Baytex Energy Corp. ("Baytex") (TSX:BTE) (NYSE:BTE) reports its

operating and financial results for the three and nine months ended

September 30, 2017 (all amounts are in Canadian dollars unless

otherwise noted).

“We continue to reposition our business for the

current low commodity price environment by reducing our cash costs

and improving capital efficiencies. I am pleased that

production is trending toward the high end of guidance while our

capital program is funded within cash flow. In the Eagle Ford,

strong well performance mitigated the impact of Hurricane

Harvey. In Canada, our drilling program continues to deliver

solid results and we have achieved substantial cost reductions on

our acquired assets at Peace River. We maintain strong financial

liquidity and our first long-term note maturity is not until 2021,”

commented Ed LaFehr, President and Chief Executive Officer.

Highlights

- Produced 69,310 boe/d (80% oil and NGL) in Q3/2017 and 70,473

boe/d (79% oil and NGL) for the first nine months of 2017;

- Delivered funds from operations ("FFO") of $77.3 million ($0.33

per basic share) in Q3/2017 and $241.8 million ($1.03 per

basic share) in the first nine months of 2017;

- Established average 30-day initial gross production rates of

approximately 1,500 boe/d per well from 22 gross (5.8 net) wells in

the Eagle Ford that commenced production in the third quarter;

- Reduced net debt by $70.6 million in Q3/2017 through excess

FFO, a non-core asset sale and the strengthening of the Canadian

dollar relative to the U.S. dollar;

- Achieved a 35% reduction in operating expenses on our recently

acquired Peace River lands, which contributed to a further 5%

reduction in annual guidance to $10.50/boe; and

- Tightened 2017 production guidance range to 69,500 to 70,000

boe/d (previously 69,000 to 70,000 boe/d) despite the impact of

Hurricane Harvey in the third quarter.

