Sabre Gold Files Brewery Creek Preliminary Economic Assessment

January 28 2022 - 12:16PM

Sabre Gold Mines Corp. (TSX: SGLD, OTCQB: SGLDF) (“Sabre Gold” or

the “Company”) has filed on SEDAR an independent technical report

prepared in accordance with National Instrument 43-101 supporting

the result of a Preliminary Economic Assessment (“PEA”) at its

100%-owned Brewery Creek gold project located in Yukon Territory,

Canada. The summary results of the PEA were reported in the

Company’s news release dated January 18, 2022, and there are no

material differences in the report from those results.

PEA Highlights:

-

After-tax NPV at 5% of $112 million at an Internal Rate of Return

(“IRR”) of 27.6% at $1,700 per ounce gold increasing to $157

million at an IRR of 35.7% at $1,900 per ounce gold;

-

After-tax average annual cash flow of $36 million at $1,700 per

ounce gold increasing to $44 million at $1,900 per ounce gold

-

Average Annual Production of 60,000 ounces per year for a total

473,000 ounces gold over an initial 8 year mine life;

-

Total cash cost of $850 per ounce and all-in sustaining cost

(“AISC”) US$966 per ounce gold;

-

Pre-production capital costs of $105 million with life of mine

sustaining costs of $18 million;

-

Payback period of 2.6 years at $1,700 per ounce gold;

-

Excellent expansion potential to extend mine life and annual

production with three open prospective resource areas and several

targets within a 182 square kilometers project boundary; and,

- Lower technical and execution risk

as a past brownfields producer with existing infrastructure and

road access from previous mining operation.

The Preliminary Economic Assessment has an

effective date of January 18, 2022 and was prepared in accordance

with National Instrument 43-101 (“NI 43-101”) and evaluated the

economics of resuming mining at Brewery Creek through open pit

mining and heap leaching mined material for gold recovery to doré.

The PEA study was prepared by Kappes, Cassiday & Associates of

Reno, Nevada in cooperation with Tetra Tech Inc. of Golden, CO,

Gustavson and Associates of Lakewood, CO and Wood Environment &

Infrastructure Solutions, of Vancouver, British Columbia.

