Generation Mining Limited (TSX: GENM; OTCQB: GENMF) (“Gen

Mining” or the “Company”) has agreed to sell its rights

and interests in an option agreement (the “Davidson

Agreement”) to acquire a 100% interest in six (6) mineral

leases (the “Davidson Property”) hosting a

molybdenum-tungsten deposit, located near the town of Smithers,

British Columbia, to Moon River Capital Ltd. (“Moon River”),

a capital pool company listed on the TSX Venture Exchange, for

$630,000 in cash, 9.0 million common shares of Moon River and

certain nomination and pre-emptive shareholder rights described

below (the “Proposed Transaction”). Moon River intends for

the Proposed Transaction to constitute its Qualifying Transaction

under the rules of the TSX Venture Exchange. Following completion

of the transaction, Moon River will engage in exploration and

development activities in order to advance a preliminary economic

assessment on the Davidson Property.

Paul Murphy, independent Lead Director of Gen Mining of Gen

Mining stated, “The Davidson Property is a large

molybdenum-tungsten deposit which deserves additional attention and

resources in this robust market for both molybdenum and tungsten.

Ian McDonald, Interim Chief Executive Officer and a Director of

Moon River, is the former Executive Chairman and CEO of Thompson

Creek Metals Company Inc., which was focused on molybdenum

production and was previously involved with the Davidson Property

through Patent Enforcement & Royalties Ltd. (a predecessor

company to Thompson Creek), which completed a resource evaluation

on the property in 2004/2005. Given our focus on developing the

Marathon Palladium-Copper Project, this deal with Moon River meets

two key goals. It allows Gen Mining to retain an interest in the

property and for the Davidson Property to get the attention it so

richly deserves.” Mr. Murphy went on, “The approval of this

transaction by the independent members of the Board signifies the

strength and prudence of the deal, reflecting the commitment of

both parties to a successful outcome.”

Following an unsolicited offer from Moon River to acquire the

Company’s rights and interests in the Davidson Property, the

independent directors of the Company (which excluded Messrs. Levy

and Knoll who currently serve as directors of Moon River), engaged

Accelera Capital Inc. (“Accelera”) to provide independent

financial advisory services to the Company. Accelera canvassed a

broad range of potential purchasers and two competing offers from

third parties were received. After negotiating with the offerors

and inviting them to enhance their initial proposals in their

submission of final offers, the independent directors of the

Company, in consultation with Accelera, concluded that the terms

and conditions of the final revised Moon River offer were the most

favourable for the Company and its shareholders, as Moon River

offered near term cash consideration and continued exposure to

further exploration and development of the Davidson Property

through the equity ownership position. In addition, the proposed

Transaction was subject to less execution risk than the competing

offers.

The transaction is subject to customary closing conditions and

is expected to be completed by the end of October. Following the

closing of the transaction, the Company is expected to hold between

29% and 31% of the Common Shares of Moon River. It will also have

the right to appoint a director to the Board of Moon River and will

have pre-emptive shareholder rights for as long as it continues to

hold more than 10% of Moon River’s issued and outstanding common

shares.

About the Company

Gen Mining’s focus is the development of the Marathon Project, a

large undeveloped palladium-copper deposit in Northwestern Ontario,

Canada. The Company released the results of the Feasibility Study

Update on March 31, 2023.

The Feasibility Study Update estimated a Net Present Value

(using a 6% discount rate) of C$1.16 billion, an Internal Rate of

Return of 25.8%, and a 2.3-year payback. The mine is expected to

produce an average of 166,000 ounces of payable palladium and 41

million pounds of payable copper per year over a 13-year mine life

(“LOM”). Over the LOM, the Marathon Project is anticipated

to produce 2,122,000 ounces of palladium, 517 million lbs of

copper, 485,000 ounces of platinum, 158,000 ounces of gold and

3,156,000 ounces of silver in payable metals. For more information,

please review the Feasibility Study Update dated March 31, 2023,

filed under the Company’s profile at SEDAR.com or on the Company’s

website at https://genmining.com/projects/feasibility-study/.