| |

|

|

| |

Three Months Ended |

Nine Months Ended |

|

|

September 30, 2017 |

June 30,2017 |

September 30, 2016 |

September 30, 2017 |

September 30, 2016 |

|

FINANCIAL(thousands of Canadian dollars, except

per common share amounts) |

|

|

|

|

|

| Petroleum and

natural gas sales |

$ |

254,430 |

|

$ |

274,369 |

|

$ |

197,648 |

|

$ |

789,348 |

|

$ |

546,979 |

|

| Funds from

operations (1) |

77,340 |

|

83,136 |

|

72,106 |

|

241,845 |

|

199,012 |

|

| Per share

- basic |

0.33 |

|

0.35 |

|

0.34 |

|

1.03 |

|

0.94 |

|

| Per share

- diluted |

0.33 |

|

0.35 |

|

0.34 |

|

1.02 |

|

0.94 |

|

| Net income

(loss) |

(9,228 |

) |

9,268 |

|

(39,430 |

) |

11,136 |

|

(125,760 |

) |

| Per share

- basic |

(0.04 |

) |

0.04 |

|

(0.19 |

) |

0.05 |

|

(0.60 |

) |

| Per share

- diluted |

(0.04 |

) |

0.04 |

|

(0.19 |

) |

0.05 |

|

(0.60 |

) |

| Exploration and

development |

61,544 |

|

78,007 |

|

39,579 |

|

236,110 |

|

156,754 |

|

|

Acquisitions, net of divestitures |

(7,436 |

) |

5,226 |

|

(62,752 |

) |

63,794 |

|

(62,798 |

) |

|

Total oil and natural gas capital

expenditures |

$ |

54,108 |

|

$ |

83,233 |

|

$ |

(23,173 |

) |

$ |

299,904 |

|

$ |

93,956 |

|

| |

|

|

|

|

|

| Bank loan

(2) |

$ |

226,249 |

|

$ |

264,032 |

|

$ |

289,859 |

|

$ |

226,249 |

|

$ |

289,859 |

|

|

Long-term notes (2) |

1,488,450 |

|

1,541,694 |

|

1,544,510 |

|

1,488,450 |

|

1,554,510 |

|

| Long-term

debt |

1,714,699 |

|

1,805,726 |

|

1,844,369 |

|

1,714,699 |

|

1,844,369 |

|

| Working capital

deficiency |

34,106 |

|

13,661 |

|

19,653 |

|

34,106 |

|

19,653 |

|

|

Net debt (3) |

$ |

1,748,805 |

|

$ |

1,819,387 |

|

$ |

1,864,022 |

|

$ |

1,748,805 |

|

$ |

1,864,022 |

|

| |

|

|

| |

Three Months Ended |

Nine Months Ended |

|

|

September 30,2017 |

June 30,2017 |

September 30,2016 |

September 30,2017 |

September 30,2016 |

|

OPERATING |

|

|

|

|

|

| Daily

production |

|

|

|

|

|

| Heavy oil

(bbl/d) |

26,161 |

25,577 |

24,132 |

25,454 |

23,789 |

| Light oil

and condensate (bbl/d) |

20,041 |

22,370 |

19,001 |

21,343 |

21,785 |

| NGL

(bbl/d) |

8,940 |

9,693 |

9,149 |

8,982 |

9,695 |

| Total oil

and NGL (bbl/d) |

55,142 |

57,640 |

52,282 |

55,779 |

55,269 |

| Natural

gas (mcf/d) |

85,006 |

91,028 |

89,314 |

88,166 |

94,253 |

| Oil

equivalent (boe/d @ 6:1) (4) |

69,310 |

72,812 |

67,167 |

70,473 |

70,978 |

| |

|

|

|

|

|

| Benchmark

prices |

|

|

|

|

|

| WTI oil

(US$/bbl) |

48.20 |

48.29 |

44.94 |

49.46 |

41.34 |

| WCS heavy

oil (US$/bbl) |

38.26 |

37.16 |

31.44 |

37.59 |

27.66 |

| Edmonton

par oil ($/bbl) |

56.74 |

61.92 |

54.80 |

60.87 |

50.14 |

| LLS oil

(US$/bbl) |

50.27 |

49.70 |

45.82 |

50.82 |

41.76 |

| |

|

|

|

|

|

| Baytex average

prices (before hedging) |

|

|

|

|

|

| Heavy oil

($/bbl) (5) |

38.18 |

37.62 |

29.79 |

37.29 |

23.91 |

| Light oil

and condensate ($/bbl) |

58.22 |

60.68 |

53.25 |

60.75 |

47.27 |

| NGL

($/bbl) |

25.18 |

22.70 |

14.96 |

24.65 |

15.58 |

| Total oil

and NGL ($/bbl) |

43.36 |

44.06 |

35.72 |

44.23 |

31.65 |

| Natural

gas ($/mcf) |

2.89 |

3.62 |

2.95 |

3.35 |

2.42 |

| Oil

equivalent ($/boe) |

38.04 |

39.41 |

31.73 |

39.20 |

27.86 |

| |

|

|

|

|

|

|

CAD/USD noon rate at period end |

1.2510 |

1.2983 |

1.3117 |

1.2510 |

1.3117 |

|

CAD/USD average rate for period |

1.2524 |

1.3447 |

1.3051 |

1.3067 |

1.3228 |

|

COMMON SHARE INFORMATION |

|

|

|

|

|

|

TSX |

|

|

|

|

|

| Share

price (Cdn$) |

|

|

|

|

|

| High |

4.13 |

4.81 |

7.72 |

6.97 |

9.04 |

| Low |

2.76 |

2.87 |

4.76 |

2.76 |

1.57 |

|

Close |

3.76 |

3.15 |

5.57 |

3.76 |

5.57 |

| Volume

traded (thousands) |

156,562 |

216,383 |

377,435 |

628,577 |

1,326,946 |

| |

|

|

|

|

|

NYSE |

|

|

|

|

| Share

price (US$) |

|

|

|

|

|

| High |

3.16 |

3.63 |

6.18 |

5.20 |

7.14 |

| Low |

2.13 |

2.15 |

3.59 |

2.13 |

1.08 |

|

Close |

3.01 |

2.43 |

4.25 |

3.01 |

4.25 |

| Volume

traded (thousands) |

81,848 |

109,758 |

168,984 |

330,759 |

521,550 |

|

Common shares outstanding (thousands) |

235,451 |

234,204 |

211,542 |

235,451 |

211,542 |

Notes:

