Solid third quarter 2024 at €1,334 m up 9%

at reported and constant currency

Regulatory News:

Exclusive Networks (Paris:EXN):

SUSTAINED GROWTH

- Gross Sales up 9% reported and up 9% at constant currency to

€1,334 m

- Geographic consolidation with M&A strategy paying off in

APAC and solid growth in NAM at 11% at constant currency

- YTD growth up 9% reported and up 10% at constant currency

- FY-24 outlook confirmed

Exclusive Networks (Euronext Paris: EXN), a global leader in

cybersecurity, today announces its Gross Sales and IFRS Revenue for

the third quarter ended September 30, 2024. Please note that

management will not hold a conference call on November 5, 2024, as

originally scheduled.

Jesper Trolle, Chief Executive Officer, commented: “I'm

pleased to report that we had a solid third quarter, considering

persistent challenging market conditions. We delivered continued

growth, with gross sales at €1,334 million, up 9% both at constant

currency and reported. This performance was mainly driven by APAC,

up 71%, and Americas, up 11%.

In APAC, the integration of the Nextgen Group has strengthened

and accelerated our growth, demonstrating that our M&A strategy

aimed at geographic consolidation in the ANZ is paying off.

Our fundamentals are solid, our reputation as a trusted partner

continues to be appreciated by vendors and customers alike, with

retention rates consistently above 100%, paving the way for

continued growth.

Even though deals have slipped due to lengthening

decision-making processes, we see the year ending on a positive

note, with a double-digit booking growth in the second and third

quarters, confirming our confidence in achieving our 2024

guidance.”

Q3 2024 FINANCIAL PERFORMANCE HIGHLIGHTS

Net vendors retention rate1 were at 105% on a rolling

12-month basis at Q3-24 (vs 122% in Q3-23) with Net customers

retention rates1 at 104% on a rolling 12-month basis at Q3-24

(vs 121% in Q3-23), supported by the sustained demand for our

vendors’ solutions and the continued engagement of our channel

partners.

Q3 2024 Gross sales

in € million

Q3 2023

Q3 2024

Variation

Reported

Constant Currency*

EMEA

973

992

+2%

+2%

AMERICAS

157

173

+10%

+11%

APAC

99

169

+71%

+72%

GROUP

1,228

1,334

+9%

+9%

* Variation at constant currency is computed using the third

quarter of 2023 rates applied to the third quarter of 2024 Gross

sales. The USD, GBP and PLN evolved as follows; 1EUR: 1.087 USD;

1EUR: 0.851 GBP, 1EUR: 4.306 PLN respectively for Q4 2024 and 1EUR:

1.084 USD; 1EUR: 0.871 GBP, 1EUR: 4.584 PLN respectively for Q3

2023.

Gross sales were €1,334 million, an increase of 9% year

over year on a reported basis, 9% at constant currency. Part of

this reported growth (5.5%) was driven by M&A activities with

the integration of NextGen Group. The remainder of the growth was a

combination of Existing vendors in their current geographies

(1.6%), vendors entering into new geographies (1.0%) and new vendor

relationship (0.5%). Growth has been impacted by slippage of deals

into Q4. As Q4 is the last quarter of the calendar year, the

Company is confident to achieve a solid Q4 vs LY.

EMEA (74% of total quarterly Gross sales): Gross sales

rose to €992 million, an increase of €19 million or +2% at reported

and at constant currency

AMERICAS (13% of total quarterly Gross sales): Gross

sales were €173 million, up +10% reported or +11% at constant

currency.

APAC (13% of total quarterly Gross sales): Gross sales

were up to 169 million, up 71% year over year on reported basis and

72% at constant currency. The organic growth of APAC is 3.4%

reported, 3.8% at constant currency experiencing its second quarter

of positive growth vs LY, which clearly demonstrates our recovery

capabilities.

