– Record Q4, and F2021 Manufacturing Segment

Revenue of $5.3M, a 3-fold Increase vs. F2020 – Expansion of

Pliaglis® Licenses to 32 New Countries – Strong Liquidity Position

of $11.3M – Q4-F2021 Adjusted EBITDA1 of $1.6M

Crescita Therapeutics Inc. (TSX: CTX and OTC US: CRRTF)

(“Crescita” or the “Company”), a growth-oriented, innovation-driven

Canadian commercial dermatology company, today reported its

financial results for the three months and fiscal year ended

December 31, 2021 (“Q4-F2021” and “F2021”). All amounts presented

are in thousands of Canadian dollars (“CAD”) unless otherwise

noted.

Financial Highlights

Q4-F2021 vs. Q4-F2020

- Revenue was $7,562 compared to $2,791, up $4,771;

- Gross profit was $4,651 compared to $1,588, up $3,063;

- Operating expenses were $3,536 compared to $2,316, up

$1,220;

- Adjusted EBITDA1 was $1,585 compared to $(446), up $2,031;

F2021 vs. F2020

- Revenue was $16,769 compared to $15,640, up $1,129;

- Gross profit was $10,014 compared to $11,273, down $1,259;

- Operating expenses were $10,733 compared to $9,718, up

$1,015;

- Adjusted EBITDA1 was $932 compared to $3,201, down $2,269;

- Ending cash of $11,331 compared to $14,281, down $2,950.

“We made considerable headway in achieving near-term milestones

in 2021,” commented Serge Verreault, President and CEO of Crescita.

“Our business bounced back from the impacts of COVID-19 in the

prior year with 7.2% total revenue growth to $16.8 million. With a

strong balance sheet and encouraging consumer trends, we invested

in our commercial infrastructure this year. Our aim is to

accelerate product sales across all our channels, with a particular

emphasis on our digital footprint, and on expanding our presence in

the growing medical aesthetics market.

“We also added production volume to our plant, more than

tripling our revenue compared to 2020 and our manufacturing team is

streamlining our processes to enhance future scalability. We

expanded Pliaglis across the globe, adding three partners that will

commercialize Pliaglis in 32 new countries. With all major

countries now licensed, we are helping our partners obtain

regulatory approval to launch Pliaglis in 2022 and beyond so that

it becomes a solid recurring revenue stream for Crescita. With 2022

well underway, our team is stronger than ever and well positioned

to execute on our growth pillars,” concluded Mr. Verreault.

F2021 Corporate Developments

Expansion of our Board of Directors

- The Board of Directors appointed Mrs. Deborah Shannon-Trudeau

as a director effective November 10, 2021. Mrs. Trudeau has over 30

years’ experience in strategy, business development, commercial and

manufacturing operations.

Key New Partners for the Commercialization of Pliaglis in 32

Countries

- 8-Country Exclusive Licensing Agreement with Egis

Pharmaceuticals PLC, a pharmaceutical company in Central Eastern

Europe for the rights to Pliaglis.

- 15-Country Exclusive Licensing Agreement with STADA MENA

DWC-LLC, a subsidiary of STADA Arzneimittel AG, a specialty pharma,

generics and consumer healthcare group, for the rights to Pliaglis

in 15 countries in the Middle East and North Africa (“MENA”)

region.

- 9-Country Exclusive Licensing Agreement with Croma Pharma GmbH,

a globally acclaimed pharmaceutical company with specializations in

medical aesthetics, ophthalmology, and orthopaedics for the rights

to Pliaglis in eight European countries and Brazil.

Distribution Agreement with Obagi Cosmeceuticals LLC

- We entered into a distribution agreement with Obagi

Cosmeceuticals LLC (“Obagi”) providing us with the exclusive rights

to promote, distribute and sell the Obagi Medical® product line in

Canada. We expect to launch the Obagi line nationwide through our

existing sales network in the first half of 2022.

Acquisition of Minority Interest in The Best You®

- We acquired a minority interest in Akyucorp Ltd. d/b/a The Best

You, a privately held network of six medical aesthetic clinics in

Ontario (“The Best You”). In consideration, Crescita issued 470,128

common shares at a price of $0.70 per common share and to support

The Best You’s growth, we also invested in a secured convertible

promissory note with an initial principal amount of $0.5M that

could reach $1.25M based on financial performance and certain

events and conditions being met.

Launch of NCTF®

- We launched New Cellular Treatment Factor® (“NCTF”), a skin

revitalization solution primarily used for the improvement of skin

quality and fine lines. NCTF represents a key opportunity for us to

take advantage of the increasing popularity of minimally invasive

and non-invasive aesthetic procedures and to strengthen our

presence in the rapidly growing Canadian medical aesthetics

market.