(1) Funds from operations is not a measurement based on

generally accepted accounting principles ("GAAP") in Canada, but is

a financial term commonly used in the oil and gas industry. We

define funds from operations as cash flow from operating activities

adjusted for changes in non-cash operating working capital and

asset retirement expenditures. Baytex's determination of funds from

operations may not be comparable to other issuers. Baytex considers

funds from operations a key measure of performance as it

demonstrates its ability to generate the cash flow necessary to

fund capital investments and potential future dividends. For a

reconciliation of funds from operations to cash flow from operating

activities, see Management's Discussion and Analysis of the

operating and financial results for the three and nine months ended

September 30, 2017.(2) Principal amount of instruments.(3) Net debt

is not a measurement based on GAAP in Canada, but is a financial

term commonly used in the oil and gas industry. We define net debt

to be the sum of monetary working capital (which is current assets

less current liabilities excluding current financial derivatives

and onerous contracts) and the principal amount of both the

long-term notes and the bank loan.(4) Barrel of oil equivalent

("boe") amounts have been calculated using a conversion rate of six

thousand cubic feet of natural gas to one barrel of oil. The use of

boe amounts may be misleading, particularly if used in isolation. A

boe conversion ratio of six thousand cubic feet of natural gas to

one barrel of oil is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead.(5) Heavy oil prices

are calculated based on sales volumes, net of blending costs.

Operating Results

Our operating results for the third quarter

reflect strong performance across our three core operating areas as

we position our business for success in a lower commodity price

environment. In the Eagle Ford, enhanced completions continue to

drive strong well performance. In Peace River, we drilled our first

well on the recently acquired acreage with results exceeding our

budget expectation. In Lloydminster, our drilling program continues

to generate impressive results.

Production averaged 69,310 boe/d (80% oil and

NGL) in Q3/2017, as compared to 72,812 boe/d (79% oil and NGL) in

Q2/2017. Production in the first nine months of 2017 averaged

70,473 boe/d. During the third quarter, exploration and development

capital expenditures totaled $61.5 million and we participated in

the drilling of 50 (15.3 net) wells with a 100% success rate.

We employ a flexible approach to prudently

manage our capital program as we target exploration and development

capital expenditures at a level that approximates our FFO. In the

first nine months of 2017, exploration and development capital

expenditures totaled $236.1 million, as compared to FFO of $241.8

million.

As previously disclosed, due to Hurricane

Harvey, on August 25, 2017 our Eagle Ford operations were shut-in

and drilling and completion operations were suspended. With very

little damage to production facilities on Baytex lands, production

in the Eagle Ford steadily increased as market access improved and

production was restored to pre-hurricane levels by mid-September.

Due to flush production from well restarts in September, we

estimate downtime in the third quarter of approximately 1,500

boe/d, as compared to our prior estimate of 2,500 boe/d.

We continuously evaluate opportunities to

optimize and enhance our portfolio. During the third quarter, we

disposed of our Red Earth assets located in north central Alberta

for net proceeds of $7.3 million. The assets were producing

approximately 250 boe/d of crude oil at the time of closing

and included undiscounted asset retirement obligations of $11.6

million.

Due to low natural gas prices in Alberta and our

desire to optimize the value of our resource base, we shut-in

approximately 6 mmcf/d (approximately 1,000 boe/d) of natural

gas production during the month of October. We subsequently

re-started this production as natural gas prices improved.

We are tightening our 2017 production guidance

to 69,500 to 70,000 boe/d (previously 69,000 to 70,000 boe/d),

despite the impact of Hurricane Harvey in the Eagle Ford and the

shut-in of natural gas production in Alberta. We are maintaining

our capital budget guidance at $310 to $330 million. We

continue to drive cost efficiencies in our business with notable

operating expense savings in Peace River. Following a 4% reduction

in our annual guidance for operating expenses in the second

quarter, we are reducing our guidance a further 5% to

$10.50/boe.

We are in the process of setting our 2018

capital budget, the details of which are expected to be released in

December following approval by our Board of Directors.

Eagle Ford

Our Eagle Ford asset in South Texas is one of

the premier oil resource plays in North America. The assets

generate the highest cash netbacks in our portfolio and contain a

significant inventory of development prospects. In Q3/2017, we

directed 76% of our exploration and development expenditures toward

these assets.

