Bri-Chem Corp. ("Bri-Chem" or "Company") (TSX:BRY), a leading North American

wholesale distributor and manufacturer of oil and gas drilling fluids and steel

pipe is pleased to announce its financial results for the second quarter ended

June 30, 2013.

During the second quarter of 2013, Bri-Chem continued to make significant

progress in growing year over year sales in its USA fluids distribution

division, realizing a 72% increase, and its steel pipe manufacturing division,

realizing a 74% increase. In addition, overall consolidated gross profit

increased 16.7% due to management's ongoing geographic and product

diversification strategy, targeting increased profitability.

Bri-Chem generated consolidated revenues of $28,243,483 for the quarter compared

to $30,931,414 from the prior quarter despite excessive wet weather and flooding

in Western Canada resulting in delays to Q2 summer drilling programs.

Consolidated revenues for the six months ended June 30, 2013 were $77,939,019

compared to $83,637,551 for the first half of 2012, a decrease of 6.8%. Adjusted

earnings before interest, taxes, amortization and share-based payments expense

("Adjusted EBITDAC") were $482,916 or $0.03 per share and $4,872,880 or $0.28

per share respectively for the three and six month periods ended June 30, 2013,

compared to $181,640 and $5,482,085 respectively for the same periods in 2012.

The Company incurred a net loss of $1,043,813 or $0.05 loss per share for the

quarter and net earnings of $790,891 or $0.06 earnings per share for the six

months ended June 30, 2013 as compared to a net loss of $769,807 and net

earnings of $2,123,796 respectively for the same periods in 2012. The year to

date decrease in earnings and Adjusted EBITDAC is mainly due to two significant

non-cash related items being foreign exchange, as the US dollar rose in

comparison to the Canadian dollar, resulting in a $365,484 foreign exchange

difference from the prior six month period, as well as a $484,271 increase in

stock-based compensation.

The Company's combined North American oil and gas drilling fluids divisions

recorded sales of $18,199,593 and $55,383,537 respectively for the three and six

month periods ended June 30, 2013, an increase of 9.1% for the second quarter of

2013 compared to the same period in 2012. On April 30, 2013, the Company

announced a letter of intent to acquire the assets and ongoing operations of a

California, USA based specialty cement chemical blending and packaging company

("Cementco"). Under the terms of the letter of intent, Bri-Chem has agreed to

purchase certain assets of Cementco. The closing of the transaction is expected

to be completed in the third quarter of 2013, subject to certain closing

conditions and outstanding due diligence matters being resolved.

In Canada, drilling rig utilization averaged 18.4% for the second quarter, a

decrease of 3.6% from the same quarter in 2012 when utilization rates average

22.0%. The Canadian fluids distribution division generated sales of $7,875,784

and $37,317,128 for the three and six months ended June 30, 2013, compared to

sales of $10,675,213 and $48,672,049 for the comparable periods in 2012. The 26%

decrease in Q2 Canadian fluid sales is mainly due to lower overall rig

utilization during Q2 and the excessive amount of wet weather and flooding in

Western Canada during the spring which has delayed the start of the summer

drilling programs. Sales for the fluids blending and packaging division were

$2,091,831 and $6,433,446 compared to prior year sales of $1,290,580 and

$3,921,551 representing a 62% and 64% increase respectively for the three and

six months ended June 30, 2013. The division has realized increased sales as a

result of providing cementing products into new geographic regions throughout

North America.

The USA fluids distribution division continues its market outreach with

customers in various geographic regions in the USA, resulting in revenues of

$10,323,809 and $18,066,409 for the three and six month periods ended June 30,

2013, an increase of 72% and 105% respectively over the same periods in 2012.

This increase is the result of the strategic warehouse and infrastructure

investment that occurred throughout 2012. With fourteen warehouses operating in

all the major resource plays in the USA, the division will focus on continuing

to grow its market share.

The steel pipe distribution division recorded sales of $3,461,319 and $7,279,611

respectively for the three and six month periods ended June 30, 2013, compared

to revenues of $10,110,382 and $17,226,183 for the same periods in 2012. Since

the fourth quarter of 2012, the Canadian market has excess steel pipe inventory

as many distributors were anticipating a stronger demand for steel pipe product

during the 2013 winter drilling season. In addition, sales in the second quarter

of 2012 included a substantial one-time mill direct order of approximately $5.1

million. The steel pipe distribution division will concentrate on reducing

inventory and increasing turns while maintaining superior customer service, with

the appropriate quantities and sizes of steel pipe to meet the demand of its

customers.

The steel pipe manufacturing division continued to increase its production

output during the first half of 2013 and recorded sales of $4,490,740 and

$8,824,425 respectively for the three and six month periods ended June 30, 2013,

an increase of 74% and 91% over the prior comparable periods. Despite the

decreased demand for large diameter seamless pipe during the first half of the

year, the division is cautiously optimistic that the second half of 2013 will

see increased demand which will drive increased sales and earnings growth.

