Algoma Central Corporation Reports Operating Results for the Three and Six Months Ended June 30, 2021

August 05 2021 - 6:00AM

Business Wire

Algoma Central Corporation (“Algoma” or “the Company”) (TSX:

ALC), a leading provider of marine transportation services, today

announced its results for the three and six months ended June 30,

2021. (All amounts reported below are in thousands of Canadian

dollars, except for per share data and where the context dictates

otherwise.)

Second quarter 2021 business highlights include:

- The Domestic Dry-Bulk segment revenues increased 23% to $96,855

compared to $78,957 in 2020, reflecting a 14% increase in volumes

driven by higher cargoes in iron and steel, construction and salt

sectors and higher fuel cost recoveries. Net earnings increased 81%

to $25,922 compared to $14,326 in the prior year.

- The Global Short Sea Shipping segment generated earnings of

$9,374 compared to $2,312, an increase of $7,062 compared to 2020.

Market rates continued to improve significantly in the mini bulker

sector and steady cement business drove a major improvement in the

results for the segment.

- The Ocean Self-Unloader segment reported earnings of $3,896 in

the 2021 second quarter compared to $2,843, an increase of $1,053

compared to the same period in 2020. Volumes in the segment are

recovering, especially in gypsum, and fewer dry-dockings this

quarter resulted in increased vessel on-hire time. Earnings for the

quarter were impacted by a $5,513 one-time compensation payment

made to effect retirement of two older vessels owned by our partner

in the Pool.

- Segment earnings for Product Tankers were $3,203 compared to

$5,926 in the prior year. Customer requirements in the second

quarter of 2020 favourably impacted earnings last year as the fleet

was in full utilization; however, an expected decrease in customer

demand in 2021 resulted in lower vessel utilization.

- We are reporting gains totaling $5,455 in the 2021 second

quarter related to the sale of a property that belonged to Algoma

Ship Repair and a gain from an insurance settlement and post

quarter-end recycling of the Algoma Spirit.

EBITDA, which includes our share of joint venture EBITDA, for

the three months ended June 30, 2021 was $61,860 an increase of 15%

compared to the same period in the prior year. The increase to

EBITDA was primarily driven by significantly higher earnings in

both the Domestic Dry-Bulk and Global Short Sea segments compared

to 2020. EBITDA is determined as follows:

Three Months Ended

Six Months Ended

For the periods ended June 30

2021

2020

2021

2020

Net earnings (loss)

$

32,315

$

17,742

$

9,899

$

(5,884

)

Depreciation and amortization

21,118

22,696

42,388

45,539

Interest and taxes

14,489

12,294

9,702

8,754

Foreign exchange (gain) loss

(607

)

1,219

(817

)

(64

)

Gains on sale of assets

(2,725

)

(44

)

(2,933

)

(317

)

Gain from insurance settlement

(2,730

)

—

(2,730

)

—

EBITDA

$

61,860

$

53,907

$

55,509

$

48,028

"When we look back at the second quarter of 2020, Algoma was in

a very different position," said Gregg Ruhl, President and CEO of

Algoma Central Corporation. "At the beginning of the quarter last

year we were right-sizing our fleet in order to better position

ourselves for uncertainty about the impact the pandemic would have

on the markets we serve. As we enter the third quarter of 2021,

although we are still faced with some uncertainties, we are

experiencing market recovery, higher volumes across most sectors

and higher overall earnings. Our results this quarter indicate not

only that the economy is recovering, but also demonstrate the hard

work of all our teams ensuring that we are always well positioned

to meet customer requirements, no matter the economic environment.

I should also mention the arrival of the Captain Henry Jackman in

Canada in June. On her first trip, she loaded a record grain cargo

in Thunder Bay, Ontario," Mr. Ruhl concluded.

Outlook As restrictions ease and global supply chains

improve, the Domestic Dry-Bulk segment is expecting volumes in the

iron and steel and construction sectors to continue to strengthen

compared to last year, with salt and agriculture volumes expected

to return to more normal levels in the third quarter. Higher fuel

prices are also likely to continue, driving higher fuel recoveries

in the second half of 2021. As we noted in our 2020 financial

reports, Product Tanker utilization was not immediately impacted by

the onset of the pandemic as our vessels were utilized to move

product between major markets, absorbing available days that were

not required to service the Ontario market. This trade pattern

ceased in late 2020 and tanker utilization is now being impacted by

weaker demand in wholesale petroleum product markets in central

Canada. In the Ocean Self-Unloader segment, Pool performance has

not recovered as quickly as hoped, but we are still expecting a

positive third and fourth quarter compared to 2020 with volumes in

certain sectors expected to continue to improve. There are no

dry-dockings planned for the remainder of 2021 and the fleet is set

to be fully utilized. In the Global Short Sea segment, the cement

sector is expected to remain steady for the remainder of 2021 and,

if the substantially improved market rates in the mini-bulker

sector remain strong, the segment should continue to experience

improved operating results.