Production during the third quarter averaged

34,750 boe/d (77% liquids), as compared to 38,528 boe/d in Q2/2017.

The reduced volumes reflect the impact of Hurricane Harvey combined

with fewer net wells brought on production in Q3/2017 relative to

the first half of 2017.

During the third quarter, we averaged 3-4

drilling rigs and 1-2 completion crews on our lands. In Q3/2017, we

participated in the drilling of 30 (7.9 net) wells and commenced

production from 22 (5.8 net) wells. At quarter end, we had

48 (13.8 net) wells waiting on completion.

We continue to see strong well performance

driven by enhanced completions in Karnes County. In addition, early

results from Atascosa County are encouraging as we exploit the oil

window on the western portion of our lands. The wells that

commenced production during the quarter established 30-day initial

gross production rates of approximately 1,500 boe/d per well.

During the third quarter, we averaged 28 effective frac stages per

well and proppant per completed foot of approximately 1,800 pounds.

Peace River

Our Peace River region, located in northwest

Alberta, has been a core asset since we commenced operations in the

area in 2004. Through our innovative multi-lateral horizontal

drilling and production techniques, we are able to generate some of

the strongest capital efficiencies in the oil and gas industry. In

addition, through detailed re-mapping of the Bluesky formation, we

have been able to effectively increase our exposure to pay in the

laterals of new wells, achieving 97% in zone performance.

Production was stable during the third quarter,

averaging 18,400 boe/d (93% heavy oil), as compared to 18,300 boe/d

in Q2/2017. We drilled 1 (1.0 net) well during the third quarter

and 8 (8.0 net) wells during the first nine months of 2017. These

wells have established an average 30-day initial production rate of

approximately 400 bbl/d per well.

Our Peace River team has been working diligently

to integrate our recent acquisition in Peace River as we align the

acquired assets with our operating philosophy. During the third

quarter, we drilled our first well at Seal, which generated a

30-day initial production rate of approximately 400 bbl/d. We also

restarted 10 pads that were shut-in at the time of the acquisition,

resulting in incremental production of 800 bbl/d. We have

undertaken an extensive review of operations to ensure regulatory

compliance and have made meaningful progress in reducing operating

costs. To-date, we have achieved a 35% reduction with further

improvements anticipated in 2018 and beyond. Production on the

acquired assets averaged 3,800 boe/d during the third quarter,

up 26% from the time of the acquisition.

Lloydminster

Our Lloydminster region, which straddles the

Alberta and Saskatchewan border, is characterized by multiple

stacked pay formations at relatively shallow depths, which we have

successfully developed through vertical and horizontal drilling,

water flood and steam-assisted gravity drainage operations. We have

also adopted, where applicable, the multi-lateral well design and

geosteering capability that we have successfully utilized at Peace

River.

Production averaged approximately 9,100 boe/d

(98% heavy oil) during the third quarter, as compared to 8,600

boe/d in Q2/2017. The higher volumes reflect an increased pace of

development activity following spring break-up. We drilled 19 (6.4

net) wells during the third quarter and 41 (21.3 net) wells during

the first nine months of 2017. During the third quarter,

three operated wells (including two multi-lateral horizontal wells)

established an average 30-day initial production rate of

approximately 200 bbl/d per well.

Financial Review

We generated FFO of $77.3 million ($0.33 per

share) in Q3/2017, compared to $83.1 million ($0.35 per share) in

Q2/2017. The decrease in FFO is largely due to lower production

volumes associated with Hurricane Harvey and the decline in crude

oil prices, expressed in Canadian dollars, due to the strengthening

of the Canadian dollar relative to the U.S. dollar.

In the first nine months of 2017, we generated

FFO of $241.8 million ($1.03 per share), compared to $199.0 million

($0.94 per share) in the first nine months of 2016. This increase

is largely attributable to higher realized commodity prices.

Financial Liquidity

We continue to maintain strong financial

liquidity as our US$575 million revolving credit facilities are

approximately two-thirds undrawn and our first long-term note

maturity is not until 2021. With our strategy to target exploration

and development capital expenditures at a level that approximates

our funds from operations, we expect this liquidity position to be

stable going forward.