The Marathon Property covers a land package of approximately

22,000 hectares, or 220 square kilometres. Gen Mining owns a 100%

interest in the Marathon Project.

Qualified Person

The scientific and technical content of this news release was

reviewed, verified, and approved by Drew Anwyll, P.Eng., M.Eng,

Chief Operating Officer of the Company, and a Qualified Person as

defined by Canadian Securities Administrators National Instrument

43-101 - Standards of Disclosure for Mineral Projects.

Forward-Looking Information

This news release contains certain forward-looking information

and forward-looking statements, as defined in applicable securities

laws (collectively referred to herein as "forward-looking

statements"). Forward-looking statements reflect current

expectations or beliefs regarding future events or the Company’s

future performance. All statements other than statements of

historical fact are forward-looking statements. Often, but not

always, forward-looking statements can be identified by the use of

words such as "plans", "expects", "is expected", "budget",

"scheduled", "estimates", "continues", "forecasts", "Projects",

"predicts", "intends", "anticipates", "targets" or "believes", or

variations of, or the negatives of, such words and phrases or state

that certain actions, events or results "may", "could", "would",

"should", "might" or "will" be taken, occur or be achieved,

including statements related to the anticipated timing for the

closing of the transaction; the Company’s expected percentage

ownership of Moon River; Moon River’s business plans; and the life

of mine, mineral production estimates, payback period, and

financial returns from the Marathon Project. All forward-looking

statements, including those herein, are qualified by this

cautionary statement.

Although the Company believes that the expectations expressed in

such statements are based on reasonable assumptions, such

statements are not guarantees of future performance and actual

results or developments may differ materially from those in the

statements. There are certain factors that could cause actual

results to differ materially from those in the forward-looking

information. These include the timing for Moon River and its

development activities at the Davidson Property; the progress of

the planned updated technical report on the Davidson Property, and

the impact of COVID-19, inflation, global supply chain disruptions

and the war in Ukraine on , key inputs, staffing and contractors,

commodity price volatility, uncertainties involved in interpreting

geological data environmental compliance and changes in

environmental legislation and regulation, relationships with First

Nations communities, exploration successes, and general economic,

market or business conditions, as well as those risk factors set

out in the Company’s annual information form for the year ended

December 31, 2022, and in the continuous disclosure documents filed

by the Company on SEDAR at www.sedar.com. Readers are cautioned

that the foregoing list of factors is not exhaustive of the factors

that may affect forward-looking statements. Accordingly, readers

should not place undue reliance on forward-looking statements. The

forward-looking statements in this news release speak only as of

the date of this news release or as of the date or dates specified

in such statements.

Investors are cautioned that any such statements are not

guarantees of future performance and actual results or developments

may differ materially from those projected in the forward-looking

information. For more information on the Company, investors are

encouraged to review the Company’s public filings on SEDAR at

www.sedar.com. The Company disclaims any intention or obligation to

update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, other than

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230913176051/en/

Jamie Levy President and Chief Executive Officer (416) 640-2934

(O) (416) 567-2440 (M) jlevy@genmining.com

Ann Wilkinson Vice President, Investor Relations (416) 640-3954

(O) (416) 357-5511 (M) awilkinson@genmining.com

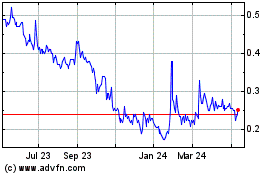

Generation Mining (TSX:GENM)

Historical Stock Chart

From Feb 2025 to Mar 2025

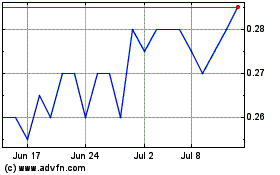

Generation Mining (TSX:GENM)

Historical Stock Chart

From Mar 2024 to Mar 2025