Three Months Ended

Six Months Ended

For the periods ended June 30

2021

2020

2021

2020

Revenue

$

167,687

$

151,270

$

245,286

$

236,367

Operating expenses

(101,311

)

(96,339

)

(182,300

)

(181,672

)

Selling, general and administrative

(7,306

)

(7,290

)

(15,816

)

(15,673

)

Other items

(1,197

)

—

(1,197

)

—

Depreciation and amortization

(16,992

)

(18,642

)

(34,485

)

(37,456

)

Operating earnings

40,881

28,999

11,488

1,566

Interest expense

(4,931

)

(5,185

)

(10,248

)

(10,176

)

Interest income

15

40

42

226

Foreign currency gain (loss)

527

(68

)

580

174

36,492

23,786

1,862

(8,210

)

Income tax (expense) recovery

(8,752

)

(6,139

)

1,990

3,494

Net earnings (loss) from investments in

joint ventures

4,575

95

6,047

(1,168

)

Net Earnings (Loss)

$

32,315

$

17,742

$

9,899

$

(5,884

)

Basic earnings (loss) per share

$

0.85

$

0.47

$

0.26

$

(0.16

)

Diluted earnings (loss) per share

$

0.78

$

0.45

$

0.26

$

(0.16

)

Three Months Ended

Six Months Ended

For the periods ended June 30

2021

2020

2021

2020

Domestic Dry-Bulk

Revenue

$

96,855

$

78,957

$

121,408

$

100,052

Operating earnings

35,140

19,429

5,457

(6,980

)

Product Tankers

Revenue

28,688

36,021

46,905

60,446

Operating earnings

4,821

8,124

5,044

6,577

Ocean Self-Unloaders

Revenue

40,006

33,518

72,501

69,895

Operating earnings

3,865

3,749

8,233

7,398

Corporate and Other

Revenue

2,138

2,774

4,472

5,974

Operating loss

(2,945

)

(2,303

)

(7,246

)

(5,429

)

The MD&A for the three and six months ended June 30, 2021

includes further details. Full results for the second quarter ended

June 30, 2021 can be found on the Company’s website at www.algonet.com/investor-relations and on SEDAR at

www.sedar.com.

Normal Course Issuer Bid On March 19, 2021, the Company

renewed its normal course issuer bid with the intention to

purchase, through the facilities of the TSX, up to 1,890,457 of its

Common Shares ("Shares") representing approximately 5% of the

37,800,943 Shares which were issued and outstanding as at the close

of business on March 8, 2021 (the “NCIB”). No shares have been

purchased to date under this NCIB.

Cash Dividends The Company's Board of Directors has

authorized payment of a quarterly dividend to shareholders of $0.17

per common share. The dividend will be paid on September 1, 2021 to

shareholders of record on August 18, 2021.

Use of Non-GAAP Measures There are measures included in

this press release that do not have a standardized meaning under

generally accepted accounting principles (GAAP). The Company

includes these measures because it believes certain investors use

these measures as a means of assessing financial performance.

EBITDA is a non-GAAP measure that does not have any standardized

meaning prescribed by IFRS and may not be comparable to similar

measures presented by other companies. Please refer to the

Management’s Discussions and Analysis for the three and six months

ended June 30, 2021 for further information regarding non-GAAP

measures.

About Algoma Central Algoma owns and operates the largest

fleet of dry and liquid bulk carriers operating on the Great Lakes

- St. Lawrence Waterway, including self-unloading dry-bulk

carriers, gearless dry-bulk carriers, cement carriers, and product

tankers. Algoma also owns ocean self-unloading dry-bulk vessels

operating in international markets and a 50% interest in

NovaAlgoma, which owns and operates a diversified portfolio of

dry-bulk fleets serving customers internationally.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210805005238/en/

For further information please contact:

Gregg A. Ruhl President & CEO 905-687-7890

Peter D. Winkley Chief Financial Officer 905-687-7897

Or visit www.algonet.com or www.sedar.com

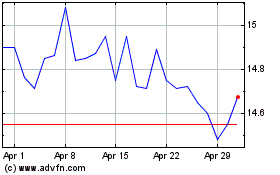

Algoma Central (TSX:ALC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Algoma Central (TSX:ALC)

Historical Stock Chart

From Feb 2024 to Feb 2025