Expansion of Production Volumes

- We received firm purchase orders of approximately $7 million in

our Manufacturing and Services segment, representing a significant

increase in production and sales volume. The increase is a result

of our customers’ anticipated launches into new key markets and may

not be representative of future orders.

Amendment to Credit Facility

- We amended our existing revolving demand operating credit

facility for a temporary $2.5 million increase in the available

amount from $3.5 million to $6.0 million until April 30, 2022. The

temporary increase provides us with additional financial

flexibility to fund increases in production volumes in the

Manufacturing and Services segment. The Company has not drawn down

any amounts from this facility.

Q4-F2021 and F2021 Financial Results

Note: The Management’s Discussion and Analysis

(“MD&A”), the consolidated audited Financial Statements and

accompanying notes for the fiscal year ended December 31, 2021 are

available at www.crescitatherapeutics.com/investors and have been

filed with SEDAR at www.sedar.com.

Summary Financial Results

In thousands of CAD, except per share data

and number of shares

Three months ended December

31,

Year ended December

31,

2021

2020

2021

2020

$

$

$

$

Commercial Skincare

2,270

2,079

7,469

6,704

Licensing and Royalties

2,367

359

3,967

7,224

Manufacturing and Services

2,925

353

5,333

1,712

Revenues

7,562

2,791

16,769

15,640

Cost of goods sold

2,911

1,203

6,755

4,367

Gross profit

4,651

1,588

10,014

11,273

Gross margin (%)

61.5%

56.9%

59.7%

72.1%

Research and development

171

325

634

1,101

Selling, general and administrative

3,018

1,743

8,720

7,126

Depreciation and amortization

347

248

1,379

1,491

Total operating expenses

3,536

2,316

10,733

9,718

Operating profit (loss)

1,115

(728)

(719)

1,555

Total other (income) expenses

84

(40)

298

1,035

Share of profit in associate

8

-

8

-

Income (loss) before income

taxes

1,039

(688)

(1,009)

520

Deferred income tax (recovery) expense

96

(96)

96

483

Net income (loss)

943

(592)

(1,105)

37

Adjusted EBITDA1

1,585

(446)

932

3,201

Earnings per share

Basic

$

0.04

$

(0.03)

$

(0.05)

$

-

Diluted

$

0.04

$

(0.03)

$

(0.05)

$

-

Weighted average number of common

shares outstanding

Basic

21,016,282

20,648,448

20,755,290

20,661,477

Diluted

22,295,112

20,648,448

20,755,290

20,969,205

Selected Balance Sheet

Information

Cash and cash equivalents, end of

period

11,331

14,281

Selected Cash Flow Information

Cash provided by (used in) operating

activities

(469)

568

(1,597)

5,608

Cash used in investing activities

(222)

-

(846)

(59)

Cash used in financing activities

(194)

(94)

(500)

(476)

Revenue We have three reportable segments: 1) Commercial

Skincare (“Commercial”), which manufactures and sells branded

non-prescription skincare products in both the Canadian and

international markets, and also commercializes Pliaglis and NCTF in

Canada; 2) Licensing and Royalties (“Licensing”), which primarily

generates revenue from licensing our intellectual property related

to Pliaglis or our transdermal delivery technologies; and 3)

Manufacturing and Services (“Manufacturing”), which generates

revenue from contract manufacturing and product development

services.

For the three months ended December 31, 2021, total revenue was

$7,562 compared to $2,791 for the three months ended December 31,

2020, representing an increase of $4,771. Our Licensing segment

revenue increased by $2,008 reflecting the recognition of minimum

guaranteed royalties of $1,279 (US$1,000) under our agreement with

Taro Pharmaceuticals Inc. (“Taro” and the “Taro Agreement”) and an

upfront payment of $932 (€650) in connection with the licensing

agreement with Egis, while our Manufacturing segment revenue

increased by $2,572, reflecting the additional purchase orders from

new and existing clients, combined with the recovery from the

impact of COVID-19 on our Manufacturing segment in the prior year.

Our Commercial Skincare segment posted an increase of $191, driven

by incremental sales of NCTF launched in 2021 and an increase in

domestic sales from our lead aesthetic brand, Laboratoire Dr

Renaud®, partly offset by lower export revenue in Asian

markets.