Our revolving credit facilities, which currently

mature in June 2019, are covenant-based and do not require annual

or semi-annual reviews. We are well within our financial covenants

on these facilities as our Senior Secured Debt to Bank EBITDA ratio

as at September 30, 2017 was 0.6:1.0, compared to a maximum

permitted ratio of 5.0:1.0, and our interest coverage ratio was

4.2:1.0, compared to a minimum required ratio of 1.25:1.0.

Our net debt totaled $1.75 billion at September

30, 2017, which is down $115 million from September 30, 2016. Our

net debt is comprised of over 75% U.S. dollar borrowings and with

the recent strengthening of the Canadian dollar relative to the

U.S. dollar, our net debt expressed in Canadian dollars is reduced.

Additionally, our exposure to fluctuations in the Canada-U.S.

dollar exchange rate is mitigated as more than half of our

operations are in the U.S. and approximately 70% of our 2017

exploration and development capital program is forecast to be

invested in the U.S.

Operating Netback

In Q3/2017, the price for West Texas

Intermediate light oil (“WTI”) averaged US$48.20/bbl, as compared

to US$48.29/bbl in Q2/2017. While WTI was relatively stable during

the third quarter, we benefited from an improved pricing

environment for Canadian heavy oil. The discount for Canadian heavy

oil, as measured by the price differential between Western Canadian

Select (“WCS”) and WTI, averaged US$9.94/bbl, as compared to

US$11.13/bbl in Q2/2017.

In the Eagle Ford, our assets are proximal to

Gulf Coast markets with light oil and condensate production priced

off the Louisiana Light Sweet (“LLS”) crude oil benchmark, which is

a function of the Brent price. As a result, we are currently

benefiting from a widening of the Brent-WTI spread. In addition,

increased competition for physical field supplies has resulted in

improved price realizations relative to LLS. During the third

quarter, our light oil and condensate price in the Eagle Ford of

US$45.78/bbl (or $58.59/bbl) represented a US$3.49/bbl discount to

LLS, as compared to a historical discount of approximately

US$6.00/bbl.

We generated an operating netback in Q3/2017 of

$17.83/boe ($18.27/boe including financial derivatives gain), as

compared to $18.30/boe ($18.70/boe including financial derivatives

gain) in Q2/2017 and $13.91/boe ($16.95/boe including financial

derivatives gain) in Q3/2016. The Eagle Ford generated an operating

netback of $23.53/boe during Q3/2017 while our Canadian operations

generated an operating netback of $12.08/boe.

The following table summarizes our operating

netbacks for the periods noted.

| |

|

| |

Three Months Ended September 30 |

|

|

2017 |

2016 |

|

($ per boe except for sales volume) |

Canada |

U.S. |

Total |

Canada |

U.S. |

Total |

| Sales volume

(boe/d) |

34,560 |

|

34,750 |

|

69,310 |

|

33,615 |

|

33,552 |

|

67,167 |

|

| |

|

|

|

|

|

|

| Realized sales

price |

$ |

33.41 |

|

$ |

42.64 |

|

$ |

38.04 |

|

$ |

26.52 |

|

$ |

36.95 |

|

$ |

31.73 |

|

| Less: |

|

|

|

|

|

|

|

Royalty |

4.71 |

|

12.58 |

|

8.65 |

|

3.85 |

|

10.89 |

|

7.37 |

|

| Operating

expense |

13.69 |

|

6.53 |

|

10.10 |

|

12.32 |

|

5.82 |

|

9.07 |

|

|

Transportation expense |

2.93 |

|

— |

|

1.46 |

|

2.76 |

|

— |

|

1.38 |

|

| Operating netback |

$ |

12.08 |

|

$ |

23.53 |

|

$ |

17.83 |

|

$ |

7.59 |

|

$ |

20.24 |

|

$ |

13.91 |

|

| Realized

financial derivatives gain |

|

— |

|

|

— |

|

|

0.44 |

|

|

— |

|

|

— |

|

|

3.04 |

|

| Operating netback after

financial derivatives gain |

$ |

12.08 |

|

$ |

23.53 |

|

$ |

18.27 |

|

$ |

7.59 |

|

$ |

20.24 |

|

$ |

16.95 |

|

|

|

Risk Management

As part of our normal operations, we are exposed

to movements in commodity prices, foreign exchange rates and

interest rates. In an effort to manage these exposures, we utilize

various financial derivative contracts which are intended to

partially reduce the volatility in our FFO. We realized a financial

derivatives gain of $2.8 million in Q3/2017.