In Q3-24, Gross sales mix grew towards Software and Support

& Maintenance, in line with the strategy in place and

confirming the relevance of the value proposition. Hardware

on a rolling 12-month basis decreased to 23% of the Group (vs 26%

in Q3-23), Software was up at 51% (vs 48% in Q3-23) and

Support & Maintenance was stable at 26% (vs 26% in

Q3-23). Cloud-based business accounted for 34% of the Group in

Q3-24 on a rolling 12-month basis, up 6 points compared to Q3-23 in

line with our digital growth strategy.

Q3 2024 IFRS Revenue

in € million

Q3 2023

Q3 2024

Variation

Reported

Constant Currency*

EMEA

275

281

+2%

+3%

AMERICAS

64

80

+24%

+26%

APAC

39

55

+42%

+43%

GROUP

378

415

+10%

+11%

* Variation at constant currency is computed using the third

quarter of 2023 rates applied to the third quarter of 2024

revenue.

IFRS Revenue takes into account the recognition of the

sales of support and maintenance on a Net Margin basis as per IFRS

as Exclusive Networks is not the primary obligor for these

solutions. IFRS Revenue reached €415 million, up 10% on a reported

basis, in line with Gross sales evolution.

2024 OUTLOOK

In an environment still challenged by macroeconomic volatility,

we remain confident in meeting our FY 2024 guidance:

- Gross sales growth in a range between 10% and 12% at

constant currency

- Net margin in the range of €500 million to €515

million

- Adj. EBIT in the range of €200 and €210 million

- Adj. Operating FCF above 80% of Adj. EBITDA

SIGNIFICANT EVENTS SINCE SEPTEMBER 30, 2024

As described in the press release issued by the Company on July

24, 2024, a consortium comprising CD&R and Everest UK HoldCo

Limited, an entity controlled by the Permira funds and the majority

shareholder of Exclusive Networks, is contemplating to acquire a

majority shareholding in the Company (the "Block Acquisition"),

which will be followed by a simplified mandatory tender offer on

the remaining Company shares (the "Offer"), and if the legal

conditions are met the implementation of a squeeze-out at the end

of the Offer (together, the "Transaction"). In the context of the

Transaction, and as also described in the press release of July 24,

2024, it is contemplated for the Company and Everest SubBidco to

enter into new facilities agreement in order to, among others,

finance the payment of the exceptional distribution approved by the

shareholders meeting of October 31, 2024, and globally to refinance

the existing indebtedness of the Group.

The Board of the company approved on November 4, 2024, the

corresponding senior facilities agreement to which, among others,

the Company and its subsidiary Everest SubBidco will be borrowers,

which is in line with the conditions announced in July 2024 and

will comprise a term loan made available to Everest SubBidco for a

maximum principal amount of €925,000,000, deferred term loans made

available to Everest SubBidco for a maximum combined principal

amount of €235,000,000 and a revolving credit facility made

available, among others, to the Company and Everest SubBidco for a

principal amount of €235,000,000. A term loan is also available to

Etna French Bidco under the senior facilities agreement for a

maximum principal amount of €425,000,000 to finance the Block

Acquisition, the Offer and if applicable the subsequent

squeeze-out.

CONFERENCE CALL

As mentioned at the beginning of this press release, please note

that management will not be holding a conference call on November

5, 2024, as originally planned.

PROVISIONAL CALENDAR

- FY 2024 Financial Results: March 25, 2025.

APPENDICES

9 months of 2024 Gross Sales

in € million

9 months of 2023

9 months of 2024

Variation

Reported

Constant

Currency*

EMEA

2,795

2,971

+6%

+7%

AMERICAS

455

487

+7%

+7%

APAC

310

440

+42%

+44%

GROUP

3,560

3,898

+9%

+10%

* Variation at constant currency is computed using the third

quarter of 2023 rates applied to the third quarter of 2024 Gross

sales. The USD, GBP and PLN evolved as follows; 1EUR: 1.087 USD;

1EUR: 0.851 GBP, 1EUR: 4.306 PLN respectively for Q4 2024 and 1EUR:

1.084 USD; 1EUR: 0.871 GBP, 1EUR: 4.584 PLN respectively for Q3

2023.