For the year ended December 31, 2021, total revenue was $16,769

compared to $15,640 for the year ended December 31, 2020,

representing an increase of $1,129. The most significant increases

came from our Manufacturing segment in the amount of $3,621,

reflecting purchase orders from new and existing clients, and from

our Commercial segment in the amount of $765, reflecting higher

product sales mainly driven by digital marketing investments and

the launch of NCTF, with both segments showing recovery from the

prior year’s COVID-19 impact. These increases were partly offset by

the $3,257 decrease in our Licensing segment, mainly as a result of

the one-time revenue recognized in the prior year from amending our

U.S. licensing agreement with Taro (the “Taro Amendment”) in the

amount of $4,483, offset in part by the minimum royalties under the

Taro Agreement and upfront payments under various Pliaglis

licensing agreements in the rest-of-world. No royalties were

recognized from the U.S. sales of Pliaglis during the year.

Gross Profit For the three months ended December 31,

2021, gross profit was $4,651, representing a gross margin of

61.5%, compared to $1,588 and 56.9%, respectively, for the three

months ended December 31, 2020. The increase of $3,063 in gross

profit and 4.6% in gross margin were both mainly due to the

increase in high-margin licensing revenue year-over-year as well

as, to a lesser extent, the benefit of higher manufacturing

volumes.

For the year ended December 31, 2021, gross profit was $10,014,

representing a gross margin of 59.7%, compared to $11,273 and

72.1%, respectively, for the year ended December 31, 2020. The

decrease in gross profit of $1,259 was mainly due to the drop in

high-margin licensing revenue year-over-year, partly offset by the

growth in our Commercial and Manufacturing segments and the benefit

of government wage and rent subsidies related to COVID-19. The

decrease in gross margin of 12.4% was mainly driven by the decrease

in high-margin licensing revenue and the unfavourable revenue mix

with higher Manufacturing segment revenue year-over-year, offset in

part by the benefit of higher manufacturing volumes.

Operating Expenses For the three months ended December

31, 2021, total operating expenses were $3,536 compared to $2,316

for the three months ended December 31, 2020, representing a net

increase of $1,220. The increase was primarily driven by higher

selling, general and administrative (“SG&A”) expenses, mainly

reflecting investments in advertising and promotion to grow our

brands and in various key positions across the organization, and to

a lesser extent, higher depreciation and amortization expense of

$99. These additional costs were partly offset by lower research

and development (“R&D”) spend of $154.

For the year ended December 31, 2021, total operating expenses

were $10,733 compared to $9,718 for the year ended December 31,

2020, representing a net increase of $1,015. The increase was

mainly reflective of a return to a pre-pandemic level of

headcount-related costs, investments in advertising and promotion

spend to grow our brands and in various key positions across the

organization, mainly in the sales, marketing and digital marketing

departments. These additional costs were partly offset by lower

R&D spend of $467, primarily reflecting the Company’s

proportionate funding of clinical development activities related to

CTX-101 in Q2-F2020, and to a lesser extent, lower depreciation

expense of $112.

During the year ended December 31, 2021, we recognized the

benefit of $777 in wage subsidies under the Canada Emergency Wage

Subsidy (“CEWS”) program, compared to $722 for the year ended

December 31, 2020. In Q2-F2020, we initiated cash conservation

measures including temporary layoffs and salary reductions in

response to the pandemic.

Cash and Cash Equivalents Cash and cash equivalents were

$11,331 at December 31 2021, reflecting a net year-over-year change

of $(2,950), mainly due to the cash used in operations, which

includes the impact of non-cash working capital items that will be

collected in the first half of fiscal 2022, the investment in a

secured convertible promissory note in connection with our minority

interest in The Best You, purchases of capital assets and

repurchase of shares under our Normal Course Issuer Bid.

Non-IFRS Financial Measures We report our financial

results in accordance with International Financial Reporting

Standards (“IFRS”). However, we use certain non-IFRS financial

measures to assess our Company’s performance. We believe these to

be useful to management, investors, and other financial

stakeholders in assessing Crescita’s performance. The non-IFRS

measures used in this press release do not have any standardized

meaning prescribed by IFRS and are therefore not comparable to

similar measures presented by other issuers. These measures should

be considered as supplemental in nature and not as a substitute for

the related financial information prepared in accordance with IFRS.

The following are the Company’s non-IFRS measures along with their

respective definitions:

- EBITDA is defined as earnings before interest, income taxes,

depreciation, and amortization.

- Adjusted EBITDA is defined as earnings before interest, income

taxes, depreciation and amortization, share of (profit) losses of

associates, other (income) expenses, share-based compensation

costs, goodwill and intangible asset impairment, and foreign

exchange (gains) losses, as applicable.