For the fourth quarter of 2017, we have entered

into hedges on approximately 48% of our net WTI exposure with 9%

fixed at US$54.46/bbl and 39% hedged utilizing a 3-way option

structure that provides us with downside price protection at

US$47.17/bbl and upside participation to US$58.60/bbl. We have also

entered into hedges on approximately 48% of our net WCS

differential exposure at a price differential to WTI of

US$13.67/bbl and 62% of our net natural gas exposure through a

combination of AECO swaps at C$3.00/mcf and NYMEX swaps at

US$2.98/mmbtu.

We are also executing our hedge program for

2018. We have now entered into hedges on approximately 23% of our

net WTI exposure with 18% fixed at US$51.18/bbl and 5% hedged

utilizing a 3-way option structure that provides us with downside

price protection at US$54.40/bbl and upside participation to

US$60.00/bbl. To enhance the value of our fixed price hedges, we

have entered into WTI swaptions at an average price of

US$51.28/bbl, which, if exercised on December 29, 2017, would bring

our crude oil hedge position for 2018 to approximately 38%. In

addition, we have entered into a Brent-based hedge for 1,000 bbl/d

at US$59.00/bbl.

For 2018, we have also entered into hedges on

approximately 42% of our net WCS differential exposure at a price

differential to WTI of US$14.19/bbl and 21% of our net natural gas

exposure through a combination of AECO swaps at C$2.82/mcf and

NYMEX swaps at US$3.02/mmbtu.

A complete listing of our financial derivative

contracts can be found in Note 17 to our Q3/2017 financial

statements.

2017 Guidance

The following table summarizes our 2017 annual

guidance and compares it to our 2017 year-to-date actual

results.

| |

|

|

2017 Guidance |

|

Variance to |

|

|

|

Original (1) |

Current |

YTD 2017 |

Current |

|

| Exploration and

development capital ($ millions) |

300 -

350 |

310 -

330 |

236.1 |

N/A |

|

| Production (boe/d) |

66,000

- 70,000 |

69,500

- 70,000 |

70,473 |

1 |

% |

| |

|

|

|

|

| Expenses: |

|

|

|

|

| Royalty

rate (%) |

~23.0 |

~23.0 |

22.9 |

(1) |

% |

| Operating

($/boe) |

11.00 -

12.00 |

~10.50 |

10.37 |

(1) |

% |

|

Transportation ($/boe) |

1.10 -

1.30 |

~1.40 |

1.37 |

(2) |

% |

| General

and administrative ($/boe) |

~2.00 |

~2.00 |

1.96 |

(2) |

% |

|

Interest ($/boe) |

~4.00 |

~4.00 |

3.93 |

(2) |

% |

Notes:

(1) Original guidance as announced on December 12, 2016.

Board Appointment

The Board of Directors is pleased to announce

the appointment of Mark Bly as a director of Baytex.

Mr. Bly is an independent businessman with over 35 years of

experience in the oil and gas industry, primarily with BP, a global

producer of oil and gas. Since retiring from BP in 2013, Mr.

Bly has worked with private oil and gas production and service

companies serving as an executive, a board member and an advisor.

At BP, Mr. Bly held various senior leadership roles in its domestic

and international operations, including leading the North American

onshore unit, Group Vice President for approximately 25% of BP’s

global production, and Executive Vice President of Group Safety and

Operational Risk. Mr. Bly holds a Master of Science degree in

structural engineering from the University of California, Berkeley

and a Bachelor of Science degree in civil engineering from the

University of California, Davis.