9 months of 2024 IFRS Revenue

in € million

9 months of 2023

9 months of 2024

Variation

Reported

Constant

Currency*

EMEA

842

800

-5%

-4%

AMERICAS

179

203

+13%

+14%

APAC

134

136

+1%

+3%

GROUP

1,155

1,139

-1%

-1%

** Variation at constant currency is computed using 9 months of

2023 rates applied to 9 months of 2024 revenue.

Gross sales to revenue reconciliation

in € million

Q3-23

9 months of 2023

Q3-24

9 months of 2024

Gross sales

1,228

3,560

1,334

3,898

Agent vs principal – IFRS 15

(850)

(2,405)

(918)

(2,759)

Revenue

378

1,155

415

1,139

EXCLUSIVE NETWORKS CONTACTS

About Exclusive Networks

Exclusive Networks (EXN) is a global cybersecurity specialist

that provides partners and end-customers with a wide range of

services and product portfolios via proven routes to market. With

offices in over 45 countries and the ability to serve customers in

over 170 countries, we combine a local perspective with the scale

and delivery of a single global organisation.

Our best-in-class vendor portfolio is carefully curated with all

leading industry players. Our services range from managed security

to specialist technical accreditation and training and capitalize

on rapidly evolving technologies and changing business models. For

more information visit www.exclusive-networks.com.

DISCLAIMER

This press release may contain forward-looking statements. Such

statements may include projections, estimates, assumptions,

statements regarding plans, objectives, intentions and/or

expectations with respect to future financial results, events,

operations and services and product development, as well as

statements, regarding future performance or events. Forward-looking

statements are generally identified by the words “expects”,

“anticipates”, “believes”, “intends”, “estimates”, “plans”,

“projects”, “may”, “would” “should” or the negatives of these terms

and similar expressions. Although Exclusive Network’s management

currently believes that the expectations reflected in such

forward-looking statements are reasonable, investors are cautioned

that forward-looking statements are subject to various risks and

uncertainties (including, without limitation, risks identified in

Exclusive Networks’ Registration Document available on Exclusive

Networks’ website), because they relate to future events and depend

on future circumstances that may or may not occur and may be

different from those anticipated, many of which are difficult to

predict and generally beyond the control of Exclusive Networks.

Actual results and developments may differ materially from those

expressed in, implied by or projected by forward-looking

statements. Forward-looking statements are not intended to and do

not give any assurances or comfort as to future events or results.

Other than as required by applicable law, Exclusive Networks does

not undertake any obligation to update or revise any

forward-looking statement. This press release does not contain or

constitute an offer of securities for sale or an invitation or

inducement to invest in securities in France, the United States or

any other jurisdiction.

1 Defined as reported rolling 12 months Gross sales generated in

year N from vendors/customers active in year N-1 divided by

reported rolling 12 months Gross Sales from the same

vendors/customers in year N-1.

©Copyright Exclusive Networks SA | 20, Quai du

Point du Jour, Arcs de Seine, 92100 - Boulogne, Billancourt,

France

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104955936/en/

Investors & Analysts

Nicolas Leroy Global Communications Director

ir@exclusive-networks.com

Media FTI Consulting

Emily Oliver / Jamie Ricketts +33 (0)6 28 73 45 15 +44 (0)7976 718

948 exclusivenetworks@fticonsulting.com

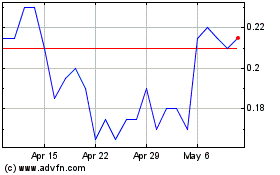

Excellon Resources (TSX:EXN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Excellon Resources (TSX:EXN)

Historical Stock Chart

From Feb 2024 to Feb 2025