Management believes that Adjusted EBITDA is an important measure

of operating performance and cash flow and provides useful

information to investors as it highlights trends in the underlying

business that may not otherwise be apparent when relying solely on

IFRS measures. Below is a reconciliation of EBITDA and Adjusted

EBITDA to their closest IFRS measures.

In thousands of CAD dollars

Three months ended December

31,

Year ended December

31,

2021

2020

2021

2020

$

$

$

$

Net income (loss)

943

(592)

(1,105)

37

Adjust for:

Depreciation and amortization

347

248

1,379

1,491

Interest (income) expense, net

14

(29)

54

(39)

Deferred income tax (recovery) expense

96

(96)

96

483

EBITDA

1,400

(469)

424

1,972

Adjust for:

Share of profit in an associate

(8)

-

(8)

-

Share-based compensation

123

34

272

155

Foreign exchange (gain) loss

70

(11)

244

(176)

Impairment of intangible assets

-

-

-

1,918

Taro Amendment

-

-

-

(668)

Adjusted EBITDA

1,585

(446)

932

3,201

Caution Concerning Limitations of Summary Financial Results

Press Release This summary earnings press release contains

limited information meant to assist the reader in assessing

Crescita’s performance, but it is not a suitable source of

information for readers who are unfamiliar with Crescita and is not

in any way a substitute for the Company's Consolidated Audited

Financial Statements and notes thereto, MD&A and our latest

Annual Information Form (“AIF”).

About Crescita Therapeutics Inc. Crescita (TSX: CTX and

OTC US: CRRTF) is a growth-oriented, innovation-driven Canadian

commercial dermatology company with in-house R&D and

manufacturing capabilities. The Company offers a portfolio of

high-quality, science-based non-prescription skincare products and

early to commercial stage prescription products. We also own

multiple proprietary transdermal delivery platforms that support

the development of patented formulations to facilitate the delivery

of active ingredients into or through the skin. For more

information visit, www.crescitatherapeutics.com.

Forward-looking Statements This press release contains

“forward-looking information” within the meaning of applicable

securities laws (collectively, “forward-looking statements”).

Forward-looking statements can be identified by words such as:

“anticipate”, “intend”, “plan”, “goal”, “seek”, “believe”,

“project”, “estimate”, “expect”, “strategy”, “future”, “likely”,

“may”, “should”, “will” and similar references to future periods.

Examples of forward-looking statements include, but are not limited

to, statements regarding the Company’s objectives, plans, goals,

strategies, growth, performance, operating results, strategy for

customer retention, product development, market position, business

prospects, opportunities and industry trends and similar statements

concerning anticipated future events, results, circumstances,

performance or expectations. Forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based only on current beliefs, expectations and

assumptions regarding the future of the Company’s business, future

plans and strategies, projections, anticipated events and trends,

the economy and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict and many of which are outside of the Company’s

control. Crescita’s actual results and financial condition may

differ materially from those indicated in the forward-looking

statements. Therefore, you should not unduly rely on any of these

forward-looking statements. Important factors that could cause

Crescita’s actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others: economic and market conditions, the impact

of the COVID-19 pandemic and the response thereto of governments

and consumers, the Company’s ability to execute its growth

strategies, reliance on third parties for clinical trials,

marketing, distribution and commercialization, the impact of

changing conditions in the regulatory environment and product

development processes, manufacturing and supply risks, increasing

competition in the industries in which the Company operates, the

Company’s ability to meet its debt commitments, the impact of

unexpected product liability matters, the impact of litigation

involving the Company and/or its products, the impact of changes in

relationships with customers and suppliers, the degree of

intellectual property protection of the Company’s products, the

degree of market acceptance of the Company’s products, developments

and changes in applicable laws and regulations, as well as other

risk factors discussed in the “Risk Factors” sections of the

Company’s most recent annual MD&A for the year ended December

31, 2021 and the Company’s AIF dated March 22, 2022. Any

forward-looking statement made in this press release is based only

on information currently available and speaks only as of the date

on which it is made. Except as required by applicable securities

laws, Crescita undertakes no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

______________________ 1Please refer to the Non-IFRS Financial

Measures section of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220323005350/en/

Crescita Therapeutics Investor Relations Linda Kisa, CPA,

CA lkisa@crescitatx.com

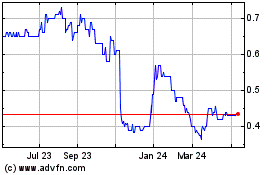

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

From Dec 2024 to Jan 2025

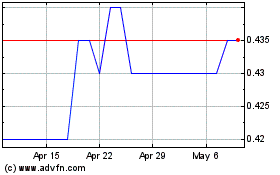

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

From Jan 2024 to Jan 2025