Additional Information

Our condensed consolidated interim unaudited

financial statements for the three and nine months ended September

30, 2017 and the related Management's Discussion and Analysis of

the operating and financial results can be accessed immediately on

our website at www.baytexenergy.com and will be available shortly

through SEDAR at www.sedar.com and EDGAR at

www.sec.gov/edgar.shtml.

|

Conference Call Today – November 2 ,

20179:00 a.m. MDT (11:00 a.m. EDT) |

|

Baytex will host a conference call today, November 2, 2017,

starting at 9:00am MDT (11:00am EDT). To participate, please dial

toll free in North America 1-866-226-4099 or international

1-647-427-2258. Alternatively, to listen to the conference call

online, please enter http://edge.media-server.com/m/p/rryie6jh in

your web browser. An archived recording of the conference call will

be available approximately two hours after the event by accessing

the webcast link above. The conference call will also be archived

on the Baytex website at www.baytexenergy.com. |

Advisory Regarding Forward-Looking

Statements

In the interest of providing Baytex's

shareholders and potential investors with information regarding

Baytex, including management's assessment of Baytex's future plans

and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can

be identified by terminology such as "anticipate", "believe",

"continue", "could", "estimate", "expect", "forecast", "intend",

"may", "objective", "ongoing", "outlook", "potential", "project",

"plan", "should", "target", "would", "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: our

business strategies, plans and objectives; our 2017 production and

capital expenditure guidance; our Eagle Ford assets, including our

assessment that it is a premier oil resource play, the initial

production rates from new wells in Q3/2017; our Peace River assets,

including that the area has some of the strongest capital

efficiencies in the oil and gas industry and initial production

rates from new wells in 2017; our belief that we have strong

financial liquidity and that our liquidity position will remain

stable going forward; our target for exploration and development

capital expenditures to approximate funds from operations; the

effect that a strengthening Canada-U.S. dollar exchange rate will

have on our U.S. dollar denominated debt; that our U.S. operations

mitigate our exposure to fluctuations in the Canada-U.S. dollar

exchange rate; our ability to partially reduce the volatility in

our funds from operations by utilizing financial derivative

contracts for commodity prices, heavy oil differentials and

interest and foreign exchange rates; the percentage of our

anticipated Q4/2017 and 2018 oil and natural gas production that is

hedged; and our expected royalty rate and per boe operating,

transportation, general and administrative and interest costs for

2017. In addition, information and statements relating to reserves

and contingent resources are deemed to be forward-looking

statements, as they involve implied assessment, based on certain

estimates and assumptions, that the reserves and contingent

resources described exist in quantities predicted or estimated, and

that they can be profitably produced in the future.

These forward-looking statements are based on

certain key assumptions regarding, among other things: petroleum

and natural gas prices and differentials between light, medium and

heavy oil prices; well production rates and reserve volumes; our

ability to add production and reserves through our exploration and

development activities; capital expenditure levels; our ability to

borrow under our credit agreements; the receipt, in a timely

manner, of regulatory and other required approvals for our

operating activities; the availability and cost of labour and other

industry services; interest and foreign exchange rates; the

continuance of existing and, in certain circumstances, proposed tax

and royalty regimes; our ability to develop our crude oil and

natural gas properties in the manner currently contemplated; and

current industry conditions, laws and regulations continuing in

effect (or, where changes are proposed, such changes being adopted

as anticipated). Readers are cautioned that such assumptions,

although considered reasonable by Baytex at the time of

preparation, may prove to be incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors. Such factors

include, but are not limited to: the volatility of oil and natural

gas prices; a decline or an extended period of the currently low

oil and natural gas prices; uncertainties in the capital markets

that may restrict or increase our cost of capital or borrowing;

that our credit facilities may not provide sufficient liquidity or

may not be renewed; failure to comply with the covenants in our

debt agreements; risks associated with a third-party operating our

Eagle Ford properties; changes in government regulations that

affect the oil and gas industry; changes in environmental, health

and safety regulations; restrictions or costs imposed by climate

change initiatives; variations in interest rates and foreign

exchange rates; risks associated with our hedging activities; the

cost of developing and operating our assets; availability and cost

of gathering, processing and pipeline systems; depletion of our

reserves; risks associated with the exploitation of our properties

and our ability to acquire reserves; changes in income tax or other

laws or government incentive programs; uncertainties associated

with estimating petroleum and natural gas reserves; our inability

to fully insure against all risks; risks of counterparty default;

risks associated with acquiring, developing and exploring for oil

and natural gas and other aspects of our operations; risks

associated with large projects; risks related to our thermal heavy

oil projects; we may lose access to our information technology

systems; risks associated with the ownership of our securities,

including changes in market-based factors; risks for United States

and other non-resident shareholders, including the ability to

enforce civil remedies, differing practices for reporting reserves

and production, additional taxation applicable to non-residents and

foreign exchange risk; and other factors, many of which are beyond

our control. These and additional risk factors are discussed in our

Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2016, as filed with Canadian securities regulatory authorities

and the U.S. Securities and Exchange Commission.

