A Leading Proxy Advisory Firm Concludes the

Board Has Been Ineffective at Overseeing Management, Citing Lack of

M&A Discipline, Rising Leverage, Execution Problems and the

Unnecessary $10 Million Payout to Outgoing CEO

ISS Recommends Shareholders “WITHHOLD” on CEO Matthew Proud, Compensation

Committee Chair Edward Prittie and Recently Appointed Blacksheep

Director Luke McCormick

Engine Reminds Shareholders That the Only Way

to Ensure a Successful CEO Search Process and the Implementation of

a Superior Value Creation Plan is by Voting for ALL SIX of Engine’s Directors

Engine Capital LP (together with its affiliates, "Engine" or

"we"), which owns approximately 7.1% of the issued and outstanding

common shares of Dye & Durham Limited (TSX: DND) ("Dye &

Durham" or the "Company"), today announced that Institutional

Shareholder Services Inc. (“ISS”), a leading independent proxy

advisory firm, has recommended that Dye & Durham shareholders

support meaningful boardroom change by voting for three of its six

directors at the Company’s 2024 Annual Meeting of Shareholders to

be held on December 17, 2024. ISS recommends that shareholders vote

the BLUE proxy card to elect

Arnaud Ajdler, Hans T. Gieskes and Anthony Kinnear to the Board of

Directors (the “Board”).

Notably, ISS recommends that shareholders WITHHOLD votes for CEO Matt Proud, Chair of

the Compensation Committee Edward Prittie and director Luke

McCormick.

Mr. Ajdler, Founder and Managing Partner of Engine,

commented:

“We appreciate that ISS has highlighted the need for urgent

Board and leadership changes at Dye & Durham. The firm’s

recommendation for the addition of our proposed Chair and interim

CEO Hans Gieskes and the removal of Matt Proud should send a clear

signal to shareholders about the root of the boardroom dysfunction

that has destroyed shareholder value and Dye & Durham’s

culture. As ISS notes, the Board’s recent refreshments have not

gone far enough to replace the directors responsible for the

Company’s undisciplined capital allocation strategy and execution

problems.

It is absolutely necessary that shareholders vote to elect all

six of Engine’s highly qualified directors to ensure that the Board

is best equipped to identity, attract and oversee the Company’s

next leader on the path to delivering value for long-suffering

shareholders. Our directors have the right backgrounds in legal

technology, software operations, corporate governance, business

transformation, CEO succession planning and capital allocation at

top-performing organizations to fix Dye & Durham’s culture and

improve performance for the benefit of all employees, customers and

shareholders.”

In its full report, ISS affirmed Engine’s case for change and

acknowledged concerns regarding the Board’s ability to attract and

retain a new CEO, as well as the Board’s questionable tactics under

Chair Colleen Moorehead:1

- “Various configurations of the board have been ineffective

at performing oversight over the company's founder, CEO, and

strategic architect, Matthew Proud.”

- “Shareholders would be right to wonder […] if Proud and the

management nominees endorsing his continued involvement in the

succession process should be trusted.”

- “[…] there is unease regarding oversight and

accountability, and the ability of the incumbent board (with

Proud involved) to attract and retain a new high-caliber CEO.”

- “[Ms. Moorehead] has served during over a period where the

company's leverage increased despite public commitments for

leverage reduction.”

- “Prittie, being the longest tenured incumbent director

alongside Proud, has overseen the entirety of Proud's actions

while CEO and was also identified by the company's former chair

Derksen as being ‘unengaged.’”

- “Considering underlying concerns about oversight and

accountability, Prittie's continued presence on the board

represents a risk of the problems of the past continuing, including

an overly deferential posture towards Proud.”

- “At times, the board has engaged in questionable tactics to

stifle the dissident campaign under [Ms. Moorehead’s] tenure,

most notably by lobbying for the Competition Bureau investigation

to serve as rationale to preserve the incumbent board and

management.”

- “[McCormick] lacks the public company board experience or legal

industry experience possessed by certain of the dissident

nominees.”

ISS noted the following with respect to Engine’s director

candidates and its CEO transition plan:

- “Dissident nominee Ajdler provides extensive public company

board experience, and importantly, ensures a valuable

shareholder perspective on the board during the critical CEO

succession process.”

- “Dissident nominees Gieskes and Kinnear both possess public

company board experience and relevant legal industry

experience.”

- “Both [Gieskes and Kinnear] appeared credible during engagement

in terms of their industry knowledge, and Gieskes also was proposed

to serve as interim CEO, if necessary, during a potential

transition.”

Shareholders are encouraged to vote FOR all six of

Engine’s nominees using only the BLUE proxy card. In order for your votes to be

counted, you must submit your BLUE proxy or voting instruction form

before 10:30 a.m. Eastern Time on December 12,

2024.

Contact your broker to obtain the 16-digit control number

associated with your BLUE

voting instruction form. Once you have your control number, visit

www.LetsFixDND.com/how-to-vote to cast your vote. If you have

already voted using the GOLD Dye & Durham proxy, you can submit

a new vote using the BLUE

proxy. Only the later dated proxy will be counted at the Annual

Meeting. If you have questions or require assistance with voting

your shares, please contact the proxy solicitation agent, Sodali

& Co, at Toll Free: 1-888-777-2094, Outside North America

(collect calls accepted): 1-289-695-3075 or Email:

assistance@sodali.com.

