Stella-Jones Reports Solid First Quarter Results

Annual meeting of shareholders later this morning

MONTREAL, QUEBEC--(Marketwired - May 1, 2014) - Stella-Jones

Inc. (TSX:SJ)

- Sales of $257.5 million, up 15.7% from $222.6 million last

year

- 17.1% growth in operating income to $34.7 million, versus $29.7

million in 2013

- Net income up 20.1% to $22.5 million, compared to $18.8 million

last year

- Diluted EPS of $0.33 versus $0.27 a year ago

Stella-Jones Inc. (TSX:SJ) ("Stella-Jones" or the "Company")

today announced financial results for its first quarter ended March

31, 2014.

"We are pleased with Stella-Jones' solid operating results in

the first quarter of 2014. Demand for our core products remained

healthy despite unfavourable weather conditions across North

America. Moreover, operating income as a percentage of sales rose

further, as greater efficiencies achieved throughout our network

more than offset higher costs stemming from a tighter procurement

market for untreated railway ties and utility poles," said Brian

McManus, President and Chief Executive Officer.

| Financial highlights |

Quarters ended March 31, |

| (in thousands of Canadian dollars, except per share

data) |

2014 |

2013 |

| Sales |

257,498 |

222,580 |

| Operating income |

34,735 |

29,671 |

| Net income for the period |

22,518 |

18,757 |

|

|

Per

share - basic ($) |

0.33 |

0.27 |

|

|

Per

share - diluted ($) |

0.33 |

0.27 |

| Weighted average shares outstanding (basic, in

'000s) |

68,737 |

68,675 |

Effective January 1, 2014, the Company's sales of

non-pole-quality logs are reported as revenue in the consolidated

statement of income in a new product category and are no longer

credited to cost of sales. Comparative figures have been restated

to comply with the current year's presentation.

FIRST QUARTER RESULTS

Sales reached $257.5 million, up 15.7% from $222.6 million in

the same period last year. The operating assets acquired from The

Pacific Wood Preserving Companiesâ ("PWP") on November 15, 2013

contributed sales of $13.2 million, while the conversion effect

from fluctuations in the value of the Canadian dollar,

Stella-Jones' reporting currency, versus the U.S. dollar, increased

the value of U.S. dollar denominated sales by about $16.2 million

when compared with the previous year. Excluding these factors,

sales increased approximately $5.5 million, or 2.5%.

Railway tie sales amounted to $108.6 million, up 12.6% from

$96.5 million a year earlier. Excluding sales from the PWP assets

and the conversion effect, railway tie sales rose approximately

$1.9 million, or 1.9%, reflecting solid market demand, partially

offset by unfavourable weather conditions that limited railcar

availability. Sales of utility poles reached $107.5 million, up

from $90.8 million last year. Excluding sales from the PWP assets

and the conversion effect, utility pole sales increased $3.1

million, or 3.5%, as a result of higher customer orders for both

distribution and transmission poles. Sales in the residential

lumber category totalled $17.3 million, versus $17.9 million a year

ago, mainly reflecting less favourable weather in Canada.

Industrial product sales reached $15.8 million, compared with $11.9

million last year due to the contribution of the PWP assets.

Finally, non-pole-quality log sales amounted to $8.3 million, up

from $5.5 million a year ago, as a result of the timing of timber

harvesting.

Operating income rose 17.1% to $34.7 million, or 13.5% of sales,

versus $29.7 million, or 13.3% of sales, last year. While the

increase in monetary terms partially reflects the contribution of

the PWP assets, the increase as a percentage of sales stems from

greater efficiencies throughout the Company's plant network,

partially offset by higher year-over-year costs for untreated

railway ties and utility poles. Of note, margins from

non-pole-quality log sales are nominal as they are sold close to

cost of sales. Net income for the first quarter of 2014 increased

20.1% to $22.5 million or $0.33 per share, fully diluted, compared

with $18.8 million or $0.27 per share, fully diluted, in the first

quarter of 2013.