Outlook Summary

The Petroleum Services Association of Canada (PSAC) has forecasted 6,578 wells

to be drilled in Western Canada for the second half of 2013, a forecasted

increase of 15.3% over 2012. During the first half of 2013, the Western Canadian

Sedimentary Basin ("WCSB") experienced a decline of 5.2% in wells drilled

compared to the same period in 2012, however, it is anticipated to improve in

the second half of 2013. Spring break up was longer than anticipated due to the

unusually wet spring which delayed many summer drilling programs in late Q2

2013. As a result, the Company anticipates drilling activity will be strong in

the third quarter as summer drilling programs ramp up, which will drive the

demand for Canadian fluid sales. Bri-Chem will continue to invest into its USA

drilling fluid market expansion plan with the goal of obtaining significant

market share. As we continue to gain market share, more product and acquisition

opportunities become available. We will also continue to closely monitor North

American steel pipe demand and seek to increase production capacity at the

Thermal Pipe Expansion manufacturing facility when demand returns to more normal

levels. In addition, we are reducing inventory levels in seamless steel pipe to

match current sales demand in an effort to increase inventory turns.

About Bri-Chem

Since our formation in 1985, Bri-Chem has established two primary segments of

business through a combination of internal growth and acquisitions: Bri-Chem's

Drilling Fluid Division is North America's largest independent wholesale

supplier of drilling fluids for the oil and gas industry. We provide over 100

drilling fluid products, cementing, acidizing and stimulation additives from 30

strategically located warehouses throughout Canada and the United States;

Bri-Chem's Steel Pipe Division is the first company to introduce and construct a

Thermal Pipe Expansion (TPE) facility in North America for manufacturing,

testing and supply of large diameter seamless steel pipe for the energy

industry. Additional information about Bri-Chem is available at www.sedar.com or

at Bri-Chem's website at www.brichem.com.

Forward-Looking Statements

Certain information set forth in this news release contains forward-looking

statements or information ("forward-looking statements"), including statements

which may contain words such as "could", "should", "expect", "anticipate",

"believe", "will", and similar expressions and statements relating to matters

that are not historical facts are forward looking statements. By their nature,

forward-looking statements are subject to numerous risks and uncertainties, some

of which are beyond the Company's control, including the impact of general

economic conditions, industry conditions, volatility of commodity prices,

currency fluctuations, environmental risks, demand for oilfield services for

drilling and completion of oil and natural gas wells; volatility in market

prices for steel, oil, natural gas, and natural gas liquids and the effect of

this volatility on the demand for oilfield services generally, competition from

other industry participants, the lack of availability of qualified personnel or

management, stock market volatility and the ability to access sufficient capital

from internal and external sources. Although the Company believes that the

expectations in our forward-looking statements are reasonable, our

forward-looking statements have been based on factors and assumptions concerning

future events which may prove to be inaccurate. Those factors and assumptions

are based upon currently available information. Such statements are subject to

known and unknown risks, uncertainties and other factors that could influence

actual results or events and cause actual results or events to differ materially

from those stated, anticipated or implied in the forward looking information. As

such, readers are cautioned not to place undue reliance on the forward looking

information, as no assurance can be provided as to future results, levels of

activity or achievements. The risks, uncertainties, material assumptions and

other factors that could affect actual results are discussed in our Annual

Information Form and other documents available at www.sedar.com. Furthermore,

the forward-looking statements contained in this document are made as of the

date of this document and, except as required by applicable law, the Company

does not undertake any obligation to publicly update or to revise any of the

included forward-looking statements, whether as a result of new information,

future events or otherwise. The forward-looking statements contained in this

document are expressly qualified by this cautionary statement.

To receive Bri-Chem news updates send your email to ir@brichem.com.

Neither the TSX nor its Regulation Services Provider (as that term is defined in

the policies of the TSX) accepts responsibility for the adequacy or accuracy of

this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bri-Chem Corp.

Jason Theiss

CFO

(780) 577-0595

jtheiss@brichem.com

www.brichem.com

CHF Investor Relations

Juliet Heading

Account Manager

(416) 868-1079 x239

juliet@chfir.com

CHF Investor Relations

Cathy Hume

CEO

(416) 868-1079 x231

cathy@chfir.com

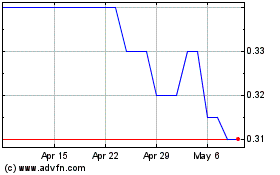

Bri Chem (TSX:BRY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Bri Chem (TSX:BRY)

Historical Stock Chart

From Mar 2024 to Mar 2025