Summary of Economic Results

|

Gold Price Sensitivity |

|

Gold Price |

|

NPV 5% After Tax |

NPV 5% Pre-Tax |

Avg. Annual After tax CF |

|

|

US$/oz |

|

US$M |

|

IRR% |

|

US$M |

|

IRR% |

|

US$M |

|

|

$1450 |

|

53.4 |

|

16.2 |

|

73.0 |

|

19.1 |

|

27.2 |

|

|

$1500 |

|

65.4 |

|

18.6 |

|

90.4 |

|

22.1 |

|

29.1 |

|

|

$1600 |

|

88.7 |

|

23.2 |

|

125.2 |

|

28.0 |

|

32.7 |

|

|

$1700 |

|

111.6 |

|

27.6 |

|

160.0 |

|

33.5 |

|

36.3 |

|

|

$1800 |

|

134.3 |

|

31.7 |

|

194.7 |

|

38.9 |

|

39.9 |

|

|

$1900 |

|

156.8 |

|

35.7 |

|

229.5 |

|

44.2 |

|

43.5 |

|

|

$2000 |

|

179.3 |

|

39.6 |

|

264.2 |

|

49.2 |

|

47.1 |

|

|

PEA Capital Cost Summary |

|

|

Description |

Pre-Production |

|

Sustaining Capital |

|

Life of Mine |

|

|

|

|

US$000s |

|

US$000s |

|

US$000s |

|

|

|

Pre-strip, off load heap |

$18,105 |

|

|

|

$18,105 |

|

|

|

Mine

equipment (net of lease) |

4,499 |

|

$4,601 |

|

9,100 |

|

|

|

Site

Infrastructure |

29,207 |

|

11,182 |

|

40,389 |

|

|

|

Site

Infrastructure Haul Roads |

1,810 |

|

|

|

1,810 |

|

|

|

Process

Plant |

29,649 |

|

|

|

29,649 |

|

|

|

Indirects |

2,655 |

|

|

|

2,655 |

|

|

|

Owners,

EPCM |

8,487 |

|

|

|

8,487 |

|

|

|

Contingency |

10,974 |

|

2,236 |

|

13,210 |

|

|

|

Subtotal |

$105,386 |

|

$18,019 |

|

$123,405 |

|

|

|

Working

Capital |

11,181 |

|

(11,181) |

|

- |

|

|

|

GST

(recovery) |

5,269 |

|

(5,269) |

|

- |

|

|

|

Reclamation |

- |

|

13,992 |

|

13,992 |

|

|

|

Total Capital |

$121,836 |

|

$15,561 |

|

$137,397 |

|

|

PEA Operating Costs Summary |

|

|

Mining per tonne moved |

1.96 |

|

|

|

Strip ratio |

4:1 |

|

|

|

Unit Operating Costs (per tonne leached) |

US$/tonne |

|

|

|

Mining |

$11.31 |

|

|

|

Processing |

7.62 |

|

|

|

General & Administrative |

2.52 |

|

|

|

Total Operating Costs |

$21.45 |

|

|

|

Total Cash Costs per ounce gold sold |

$850/oz |

|

|

|

All-in-Sustaining Costs per ounce gold sold |

$966/oz |

|

The technical information in this news release

has been reviewed and approved by Michael Maslowski, CPG, a

qualified person as defined by National Instrument 43-101 and is

employed by the company as its Vice President, Technical Services

& Exploration.

About Sabre Gold Mines

Corp.Sabre Gold is a diversified, multi-asset near-term

gold producer in North America which holds 100-per-cent ownership

of both the fully permitted Copperstone gold mine located in

Arizona, United States, and the Brewery Creek gold mine located in

Yukon, Canada, both of which are former producers. Management

intends to restart production at Copperstone followed by Brewery

Creek in the near term. Sabre Gold also holds other investments and

projects at varying stages of development.

Sabre Gold has approximately 1.1 million ounces

gold in the Measured and Indicated categories, and approximately

1.5 million ounces gold in the Inferred category. Additionally,

both Copperstone and Brewery Creek have considerable exploration

upside with a combined land package of over 230 square kilometres

that will be further drill tested with high-priority targets

currently identified. Sabre Gold is led by an experienced team of

mining professionals with backgrounds in exploration, mine building

and operations.

For further information please visit the Sabre

Gold Mines Corp. website (www.sabre.gold).

Cautionary Note Regarding Forward Looking

Statements

This news release contains forward-looking

information under Canadian securities legislation including

statements regarding drill results, potential mineralization,

potential expansion and upgrade of mineral resources and current

expectations on future exploration and development plans. Forward

looking information includes, but is not limited to, the results of

the Brewery Creek PEA, including statements relating to net present

value, future production, estimates of cash cost, proposed mining

plans and methods, mine life estimates, cash flow forecasts, metal

recoveries, estimates of capital and operating costs, timing for

permitting and environmental assessments, realization of mineral

resource estimates, capital and operating cost estimates, project

and life of mine estimates, ability to obtain permitting by the

time targeted, size and ranking of project upon achieving

production, economic return estimates, the timing and amount of

estimated future production and capital, operating and exploration

expenditures and potential upside and alternatives.

These forward-looking statements also entail

various risks and uncertainties that could cause actual results to

differ materially from those reflected in these forward-looking

statements. Such statements are based on current expectations, are

subject to a number of uncertainties and risks, and actual results

may differ materially from those contained in such statements.

These uncertainties and risks include, but are not limited to: the

strength of the Canadian economy; the price of gold; operational,

funding, and liquidity risks; reliance on third parties,

exploration risk, failure to upgrade resources, the degree to which

mineral resource and reserve estimates are reflective of actual

mineral resources and reserves; the degree to which factors which

would make a mineral deposit commercially viable are present, and

the risks and hazards associated with underground operations and

other risks involved in the mineral exploration and development

industry.

Risks and uncertainties about Sabre Gold’s

business are more fully discussed in the Company’s disclosure

materials, including its annual information form and MD&A,

filed with the securities regulatory authorities in Canada and

available at www.sedar.com and readers are urged to read these

materials. Sabre Gold assumes no obligation to update any

forward-looking statement or to update the reasons why actual

results could differ from such statements unless required by

law.

For further information please contact:

Sabre Gold Mines Corp. Giulio Bonifacio President & Chief

Executive Officer gtbonifacio@sabre.gold

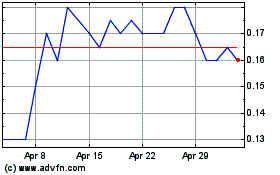

Sabre Gold Mines (TSX:SGLD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sabre Gold Mines (TSX:SGLD)

Historical Stock Chart

From Nov 2023 to Nov 2024