The above summary of assumptions and risks

related to forward-looking statements has been provided in order to

provide shareholders and potential investors with a more complete

perspective on Baytex’s current and future operations and such

information may not be appropriate for other purposes.

There is no representation by Baytex that actual

results achieved will be the same in whole or in part as those

referenced in the forward-looking statements and Baytex does not

undertake any obligation to update publicly or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

All amounts in this press release are stated in

Canadian dollars unless otherwise specified.

Non-GAAP Financial Measures

Funds from operations is not a measurement based

on Generally Accepted Accounting Principles ("GAAP") in Canada, but

is a financial term commonly used in the oil and gas

industry. Funds from operations represents cash generated

from operating activities adjusted for changes in non-cash

operating working capital and asset retirement expenditures.

Baytex's determination of funds from operations may not be

comparable with the calculation of similar measures for other

entities. Baytex considers funds from operations a key

measure of performance as it demonstrates its ability to generate

the cash flow necessary to fund capital investments and potential

future dividends to shareholders. The most directly

comparable measures calculated in accordance with GAAP are cash

flow from operating activities and net income.

Net debt is not a measurement based on GAAP in

Canada. We define net debt to be the sum of monetary working

capital (which is current assets less current liabilities

(excluding current financial derivatives and onerous contracts))

and the principal amount of both the long-term notes and the bank

loan. We believe that this measure assists in providing a more

complete understanding of our cash liabilities.

Bank EBITDA is not a measurement based on GAAP

in Canada. We define Bank EBITDA as our consolidated net

income attributable to shareholders before interest, taxes,

depletion and depreciation, and certain other non-cash items as set

out in the credit agreement governing our revolving credit

facilities. Bank EBITDA is used to measure compliance with certain

financial covenants.

Operating netback is not a measurement based on

GAAP in Canada, but is a financial term commonly used in the oil

and gas industry. Operating netback is equal to product

revenue less royalties, production and operating expenses and

transportation expenses divided by barrels of oil equivalent sales

volume for the applicable period. Our determination of

operating netback may not be comparable with the calculation of

similar measures for other entities. We believe that this

measure assists in characterizing our ability to generate cash

margin on a unit of production basis.

Advisory Regarding Oil and Gas Information

Where applicable, oil equivalent amounts have

been calculated using a conversion rate of six thousand cubic feet

of natural gas to one barrel of oil. The use of boe amounts

may be misleading, particularly if used in isolation. A boe

conversion ratio of six thousand cubic feet of natural gas to one

barrel of oil is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead.

References herein to average 30-day initial

production rates and other short-term production rates are useful

in confirming the presence of hydrocarbons, however, such rates are

not determinative of the rates at which such wells will commence

production and decline thereafter and are not indicative of long

term performance or of ultimate recovery. While encouraging,

readers are cautioned not to place reliance on such rates in

calculating aggregate production for us or the assets for which

such rates are provided. A pressure transient analysis or well-test

interpretation has not been carried out in respect of all wells.

Accordingly, we caution that the test results should be considered

to be preliminary.

Baytex Energy Corp.

Baytex Energy Corp. is an oil and gas

corporation based in Calgary, Alberta. The company is engaged in

the acquisition, development and production of crude oil and

natural gas in the Western Canadian Sedimentary Basin and in the

Eagle Ford in the United States. Approximately 80% of Baytex’s

production is weighted toward crude oil and natural gas liquids.

Baytex’s common shares trade on the Toronto Stock Exchange and the

New York Stock Exchange under the symbol BTE.

For further information about Baytex, please

visit our website at www.baytexenergy.com or contact:

Brian Ector, Senior Vice President,

Capital Markets and Public Affairs

Toll Free Number: 1-800-524-5521Email:

investor@baytexenergy.com

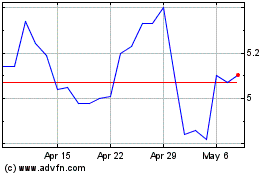

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Feb 2024 to Feb 2025