For more information on how to vote for the entire Engine slate

on the BLUE Proxy Card, to

download a copy of the full presentation and to share feedback on

Dye & Durham, visit www.LetsFixDND.com. Visit SEDAR+

(www.sedarplus.ca) to review a copy of Engine’s Information Proxy

Circular, dated November 29, 2024.

Disclaimer for Forward-Looking

Information

Statements contained herein that are not historical facts

constitute “forward-looking statements” and “forward-looking

information” (together, “forward-looking statements”) within the

meaning of applicable securities laws that reflect Engine’s current

expectations, assumptions, and estimates of future events,

performance and economic conditions. Such forward-looking

statements rely on the safe harbor provisions of applicable

securities laws. Because such statements are subject to risks and

uncertainties, actual results may differ materially from those

expressed or implied by such forward-looking statements and there

can be no assurance that the Company’s securities will trade at the

prices that may be implied herein, and there can be no assurance

that any opinion or assumption herein is, or will be proven,

correct. Words and phrases such as “anticipate,” “believe,”

“create,” “drive,” “expect,” “forecast,” “future,” “growth,”

“intend,” “hope,” “opportunity,” “plan,” “confident,” “restore,”

“reduce,” “potential,” “proposal,” “unlock,” “upside,” “will,”

“would,” and similar words and phrases are intended to identify

forward-looking statements. These forward-looking statements may

include, but are not limited to, statements concerning: the

anticipated financial and operating performance of Dye &

Durham; anticipated changes to Dye & Durham’s debt levels and

financial ratios; the outcome of the Annual Meeting; the release of

a transition plan and go-forward strategy; anticipated EBITDA; and

achieving organic growth, free cash flow generation and leverage

reduction. Such forward-looking statements are not guarantees of

future performance or actual results, and readers should not place

undue reliance on any forward-looking statement as actual results

may differ materially and adversely from forward-looking

statements. All forward-looking statements contained herein are

made only as of the date hereof, and Engine disclaims any intention

or obligation to update or revise any such forward-looking

statements to reflect events or circumstances that subsequently

occur, or of which Engine hereafter becomes aware, except as

required by applicable law.

Non-IFRS Measures

This press release makes reference to certain non-IFRS financial

measures. These measures are not recognized measures under IFRS, do

not have a standardized meaning prescribed by IFRS and may not be

comparable to similar measures presented by other companies.

Rather, these measures are provided as additional information to

complement IFRS financial measures by providing further

understanding of the Company’s results of operations from the

Company’s perspective as disclosed by the Company in its public

disclosure, including in the Company’s Management Circular. The

Company’s definitions of non-IFRS measures may not be the same as

the definitions for such measures used by other companies or

investors in their reporting. Non-IFRS measures have limitations as

analytical tools and should not be considered in isolation nor as a

substitute for analysis of the Company’s financial information

reported under IFRS. The Company discloses that it uses non-IFRS

financial measures, including “EBITDA” and “Leveraged Free Cash

Flow”, to provide investors with supplemental measures of the

Company’s operating performance and to eliminate items that have

less bearing on operating performance or operating conditions and

thus highlight trends in the Company’s core business that may not

otherwise be apparent when relying solely on IFRS financial

measures. Engine believes that securities analysts, investors and

other interested parties frequently use non-IFRS financial measures

in the evaluation of issuers such as the Company. The Company also

discloses that it uses non-IFRS financial measures in order to

facilitate operating performance comparisons from period to period.

Please see “Cautionary Note Regarding Non-IFRS Measures” and

“Select Information and Reconciliation of Non-IFRS Measures” in the

Company’s most recent Management’s Discussion and Analysis, which

is available on the Company’s profile on SEDAR+ at

www.sedarplus.ca, for further details on these non-IFRS measures,

including (i) definitions of each non-IFRS measure and an

explanation of the composition of each non-IFRS financial measure,

and (ii) relevant reconciliations of each non-IFRS measure to its

most directly comparable IFRS measure, which information is

incorporated by reference herein. Engine believes that its

disclosure of non-IFRS measures in this press release is consistent

with the use of such measures by the Company.

About Engine Capital

Engine Capital LP is a value-oriented special situations fund

that invests both actively and passively in companies undergoing

change.

1 Permission to use quotations from ISS was neither sought nor

obtained.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241206835167/en/

For Investors: Engine Capital LP 212-321-0048

info@enginecap.com Sodali & Co. North American Toll-Free

Number: 1-888-777-2094 Outside North America (collect calls

accepted): 1-289-695-3075 assistance@sodali.com For Media:

Longacre Square Partners Charlotte Kiaie / Bela Kirpalani,

646-386-0091 engine-DND@longacresquare.com

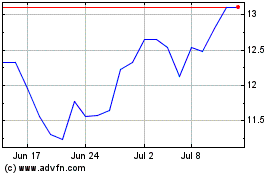

Dye and Durham (TSX:DND)

Historical Stock Chart

From Jan 2025 to Feb 2025

Dye and Durham (TSX:DND)

Historical Stock Chart

From Feb 2024 to Feb 2025