FINANCIAL POSITION

As at March 31, 2014, the Company's long-term debt, including

the current portion, stood at $407.0 million compared with $372.9

million three months earlier. The increase essentially reflects

higher working capital requirements, as per normal seasonal demand

patterns, and the effect of local currency translation on U.S.

dollar denominated long-term debt. As a result of this higher debt,

Stella-Jones' total debt to total capitalization ratio was 0.40:1

as at March 31, 2014, versus 0.39:1 three months earlier.

QUARTERLY DIVIDEND OF $0.07 PER SHARE

On April 30, 2014, the Board of Directors declared a quarterly

dividend of $0.07 per common share payable on June 27, 2014 to

shareholders of record at the close of business on June 2,

2014.

OUTLOOK

"As we look ahead to the remainder of 2014, we expect demand for

our core products to remain healthy, driven by a stronger economy

and sound fundamentals in our main sectors of activity. However,

the procurement market for untreated railway ties and utility poles

remains tight and our margins may be slightly impacted in the short

term. Still, we believe that our current inventory position and the

strength of our procurement network should allow Stella-Jones to

meet demand at an optimal cost. We remain focused on integrating

the PWP assets and pursuing the proposed acquisition of two wood

treating facilities from Boatright Railroad Products, Inc. expected

to close, if the transaction is finalized, in the latter part of

the second quarter," concluded Mr. McManus.

CONFERENCE CALL

Stella-Jones will hold a conference call to discuss these

results on May 1, 2014, at 1:30 PM Eastern Time. Interested parties

can join the call by dialing 647-427-7450 (Toronto or overseas) or

1-888-231-8191 (elsewhere in North America). Parties unable to call

in at this time may access a tape recording of the meeting by

calling 1-855-859-2056 and entering the passcode 29419192. This

tape recording will be available on Thursday, May 1, 2014 as of

5:30 PM Eastern Time until 11:59 PM Eastern Time on Thursday, May

8, 2014.

NON-IFRS FINANCIAL MEASURE

Operating income is a financial measure not prescribed by IFRS

and is not likely to be comparable to similar measures presented by

other issuers. Management considers this non-IFRS measure to be

useful information to assist knowledgeable investors regarding the

Company's financial condition and results of operations as it

provides an additional measure of its performance.

ABOUT STELLA-JONES

Stella-Jones Inc. (TSX:SJ) is a leading producer and marketer of

pressure treated wood products. The Company supplies North

America's railroad operators with railway ties and timbers, and the

continent's electrical utilities and telecommunication companies

with utility poles. Stella-Jones also provides residential lumber

to retailers and wholesalers for outdoor applications, as well as

industrial products for construction and marine applications. The

Company's common shares are listed on the Toronto Stock

Exchange.

Except for historical information provided herein, this press

release may contain information and statements of a forward-looking

nature concerning the future performance of the Company. These

statements are based on suppositions and uncertainties as well as

on management's best possible evaluation of future events. Such

factors may include, without excluding other considerations,

fluctuations in quarterly results, evolution in customer demand for

the Company's products and services, the impact of price pressures

exerted by competitors, the ability of the Company to raise the

capital required for acquisitions, and general market trends or

economic changes. As a result, readers are advised that actual

results may differ from expected results.

Note to readers:

Condensed interim unaudited consolidated financial statements for

the first quarter ended March 31, 2014 are available on

Stella-Jones' website at www.stella-jones.com

Source:Stella-Jones Inc.Contacts:Eric Vachon, CPA, CASenior

Vice-President and Chief Financial Officer(514)

940-3903evachon@stella-jones.comMartin Goulet, CFAMaisonBrison

Communications(514) 731-0000martin@maisonbrison.com

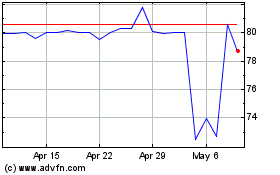

Stella Jones (TSX:SJ)

Historical Stock Chart

From Nov 2024 to Dec 2024

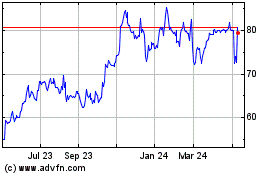

Stella Jones (TSX:SJ)

Historical Stock Chart

From Dec 2023 to Dec 2024