The above statements should be read in conjunction with the entire annual

consolidated financial statements and notes.

They will be available on the Investor Relations section of

http://www.andrewpeller.com/ or at http://www.sedar.com/ on June 26, 2014.

Andrew Peller Limited

Consolidated Statements of Earnings

For the years ended March 31, 2014 and 2013

----------------------------------------------------------------------------

Unaudited

(in thousands of Canadian dollars, except per share amounts)

2014 2013 (1)

Sales $ 297,824 $ 289,143

Cost of goods sold 189,842 179,400

Amortization of plant and equipment used in

production 4,979 5,098

--------------------------

Gross profit 103,003 104,645

Selling and administration 74,253 76,254

Amortization of equipment and intangible assets

used in selling and administration 3,316 3,030

Interest 5,386 5,427

Restructuring costs 1,409 1,118

--------------------------

Operating earnings 18,639 18,816

Net unrealized gains on derivative financial

instruments (750) (1,295)

Other expenses (income) 145 (544)

--------------------------

Earnings before income taxes 19,244 20,655

--------------------------

Provision for income taxes

Current 3,239 4,045

Deferred 1,984 2,091

--------------------------

5,223 6,136

--------------------------

Net earnings for the year $ 14,021 $ 14,519

--------------------------

--------------------------

Net earnings per share

Basic and diluted

Class A shares $ 1.01 $ 1.04

--------------------------

--------------------------

Class B shares $ 0.88 $ 0.91

--------------------------

--------------------------

(1) Restated to reflect the adoption of IAS 19.

The above statements should be read in conjunction with the entire annual

consolidated financial statements and notes.

They will be available on the Investor Relations section of

http://www.andrewpeller.com/ or at http://www.sedar.com/ on June 26, 2014.

Andrew Peller Limited

Consolidated Statements of Comprehensive Income

For the years ended March 31, 2014 and 2013

----------------------------------------------------------------------------

Unaudited

(in thousands of Canadian dollars)

2014 2013(1)

Net earnings for the year $ 14,021 $ 14,519

--------------------------

Items that are never reclassified to net

earnings

Net actuarial losses on post-employment benefit

plans (210) (964)

Deferred income taxes 54 248

--------------------------

Other comprehensive loss for the year (156) (716)

--------------------------

Net comprehensive income for the year $ 13,865 $ 13,803

--------------------------

--------------------------

(1) Restated to reflect the adoption of IAS 19.

The above statements should be read in conjunction with the entire annual

consolidated financial statements and notes.

They will be available on the Investor Relations section of

http://www.andrewpeller.com/ or at http://www.sedar.com/ on June 26, 2014.

Andrew Peller Limited

Consolidated Statements of Cash Flows

For the years ended March 31, 2014 and 2013

----------------------------------------------------------------------------

Unaudited

(in thousands of Canadian dollars)

2014 2013 (1)

Cash provided by (used in)

Operating activities

Net earnings for the year $ 14,021 $ 14,519

Adjustments for

Loss (gain) on disposal of property and

equipment 154 (536)

Amortization of plant, equipment and

intangible assets 8,295 8,128

Interest expense 5,386 5,427

Provision for income taxes 5,223 6,136

Revaluation of biological assets - net of

insurance recovery 67 (33)

Net unrealized loss on derivative

financial instruments (750) (1,295)

Post-employment benefits (489) (1,218)

Deferred income (404) 1,718

Interest paid (4,904) (5,108)

Income taxes paid (3,211) (4,353)

--------------------------

23,388 23,385

Change in non-cash working capital items related

to operations 1,630 (10,060)

--------------------------

25,018 13,325

--------------------------

Investing activities

Proceeds from disposal of property, plant and

equipment 18 533

Purchase of property, equipment and vine

biological assets (9,388) (12,949)

Purchase of intangible assets (1,797) -

Proceeds from disposal of a business - 1,000

--------------------------

(11,167) (11,416)

--------------------------

Financing activities

(Decrease) increase in bank indebtedness (5,692) 2,604

Issuance of long-term debt 4,086 6,500

Repayment of long-term debt (6,821) (5,849)

Deferred financing costs - (155)

Dividends paid (5,424) (5,009)

--------------------------

(13,851) (1,909)

--------------------------

Cash - Beginning and end of year $ - $ -

--------------------------

--------------------------

(1) Restated to reflect the adoption of IAS 19

The above statements should be read in conjunction with the entire annual

consolidated financial statements and notes.

They will be available on the Investor Relations section of

http://www.andrewpeller.com/ or at http://www.sedar.com/ on June 26, 2014.

FOR FURTHER INFORMATION PLEASE CONTACT:

Andrew Peller Limited

Mr. Peter Patchet

CFO and EVP Human Resources

(905) 643-4131 Ext. 2210

peter.patchet@andrewpeller.com

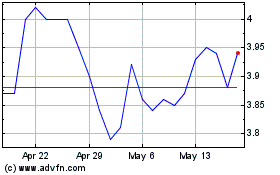

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Apr 2024 to May 2024

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From May 2023 to May 2024